Transactions that are reflected in accounting on account 71

Account 71 in the accounting department is intended to reflect the company's settlements with its accountables, i.e., with persons who received money on account from the company to pay for any of its needs.

Such expenses may include:

- procurement of goods and materials;

- payment for work or services;

- expenses associated with business trips.

Only persons working for the company under an employment contract or within the framework of the GPA can be accountable. The issuance of money on account can be carried out on an ongoing basis or on a one-time basis.

The list of employees who receive money regularly is approved in the order of the manager. It also indicates the period for which the employee is given the company's money. To receive money one-time, the employee must write an application indicating the amount and period for which it is required.

The employee who received the money, in accordance with clause 6.3 of the instructions of the Central Bank of the Russian Federation “On the procedure for conducting cash transactions” dated March 11, 2014 No. 3210-U, must report on expenses no later than 3 days:

- after the end of the period for which the money was issued;

- completion of a business trip;

- the end of the period of incapacity;

- coming out of vacation.

Accountable persons report by filling out an advance report. How to reflect in accounting the expenses of an accountable person and exchange rate differences on an advance report in foreign currency? The answer to this question can be found in a ready-made solution from ConsultantPlus experts. If you don't already have access to the system, get a free trial online.

Operations on account 71 “Settlements with accountable persons” are carried out in accordance with the requirements of the Chart of Accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 30, 2000 No. 94n.

The procedure for issuing money for reporting

The issuance of funds to an employee can be carried out in several ways.

You might be interested in:

Account 03 in accounting “Profitable investments in material assets”, what is taken into account, correspondence of accounts, postings

The simplest and most common way is to issue money from the cash register. In this case, the cashier, at the time of issue, formalizes the operation with an expense cash order.

Until mid-2021, when issuing money, the employee must fill out an application for the issuance of the amount. This had to be done by any employee of the organization, including the director. Applications were allowed not to be filled out when reimbursing excess reporting and issuing daily allowances for business trips.

Since 2021, changes have been made to this procedure. The company can continue to use statements, or issue an order from the manager, which will indicate the full name. accountants, amounts and deadlines for reporting on funds received.

Attention! If there is no application or order, or if they are drawn up incorrectly, fines of up to 50 thousand rubles may be imposed on the company and responsible persons.

The application for the director should differ from the forms of ordinary employees - in it he does not ask for a report, but gives an order to perform this action.

The latest amendments to the procedure for cash transactions allow the issuance of a new amount if the employee has not yet reported the old one. Previously, such a step was prohibited.

In addition to cash, reports can also be issued by transferring from a current account to an employee’s card. For this step, he fills out an application and includes in it the bank details for making the payment.

If the application is not completed, the tax authority, upon inspection, will decide that income (salary) was transferred and will charge additional personal income tax on the amount. Also, the payment order must indicate that it is the issuance of the report.

If the issue is made to a card, then the employee can attach a receipt from the terminal, ATM, bank statement and similar forms as a supporting document. If the employee is on a business trip and an additional daily allowance is transferred to him, then there is no need to fill out another application. But you will need to report all amounts at the same time.

Attention! If the employee has not spent the accountable amount in full, then after completing the advance report, he must return the unused balance back to the cashier

Account 71 active or passive

To understand whether account 71 is active or passive, you need to understand what the postings reflected on it show.

Accounting account 71 is a synthetic account, the analytics of which are carried out for each accountable amount. It can have a credit and debit balance both for analytical accounts and for the account as a whole. Therefore, account 71 in accounting is classified as active-passive accounts.

At the same time, this is essentially an active account. After all, what is shown here are settlements with employees for amounts received to pay for the company’s needs, and not at all settlements for “hidden lending” to the organization by its employees in the form of payment for production and business expenses.

When preparing financial statements, the balance of settlements with accountable persons on account 71 is shown in detail. The debit balance of account 71 is shown as part of short-term receivables on line 1230, and the credit balance is shown as part of short-term accounts payable, which is shown on line 1520.

Small enterprises that have the right to keep records in a simplified manner in accordance with clause 4 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, reflect credit balances in line 1230 “Financial and other assets”, and credit balances in line 1520 “ Accounts payable".

Characteristic

The information content of the account defines this account as a register of material accounting of funds. The Order “On the Accounting Policy of an Enterprise” regulates the specifics of maintaining account 71 - on the active or passive side.

- Credit balance

. The occasional use of small-scale reporting in enterprises with modest turnover allows you to pay expenses after they have been incurred. - Debit balance

. Management chooses a policy of advance payment. Advance payment is the most convenient option for enterprises where frequent, long-term business trips or constant large-scale purchases for cash are practiced.

For each accountant, the enterprise maintains detailed analytical records in the context of 71 accounts. If analytical accounting records specific turnover for each individual employee, then thanks to synthetic accounting the total amount of turnover is reflected, balances characterizing the relationship between personnel and the organization in the area of production expenses.

Cash discipline is as follows

:

- Seconded employees report on the day of arrival if this happened during working hours. In other situations, the legislation allocates three working days for the report - Directive of the Central Bank of the Russian Federation No. 3210 dated March 11, 2014 in paragraph 6.3.

- Full-time personnel who are constantly at the workplace must report from the moment they receive money on an expense order from the cash register or the receipt of funds on the card.

What does the debit of account 71 show?

The debit of account 71 shows the issuance of funds for reporting to employees of the organization in correspondence with accounts reflecting the accounting of funds:

- Dt 71 Kt 50 - the employee was given money for household needs from the company’s cash desk;

- Dt 71 Kt 51 (52) - money was transferred to the employee from the company’s current or foreign currency account for travel expenses,

Where:

accounts 50, 51, 52 - accounts on which funds are kept. The operation shows the advance of expenses made by the employee in the interests of the company. Such transactions are reflected in the left table on the front side of the expense report. The debit balance of 71 accounts consists of funds remaining in the hands of the accountants.

Debit and credit

Account 71 belongs to the category of active-passive

. This feature is related to the fact that account balances can be debit and credit:

- Dt 71

reflects the amount of money that was issued from the cash register and received by the employee. - Kt 71

shows the expenditure of money, confirmed by documents attached to the advance payment.

After the manager’s order, money is issued both from the cash register and transferred from a bank account to a plastic card. The basic rule is to receive a report on the use of previous subreports, only after which a new amount is issued. To simplify the systematization of accounting, persons who can receive money for business expenses are assigned by internal order

organization and a special document is signed with them - a Liability Agreement.

What does account credit 71 show?

Credit 71 of the account shows expenses made by the accountant for the needs of the organization. At the same time, the debit side of the transaction indicates the accounts on which the costs of purchasing goods and materials, services, etc. are kept. They show for what purposes the money received under the report was spent:

- Dt 10, 11, 41 Kt 71 - inventory items paid by the accountable were capitalized;

- Dt 19 Kt 71 - VAT issued by suppliers is accepted for accounting;

- Dt 76 Kt 71 - paid for the services of a third party;

- Dt 20, 26, 44 Kt 71 - reflects the payment of costs associated directly with the needs of the main production, general economic needs or with the sale of goods;

- Dt 50 (51) Kt 71 - the accountant returned unused money to the cash desk or to the company’s current account,

Where:

- accounts 10, 11, 41 - accounts for recording material assets;

- account 19 - “VAT on acquired values”;

- accounts 20, 26, 44 - accounts for recording costs for main production, economic needs or sales of goods;

- account 76 - “Settlements with other debtors and creditors.”

These entries to account 71 are made after the accountable person submits the advance report and are reflected in the right table on the front side of the advance report.

The credit balance of the account shows the presence of overspending on the accountant.

Correspondence

The consistency of general synthetic accounting, the formation of a balance sheet and tax reporting subsequently depends on how correctly and accurately each posting is made. Accounting theory assumes correspondence between account 71 and certain accounts, both debit and credit.

Debit

— 50 “Cash accounting”, 51 “Current account”, 52 “Currency account”, 55 “Correspondent bank account”, 79 “Intra-business settlements”, 91 “Other income and expenses”.

Credit

– accounts 10, 11, 15, reflecting settlements for transactions with material assets, fixed assets, and non-current assets. Production section - 20, 23, 25, 26, 28, 29. Commodity accounting category - 41, 45. Accounting for funds in various forms - 50, 52, 55, calculations are reflected in the account. 70, 76, 79. Closing turnover and drawing up results for sub-reports is carried out on accounts , 97. The withdrawal of profits or losses is carried out on the credit side of account 99.

Maintaining double entries must be accompanied by Instructions for using the Chart of Accounts.

Postings and accounting of unreturned imprest amounts

Amounts not returned on time by the accountable person are shown on credit account 71 in correspondence with account 94 “Shortages and losses from damage to valuables”:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Dt 94 Kt 71 - writing off amounts not returned by the accountable as shortages.

Thereafter, depending on the circumstances, such amounts may be reflected as follows:

- deductions from the employee’s salary - Dt 70 Dt 94;

- other settlements with employees - Dt 73 Dt 94.

The unspent amount of the account can be withheld from the employee’s salary only within one month after the date by which the advance must be returned (Article 137 of the Labor Code of the Russian Federation). The deduction is made on the basis of a written order from the manager with the consent of the employee.

In all other cases, this amount is included in other expenses with the employee.

Note! According to Art. 138 of the Labor Code of the Russian Federation, the amount of deduction cannot exceed 20% of the wages paid to the employee.

Accountable travel funds

An employee, going on a business trip, has the right to reimbursement of the amount of travel expenses incurred for the purpose of:

- payment for travel to the destination;

- payment of housing rent;

- payment of daily expenses;

- payment of other expenses agreed with the employer.

It is also necessary to take into account that an employee can only claim travel allowances if he is a full-time employee. The amount of money issued on account is regulated by collective labor agreements or the charter of the enterprise. Funds issued in foreign currencies must be accounted for in separate subaccounts.

What can the balance sheet show for account 71

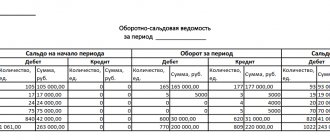

The balance sheet for account 71 allows you to see the process of forming balances on the synthetic account in the context of its analytics.

The analytical attribute (subconto) on which the statement is constructed is the accountable persons.

The balance sheet is formed over a certain period of time and allows you to control:

- incoming and final debt of accountable persons to the organization;

- incoming and final debt of the company to employees;

- amounts received for reporting;

- amounts reported by accountables.

It consists of 7 columns:

- the first indicates the score and its analytical sign;

- in the 2nd and 3rd - the balance at the beginning of the period;

- in the 4th and 5th - debit and credit turnover of account 71;

- in the 6th and 7th - the balance at the end of the period.

A separate final result is displayed for each column of the table.

Postings

Active-passive account 71 corresponds with a certain list of accounts

, reflecting the operations inherent in this part of the company’s activities.

First of all, these are accounts for accounting for cash (50 “Cash”) and non-cash (51 “Bank”), as well as material accounting for goods, services, production - 08, 10, 20, 26, 44. Correspondence for any accounting activities is reflected in the main register - the Journal of Accounting Transactions, which has the following form

:

| № | Operation | Dt | CT | Sum | Document |

| 1 | Money issued from the cash register | 71 | 60 | RKO, cash book | |

| 2 | Credited to the card from the current account | 71 | 51 | Payment order, statement | |

| 3 | Transfer of funds for reporting to a corporate card | 71 | 55 | Extracts from special accounts | |

| 4 | A report on the acquisition of OS was carried out | 08 | 71 | Transfer and Acceptance Certificate | |

| 5 | A report on the acquisition of goods and inventory items was carried out | 10 | 71 | Commodity or consignment note, acceptance certificate | |

| 6 | A report on costs for production purposes was carried out | 20, 23, 44 | 71 | Advance report – JSC | |

| 7 | A report on goods for further sale is carried out | 41 | 71 | Consignment note, JSC | |

| 8 | The balance of the report is entered into the cash register | 71 | 50 | PKO, cash book | |

| 9 | Accrual of debt for non-repayment of money on time from accountable persons | 73 | 71 | JSC |

Payments to employees are made as follows:

.

- the amount of debt owed by employees to the enterprise;

- the amount of debt the company owes to its staff;

- turnovers on the debit and credit sides are displayed;

- The expanded balance as of the end of the reporting period is displayed.

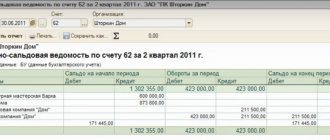

An example of filling out a balance sheet

As of 04/01/2020, the accountable Simonov S. has an overexpenditure of one amount received under the report in the amount of 1000 rubles. and debt on the second in the amount of 5,000 rubles. The deadline for the report has not yet arrived. The amounts are reflected in the opening balances.

In the second quarter, S. Simonov received 1,000 rubles from the cash register. (debit turnover) and compiled an advance report for the second amount in the amount of 4,500 rubles. (credit turnover).

After this, another accountable Vasiliev A. received an amount for household needs - 2800 rubles. (debit turnover).

Now the ending balance in the statement will look like:

Simonov S. - final debit balance: 500 rub.

Vasiliev A. - final debit balance: 2800 rub.

The company records settlements with accountants using subaccount 71.01 “Settlements with accountants in rubles.”

Note! An employee can receive a new sum of money against the report before the previous one is fully settled.

Account purpose

Account 71 is intended to record the issuance and return of unspent accountable amounts. Money from the cash register is issued with the execution of an expense cash order and only on the condition that the employee has submitted an advance report on the spent accountable funds received earlier.

To receive funds, the employee writes an application, which must be certified by the head of the company. After the expiration of the period for which the funds were provided, the employee must provide reports within 3 days on the purpose and amount of money spent. Unspent funds are returned to the company's cash desk.

***

Account 71 reflects settlements between the organization and its accountable persons. The debit of the account shows the amounts issued to pay for the needs of the company, and the credit of the account shows paid goods, works, and services. To clearly monitor the movement of amounts in an account, a balance sheet is used.

Even more materials on the topic can be found in the “Accounting” section.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Postings for payment of travel allowances

The issuance of travel allowances to an employee is accompanied by accounting entries and execution of relevant documents. Having paid funds from the cash register to the account, the following entry is made: Dt account 71 Kt account 50. If the money was transferred to a corporate payment card, the operation is recorded with the entries: Dt 55 Kt 51, Dt 71 Kt 55.

The further accounting procedure depends on the purpose for which the employee was sent on a business trip. If production needs are fulfilled, accounts 20, 23 or 29 are debited with account 71. Travel of an administrative and managerial nature is written off to account 26, for the sale of goods - to account 44.

A business trip associated with the acquisition of property for an enterprise is included in the cost of the purchased asset and is reflected in the corresponding account for inventory, non-current assets, and goods.

The amount of VAT on travel payments of a production nature is taken into account by the following entries:

- Dt “VAT” Ct “Calculations for accountable amounts” – the VAT amount is accepted for accounting.

- Dt 68 “Calculations for taxes” Kt 19 “VAT” - tax deduction of VAT was carried out.

It should be remembered that VAT is not deducted for expenses not related to production. A posting is made: Dt “Other expenses” Kt “VAT”, meaning VAT is written off.

Confirmed expenditure of travel funds for a large amount is subject to reimbursement by the enterprise in favor of the employee, posting - Dt account 71 Kt account 50. If the employee returns unspent amounts, the operation has the opposite form: Dt “Cash” Kt “Calculations for accountable amounts”.

Reflection of entertainment expenses in accounting

To account for the issued accountable amounts for the purpose of paying for entertainment events, entries are made for 71 accounts:

- DT “Calculations for accountable amounts” CT “Cash” - money was issued for reporting.

- DT “General business expenses” CT “Calculations for accountable amounts” – reflects the amount of entertainment expenses.

- Dt “VAT” Ct “Calculations for accountable amounts” – the amount of VAT is taken into account.

- Dt "Cash" Kt "Settlements for imprest amounts" - unused funds are returned to the enterprise's cash desk.

- DT “Calculations for accountable amounts” CT “Cash” - funds were issued as compensation to the employee for overexpenditure.

- DT “Retained profit/loss” DT “Calculations for taxes” - in case of excess of standardized expenses, the amount of VAT on the overexpenditure is restored.

The amount of entertainment expenses should not exceed 4% of labor costs in the reporting period.

What is it used for?

Accountable employees are determined by order of the head of the enterprise. They are given goals and given funds. The description of the accounting accounts suggests that such persons are required to use 71 accounting accounts.

Important! Employees are called this because after completing their work for which money was allocated, they are required to provide reports and attached documents on the expenditure of funds to the accounting department of their enterprise.

71 accounting account is a special register that summarizes information about the formation of debts of an employee to a legal entity for money issued to him for the performance of specific tasks. The special account71 also contains information on the repayment of debts for the provision of expenses according to the advance report. However, that's not all. The organization may also owe the employee a certain amount if he wasted his own money on the needs of legal entities. Reimbursement occurs by order of management with an advance report.

Balance sheet for a specific period

Important! It is impossible to place information about loans and credits issued to employees in the 71st special account, since this is the competence of the 73rd position. Many unscrupulous entrepreneurs, under the guise of accountable money, issue microloans to their employees, which is a violation of the law.

The current law in this area suggests that amounts can only be issued for the purposes specified in the orders, and that the employee must return them in case of failure or account for their use. To keep records of accountable employees, journal order No. 7 is used. It records all expenses incurred and money issued for the reporting month.

An example of an advance report that may indicate debt repayment

What it is

Any company interacts with other legal entities and entrepreneurs to achieve mutual benefit. Often interaction occurs through hired workers. Employees representing the interests of their superiors may incur certain expenses in the performance of their professional duties. That is why the heads of organizations or enterprises allocate an accountable amount of money to them. 71 accounts in the accounting department are used specifically to account for this money.

Registration of the operation of issuing funds to an authorized person