An organization can purchase or develop a trademark (service mark) independently. At the same time, she has rights to this sign. Rights to a trademark (service mark) may be exclusive or non-exclusive.

Possessing exclusive rights, the organization becomes the only one who can use the mark, dispose of it and prohibit its use by others. In this case, she is considered the copyright holder.

Non-exclusive rights give an organization the opportunity to use a mark with the permission of the copyright holder on the basis of a license agreement.

This procedure follows from Articles 1229, 1235 and 1236 of the Civil Code of the Russian Federation.

Both exclusive and non-exclusive rights to a trademark (service mark) must be registered (Clause 2 of Article 1232, Articles 1479 and 1480 of the Civil Code of the Russian Federation).

Trademark as an intangible asset

Every year, more and more companies make a conscious choice to register a trademark as a means of recognition and attracting customer attention. A trademark, being an intangible asset, is part of the property of a legal entity, which will increase its value if a decision is made to sell the enterprise. And like any property, a trademark can be sold to pay off a debt or it can be foreclosed on by the bailiff service. According to a commentary from the legal portal www.law-consult.ru, during the bankruptcy procedure of a legal entity or individual entrepreneur, the trademark is included in the bankruptcy estate for subsequent evaluation and sale. The difficulties of registering a trademark lie in the correct determination of its initial value and correct taxation. In this article we will analyze in detail how a trademark can be acquired and tell you how to evaluate a trademark, accept it on the balance sheet of an organization and take into account VAT.

Since a trademark is an intangible asset, in accounting and tax accounting, in accordance with clause 5 of PBU 14/2007 “Accounting for intangible assets,” the right to this trademark is taken into account, regardless of the method of its acquisition.

OSNO and UTII

The cost of an intellectual property item (rights to it) is taken into account according to the rules of the taxation regime for which it is used.

An object of intellectual property can simultaneously be used in the activities of an organization subject to UTII and in activities for which the organization pays taxes under the general taxation system. In this case, the cost of this object or the organization’s costs associated with its acquisition (creation) must be distributed.

If the object is included in intangible assets, the monthly amount of depreciation charges is subject to distribution. If an organization does not have exclusive rights to an object, the costs of its acquisition (including VAT) should be distributed. For more information about this, see How to take into account expenses for income tax when combining OSNO with UTII and How to deduct input VAT when separately accounting for taxable and non-taxable transactions. The costs of acquiring (receiving) rights to an object of intellectual property that is used in one type of activity of the organization do not need to be distributed.

This procedure follows from paragraph 9 of Article 274 and paragraph 7 of Article 346.26 of the Tax Code of the Russian Federation.

Initial cost of the trademark

An accountant accepts a trademark at its original cost, the formation of which directly depends on how it was acquired. Let's consider all the options:

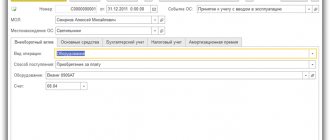

1 When creating a trademark yourself, subaccount 08-5 “Acquisition of intangible assets” will accumulate expenses that make up the initial cost of the trademark. Here we will include the following expenses: wages of employees directly involved in the creation of a trademark with accruals, materials used in the development of the trademark, as well as the amount of expenses associated with registering the trademark. After receiving a certificate for a trademark, the expenses that formed its initial cost in subaccount 08-5 will be written off to account 04 “Intangible assets”.

Example. Vesta LLC registers a trademark created independently. An employee of Vesta LLC, Petrov, developed a trademark as part of his job duties. Vesta LLC applied to Rosreestr to register a trademark, paying the state fee.

The following entries will be reflected in the accounting records:

|

2 If a trademark is purchased from the copyright holder, then subaccount 08-5 “Acquisition of intangible assets” will reflect amounts directly related to the costs of acquiring the trademark. For example, to such expenses we will include the amount paid to the copyright holder, expenses for payment of intermediary, consulting, information services if they relate to a trademark, and state fees.

Example. LLC "Gamma" acquired the trademark under an agreement on the alienation of the exclusive right from LLC "Voskhod", and also turned to LLC "Vesna" for consulting services on the registration of the trademark. Gamma LLC paid a state fee for registering a trademark.

The accounting records of Gamma LLC will reflect the following entries:

|

3 The acquisition of the right to use a trademark under a license agreement determines a special procedure for registering a trademark. A trademark received for temporary use is taken into account by both the licensee (user) and the copyright holder.

The user takes into account the existence of the right to the mark in the off-balance sheet account. Depreciation is accrued only by the copyright holder (licensor). Accounting for the right to use a trademark depends on the terms of payment (one-time or periodic payments) and the type of activity of the organization.

If the license agreement provides for a one-time payment (lump sum payment) for the use of a trademark, then the payment amount is taken into account as deferred expenses and is written off evenly over the term of the agreement. Periodic payments (royalties) are taken into account by the user of the trademark as expenses of the reporting period.

4 A trademark can be obtained free of charge, but this also requires an assessment of its value and acceptance on the balance sheet. In this case, the value of the trademark must be determined either independently, based on the cost for which this trademark could be sold or use the services of an appraiser, as required by clause 23 of the Regulations on Accounting and Financial Reporting, clause 13 of the PBU 14/2007. Accounting for a gratuitously transferred trademark can cause difficulties due to different initial costs for accounting and tax purposes.

The cost of a trademark received free of charge is recognized as other income of the organization (clause 7 of PBU “Income of the organization” 9/99) and is taken into account in account 98 “Deferred income”. Further, the initial cost of the trademark will be depreciated and written off as other income for the current period.

Example. LLC "Omega" received a trademark free of charge, paid the state duty for registration actions in Rosreestr. The assessment was carried out with the assistance of an appraiser. The useful life of the trademark is 10 years (120 months), with depreciation calculated using the straight-line method.

Omega LLC will reflect the following accounting entries:

|

When accepting a trademark received free of charge on your balance sheet, it is necessary to control its tax accounting, since only the actual expenses incurred will be included in the cost of the trademark. In our example, these are the costs of the appraiser’s services and the amount of state duty.

Every month, when depreciation is calculated, a constant difference and a constant tax liability will arise, since the cost of the trademark in accounting will exceed its tax value.

In accounting and tax accounting, the moment of income recognition will be different. In accounting, such income will be taken into account gradually, with depreciation. Tax accounting recognizes income at once. As a consequence, a deductible temporary difference and a deferred tax asset will arise in accounting.

5 A trademark can be included in the authorized capital. In accounting, the value of a trademark will be determined by the amount of valuation of a specific trademark by all founders of the organization. For tax accounting, a trademark must be accepted at the residual value indicated in the founder’s reporting documents. At the same time, in accordance with clause 1 of Article 277 of the Tax Code of the Russian Federation, if an organization cannot document the value of a trademark, then its value for tax accounting purposes is recognized as zero.

Example. The founder of Vesna LLC contributed a trademark as a contribution to the authorized capital.

The organization will reflect the following transactions:

|

Today, many companies do not take trademarks into account on their balance sheets, attributing this, first of all, to the complexities of accounting and tax accounting. Lawyer Orlovskaya K.V., specializing in the field of tax law, copyright and related rights, believes that the importance of correctly determining the value of a trademark is the key to a successful tax policy. Companies that have trademarks in their reserves can ensure the identification of significant tax reserves for value added tax and income tax.

Registration of rights

If an organization has developed a mark on its own, register the exclusive right to it (Article 1479 of the Civil Code of the Russian Federation).

To register rights to a trademark, you need to submit an application to Rospatent. The rules for drawing up an application were approved by Rospatent Order No. 32 dated March 5, 2003. Recognition of exclusive rights is confirmed by a certificate issued to the copyright holder organization. This procedure follows from Article 1481 of the Civil Code of the Russian Federation.

If an organization acquires the exclusive right to a mark from other persons, an agreement on the alienation of exclusive rights is concluded between them (Article 1488 of the Civil Code of the Russian Federation). In this case, the organization becomes the copyright holder only after registration of this agreement with Rospatent. This procedure follows from paragraph 2 of Article 1232 and paragraph 2 of Article 1234 of the Civil Code of the Russian Federation.

If an organization receives a non-exclusive right to a trademark (service mark), the copyright holder issues a license to it. The basis for this is a license agreement, which must also be registered with Rospatent. This procedure follows from paragraph 2 of Article 1232 and paragraph 2 of Article 1235 of the Civil Code of the Russian Federation. In addition, the right to use a trademark (service mark) can be transferred to an organization under a commercial concession agreement (Article 1027 of the Civil Code of the Russian Federation). This agreement is also registered with Rospatent (Article 1028 of the Civil Code of the Russian Federation).

The procedure and conditions for registering agreements on the disposal of the exclusive right to a trademark (service mark) are established by the Rules approved by Decree of the Government of the Russian Federation of December 24, 2015 No. 1416.

In all cases, when registering the right to a trademark (service mark), it is necessary to pay a fee (Article 1249 of the Civil Code of the Russian Federation). Its size is established in the Regulations approved by Decree of the Government of the Russian Federation of December 10, 2008 No. 941.

Along with trademarks (service marks), an organization can acquire or independently create an invention (utility model, industrial design). In these cases, it also has exclusive or non-exclusive rights to the acquired (created) intellectual property objects. Rights to created intellectual property objects also need to be registered. The procedure for registering rights to inventions (utility models, industrial designs) is similar to that applied when registering rights to trademarks (service marks). The only difference is the form of the document confirming the existence of rights. If the rights to trademarks (service marks) are confirmed by certificates, then the rights to an invention (utility model, industrial design) are confirmed by patents. This is stated in Articles 1353 and 1354 of the Civil Code of the Russian Federation.

The procedure for accounting for rights to a trademark, invention (utility model, industrial design) depends on whether they are exclusive or not.

For organizations that have the right to keep accounting in a simplified form, a special procedure for accounting for expenses is provided (Parts 4, 5, Article 6 of the Law of December 6, 2011 No. 402-FZ).

Value added tax

As a general rule, the amounts of expenses, for the purpose of forming the initial cost of a trademark, are displayed excluding VAT and other refundable taxes.

For an organization that is not a VAT payer, by virtue of clause 2 of Article 170 of the Tax Code of the Russian Federation, the amount of “input” VAT is taken into account in the cost of the trademark.

If the trademark is used in activities subject to VAT, then the amount of VAT presented by counterparties for services constituting the initial cost of the trademark is reflected in the debit of account 19 “Value added tax on acquired assets.” This amount of VAT can be deducted after the trademark is registered as an intangible asset by writing off the VAT amount to the debit of account 68 “Calculations for taxes and fees” from the credit of account 19.

Basic postings

| Business transaction | Debit | Credit |

| The costs of developing a trademark are reflected | 08 | 70,69,60 |

| The trademark has been accepted for registration | 04 | 08 |

| Depreciation accrued | 20 | 05 |

| Depreciation written off upon disposal | 05 | 04 |

| The amount of additional valuation of intangible assets is reflected | 04 | 83 |

| Correction of the amount of depreciation of intangible assets upon revaluation | 83 | 05 |

Trademark depreciation

The trademark is subject to depreciation. The method of calculating depreciation (linear or non-linear) is established by the accounting policy of the organization and cannot be changed during the entire period of use of the trademark. Depreciation is not charged on a trademark owned by a non-profit organization (clause 24 of PBU 14/2007).

The amounts of accrued depreciation can accumulate on account 05 “Amortization of intangible assets” or reduce the amount of the initial cost of the trademark on account 04 “Intangible assets”.

The useful life of a trademark as an intangible asset is defined by Article 258 of the Tax Code of the Russian Federation and can be determined in three ways: as the validity period of the trademark registration certificate, as the useful life defined in the contract, or the useful life is set equal to 10 years.

The useful life of the trademark determined in this way must be reduced by the time spent to obtain a certificate for the trademark.

That is, if the useful life is 10 years and the time spent on obtaining the certificate is 8 months, the useful life for calculating depreciation will be equal to 9 years 4 months.

When using a trademark in the sale or production of goods (work, services), the amount of accrued depreciation, in accordance with clause 2 of Article 253 of the Tax Code of the Russian Federation, is included in the costs associated with production and sales. Article 1484 of the Civil Code of the Russian Federation defines the following methods of using a trademark:

|

If an organization has acquired the exclusive right to a trademark for the purpose of its further resale and does not use this trademark in the sale or production of goods (work, services), depreciation is not accrued on such an object. Such a trademark must be accounted for as a product and the proceeds from the sale of the trademark can be reduced by the amount of its cost (clause 2, clause 1, article 268 of the Tax Code of the Russian Federation). This is also evidenced by the letter of the Ministry of Finance of Russia dated July 29, 2004 No. 07-05-14/199, the letter of the Federal Tax Service of Russia for Moscow dated April 7, 2005 No. 20-12/23565.

Results

A registered trademark is an intangible asset. It can be sold or transferred for temporary use. In each case, the sale (transfer) agreement requires registration, and accounting occurs using special accounting algorithms.

Sources:

- Tax Code of the Russian Federation

- Civil Code of the Russian Federation

- Law “On Advertising” dated March 13, 2006 No. 38-FZ

- PBU 9/99, approved. by order of the Ministry of Finance of Russia dated May 6, 1999 N 32n

- PBU 10/99, approved. Order of the Ministry of Finance of Russia dated 05/06/1999 N 33n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Decommissioning of a trademark

A trademark as an intangible asset, with the exception of a trademark received for use, can be written off from accounting in the following cases:

|

The amount of the cost of the trademark and the amount of accrued depreciation are written off from the corresponding accounting accounts to the financial results of the organization (other income or expenses).

The article was prepared by the legal portal www.law-consult.ru Read about Bankruptcy of Individuals here.

Tax accounting of royalties

In the Tax Code of the Russian Federation the concept of royalty is not disclosed, and the very mention of the term is only present in paragraph 3 of paragraph 4 of Art. 271 Tax Code of the Russian Federation.

In international practice, royalties are periodic payments to the owner of the exclusive right during the term of the license agreement.

This type of expense is contained in clause 37 of Art. 264 Tax Code of the Russian Federation:

“periodic (current) payments for the use of rights to the results of intellectual activity and rights to means of individualization...”. Accordingly, tax accounting of royalties is carried out according to the rules of Article 264 of the Tax Code of the Russian Federation.

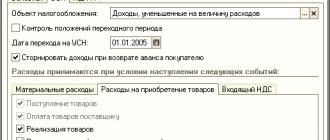

A similar type of expense is contained in clause 32 of Art. 346.17 of the Tax Code of the Russian Federation for those using the simplified taxation system (STS) with the object of taxation “income reduced by the amount of expenses”.

Tax accounting of royalties is legal when such expenses meet the requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation (substantiated and documented), and the company is able to confirm the fact of using the trademark in its activities (Letter of the Ministry of Finance of Russia dated May 19, 2011 No. 03-03-06/1/301).

Such payments should be taken into account as expenses evenly throughout the duration of the contract. If the amount of payments is known in advance, then monthly. In the case where the license payment is determined by calculation periodically, for example, quarterly, expenses are accepted on the date of settlement of the agreement or on the date of presentation of documents serving as the basis for calculating the payment.