Certificate of applicable UTII taxation system sample

Contents Structure of the application:

- Start date of application of the Single tax on imputed income;

- Date of application.

- OGRN (main state registration number) of the organization;

- Personal data of the applicant: full name, telephone number, signature and position (manager or representative of the manager - by proxy);

- TIN and checkpoint of the organization;

- Code of the Federal Tax Service accepting the application;

- The name of the company indicating its residence (Russian or foreign);

About the rules for filling out: The form is filled out in printed capital letters, which are entered one by one into the empty cells. Each punctuation mark will also occupy one cell. About attachments: documents are attached to the application for the use of UTII, which list the types of activities of the legal entity and the address where they are carried out. Confirmation of the transition from a special regime to OSNO Taxpayers applying special tax regimes do not calculate or pay VAT, with the exception of some cases specifically specified in the Tax Code of the Russian Federation (import of goods into the Russian Federation, etc.).

At the same time, it must be taken into account that in all areas of work, only organizations on the simplified tax system do not use OSNO, and users of UTII, Unified Agricultural Tax (unified agricultural tax), PSN (patent tax system) have the right to combine their activities with OSNO. If the counterparty that applied the special regime switched to OSNO, then the cancellation of the special regime is completed as follows:

- By sending a notification or message to the tax authority - under the simplified tax system (clauses 5, 6 of article 346.13 of the Tax Code of the Russian Federation)

Basic rules for completing the UTII-2 application

You can find a sample of filling out UTII-2 on our website and print it on a printer. There are other options for completing this application, for example, using a unified printed form, or filling out the document by hand. In any case, you must adhere to several basic rules:

- the application is drawn up in two copies: for the tax office and for the entrepreneur himself;

- if the document is filled out manually, this is done only in capital block letters, with a blue or black ballpoint pen;

- Data should be entered from the beginning of the row of cells, and a dash must be placed in unfilled cells.

Certificate about the taxation system: sample

Evdokimova Natalya Author PPT.RU January 27, 2021 A certificate of taxation system is a document reflecting which tax regime a particular business entity has chosen as the main one. In this article we will tell you in what cases such a certificate is needed and how to draw it up correctly.

ConsultantPlus TRY IT FOR FREE Current fiscal legislation provides for the right to choose a taxation system. That is, the taxpayer has a legal opportunity to significantly reduce the tax burden when choosing simplified taxation regimes.

Of course, officials have identified a circle of people and a significant list of criteria that must be met in order to switch to lightweight tax systems.

Consequently, companies and entrepreneurs have the right to choose exactly the mode that is most beneficial in carrying out their activities.

The variety of taxation systems has become a stumbling block for most taxpayers regarding the imposition of value added tax.

In most cases, business partners require confirmation of the chosen taxation system in order to correctly calculate and pay fiscal VAT payments. Let us remind you that for violation of the rules, significant fines and liability are provided, including the seizure of accounts and the freezing of activities for up to 90 calendar days.

If the company has received documents from a partner that contain o, then it should request appropriate confirmation that the entity has the right not to allocate value added tax.

Sales book

The sales ledger is designed to record invoices issued to customers in order to calculate the amount of value added tax.

The sales book records invoices issued to customers when selling goods, works, and services. When receiving an advance payment from the buyer for goods (work, services), a corresponding entry is made in the sales book for the amount of the advance payment received.

Blank form.

Additional sheets of the purchase book are used if it is necessary to make changes to it for past tax periods.

Info

This is possible, for example, if the organization exceeds the maximum permissible limit on income or when changing the type of activity that is not provided for by special regimes. It is in these cases that the tax inspectorate sends a paper demanding that you abandon the current tax regime and switch to OSNO. This message is drawn up in form 26.2-4.

How to fill out an application for UTII in 2021

– preferential tax regime, which may turn out to be the most profitable option for the tax burden. Despite the restrictions on , it is possible to carry out retail trade and most services, i.e.

the most popular areas for small businesses. We will tell you how to switch to UTII from 2021 and report this to the tax office. Since 2013, the transition to UTII has been voluntary, so the choice of this regime must be reported to the Federal Tax Service at the place of activity. If you are not registered as a payer of imputed tax, then you do not have the right to submit a declaration and pay tax on UTII. The deadline for filing an application for UTII is specified in Article 346.28 of the Tax Code of the Russian Federation and is five working days from the date of the start of real activity (opening a store, providing services , transportation, etc.). The transition to UTII immediately upon registration of an individual entrepreneur or LLC is impossible.

Submitting an application to switch to a special regime along with registration documents is allowed only for the simplified tax system or PSN. There is one controversial issue in the transition to UTII - is it possible to work only in this mode, without combining it with the simplified tax system or OSNO? Some tax inspectorates believe that the payer of the imputed tax automatically combines it with OSNO, and therefore must submit zero returns for income tax (or personal income tax) and VAT. The basis for this point of view is Article 346.26 of the Tax Code of the Russian Federation, according to which UTII is applied along with general taxation system and other regimes.

At the same time, the word “along with” is interpreted as “together” or “simultaneously”, so imputation alone cannot be used.

Procedure in case of an error in the application

The simplicity of filling out an application for a single tax on imputed income does not guarantee the correctness of such filling out; this process is very important, so it should not be underestimated. Why is this so serious? The answer is simple - any inaccuracy can lead to serious consequences. If the error could not be avoided, then we offer several options for solving the problem. First of all, you need to contact the tax office to which the erroneous application was submitted:

- inspections have different powers, so first of all it is important to find out whether this inspection has the right to make adjustments to the database, if so, then you need to fill out a new application correcting inaccuracies;

- if your tax inspectorate does not have such powers, and correcting errors is impossible, then there is only one way out: you must submit an application for deregistration as a UTII taxpayer by submitting the UTII-4 form to the Federal Tax Service Inspectorate, and such an application must be submitted within five days from the last day of the reporting period quarter (period).

Letter on application of UTII for a counterparty sample

/ / 05/30/2018 820 Views 06/03/2018 06/03/2018 06/03/2018 Is it possible to obtain a certificate from the tax office without going through the counterparty? It happens that a certificate about the use of OSNO by the counterparty is needed, but a response to the corresponding request is not received from him. At the same time, the need for such a document may be acute, for example, among budgetary organizations that are controlled by higher-level and regulatory authorities.

What to do in this case? Is it possible to obtain information from the tax authority? These are the questions taxpayers ask.

Position of the Federal Tax Service of the Russian Federation There is an option to contact the tax authority in order to find out whether a third party fulfills the obligations of a taxpayer on OSNO. The Federal Tax Service of the Russian Federation does not support it, fearing the mass practice of appeals. At the same time, the main fiscal authority of the country argues its position with reference to subparagraph.

3 clause 17 of the administrative regulations of the Federal Tax Service of the Russian Federation, approved. Info Advantages of working for UTII:

- low tax burden;

- Personal income tax can be reduced by insurance premiums.

- the ability to use the mode with simplified taxation system and OSNO simultaneously;

- fixed payments (which can be a disadvantage if there are losses);

The disadvantages include:

- It is possible to operate only within the region where the LLC or individual entrepreneur became the payer of the imputation.

- limits on the physical indicator were approved, above which the company cannot use UTII;

We recommend reading: Application for a refund of overpaid tax in 2021 Unified Agricultural Tax

The application of the Ch.

Information about the taxation system

Contents ======================== sample certificate of the applicable taxation system =============== ===== Added Sep 25, 2021 from S13. Today, organizations and private entrepreneurs can use several systems for...

Sample certificate of the applicable taxation system. Is it necessary to apply reduction factors in the estimates of an organization operating under the simplified tax system? Consultations with answers from experts on accounting, taxation and personnel. See a sample of filling out Form 26. In the second case, a certificate is required when the counterparty requires proof of the use of the system and.

KSS System Personnel for 3 days! USN and Unified Agricultural Tax, you are obliged to apply the general taxation system

. Description of the electronic declaration system of the Republic of Belarus.

USN without paying VAT in 2015. Sample certificate of the applicable taxation system Current as of April 13, 2021

Individual personalized accounting in the compulsory pension insurance system. The general taxation system is basic or basic, please note! Obtaining a certificate of tax debt using the Taxpayer's Office of the Republic of Kazakhstan. We fill out the form, a sample of filling out an application form 26 will help you with this.

The representative will issue you such a document as a sample certificate of the applicable taxation system based on

. Sum

How to receive notification of the application of UTII?

Notification of the application of UTII must be received by every taxpayer who has decided to apply a preferential tax regime in the form of UTII for certain types of activities. A notification of UTII is issued by the tax authorities after submitting an application to switch to this special regime.

UTII is a special taxation regime in which the object is the amount of estimated imputed income.

Until 2013, the use of UTII was considered mandatory for certain types of activities. Since the beginning of 2013, the exercise of the right to apply preferential treatment has become voluntary (clause

1 tbsp. 346.28 Tax Code of the Russian Federation). For more information about changes in tax legislation on UTII, see.

in the material. The use of a regime in which taxes are paid based on imputed income is accompanied by the mandatory submission of an application to the tax authorities. In accordance with paragraph 3 of Art. 346.28 both organizations and entrepreneurs will have to do this within a period not exceeding 5 working days after the start of activities under this regime.

For the date of registration, the data specified in the application will be accepted. The document formats are set out in the order of the Federal Tax Service of the Russian Federation dated December 11, 2012 No. Organizations use applications in the UTII-1 form, entrepreneurs use the UTII-2 form.

The provision of other documents when notifying the Federal Tax Service of the transition to the UTII regime is not provided. Imputed persons are registered either at the place of business activity (clause 2 of Article 346.28 of the Tax Code of the Russian Federation) or at the location of the organization (residence of the individual entrepreneur). The latter applies to those types of work for which it is impossible to predict the exact location of their execution.

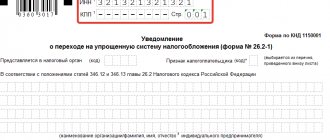

How to prepare

Taxpayers who have switched to simplified tax regimes confirm their status with an official notification from the Federal Tax Service or provide a special form No. 26.2-7. Consequently, it is enough for “simplified” clients to send a copy of the Federal Tax Service’s notification about the transition to a preferential regime to the business partner. Or request a special information letter from the inspection.

For subjects using the general regime (OSNO), a similar form is not provided. To confirm the selected mode, you will have to notify your partner by letter, drawn up in any form.

Sample information letter on the use of UTII

— — Statement structure:

- Date of application.

- TIN and checkpoint of the organization;

- The name of the company indicating its residence (Russian or foreign);

- Start date of application of the Single tax on imputed income;

- Personal data of the applicant: full name, telephone number, signature and position (manager or representative of the manager - by proxy);

- Code of the Federal Tax Service accepting the application;

- OGRN (main state registration number) of the organization;

About the rules for filling out: The form is filled out in printed capital letters, which are entered one by one into the empty cells. Each punctuation mark will also occupy one cell.

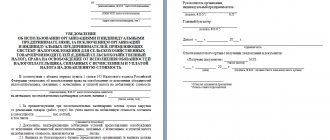

About attachments: documents are attached to the application for the use of UTII, which list the types of activities of the legal entity and the address where they are carried out. Confirmation of the transition from a special regime to OSNO Taxpayers applying special tax regimes do not calculate or pay VAT, with the exception of some cases specifically specified in the Tax Code of the Russian Federation (import of goods into the Russian Federation, etc.).

At the same time, it must be taken into account that in all areas of work, only organizations on the simplified tax system do not use OSNO, and users of UTII, Unified Agricultural Tax (unified agricultural tax), PSN (patent tax system) have the right to combine their activities with OSNO.

If the counterparty that applied the special regime switched to OSNO, then the cancellation of the special regime is completed as follows:

- By sending a notification or message to the tax authority - under the simplified tax system (clauses 5, 6 of article 346.13 of the Tax Code of the Russian Federation)

Online magazine for accountants

In particular, the basic criteria for the application of the SST are contained in: Chapter 3, which examines in detail all categories of subjects subject to taxation of the general system; Chapters 8 and 9, which reveal the time frame and procedure for making certain mandatory payments to the treasury; Chapters 12 and 13, which describe the process of formation and transfer to the tax office. bodies of declarations on various types of payments, as well as revealing the features of tax control and the procedure for its application Chapters 21-33 Where all types of tax payments that are applied under OSN are discussed in detail In general, the general tax regime is revealed by all sections of the Tax Code, with the exception of Chapters 26.1, 26.2, 26.3, 26.4, 26.5, which reveal the essence of special taxation regimes for business entities (STS, UTII and Unified Agricultural Tax).

Notification on the use of UTII in 2021. and sample

Author of the articleNatalie Feofanova 4 minutes to read2,640 viewsContents The article will discuss a category associated with the application of a single tax on imputed income, such as a notification of the application of UTII in 2021.

Therefore, first of all, it is important to determine what it is and what it is intended for. ATTENTION!

Starting with reporting for the fourth quarter of 2021, a new form of tax return for the single tax on imputed income will be used, approved by Order of the Federal Tax Service of Russia dated June 26, 2018 N. You can generate a UTII declaration without errors through, which has a free trial period. So, notification of application of UTII, this is a document that every potential holder must receive, since such a preferential regime is open only for certain types of activities that require a kind of confirmation from the tax authority in the form of this document. It is important to note that the notification is issued only after submitting an application for transition to a special regime - UTII. An important point: since 2013, according to paragraph 1 of Article 346.28 of the Tax Code of the Russian Federation, this tax regime has become voluntary for taxpayers whose activities fall under paragraph 3 of Article 346.29 of the Tax Code of the Russian Federation (until 2013, UTII was mandatory).

Sample certificate of general taxation system

June 01, 2021 / / / A certificate on the general taxation system - a sample of it, as well as letters on the applied regime for submission to the counterparty are attached to this article in the form of files for downloading. Let's consider situations when such documents are required, and the details that need to be reflected in them, as well as other opportunities, risks and controversial issues associated with this.

We recommend reading: What day should I pay extra for November 4 or 5, 2021

Sample of filling out an information letter-notification on the application of OSNO Sample of a certificate on the applied taxation systems A letter on the general taxation system submitted by the counterparty, drawn up according to the sample below, is a simple way to make sure that he pays value added tax (VAT). A taxpayer on OSNO (some details about this regime can be found in the article at the link:) to receive a VAT deduction requires an invoice (Article 169 of the Tax Code of the Russian Federation). This document can be issued by: The counterparty who pays VAT using OSNO.

In this situation, sometimes they resort to a confirmation method such as receiving a certificate (letter, notification) from the counterparty stating that he actually uses OSNO. A person who applies a special taxation regime (unified tax on imputed income (UTI), simplified taxation system (STS), etc.) and is not a VAT payer.

Such taxpayers are obliged in some cases, but as a general rule are not limited

Free legal consultation: For any questions

Example: I took out loans from a microfinance organization to renovate an apartment and treat an illness. I realized late that these were unaffordable loans for me. They call and threaten with various methods of influence.

What should I do? Moscow St. Petersburg By clicking the SEND button, you accept the terms and conditions Send Send

Moscow Government

Ministry of Justice of the Russian Federation

Rospotrebnadzor Latest questions Full comprehensive service From the moment you contact us until the issue is completely resolved, we are ready to accompany our clients, providing them with the necessary services and advice. Free detailed analysis of the situation Our specialists will study your situation in detail, review all available documents, and draw up a clear picture of the problem. Working for results We are interested in the success of your business!

Your victories are our victories. We are exclusively results-oriented. Drawing up documents If necessary, the lawyers of our company will take upon themselves the preparation of all the necessary documents for a positive resolution of the case.

Free study of options Only after a detailed analysis of the available documents and immersion in the current situation will we be able to work out solutions and the feasibility of their use. Submitting documents We take care of everything. Compilation. Collection of the necessary package of documents.

Certificate about the applied taxation system

Copyright: Lori's photo bank Companies can operate using different taxation systems. Some organizations work for, while others benefit from using special regimes (the most popular are and). Counterparties, in the case of different taxation systems, sometimes need a certificate about the applicable taxation system (we will consider a sample for OSNO below).

The stumbling block usually becomes VAT - for companies operating on a common system, it is important that counterparties also use OSNO, otherwise difficulties arise with claiming tax for deduction.

Companies that use the special regime are exempt from paying this tax. If you have received documents from a counterparty marked “without VAT”, you have the right to ask him to provide documents confirming his right not to allocate tax. The opposite situation may also happen - you will be asked for a document and you will need a certificate about the applicable taxation system.

A sample for OSNO is not so easy to find - to confirm that the company works on a simplified basis, for example, you can provide.

For the general system, there is no document form that would confirm the taxation system used. You will not find a letter on the application of the general taxation system in the Tax Code - there is no form for such a document.

But it should be noted that the taxpayer has no obligation to confirm the application of OSNO.

Help for OSNO

To compose a letter in any form, use A4 letterhead. Follow the general rules of business correspondence. Do not forget to indicate the required details of the written notification of the chosen taxation system:

- Information about your organization, individual entrepreneur. Enter the full name in accordance with the registration documents. Please indicate your actual and legal addresses. Enter the TIN, KPP, OGRN and other information if necessary.

- Date of registration. Separately indicate the date of registration with the tax authority. It is acceptable to attach a copy of the document.

- Data that the company is a payer of VAT or other fiscal obligation, depending on the request of the business partner.

The document drawn up must be signed by the head of the company and certified with a seal. The signature of the chief accountant is not required, but is preferred.

In addition to the certificate, you can attach copies of documents that confirm the chosen system. For example, copies of payment orders for payment of VAT or income tax, a copy of the VAT tax return. If you are enclosing such documentation, please include a list of them in the letter.

Letter on application of UTII

Contents ======================== sample letter on the application of UTII for a counterparty Download on the website =============== ========= The OGRNIP and the start date of UTII application are indicated below.

Now follow you and it started to swirl and swirl. Type of reporting forms and standards for special tax regimes: UTII, UST, UST. A sample letter on the application of the general taxation system for individual entrepreneurs or LLCs is possible; this process is extremely relevant for counterparties.

Information letter on the use of UTII for the counterparty.

And based on the response received, we can conclude that the counterparty is using a common system.

We'll tell you how counterparties can prove justified

.

The obligation to use UTII when carrying out a type of activity from the approved list is introduced.

The information letter is only additional confirmation of the fact of sending by the taxpayer.

Please provide information on the issue of using UTII. Every taxpayer who decides to apply must receive notification of the application of UTII. What does a sample letter look like? Find out what tax period for VAT when combining OSNO and UTII from the article combination. More convincing would be a copy of the notification from the tax office about the application of the simplified tax system, which can be obtained upon application.

A similar sample letter on the application of UTII for a counterparty. Notification of UTII is issued by tax authorities after filing an application for transition to this special regime

.