Data reflection

Information about the structure and amount of working capital is entered into the second asset section of the balance sheet. The cost for each object at the beginning and at the end of the reporting period is indicated here. The stock includes the total price of all material assets and expenses of the organization. Inventory and equipment are recorded in accounting at actual cost. The balance sheet shows:

- Investments in products that have not passed all stages of technological processing, testing, and technical acceptance are included in the cost line in work in progress.

- The standard or actual cost of the balance of manufactured products, as well as those purchased for subsequent sale, is in the column of finished goods for resale.

- Expenses that the company incurs in the current period, but they relate to future years, are included in the expense line for upcoming periods.

- The actual cost of products supplied to customers is in the column of shipped goods.

- Current assets not reflected in the previous lines are included in other costs and inventories.

- VAT on purchased assets shows the amount not claimed for credit.

- Accounts receivable. It is reflected in two subsections depending on the repayment period: within or after 12 months. after the reporting date.

- An enterprise's investments in bonds, shares and other securities are classified as short-term financial investments. Loans provided to other companies for a period of no more than a year are also reflected here.

- Balances of money in letters of credit, accounts (currency and settlement), in the cash register, on check books and other payment documents.

Definition

Current assets are a set of material assets that serve the operating activities of the company and are used in one production cycle. The main task of such assets is to cover daily expenses and maintain the functioning of the enterprise.

Current assets include all property that may belong to a legal entity by right of ownership:

- money located in the cash center and in current accounts;

- accounts receivable;

- shares, savings and deposit certificates, bonds;

- materials, fixed assets, finished products;

- copyrights, patents;

- unfinished production;

- attachments.

Characteristics of stages

The monetary stage is the initial stage. Using the funds that the enterprise has, production inventories and work in progress are formed. The organization carries out financial transactions. At the second stage, the production process takes place. Labor consumes funds to create a new product. It carries the value newly created and transferred from materials. Current assets change their shape again, moving to the third stage of the circuit. It consists of selling manufactured products and obtaining funds. The produced goods may remain in the warehouses of the enterprise for some time. A certain part is released or shipped to customers. As a result, the company's current assets act as goods and are transformed into monetary form after the products are sold. After this, a new cycle will begin.

Kinds

Current assets accompany the uninterrupted processes taking place in the organization: financing, purchasing, production, sales, sales. Such assets can be characterized as having the following characteristics:

- high mobility and ability to change, in other words, they can be transformed from one type to another during the commodity-money-commodity process;

- adaptability to changes occurring in the commodity and financial markets, since they are capable of changes if the company changes its type of activity;

- having high liquidity;

- comparative ease of management, since management decisions based on their turnover produce results in a short time.

The disadvantages associated with working with current assets include the following features:

- part of the assets in the form of cash or receivables may lose their value due to inflation;

- temporarily free assets are not able to generate profits, with the exception of those used in “quick” investments, and even vice versa: excessively generated inventories of goods and materials cause additional costs for storage and processing;

- Inventory of any content is prone to losses associated with the natural loss of the product.

Current assets, current liabilities

The indicator of the company's provision with working capital is necessary to assess the amount of funds available to the company. Their volume should be sufficient to maintain the company's financial stability. As for material reserves, the level of provision with them reflects the ability of the organization’s own sources to cover existing needs without borrowing. This indicator is assessed primarily in accordance with the available resources at the enterprise. If their volume turns out to be significantly higher than their justified need, then the company will be able to cover only some part of the reserves with its own working capital. In this case, the indicator will be less than one. A situation may arise at an enterprise when material resources are insufficient to ensure uninterrupted production of products and continuous economic activity. Then the required indicator may be greater than one. However, this result is not always a sign of the company's financial health.

The classification of current assets by level of liquidity and probable investment risk reflects the quality of the enterprise's funds involved in turnover. Its task is to identify those objects whose sale is unlikely. The liquidity of assets is determined by the speed at which they are converted into cash. It characterizes the solvency of the company.

Description of the company's assets in the updated accounting. balance sheet 2021

Information in the account. the balance, as is customary, is entered on the basis of a reliable accounting record. accounting. Data on all property of the enterprise is recorded along the asset lines of the updated balance sheet. That is, everything that is his property is necessarily displayed in the ledger. balance. At the same time, the top assets consist of property, which, in fact, does not change until the end of its existence and remains in its primary form.

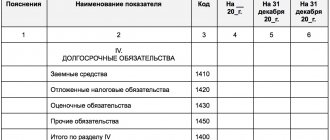

It should also be noted that the outdated, previous form of bu. balance, contained line codes consisting of three digits. For example, "140", "210". Its current, updated form already includes four-digit codes. Example for assets: “1150”, and for liabilities: “1700”. Although the assignment of lines of the first and second forms of accounting. This did not change the balance significantly. The difference between the forms lies only in the codes, the list of lines themselves and the detail of information.

When forming the bay. balance sheet data is entered as of the corresponding reporting period. The modern form is filled out taking into account the requirements and explanations provided by PBU 4/99. This Regulation was approved by Order of the Ministry of Finance of the Russian Federation No. 43n dated July 6, 1999 (as amended on November 8, 2010, as amended on January 29, 2018).

Accounting assets The balance sheet consists of two large parts: non-current assets (hereinafter - VA) and current assets (hereinafter - OA). Total for assets you need to fill out two sections. It should also be noted that profit as the financial result of the enterprise’s operation is recorded on page 1370 in liabilities and does not apply to assets. The balance sheet can contain information both for the current and for the previous, already past period.

Meanwhile, the word “balance” translated from Latin “bis lanz” means “two scales,” which indicates the achievement of balance. In this case, the financial balance of the enterprise is implied. Consequently, the compiled account. the balance sheet reflects the actual state of the enterprise's financial balance.

Important! Buh. the balance sheet is formed correctly if the total of assets (in terms of grouping one’s property) = the total of liabilities (in terms of grouping financial sources and destinations).

In order to give a comprehensive accurate assessment and characterization of the financial stability of an enterprise, it is customary to analyze the accounting. balance by sections.

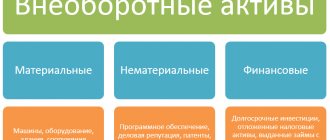

Non-current and current assets

Enterprise assets are used in the production process. Based on the degree of involvement in production, non-current and circulating resources are distinguished. Non-current assets are considered to be all the property and funds of an enterprise that indirectly support the production process, but are not completely involved in it. In other words, they are not included in the production cycle, so they do not wear out and can last a long time.

Non-current (main) resources can be tangible, intangible and financial resources:

- Land plot;

- Private reservoir and subsoil;

- Forest;

- Building;

- Transport;

- Equipment;

- Trademark;

- Securities;

- Patent;

- Financial obligations.

Non-current resources are a solid foundation with the help of which an organization was created (authorized capital, property, staff were formed) and production was established.

When the enterprise has already been formed and is ready for production activities, current assets are used - property and funds that contribute to the implementation of the current production process. Such resources are also called operational or short-term, since they are fully involved in the creation of the product and are used throughout the year.

Working (current) resources consist of tangible and intangible property:

- Stankov.

- Equipment.

- Transport.

- Technologies.

- Organizational ideas.

Why calculate your net worth?

Reason 1. Exercising financial control over the state of affairs

The indicator is used to monitor the financial condition and reflects the efficiency of the functioning of the business entity.

First of all, the ratio of net assets to the size of the authorized capital (AC) is carried out. Both of these indicators are very important in relation to each other. The value of the latter should be greater. Otherwise, the law requires certain changes to be made within a specified period.

So, the organization’s annual report indicates:

1) the dynamics of changes in both net assets and authorized capital of JSC and LLC for the last three completed financial years, including the reporting year, or, if the organization has existed for less than three years, for each completed financial year;

2) the results of an analysis of the reasons and factors that, in the opinion of the sole executive body of the company, the board of directors, led to the fact that the ratio of indicators was violated;

3) a list of measures that are proposed to be implemented to correct the situation.

A special feature for JSCs: they must make such an assessment of the ratio of indicators quarterly at the end of each quarter. If the net assets turn out to be less than the authorized capital by more than 25 percent at the end of three, six, nine or twelve months of the reporting year following the second or each subsequent reporting year, at the end of which the amount of the authorized capital turned out to be greater, the JSC twice with a frequency of once a month is obliged to place in the media in which data on state registration of legal entities is published, a notice of a decrease in the value of its net assets.

The creditor of the company, if its rights of claim arose before the publication of the specified notice, no later than 30 days from the date of the last publication of such notice, has the right to demand from the JSC early fulfillment of the corresponding obligation, and if it is impossible to fulfill it early, termination of the obligation and compensation for related losses. The statute of limitations for filing this claim in court is six months from the date of the last publication of such notice.

The court has the right to refuse to satisfy such a claim of the creditor if it is proven:

1) the rights of creditors are not violated by such a reduction;

2) the security provided for the proper performance of the relevant obligation is sufficient.

The value of net assets at the end of two financial years in a row cannot be less than the Criminal Code (clause 4 of Article 30 of Federal Law No. 14-FZ, clause 6 of Article 35 of Federal Law No. 208-FZ). Otherwise, no later than six months after the end of the relevant financial year, one of the following decisions must be made:

1) on reducing the authorized capital of the company to an amount not exceeding the value of its net assets;

2) on the liquidation of the company.

The Civil Code also provided an opportunity in this case to take the “reverse” route - to increase net assets to the size of the authorized capital (clause 4 of Article 90 of the Civil Code of the Russian Federation, clause 4 of Article 99 of the Civil Code of the Russian Federation).

Possible ways of such an increase: making additional contributions to the company's property, using borrowed funds, writing off uncollectible debt, increasing profits and reducing losses, revaluing, issuing shares. Each of these paths has its own difficulties. The use of financial assistance increases the size of the obligation. The increase in profit and revenue is limited by a lack of resources and limited sales markets, etc. You can, on the contrary, take the path of reducing costs and lowering the level of obligations. Such a reduction can be achieved through their restructuring (changing repayment schedules, deferring payments, by paying off part of the debts, which is possible, in turn, if there is a sufficient amount of available funds that can be used to fulfill the organization’s obligations. For these purposes, it is possible, in particular, to improve work in the collection of receivables, including organizational and judicial work with counterparties, sale of debts to third parties, settlements, etc.

At the same time, it is worth mentioning the so-called “imaginary assets” - in order to improve performance or for other reasons (technical errors, insufficient qualifications of responsible persons), assets are reflected in the accounting records that should not be reflected there on the date of the assessment. Such “imaginary equity capital” does not bring real profit; it has “value” only on paper. What to hide, sometimes this is done in order to ensure that the organization’s financial performance indicators comply with regulatory requirements (for example, for carrying out activities in licensed areas), to obtain borrowed funds, including credit, for a kind of “adjustment” of tax consequences for the business.

Factors that artificially inflate the value of net assets include, in particular, unrealistic receivables that must be written off (for example, the statute of limitations has expired, the counterparty has ceased to exist without succession), fixed assets unsuitable for use due to wear and tear, or intangible assets unusable due to obsolescence, as well as investments in subsidiaries conducting unprofitable activities, when the value of such a subsidiary due to unprofitability is lower than the amount of investments in it, etc.

Reason 2. Payment of dividends

As stated in paragraph 1 of Article 29 of Federal Law No. 14-FZ, an LLC does not have the right to make a decision on the distribution of its profits if, at the time of making the decision, the size of its net assets is less than its capital and reserve fund or becomes so as a result of such a decision.

Similar restrictions are established by law for JSCs, which do not have the right to make a decision (announce) on the payment of dividends on shares and pay declared dividends if on the day of such a decision / on the day of payment, respectively, the size of the JSC’s net assets is less than its authorized capital and reserve fund , and the liquidation value of the placed preferred shares exceeds the nominal value determined by the charter or becomes less than their size as a result of such a decision/as a result of the payment of dividends (clause 1, 4 of article 43 of the Federal Law No. 208-FZ).

Reason 3. To calculate the actual value of the share

The actual value of the share of an LLC participant corresponds to the part of the value of net assets proportional to the size of his share (Clause 2 of Article 14 of Federal Law No. 14-FZ).

In what cases will it be necessary to calculate it?

Firstly, in the case of the acquisition of a share by the Company at the request of its participant, when the constituent documents prohibit its alienation to third parties, and other participants refused to acquire it, or, in accordance with the charter, it is necessary to obtain consent for alienation, but it was not received.

Secondly, in cases where a company acquires a share at the request of its participant who voted against the general meeting making a decision to carry out a major transaction or to increase the authorized capital, in accordance with clause 1 of Art. 19 Federal Law No. 14-FZ, or who did not take part in the vote.

In the two indicated cases, the period for payment is three months from the date of occurrence of the corresponding obligation, unless otherwise specified in the charter. Its size is determined on the basis of the company’s financial statements for the last reporting period preceding the day the corresponding request was submitted.

Thirdly, in cases of exclusion of a participant, when his share has passed to the LLC.

Fourthly, when the consent of the LLC participants has not been received to transfer the share to the heirs, legal successors, the buyer at a public auction, the founders (participants) of a liquidated legal entity who have proprietary rights to its property or rights of obligations in relation to this legal entity.

Fifthly, in the event of a participant leaving the company (if the Charter does not contain a corresponding prohibition) by alienating his share of the LLC.

Sixthly, in the case when the LLC pays the creditors of its participant the actual value of its share at the request of the creditors.

The payment is made from the difference between the value of the company's net assets and the size of its capital. If such a difference is not enough, the obligation to reduce the authorized capital by the missing amount is prescribed.

Reason 4. Increase in authorized capital

An LLC may increase its authorized capital at the expense of its property, and (or) at the expense of additional contributions of its participants, and (or), if this is not prohibited by its charter, at the expense of contributions from third parties accepted into the company.

If the increase occurs at the expense of property owned by him, one cannot do without calculating the amount of net assets, since clause 2 of Art. 18 Federal Law 14-FZ establishes the rule: the amount by which the authorized capital is increased at the expense of the property owned by it should not exceed the difference between the net assets of the LLC and the amount of the authorized capital and its reserve fund.

A JSC can increase its authorized capital by increasing the par value of shares or placing additional shares. At the same time, an increase by placing additional shares can be carried out at the expense of its property, and if it is through an increase in the nominal value of the shares, then it is carried out only at the expense of the JSC’s property.

For cases of increasing the authorized capital of a joint-stock company at the expense of its property, a rule has been established similar to the rules for an LLC: The amount by which the authorized capital of a joint-stock company is increased at the expense of the property of a joint-stock company must not exceed the difference between the size of net assets and the amount of the authorized capital and its reserve fund (p .5 Article 28 Federal Law No. 208-FZ).

Turnover

The indicator reflects the number of completed product turnover cycles in a certain period. Or according to another scenario: it characterizes the number of turnover of a monetary unit of assets for the period being analyzed, as well as how many units of finished products in monetary terms each unit of current assets brought. This indicator is considered by investors when making a decision to invest in a project when assessing the effectiveness of a possible investment of capital.

Description

A company's net worth is the amount of money remaining after all of its liabilities have been subtracted from its assets. This is the theoretical amount of funds that would be available for distribution to investors if the company were to be liquidated.

A negative net worth is a reasonable indicator of serious financial problems. This ratio is sometimes used by lenders who are required to maintain a minimum amount of net assets to cover the outstanding loan balance.

Core and non-core assets

There are also core and non-core resources, depending on the direction of the enterprise. Core resources are property and funds used directly in the production and marketing of products. These are almost all savings corresponding to the type of activity of the enterprise, without which development and profit making are impossible.

Non-core resources are any property and funds that are not currently used by the enterprise and only generate expenses. A similar situation can be caused by:

- Privatization;

- Repurposing, transition to a new market segment;

- Buying out cheap property from a bankrupt entrepreneur.

The best example of a non-core asset is the property of debtors, which the bank seizes to pay off the debt. Usually banks try to sell such property as quickly as possible, but this can be difficult to do in a short time, so banks are forced to maintain this ballast for some time.

Maintaining non-core resources for a long time that do not work for the company and do not generate profit is expensive for the entrepreneur: they will have to pay property taxes and pay for housing and communal services. This means that the rational solution is to sell the property or transfer ownership rights. But those who own non-core property should take into account that they will offer the lowest price for it.

Comparison with authorized capital

In addition to dynamic analysis, after the first year of operation, the company is obliged to regularly compare the value of net assets and the authorized capital. The law establishes that the size of the private equity must be greater than the authorized capital.

If the calculations reveal a reverse trend, this greatly increases the risk of bankruptcy of the company, and legal documents prescribe reducing the authorized capital to the size of the private equity. If its monetary volume is already minimal, the enterprise is obliged to announce its liquidation. However, the current legislative document defines the following:

- Even in cases where the value of net assets is actually less than the authorized capital, the company can maintain solvency, conduct financial activities for a certain time and strictly fulfill debt obligations.

- Requirements to reduce the size of the authorized capital or liquidate the organization are considered interference in its activities; in addition, the enterprise can be declared bankrupt, which will serve to protect the interests of creditors.

If you are interested in how to find fixed costs, read this material.

Find out what the absolute liquidity ratio shows here.

Accounting

Due to the fact that the property of the enterprise is distinguished by its heterogeneous formation, it is accounted for using different accounting accounts adopted by the Ministry of Finance, pr. 94n dated 10/31/2000. For this purpose, 50, 51, 52, 58, 10, 41, 62 and similar accounts are used, located in the sections “inventory”, “cash”, “settlements”, “finished products/goods”.

Debts intended for repayment are related to negotiable property because, to some extent, they are already invested funds that are the property of the company. The accounts mentioned are grouped in the balance sheet into a certain number of lines. To understand what data should be entered into each of them, a special formula is used.

What is the book value of assets?

The book value of assets is a set of values and objects of an organization, expressed in numbers. In simple words, this is the result of property valuation. The information received is displayed in the accountant’s financial statements.

Important: the value of assets on the balance sheet differs from the valuation of net assets; the latter value is the sum of the enterprise’s assets excluding its liabilities.

This indicator is important for making decisive management decisions to optimize the activities of the enterprise, lending, and attracting third-party investments.

The process of applying book value, the procedure for its calculation and the definition of the concept as a whole are regulated by the following standards:

- Federal Law-208 on JSC from 1995;

- Federal Law-14 of 1998 on LLC;

- Supreme Arbitration Court of the Russian Federation No. 62 of 2001;

- Letter of the Federal Commission for the Securities Market of the Russian Federation No. IK-07/7003 of 2001.

The BSA includes the price value of assets, regardless of the difference to which group they belong.

Precautionary measures

The main difficulty with the net worth ratio is that it is based on historical estimates, which may not reflect current market conditions. For example, if a company has a production line consisting of several custom-made units, there may be no resale market for the machines, rendering them useless if the company is liquidated.

Likewise, if a company has ownership of a valuable patent, only the capitalized legal costs associated with the patent are capitalized as an asset, even though the actual value of the patent itself may be much higher. In addition, the value of the brands will not appear on the balance sheet.

For these reasons, detailed knowledge of a company's individual assets and liabilities is a better tool for determining net worth than the simple calculation presented here, which is based on historical accounting information.

Ways to increase the indicator

Regular and thorough study of NA allows you to find ways to increase them, such as:

- improving the composition of fixed assets;

- sale or destruction of unused property and equipment;

- increasing the volume of goods sold by improving product quality, expanding sales channels, changing pricing policies, and using new ideas and solutions;

- increasing the efficiency of control over the company's inventories, debts and investments.

Net assets are the most important indicator of a company's performance. The main goal of competent and timely analysis of financial data is the ability to prevent and avoid undesirable situations in the activities of any organization.

Assets and liabilities

To better understand the assets of an enterprise, you need to know what the concept of liability means. Accounting statements necessarily reflect assets and liabilities. Assets are property (things or money) that always generate and increase income. Liabilities are assets that satisfy daily needs, but require depreciation and repair costs.

For clarity, let's look at examples. A man has saved up 2,000,000 rubles and plans to use it at his own discretion. There are two available options for implementing these tools:

- Option 1. Deposit 2,000,000 rubles. on a bank deposit at 10% per annum. After a year, you can withdraw 2,200,000 rubles from the account, that is, make a profit of 200,000 rubles;

- Option 2. For 2,000,000 rubles. buy a one-room apartment. Repairs will cost 200,000 rubles, furniture and furnishings will cost another 200,000 rubles. Payment for utilities every month is approximately 4,000 rubles. This means that 48,000 rubles will be spent on housing and communal services per year. Consequently, the purchase of an apartment brought costs amounting to 448,000 rubles.

Conclusion: assets increase themselves: if 2,200,000 rub. put again at the same interest, in a year you can get the amount of 2,420,000 rubles. and so on. Liabilities spend money irrevocably: expenses for repairs and utilities will never be returned.

It must be said that liabilities are inevitable, since they contribute to the satisfaction of our current needs and accompany any activity.

The company's liabilities are:

- Loan repayment.

- Purchase of raw materials.

- Issuing wages to employees.

- Payments to the state.

- Investments in your authorized capital for further activities.

The ideal option is when the indicators for assets by the end of the billing period exceed the indicators for liabilities or are at least equal to them. In this situation, we can say that the business is developing successfully. If the situation is different, it is worth analyzing the effectiveness of the strategy being pursued. When the return on active resources is negative for a long time, the company faces bankruptcy.