Completing 1 section

The first section should contain general indicators for production, shipment and sales. Amounts are paid excluding excise taxes and VAT.

- Line 01 – it does not include income received by the company from the sale of fixed assets, intangible assets, securities, inventories and currency;

- Lines 03 and 05 are filled out only in forms submitted for March, June, September, December;

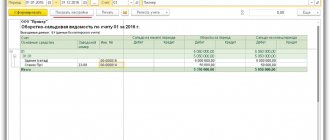

- Line 05 contains the balances of purchased goods (for this you can use the turnover of account 41, taking the final balance on it).

Section 1. General economic indicators

By line 01

indicates the cost of goods (work, services) of own production, actually shipped (transferred) in the reporting period to the third party.

Attention! This line does not reflect income from the sale of fixed assets, intangible assets, inventories, currency values, and securities.

On line 02

indicates the cost of goods sold purchased externally for resale.

By lines 03-04

the balances of finished industrial and agricultural products of own production are reflected as of the end of the month, and

line 05

shows the balances of goods of non-own production.

Attention! Lines 03-05

are filled out only for the following reporting periods: March, June, September and December.

On line 06

reflects the cost of industrial products (goods) of own production, credited in the reporting period to the organization's fixed assets.

On line 07

reflects the cost of construction and installation work performed by the organization’s own resources for its own needs.

On line 08

indicates the cost of agricultural products of own production, included in fixed assets in the reporting period.

On line 09

indicates the cost of agricultural products of own production, transferred to its industrial divisions for further processing (for example, the cost of grain transferred for processing into flour, etc.).

On line 10

the cost of processed customer-supplied raw materials and materials is indicated.

On lines 11-12

details the revenue reflected on

line 01

:

- line 11

indicates that part of the revenue that comes from innovative goods (works, services); - line 12

reflects the cost of shipped goods (works, services) manufactured using nanotechnology.

On line 13

the total volume of orders (contracts) for the supply of products in subsequent periods is indicated. This order is formed on the basis of concluded contracts, regardless of the deadline for their execution, with the exception of completed and canceled contracts.

On line 14

the volume of orders (out of the total volume on line 13) attributable to export deliveries of products is reflected.

In lines 15-17

reference data on the export and import of services is indicated. In case of availability (absence) of services, marks are made in the appropriate fields.

Completing section 3

Section 3 indicates the turnover of wholesale and retail trade, as well as public catering. In this section, unlike the previous ones, values are given taking into account excise taxes and VAT. Some goods sold are not included in retail trade turnover. These include goods that did not meet the warranty period and were sold by the company through the retail network.

Line 22 of Section 3 should reflect revenue from the sale of goods for the personal needs of the population. This line does not include:

- goods that were received by employees as payment for labor or that did not meet the warranty period;

- travel tickets, lottery tickets;

- real estate;

- transport coupons;

- telephone cards, cards for payment of communication services

Line 26 reflects revenue from the sale of purchased goods. Revenue from goods sold to the public, but this line is not included.

Line 27 reflects revenue from sales of own products to the public, as well as purchased goods without processing.

Who submits Form P-1

The list of respondents includes:

- organizations. Exception: SMEs, credit and non-credit financial organizations, companies with no more than 15 employees during the previous two years and an annual turnover of up to 800 million rubles;

- organizations with a license to extract minerals (the number of employees and turnover do not matter);

- legal entities reorganized or registered in the previous or previous year;

- non-profit organizations that produce goods and provide services to other legal entities and individuals.

The report is sent to the Rosstat branch at the location of the company or separate division. If the activity is carried out at a different address, Form P-1 must be submitted at the place where the activity is actually carried out.

How to make changes to reporting

In order to clarify the data previously submitted to the territorial department of Rosstat for January - December of the reporting year, you should send changes in an official letter no later than January 15 of the year following the reporting year to generate final data on the number and salary of employees.

If you need to change information for July, November or another month, you should officially notify the territorial department of Rosstat. This can be done no later than the 15th day of the month following the reporting month.

How to reflect non-working days in P-4

Non-working day

July 1, 2021 does not need to be included in the number of man-hours worked, since in fact the employees did not perform labor duties. The same decision was applied for non-working days on June 24 and the period from March 30 to May 8.

The number of man-hours worked (columns 5-6) takes into account data on remote employees.

Compensation and incentive payments

those working in the fight against coronavirus (medical workers) must be included in the accrued wage fund (columns 7-9 of form P-4).

Documentation:

Design rules

Employers use only a unified form to submit reports. The use of forms independently developed by the enterprise is not permitted. Let's look at how to fill out the P-4 report.

Title page

On the first page indicate:

- the reporting period for which information is submitted;

- full and short name of the enterprise; on the form containing information on a separate division of a legal entity, the name of the separate division and the legal entity to which it belongs is indicated;

- actual and postal addresses of the organization;

- OKPO code;

- identification number - for the head and separate divisions of the legal entity.

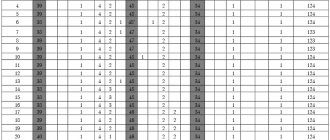

Filling out the tables

The second page of the document contains two tables that reflect information about the number of employees, the wages accrued to them and the time they worked.

First table by columns:

- A (lines 02 to 11) is intended to indicate the types of activities of the enterprise;

- B - code according to OKVED2;

- 1 is the sum of the values of columns 2, 3 and 4;

- 2 - average number of workers; to calculate this indicator, we add up the number of employees for each calendar day of the month and divide by the number of days in the month; when submitting the report for the 4th quarter, we first count the number of employees for each of the 12 months (information is transmitted to Rosstat from the beginning of the year), then we divide the result by 12, and write down the final figure; if the report is submitted for the 2nd quarter, calculate the number of employees for each of the 6 months and divide by 6; in our example, the report is for a month, so we don’t enter anything;

- 3 - average number of external part-time workers (use the calculation method described in the Rosstat instructions);

- 4 - the average number of employees who performed work under civil contracts (a similar algorithm is used for calculation).

Second table of the form:

- 5, 6 - the number of man-hours actually worked by payroll employees and external part-time workers; This does not take into account the time a worker is on vacation, on off-the-job training courses, or during periods of illness, but it is necessary to take into account employees who perform job duties remotely (see Rosstat letter No. 07-07-2/3061-TO dated 07/08 .2020);

- 7–10 - data on the accrued salary fund, which is taken from accounting documents; include in columns 7, 8 and 9 incentive payments that employees are paid for special working conditions in the fight against coronavirus (see letter of Rosstat No. 1540/OG dated 07/08/2020);

- 11 - social payments.

There are small exceptions to the rules. Companies employing more than 15 people and which are not small businesses:

- in the monthly report for columns 1, 2, 3, 4, 7, 8, 9, 10, columns 5, 6, 11 are omitted;

- in the quarterly P-4, all columns are filled in, but the indicators in columns 5, 6, 11 must reflect data for the period from the beginning of the year.

Even if the company is not a small business, but it employs less than 15 people, all fields must be filled out. But the data in columns 5–11 is needed not for the quarter, but for the period from the beginning of the year.

What is double chance

Gambling means taking risks.

But there are a number of bets at which the share of risk is reduced. In popular team sports, there are usually three possible outcomes: the first team to win (1), the second team to win (2) and a draw (X). In the bookmaker's line there are bets indicated by a combination of these symbols: 1X, 2X, 12. These are called “double chance” or “double outcome” bets. Such bets are very popular, since the player receives a win in two possible outcomes of the match, namely:

- The 1X bet will win if the real or nominal (selected by lot) home team wins, or the match ends with an equal score.

- The 2X bet will bring profit to the player if the visiting team wins or if the teams play in a draw.

- For the bookmaker to count the winning bet as 12, either team must win. If the match ends with an equal score, the bettor will lose the bet amount.

In such bets, the risk of losing is lower, so the odds are lower. Let's consider a 1X bet using the example of the Norwich City - Brighton match.

- The player will receive the winnings if the winner of the match, no matter what the score, is the Norwich City team or if the score at the end of the game is equal. Winning amount at a bet of 100 rubles. will amount to 168 rubles for both outcomes.

- If Brighton wins, the bettor will lose 100 rubles.

Let's consider the X2 bet using the example of the English Premier League match "Liverpool" - "Aston Villa".

The Aston Villa team has serious motivation to win, they are one point away from relegation. Liverpool is a stronger team and the current Premier League champion. But the team sometimes behaves strangely, for example, it lost to Manchester City in vain. In this game, betting on a double outcome is less risky and therefore more reasonable.

- The bettor will win if the match ends with the score in favor of the second team - Aston Villa or the teams play in a draw. With a bet of 100 rubles. the player will receive 328 rubles.

- The bettor will lose if Liverpool win. In this situation, the player’s loss will be 100 rubles.

And finally, let's look at the last beta variation for a double outcome - 12. Matches end with an equal score not very often. The probability that the forecast will come true is maximum, so bookmakers set very low odds. Let's take as an example the match between the Russian hockey teams “Moscow Kremlevtsy” - “Central Culturologists”.

- The player will receive winnings if either team wins.

- The bet will be lost if the match ends with an equal score.

Since the odds are small, in order to make a profit, it is better to form these types of bets into express bets, or better yet, into systems.

W1 in football betting

Almost all bookmakers have the widest range of offers for football matches. But, despite the fact that a huge selection of bets is always offered for this sport, even experienced bettors who know the intricacies of handicaps and totals often place bets on the victory of the team considered first.

In group qualifying matches, the first team status is given to the teams that play at home. It is given to them automatically. At the UEFA Championships and the World Championships, the opportunity to play on their own field falls to rare teams; the championship is determined by drawing lots.

In football, the outcome of a match can be in favor of one team or another or with an equal score. In order for a bet on team 1 to win, only the team that is considered first must win.

Let's look at the example of the London Cup match between Arsenal and Manchester City at the Fonbet bookmaker. In the line of this bookmaker, the bet on the victory of the first team is designated as “1”, but its value does not change.

Arsenal is the first team and a clear favorite, as indicated by the high betting odds. Since the chances of winning are high, you can bet a large amount, for example, 1000 rubles.

- The bet will win and the player will receive 9,500 rubles if Arsenal wins.

- The bet will lose if Manchester City wins or the match ends in a draw, and the bettor will lose 1000 rubles.

Refunds for this type of bet are provided only if the match did not take place or was interrupted and could not resume again.

Half time/match betting

Betting on time-matches, which are common in football and hockey, is popular among experienced players. Their essence lies in correctly predicting simultaneously the outcomes of a half and the entire match. But few bookmakers offer these types of bets. There are a total of 9 types of bets for time matches:

- W1W1 – the home team will win the first half and the game.

- W1X – the first half will end with the victory of the real or nominal home team, and the match will end with a draw.

- W1 W2 – the home team will win in the first half, and the away team will win the match.

- HP1 – in the first half the teams will play a draw, the match will end with the score in favor of the team playing as the hosts.

- XX - the game will be either tense or boring, since the score will be equal in the outcome of both the half and the entire match.

- HP2 – in the first half of the game, neither team will open the score, or it will be equal, but the team playing as guests will win the game.

- W2 W1 is the most popular bet offered for time matches. It will play if the visitors win at the end of the first half and the hosts win the game.

- W2X – in the first half, the visiting team will win, and the match will end with an equal score.

- P2P2 – both in the first half and in the match, the scores will be kept by real or nominal guests.

Regardless of which bet is chosen, it is necessary to collect as much data as possible to confirm the correctness of the forecast.

How to fill out form P-4 (NZ)

The same Rosstat instructions from Order No. 404 contain instructions for filling out P-4 (NZ) statistics in 2021; officials have not developed any other recommendations.

Like the P-4 form, the P-4 (NZ) form consists of two pages and has a similar structure. View the completed sample quarterly report P-4 (NZ) based on the results of the 4th quarter of 2021.

Title page

Here they indicate:

- the reporting period for which information is submitted;

- full and short name of the enterprise;

- actual and postal addresses of the organization;

- OKPO code.

Table

The table consists of three columns and 22 numbered lines; they record information about employees who:

- work part time;

- are involved in the watch;

- scheduled to be released;

- are on vacation at their own expense;

- provided to other organizations or sent by other organizations.

Each row of the last column contains data corresponding to the information in the first column.

What is P2 in football betting?

Every sport has its own subtleties. In betting on matches of the most popular sport, the second team is not necessarily the guests. In North American leagues, second refers to the host team, but more often, who will be first is decided by lot.

When choosing bets, you should first find out which of the participants in the competition is playing on their territory. It is more difficult to play away, and betting odds do not always indicate who is the favorite and who is the underdog. A bet on the second team to win makes sense if there is maximum confidence that he will play. Let's consider a bet using the example of the Spanish Premier League game Sevilla - Eibar.

Bets on team victories have a large difference in odds, which means that the bookmaker highly estimates the chances of the second team winning. Eibar is behind Sevilla on points. But in this match, 7 Sevilla players will not be able to play due to injuries and disqualification. Suppose a player places a bet of 1000 rubles on the victory of the second team.

- If Eibar wins, the bettor will receive a profit from the bet in the amount of 7,350 rubles.

- If the second team loses or there is a draw, the bet will not work and the player will lose 1000 rubles.

Possible penalties for failure to submit

If the procedure for submitting a report is violated, the legislation of the Russian Federation, in particular Article 13.19 of the Code of Administrative Offenses and Article 3 of Law No. 2761-1, provides for penalties.

The fine for violating the procedure for submitting a report to Rosstat, in particular for failure to provide primary static information for any reason, is:

- up to 20,000 rubles directly for officials;

- up to 70,000 rubles to the companies themselves.

If a violation is detected again, the fines increase:

- up to 50,000 rubles for officials;

- up to 150,000 rubles per company.

The possibility of increasing the fine for a repeated violation is provided for in Article 13.19 of the Code of Administrative Offenses of the Russian Federation.

If there are no indicators

Rosstat emphasizes that everyone is required to submit reports. If the company has not worked for some time or there is no data that should be entered, for example, there are no employees who work part-time, it is acceptable to submit the forms with zeros. It is also possible to submit a blank report if the organization did not operate during the reporting period.

IMPORTANT!

Previously, Rosstat asked to send an official letter stating that the P-4 (NZ) or P-4 report was not submitted because there were no indicators in the reporting quarter. But by order No. 412 of July 24, 2020, this rule was canceled; it is enough to submit only the zero form with a completed title page.

Statistical reporting in 2021: deadlines

In addition to the official Rosstat resource, there is another way to find out which forms of statistics to submit in 2021 using the TIN - contact the territorial body of the department at the place of registration and clarify the list of current reports. Statistical service employees are required to inform business entities about all reporting forms and the procedure for filling them out, in accordance with the rules approved by the Government of the Russian Federation No. 620 dated August 18, 2008. Information is also available on the official website of Rosstat.

Since administrative fines are provided for violating the deadlines for statistical reporting, below is a table of deadlines for submitting statistical reporting in 2021, which will help you submit forms on time (by following the links in the right column of the table, you will see instructions for filling out the specified report).

| Statistical Observation Form | Deadline | Form |

| No. 1-T “Information on the number and wages of employees” | Until 01/22/2020 | 1-T |

| No. 7-injuries - about injuries at work and occupational diseases | Until 01/27/2020 | 7-injury |

| No. MP (micro) - data on the main performance indicators of a micro-enterprise | Until 02/05/2020 | MP-micro |

| No. 1-P - about the activities of the organization | Until 04/01/2020 | 1-P |

| No. 12-F - on the use of funds | Until 04/01/2020 | 12-F |

| No. 57-T - on wages of workers by profession and position | The form must be submitted once every 2 years, the next time - until November 29, 2021 for October 2021 | 57-T |