Operations for accounting for losses and shortages are specific and atypical for many enterprises. The accounting account is used to reflect the amounts of identified shortages. In this article we will look at the features of accounting for shortages and damage to valuables, and also look at typical account entries and examples.

Why are loss standards needed?

Account 94 “Shortages and losses from damage to valuables” influences the formation of expenses. It displays:

- Deficiencies identified during the inventory.

- Damage resulting from damage to company property.

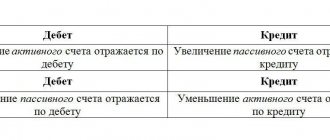

This account is active-passive, so it can have debit and credit balances. The debit collects lost property in total terms. Depending on the amount of losses, there are certain indicators, based on which the company writes off its damage:

- within the limits of natural loss;

- above the norms of natural loss with the appointment of a responsible person;

- above the norms of natural loss without a specific culprit.

Natural loss is the property’s ability to shrink, shrink, rot, break dishes and other factors beyond the control of the carrier, supplier or storekeeper.

For each such product in trade there are standards within which shortages and losses are acceptable. For example, when transporting peaches, a certain amount may be crushed in the container, since this is a very delicate product, and there are potholes and potholes on the roads.

To prevent this factor from being used for theft purposes, a specific standard has been established for the product. Loss in excess of the required standard is regarded as theft or intentional damage. Natural loss is calculated using the formula:

cost (weight) of goods * loss standard / 100.

Account 94 in accounting

When performing control and audit activities, as well as inventory checks of the activities of any economic entity, inconsistencies between accounting data and actual indicators are identified.

We will tell you in our article how to correctly reflect the identified shortcomings in the company’s accounting. ConsultantPlus FREE for 3 days Get access In accordance with Order of the Ministry of Finance No. 94n, all identified shortfalls from damage to property should be reflected in special account 94. To assign such transactions to special account 94, first of all, the fact of loss or shortage of the company’s assets must be documented. For example, draw up an inventory list that will reflect discrepancies, or draw up a special act. Then the amount of certain damage is attributed to the perpetrators, if they have been identified, or to the expenses of the enterprise, if the perpetrators cannot be identified.

Let's look at how to close account 94 at the end of the year, and also determine which transactions to reflect operations on losses and damages.

What operations are used to replenish?

When shortages and damage beyond the standard are identified, the company’s management has two options:

- Attribute the amount of damage to the person at fault.

- Decide that there are no culprits.

Property losses are reflected by the following entries:

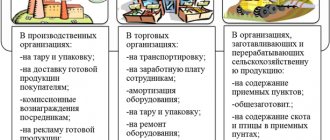

- Dt 94 Kt 01 (07, 08, 10, 44) - property lost during storage in warehouses, during construction and installation;

- Dt 94 Kt 20 (23, 25, 26, 29) - losses and shortages in the production process;

- Dt 94 Kt 60 (73, 76) - when accepting goods (products) or transporting them from suppliers.

From the author! 94 acts as an intermediate. When the amount of shortfall appears on the debit, then it must then go to the guilty person or be written off.

Typical transactions for account 94

The most common transactions on account 94 are entries to reflect the shortage of goods, materials and fixed assets identified based on the results of the inventory.

| Dt | CT | Description | Document |

| 94 | 01 | A shortage of a fixed asset item was identified (the residual value of fixed assets was written off) | Inventory sheet |

| 94 | 11 | Write-off of the cost of animals at livestock enterprises (if a shortage is identified, as well as dead and forced slaughter) | Inventory sheet |

| 94 | 07 | Equipment shortage identified | Inventory sheet |

| 94 | 08 | A shortage of investments in non-current assets has been identified | Inventory sheet |

| 94 | 10 | A shortage of materials has been identified | Inventory sheet |

| 94 | 41 | Reflection of the actual cost of goods for which shortages or damage have been identified | Inventory sheet |

The amounts of shortages identified in production are reflected in the following entries:

| Dt | CT | Description | Document |

| 94 | 20 | A shortage of work-in-progress products (main production) has been identified. | Inventory sheet |

| 94 | 23 | A shortage of work in progress products (auxiliary production) has been identified. | Inventory sheet |

| 94 | 29 | A shortage of work in progress products (service production) has been identified. | Inventory sheet |

| 20 (23, 29) | 94 | The amount of the identified shortage is attributed to the expenses of the main (auxiliary, servicing) production | Write-off act |

Depending on the fact of identifying the person responsible for the shortage, the cost of losses can be covered or written off as expenses:

| Dt | CT | Description | Document |

| 73 | 94 | The amount of the shortfall is attributed to the guilty party | Inventory sheet, Commission report |

| 91 | 94 | The amount of the shortfall is charged to other expenses (in the absence of the culprit) | Inventory sheet, Commission report |

| 99 | 94 | The fact of the shortage is recognized as an extraordinary expense | Inventory sheet, Commission report |

Where to write off lost property?

Accordingly, the stage of closing account 94 begins. It occurs depending on the definition of the measure of responsibility.

When they go to costs

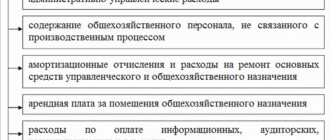

If the damage is caused within the limits of natural loss, then it is considered that no one is guilty. In such cases, you need to use expense accounts:

- Dt 44 “Sale expenses” Kt 94 - material costs written off for damage during the sale;

- Dt 20 (23, 25, 26, 29) Kt 94 - damage written off as costs in the process of production activities;

- Dt 96 “Reserves for future expenses” Kt 94 - losses are charged to estimated reserves.

If there is a person responsible

However, if more is damaged or stolen than required by the standard, then the postings for closing the 94th account depend on whether the culprit is found. If a specific person is detected, then the accounting department needs to make entries:

- Dt 73 “Settlements with personnel for other operations” subconto responsible person Kt 94 - the amount of damage is assigned to the culprit;

- Dt 70 “Settlements with personnel for wages” Kt 73 - damage is deducted from the salary of the responsible person;

- Dt 98 “Future income” Kt 91.1 “Other income” - the amount of damage is recovered from the guilty party if the losses relate to previous periods;

- Dt 94 Kt 76 “Settlements with various debtors and creditors” - if a third party is at fault.

Important point! The responsible person must admit his guilt, otherwise nothing can be recovered from him. In such a situation, the company can only go to court and wait for a decision in its favor.

For tax accounting purposes, the amount of the shortfall will be included in non-operating expenses. What the employee paid must be taken into account in non-operating income. The manager may decide to forgive the guilty person. In such cases, the amount of compensation is not included in the tax base.

When no one is to blame

It may happen that the culprits will not be found. This happens when, over the course of a year, worn-out equipment is thrown into a landfill, and no movements occur in accounting. As a result, there is a shortage during inventory. But since management is aware of the situation, there are no guilty parties:

- Dt 91.02 “Other expenses” Kt 94 - the shortage is written off as a loss at the expense of the company.

If the cause of the loss is a natural disaster, then instead of 91, the 99 “Profit and Loss” account is used:

- Dt 99 Kt 94.

In tax accounting, such losses are written off simultaneously as non-operating expenses.

How to close 94 account

When registering the write-off of identified losses from account 94, as the period of control and audit activities is closed, the corresponding accounting records should be compiled. However, the postings where account 94 is closed will depend on the type and causes of losses, as well as on the methods of covering them.

Typical write-off transactions:

| Operation | Debit | Credit | Notes |

| Shortages and losses were written off within the limits specified in the supply agreement | Should be included in the cost of finished products or raw materials used in production (manufacturing of goods) | ||

| Losses of raw materials were written off within the limits of natural loss | Should be charged to the accounts of main or auxiliary production or included in sales expenses | ||

| Shortages, losses in inventories in excess of natural loss norms | Included in other expenses, that is, company expenses not related to core activities | ||

| The amount of the shortfall is written off to the guilty party | Reflected solely at actual cost |

Note that if the company decided to recover from the culprit the market value of the lost object, then on the account. 94, still take into account the actual cost of the property, and reflect the difference with additional posting: Dt 73 Kt 98 “Deferred income”.

Account 94 in the balance sheet, where is it reflected? There are no separate lines provided for the inclusion of damage amounts in the financial statements. In the balance sheet, reflect the amount of losses and shortages in line 1260 “Other current assets.”

An example of a shortage with the definition of MOL

For example, during a quarterly inventory of the Teplitsa LLC warehouse, a shortage of tangerines in the amount of 14,000 rubles was discovered. Damage within the limits of natural loss - 7,000 rubles. The accountant applied the calculation formula to find out how many tangerines need to be written off in excess of the required standard:

- 14,000 - 7,000 = 7,000 rubles.

Now you need to reflect the deficiency in the program:

- Dt 94 Kt 41 “Goods in warehouses” - 14,000 rubles.

The storekeeper admitted his guilt and agreed to compensate for material damage from his wages. Operations need to be recorded:

- Dt 44 Kt 94 - the account is closed for the amount of natural loss in the amount of 7,000 rubles;

- Dt 73 Kt 94 - the amount of the shortage of 7,000 rubles was transferred to the storekeeper;

- Dt 70 Kt 73 - a deduction of 7,000 rubles was made from the salary of the official responsible for the shortage.

It remains to generate an analysis of the account to see whether the account has been closed:

Table 1. Analysis of account 94 for July 2021 Limited Liability Company "Teplitsa"

| Cor. Check | Debit | Credit | |

| Opening balance | |||

| 41 | 14.000,00 | ||

| 44 | 7.000,00 | ||

| 73 | 7.000,00 | ||

| Turnover | 14.000,00 | 14.000,00 | |

| Closing balance | 0,00 | ||

Output data: BU (accounting data)

There should be no balance on account 94. It may remain at the end of the year only if the investigation has not been completed and the person responsible has not been identified.

An example of accounting for transactions on account 94

An inventory was carried out at Mechanic LLC, as a result of which a shortage of goods and materials was revealed (working clothing in the amount of 3 units). Based on the fact of the investigation, the culprit was identified - the mechanic of the production workshop S.R. Petrenko. The cost of workwear (4,275 rubles) was withheld from Petrenko’s salary.

Reflection of the shortage and its compensation were reflected in the accounting of Mechanic LLC:

| Dt | CT | Description | Sum | Document |

| 10.11 | 10.10 | Special clothing was issued to workshop foreman Petrenko | 4275 rub. | Transfer and Acceptance Certificate |

| 20 | 10.11 | The issued protective clothing is reflected in expenses | 4275 rub. | Transfer and Acceptance Certificate |

| 94 | 98 | A shortage was identified (3 sets of workwear * 1425 RUR) | 4275 rub. | Inventory sheet |

| 73 | 94 | The debt of Petrenko S.R. was taken into account. according to identified shortage | 4275 rub. | Commission act |

| 70 | 73 | An amount was withheld from Petrenko’s salary to cover losses from the identified shortage | 4275 rub. | Payroll |

| 98 | 91.1 | The amount of repaid damage is reflected in non-operating income | 4275 rub. | Inventory sheet, Commission report |

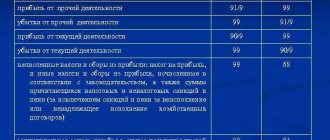

In accounting 94, the account is closed under the following conditions:

- shortages are compensated by the guilty person through 73 accounts;

- in the absence of the culprit, the losses are written off on 91.02;

- shortfalls within the limits of natural loss are covered by costs and expenses;

- when property is damaged as a result of natural disasters, 99 is used.

During the reporting period, the company needs to record all account transactions as much as possible in order to get a complete picture of costs and revenue. At the end of the month, the company's work is summed up in order to have an idea of the financial situation.

Should I expect help from the program?

Software products designed for accounting provide various opportunities for identifying shortages and closing turnover.

In 1C version 8.3, you can reflect the amount of shortages found during inventory using the document “Inventory of goods in the warehouse” by department and MOL.

After filling it out and posting it, you can “create based on” this document “Write-off of goods”. Here you need to manually select the product range, enter the quantity, and the program will enter the amount. You can learn this process using a video.

Write-offs within the norms and above, regardless of the presence of the culprit, will have to be done in any version of 1C in manual operations. In versions 8.2 and 8.3, to do this, you need to go to the “Accounting, Taxes and Reporting” menu, select the “Accounting” section and go to the “Manual Transactions” subsection. When creating an operation yourself, you need to register all the transactions and fill out all the required subaccounts.

For the 1C UPP 94 configuration, the account is closed by writing off the goods, but it is necessary to specify in the settings the cost estimation method “At planned cost”. Otherwise, the cost price may be calculated incorrectly due to skewed registers.

Accounting entries for account 94

Operations for accounting for losses and shortages are specific and atypical for many enterprises. Accounting account 94 is used to reflect the amounts of identified shortfalls. In the article we will look at the features of accounting for shortages and damage to valuables, and also consider typical entries and examples for account 94.

The fact of a shortage of goods, materials and other valuables that are the property of the organization can be identified based on the results of the inventory, as well as when checking the quantitative availability of goods and materials received from the supplier. Losses of valuables established after an inventory can be identified in connection with:

- natural loss of inventory;

- abuse of officials of the organization;

- force majeure situations (natural disasters, accidents, etc.).

Shortage of valuables from the supplier may be due to incorrect execution of documents, as well as violations that were committed during the release and acceptance of goods.

To reflect generalized information about the amounts of losses and shortages identified upon acceptance of goods from the supplier or after an inventory, account 94 is used. Write-off of inventory items (at actual cost), fixed assets (at residual cost) and partially damaged valuables (at the amount of actual losses) carried out according to Dt 94. Also according to Dt 94 the cost of inventory items not received from suppliers is reflected.

The basis for recording transactions on account 94 is the inventory sheet. If a shortage of purchased goods is identified, its amount is reflected in accounting according to primary documents (invoices/receipt invoices, acts of acceptance and transfer of goods).

Types of natural loss

How does it arise and how can its rate be calculated? In general, there is no strict definition of the concept of attrition in the legislation.

But we can come to the conclusion that natural loss is the loss of a mass of goods that occurs due to natural causes. More specifically, the following types of natural loss can be distinguished:

- shrinkage (when humidity changes, moisture evaporates and, as a result, the mass of raw materials decreases);

- utruska (spraying of bulk goods and materials);

- crumble (well, no need to explain here, everyone cuts bread at home);

- leakage (melting, absorption into the container, seepage from the container);

- spill (for example, when pumping from container to container);

- fight (when transporting something fragile, for example, glass containers, mirrors, ceramics, etc.).

Natural loss applies to the following types of goods:

- for food products and agricultural products;

- for medicines;

- for some types of non-food products.

The norms by which natural decline occurs are approved by the relevant industry departments. Some approved standards have existed since the times of the Soviet Union.

Indicators

Two cases recorded on account 94:

- The available quantity of valuables does not coincide with the documented one (something is missing; complete absence of units of goods; shortage).

- The existing property is damaged, its qualitative characteristics have changed, and because of this, quantitative ones (shrinkage, shaking, rotting, evaporation).

Losses and shortages may meet or exceed existing standards. As a rule, the standards include losses associated with the technical side of storage and transportation of various materials and their physical properties. For example, food spoils, becomes wrinkled, liquids evaporate or spill. These possibilities are taken into account and the corresponding loss rates are calculated. Excessive losses are more likely a consequence of theft or negligence.

The separation of standard and non-standard losses is necessary in order to make a decision about which account to write off the amounts of losses to. Depending on the nature of the loss, expenses are written off to the organization’s business account, or deducted from the salaries of the responsible persons. Account 94 is closed on credit with the same amounts and values provided for by debit. Write-off depends on the actual cost of goods:

- main costs – debit account 20>;

- the employee’s fault – debit account 73;

- absence of the culprit – debit of account 91;

- force majeure circumstances – debit account 99.

Account 94 does not include valuables that were damaged as a result of natural disasters. Before closing the account, a shortage is established and the reasons that led to the discrepancy between the actual quantity of goods and the values in the accounting documentation are identified. The calculated amounts are written off either to the culprit or to the organization itself.

Inventory of goods

Account 94 is active. The amounts of shortfalls from the credit of other accounts - for example, inventory or fixed assets - are entered into its debit. These amounts are determined as follows: in case of complete loss or damage to an object, its actual value is paid, and in case of partial damage, an amount is paid in accordance with the amount of the loss.

We will take an inventory of goods. The document is located in the “Warehouse - Inventory” menu.

Specify the warehouse and click the “Fill - Fill according to warehouse balances” button.

The result of the check is entered in the “Quantity of fact” field. For example, if a shortage has been identified for one of the items, we change the actual quantity. The deviation will be automatically calculated.

We save the document; it does not make any postings.

Tasks

Determining the profitability of an organization - in order to find out how many expenses there were for a specified period and compare them with income, you need to accumulate information about this, including information about the lack of the required amount of funds or damage to stored products.

Such information is collected on account 94. Determining the amount of loss that has not yet been definitively correlated with the class of losses/shortages - it happens that property deteriorates and the reason has not been established - there are doubts whether this was a force majeure circumstance, or the intent of the employee, or something else.

Account 94 shows the amount of compensation costs, focusing the attention of responsible persons on the issues of correlating the loss with the culprit (or with the fact that there are no culprits).