It is important to know that the transition to UPD requires the company to take certain organizational actions. Is the transition to a universal transfer document a mandatory procedure? Can a counterparty refuse to accept UTD? What documents are changed when switching to UPD? You will learn the procedure for changes in the organization’s document flow in connection with the transition to UPD from this article.

Also see:

- Who signs the UPD

- Replacing the certificate of completion and invoice with UPD

Areas of application of UPD

UPD is a document that appeared in accountant use in 2013. It was designed to reduce the number of papers accompanying the transaction. It bears the name universal because it can replace:

As can be seen from the diagram, UTD is a combination of a primary document and an invoice.

Let us designate the areas of application of UPD:

The use of UTD is relevant for organizations on the general taxation system (GTS). However, special regime officers are not prohibited from using UPD in their work. For them, it is not a combination of two documents, but only one – the primary one.

The use of UPD in work is not a prerequisite. Organizations independently decide on the choice of documents accompanying the transaction. Of course, within the legal framework.

We'll tell you how to switch to UPD below.

If a company switches to using UPD, work is carried out to introduce this new document in two directions:

- Within the organization.

- When working with counterparties.

What is UPD?

On October 21, 2013, the Federal Tax Service of Russia issued a letter “On the use of a primary document drawn up on the basis of an invoice” No. ММВ-20 / [email protected] According to the explanations given in this letter, taxpayers are given the opportunity instead of the standard set of documents: accounting (TORG- 12, TTN, M-15, OS-1 and the like) and invoices, use one document containing all the necessary details.

This is a universal transfer document (UDD), and the form recommended by the Federal Tax Service letter is based on the invoice.

IMPORTANT! In accordance with letter No. ММВ-20/ [email protected], the Federal Tax Service form is exactly the recommended one. The taxpayer has the right to develop his own UPD form in accordance with the requirements of the law and clarifications of the Federal Tax Service. At the same time, he can use his UTD for accounting and tax purposes.

You can learn more about the UPD, as well as download its current form, in the article “Universal transfer documents.”

See also “UTD when exporting to the EAEU: to use or not” .

How to organize the transition to UPD within the company

What actions are taken within the organization when a new form is introduced into the document flow?

We must remember that unified forms of documents have not been used in work for a long time (with rare exceptions). They can be developed by the company independently. The only condition is the presence of all required details. UPD in this case is no exception.

The required details for UPD are specified in Appendix No. 4 to the letter of the Federal Tax Service of Russia dated October 21, 2013 No. ММВ-20-3/96.

For a list of mandatory UPD details, see our article “What is UPD in accounting.”

If the unified form of the document is modified or adjusted, it must be approved in the accounting policy of the enterprise. Thus, if a company decides to switch to UTD, its form must be fixed in its policy for accounting purposes.

The second step is to send out a notice to all responsible persons about the transition to UPD and issue local regulations on the procedure for working with UPD. The responsible persons in this case are those who ensure the preparation and storage of UTD, who have the right to sign primary documents and invoices.

There is no sample notification of the transition to UPD . This can be done in free form in the form of a memo, developed regulations, orders, etc.

So, let’s summarize the steps for switching to UPD within an organization in the diagram:

How to start using UPD in a company

The taxpayer company must take certain actions in order to switch to the use of UTD:

- Approve for which documents, actions, transactions the UPD will be applied. If you plan to transfer only some units to this form, then you need to approve them.

- Decide which form will be used for approved transactions or documents. You can use the form proposed by the Federal Tax Service or your own, taking into account the characteristics of the company.

- Approve the list of officials who will be able to sign the completed form for its certification. Usually these are the same persons who had the right to certify invoices and other primary documentation.

- Issue an order and familiarize the necessary employees with it.

- Notify your partners, customers, etc. on the application of the UPD, offer to draw up and sign additional agreements. Notifications can be sent by mail or via the Internet. If the counterparty refuses to use the UTD, you will have to send him invoices and other forms.

After carrying out the listed activities, the company can use UTD for transactions with counterparties.

Notifying counterparties about the transition to UPD

Often, contracts with counterparties specify which documents are included in the package closing the transaction. If we are talking about new contracts drawn up after the decision to switch to UPD, there is nothing complicated. You just need to stipulate the use of UPD in the new contract.

If the contract with the counterparty was drawn up a long time ago, two steps are taken:

- Sending a letter to the counterparty about the transition to UPD.

- Drawing up an additional agreement to the contract, which indicates a change in the type of closing documents - from a bill of lading (act) and an invoice to a UPD.

A sample letter about the transition to UPD can be downloaded for free from our website using the link below:

SAMPLE LETTER ABOUT TRANSITION TO UPD

may well to receive UPD from you, especially if we are talking about the electronic format of documents. He may simply not have the technical ability to accept UPD electronically. In this case, there is no need to switch to UPD with this counterparty.

The introduction of UPD when working only with certain counterparties is not prohibited .

How to draw up an order for the use of UPD in a company

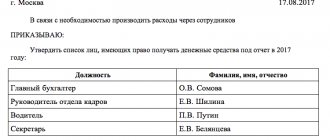

There is no legally approved form for such an order, so the organization draws it up at its own discretion, using the standard structure for the order.

The document must include the following information:

- Name of the organization, its details. If the order is drawn up on the organization’s letterhead, where all the details have already been entered, then they may not be indicated.

- Title of the document.

- Order number and date of signing.

- The essence of the order (“subtitle”).

- Basis for drawing up the order. Refer to the above letter from the Federal Tax Service.

- Officials of departments who must use UTD for certain operations.

- Full name and position of employees whose responsibilities will include familiarizing employees with the instructions for using the UPD and the rules for filling it out.

- Full name and position of the employee who must enter this document into the accounting records database.

- Rules for numbering UPD in an organization, document storage periods.

- Full name and position of employees who will need to draw up additional agreements with counterparties, notifications to counterparties and other documents.

- Full name and position of the employee responsible for the execution of this order.

The document must be signed by the head of the organization and the employees who were listed in the order.

For your information! If the order will be accompanied by a UPD form and instructions for filling it out, then you must also indicate them in the appendices.

Below is a sample order for the application of UPD in a company. If necessary, you can use it and change the content of the document to suit the needs of a specific organization.

Is it necessary to enter into additional agreements with buyers when switching to the use of UPD?

Hello, dear forum users. Urgently need advice. I just don’t have time to think for myself anymore. Because it needs to be done today. When asked when it needs to be done, management quite often answers - yesterday.

We decided (directors) to switch to UPD from October 16

. Today (2 weeks in advance) I received an order to send out an information letter to clients. In almost all of our standard contracts, TORG 12 and s/f are stipulated.

You can write an information letter in such a way that no additional information is required. agreements? Or is it still necessary to sign additional agreements with all buyers? UPD agreements for all existing contracts and should I immediately prepare supplementary documents? And what should we do if one of our clients suddenly declares: no, we don’t want UPD, we want TORG 12 and s/f? And this will be a real problem, since our logistics cannot provide documents selectively, either to all UPDs, or to all invoices and c/f.

About the procedure for filling out the UPD

Features of filling the UTD are determined by its multifunctionality. The letter from the Federal Tax Service contains detailed line-by-line recommendations for filling out the form (Appendix 3). It is worth noting that, in general, filling out the UPD should not cause serious problems. The document contains lines already familiar from other forms. For clarity, an example of filling out the form is shown in the figure below. Details that are required only for an invoice are marked in green, while details that are required for the primary document are marked in blue. The details required for both forms at the same time are highlighted in orange.

The part of the document highlighted in bold corresponds to the invoice, which is why this part is required to be filled out. It contains data about the participants in the transaction, information about the currency of the transaction, and the table reflects information about the content of the transaction. When adding or changing the form, the organization must take into account that in the area highlighted by the frame, it is allowed to enter information acceptable for reflection in the invoice.

The part under the frame in line 8 reflects information about the agreement concluded by the parties to the transaction. This indicator allows you to identify the content of the transaction, so it is considered mandatory details, despite the fact that it is outside the frame.

Line 9 reflects information about waybills and other accompanying documents. This information is not mandatory, but is for clarifying purposes only.

At the bottom of the UPD, the dates of delivery and acceptance are reflected, and information about the responsible persons is also filled in. The signature of these persons is required. In this case, stamps are affixed at the request of the parties. UPD without stamps is fully accepted for tax accounting.

UPD sample filling

As a result, the Federal Tax Service of Russia created a version of a single document, calling it a universal transfer document (UDD). Let's figure out how to fill it out.

So, the recommended form allows you to simultaneously draw up a primary document and an invoice. But it can only be used as a primary document if the transfer of goods (work, services, etc.)

d.) does not generate an object of taxation for value added tax. Then in the corresponding “Status” field in the upper left part of the form you need to put 2.

Let us remind you: the invoice form approved by the Decree of the Government of the Russian Federation dated December 26, 2011.

No. 1137, is the same for all companies and is not subject to adjustment (clause

8 tbsp. 169 of the Tax Code of the Russian Federation).

Therefore, it is included in the structure of the universal document without changes.

We will not find any deviations from the established form of the invoice as part of the UTD. The universal document is

Is it possible to start using the universal transfer document from the middle of the year?

As well as assignments of the right to claim, factoring, storage, trust management, R&D, transport expeditions, licensing agreements, transactions for the alienation of exclusive rights, commercial concessions. This follows from Appendix 2 to the letter of the Federal Tax Service of Russia dated October 21, 2013.

Therefore, it is better to develop a memo for employees who deal with invoices and primary documents. It can include:

| Dear visitors! The site offers standard solutions to problems, but each case is individual and has its own nuances. |

| If you want to find out how to solve your particular problem, call toll-free ext. 504 (consultation free) |

- how to fill out the UPD;

- what details need to be checked when the universal document arrived from the supplier;

- who should sign the universal document, whether to put a stamp on the UTD;

- how to correct errors in a universal document.

If, according to agreements, counterparties need to be issued different forms of primary receipts, this can also be written in the memo.

Is it possible to issue UTD in foreign currency?

The question of the possibility of reflecting transactions denominated in foreign currency in the UTD may raise serious doubts and lead the company to a complete refusal to use this form. However, one of the advantages of UPD, for example, over the TORG-12 form is precisely in reducing the risks when reflecting such transactions. Accounting legislation stipulates that primary accounting documentation is filled out in Russian currency. The Ministry of Finance has a strong opinion on this matter. At the same time, tax legislation establishes that filling out an invoice in foreign currency is acceptable.

Taking into account both of these facts, in practice it was decided that filling out the UTD in foreign currency is acceptable. But at the same time, the form should be supplemented with information about the cost of the transaction in rubles. To do this, you can supplement the table with the necessary columns.

Prepare a memo for employees

At first, employees will likely have many questions regarding UPD. And there will certainly be shortcomings in the documents themselves. Therefore, it is better to develop a memo for employees who deal with invoices and primary documents. And include in it, at the discretion of the accounting department, everything that an employee needs to know and do when he works with UPD.

So, the supplier can write in it how to fill out, sign the UPD and correct errors. You can also provide lists of buyers who need to draw up universal documents and who need separate invoices and TORG-12.

The buyer can specify the rules on how to check incoming UTD by details.

More on the topic:

- Criminal Code of the Republic of Kazakhstan 2021 Articles Criminal Code of the Republic of Kazakhstan Article 194. Extortion 1. Extortion, that is, the demand for the transfer of someone else’s property or the right to property or the commission of other actions of a property nature [...]

- Borrowing money from Tele2 Borrowing money from Tele2 One of Tele2’s main priorities is to provide uninterrupted communications and Internet access under any conditions, even if the subscriber’s account has run out of money. […]

- Buy confiscated property in Yekaterinburg Non-core assets, collateral, seized and confiscated property from banks in the Yekaterinburg region (Sverdlovsk region) Sale of non-core assets, collateral property from banks […]

- Practice under Article 154 of the Criminal Code of the Russian Federation Article 154. Illegal adoption (adoption) Article 154 of the Criminal Code of the Russian Federation. Illegal actions for the adoption of children, placing them under guardianship (trusteeship), for foster care, [...]

- Magistrate's Court, precinct 408 Magistrate's Court, precinct 408 Maria Mikhailovna Fayustova Telephone Chief of Staff of the Magistrate Judge Zakharchuk Anna Aleksandrovna Court Secretary Pestova Ksenia […]

- Article 265 of the Labor Code Labor Code of Ukraine Article 265. Responsibility for violation of labor legislation Officials of state authorities and local government […]

How to fix errors in UPD?

In the course of activities, situations inevitably arise when errors are made in the primary documentation. The procedure for adjusting the UPD is not standard and depends on many factors, since this is not a typical primary document.

| Status | Place | Character | Correction procedure | Features of the fix |

| 1 | SF and primary document | Prevents identification | It is mandatory to create a new document with status “1” | The number and date assigned before the adjustment are saved (line 1). The number and date of the correction are indicated (line 1a). Signed by authorized persons. |

| Does not interfere with identification | If necessary, a new document is created with status “2” | The number and date assigned before the adjustment are saved (line 1). The number and date of the correction are indicated (line 1a). Doesn't re-subscribe. | ||

| Primary document only | — | Let's accept the previous option or by direct editing | The correction in the original document is certified by the inscription “Corrected”, as well as the signature of authorized persons indicating the date of correction. | |

| 2 | Primary document only | — | Only by directly editing the document | The correction in the original document is certified by the inscription “Corrected”, as well as the signature of authorized persons indicating the date of correction. |

Please note that the nature of the error made in the document is determined from the point of view of a tax audit. Thus, identification is hampered by errors that distort information about the parties, the content or value of the transaction, the tax rate or the amount of tax.

Is it possible to switch to UPD in the middle of the reporting period?

If necessary, the official form can be modified to suit your specific needs and supplemented with details. It is important that all mandatory details required by law are in such a document. The official form contains them.

- Organize the work of the company’s structural divisions with the transfer document. Here you can develop regulations (procedure) for the work, registration, and storage of such documents (you can do without regulations by developing a memo for employees or preparing appropriate instructions). Establish in which cases universal transfer documents should be used when registering business transactions. When switching to UTD, companies are not required to carry out all types of transactions using such documents.

Approve the UPD form

Now you need to approve the form of the universal document for those business transactions for which you decide to use it. For example, to record the shipment of goods. This can be done in a separate order from the manager or in the accounting policy.

Accounting policies can be changed during the year in a limited number of situations. Formally, the issuance by tax authorities of the UPD form does not apply to them (clauses 6, 7, article 8 of the Federal Law of December 6, 2011 No. 402-FZ). However, in this case, the company adjusts only the primary forms given in the appendix to the accounting policies. These changes do not affect the reliability of reporting and do not require recalculation of its indicators. Therefore, it is unlikely that tax officials will have any complaints, especially since they themselves strongly recommend using the new form.

We recommend making a reservation in the accounting policy that the company can use other forms of primary accounting that are established in the agreement with the client. For example, No. TORG-12. Or the same universal document into which the parties agreed to add some additional indicators (officials do not object to this). Then the tax authorities will not have any questions about why the company, for the same business transaction, offers different formats of primary tax to customers.

Three more questions that are useful to record in the accounting policy or manager’s order are given below.