In the process of carrying out business activities, no organization is immune from cooperation with unscrupulous counterparties. The presence of accounts receivable has a negative impact on the financial condition of the organization, and often it comes to legal proceedings. In the process of disputes, in addition to the primary documents, an accounting certificate about the existence of a debt may be required for the court, a sample of which can be filled out below. As a rule, the arbitration court requests such a certificate from the organization that filed the claim.

What are the statutes of limitations?

Accounts receivable (RA) is the amount of debts and obligations of third parties to an enterprise or organization (creditor). Debtors (obligors) are obliged to repay the debt in accordance with the agreements. If this does not happen, the organization must apply to the court to protect its interests.

The statute of limitations for a loan is the period during which the creditor has the opportunity to file a statement of claim in court to protect his interests. The total value is usually 3 years. This means that after this time the debt is considered bad and cannot be paid. The countdown begins not from the moment debt obligations arise, but from the end of the deadline for repaying the debt under the terms of the contract.

To make legal proceedings go faster, it is recommended to seek help from specialists in the field of debt collection. A lawyer can act on behalf of a company under a contract. The process and final decision sometimes takes months.

It is worth noting that there are factors under which this period is interrupted. Among them are:

- the creditor went to court

- the debtor partially repaid the debt

- the debtor requested a deferment

- the debtor admitted the debt

The company must monitor debtors and monitor the status of debt. Problem debt is considered to be debt obligations that have not been fulfilled for more than 90 days.

The procedure for conducting remote sensing on video:

When may a certificate of absence or presence of wage arrears be required?

There are many such situations, and in some cases the certificate is needed by the employee, and in others by the employer himself. Here are just a few of them:

Thus, a certificate of arrears of wages is an important supporting document, and therefore it must be drawn up carefully and taking into account the circumstances in connection with which it is required.

IMPORTANT! This document should not be confused with certificates confirming the employee’s income. They are needed in other cases and are designed differently.

What are the grounds for writing off debt?

The grounds for writing off debt are:

- debtor bankruptcy

- inability to locate the debtor

- death (if we are talking about an individual)

- liquidation of a company (if we are talking about a legal entity)

Also, a debt is considered hopeless if the impossibility of satisfying it is established by a resolution of the bailiff.

A large organization that collaborates with a large number of people and other companies often has debtors. Bad debts are taken into account and written off in order to reduce the tax burden on profits.

Types of document

There are many types of certificates about the presence or absence of debt. Depending on which organization issues it, where such a certificate may be required, the forms and details of the document differ. Let's look at the most popular of them.

By salary

Despite the fact that labor legislation enshrines the employer’s obligation to pay employees on time, delays in wages and the formation of debt on them are quite common phenomena. Most often, such delays are irregular and short-term, and employees soon receive the payment due to them.

But it also happens that workers wait for their money for several months and even six months and a year. In such a situation, they may decide to leave the organization, and in order to receive the money they have earned, they must file a complaint with the labor inspectorate, the prosecutor's office or the court. Then they will need a certificate of arrears of wages, which must be given to them free of charge upon request; the employer has no right to refuse to issue it.

The document is drawn up in any form; the chief accountant and the head of the enterprise are responsible for the correctness and completeness of the information in it. It is their two signatures that should be on the certificate. In addition, it should contain the following information:

- information about the organization (name, details, address);

- information about the employee (full name, position, salary, total period of work at the enterprise and the period when there was no payment);

- amount of actual debt.

Certificate of wage arrears to employees

For taxes

The applicant can receive one of two types of certificates from the tax authorities:

- on the fulfillment of the obligation to pay taxes;

- about the status of tax payments.

The first type of certificate can be considered a document confirming the presence or absence of tax debt, but it will not contain information about its amount. The status of settlements as of the current date for all types of taxes, fees, fines and penalties will be reflected in the second certificate.

A certificate of the presence (absence) of debt issued by the tax office will contain the entry: “has an unfulfilled obligation...” or “does not have an unfulfilled obligation.” The form of the certificate is established by order of the Federal Tax Service. According to the regulations, the document is issued free of charge within ten days after registration of the taxpayer’s request. The following may refuse to issue a certificate:

- if the application sent via telecommunication channels is not signed with an electronic signature or it is not confirmed;

- if the applicant does not have a power of attorney from the organization;

- if the text of the application is impossible to read.

Certificate from the tax office confirming payment of taxes

Such a certificate may be needed to verify counterparties, when participating in tenders or to obtain a loan.

Documents for obtaining a certificate of no tax arrears are described in this video:

For accounts receivable

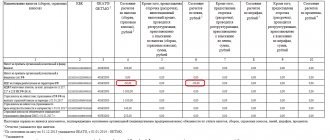

An enterprise often has accounts receivable when buyers, customers and other persons - debtors - owe it money. The size of this debt is determined as a result of the work of the inventory commission. The inventory procedure is formalized by an inventory act in form No. INV-17 and a certificate to the act, which, in essence, will be a certificate of the presence (absence) of receivables.

Compiled in the context of synthetic accounting accounts, a certificate of settlements with buyers, suppliers and other debtors and creditors is made in two copies, one is stored in the accounting department of the organization, the other is kept by the inventory commission.

Sample certificate of accounts receivable and payable

The document is a mandatory document in accounting, and is drawn up annually to write off bad receivables. Can serve as evidence in court if a creditor files a lawsuit to recover funds from the debtor.

For overdue debt

Overdue loan debt is also a fairly common phenomenon among bank clients. If a borrower, due to the deterioration of his financial situation, does not pay his loan for a long time, he develops overdue debt, which spoils his credit history. All banks now submit lending data to a common database on the basis of which the NBKI (National Bureau of Credit Histories) operates.

NKBI data is publicly available. If the borrower decides to take out another loan, the bank can check his solvency by looking at his credit history. Seeing the presence of overdue debt there, the credit institution will refuse such a client, even if in fact the old loan is already closed. NKBI databases are often out of date. Therefore, after repaying the overdue debt, it is better for the borrower to take such a certificate.

The document is issued by the bank that issued the loan. The certificate is called “Confirmation of the absence of overdue debt on the borrower’s loan” and is drawn up according to standard form No. 10-040.

Almost any correctly executed certificate of the presence or absence of debt can serve as evidence in court. For example, during a court hearing of a debt collection case, the defendant can prove that he has no debts with the help of such a certificate.

For loan debt

The loan debt is the amount of the remaining debt. There are times when it needs to be confirmed. For example, a citizen took out a long-term mortgage loan from a bank to purchase a home.

Due to the fact that he is an officially working citizen paying personal income tax, he has the right to receive a property deduction. The package of documents required to obtain it may include a certificate of absence of loan debt to confirm that payments have been made.

Certificate of absence of loan debt

For accounts payable

Accounts payable are closely related to accounts receivable when it comes to obligations of the same individuals to each other. Accounts payable are subtracted from accounts receivable if counterparties have counter debts.

Therefore, the previously described inventory act in form No. INV-17 and the attached certificate of settlements with creditors and debtors reflect both types of these debts. Documents may be required, for example, during enterprise reorganization, merger or change of owners.

Before the budget

You can obtain a certificate from the tax office about the status of settlements with the budget. It will reflect information on all types of taxes, fees, fines, penalties, contributions for which the taxpayer may be in debt to the budget, as well as on amounts. In this way, this certificate differs from other tax certificates, which contain only a record of the presence or absence of debts on taxes and fees.

As in the previous example, a certificate is often required when participating in tenders, checking counterparties, concluding contracts and taking out loans. The form of both such certificates, which can be obtained from the tax office, was approved by Order of the Federal Tax Service dated December 28, 2016 No. ММВ-7-17/ The document preparation period is 5 working days.

For utility bills

Not everyone pays utility bills in good faith; for some, this is a sore subject. However, it is often necessary to confirm the absence of utility debts in various situations. Most often this is necessary when making real estate transactions. Potential buyers or tenants want to receive proof of the absence of utility debts, so that later they do not have to pay off other people’s debts.

This certificate is not mandatory for the sale or privatization of housing; it is done at the request of the purchaser, therefore its form is not strictly regulated. Its recommended form can be called the EIRTs-22 form. You can obtain the document at the Unified Settlement Center, where people most often pay for housing and communal services.

Rent arrears (certificate)

The video below will tell you what a certificate of absence of debt for housing and communal services is and how it is made:

A certificate about the presence (absence) of debt in a bank is often needed for another bank. Therefore, it is best to immediately confirm any closed loan with such a certificate.

Thus, the client will have in his hands all the evidence of the absence of overdue or outstanding debt on loans. The procedure for issuing these certificates is not established by law, so various banks themselves set the amount of the fee for it and the timing of receipt.

Accounting for write-offs

Accountants write off accounts receivable. The procedure follows a certain algorithm. The following actions are performed:

an inventory order is created- certificate is filled out

- the manager creates an order

Only those debts that cannot be collected can be written off. The inventory report is accompanied by documents indicating the reality of the transaction, and papers confirming the bad debt (a bailiff's decree will do).

In accounting, the company’s responsibilities necessarily include compiling a specialized reserve for doubtful debts. The organization is required to retain debt write-off documents for 5 years. After this period of time, the debt is considered permanently written off.

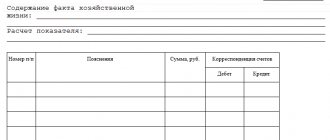

Sample of writing an accounting certificate

Some accounting transactions cannot be documented with primary documents. But according to the rules, an accountant cannot carry out anything without a documented basis. What should I do? Draw up such a document yourself. In this article you will find a sample of writing an accounting statement and learn about its features.

Every accountant should be able to do at least three things:

- draw up a balance sheet;

- find the error;

- draw up an accounting statement.

It is the last point that will be discussed in this material. First, let’s find out what kind of paper this is. And where can I find a sample accounting certificate?

Tax accounting for write-offs

When maintaining tax records, creating a reserve for doubtful debts is considered an optional procedure. If there is no reserve, then the debt is written off for non-operating expenses. If it is available, then the write-off of the receivables is carried out at the expense of the reserve.

Only companies that calculate their income tax liability using the accrual method have the opportunity to write off debt that cannot be collected as expenses. Organizations that keep records in another way cannot do this.

Types of document

There are many types of certificates about the presence or absence of debt. Depending on which organization issues it, where such a certificate may be required, the forms and details of the document differ. Let's look at the most popular of them.

By salary

Despite the fact that labor legislation enshrines the employer’s obligation to pay employees on time, delays in wages and the formation of debt on them are quite common phenomena. Most often, such delays are irregular and short-term, and employees soon receive the payment due to them.

But it also happens that workers wait for their money for several months and even six months and a year. In such a situation, they may decide to leave the organization, and in order to receive the money they have earned, they must file a complaint with the labor inspectorate, the prosecutor's office or the court. Then they will need a certificate of arrears of wages, which must be given to them free of charge upon request; the employer has no right to refuse to issue it.

The document is drawn up in any form; the chief accountant and the head of the enterprise are responsible for the correctness and completeness of the information in it. It is their two signatures that should be on the certificate. In addition, it should contain the following information:

- information about the organization (name, details, address);

- information about the employee (full name, position, salary, total period of work at the enterprise and the period when there was no payment);

- amount of actual debt.

Certificate of wage arrears to employees

For taxes

The applicant can receive one of two types of certificates from the tax authorities:

- on the fulfillment of the obligation to pay taxes;

- about the status of tax payments.

The first type of certificate can be considered a document confirming the presence or absence of tax debt, but it will not contain information about its amount. The status of settlements as of the current date for all types of taxes, fees, fines and penalties will be reflected in the second certificate.

A certificate of the presence (absence) of debt issued by the tax office will contain the entry: “has an unfulfilled obligation...” or “does not have an unfulfilled obligation.” The form of the certificate is established by order of the Federal Tax Service. According to the regulations, the document is issued free of charge within ten days after registration of the taxpayer’s request. The following may refuse to issue a certificate:

- if the application sent via telecommunication channels is not signed with an electronic signature or it is not confirmed;

- if the applicant does not have a power of attorney from the organization;

- if the text of the application is impossible to read.

Certificate from the tax office confirming payment of taxes

Such a certificate may be needed to verify counterparties, when participating in tenders or to obtain a loan.

Documents for obtaining a certificate of no tax arrears are described in this video:

For accounts receivable

An enterprise often has accounts receivable when buyers, customers and other persons - debtors - owe it money. The size of this debt is determined as a result of the work of the inventory commission. The inventory procedure is formalized by an inventory act in form No. INV-17 and a certificate to the act, which, in essence, will be a certificate of the presence (absence) of receivables.

Compiled in the context of synthetic accounting accounts, a certificate of settlements with buyers, suppliers and other debtors and creditors is made in two copies, one is stored in the accounting department of the organization, the other is kept by the inventory commission.

Sample certificate of accounts receivable and payable

The document is a mandatory document in accounting, and is drawn up annually to write off bad receivables. Can serve as evidence in court if a creditor files a lawsuit to recover funds from the debtor.

For overdue debt

Overdue loan debt is also a fairly common phenomenon among bank clients. If a borrower, due to the deterioration of his financial situation, does not pay his loan for a long time, he develops overdue debt, which spoils his credit history. All banks now submit lending data to a common database on the basis of which the NBKI (National Bureau of Credit Histories) operates.

NKBI data is publicly available. If the borrower decides to take out another loan, the bank can check his solvency by looking at his credit history. Seeing the presence of overdue debt there, the credit institution will refuse such a client, even if in fact the old loan is already closed. NKBI databases are often out of date. Therefore, after repaying the overdue debt, it is better for the borrower to take such a certificate.

The document is issued by the bank that issued the loan. The certificate is called “Confirmation of the absence of overdue debt on the borrower’s loan” and is drawn up according to standard form No. 10-040.

Almost any correctly executed certificate of the presence or absence of debt can serve as evidence in court. For example, during a court hearing of a debt collection case, the defendant can prove that he has no debts with the help of such a certificate.

For loan debt

The loan debt is the amount of the remaining debt. There are times when it needs to be confirmed. For example, a citizen took out a long-term mortgage loan from a bank to purchase a home.

Due to the fact that he is an officially working citizen paying personal income tax, he has the right to receive a property deduction. The package of documents required to obtain it may include a certificate of absence of loan debt to confirm that payments have been made.

Certificate of absence of loan debt

For accounts payable

Accounts payable are closely related to accounts receivable when it comes to obligations of the same individuals to each other. Accounts payable are subtracted from accounts receivable if counterparties have counter debts.

Therefore, the previously described inventory act in form No. INV-17 and the attached certificate of settlements with creditors and debtors reflect both types of these debts. Documents may be required, for example, during enterprise reorganization, merger or change of owners.

Before the budget

You can obtain a certificate from the tax office about the status of settlements with the budget. It will reflect information on all types of taxes, fees, fines, penalties, contributions for which the taxpayer may be in debt to the budget, as well as on amounts. In this way, this certificate differs from other tax certificates, which contain only a record of the presence or absence of debts on taxes and fees.

As in the previous example, a certificate is often required when participating in tenders, checking counterparties, concluding contracts and taking out loans. The form of both such certificates, which can be obtained from the tax office, was approved by Order of the Federal Tax Service dated December 28, 2016 No. ММВ-7-17/ The document preparation period is 5 working days.

For utility bills

Not everyone pays utility bills in good faith; for some, this is a sore subject. However, it is often necessary to confirm the absence of utility debts in various situations. Most often this is necessary when making real estate transactions. Potential buyers or tenants want to receive proof of the absence of utility debts, so that later they do not have to pay off other people’s debts.

This certificate is not mandatory for the sale or privatization of housing; it is done at the request of the purchaser, therefore its form is not strictly regulated. Its recommended form can be called the EIRTs-22 form. You can obtain the document at the Unified Settlement Center, where people most often pay for housing and communal services.

Rent arrears (certificate)

The video below will tell you what a certificate of absence of debt for housing and communal services is and how it is made:

A certificate about the presence (absence) of debt in a bank is often needed for another bank. Therefore, it is best to immediately confirm any closed loan with such a certificate.

Thus, the client will have in his hands all the evidence of the absence of overdue or outstanding debt on loans. The procedure for issuing these certificates is not established by law, so various banks themselves set the amount of the fee for it and the timing of receipt.

Carrying out a debt check

The company must regularly check the data when creating reports. As a rule, verification is performed during a debt inventory. Obtaining information is necessary to assess the property and financial situation, determine the amount of available cash, and take measures to control debts.

Before drawing up most reports, a debt review is carried out. It is worth noting that a rapid increase in receivables indicates unreliability of counterparties or a significant increase in unnecessary expenses.

During the inspection, an information paper about the remote control is drawn up. It can be compiled for internal or external use. The document is created and filled out according to the sample or in free form.

What role does it play?

In practice, one of the most common accounting statements for the court is about debt. Debtor and/or creditor. She simultaneously performs:

- supporting document (duplicates the necessary information from accounting and tax accounting);

- We prove to the court and the parties to the conflict the existence of specific facts.

Also see “Changes in state duty in 2021: how much you will have to pay.”

The required sample accounting certificate for the court can be drawn up in the most general form, since the law does not establish either a mandatory or recommended form for this document.

The main thing is that it contains accurate, legally competent and relevant references to the provisions of the law, and also provides accessible reference data that the company wants to confirm or refute in court.

Please note that recently courts are increasingly accepting accounting statements drawn up in free form as appropriate evidence in a particular dispute.

Keep in mind (!): Article 313 of the Tax Code directly calls an accountant’s certificate (along with other “primary documents”) a document confirming tax accounting. And any court has no right to ignore this normative rule. Including on the grounds that the law does not establish a mandatory form for such a certificate.

It is better to prepare any accounting certificate for the court on the organization’s letterhead.

Keep in mind: it is not at all necessary to refer in this certificate to the fact that it was issued specifically for judicial purposes. But it is very desirable for it to be signed not only by the chief accountant, but also by the head of the organization. This will give the certificate evidentiary weight in court.

Also see “Accounting statement: how to draw it up correctly.”

Functions of help about remote sensing

The certificate for internal use is used for reporting. With its help, the current situation of the organization is monitored and assessed. Paper intended for external use is attached to the statement of claim and is used in legal proceedings.

The paper can also be drawn up at the request of other persons and government bodies. The data can be used to evaluate existing assets. The certificate is often requested by insurers and other creditors.

When using the sample, no problems with drawing up the document arise. An experienced accountant, having access to all the data, takes very little time to compile a certificate.

Certificate of absence of wage arrears to confirm the total amount of debt

Such a certificate is suitable in cases where there is no need to indicate a debt to a specific employee, but only the fact of the absence (presence) of a debt needs to be certified, for example, at the request of the State Tax Inspectorate, another government agency or bank.

There is no strict form of the certificate, however, based on established business practice, it reflects:

- employer name;

- outgoing number and date of document preparation;

- wording about the absence or presence of debt (if there is a debt, give its amount - total or broken down);

- FULL NAME. the compiler, to whom you can contact for clarification, his telephone number.

The certificate is endorsed by the general director (possibly together with the chief accountant), and if available, a stamp is placed.

For those who are officially allowed to do without a seal, read this publication.

For a sample certificate of arrears of wages drawn up in the form discussed above, please see the link below:

Legal basis

The legislation does not provide recommendations on the choice of a specific form of certificate to reflect the PD. When compiling, you can use different samples depending on your goals and objectives. Most often, when drawing up a document, the INV-17 form is used. Ultimately, the paper should reflect detailed information about the loan agreement, the reporting period, the amount of obligations and other nuances.

The certificate is always compiled by the organization itself for internal or external use. An organization can use its own sample certificate, which is created from scratch or built on the basis of an existing form.

How to draw up and issue an accounting certificate

The form of the primary document is developed by organizations independently. But some operations cannot be carried out on such media; such papers include the calculation of daily expenses. This issue is resolved by an accounting certificate , despite the fact that it is not a primary document.

The certificate is used if an error has been made in any economic reports, as well as if it is necessary to record any transaction.

Classification of certificate forms

Typically, classification is carried out based on the purpose of the paper. The document can be used in the following cases:

- to create swelling

- to provide information about current receivables for other persons

- during legal proceedings

A plaintiff who attaches a certificate of confidentiality to his claim significantly increases the likelihood that the court will satisfy the requirements specified in the claim. The certificate acts as one of the documents that confirms the existence of debt obligations of the defendant to the plaintiff.

Regardless of the purpose of creation, the universal form INV-17 can almost always be used for compilation. The template is freely available, so anyone can use it.

Calculation of interest for delayed wages

This is called compensation. The amount of compensation for back wages can be calculated using a simple formula. You should divide the amount of wage arrears by 300. Then, you need to multiply the resulting value by the number of days overdue. Compensation is withheld from the employer in all cases, since this is a direct requirement of the law.

Procedure for paying compensation for delayed payment of wages

When compensation for wages is indicated in a court decision, it should be received in hand along with the writ of execution. Such a document must be submitted to the bailiff service. They will be carried out by debiting funds from the company account in favor of the employee. In this case, the bailiffs have the right to seize the account of the enterprise and its property.

www.samso.ru

This is interesting:

Rules for issuing a certificate

Among the basic design rules are:

indication of information about the amount of obligations, the name of the creditor and debtor and the period of occurrence of the debt- filling in information based on inventory results

- use of a single template if the organization has approved a specific template

- paying attention to the purpose of the paper

For internal use, a document may be drawn up that additionally includes information about accounts payable. Such paper will allow you to obtain more data about the financial condition of the company, its assets and debts.

Results

A certificate reflecting information about accounts receivable can be drawn up for presentation to the court - as a document approving the list of unfulfilled obligations of the counterparty - or generated in the order of reporting by a business entity to a higher-level structure. In both cases, unified forms can be used to draw up a certificate.

You can learn more about working with accounts receivable and payable in the articles:

- “Keeping records of receivables and payables”;

- "Ratio of accounts receivable and accounts payable."

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

In the process of carrying out business activities, no organization is immune from cooperation with unscrupulous counterparties. The presence of accounts receivable has a negative impact on the financial condition of the organization, and often it comes to legal proceedings. In the process of disputes, in addition to the primary documents, an accounting certificate about the existence of a debt may be required for the court, a sample of which can be filled out below. As a rule, the arbitration court requests such a certificate from the organization that filed the claim.

Instructions for compilation

In order to properly issue a certificate, it is advisable to draw it up according to a ready-made sample. The template contains individual thematic blocks. The following information must be reflected in the paper:

detailed name of the debtor- reason for accrual of debt (provision of services, sale of goods)

- Date the debt arose

- name of the papers damaging the existence of the debt (act of work performed or transfer of goods)

- amount of debt

The details of the persons responsible for drawing up the certificate are also indicated. If necessary, an additional column is created in which special tags or individual comments can be placed. In addition to signatures, the organization’s seals are affixed to the certificate.

Form and required details

Since this is a primary document, two important conditions must be met:

- The form and procedure for compilation must be prescribed in the accounting policies of the organization.

- Availability of the mandatory details provided for in Article 9 of the Federal Law of December 6, 2011 No. 402 on accounting.

If an organization can develop the form on its own or use a sample for filling out an accounting certificate (0504833), which was developed and approved by Order of the Ministry of Finance dated March 30, 2015 No. 52n for government institutions, then the requirements for the details are quite strict. The form must include:

Only if these requirements are met will the completed form be considered valid.

How to get

The certificate is usually compiled by a senior economist or financial director of the company. An organization can use third-party help from specialists when creating reports and drawing up certificates of remote sensing.

Within the company, the paper is filled out when reporting or at the request of management. Controlling and supervisory authorities do not have the right to require the provision of a certificate of PD. If desired, the organization provides paper on a voluntary basis.

Sample on how to draw up an accounting statement

There is nothing complicated in compiling this paper. Let's consider, for example, a sample accounting certificate about the correction of an error, or, as it is called, reversal. In it, the accountant must outline the essence of the transaction, as well as the circumstances under which the error occurred. It is also necessary to write entries with corrections and indicate how this affected taxes. If there have been changes in their calculation, you need to indicate which updated reports need to be submitted. The chief accountant certifies the accounting certificate with his signature.

Only on the basis of such paper can an accountant make corrections in the General Ledger of the organization, where no corrections are allowed.

m.ppt.ru

Features of filling in a legal dispute

In the certificate that will be used in court proceedings, it is recommended to additionally indicate the following information:

- detailed details of your own company

- date of compilation

- manager's signature

Sometimes additional information about the destination (name of the court) is added to the paper for the court. Signatures of members of the commission that conducted the inventory may also be required.

The certificate duplicates the information from the reporting, providing data in a compressed form. A correctly drawn up paper will help you count on receiving a positive decision in a dispute related to debt collection.

Large companies are recommended to have their own lawyer on staff in order to resolve debt problems as quickly as possible. The statement of claim must clearly reflect the organization's requirements and refer to available documents confirming the debt to the plaintiff.

Structure and varieties

There are two types of certificates . They can be of a professional nature or personal. To ensure that tax authorities or other organizations do not have additional questions, you need to correctly draw up a document of an official nature.

The certificate is submitted to the court, investigative committee, prosecutor's office, and state supervision. There are no mandatory accounting certificate forms, but there are certain rules for preparation.

In the first part of the document, the following data must be indicated:

In the second part you need to indicate the essence of the document, it could be:

In the third part , you need to date and sign the paper to the responsible party to confirm the transaction.

If an employee needs a document confirming his employment, salary, or length of service, he is issued a personal certificate. In this case, the following information :

The employee's full name is indicated in the nominative case - this is the beginning of the certificate. You must specify the organization for which the document is being created. It must bear the signature of the relevant official and seal.

Supporting papers for going to court

Only a certificate of confidentiality is not enough for the court to take the plaintiff’s side. The following documents must be submitted along with the claim:

- contracts concluded with the counterparty (supply of goods, provision of services, etc.)

- invoices

- signed acts

- invoices

It is documents confirming that the company provided certain services to the other party or transferred goods that play a critical role in debt collection.

After receiving a positive result, the federal bailiff service is responsible for the execution of the court decision. If the debtor refuses to fulfill his obligations under the contract, it is recommended to try to resolve the issue in court as quickly as possible. It is advisable that all actions be carried out within 1 year, when the debt is still considered problematic and not hopeless.

Certificate of ownership is an important document that is required for both internal and external use. Drawing up a document does not require much time. There are no strictly regulated samples, but it is recommended to use common and unified templates.

Top

Write your question in the form below

Sample filling

The Ministry of Finance of the Russian Federation, according to Order No. 52n dated March 30, 2015, adopted a single form (0504833) for an accounting certificate, which can be used as a sample.

The document must indicate the name of the company, the date of preparation and the assigned document number, account number and amount.

You need to enter information about the institution. The certificate must bear the signature of the executor or inspector. The certificate is accepted for accounting by the chief accountant. The document is reflected in the marks in the accounting registers.

But the sample certificate approved by the Ministry of Finance may not be suitable for all cases without exception.

The settlement document is recorded as primary paper. If inaccuracies are found in the report, you must fill out this certificate. It is used in the following situations :

Information about the organization, information about changes, the date of creation of the document and the full names of accountable persons should be displayed.

In Article No. 9 of the Law “On Accounting” No. 402-F3 you can find additional information on how to draw up an accounting certificate.

About confirming corrections

The certificate confirming corrections must display the following information :

At the end of the document there must be a signature of the accountant who made the mistake and the chief accountant.

For example, accountant Bokova D.V. discovered an error in depreciation charges for April 2021: the amount of 45,000 rubles was reflected, but the correct calculation was 42,000 rubles. It is necessary to cancel the excess using the posting: Dt 44 Kt 02 - 3000.

There must be signatures at the end of the certificate. This document indicates that accounting corrections must be made.

About writing off the “creditor”

If the company has overdue accounts payable and the time for filing a claim has passed, it is necessary to include this data in the line on unrealized income. According to the regulations of paragraph 18 of Article 250 of the Tax Code of the Russian Federation, this information must be provided without fail.

This procedure is usually carried out during the inventory process. That is, you should issue an accounting certificate for writing off accounts payable. The document must include the following:

The certificate is prepared as follows :

- address, year;

- time of identification of the creditor obligation;

- the result of debt;

- amount of debt;

- expiration time;

- write-off;

- signature of the chief accountant (and the preparer of the certificate).

To be sure of the accuracy of the calculations, it is recommended to draw up a certificate in accordance with Chapter 12 of the Civil Code, since it reflects the main issues of limitation of actions .

If we imagine a situation where the organization Vostok LLC carried out an audit of settlements with clients, in the process a creditor obligation to Put LLC was discovered equal to 90,000 rubles. And on May 2, 2017, the limitation period for it ended.

According to separate accounting

Paragraph 4 of Article 149 of the Tax Code of the Russian Federation says that all organizations are required to keep separate records of actions, regardless of whether they are free from VAT or not. To have an idea of what the separate VAT accounting document reflects, you need to refer to Article 170 of the Tax Code of the Russian Federation.

About debt for court

If the company owes money to customers, then it is required to draw up a certificate of receivables.

Help may be required in any unforeseen situations that may arise during the work of the organization. This can happen if an employee is overpaid.

Situation 1 : paid wages to Mayakovsky N.K. in the amount of 60,000 in September and in the amount of 58,000 in October. In November, it turned out that an extra amount of 2,000 rubles had been accrued for September, since his real salary was 58,000 rubles.

Mayakovsky N.K. reacted loyally to the situation and returned the surplus to the cash register. An accounting employee needs to change the amount of personal income tax withheld.

D26 K70 – 3000 rub . Excess amount of accrued wages.

D70 K68 – 390 rub . Excess amount of income tax withheld.

D50 K70 – 2610 rub . The amount deposited into the cash register.

Overpayment of personal income tax will be taken into account in the next tax payment period.

Situation 2 : LLC "YUG" pays rent 1 per quarter. The monthly payment is 30,000 rubles. During the first quarter, the organization transferred 90,000 rubles to the landlord. The organization's accountant prepares a monthly certificate to formalize the acceptance of expenses for accounting.

Situation 3 : loan agreement dated January 1, 2016 No. 5 indicates that the organization Shtil LLC received a loan in the amount of 1,000,000 rubles for 1 year at 15% per annum. Funds were provided on January 2, 2021. Interest is calculated by the accountant on a monthly basis. For February, the amount of interest will be equal to 11,506 rubles (1,000,000 * 15% * 28 days / 365 days).

There are many examples when an accounting certificate may be needed.

How is the VAT tax credit reflected in the accounting certificate? Find out in this video.

znaybiz.ru

Where can I get it?

You can obtain a certificate of debt from authorized government, residential or financial authorities. It all depends on what kind of certificate there should be. For example, a certificate of no debt can be issued to indicate that there is no debt to pay for utilities.

You can obtain a certificate of debt or lack thereof in the following places:

- At the MFC. Such a place is in great demand because workers provide a full range of necessary services to the population of the country. They provide both state and municipal services.

- Through the official website of government services. If the user does not have his own personal account, he must register and then contact the MFC to confirm registration.

- In the management company. In such places, a certificate is issued indicating the presence of debts to the employer and employee.

Thus, before you go and get a certificate, you need to know which document is needed. If it is necessary to prove that a person has paid for all utilities, he must contact organizations that work in the housing and communal services sector. And if you need a footnote about the existence of debts to the employer and employee, you should go to the employer himself.

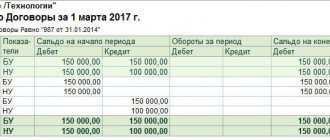

Purpose and form of the reconciliation report

The document represents systematized information on the status of mutual settlements between the parties to the transaction based on the results of a certain period, broken down by turnover. The form reflects all existing business transactions within the framework of the contract: sales, payments, offsets, write-offs, etc. Most often, the form looks like a spreadsheet document with a separate part for entering data for each of the parties. The information is not always completely consistent; discrepancies are possible.

Periodic reconciliation allows the parties to optimize accounting and promptly eliminate possible errors and inaccuracies. An explanatory note from the accounting service may be attached to the form if significant deficiencies are identified. It is worth considering that, despite the fact that the preparation of the document is of an informational nature, the form signed on both sides will be confirmation of the debt and the claim period begins to be calculated anew.

A reconciliation report may be required when going to court

It is advisable to draw up a reconciliation report in the following cases:

- For systematic, regular supply of goods and services, performance of work.

- If there are several contracts in force between counterparties.

- When concluding agreements on the provision of deferment, installment plans, restructuring, debt forgiveness.

- Controlling the receipt of significant amounts of funds.

- For transactions with expensive inventory items, especially when valuing deliveries in foreign currency.

- When multi-item purchases and sales are made, documented by several primary documents.

- To confirm the existence of a debt.

- When filing claims in court.

- If the debtor decides to claim the excess transferred funds, the uncovered advance.

- In order to track the statute of limitations of debts, etc.

Here are some sample lines from the document:

- Name.

- Details of the parties to the reconciliation.

- Period of control of mutual settlements.

- Contract information.

- Number the lines in order.

- Debt balance at the beginning and end of the established period.

- Debit and credit turnover, total amount.

- Base document (date, number).

- Reconciliation result.

- Signatures of the parties.

The reconciliation report allows you to track the statute of limitations

If the terms of the transaction do not stipulate the obligation to regularly reconcile obligations, the parties should not distribute the document or require the counterparty to unquestioningly carry out the procedure. In practice, some unscrupulous debtors deliberately avoid any possible actions to confirm the existence of an unfulfilled obligation, counting on the rapid expiration of the statute of limitations and the unhindered write-off of the debt.

Carrying out regular reconciliations will be additional evidence for the court about the transparency and correctness of information about the debt. The regulatory authorities will not make a remark to the creditor or debtor about the absence of measures to collect debts if this document is present in the inspection materials.