Application for Unified Agricultural Tax when creating a peasant farm

In order to tax peasant farms under the Unified Agricultural Tax, it is necessary to switch to this special regime.

To switch to the Unified Agricultural Tax, you need to submit a corresponding notification to the tax office no later than December 31 of the year preceding the calendar year from which this special regime will be applied (clause 1 of Article 346.3 of the Tax Code of the Russian Federation). Notification form No. 26.1-1 was approved by Order of the Federal Tax Service dated January 28, 2013 No. ММВ-7-3/ [email protected]

In this case, you need to take into account the general rule: if the deadline for submitting a notice falls on a weekend or a non-working holiday, it will be possible to submit a notice on the first working day following such a day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). So, for example, to switch to the Unified Agricultural Tax from 01/01/2019, a notification can be submitted until 01/09/2019 inclusive.

A newly created peasant farm for the application of the Unified Agricultural Tax can submit a notification of transition to a special regime no later than 30 calendar days from the date of registration as an organization or individual entrepreneur. In this case, the unified agricultural tax is applied from the date of registration of the organization or individual entrepreneur (clause 2 of article 346.3 of the Tax Code of the Russian Federation).

Taxation of heads of peasant farms under the general regime. I can’t figure out whether it is necessary to pay personal income tax on income if the head produces agricultural products, the share of which exceeds 70%{q} What confuses me is that agricultural producing organizations pay income tax at a rate of 0%, and the head must pay 13% .

In accordance with paragraph 1 of Article 1 of the Federal Law of June 11, 2003 N 74-FZ “On Peasant (Farm) Economy” (hereinafter referred to as the Law on Farming), a peasant (farm) enterprise is an association of citizens related by kinship and (or) property who have property in common ownership and jointly carry out production and other economic activities (production, processing, storage, transportation and sale of agricultural products), based on their personal participation.

Clause 2 of Art. 1 of the Law on Farming establishes that a farm can be created by one citizen. In accordance with paragraph 2 of Art. 23 of the Civil Code of the Russian Federation, the head of a peasant (farm) enterprise operating without forming a legal entity is recognized as an entrepreneur from the moment of state registration of the peasant (farm) enterprise (hereinafter - peasant farm).

According to Article 15 of Federal Law N 74-FZ, each member of a peasant farm has the right to a portion of the income received from the activities of the farm in cash and (or) in kind, fruits, products (personal income of each member of the farm). The amount and form of payment of personal income to each member of the farm are determined by agreement between the members of the farm.

In accordance with paragraphs. 14th century 217 of the Tax Code of the Russian Federation, the income of members of a peasant (farm) enterprise, received in this enterprise from the production and sale of agricultural products, as well as from the production of agricultural products, their processing and sale, is not subject to taxation - for a period of five years, counting from the year of registration of the specified enterprise.

After five years after registration of a peasant (farm) enterprise, taxation of the income of members of the enterprise must be carried out in the generally established manner, and taxation of the income of the head of the enterprise - in the manner established by Chapter. 23 of the Tax Code of the Russian Federation for individual entrepreneurs.

Income received from business activities is indicated on sheet B of the Personal Income Tax Declaration. This sheet is filled out by individual entrepreneurs, including those who are the heads of peasant (farm) farms.

https://www.youtube.com/watch{q}v=subscribe_widget

In paragraph 4 “For the head of a peasant (farm) enterprise” of Sheet B it is indicated: in subparagraph 4.1 - the year of registration of the peasant (farm) enterprise (150); in subparagraph 4.2 - the amount of income not subject to taxation in accordance with paragraph 14 of Article 217 of the Code ( 160)

Main elements of the Unified Agricultural Tax: payers, tax base, rate

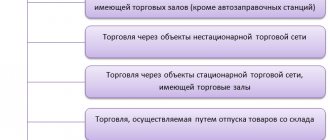

Which representatives of domestic business are allowed to apply the Unified Agricultural Tax payment regime? These include:

- Organizations and entrepreneurs engaged in the production and processing of agricultural products;

- Organizations providing secondary services to agricultural producers;

- Cooperatives of Russian citizens who are engaged in the development of territories, livestock breeding and crop production.

Peasant farms (hereinafter referred to as peasant farms) are one of the main payers of the Unified Agricultural Tax. According to the requirements of Russian legislation, peasant farms can be created both in the form of organizations and without forming a legal entity.

The main criterion that allows business representatives to apply the Unified Agricultural Tax is the share of income from agricultural activities in the total amount of income received. According to Art. 346 of the Tax Code of the Russian Federation, it must be at least 70 percent.

The use of Unified Agricultural Tax is possible for peasant farms both from the moment of registration and starting from January 1 of the year, if the company previously operated under a different tax regime. A new organization is allowed to submit an application to the inspectorate in Form 26-1 along with a package of documents for registration or within one month after it.

If a company applying a different tax regime in its activities decides to switch to the Unified Agricultural Tax, it should submit this application no later than December 31 of the year preceding the year of application of the single tax.

The tax payable to the budget is calculated by multiplying the tax base for the single tax by the accepted tax rate. The tax base, which is the basis for calculating the single tax, is determined as the difference between the income and expenses received by the payer.

The Unified Agricultural Tax rate is set by the Federal Tax Service at 6 percent.

Peasant farms should report to the tax control authorities on the unified agricultural tax twice a year, since the reporting period is half a year. Based on the results of the first half of the year, the advance payment for the single tax is calculated and transferred to the budget.

This must be done no later than the 25th day of the month following the semester. At the end of the calendar year, no later than April 1, the company must submit a completed tax return to the inspectorate.

General rules and features of taxation of peasant farm activities

Unified agricultural tax = fixed interest rate * (amount of profit - amount of expenses).

Tax payments are paid at the end of the half-year and for the year. In addition, simplified accounting is used in accounting using the “cash” method. The head of the peasant farm maintains an accounting book of expenses and profits, which is not certified by the tax authorities. Rented annually:

- declaration to the Unified Agricultural Tax at the place of registration by March 31 of the following reporting year;

- Form RSV-2 (for the Pension Fund of Russia) must be submitted by March 1.

The Unified Agricultural Tax has enough advantages. A single special regime allows, for example, to write off fixed assets when they are put into operation and to include advance payments in profit. But at the same time, the head of the household will not be able to take advantage of the deferment on payments and will be required to pay land tax. Read in more detail about the use of unified agricultural tax in the article: → application of unified agricultural tax for peasant farms, payment procedure, calculation formula.

To switch to a single special regime, you must submit a corresponding application within the established time frame. Applicants can only be those from farms that are engaged in the production, sale, and processing of exclusively agricultural products with a share of this type of income of at least 70% of the total profit. Moreover, the production and sale of agricultural products in this case act as a mandatory requirement. For example, if a farm is engaged only in processing products without production, then it may be denied the transition to the Unified Agricultural Tax.

A peasant farm consisting of 3 people is engaged in the cultivation, processing and sale of vegetables and fruits. The profit of the farm is 800 thousand rubles, costs are 600 thousand rubles. Based on these data, the tax base is first calculated (based on the difference between profits and expenses): 800,000—600,000 = 200,000 rubles.

After this, the unified agricultural tax for payment to the budget is calculated. The current rate of 6% is used for calculations. The result is the following: 200,000 * 6% = 12 thousand rubles. This is the amount of single tax that will need to be paid.

| Main components of counting | Estimated data and costing |

| Data for calculation | Tax rate for Unified Agricultural Tax (6%); expenses (600 thousand rubles), profit (800 thousand rubles) |

| Tax base | Calculated using the formula: amount of profit – amount of expenses; 800000—600000=200 thousand rubles. |

| Unified agricultural tax payable | Calculation using the formula: tax base * fixed rate (6%); 200000 * 6%=12 thousand rubles. |

In order to use the unified agricultural tax, you must draw up an application in the established form and submit it to the tax office within the time limits specified by law.

The head of the peasant farm pays a single fee at the approved rate - 6.0%.

Since January 1, 2021, an innovation has appeared in the legislation, according to which individual entrepreneurs and organizations become VAT payers, in accordance with the current general procedure (clause 12 of article 9 of the Federal Law of November 27, 2017 No. 335-FZ).

The same law provides for a number of conditions that allow individual entrepreneurs and organizations working on the Unified Agricultural Tax to obtain the right to VAT exemption.

Conditions for obtaining the right not to be a value added tax payer:

If two actions were completed within one calendar year:

– transition to a special unified agricultural tax regime;

– exemption from obligations to pay VAT.

If in 2021 the peasant farm received less than 100.0 million rubles in income from its activities at the Unified Agricultural Tax

Important! For subsequent years, a limiting amount is also prescribed, which is reduced by 10 million rubles

in each subsequent annual period, so in 2021. it will amount to 70 million rubles in 2021. – 80 million rubles, for 2021 – 90 million rubles).

One-click call

The Unified Agricultural Tax has enough advantages. A single special regime allows, for example, to write off fixed assets when they are put into operation and to include advance payments in profit. But at the same time, the head of the household will not be able to take advantage of the deferment on payments and will be required to pay land tax. Read in more detail about the use of unified agricultural tax in the article: → application of unified agricultural tax for peasant farms, payment procedure, calculation formula.

Notification for VAT exemption in 2021: submission conditions

Organizations and individual entrepreneurs who have chosen the OSN as their tax system can temporarily exempt themselves from calculating and paying VAT.

When organizations and companies are exempt from VAT:

- They do not create a purchase book.

- They do not calculate or pay VAT to the budget.

- They do not submit VAT reports.

- Invoices are generated without tax.

- Input VAT is included in the total purchase price.

It is worth noting that the exemption applies to transactions carried out within the country. When importing goods into Russia, you will have to pay VAT.

Of course, for this you need to meet several conditions:

- The volume of revenue excluding VAT should not exceed 2 million rubles for any of the last three months, without reference to quarters. When determining revenue, you need to take into account only those transactions that are subject to VAT.

- Revenue can range from zero to two million rubles.

- No excisable goods were sold in the previous three months.

- The company was registered more than three months ago.

If these conditions are met, then you need to fill out a notification in the form approved by Order of the Ministry of Finance of Russia dated December 26, 2021 No. 286n and submit it to the Federal Tax Service.

Notice deadline

The notification must be submitted before the 20th day of the month in which the company began to apply its right to the benefit.

In addition to the notification, you will need to provide extracts:

- from the balance sheet;

- from the sales book;

- from the book of income and expenses (for individual entrepreneurs).

Extracts in any form are provided. There are no approved forms yet.

The exemption will be valid for twelve months. After this period, it will be necessary to confirm that the company retains the right to use the benefit - that is, revenue during the year for every three consecutive months should not exceed 2 million rubles

.

At the same time, you will need to submit a notice of prolongation of the VAT exemption, or of refusal of the exemption.

It will be impossible to refuse the benefit during this entire time. But you can lose your right if, during the period of validity of the exemption:

- Revenue for three consecutive months will be more than two million rubles.

- The taxpayer will begin to sell excisable goods.

Then, from the month when this happened, the company will have to begin calculating and paying VAT.

Who can get exemption

Notification of VAT exemption can only be received by those entrepreneurs who, in the last three months:

- Have an income of less than one million rubles (not counting value added tax and sales excise tax);

- They did not sell excisable goods.

Securities that give the right to disposal under the Excise Code, in order to obtain disposal, companies are required to bring to the excise supervision such documents as:

- letter of deliverance.

- report from the balance sheet (it is enough to create a period of three months that have passed since the beginning of the use of the opportunity to get rid of the value added excise tax, and indicate the amount of income for such a period with and without excise tax).

- report from the sales book (allowed to be included in the table design).

- photocopy of the log of received and issued invoices

Unified agricultural tax for peasant farms

These are: In the Federal Tax Service, personal income tax declarations for their employees: 2-personal income tax for each employee until April 1; 6-NDFL for everyone quarterly within 30 days after the end of the quarter and annual form until April 1. Once a year, before January 20, information on the average number of employees is submitted to the Federal Tax Service; Payment of insurance premiums is made within 30 days after the reporting quarter, also to the Federal Tax Service.

In the Pension Fund: SZV-M until the 15th of every month; SZV-experience, EDV-1 – once a year until March 1. 4-FSS for contributions for injuries, submitted to the Social Insurance Fund by the 20th day after the reporting quarter (for electronic reporting, the deadline is until the 25th day). Can the reporting of individual entrepreneur KFC be zero? Article 346.3 states that a newly registered individual entrepreneur retains the right to apply the Unified Agricultural Tax regime if he had no income in the first tax period.

In simple words, you can take the zero grade only once. There is no need for the Federal Tax Service. 4) 2 personal income taxes until April 1 of the next year (once a year). 5) 6-NDFL is provided quarterly (no later than 1st quarter - 30.04; 2nd quarter - 31.07; 3rd quarter - 31.10; 4th quarter - 01.04). 6) ESSS (Unified Social Insurance Tax) - quarterly (no later than 1st quarter - 30.04; 2nd quarter - 31.07; 3rd quarter - 31.10; 4th quarter - 30.01) After concluding an agreement with the first hired employee, the head of the peasant farm must register in extra-budgetary funds (to the Pension Fund of the Russian Federation - within 30 days, to the Social Insurance Fund - within 10 days) Reporting to the Pension Fund of the Russian Federation (PFR): 1) SZV-M - information about insured persons monthly until the 15th day 2) Information about the length of service - SZV-M experience - once a year until March 1 For peasant farms and individual entrepreneurs using the Unified Agricultural Tax, reduced rates of insurance contributions are provided for payments and other remuneration in favor of individuals (27.1% of wages).

Attention

For some peasant farms, income tax can be reduced to zero. The full list of preferential areas is reflected in Article 284 of the Tax Code.

Income from activities not related to agriculture and farming is taxed without special benefits. Government subsidies and grants are not taxed.

The VAT return is submitted to the tax office once a quarter (in January, April, July and October before the 25th). Every year until April 30, forms 3-NDFL and 4-NDFL are provided.

These requirements apply to both individual entrepreneurs and LLCs. Form 3-NDFL must be submitted even if there was no profit.

What is the price

The question about the cost of a peasant farm should be divided into two sub-questions: How much does it cost to register a peasant farm, and how much does it cost to open a peasant farm “from scratch”.

Let’s dwell on the question “how much does it cost to register”:

- state registration fee 800 rub.

- Certificate from a notary, form P21002 - 1500 rub.

- Notarized power of attorney from 2000 rub.

- Notarized copy of the applicant's passport within 1000 rubles.

Notary costs are required if the applicant will not submit the documents himself.

And also, the cost of travel to the MFC or registry. authority, or for postal transfer of documents. And, if a hired specialist prepares the documents for you, he will also require a certain fee.

The approximate costs of starting a business depend on what you want to do - livestock farming or crop farming (plants are more profitable at first, they pay for themselves faster).

For example, for raising pigs, the cost for each sow will be about 40 thousand rubles. Cost effective - from 10 heads. In other words, you will have to invest.

True, there are subsidies and state support for farms, it is better to find out about them in each specific subject of the Russian Federation,

Specifics of applied taxation and reporting systems for peasant farms

The activities of a farm and its taxation are regulated in Russia by the Tax Code, as well as Federal Law No. 74 “On Peasant Farming” dated June 11, 2003, as amended in 2021. When submitting documents for registration of a farm, the head of the peasant farm can immediately declare the taxation regime (see →). The peasant farm (as an entrepreneur) has the right to work according to one of the systems to choose from:

- OSNO;

- Unified Agricultural Sciences.

In this case, from the moment of registration the selected taxation regime will come into force. By default, peasant farms switch to OSNO. If a month has passed after registration, if the peasant farm does not declare a transition to the unified agricultural tax or simplified tax system, the farm will be able to switch to one of these regimes only from next year. He will need to submit the application to the tax authorities by December 31.

It should be taken into account that, according to the law, peasant farms calculate, in addition to taxes, insurance contributions (to the Pension Fund of the Russian Federation, Social Insurance Fund, Federal Compulsory Medical Insurance Fund) regardless of the special regime applied. Since the participants of peasant farms are not only members of the farm, but also hired workers, the head of the farm (IP) transfers fixed insurance payments for himself and the members of the farm and at the same time pays for compulsory insurance for all employees. The procedure for payment of contributions for heads of farms is determined by Federal Law 212 of July 24, 2009, Article 14

If hired workers work in a peasant farm, under any special regime it is necessary to submit the following reports.

| Reporting forms | Due dates | Who to submit reports to? |

| 2-NDFL (on employee income); 6-NDFL (information about deductions made by the tax agent for all employees); KND 1110018 (information on the average number of employees) | Annually until 01.04; quarterly (in the current year: until May 4, August 1, October 31, annually - together with form 2-NDFL until 04/01/2017); annually: for farms created during the year - until the 20th day of the month following the one in which they were created, newly registered payers do not submit this information in the year of opening | Tax Service |

| Personalized accounting and form RSV-1; SEV-M (data on insured workers) | Quarterly (submitted on paper if there are up to 25 employees, in 2021: until May 16, August 15, November 15, for a year - until 02/15/2017); monthly (until the 10th) | Pension Fund |

| Information confirming the main activity; | Annually (until April 15); quarterly: on paper if the number of employees is up to 25, submitted before the 20th day of the month following the reporting period, in other cases, the electronic version is submitted until the 25th after the reporting period | FSS |

Validity period of the benefit

After notifying the Federal Tax Service about the application of the exemption, the company has the right not to pay VAT for 12 months. After the year has passed, notify the tax office of the extension of the grace period or the refusal of the benefit.

The taxpayer has the right to refuse to apply the exemption at any time. And sometimes you may lose the right to it. A particularly common cause of such loss is exceeding the revenue limit. Monitor compliance with the revenue limit closely throughout the grace period. As soon as it is exceeded, the organization is obliged to pay VAT on a general basis. The benefit is lost from the first day of the month in which the excess occurred.

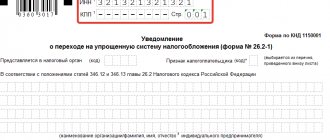

Application for transition to Unified Agricultural Tax, form 26.1-1

One of the more favorable preferential regimes for agricultural producers is the Unified National Economy. When choosing it, a business entity must know for sure that it meets the established criteria, and most importantly, the release of this product is not associated with the processing of such products. To apply this system, you need to fill out an application for transition to the Unified Agricultural Tax.

Application deadlines

The procedure for use and transition procedure are established by the Tax Code of the Russian Federation. According to these rules of law, the Unified National Economic Tax can begin to be used either from January 1 of the new year, or from the moment of registration with the Federal Tax Service.

In the first case, the business entity must send, before December 31 of the year preceding the start of application of this regime, an application, for which the order of the Federal Tax Service provides for a specific form No. 26.1-1.

The main criterion for the possibility of changing the tax system to an agricultural tax is the value of the share of revenue from the sale of agricultural products, it must be at least 70%.

Enterprises submit this form at their location, and entrepreneurs - at their registration address.

To fill out the document, you can use accounting programs or specialized Internet services. Also, organizations and individual entrepreneurs have the right to purchase a form from a printing house or print it on a computer and fill it out by hand, observing the established requirements and rules.

The application is submitted to the tax office in person, or via mail or electronic communication channel. In the first case, Form 26.1-1 can be submitted by an authorized person (individual entrepreneur or director) or a representative by power of attorney, which must be attached to the application.

An economic entity has the right to change the Unified National Economic Economy regime to another regime only at the end of the current year; to do this, it must submit a corresponding application before January 15 of the next year.

Application for closing an individual entrepreneur, form P26001

On the right is the required attribute of the applicant:

- “1” – if the document is submitted when registering a company or individual entrepreneur.

- “2” – if the document is submitted by a re-established company or entrepreneur within 30 days from the fact of registration.

- “3” – when switching from another tax system.

Then enter your full name. entrepreneur or company name. All empty cells in this block should be marked “-”.

The next step is to indicate at what point the transition to unified agricultural tax is being made. Two codes are used for this:

- “1” – from January 1, and you need to indicate from which year (Code “1” can be used by those applicants who previously indicated the sign “3”).

- “2” – from the date of registration with the tax service (new and newly opened taxpayers use code “2”.) Code “1” can be used by those applicants who previously indicated the attribute.

- “3” – transition from another system.

All empty cells are marked with a “-”.

Individual entrepreneurs and companies that previously indicated the sign “3” must enter below the percentage of income from sales of agricultural products, as well as at what point this share is calculated: “1” - based on the results of the previous year, if a transition is made from another regime; “2” – based on the results of the last reporting period for taxpayers engaged in fishing and wishing to switch from January 1 of the next year; “3” – for entrepreneurs until October 1 of the current year, transferring from the beginning of the next year.

If the application is submitted not personally by the individual entrepreneur or the director of the company, but by a representative, you must indicate on how many sheets of documents confirming the rights are attached.

Next, the form is divided into two parts; you need to fill out everything on the left. Here it is indicated who is submitting the application: “1” – personally, “2” – by a representative, enter full name.

the submitter, his telephone number, date and signature. If the application is submitted by a representative, then the name of the document confirming the authority is indicated here.

All empty cells in this part of the form are marked with a dash.

Application form according to form 26.1-1

statements in form 26.1-1 in Excel format.

Application for the transition to Unified Agricultural Tax in Pdf format.

filling out form 26.1-1 in Excel format.

How to compose correctly

The required document—a VAT exemption notification form—must be submitted to the Federal Tax Service and contain information that confirms the taxpayer’s right to use the benefit.

All that is required is to indicate revenue data and confirm it with extracts from the sales book, balance sheet, and profitability accounting for the last three months. In this case, the taxpayer can count on a positive outcome of the revision of deductions and receiving a tax benefit.

Filling out the form should not cause any problems. You should indicate general information about the company (TIN, name, checkpoint) and write down the amount of revenue for the quarter (it must be deciphered for each month separately).

Procedure for filling out a notice for VAT exemption

It is necessary to draw up a notice of exemption from VAT if the refusal is issued under Article 145 of the Tax Code. Companies that have little income have the right to fill out an application and submit to the tax office to receive the benefit. In addition to notification of the exercise of the right to exemption, certain documents are required.

In addition to the application, you must provide extracts from your accounts. balance sheet, sales books, copies of the Federation Council journal. There is a certain deadline for providing this documentation. All papers must be submitted no later than the 20th day of the month from which you plan to use the right. Once the benefit is issued, it can be applied for 12 months, then you need to submit documents again to increase the period of non-payment of payments.

When drawing up a notification, you must provide information about the tax office with which the person is registered, the name of the organization, registration address, details and contact information.

Application for Unified Agricultural Tax when creating a peasant farm

Unified Agricultural Tax (USAT), Special tax regime for You need to pay it as when registering an individual entrepreneur - in the amount of rubles for personal To create and send an application electronically, you need. Official Internet portal of public services, city.

The general taxation system provides for the following taxes and duties to be paid by an individual entrepreneur: As can be seen from the above, most taxes and fees are associated with doing business in certain areas. Therefore, many peasant farms pay only some of the listed types of taxes: personal income tax and value added tax.

What to pay If the participants of the farm have decided to register an organization, then it becomes possible to use one of the following systems: General Taxpayer When you are on the OSSN, you must pay property, land and transport taxes, if necessary, value added tax, personal income tax as a tax agent. The mentioned benefit can be found in paragraph. Explanations are also available for personal income tax payments. For five years from the moment of registration of the farm, its members, including the head, are released from these obligations.

This benefit will remain in the event that during this time he switches to the taxation regime in the form of paying the unified agricultural tax, and then returns to the general regime of Lagutin L.

Unified agricultural tax can be used by organizations and individual entrepreneurs that are recognized as agricultural producers in accordance with Chapter. We talked in more detail about what the unified agricultural tax is and how it is calculated in a separate consultation. What is meant by peasant farm? Peasant farms are an association of citizens related by kinship or affinity, have property in common ownership and jointly carry out production and other economic activities - production, processing, storage, transportation and sale of agricultural products, based on their personal participation. Peasant farms can even consist of one person p. If a peasant farm is created by citizens, they enter into an appropriate agreement among themselves p. The peasant farm operates without forming a legal entity.

Unified agricultural tax Last updated: Only organizations and individual entrepreneurs that are agricultural producers can be transferred to pay the unified agricultural tax Unified Agricultural Tax. Agricultural producers Agricultural producers are organizations that meet the criteria given in the article

VIDEO ON THE TOPIC: Simplified taxation, imputation and patent, how to choose a tax system

What documents are required

To register a peasant farm, you must submit the following documents to the registration authority at the place of residence of the head of the peasant farm:

- Agreement on the creation of a peasant (farm) enterprise (necessary if the enterprise consists of two or more members);

- Application for state registration of a peasant (farm) enterprise in the form P21002;

- A copy of the main identification document of the head of the peasant farm (passport);

- Receipt for payment of state duty (800 rubles);

- Notification of transition to a special tax regime.

It is also recommended to submit copies of documents confirming the relationship between members of the peasant farm.

Taxation of peasant farming, special regimes and reporting

Many peasant farms remain on the general taxation system in order to retain customers for their products, since most wholesale buyers work for OSNO and in order to reduce their tax burden they simply need to purchase products from organizations (individual entrepreneurs, peasant farms) that work with VAT, since only in this case they will be able to reimburse the VAT paid for the products from the budget. Insurance premiums are differentiated for members of peasant farms and for employees.

Info

For members of peasant farms there are fixed rates, calculated on the basis of the minimum wage, relevant for individual entrepreneurs. The simplified taxation system for KFC is traditional.

Release under Art. 149 Tax Code of the Russian Federation

In addition to the benefits provided for in Article 145, the Tax Code identifies transactions that are not subject to VAT. Their full list is contained in Article 149. Non-taxable activities include:

- providing loans;

- transfer of goods, works, services for charitable purposes;

- transfer of promotional items for no more than 100 rubles;

- medical services;

- educational services provided by non-profit organizations (for example, schools);

- Bank operations;

- services in the field of insurance.

The listed operations are exempt from tax regardless of the company's revenue.

Specifics and advantages of possible taxation regimes for peasant farms in comparison

The choice of special regime depends largely on the main indicators of the farm’s agricultural activity, primarily on the amount of profit, size and volume of products produced. One should proceed from the specifics of the operation of the farm itself and the taxation that suits it best.

The significant difference between the three systems is visible primarily in the tax burden and associated restrictions, which should be taken into account when deciding on the use of special regimes. It should also be noted when comparing the fact that the composition of the calculated taxes of peasant farms and individual entrepreneurs is mostly identical.

| Special modes | BASIC | USN (Profit): | USN (Profit-Expense) | Unified agricultural tax |

| Basic tax payments and rates | Personal income tax (13% for residents, 30% for non-residents of the Russian Federation), VAT (10 or 18%), property, transport and land taxes | Single profit tax at a rate of 6% | A single tax at a rate of 5-15% on the difference between profit and expense (if costs exceeded profit, then 1% of annual profit) | Unified agricultural tax at a rate of 6%; 0% for Crimea and Sevastopol in 2021 and 4% in subsequent years until 2021; transport and land taxes |

| Restrictions on use | — | yes (Tax Code of the Russian Federation, Art. 346.12 and 346.13) | yes (Tax Code of the Russian Federation, Art. 346.12 and 346.13) | yes (Tax Code of the Russian Federation, Art. 346.2, clause 2 and clause 5) |

| Restrictions on type of activity | — | — | — | yes (Tax Code of the Russian Federation, Art. 346.2, clause 2) |

The general taxation procedure provides a wide range of opportunities for developing a serious business. Among the obvious advantages are the possibility of VAT reimbursement, taking into account costs and damages in tax calculations, and the absence of any restrictions. The simplified tax system significantly reduces the tax burden, which will most likely attract newcomers to entrepreneurship. Well, the Unified Agricultural Tax is designed specifically for workers in the agro-industrial complex, taking into account the specifics of their work.

Let's sum it up

Farmers have the right to choose one of three possible special regimes. They cannot be combined.

The Unified Agricultural Tax is intended for a narrow circle of agricultural producers with a profit of at least 70% of the total income. It is for them that a low rate, simplified accounting, and favorable payment terms are provided.

The simplified tax system is more often used when the number of employees is up to 100 people and the annual profit exceeds 45 million rubles. The simplified tax system (Profit) is suitable for a farm whose profit exceeds expenses, and the simplified tax system (Profit-Expense) is suitable for activities with high production costs.

One-click call

Release under Art. 145 Tax Code of the Russian Federation

The Tax Code of the Russian Federation provides for the possibility of a taxpayer to obtain temporary exemption from VAT. It is provided to those organizations and individual entrepreneurs who have received revenue not exceeding two million rubles for three months in a row. Calculate revenue according to accounting rules. It is determined minus value added tax.

Newly created organizations have the right to apply the benefit. For them, the three-month period is determined taking into account the month of registration. If the company is registered in September, then take into account the revenue received in September, October and November for the calculation. Even if an organization or individual entrepreneur did not conduct business, they have the right to receive an exemption (letter of the Ministry of Finance dated August 23, 2019 No. 03-07-14/64961).

How to apply the benefit

When applying benefits under Article 145, an organization or individual entrepreneur:

- does not calculate or pay VAT (except for the export and sale of excisable goods);

- does not claim a deduction for input VAT, but includes it in the cost of purchased goods, works, services;

- issues invoices, but puts o in the tax column;

- does not submit a VAT return (this rule does not apply if you are a tax agent or have issued an invoice to the client with a separate tax).