BCC “Property tax for 2021 for legal entities” is the code indicated in the payment order to correctly identify the payment in the budget.

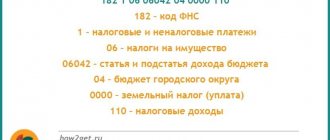

BCC “Property 2021 for legal entities” is one of the main details of the payment order for the payment of this obligation. Budget classification codes consist of 20 digits, which store information about the payment and its purpose. They are needed to correctly allocate transfer amounts to budget items. In order for a financial obligation to be considered fulfilled, you must correctly indicate the BCC for the property tax of legal entities; In 2021, there have been major changes in the scheme for paying this fee to the budget.

KBK for payment of penalties on property tax for legal entities and organizations

| PENALIES, INTEREST, FINES | KBK | |

| Penalties, interest, fines on property tax of organizations not included in the Unified Gas Supply System | penalties | 182 1 06 02010 02 2100 110 |

| interest | 182 1 06 02010 02 2200 110 | |

| fines | 182 1 06 02010 02 3000 110 | |

| Penalties, interest, fines on property tax of organizations included in the Unified Gas Supply System | penalties | 182 1 06 02020 02 2100 110 |

| interest | 182 1 06 02020 02 2200 110 | |

| fines | 182 1 06 02020 02 3000 110 | |

For individuals

How to determine BCC for payment

The key question is: what is the Unified Gas Supply System, and whether the assets of the institution are included in this section. Indeed, in order to choose the correct BCC property tax for 2021 for legal entities, you need to determine whether your property assets belong to the Unified State Gas System.

The main regulatory document establishing general provisions on the Unified Gas Supply System is Federal Law No. 69-FZ dated March 31, 1999. Consequently, if your organization is guided in its activities by this standard, then, most likely, the property will be classified as part of the unified gas supply system.

The BCC of property tax for legal entities in 2021 is collected in the table:

Principal payment on obligations

KBK penalties for corporate property tax in 2021

Interest on payment

Fines and penalties

Payments for property objects not included in the Unified Gas Supply System

Payments for property objects included in the Unified Gas Supply System

KBK for payment of property tax for individuals

| TAX | KBK |

| Tax levied in cities of federal significance (Moscow, St. Petersburg, Sevastopol) | 182 1 06 01010 03 1000 110 |

| Tax levied within urban district boundaries | 182 1 06 01020 04 1000 110 |

| Tax levied within the boundaries of inter-settlement territories | 182 1 06 01030 05 1000 110 |

| Tax levied within settlement boundaries | 182 1 06 01030 10 1000 110 |

BCC for individual entrepreneur contributions for 2021

Individual entrepreneurs pay the BCC on their own. If an individual entrepreneur simultaneously works as an employee, he still must pay contributions for himself - as an individual entrepreneur.

Entrepreneurs are required to pay mandatory contributions to their own pension and health insurance until they are “listed” as individual entrepreneurs and have a Unified State Register of Entrepreneurs (USRIP) entry about them. The age of the entrepreneur and occupation does not matter. And most importantly, contributions must be paid even if the individual entrepreneur does not receive any income.

KBK for payment of penalties on property tax for individuals

| PENALIES, INTEREST, FINES | KBK | |

| Penalties, interest, fines on taxes levied in cities of federal significance (Moscow, St. Petersburg, Sevastopol) | penalties | 182 1 06 01010 03 2100 110 |

| interest | 182 1 06 01010 03 2200 110 | |

| fines | 182 1 06 01010 03 3000 110 | |

| Penalties, interest, fines on taxes levied within the boundaries of urban districts | penalties | 182 1 06 01020 04 2100 110 |

| interest | 182 1 06 01020 04 2200 110 | |

| fines | 182 1 06 01020 04 3000 110 | |

| Penalties, interest, fines on taxes levied within the boundaries of inter-settlement territories | penalties | 182 1 06 01030 05 2100 110 |

| interest | 182 1 06 01030 05 2200 110 | |

| fines | 182 1 06 01030 05 3000 110 | |

| Penalties, interest, fines on taxes levied within the boundaries of settlements | penalties | 182 1 06 01030 10 2100 110 |

| interest | 182 1 06 01030 10 2200 110 | |

| fines | 182 1 06 01030 10 3000 110 | |

FILES

Calculation features

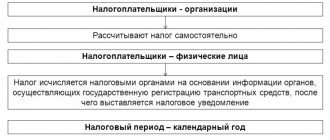

The property tax is required to be paid by ordinary citizens - “owners of houses, factories, apartments, cottages”, as well as organizations. Thus, taxpayers for this obligation are companies that own taxable real estate, as well as some movable property (depreciation groups 3-10). However, from January 1, 2019, the composition of the tax base will be changed, this is discussed below.

The amount of liabilities for institutions is determined based on the cadastral value of the objects or based on the calculation of the average annual book value of taxable assets. The key rules for calculating tax obligations on property encumbrances, as well as the current online calculator for carrying out and reconciling calculations, are in the material “Online calculation of property tax for organizations.”

Innovations and features of calculus

Tax on the ownership of certain property is paid by individuals and organizations. This tax is calculated by the regulatory authority and sends a notification according to which the tax must be paid strictly within the specified period.

Innovations in 2021 for individuals

The Tax Code has introduced new rules for calculating property tax, effective from January 1, 2021: its cadastral value is taken as the tax base. That is, the more expensive the housing, the less profitable it will be for owners to own it, because they will have to pay a tax that differs tens of times from what they are used to.

Benefits were retained, but only for 1 of the properties of each type provided.

IMPORTANT! If your property contains objects that are subject to preferential taxation, and you did not indicate them in the declaration (you did not choose which of the objects will be the basis for the preferential tax rate), then the tax office will make a choice in favor of the highest for calculation.

Changes for 2021

From 2021, payments for movable property will not be transferred. But reporting for 2021 must be done according to the old rules.

Changes were made in 2021. Thus, the first and second depreciation groups were excluded from taxable assets for this property levy. Until 2021, fixed assets classified as 3-10 depreciation groups were recognized as objects of taxation.

Regions received the right to establish benefits, while some constituent entities of the Russian Federation immediately released payers from the obligation to transfer property taxes on movable fixed assets. Now this new provision has also been cancelled. Thus, only real estate becomes the object of taxation: federal legislation follows regional legislation. These changes were introduced by Federal Law No. 302-FZ of August 3, 2018.

Property tax rates

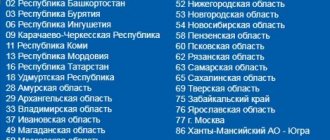

Setting “tariffs” for the percentage calculation of tax collection of the required type is the responsibility of the subjects of the country, however, there are restrictions of two and two tenths of a percent, which cannot be exceeded.

The authorities of the constituent entities have the right to change the terms of taxation for the tax under discussion for various categories of citizens, including the size of the rate. The same applies to types of property; differentiation is allowed according to each of them.

How to calculate property tax for individuals and real estate

In this article we will tell you in detail about property tax and the features of its payment. In it you will find a formula that will help you independently calculate the amount of tax depending on the cost.

Who should pay tax

When the required tax levy comes into force on the territory of any subject of the country, the authorities representing the region carry out a procedure for independently determining the rate. This tariff subsequently becomes valid in the desired territory. During the determination, the government is guided by the limits established by the main body of information on the country's tax legal relations.

In addition, regional authorities can arbitrarily reduce tax rates, introduce other types of preferential items, or completely cancel payments to certain categories of payers. The introduction of such a possibility is determined by the federal level of the state.

Tax on owned property is paid by companies that own objects included in the list of taxable items defined by the Tax Code.

Objects of taxation of organizations according to Article 374 of the Tax Code of the Russian Federation

These can be both domestic and foreign companies operating in our country by opening their own point - a representative office. For both presented categories, the object of taxation is property:

- movable;

- immovable.

At the same time, it must be registered on the balance sheet as an object from the category of funds of a basic nature.

If a company does not carry out foreign activities on the territory of our country and does not have permanent representative offices, then it is subject to the required type of tax collection on real estate owned by it, owned in the form of ownership and acquired through the conclusion of an agreement of a concession nature.

The following property names are not relevant to the list of taxable objects.

- Land territories or other names represented by environmental resources.

- Operational property owned by the executive structure of the Federation by right of management, for which, according to the letter of the law, the presence of military service and similar other types is provided, in order to conduct defensive activities, ensuring the proper level of security and the primacy of law and order on the territory of the Russian Federation.

What objects are not subject to taxation according to the Tax Code of the Russian Federation

How to calculate penalties

The amount of penalties depends on the refinancing rate (or the key rate of the Central Bank). The amount is calculated differently for individual entrepreneurs and organizations, and also depends on the number of days of delay. All individual entrepreneurs with any number of days of delay and organizations with a delay of up to 30 days inclusive calculate penalties from 1/300 of the refinancing rate:

Amount of arrears * (Key rate of the Central Bank of the Russian Federation for the period of violation / 300) * Number of days of delay

If the organization is overdue for 31 days or more, calculate the penalties as follows:

- First, we calculate penalties for the first 30 days of delay:

Amount of arrears * (Key rate of the Central Bank of the Russian Federation for the period of violation / 300) * 30

- Then we calculate penalties for subsequent days of delay:

Amount of arrears * (Key rate of the Central Bank of the Russian Federation for the period of violation / 150) * Number of days of delay from 31 days

- Let's sum both values.

KBK on excise taxes in 2021

Execute payment orders for the transfer of excise tax in accordance with the Regulations of the Bank of Russia dated June 19, 2012 No. 383-P and the Rules approved by Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. In field 104, put KBK - we have listed them in the table below.

KBC for the transfer of excise taxes in 2021

| Purpose | Mandatory payment | Penalty | Fine |

| Excise taxes on goods produced in Russia | |||

| ethyl alcohol from food raw materials. In addition to distillates of wine, grape, fruit, cognac, Calvados, whiskey | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| ethyl alcohol from non-food raw materials | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| wine, grape, fruit, cognac, calvados, whiskey distillates | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| alcohol-containing products | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| tobacco products | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| electronic nicotine delivery systems | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| nicotine-containing liquids | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| tobacco and tobacco products intended for consumption by heating | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| automobile gasoline | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| straight-run gasoline | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| cars and motorcycles | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| diesel fuel | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| motor oils for diesel, carburetor (injection) engines | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| fruit, sparkling (champagne) and other wines, wine drinks, without rectified ethyl alcohol | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| beer | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| alcoholic products with a volume fraction of ethyl alcohol over 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| alcoholic products with a volume fraction of ethyl alcohol up to 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| cider, poiret, mead | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| benzene, paraxylene, orthoxylene | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| aviation kerosene | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| middle distillates | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| wines with a protected geographical indication, with a protected designation of origin, except for sparkling wines (champagnes) | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| sparkling wines (champagnes) with a protected geographical indication, with a protected designation of origin | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise duties on goods imported from member states of the Customs Union (payment of excise duty through tax inspectorates) | |||

| ethyl alcohol from food raw materials. In addition to distillates of wine, grape, fruit, cognac, Calvados, whiskey | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| distillates – wine, grape, fruit, cognac, calvados, whiskey | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| cider, poiret, mead | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| ethyl alcohol from non-food raw materials | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| alcohol-containing products | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| tobacco products | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| electronic nicotine delivery systems | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| nicotine-containing liquids | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| tobacco and tobacco products intended for consumption by heating | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| automobile gasoline | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| cars and motorcycles | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| diesel fuel | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| motor oils for diesel, carburetor (injection) engines | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| fruit, sparkling (champagne) and other wines, wine drinks, without rectified ethyl alcohol | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| beer | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| alcoholic products with a volume fraction of ethyl alcohol over 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| alcoholic products with a volume fraction of ethyl alcohol up to 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| straight-run gasoline | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| middle distillates | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on goods imported from other countries (payment of excise duty at customs) | |||

| ethyl alcohol from food raw materials. In addition to distillates of wine, grape, fruit, cognac, Calvados, whiskey | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| distillates – wine, grape, fruit, cognac, calvados, whiskey | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| cider, poiret, mead | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| ethyl alcohol from non-food raw materials | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| alcohol-containing products | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| tobacco products | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| electronic nicotine delivery systems | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| nicotine-containing liquids | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| tobacco and tobacco products intended for consumption by heating | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| automobile gasoline | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| cars and motorcycles | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| diesel fuel | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| motor oils for diesel, carburetor (injection) engines | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| fruit, sparkling (champagne) and other wines, wine drinks, without rectified ethyl alcohol | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| beer | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| alcoholic products with a volume fraction of ethyl alcohol over 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| alcoholic products with a volume fraction of ethyl alcohol up to 9 percent. Except beer, wines, wine drinks, without rectified ethyl alcohol | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| straight-run gasoline | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

| middle distillates | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

Concept of KBK

The KBK refers to the classification of special 20-digit budget codes, which systematizes the income and expenses of the municipal, regional and federal levels. When paying taxes, fees and other payments, the payer indicates one or another code. Then the amount is automatically credited to the required destination. That is, this is a kind of account where money is transferred to the budget.

Each of the 20 digits has special information:

- the first ones mean the code of the government agency where the money is paid;

- further – the income code and its group;

- further – payment code;

- income item and its subitem;

- then - numbers indicating the budget level, for example, regional;

- the following numbers indicate the type of payment, that is, interest, tax, fine, etc.;

- the last 3 digits indicate the type of income.

BCCs change frequently. Some are added, others are excluded.

Let's sum it up

The importance of budget classification codes in the work of authorities for recording payments to the country's budget cannot be underestimated, since it is obvious. An orderly accounting system was formed largely thanks to the presented encodings. Finding out which code is suitable in your case is very simple. Typically, companies receive tax notices containing the required sequences of numbers, but experienced accountants remember many of them from memory or always keep a list containing all the names on hand.

It is important to understand that the differences between codes of the same category are insignificant

Be careful when filling out payment documents! One wrong number and the payment will be sent in the wrong direction, which means that you face not only a lengthy search for funds that went the wrong way, but also a penalty for failure to make a payment.

Tax period

For the type of tax levies under discussion, the taxation period is twelve calendar months. Reporting is provided several times a year, in the following time periods:

- in the first 3 months;

- half year;

- at the end of the third quarter.

The countdown of deadlines starts directly from the beginning of the calendar year period

Some authorities of the constituent entities of our country took advantage of the right to cancel reporting periods, which was granted to them by the government of the Federation.