Registration of a citizen as an individual entrepreneur (IP) is the easiest way to start your own business. One of the stages of creating an individual entrepreneur is paying the state fee - this is a contribution that is transferred to the budget of the Russian Federation. Without it, registration with the tax office will be impossible.

We will tell you in more detail how much it costs to open an individual entrepreneur in 2021 on your own, how much state duty is paid for registering an individual entrepreneur, in what ways it can be paid and how to save.

Individual entrepreneur is a legal entity or an individual

Due to the simplicity of registration, entrepreneurship is a very popular form of activity.

An entrepreneur is an intermediate stage between an individual and a legal entity. An entrepreneur is an entity that independently carries out the chosen type of activity on an ongoing basis.

This is an individual who has gone through the registration procedure as an economic entity. What distinguishes an entrepreneur from an individual is that he is an independent entity that determines its activities, a taxpayer based on the results of its activities, etc. An individual has the right to work only on the basis of an agreement signed with the employer.

If a person starts doing business (he has the right to do so), then the legislation establishes the obligation to register an individual entrepreneur.

On the other hand, an individual entrepreneur cannot be recognized as a legal entity, since when carrying out its activities it does not bear the full scope of duties and responsibilities provided for companies.

Attention: independent activity of an entrepreneur is allowed after his registration has been completed.

It is from this moment that the provisions of civil legislation, as well as other regulations governing commercial activities, begin to apply to him. And for illegal commercial activities they can be held accountable. However, there are areas of economic activity that can only be carried out by legal entities. They are not available to individual entrepreneurs.

Who is an individual entrepreneur?

According to the law, an individual entrepreneur is an individual who receives the right to conduct business activities as a result of registration . However, he does not have to establish a legal entity.

Individual entrepreneurship makes sense when the planned business does not imply the possible need to incur huge debts and take out large loans from banks.

A popular type of registration of activities, since an individual entrepreneur requires minimal paperwork compared to opening an LLC, PJSC, and so on. And taxes are often much lower than for legal entities.

Who can become an individual entrepreneur

A person who has reached the age of majority can become an individual entrepreneur. However, he should not be a municipal or government employee. Any Russian citizen or foreigner can become a businessman .

Important! If a foreign citizen decides to become an individual entrepreneur, then all he needs is registration. This is perhaps the only difference from registering an individual entrepreneur as a citizen of the Russian Federation. At the beginning of registration, you go to the nearest tax office, make yourself a TIN, and then take off your individual entrepreneur. A nuance is the fact that if a foreigner does not arrive from the customs union (Belarus, Kazakhstan, Russia), he will also need a temporary residence permit (TRP). Ideally, a foreigner should have a residence permit (residence permit), but as mentioned above, this is not a mandatory criterion.

Some types of activities of an individual entrepreneur impose other restrictions. For example, convicted citizens cannot work in areas that concern minors: their education, medical care, social protection, and so on.

This does not apply to any criminal record. Restrictions are imposed on people who have committed crimes against fundamental human rights (life and health, sexual integrity, freedom, honor and dignity, and so on).

If the criminal record has been withdrawn or expunged, there are no restrictions for such persons.

In what case is an individual entrepreneur more profitable than an LLC?

Before making his choice, an individual must weigh all the positive and negative aspects, and after that only make his choice. The entrepreneur can take over the management of the activities without involving additional hired employees.

Attention: many businessmen give preference to individual entrepreneurs - they are attracted by the simple setup procedure and low costs. It is believed that entrepreneurship is also profitable if the number of employees is small.

Notification of transition to simplified tax system

In accordance with Article 346.13 of the Tax Code of the Russian Federation, the transition of an individual entrepreneur to the simplified tax system after registration can be carried out ONLY within 30 days from the date of registration with the tax authority. Therefore, as a rule, a notification is submitted along with a package of documents when opening an individual entrepreneur.

In addition, the website of the Federal Tax Service states that the notification can be submitted in any form or in the form recommended by the Federal Tax Service (Form 26.2-1).

Let's take a closer look at how to fill out the notification:

- Please provide your Taxpayer Identification Number (TIN). If it is not there, then put dashes

- Enter the tax service code. You can view it on the official website of the Federal Tax Service

- Indicate the characteristics of the taxpayer specified from the list provided in the form

- Enter your personal information - last name, first name and patronymic

- Indicate the period from which the transition to the simplified tax system is carried out

- Designate the object of taxation (income or income minus expenses)

- Please enter your phone number

- Sign here

An example of filling out a notice of transition to the simplified tax system:

Pros and cons of being an entrepreneur

There are the following advantages of entrepreneurship:

- Registration with the registration authorities follows a simplified procedure. It is enough to fill out and submit to the Federal Tax Service an application drawn up in the prescribed form. You only need to attach to it a copy of your identity document and a receipt confirming payment of the state duty. The registration fee is 800 rubles, which is significantly less than the state duty when registering an enterprise. In addition, the registration procedure through government services is available. In this case, the fee will be only 560 rubles.

- An entrepreneur does not need to register in all places where he carries out his activities; he can register in one region and work in others. In this case, he does not need to carry out any actions to register.

- Existing legal norms for an entrepreneur establish an order of magnitude lower liability for violation of the law.

- Also, individual entrepreneurs are given the right to carry out accounting according to a simplified scheme. This is not affected by the applicable tax systems. The tax accounting registers provided for by law are required to be filled out.

- Individual entrepreneurs under the general regime pay taxes in quantity and amounts significantly less than a legal entity.

- If a subject decides to close a business, he can do this in a short time, because he does not need to go through the liquidation procedure provided for legal entities. In addition, the fee for deregistration as an individual entrepreneur is only 160 rubles.

Do not forget about the negative aspects that may arise when carrying out activities as an individual entrepreneur, these include:

- Entrepreneurs do not have the opportunity to attract outside investment to develop their business. This is due to the fact that the individual entrepreneur does not have an authorized capital, and this person cannot increase it by attracting additional founders.

- If an entrepreneur incurs a debt in the process of doing business, he will be liable for it even if the individual entrepreneur is closed.

- An entrepreneur must submit all declarations and reports at the place of his registration. This rule is quite problematic to follow if the individual entrepreneur does business in another region. The problem is partly solved by using electronic document management when sending reports. But do not forget that inspectors of the Federal Tax Service can call taxpayers to give explanations. Then the entrepreneur will have to go to his place of registration.

- Certain types of activities defined by law are not available to an entrepreneur, that is, there are restrictions on types. All such directions are established in the relevant legal acts.

- An individual entrepreneur must understand that he will not be able to fully sell his business to another person, as can be done with an LLC. Only property is available for transfer, but various permits are valid only in relation to a strictly defined person. Therefore, if necessary, they will have to be issued again.

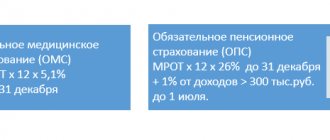

- Citizens registered as individual entrepreneurs have the obligation to calculate insurance premiums for themselves. Fixed payments will need to be paid to the budget even if there is no actual activity, but the individual entrepreneur is open.

- If an entrepreneur is an employer, then he is required to register in this status with the Social Insurance Fund.

- An entrepreneur must manage all processes independently when carrying out his activities.

Additional costs when opening an individual entrepreneur

All other costs (maintaining an individual entrepreneur, printing, account, cash register) relate to expenses that arise at the start of a business, but are not always mandatory. Let's take a closer look at them.

Seal

The law does not oblige an entrepreneur to issue a seal. This is at his discretion. To open an individual entrepreneur, printing is also not required. But very often counterparties insist that the primary documents, in addition to the signature, have a seal. The cost of printing starts from 500 rubles. Read this article about how to draw up documents if an individual entrepreneur will work without a seal.

Checking account

Just as in the case of printing, it is not necessary to open a current account to conduct business. But it may be needed if the amount of settlements with counterparties exceeds 100,000 rubles. In addition, when receiving money from individual entrepreneurs and organizations to a current account, you do not need to use a cash register.

In most banks, opening a bank account is free and you only need to pay for maintaining the account. On average, the monthly cost of account maintenance services ranges from 500 to 3,000 rubles.

Tax accounting

If an entrepreneur does not want to deal with the calculation and payment of taxes, the generation of reports and other documentation himself, he can outsource all this. In this case, a professional is engaged in maintaining individual entrepreneur records and the cost of his services per month starts from 3,000 rubles. If a business operates on OSNO, with a large number of operations, then the monthly cost of an accountant’s services will be much higher.

Reasons for refusal of registration

Registration of individual entrepreneurs in 2021 is carried out in the same way as in previous years. An individual must submit an application and a receipt with the state duty to the Federal Tax Service. Officials of the Federal Tax Service examine the received document for a certain period, after which they make a decision - to open an individual entrepreneur or refuse registration.

The provisions of the regulations establish the following situations when an individual may be refused registration as an individual entrepreneur:

- If errors are found in the submitted application due to which the registration procedure becomes unavailable.

- The application does not include the required document forms for this case - there is no copy of the passport or a receipt for payment of the state duty.

- When submitting an application, the territorial jurisdiction of the registration authorities was not observed. For example, an individual entrepreneur submitted documents for registration not according to his registration, but at the place of doing business.

- If a citizen who has declared his desire to become an individual entrepreneur is already registered as an entrepreneur, that is, his previous individual entrepreneur has not been closed.

- When the citizen who sent the application for registration has not yet reached the age of majority or is considered incompetent.

- When a court determines that a future entrepreneur is prohibited from engaging in entrepreneurial activities as a punitive measure.

- In a situation where the previous business was closed forcibly. In this case, an individual cannot register as an individual entrepreneur for one year.

- When the area of activity that the individual entrepreneur declares is available only to legal entities.

The tax authority that refused to register an individual entrepreneur must reflect the reason for its refusal in the appropriate document.

Important: starting October 1, 2021, the entrepreneur has the opportunity to adjust the data specified in the application and again send this form to the Federal Tax Service using the old payment receipt.

An individual entrepreneur can use this case only once within three months from the date of receipt of the refusal to register.

Payment Methods

In the recent past, paying state fees took quite a lot of time. It was necessary to obtain a form from a bank branch or tax office, find payment details (as a rule, they were located on information stands at the tax office) and pay by visiting a bank branch in person, while standing in a long line.

Over time, this process has become much simpler, providing citizens with several options for paying this payment. In 2021, payment of the state fee for opening an individual entrepreneur can be made in the following ways:

- by personal visit to a bank branch with a printed receipt;

- in electronic form on the website of the Federal Tax Service (FTS);

- through terminals located at the Federal Tax Service Inspectorate (local tax authority inspectorates) dealing exclusively with the registration of individual entrepreneurs and LLCs (i.e., not everywhere).

Let's take a closer look at each of the methods.

What types of activities do not fall under individual entrepreneurs in 2021

Regulatory acts regulating certain areas of activity in the economic sphere establish what types an entrepreneur cannot carry out. For this area it will be necessary to open an LLC.

These include:

- Creation and wholesale and retail sale of finished products containing alcohol.

- Production and sale of products containing narcotic and psychotropic substances.

- Production of medicinal products.

- Air transportation.

- Production and repair of aviation equipment.

- Activities related to space.

- Manufacturing, sales and other activities related to the handling and use of weapons and ammunition.

- Notarial activities.

- Operation of investment funds.

- Lending activities.

- Insurance activities.

- Private security services.

- Production of pyrotechnic products.

- Works on industrial safety.

- Sales of electricity.

- Search for work for citizens outside of Russia.

Refund of state duty

If you paid the state fee, but suddenly changed your mind about registering an individual entrepreneur, you can return it. To do this, within three years you need to contact the Federal Tax Service with an application for a refund of the duty. A copy of the payment receipt is attached to it. One month is allotted for the transfer of the refunded state duty.

Here you can find out about the refund of state duty.

In addition, from October 1, when resubmitting documents for state registration due to an incomplete set of documents or errors in registration, you will not have to pay the state fee.

How can I register?

There are several ways to submit documents for business registration.

On one's own

This is the easiest way to submit documents for registration, and it usually does not require any additional investment. An individual must independently complete an application and pay the fee. The application form can be purchased at a printing house, downloaded from the website and printed, or filled out directly on the computer.

The collected documents are transferred to the Federal Tax Service at the place of registration of the person. This is done by personal appearance, via mail or the Internet. Registration is also available through MFC centers, where the procedure period has been reduced to 3 days since 2018.

Some authorities have now stopped receiving paper documents for registration. Therefore, before visiting a government agency, it is advisable to clarify whether it is possible to submit forms from them.

Via Internet services

There are several services on the Internet that offer the service of preparing an application for registration:

- Nalog.ru - makes it possible to fill out an application in the P21001 format. Next, the form is printed and submitted in any available way to the registration authority;

- Service "MoeDelo";

- Service "Contour Elbe";

- Service "Regberry";

- Service "Sky";

- etc.

Attention: as a rule, these services do not send an application to the tax office. It can be printed and submitted manually, or signed with an electronic digital signature and sent using the State Services portal.

Through banks

Many commercial banks currently provide a service for registering a business with the subsequent opening of a current account. They take full responsibility for preparing documents and submitting them to the government agency.

As a rule, the client must sign documents electronically using an electronic signature, after which they are sent for registration using a special system.

However, not all banks currently offer turnkey registration. Some simply prepare the necessary documents, and their transfer to the tax office is already carried out directly by the entrepreneur.

Through law firms

Many law firms offer turnkey registration of individual entrepreneurs as a service. It turns out that this service is provided on a paid basis and in a short time.

This method will allow the future entrepreneur to completely avoid the registration procedure, but he will have to pay for the services of this type of company. In addition, in order for a representative of the company to submit a package of documents for registration, it will be necessary to issue a power of attorney for him.

How to reduce the state duty?

When submitting applications through the State Services portal, discounts apply: the state fee can be paid with a 30% discount. The innovation was introduced on 01/01/2017 and is valid until 01/01/2019. It applies to the registration of individual entrepreneurs.

To receive a discount, you need to fill out an application form on the portal and wait until an invoice for paying the fee appears in your personal account.

There are several calculation options:

- MasterCard, Visa, Mir cards;

- through a wallet (Webmoney);

- through federal mobile operators.

This rule was introduced by 221-FZ of July 21, 2014 “On amendments to Chapter 25.3 of Part Two of the Tax Code of the Russian Federation,” and more specifically, by paragraph 3 of Art. 2. If these conditions are met, you will have to pay not 800, but 560 rubles. It is not possible to return a previously paid fee in order to repay it at a discount.

Order to increase salary in connection with an increase in the minimum wage - sample

How much does it cost to open an individual entrepreneur in 2018?

Let us summarize in the form of a table how much it costs to open an individual entrepreneur:

| Registration | Duty amount | other expenses | Total |

| Independently through the Federal Tax Service | 800 | – | 800 |

| Independently through the MFC | 800 | – | 800 |

| Independently through State Services | 560 | Digital signature from 1000 rubles Programs from 900 rubles. | 2460 |

| On your own via Mail | 800 | Notary from 1500 rubles Postal services from 200 rubles | 2700 |

| Through the Nalog.ru service | 800 | Digital signature from 1000 rubles Programs from 900 rubles. | 2700 |

| Through banks | 800 | Digital signature from 1000 rubles Bank services from 2000 rubles | 3800 |

| Through an intermediary (law firm) | 800 | Registration services from RUB 2,500 | 3300 |

Attention: from January 1, 2021, the state fee for registering individual entrepreneurs will not be charged, provided that documents are submitted electronically, for example, through the State Services website.

Instructions for payment via Sberbank Online

Many people ask how to pay the state fee for opening an individual entrepreneur in Sberbank online. Any payment can be made through this mobile application, the only condition is to know the necessary details. To do this, you can use an already generated payment order from the Federal Tax Service website, enter all the values: BIC, KBK, INN and KPP UFK, OKTMO, account number, payer data and his INN.

You can simplify the procedure for entering details by reading the QR code located on the payment card, if your mobile device supports such a function. In the “Payments” tab of the Sberbank mobile application there is a “Payment by QR code” function.

Registration of individual entrepreneurs in 2021: necessary documents and actions

Registration of individual entrepreneurs step-by-step instructions will help if you decide to draw up and submit documents yourself.

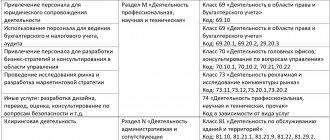

Step 1. Select activities

If an individual decides to start an activity as an entrepreneur, he already knows what kind of activity he will be engaged in. At the same time, he can choose several directions, but one of them must be designated as the main one.

When the application is filled out, these areas of activity must be indicated in it using the current OKVED2 codes. It is recommended to reflect all possible types of work on the form so that you do not have to make changes to the registration in the future.

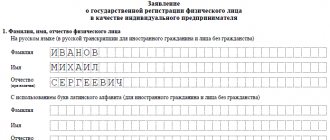

Step 2. Fill out the application form P21001

The tax authority registers an individual as an entrepreneur based on a submitted application in the P21001 format.

You can compile this document manually on a paper form, or fill it out using a computer. In each case, the data must be entered according to the instructions, observing all established rules and avoiding any errors.

Therefore, to draw up an application, it is recommended to use special Internet services or accounting programs.

If the application is drawn up on a computer, then you must set the font for the characters to Courier New with a size of 18pt.

If data is entered by hand on a paper form, then this must be done only with a black pen, and only printed symbols must be used. In this case, each letter or sign is written in a separate cell.

The original application form includes sheets that apply to all cases. When actually filling out, only those that are necessary should be used. Blank pages from the application are removed and are not submitted for verification.

Important: It is prohibited to make corrections to the form. If an error is found in the document, then this sheet must be rewritten again.

Files:

.

Step 3. Prepare the necessary package of documents

The procedure for registering a business is quite simple and does not require the preparation of a large package of documents:

- Compiled application in format P21001;

- Full copy of passport;

- A receipt indicating that the state duty has been paid.

In case the documents are transferred by an authorized person:

- A power of attorney drawn up by a notary for the transfer of documents and receipt of the result;

If a future individual entrepreneur immediately wants to change the tax calculation system:

- Application for transition to a special tax regime (STS, PSN, UTII);

If a foreigner wants to become an entrepreneur:

- Notarized translation of all pages of his passport;

- A copy of the received permit to stay in Russia.

Attention: when submitting documents through the MFC, an application for the transition to simplified tax regimes will need to be submitted to the Federal Tax Service after receiving documents on business registration.

Step 4. Pay the state fee

When submitting documents for registration of an entrepreneur, payment of the state fee is a mandatory requirement. Its size is now 800 rubles.

If the paperwork is completed using the State Services portal, then you can also transfer the payment through it. In this case, the applicant will be given a discount, resulting in the fee amounting to 560 rubles.

Also, the Federal Tax Service website makes it possible to generate a receipt for payment of the duty through a bank, or pay it immediately on the spot using electronic money. There is no discount for this payment method.

For any method of paying the fee, a copy of the receipt must be attached to the package of documents. If an error was made in the documents and the government agency refused to carry out registration, then when resubmitting them you will need to pay the fee again (valid until October 1, 2021).

Attention: this procedure was canceled on October 1, 2018 - starting from this date, the paid fee can be used one more time within 3 months from the date of refusal.

Step 5. Submit documents

You can submit the collected documents for verification in one of the following ways:

- Upon personal visit to the inspection. It is necessary to clarify the possibility of using this method, since in some regions documents from the Federal Tax Service are sent to the MFC ;

- Upon personal appearance at the MFC “State Services”;

- When using the Internet portal "State Services" - this method requires an electronic digital signature;

- When using the tax authority’s Internet portal, this method requires an electronic digital signature;

- By mail with the described attachment. For Moscow, shipping by DHL or Pony Express courier service is also available.

Attention: if documents are submitted in person to the Federal Tax Service or MFC, the employee receiving them must issue a receipt for receipt of the forms.

Step 6. Getting the result

The Statement of the World in the World üíîão ïðäïðèíàtåëÿ, ïàñïîòïè ïå÷àòü

Currently, the registration authority reviews documents within 3 days. Moreover, this period is valid for all registration methods.

Thus, changes in the current legislation, as well as the organization of the exchange of documents between the MFC and the tax authorities, currently allow registration by this method in the same time.

If the forms are successfully reviewed, the newly minted entrepreneur receives the following documents:

- Notification of registration using form No. 2-3-Accounting. This document is drawn up on plain paper with the seal of the registering authority. OGRIP forms are currently not issued as before.

- Extract from the Unified State Register of Individual Entrepreneurs in format P60009;

- A form with the TIN code (if a request for its assignment was also made when submitting documents).

Attention: if the documents do not pass the verification, the applicant is given a written refusal with justification for refusing registration. He can issue them again and resubmit for verification.

Why register as an individual entrepreneur?

You cannot work without paying taxes. A pension will be formed from taxes, and for conducting business activities without registration you can run into a fine. In addition, for individual entrepreneurs there is also an accrual of experience. Therefore, you definitely need to think about opening an individual entrepreneur in order to work officially and for yourself.

Therefore, it is imperative to register the activity. It is worth focusing specifically on individual entrepreneurship. This is the most profitable option for a novice businessman.

Advantages of opening an individual entrepreneur

Individual entrepreneurship attracts citizens because it has a number of positive aspects:

- Simplicity of design . You don’t need a lot of documents to open an individual entrepreneur;

- Small fines for violations . The tax authorities are not very interested in small businesses, so they rarely check them, and the punishment for incorrect reporting is small;

- Greater freedom to work with finances . An entrepreneur can spend everything he earns as he pleases;

- It is not necessary to order a stamp and place a cash register (for some types of activities);

- You can work in cash;

- An individual entrepreneur is his own boss . Therefore, he can work with maximum convenience for himself.

Moreover, an individual entrepreneur can get by with “little loss” when paying taxes if he chooses a taxation system that can provide maximum benefit. Whereas it will be more difficult for a legal entity to officially save on tax deductions.

Disadvantages of IP

Unfortunately, any form of entrepreneurial activity has quite a few disadvantages. And IP is no exception. It has several unpleasant disadvantages:

- Responsibility . An entrepreneur is responsible for his every action not only before the law, but also before those with whom he works. By the way, if something happens, the individual entrepreneur risks all his property if he suddenly accrues exorbitant debts;

- Difficulties . The tax authorities don’t care how much the individual entrepreneur earns - you will have to pay minimum deductions, even if the company is operating in the red;

- Bureaucracy . It is imperative to prepare reports, keep records of income and expenses, and provide this to the tax authorities during audits. Additionally, it is important to remember to pay taxes;

- Disrespect . Few people want to work with individual entrepreneurs, since it is very easy to register, and the owner has less responsibility (that is, there is a stereotype that individual entrepreneurs are not necessary);

- Restrictions . Individual entrepreneurs cannot obtain part of the licenses (for example, for selling alcohol). The owner cannot appoint a director and withdraw from running the business. You cannot conduct business together, and so on;

- Banality . It is impossible to assign a beautiful name to an individual entrepreneur - the company will have to be called by the surname and initials of the owner. However, no one bothers you to register a trademark, service mark, or choose a commercial designation.

These shortcomings, however, have virtually no effect on the operation of the future enterprise. If you approach your business wisely, don’t forget to draw up reports and keep documentation correctly, then no problems will arise.

Tax systems: which one to choose?

Currently, six different tax systems are available to individual entrepreneurs.

- general taxation system (GTS);

- unified tax on imputed income (UTII);

- patent tax system (PTS);

- unified agricultural tax (UAT);

- simplified taxation system (STS);

- professional income tax (PIT).

What are their differences? How much will you have to pay for each system and which one is more profitable for an individual entrepreneur?

In fact, there is no universal benefit for all entrepreneurs. Depends on what exactly the IP will be working on.

What taxes should an entrepreneur pay? What conditions apply to each tax system? We need to figure it out.

DOS implies taxes that are standard for all. This system is assigned automatically when creating an individual entrepreneur. You will have to pay:

- 20% income tax or 13% income tax (NDFL);

- 18% value added tax (VAT) on money received from the sale of goods or services;

- payment of property tax.

UTII is available only to companies with no more than 100 employees. It involves paying taxes on estimated income, not actual income. That is, someone calculates the profit, and the entrepreneur is obliged to pay the state a percentage of this estimated amount (in fact, it may be less or more). Replaces personal income tax, VAT and property tax. But it is not suitable for all entrepreneurs - UTII is available only for some categories.

PSN implies that the entrepreneur has a patent for his activities. At the same time, the number of people in the company should not exceed 15. Replaces VAT (with the exception of certain types of activities), personal income tax and property tax.

The simplified tax system requires maintaining a ledger of expenses and income. Income (less expenses) is taxed at 5-15% (depending on the region) or only income at 6%. The most popular and simplest type of taxation.

Unified agricultural tax is the same as the simplified tax system , but only works for entrepreneurs engaged in agricultural activities. The main condition is that income from the sale of agricultural products should not be less than 70%.

NPD (Professional Income Tax) is a “tax on the self-employed”, available for some types of activities, without employees, and only in 4 constituent entities of the Russian Federation (Moscow and the region, Tatarstan and Kaluga region).