If an employee’s income from the beginning of the year reaches a certain amount, a regressive scale is used when calculating insurance premiums for it. This means that the amounts of deductions are calculated at reduced rates or at zero. Thanks to this, companies with above-average salaries can save a little on insurance premiums. This is especially true in the second half of the year, when large amounts of payments to employees have accumulated. Therefore, now is the time to remind you what the maximum value of the base for calculating insurance premiums is in 2019. And also understand how it is used.

What is the new contribution limit for 2020?

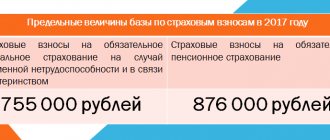

The maximum base for calculating insurance premiums in 2020 affects two types of contributions:

- for compulsory social insurance (OSI) in case of temporary disability (sick leave) and in connection with maternity (paid to the Social Insurance Fund);

- for compulsory pension insurance (OPI) (paid to the Pension Fund).

According to the decree of the Russian Government, the maximum value of the insurance premium base in 2021 is:

- contributions in case of temporary disability and maternity – 912,000 rubles inclusive ;

- contributions to compulsory health insurance – 1,292,000 rubles inclusive .

As for the maximum base for medical contributions for 2021, it has not been established since 2015. That is, regardless of the cumulative income, insurance premiums for compulsory medical insurance must continue to be accrued and paid in the general manner.

New form for calculations

From the 1st quarter of 2021, calculations for insurance premiums (DAM) must be submitted using a new form, which was approved by Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected]

This order approved the printed form, the filling procedure, as well as the format for the electronic presentation of the DAM.

The new form includes various innovations: in particular, fields have been added on the title page to indicate information about a separate unit that has been deprived of authority; a field was introduced to indicate the payer type code and lines were excluded that indicated the total amounts of insurance premiums payable for the billing (reporting) period (the changes affected section I); The sheet with information about an individual who is not an individual entrepreneur was canceled.

The DAM according to the new form, starting from the reporting period for the first quarter of 2021, but no later than April 30, 2021, must be submitted electronically to those businesses that employ more than 10 people.

If insurance premium payers have 10 or fewer employees, they can submit the DAM either electronically or in paper form.

The quarterly DAM is due in 2021 on the following dates:

- no later than January 30 - for 2021;

- no later than April 30 - for the 1st quarter;

- no later than July 30 - for half a year;

- no later than October 30 - 9 months in advance.

For 2021, the DAM must be submitted by February 1, 2021.

Submit a single calculation of insurance premiums on time and without errors. As a gift - 3 months of free reporting!

To learn more

How the maximum base of insurance premiums has changed since 2021

In 2021, the maximum value of the insurance premium base was (Resolution of the Government of the Russian Federation dated November 28, 2018 No. 1426):

- contributions in case of temporary disability and maternity – 865,000 rubles;

- contributions to compulsory pension insurance – 1,150,000 rubles.

Thus, the base for excess insurance premiums for 2021 compared to 2019:

- for insurance premiums for OSS in case of temporary disability and maternity – increased by 5.4 % ;

- for insurance premiums for compulsory health insurance – increased by 12.3%.

The growth of the base for calculating insurance premiums in 2021 is due to the fact that, by law, the Government of the Russian Federation is obliged to index the maximum values of the base annually according to the growth of average wages in Russia. This is evidenced, in particular, by paragraphs 4 and 6 of Art. 421 of the Tax Code of the Russian Federation. Therefore, a slight increase in the maximum contribution base occurs every year.

REFERENCE

According to the parameters developed by the Ministry of Economic Development of the Russian Federation for the forecast of socio-economic development of Russia for 2021 and the planning period of 2021 and 2022. the average monthly accrued salary per employee in 2021 is 48,942 rubles (in 2019 – 46,432 rubles).

Thus, the size of the nominal accrued average monthly salary per employee in 2021 compared to 2021 increased by 5.4% (48,942: 46,432 = 1.054).

In addition, according to the law, the limit of the taxable base for insurance premiums in 2021 for compulsory insurance is established taking into account (clause 5 of Article 421 of the Tax Code of the Russian Federation):

- the average salary in the Russian Federation determined for 2021, increased by 12 times;

- increasing coefficient for 2021, which is equal to 2.2.

As a result, here is how the exact amount of the maximum base of insurance premiums in 2021 was obtained:

- in case of temporary disability/maternity in relation to each individual, taking into account indexation: 865,000 × 1.054 = 911,710 rubles, taking into account rounding - 912,000 rubles ;

- for OPS, taking into account the increasing factor of 2.2: 48,942 × 12 × 2.2 = 1,292,068.8 rubles, taking into account rounding - 1,292,000 rubles .

Changes in insurance coverage due to coronavirus

To support Russian business during the coronavirus epidemic in Russia, the President and Government of the Russian Federation are introducing special measures. Helping entrepreneurs and businessmen includes several privileges:

- Deferment of taxes and contributions.

- Reducing the tariff for insurance coverage to 15%.

- Delays in submitting reports, prohibition of tax audits.

- The Federal Tax Service bans blocking accounts and forced collection of debts until May 1.

- Credit holidays, preferential lending.

- Cancellation of rental payments (on state and municipal property).

All these benefits are provided for small and medium-sized businesses. Moreover, the government has identified 22 sectors of the economy that were most affected by the coronavirus. Businessmen from these industries will receive support first.

Tax holidays due to coronavirus

Representatives of small and medium-sized businesses will receive a six-month deferment on all taxes, except VAT and personal income tax. If a businessman belongs to the category of micro-enterprises, then he is entitled to a deferment on insurance premiums.

The new deadlines for payment of insurance premiums are as follows:

| Type of insurance premium | Duration of deferment for emergency services | Comments |

| For March, April and May 2021 | 6 months | The condition applies only to micro-enterprises |

| For June and July 2021 | 4 months | |

| Individual entrepreneur for himself, with an income exceeding 300,000 rubles. for 2019 (date until 07/01/2020 according to the Tax Code of the Russian Federation) | 4 months | Penalties and penalties are not accrued during the deferment period. |

Representatives of small and medium-sized businesses are provided with a deferment without an application. There is no need to submit any applications or documents to the Federal Tax Service. There will be no need for a corresponding decision or notification from the inspectorate.

Reduced insurance premium rates

Vladimir Putin, in his address dated March 25, 2020, announced a reduction in the tariff for insurance premiums from 30% to 15%. The privilege is provided only for small and medium-sized enterprises. Moreover, the benefit does not apply to all wages and other remuneration for work. The reduction in contribution rates is applied according to the new rules:

- for wages that do not exceed the minimum wage, the tariff for insurance premiums remains at the same level - 30%;

- for the part of wages that exceeds the minimum wage, the insurance rate is reduced to 15%.

Example:

Vesna LLC is a small business entity. The salary of a company manager is 30,000 rubles. The minimum wage from 01/01/2020 is 12,130 rubles. We calculate the volume of insurance coverage in a new way:

- We charge according to the basic tariff: 12,130 rubles * 30% = 3,639 rubles;

- We consider the amount of earnings exceeding the minimum wage: 30,000 rubles - 12,130 rubles. = 17,870 rubles;

- We calculate the amount of insurance at a reduced rate: 17,870 rubles * 15% = 2,680.50 rubles.

The tariff reduction is not a temporary measure due to the coronavirus pandemic. The President proposed introducing a new procedure for calculating insurance premiums for small and medium-sized businesses for the long term

What is the meaning of the base limit for insurance premiums for 2021?

When the amount of payments to each employee during the year reaches the cumulative total of the limit value (see above), the procedure for calculating contributions changes from exceeding the limit base in 2021. Namely:

- contributions in case of temporary disability/maternity cease to accrue ;

- contributions to compulsory pension insurance are charged at a lower rate of 10%.

EXAMPLE 1

In 2021, Shirokova’s salary at Guru LLC, according to the employment contract, is 150,000 rubles (let’s agree that there are no other payments subject to insurance contributions). Thus, her income from January to June inclusive will be:

150,000 rub. × 6 months = 900,000 rub.

That is, during these months there is no excess of the maximum base for contributions to OSS (912,000 rubles).

Taking into account July 2021, its cumulative income from the beginning of the year will be:

150,000 rub. × 7 months = 1,050,000 rub.

It will exceed the maximum base for contributions to OSS for cases of disability and maternity in 2021:

912,000 rub. <1,050,000 rub.

This means that the accounting department of Guru LLC must stop calculating and paying insurance premiums for OSS (2.9%) from July 2021. Including starting from the following amount of excess of the base:

RUB 1,050,000 – 912,000 rub. = 138,000 rub.

EXAMPLE 2

In 2021, Shirokova’s salary at Guru LLC, according to the employment contract, is 150,000 rubles (let’s agree that there are no other payments subject to insurance contributions). Thus, her income from January to August inclusive will be:

150,000 rub. × 8 months = 1,200,000 rub.

That is, during these months there is no excess of the maximum base for contributions to compulsory health insurance (RUB 1,292,000).

Taking into account September 2021, its cumulative income from the beginning of the year will be:

150,000 rub. × 9 months = 1,350,000 rub.

It will exceed the maximum base for contributions to compulsory health insurance in 2021:

RUB 1,292,000 <1,350,000 rub.

This means that from September 2021, the accounting department of Guru LLC should begin to calculate and pay insurance premiums for compulsory health insurance for Shirokova at a reduced rate of 10%, and not the general 22%. Including the following amount of excess of the base:

RUB 1,350,000 – 1,292,000 rub. = 58,000 rub.

Point formula

The contribution limit set for each year has a major impact on the number of points you earn that count towards your pension.

In the formula for calculating the score, this indicator is in the denominator; accordingly, the larger the base, the fewer points you will earn. And the fewer points, the lower the pension.

That is, an annual increase in the maximum base leads to an annual decrease in the number of points earned, all other things being equal.

The formula for calculating the score is:

IPC = SV / SVmax * 10

IPC - individual pension coefficient (point);

SV - the amount of contributions at the individual rate (your salary for the year * 16%);

SVmax – the amount of contributions at the individual rate from the maximum base (maximum base * 16%).

At the same time, there is a limit on the number of points that the Pension Fund will award you. Those who have a small salary are not interested in this restriction. They still don't reach the maximum. But those who earn decent money should know that not all contributions paid by the employer (even taking into account the “cut-off” rate of 16%) will be reflected in their future pension. No matter how huge the salary is, you can’t jump above the ceiling in terms of points.

| Year | Maximum points |

| 2018 | 8,7 |

| 2019 | 9,13 |

| 2020 | 9,57 |

| 2021 | 10 |

By the way, about the tariff. Do not forget that not all 22% of the contributions paid from your salary by your employer are reflected in your individual personal account with the Pension Fund. The tariff is divided into 2 parts - individual (16%) and joint (6%). The number of points earned is calculated only on the basis of the individual part.

If your employer pays contributions at a reduced rate, this will not affect the number of points. The calculation is based on the salary amount.

Source:

"Clerk"

Categories:

Pensions, Insurance contributions

maximum value of the base for calculating insurance contributions pension point pension

- Natalya Petrova, editor of “Clerk”

Sign up 7800

9750 ₽

–20%

Features of contributions to the Pension Fund

Please note that contributions to the Pension Fund for exceeding the maximum base in 2020 are calculated when they are calculated according to basic tariffs. But when calculating contributions to compulsory health insurance at additional tariffs, the maximum base value does not apply (clause 5 of Article 421 of the Tax Code of the Russian Federation). That is, they continue to be charged at a rate corresponding to the class of working conditions.

EXAMPLE

Shirokova at Guru Processing LLC is employed in hazardous production and, according to her employment contract, receives 150,000 rubles per month. The subclass of her working conditions is 3.2, the additional tariff rate for it is 4%.

That is, for the entire year 2021, the accounting department of Guru LLC charges insurance premiums for compulsory health insurance at a rate of 22% + 4% from 150,000 rubles per month.

When paying pension insurance contributions at reduced rates (Article 427 of the Tax Code of the Russian Federation) from amounts of payments to individuals exceeding the maximum base value for this type of insurance, contributions are not calculated or paid (letter of the Ministry of Finance dated August 13, 2019 No. 03-15-06/61097 ).

EXAMPLE

Shirokova works for an IT company that pays insurance premiums for compulsory health insurance at a reduced rate - 8% (Article 427 of the Tax Code of the Russian Federation). In 2020, Shirokova’s salary at Guru Soft LLC, according to the employment contract, is 150,000 rubles (let’s agree that there are no other payments subject to insurance contributions).

Thus, her income from January to August inclusive will be:

150,000 rub. × 8 months = 1,200,000 rub.

That is, during these months there is no excess of the maximum base for contributions to compulsory health insurance (RUB 1,292,000).

Taking into account September 2021, its cumulative income from the beginning of the year will be:

150,000 rub. × 9 months = 1,350,000 rub.

It will exceed the maximum base for contributions to compulsory health insurance in 2021:

RUB 1,292,000 <1,350,000 rub.

This means that the accounting department of Guru LLC, starting from September 2021, must stop accruing and paying insurance premiums for compulsory health insurance for Shirokova from the following amount of excess of the base:

RUB 1,350,000 – 1,292,000 rub. = 58,000 rub.

Read also

23.09.2019

Who should pay

All employers must pay social contributions. That is, organizations and individual entrepreneurs who have hired at least one employee, and individuals who do not have the status of individual entrepreneurs, but make any payments to employees. In addition, this responsibility is assigned to individual entrepreneurs who work for themselves, for example, lawyers, notaries.

Quite often there are situations when one person falls under several categories of insurance premium payers. In this case, insurance contributions must be made on each basis. For example, an individual entrepreneur who has employees. In this case, he pays both for himself and for his employees.