“Equipment for installation” (account 07) is an accounting account that is used to reflect the costs of purchasing equipment and transferring it for installation. The article will be of interest to enterprises that have fixed assets on their balance sheets that must be installed before commissioning.

How can an organization take into account technological, energy and production equipment that requires installation and is intended for installation in facilities under construction or reconstruction? Let's remember why account 07 is needed in accounting, what is taken into account in this account.

In accordance with Instruction 94n, account 07 “Equipment for installation” is used to show in accounting (capitalize) the technical equipment intended for installation, assembly, complex fastening to the foundation, and other assembly and installation work, without which its operation is impossible.

Acceptance for accounting of technical equipment contributed by the founders on account of their contributions to the authorized (share) capital of the company is reflected in the debit of account 07 “Equipment for installation” and the credit of account 75 “Settlements with founders”.

The cost of technical equipment handed over for installation must be written off from account 07 “Equipment for installation” to the debit of account 08 “Investments in non-current assets”.

When selling, writing off, transferring for free, etc. equipment for installation, its cost is written off as a debit to account 91 “Other income and expenses”.

What is taken into account on account 07

It is necessary to record on account 07 only that equipment for which, before putting it into operation, it is necessary to assemble its components and attach it to load-bearing structures - the floor, foundation, supports. Account 07 is only active.

This can be equipment of a technological, production, energy nature, as well as equipment used in workshops and laboratories during the construction of a new construction project or modification of an existing one.

It also takes into account sets of spare parts for such equipment, various control, measuring and other instruments installed in the mounted equipment.

Account 07 does not take into account objects that do not require assembly before being used for their intended purpose: (click to expand)

- Various types of transport;

- Machines that are integral structures;

- Mechanisms for construction purposes;

- Agricultural machines;

- Tool;

- Manufacturing equipment;

- Devices not related to the components of the mounted object.

The above assets should be accepted immediately through account 08 in the form of fixed assets to the debit of account 01, bypassing account 07.

Organization of accounting

The amount of costs included in account 07 consists of:

- equipment prices;

- the cost of its delivery;

- storage and installation costs.

Subsequently, the cost of setting up and bringing the equipment to working condition is added to the expense item. In the organization's balance sheet, the above-described expenses are recorded as non-current assets on line 1190. Equipment not transferred for installation is reflected in line 1150 as part of the organization's fixed assets.

Using account 07, only equipment that requires installation and fixation is accounted for. These are all kinds of devices and equipment attached to the foundation of the building, floor, ceilings, as well as its components. Account 07 does not take into account vehicles, machines, tools and other mechanisms that do not require mandatory securing.

The cost of purchasing and installing equipment is usually reflected using the established forms OS-14 and OS-15, respectively. In case of equipment breakdown, accounting is carried out according to the OS-16 form. When filling them out, the details described in the federal law “On Accounting” are used. However, it is worth noting that organizations have the right to use independently developed and approved forms.

Taxation is carried out in accordance with Article 346.16 of the Tax Code of the Russian Federation. It states that the initial cost of depreciable property consists of the costs of purchasing and assembling equipment. Thus, tax accounting is carried out simultaneously according to the general and simplified systems.

Receipt of equipment for installation

Possible receipt at the time of purchase, in the form of a free gift or through a contribution to the capital of the company. All costs that the company incurs in this case are recorded in debit 07. Their amount determines the actual cost of the purchased equipment that needs installation.

This cost includes:

- The price of the components of the equipment indicated in the attached accompanying documentation (agreement, invoice, act);

- Costs of delivering valuables to the warehouse;

- Setup and storage costs;

- % on loans received to pay for the cost of components of equipment;

- Expenses of an accountable person purchasing equipment independently;

- Other costs.

Installation work

Installation work includes:

- assembly and installation of equipment at the site of permanent operation;

- technological supply (water, air, installation of cables and electrical wires, etc.);

- equipment check;

- insulation and painting;

- etc.

The equipment can be of a production, or energy, technological nature, etc. The main feature of such equipment is the impossibility of putting it into operation without assembly (connection, configuration). All costs for delivery, storage, setup, etc. are also taken into account in the account to determine the actual cost of the equipment.

Equipment that does not require assembly cannot be included in the account.

Postings to the debit of account 07

When the equipment components are received at the warehouse for installation, entries are made to reflect all expenses incurred by the company. These expenses are reflected in debit 07 in correspondence with accounts, the type of which depends on the method of receipt of equipment to the enterprise.

Cost accounting entries in relation to purchased equipment requiring installation or assembly are carried out on the basis of the relevant documentation accompanying these objects.

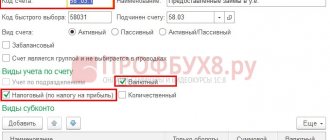

If this documentation includes an invoice, and the company is one of the payers of the added tax, then the expenses are reflected in account 07 excluding VAT, which must be allocated to a separate account 19. If the company is not a payer due to the exemption or absence of such an obligation, then the claimed VAT must be included in the cost of the equipment, formed by debit 07 of the account.

An option is possible when the company accepts such equipment at discount prices in a manner similar to the receipt of material assets through the 15th account.

Possible entries for debit 07 are reflected in the table: (click to expand)

| Operation | Debit | Credit |

| The price of equipment from suppliers’ documents is taken into account | 07 | 60 |

| Costs for delivery of equipment parts produced in-house are taken into account | 07 | 23 |

| Transport costs incurred in connection with arranging delivery by a third party company are taken into account | 07 | 76 |

| The receipt of equipment at discount prices is reflected | 07 | 15 |

| Interest on loans received for the purchase of equipment for a period of up to 1 year is taken into account. | 07 | 66 |

| Interest on loans with a term exceeding 1 year is taken into account. | 07 | 67 |

| The accountable person's costs associated with the acquisition are taken into account | 07 | 71 |

| The cost of equipment contributed by a company participant in the form of a contribution to the company’s capital is reflected | 07 | 75 |

| Equipment from the head office or branch of the organization has been accepted for accounting | 07 | 79.1 |

| The object was accepted in the form of a contribution under a joint activity agreement | 07 | 80 |

| Accepted equipment for targeted events | 07 | 86 |

| An object discovered during inventory in the form of surplus was capitalized | 07 | 91.1 |

Repair of equipment

Equipment repair refers to work that eliminates its malfunction and restores its functionality. The technical properties of the equipment do not change.

Let's consider an example: Kholod Plus LLC carried out repairs of refrigeration equipment on its own in October 2015, for which a compressor was purchased at a cost of 4,125 rubles, VAT 629 rubles. The remuneration to the employees who performed the repairs amounted to RUB 3,115.

The following entries were made in the accounting of Kholod Plus LLC:

| Dt | CT | Description | Sum | Document |

| 10_5 | 50 | Purchasing a compressor | RUB 3,496 | Packing list |

| 19 | 60 | Accounting for VAT on the cost of the compressor | 629 rub. | Packing list |

| 68 VAT | 19 | Acceptance of VAT deduction | 629 rub. | Invoice |

| 60 | Payment to the supplier for the compressor | 4,125 rub. | Payment order | |

| 44 | 10_5 | Compressor cost write-off | RUB 3,496 | Act OS-3 |

| 44 | Accounting for the costs of repairing refrigeration equipment on your own | RUB 3,115 | Act OS-3 |

Transfer to installation

When transferred for installation, the amount of all costs recorded in debit 07 is written off from the loan in one amount in debit 08 . Such posting is carried out on the basis of a transfer and acceptance certificate, for the execution of which you can use the unified OS-15 form.

Assembly can be carried out by hiring a contractor or using your own employees.

If the assembly is carried out by a third-party contracting organization, then the contractor records the received equipment spare parts in off-balance sheet account 005. At the time the finished object is delivered to the customer, its cost is written off from the credit of account 005.

Next, all components of the equipment are assembled; if necessary, the necessary parts are attached to the supporting structures of the construction site. All associated costs are recorded in debit 08.

Depending on the type of costs, debit 08 interacts with the credit of accounts:

- 60 or 76 – when paying for services of third-party companies;

- 23 – when taking into account the expenses of auxiliary production incurred in connection with the assembly and fastening of the components of the equipment;

Accounting for these costs is carried out on the basis of relevant documentation. If the installation is carried out by a third-party company, then this is an act of completion of work; if the installation is carried out by in-house personnel, then this is an accounting certificate.

If the contractor presents an invoice, then VAT is deducted on account 19, provided that the developer company is classified as a payer of the added tax.

The object assembled and installed in the right place is credited as OS to account 01.

Postings for acceptance of finished equipment for accounting are summarized in the table:

| Operation | Debit | Credit |

| Equipment for assembly and fastening was transferred | 08 | 07 |

| Various costs associated with equipment assembly are taken into account | 08 | 60,23,76 |

| Finished equipment is received in the form of an OS object for subsequent use for its intended purpose. | 01 | 08 |

Purchase of equipment

When purchasing equipment, you should take into account not only its cost, but also the costs associated with purchasing the OS (transportation, installation, etc.). It is the sum of these expenses that will constitute the initial cost of the object to be reflected in accounting.

Let's look at an example:

Magnum LLC purchased machines for the production workshop in the amount of RUB 7,488,000, VAT RUB 1,142,237. To deliver the machines, Magnum LLC hired a transport company, whose services amounted to 614,500 rubles, VAT 93,737 rubles.

Upon commissioning of the equipment, the following transactions were made:

| Dt | CT | Description | Sum | Document |

| 08 | 60 | Accounting for the cost of purchased machines | RUB 6,345,763 | Sales Invoice |

| 08 | 60 | Accounting for transport company services | RUB 520,763 | Certificate of completion |

| 19 | 60 | VAT accounting (1 142 237 + 93 737) | RUB 1,235,974 | Invoice |

| 01 | 08 | Commissioning of machines (6 345 763 + 520 763) | RUB 6,866,826 | Act OS-1 |

Disposal of equipment for installation

Disposal of purchased but not installed equipment listed on account 07 is possible as a result of:

- Write-offs due to unsuitability;

- Sales to another person;

- Free transfer, etc.

Unusable equipment that did not have time to be transferred for installation is subject to write-off from credit 07 to debit 94. If no specific person is to blame for the cause of the write-off, then the losses are included in other expenses, otherwise - to the accounts of specific guilty employees.

If it is decided to sell the object without installation or transfer it as a gratuitous gift, then this procedure should be completed through 91 invoices. If there is a tax obligation to pay VAT, it must be calculated on the basis of the value (sale value upon sale or market value upon donation) for subsequent transfer to the budget.

Modernization of equipment and its depreciation

Equipment modernization refers to work related to improving its technological and service properties.

Depreciation on modernized equipment is accrued provided that the modernization will take no more than 12 months. If the improvement process has been carried out for more than a year, then depreciation must be stopped.

Let's look at transactions for depreciation and modernization of equipment using an example: Budapest LLC carried out modernization of equipment by a contractor in the amount of 62,500 rubles, VAT 9,534 rubles.

- initial cost of equipment - 418,000 rubles;

- useful life - 3 years;

- annual depreciation rate 1/3*100% = 33.33%;

- monthly depreciation amount 418,000 * 33.33% / 12 months. = 610 rub.

The transactions were reflected by the following entries:

| Dt | CT | Description | Sum | Document |

| 02 | Depreciation on modernized equipment | 610 rub. | Depreciation statement | |

| 08 OS upgrade costs | 60 | Cost of contractor's work | 966 rub. | Certificate of completion |

| 19 | 60 | VAT on the cost of the contractor's work | RUB 9,534 | Certificate of completion |

| 68 VAT | 19 | VAT deductible | RUB 9,534 | Invoice |

| 60 | Payment to the contractor | 62,500 rub. | Payment order | |

| 02 | Depreciation on modernized equipment | 610 rub. | Depreciation statement | |

| 01 | 08 OS upgrade costs | Increase in the book value of equipment by the amount of modernization | 966 rub. | Act of modernization |

Postings to account credit 07

| Operation | Debit | Credit |

| Equipment for assembly was transferred | 08 | 07 |

| Equipment not included in the operating system is used for auxiliary production purposes | 23 | 07 |

| The transfer of the object to the head office or branch of the company is reflected | 79 | 07 |

| The equipment was transferred to the joint venture participant upon termination of the relevant agreement | 80 | 07 |

| The cost of an uninstalled object is included in other expenses upon sale or donation | 91.2 | 07 |

| The cost of unusable equipment is written off . The shortage of this item, its theft or theft is reflected. | 94 | 07 |

What's behind the balance sheets?

Below is a complete breakdown of the balance sheet lines for 2018/2019. Moreover, each line is specified according to the most characteristic accounts for it, which are reflected in it. Of course, the specifics of economic activity in practice may leave their mark on this correspondence.

Also, the order of formation of accounting reports, as well as the reflection of certain indicators, is influenced by the accounting policy for accounting purposes adopted by the company.

The following is a breakdown of the balance sheet lines for the accounts in two tables - by asset and liability of the balance sheet.

Unified chart of accounts for state unitary enterprises and municipal unitary enterprises

State and municipal institutions use a unified chart of accounts, approved by order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n. It is not similar to the PSBU for commercial companies. Budget accounting accounts 2020 have a different structure. They should be used differently than in “regular” accounting (for more details, see “Budget accounting: how accounting for “state employees” differs from “commercial” accounting”).

An accountant who has decided to change his field of activity and move to a budget organization should be advised to use a specialized program for maintaining budget accounting. This will allow him to quickly understand the differences and more easily master accounting in a new area.