Payers of the simplified taxation system submit only one declaration per year. Organizations using the simplified tax system must report no later than March 31 of the year following the reporting year. For individual entrepreneurs, the declaration campaign lasts longer, the deadline for submission is April 30.

Everyone who submitted an application to switch to a simplified regime must report for 2021. If an individual entrepreneur does not operate within the framework of the simplified tax system, combining this regime with another taxation system, then the declaration will be zero.

Please note: individual entrepreneurs from affected industries who received an exemption from paying advances for the 2nd quarter of 2021 must reflect in the declaration all income received and calculated advance payments.

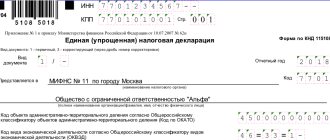

Declaration form according to the simplified tax system

The simplified tax system declaration for 2021 for payers of this preferential regime was approved by order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/ [email protected]

Please note: by order dated December 25, 2020 No. ED-7-3/ [email protected] the Federal Tax Service approved a new declaration form, which applies to reporting already for 2021! And for 2021, as well as in case of termination of activity on the simplified tax system until March 20, 2021, you must report according to the old form.

In total, the form contains 8 pages, but different pages are filled out for different tax objects. In this article we will look at filling out only the “Revenue” object, as the most popular option.

Prepare a simplified taxation system declaration online

The completed tax return under the simplified tax system Income will include the following pages:

- title page;

- section 1.1;

- section 2.1.1;

- section 2.1.2, if the simplifier pays a trade fee

- section 3, if targeted funding has been received (see paragraphs 1 and 2 of Article 251 of the Tax Code of the Russian Federation).

Sections 1.2 and 2.2 are intended only for the object “Income minus expenses”, therefore payers of the simplified tax system of 6% do not fill them out and do not attach them to the declaration.

It turns out that if an individual entrepreneur on the simplified tax system for income did not pay the trade fee and did not receive targeted funds, then he only needs to fill out 3 pages: the title page, sections 1.1 and 2.1.1.

Types of individual entrepreneur reporting when using the simplified tax system

The individual entrepreneur organizational form does not have the obligation to prepare and submit financial statements. At the same time, there is a need to maintain primary accounting forms to determine income, expenses, accounting for fixed assets, and employee salaries.

General conditions for individual entrepreneur reporting when maintaining a simplified regime:

- There is no need to submit reports on land, property, or transport taxes. The accounting of property taxes of individual entrepreneurs is carried out by the Federal Tax Service on an equal basis with individuals. The territorial body accrues, notifies and controls payments.

- Individual entrepreneurs independently calculate and submit reports on the main tax (unified in connection with the use of the simplified tax system), insurance contributions (IC) and personal income tax on employee income, and statistical data.

- The composition of the reporting depends on the characteristics of the individual entrepreneur’s activities, the combination of modes, and the presence of employees on staff.

Important! Reports are submitted at the place of registration of the individual entrepreneur (registration of an individual recognized as an individual entrepreneur) on forms valid for the period.

A paper or electronic form is provided as an attachment to the medium or reporting generated for transmission via telecommunication channels (Article 80 of the Tax Code of the Russian Federation).

What information is reflected in the simplified taxation system declaration?

Let us remind you that the income statement of an individual entrepreneur for the year is the only form of reporting that must be submitted to your tax office. But during the year, the individual entrepreneur transferred advance payments for the single tax and insurance premiums for himself. The individual entrepreneur does not submit any reports on them.

Advance payments and insurance premiums paid for yourself and employees directly affect the amount of annual tax payable, so they are reflected in the declaration. In order to report correctly, collect information about the listed advances, contributions and income received. If you have been keeping an accounting book for the simplified tax system (KUDiR) for a year, this will not be difficult.

Please note: although KUDiR is not submitted to the tax office, the information from it must fully correspond to the figures that you enter in the annual declaration. If, due to incorrect filling out of the KUDiR, the tax base in the declaration is underestimated, the individual entrepreneur faces a fine of 40 thousand rubles under Article 120 of the Tax Code of the Russian Federation.

This might also be useful:

- Limit value of the base for calculating insurance premiums in 2018

- KBK for personal income tax in 2021

- Property tax under the simplified tax system in 2021

- Changes for individual entrepreneurs in 2021

- Changes to the simplified tax system in 2021

- simplified tax system for individual entrepreneurs in 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Deadline for submitting a declaration according to the simplified tax system

We have already noted above that the deadlines for submitting a simplified declaration for LLCs and individual entrepreneurs are different. Entrepreneurs have a little more time for this. Individual entrepreneurs must submit a declaration under the simplified tax system for 2021 no later than 04/30/2021. But still, you shouldn’t put off submitting your reports until the last few days.

- Firstly, April 30 is also the deadline for submitting the 3-NDFL declaration, which is submitted by individuals when selling real estate and transport. It is likely that there will be long queues at inspections during this time.

- Secondly, if you report before the end of April, you will have time to correct a possible error in the declaration before the end of the reporting period.

- Thirdly, 04/30/2021 is the deadline for paying the single tax at the end of the year. It is better not to put off two important things at once until this date: filing a declaration and transferring taxes to the budget.

For violation of the deadlines for submitting a declaration under the simplified tax system, tax authorities not only fine, but also have the right to block the current account of an individual entrepreneur. The fine for late filing of a declaration, provided that the tax was paid on time, is 1,000 rubles. Be careful!

But in addition to annual reporting, declarations under the simplified regime are submitted by individual entrepreneurs who have ceased to be payers of the simplified tax system during the year:

- in case of voluntary departure from simplified employment - no later than the 25th day of the next month after termination of activity;

- in case of violation of the conditions for applying the preferential regime - no later than the 25th day of the month following the quarter in which the right to the simplified tax system was lost.

Optional reporting forms

Entrepreneurs who combine a simplified regime with UTII additionally submit reports on imputed tax. If you have activities under the simplified tax system, you will need to keep separate records of income and expenses under different taxation systems.

Individual entrepreneurs using the simplified tax system are not recognized as VAT payers, with the exception of cases of tax agents. When the tax is allocated in documents, the lease of state property, the purchase of scrap metals, the acquisition of goods from foreign persons and in other cases specified in the Tax Code of the Russian Federation, the company is recognized as a tax agent. The tax amount must be calculated, transferred to the budget, and presented in the VAT return.

An example of submitting a VAT return. An individual entrepreneur using a simplified accounting regime has leased municipal property. When making rental payments, it became necessary to allocate VAT, pay tax and submit a declaration. The entrepreneur submitted a report to the Federal Tax Service on paper. Unlike persons who are VAT payers, tax agents have the right to submit a declaration without using electronic forms.

Requirements for filing a declaration

The procedure for filling out a declaration for the simplified tax system is approved by Appendix No. 3 to the Order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3 / [email protected] In general, these are standard requirements for tax reporting forms:

- Only capital printed characters are used;

- When filling by hand, black, purple or blue ink is allowed;

- when using a computer, only Courier New font with a height of 16 - 18 points is allowed, and numerical indicators are aligned to the last right familiarity;

- if the declaration is filled out by hand, a dash is entered in the empty fields; when filled out on a computer, dashes are optional;

- cost indicators are rounded and indicated in full rubles;

- the completed declaration must not contain any errors, blots or cross-outs;

- Each page is printed on one sheet, double-sided printing is not allowed;

- the pages do not need to be stapled or stitched;

- Continuous numbering is used, starting from the title page, and only completed pages are numbered.

You can create your declaration yourself in a specialized online service.

Prepare a simplified taxation system declaration online

You can submit a declaration under the simplified tax system by post, electronically if you have an electronic signature, or on paper during a personal visit to the inspection. We recommend the latter option. In this case, you still have a second copy of the declaration with the Federal Tax Service stamp in your hands. It may be needed when opening a current account or to confirm the income of an entrepreneur.

How to submit individual entrepreneur reports

Today, private businessmen have access to a variety of ways to submit reports. An individual entrepreneur can submit documents to the Federal Tax Service in person, via the Internet, using the postal service, or using the services of an authorized representative. Let's consider each of the methods in more detail.

Submitting reports in person

To submit reports in person, you must prepare all documents in duplicate in paper form and make an appointment at your regional office of the Federal Tax Service. You can find out the exact address of the branch serving you on the Federal Tax Service website by entering the Federal Tax Service code known to you and the address where your company is registered in the form fields. For the convenience of users, all Federal Tax Service codes are presented on the website in the form of a directory, from which it is very convenient to select the necessary values.

Photo gallery: request form for online appointment at the regional office of the Federal Tax Service

A directory with Federal Tax Service codes allows you to quickly find your regional inspection office

Enter the address to which the individual entrepreneur is registered to find out where your Federal Tax Service office is located

You will be able to get an appointment with the Federal Tax Service quickly and without queues

Procedure and form for submitting reports

Both the immediate manager of an individual entrepreneur and an accountant can submit reports to the Federal Tax Service in person, if the appropriate power of attorney has been issued to him (see below). The date of submission of documents is considered the day of actual submission of declarations on paper. Tax authorities care about the convenience of taxpayers and warn that the waiting time in line cannot be more than 15 minutes. If you had to wait longer, you now have the opportunity to quickly file a complaint on a special page on the Federal Tax Service website.

If you had to wait longer than 15 minutes in line at the Federal Tax Service, you can easily file a complaint online

Current forms for submitting reports can be easily downloaded from the Federal Tax Service website or from the links below:

- templates for financial reporting forms (zip archive, volume 6.12 MB);

- tax return form templates (zip archive, volume 28 MB).

There are special requirements for preparing reports on paper. This is due to the fact that during further processing they will all be scanned, and in order for the information provided by taxpayers to be translated into electronic form as correctly as possible, it is necessary to comply with additional simple rules (see order of the Federal Tax Service of Russia dated July 6, 2021 No. ММВ-7–17/535) :

- Only white A4 paper is used for reporting;

- The width of the margins is regulated: for portrait page orientation, the left margin should be no narrower than 5 mm and no wider than 30 mm, the top, bottom and right margins should be no wider than 5 mm; Only one side of the sheet can be used for printing;

- The text color must be black, acceptable fonts are Arial or Times New Roman;

- the size of the main font is 9 points, the size of the font used for headings, subheadings and the name of the form is 10–11 points;

- line spacing - single;

- The form contains a bar code.

The reporting is prepared in 2 copies, one of which will remain with the Federal Tax Service inspector, and the second (with a note that the reporting has been accepted) will be returned to the entrepreneur.

Submitting reports via the Internet

Many entrepreneurs prefer to submit reports via the Internet. This method allows you to save significant time and avoid unnecessary stress. Today, two options for electronic reporting are available:

- through an electronic document management operator;

- through the website of the Federal Tax Service of Russia.

Let's discuss each method in detail.

To obtain an enhanced qualified electronic signature, you need to contact one of the certification centers

First of all, to submit reports online, the entrepreneur must make an electronic digital signature and select an operator through which the reports will be submitted. In Russia today there are three types of electronic signatures: simple (SEP), enhanced unqualified (NEP) and enhanced qualified (CEP). To submit reports, an entrepreneur needs a CEP signature. Thus, in order for an individual entrepreneur to be able to submit reports to the tax office electronically, three conditions must be met:

- have a program that allows you to create electronic reports;

- have access to a service or software for transmitting electronic reporting;

- make a security signature, and also install a cryptoprovider program.

To obtain a CEP, you must submit the following documents to the selected certification center:

- application for obtaining EPC;

- original or certified copy of the applicant’s passport;

- SNILS, INN and OGRN of the entrepreneur;

- power of attorney, if necessary.

The list of accredited certification centers can be easily downloaded on the website of the Russian Ministry of Telecom and Mass Communications.

Video: what is an electronic digital signature and why is it needed?

Software

As a cryptoprovider program that ensures the security and protection of data when exchanging information via Internet channels, the CryptoPro program is most often used on the official Internet resources of regulatory organizations, which can be purchased on the manufacturer’s website. The price list for various versions of this product is available for review.

The list of organizations operating electronic document management is quite large. Federal operators, along with their details, are presented in a list on the Federal Tax Service website. In it you can find both widely advertised companies, for example, CJSC PF "SKB Kontur" or LLC "KORUS Consulting CIS", and relatively little-known ones, supporting mainly entrepreneurs in the regions. The most well-known include Tensor, Taxcom, PF SKB Kontur CJSC and Kaluga Astral CJSC.

In addition to the services of operators directly involved in reporting, special accounting software is also available with the function of sending reports to regulatory authorities. Such services are provided on a paid basis, in particular, by 1C, “Kontur.Elba”, “Kontur.Accounting”, “My Business”, “Knopka”, “BukhSoft-Online”, ImBoss, “Sky”. The cost is determined by the type of enterprise and the tax system used.

The modern market offers software designed specifically for individual entrepreneurs

Features and advantages of the electronic reporting form

For many individual entrepreneurs, the ability to send reports online is the best choice, as it provides a number of significant advantages compared to other methods:

- saving time, since reports can be sent at any time of the day or night and from any place convenient for you;

- saving on consumables due to the absence of the need to duplicate reports on paper;

- minimizing errors and typos in reports through additional control using software;

- the ability to always use up-to-date reporting forms, since they are updated automatically;

- the ability to promptly receive confirmation of submission of reports within 24 hours;

- protection of information in reports from interference by third parties;

- the ability to quickly receive various certificates, statements, reconciliation reports and other necessary information from the Tax Inspectorate in electronic form, as well as the ability to send information requests online to the tax authorities.

In addition, you need to know that some organizations not only can, but are also required to submit reports only in electronic form. These include:

- Individual entrepreneurs required to pay VAT;

- Individual entrepreneurs with an average number of employees over the past calendar year of more than 100 people;

- Individual entrepreneurs submitting forms 2-NDFL and 6-NDFL, as well as calculation of insurance premiums, having more than 25 employees.

There are fines for violating the reporting method, so it is important to carefully check in what specific form the tax office expects to receive reporting.

When transmitting tax reporting via the Internet, the date of its submission is considered the day of sending.

It is also possible to submit electronic reports free of charge through the online services of the Federal Tax Service. The technology for receiving and subsequent processing is described in detail on the tax website. An example of sending a report through the Federal Tax Service website is presented in the video below.

Video: how to submit a tax return for individual entrepreneurs using the simplified tax system (USN) 6% via the Federal Tax Service website

Sending reports by mail

If you are unable to come to the Federal Tax Service office in person or submit reports using online channels, you are allowed to send them by mail. In this case, the date of submission is considered to be the date of dispatch (can be determined by the postmark). The reporting will be submitted on time if it was sent before 24.00 of the deadline date assigned for its submission (see clause 8 of Article 6.1 of the Tax Code of the Russian Federation). The Main Post Office is usually open 24 hours a day.

When sending declarations by postal service, be sure to make sure that the shipment includes a list of the contents signed by the manager and chief accountant.

Video: how to send reports to the tax post office

How to create an inventory of an investment

The inventory is drawn up in 2 copies, one of which must remain with you along with documents confirming payment and sending the envelope with papers. To avoid problems with confirmation of dispatch and delivery of reports, it is recommended to carefully store all such evidence. In this case, if necessary, you can easily confirm the fulfillment of your obligations to the tax authorities.

There is a standard form for listing the investment. These forms are available free of charge and in large quantities at Russian Post offices. An experienced accountant always keeps a supply of them on hand so that they can be filled out in the relaxed atmosphere of the office, rather than at the post office. However, it is possible to prepare an inventory of the investment yourself in free form, reminiscent of a standard form.

The inventory form according to Form 107 can be downloaded from the official website of the Russian Post or directly from the link.

Remember that corrections in the form for listing the contents of the package being sent are unacceptable!

Photo gallery: examples of an inventory of attachments in a valuable letter

The list of attachments must be stored together with documents confirming the sending of reports by postal services

The investment inventory is drawn up in 2 copies and signed by the manager and chief accountant

A description of the attachment must be included in the mail with the Federal Tax Service reporting

Submitting reports with the help of a representative

There is another way to submit reporting documents to the tax office - with the help of an authorized trusted representative (see paragraph 1.6 of Article 21 and paragraph 1 of Article 26 of the Tax Code of the Russian Federation). He can submit reports in person or through telecommunication channels (via the Internet). The authority of your representative must be documented. Since 2011, a power of attorney for submitting reports to the tax office requires notarization. An individual or legal entity has the right to be a representative of an individual entrepreneur. In other words, an individual entrepreneur can either entrust the submission of reports to one of his employees, or entrust these actions to a specialized organization or another entrepreneur.

To submit reports, the authorized representative must:

- before sending, provide an electronic or paper copy of the relevant power of attorney;

- When sending any declaration, it is mandatory to attach to the report a document indicating the status of the trusted representative.

Photo gallery: samples of filling out a power of attorney for submitting individual entrepreneurs’ reports to the tax authorities

A power of attorney for filing reports can be issued not only to an individual, but also to another entrepreneur

The validity period of the power of attorney is one year, unless otherwise stated in the text.

A power of attorney for an individual entrepreneur must certainly be notarized

Mistakes made when preparing reports

Mistake No. 1. Individual entrepreneurs who have the obligation to submit statistical reports, in most cases, ignore the need if the statistical authorities do not make requirements. The opinion that there is no need to independently obtain information is erroneous. Sources of information about the obligation to submit data are, in addition to information letters from the institution, the official website of Rosstat. If there is no data on the individual entrepreneur on the website at the beginning of the year, the obligation to submit information does not arise; if the individual entrepreneur is on the list, reporting must be submitted.

Individual entrepreneur reporting as a tax agent in relation to employees

Individual entrepreneurs with hired employees are required to withhold personal income tax when paying remuneration, transfer it to the budget and provide tax agent reporting. Features of the presentation of form 6-NDFL:

- Calculation data is presented on the basis of accounting indicators. For each employee receiving income from an agent, it is necessary to keep records in an independently developed register.

- When filling out reporting lines, the days on which employees receive income and transfer amounts depend on the types of remuneration paid.

To avoid errors, use the control ratios of indicators provided by the tax authorities to the reporting form. When filling out Form 6-NDFL as a tax agent, you can use the ratios approved for internal use by regulatory authorities.

The appendix to the letter of the Ministry of Finance and the Federal Tax Service of the Russian Federation dated March 10, 2016 No. BS-4-11 / [email protected] contains control ratios for form 6-NDFL, sent to lower tax authorities.

Acting State Advisor of the Russian Federation 2nd rank S.L. Bondarchuk

Answers to common questions

Question No. 1. Does an individual entrepreneur have an obligation to submit a single tax return in the absence of activities, objects, or cash flows?

Submitting a single declaration instead of other forms of reporting required for the chosen taxation regime is a right, not an obligation, of an entrepreneur. Individual entrepreneurs have the right to submit all declarations with zero indicators.

Question No. 2. Is it necessary to submit an updated calculation of insurance premiums if the registration data for the insurance numbers of individuals in the Federal Tax Service and those of individual entrepreneurs do not match?

If there are no errors in the individual entrepreneur’s data on the insurance numbers of the persons presented in the reporting, it is necessary to submit a letter requesting acceptance of the calculation and attaching copies of the employees’ insurance certificates.

Reporting on insurance premiums

Employers who employ people employed under contracts are required to accrue IC on wages. Features of the composition of information in reporting on SV:

- Contributions are made for pension, social, medical insurance and injury prevention. The requirements for calculating contributions are established by Art. 431 Tax Code of the Russian Federation. For certain types of activities under the simplified regime, reduced rates are applied (Article 427 of the Tax Code of the Russian Federation).

- Reports on the calculated and transferred amounts of CB are submitted to the Federal Tax Service, which monitors payments. The exception is payments from NS and PP, the accuracy of calculations of which is controlled by the FSS. In 2021, administrative regulations allow the submission of a form in Form 4-FSS to any branch of the fund.

- As part of the implementation of pension programs, reporting is submitted to the Pension Fund regarding the accounting of employees, their length of service, and confirmation of work in hazardous conditions.

- If inspectors of the Federal Tax Service identify inconsistencies in the submitted reports, a notification is sent to the taxpayer. The individual entrepreneur is given 5 days to correct errors. Timely change of data prevents the imposition of sanctions.

Along with the payment of SV accrued on the income of employees, the individual entrepreneur transfers to his own insurance. Amounts are determined depending on the minimum wage with annual revision. When receiving income over 300 thousand rubles, the amount of contributions to the Pension Fund is calculated depending on the amount of income. Entrepreneurs do not submit reports on accrued and transferred amounts for compulsory medical insurance and compulsory medical insurance.

Accounting forms for preparing reports for the single tax simplified tax system

Individual entrepreneur reporting in a special mode is formed on the basis of primary documentation and the book of income and expenses (KUDiR). The document flow of a company with a simplified regime depends on the chosen accounting scheme:

- When taxing income, accounting for expenses is carried out only for the purposes of management accounting for internal control.

- Individual entrepreneurs who have chosen the “income minus expenses” scheme are required to keep full records reflecting the movement of transactions in the accounting book.

Based on the log data, the base for determining the amount of the single tax is calculated and reports are compiled to the Federal Tax Service. KUDiR is recognized as an individual entrepreneur’s tax register and is stored in the company for presentation during an audit. The document is generated annually with page numbering, firmware and certification by the individual entrepreneur. Filling out the register indicators is carried out in accordance with the instructions. In accounting for individual entrepreneurs, the KUDiR form is used, approved by Order of the Ministry of Finance of the Russian Federation dated December 22, 2012 No. 135n (as amended on December 7, 2016).

Reporting submitted to statistical authorities

The need to submit statistical reporting forms is determined by the type of activity of the individual entrepreneur and the category of business (small, medium, large). Statistical reporting is based on sampling. The list of individual entrepreneurs with mandatory submission is reviewed annually.

Among the common forms provided for individual entrepreneurs are types of reports with monthly or annual submission.

| Report form | Purpose | Submission deadline |

| 1-IP | Individual entrepreneurs not operating in agriculture | Annually, until March 2 of the following year |

| 1-IP (months) | Individual entrepreneurs producing products | Monthly, until the 4th of the next month |

| 1-IP (trade) | Individual entrepreneurs engaged in retail trade | October 18 of the current period |

| 1-IP (services) | Individual entrepreneurs providing services to the public | March 2 of the year following the reporting year |

Reports on statistical data are submitted to individual entrepreneurs conducting activities. If there are no indicators, a letter about the lack of activity in the reporting period is submitted to the territorial statistics body.

Important changes from 2021

From the moment of registration of an individual entrepreneur, regardless of the presence or absence of entrepreneurial activity, there is a need to pay fixed payments for compulsory medical and pension insurance. Until 2021, these payments were transferred to:

- PFR (Pension Fund of Russia);

- FFOMS (Federal Compulsory Health Insurance Fund).

Starting from January 1, 2021, the administration of insurance contributions for pension and health insurance was transferred to the Federal Tax Service. In this regard, starting from 2021, individual entrepreneurs must transfer accrued insurance premiums to the Federal Tax Service at the place of their registration.

Due to the fact that from January 1, 2021, the administration of contributions for pension and health insurance is entrusted to the tax inspectorates, the budget classification codes for paying fixed contributions have changed.

Reducing the simplified tax system due to contributions for individual entrepreneurs and for employees

If you still have questions, you can talk about this in more detail. If an organization that operates under the simplified tax system “6%” for the reporting period gradually pays all the necessary insurance contributions for each employee and itself, then the advance payment goes into the amount of the tax reduction.

But this is where the issue of availability of workers comes into play. If their absence can help with a reduction from 6 to 0 percent, then the presence of employees allows you to reduce all tax payments by only half, even if all the necessary contributions were paid on time.

That is why for an individual entrepreneur, tax reduction is an attractive and optimal option, since it is not so difficult to implement, but the effect is great.