Accrual

When issuing a loan, the lender prescribes in the agreement the procedure and terms for paying interest. Depending on these conditions in the accounting book, the lender recognizes interest as other or income from ordinary types of employment. The second situation is possible if the issuance of loans is the subject of the organization’s activities. Then the interest is taken into account according to KT90. If interest amounts are recognized as other income, then they are reflected according to KT91.

Loan interest postings

The procedure for recording transactions in NU is prescribed in Art. 271 Tax Code of the Russian Federation. For the amount of interest you need to issue an invoice marked “excluding VAT”. For violation of this requirement, the Federal Tax Service may impose a fine of 10 thousand rubles. If the organization has not issued an invoice for more than six months, the fine increases to 30 thousand rubles. For the purposes of calculating income tax, interest is included in non-operating income on a monthly basis, on the date of repayment of the loan. In accounting, income is recognized evenly, regardless of the moment of receipt of funds. Let's look at the entries for calculating interest on a loan issued:

- D-t 76 (73) K-t 91 - interest accrued. D-t 51 (50) K-t 76 - interest received.

If a loan is provided to an individual at a small interest rate, then personal income tax must be charged at a rate of 35%. Let's consider how in this case interest on the loan will be accrued in the accounting system. Postings:

- D-t 51 (50) K-t 76 - interest received. D-t 70 K-t 68 - personal income tax accrued.

Features of issuing a loan to the founder of an organization

You might be interested in: “Baltym Park” is a residential complex in Yekaterinburg that can make citizens’ dreams of a comfortable life in nature come true

Theoretically, issuing a loan to the founder is different in that he is not an employee. Therefore, to issue an interest-free loan, a set of settlements is used not with personnel, but with other debtors. If a loan is issued to the founder, the postings will look like this:

| Debit | Credit | Note |

| 76 | 50 | Cash paid from the cash register |

| 76 | 51 | Money transferred to the current account |

In practice, issuing a loan to the founder is a way to withdraw your money from the organization. Until 2021, loans were issued to the founders interest-free and practically non-repayable, contracts on them were extended again and again, this had no consequences.

Example 1

The company received two loans: the first for six months in the amount of 150 thousand rubles, and the second for 36 months. in the amount of 680 thousand rubles. When preparing documents for the second loan, an additional fee for a lawyer was paid in the amount of 5 thousand rubles. Let's reflect these transactions in accounting: D-t K-t Description of transaction Amount, thousand rubles 5166 Short-term loan provided 1506650 Short-term loan repaid in 6 months 5167 Long-term loan provided 6806051 Lawyer's services paid 59,167 Lawyer's services included in expenses 6751 Loan repaid 680

Example 2

The company received a loan in the amount of 120 thousand rubles, for which it is necessary to pay 10% per annum. For the first (17 days) of using the funds, 567 rubles were accrued as interest, for the second month - 1 thousand rubles, for the third - 400 rubles. The loan was then repaid. D-t K-t Description of transaction Amount, thousand rubles 5166 Short-term loan provided 12091 Interest accrued for the 1st month 0.5676651 Interest paid 9166 Interest accrued for the 2nd month 16651 Interest paid 91.266 Interest accrued for the 3rd month 4006651 Interest paid Loan repayment 120 000

Obtaining a loan (borrower organization)

Now consider the reverse situation, when an enterprise receives a loan from another organization. Funds received are not included in income. In accounting, short-term loans are reflected in account 66, and long-term loans in account 67:

- Dt 51 (50) Dt 66 (67) - loan received.

In NU, interest is attributed to non-operating expenses within a certain limit. It is calculated by multiplying the refinancing rate by a factor of 1.8. This formula applies if the loan is issued in rubles. Interest must be taken into account monthly, on the date of repayment. If these amounts are transferred to the founder or individual, then additional personal income tax should be withheld at a rate of 13%. In accounting, interest is taken into account as part of other expenses. Loan interest postings:

- Dt 91 Kt 66 - interest accrued on the loan; Dt 66 Kt 68 - personal income tax withheld; Dt 66 Kt 51 - interest paid.

The exception is loans that a company receives for the purchase or construction of an investment asset. Then these expenses are included in the cost of the property. The amount of returned funds, which is not included in expenses, is reflected by posting D-t 66 K-t 51.

Reflection of loan issuance operations in accounting

Channel PROGRAMMER'S DIARY

The life of a programmer and interesting reviews of everything. Subscribe so you don't miss new videos.

For loans issued, accounting entries will depend on the terms of the agreements on the basis of which the loans were issued. Postings can be made to account 58 or 73. Account 58 records financial investments. One of the conditions for classifying an amount as a financial investment is the possibility of receiving future income. It is clear that an interest-free loan cannot be taken into account in this account. Therefore, there are two possible options for reflecting this operation:

- Loans were issued to employees. Postings to the “Financial Investments” account.

| Debit | Credit | Note |

| 58 | 50 | Cash paid from the cash register |

| 58 | 51 | Money transferred to the current account |

2. Interest-free loans were issued. Postings to the account “Settlements for loans granted”.

| Debit | Credit | Note |

| 73.1 | 50 | Cash paid from the cash register |

| 73.1 | 51 | Money transferred to the current account |

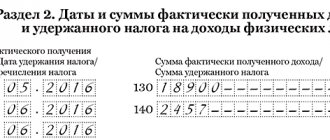

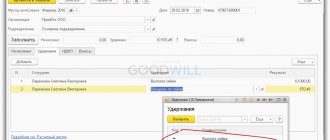

Calculation of interest on a loan: postings in 1C

Let's look at this operation using an example. On January 20, 2015, the JSC account received borrowed funds in the amount of 500 thousand rubles, on which interest will be accrued. The company used the funds for three months, after which it paid off the debt. It is necessary to carry out all these operations in NU and BU.

The first step is to calculate interest under the loan agreement. The entries used in this operation include accounts 66 (67). Since the agreement was concluded for a period of less than a year, interest on a short-term loan will be recorded in account 66.04. We will calculate interest on the loan agreement. Postings:

- 01.2015 – D-t 91 Kt 66.04 – 3005.45 RUR 02.2015 – D-t 91 K-t 66.04 – 7923.51 RUR 03.2015 – D-t 91 K-t 66.04 – 5464 .49 rub.

In NU, non-operating expenses will include interest on loans issued, the postings will be the same, but the amount will be different:

- 01.2015 – D-t 91 Kit 66.04 – 2163.92 rub. 02.2015 – D-t 91 Kit 66.04 – 5704.93 rub. 03.2015 – D-t 91 Kit 66.04 – 3934 .42 rub.

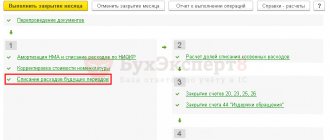

In all months, the amount of accrued interest in BU is greater than in NU. This permanent positive difference is included in expenses only in accounting. Next, you need to create the document “Operation (accounting and accounting)” in 1C, indicating the transactions for interest on the loan and reflecting the generated differences. Then, using the regulatory document, you need to make a “Calculation of income tax”. Positive differences do not reduce the tax base. Permanent tax liability (PNO) is also taxed at a rate of 20%:

- PNO January = 841.53 x 0.2 = 168.30 rubles. PNO February = 2,218.58 x 0.2 = 443.71 rubles. PNO March = 1,530.05 x 0.2 = 306 rubles.

Loan repayment: payment order

When repaying a debt through a bank transfer, the payment order must indicate the details of the loan agreement (the date of its conclusion and the assigned registration number). For interest-free loans, the payment document must contain a reference to the borrower’s lack of interest obligations. When a loan is repaid, the purpose of payment can be formulated as follows:

- repayment of an interest-free loan under agreement dated (date) No....;

- partial repayment of an interest-free loan under the agreement (details of the agreement are provided).

At the end of the payment purpose text, the phrase “Without VAT” or “VAT not subject to” is written. Without these words, the bank will not be able to process the payment order.

Loan from the founder

The founder can also provide a loan to the organization and receive loans from it. All terms of this transaction are specified in the contract. Let's take a closer look at the legal aspects of this operation. The Civil Code does not prohibit such transactions, but difficulties will arise when accounting for VAT. The postings for these transactions are similar to those discussed earlier. If the founder decides to “forgive” the debt to the company, then his share in the capital must be taken into account. If it exceeds 50%, then taxable profit is not generated. An organization can repay debt in kind, that is, with products:

- D-t 76 K-t 91 - revenue is reflected in payment of debt. D-t 90 K-t 68 - VAT on sales is charged. D-t 66 K-t 76 - debt is taken into account.

How to record loan repayment and interest payments in accounting

Depositing money into the organization's cash desk or transferring it to its current account must be carried out within the established time frame by the employee to whom the loan was issued. Postings are made to the credit of the accounts on which the accrual was made.

| Debit | Credit | Note |

| 58 | 50 | Money deposited into the cash register |

| 58 | 51 | Money transferred to the current account |

| 58 | 70 | Part of the salary was withheld to reimburse the loan and interest |

| 73.1 | 50 | Reimbursement for an interest-free loan has been deposited into the cash register |

| 73.1 | 51 | Money was transferred to the current account to repay the interest-free loan |

| 73.1 | 70 | Part of the salary was withheld to reimburse the interest-free loan. |

There is an opinion that it is impossible to deduct debt on loans and interest from wages. It is based on Article 137 of the Labor Code, which lists all types of possible deductions. The list is closed. Other federal laws provide some additional justification for certain wage deductions, but nowhere do they mention loan repayment. The issue is controversial; perhaps the State Labor Inspectorate will find violations in such retention. If, nevertheless, the organization has decided to repay the debt by deducting part of the salary, it is necessary to include this in the contract and obtain a statement of consent from the employee.

Financial aid

Do not confuse loan forgiveness with gratuitous financial assistance. In the second case, we are talking about covering losses and preventing bankruptcy at the expense of the founder’s funds. Financial assistance can be in the form of a contribution to assets (LLC) or a gratuitous transfer of funds. In the second case, the amount received for the year must be included in other income: D-t 51 K-t 91. In these operations, account 98 of the same name is not used, since it records income from receipts of non-monetary assets.

When can you not pay personal income tax?

You will not have to pay personal income tax on the amount of material benefit if the employee took out a loan to purchase housing. In this case, the loan agreement must specify the purpose for which the borrowed funds will be spent. After purchasing housing, you must provide the employer with documents confirming the intended use of the funds. If an employee with a mortgage takes out a loan at a more favorable interest rate to pay off the mortgage from the bank, personal income tax must be withheld because the housing was purchased earlier than the funds were borrowed.

Other types of investments

If financial assistance was received in the form of OS, then in the balance sheet this operation is recorded with the following entries:

- D-t 08 K-t 98 - market value of the received equipment. D-t 01 K-t 08 - putting the property into operation. D-t 20 K-t 02 - depreciation. D-t 98 K-t 91 - cost The fixed assets are written off as other income.

Let's look at how financial assistance is formalized in the form of materials:

- D-t 10 K-t 98 - market value of materials received. D-t 20 K-t 10 - consumed materials are written off as other income.

Financial assistance can also be used to pay off losses of the organization. Let's take a closer look. How to reflect this operation on the balance sheet using a specific example. At the end of the year, the company suffered a loss of 1 million rubles. The founders, Ivanov and Petrov, before the statements were approved, decided to cover the loss from their own funds. Ivanov deposited 520 thousand rubles into the Company’s account, and Petrov - 480 thousand rubles. D-t K-t Amount, thousand rubles. Operation 7584520 Partial repayment of loss by Ivanov A. A. 480 Partial repayment of loss by Petrov B. B. 5175520 Receipt of funds from Ivanov 480 Receipt of funds from Petrov This is how financial assistance is reflected in the balance sheet.