As follows from Article 333.16 of the Tax Code, state duty is a payment for performing legally significant actions in their interests in the interests of a certain person. Such actions are carried out by various state administrative bodies authorized to do so by current legislation.

Of course, all this applies to commercial activities. Any company or individual entrepreneur, as part of doing business, may be faced with the need to notarize documents, register a trademark, or file a claim in court. How does paying state duty under the simplified tax system affect expenses? Let's figure it out.

Legal side of the issue

An exhaustive list of costs that are taken into account in the tax base for a single simplified tax is set out in Article 346.16 of the Tax Code of the Russian Federation.

Subclause 31 of clause 1 of this article of the Code states that the state duty under the simplified tax system with the object “income minus expenses” is taken into account when reducing the base for the single tax of the simplified tax system. However, paragraph 2 of Article 346.16 of the Tax Code of the Russian Federation states that costs must meet the requirements listed in paragraph 1 of Article 252 of the Tax Code of the Russian Federation. Mainly, this paragraph requires the economic justification of the costs incurred in order to include them in the base for reducing the simplified tax system tax.

This means that by paying the state fee, the company must receive some significant result from this action, otherwise the fee cannot be classified as an expense.

Read about what expenses of an LLC are included in expenses under the simplified tax system “income minus expenses.”

Situations when the state duty cannot be included in expenses may be different. For example, a company submits an application to the tax authorities with a request to make changes to the Unified State Register of Legal Entities and is refused because the company itself made a mistake in the application form. The paid state duty will not be returned to the taxpayer, but the fee cannot be included in expenses, because no practical result is obtained from its payment.

Please note that if the state duty is reimbursed to a legal entity by court decision, the amount must be included in the company’s income. This opinion is shared by the Ministry of Finance of the Russian Federation in its letter dated May 17, 2013 No. 03-11-06/2/17357.

When applying the simplified tax system, the amount of state duty is included in the tax base

The Ministry of Finance of Russia in letter No. 03-11-06/2/29 dated 02/20/2012 in relation to organizations using the simplified tax system, which won the lawsuit and are returning the state duty they previously paid, indicates that the amount of the state duty increases the tax base.

According to the current tax legislation, it really turns out that the tax base must be increased by the amount of state duty reimbursement, since when applying the simplified tax system, a single tax is imposed on all income received by the organization (both from the sale of goods and services it produces, and from other sources). Exceptions to the general rule (non-taxable income) are specified in Art. 251 of the Tax Code of the Russian Federation, but state duty is not mentioned in this article.

The contradiction lies in the fact that state duty is similar in nature to taxes, since it is a fee levied in favor of the state. The procedure for collecting and the amount of state duty are established by Chapter 25.3 of the Tax Code of the Russian Federation. So what – the tax is taken from the tax?!

Let's consider this situation in more detail.

The fact is that in this case, the refund of the state duty is compensation received by the plaintiff organization that won the trial.

What expenses for the simplified tax system include state duty?

Acceptance of state duty as a cost under the simplified tax system depends on the purposes of paying this state fee. When paying the state fee for filing a claim with the judicial authorities, for making changes to the Unified State Register of Legal Entities, for issuing copies of documents and other similar procedures, the state fee is included in expenses for the purpose of reducing the single tax of the simplified tax system, regulated by the norms of subparagraph 22 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation.

If the fee is paid when registering a vehicle or during the registration procedure for real estate acquired by a company, then the state duty increases the amount of the cost of property subject to depreciation, and therefore reduces the tax base in accordance with the provisions of paragraph 3 of Article 346.16 of the Tax Code of the Russian Federation. It is important to note that this is legal for the state duty, which was paid before the depreciable object was put into operation. When paying a fee after putting this property into operation, the provisions of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation come into force, according to which the state duty should be included in one-time costs under the simplified tax system.

A convenient accounting program for the simplified tax system from Bukhsoft ensures competent maintenance and accounting of the warehouse, fixed assets, tangible and intangible inventories, as well as the company’s monetary assets in one place!

State duty for registration of fixed assets

One more specific point. Whether the state duty is considered an expense under the simplified tax system is related to the reflection of the fee paid for registering a vehicle or registering a property. The fee paid when performing such actions leads to an increase in the cost of property subject to depreciation. That is, in this case, the state duty itself is not an expense under the simplified tax system, but is taken into account in reducing the tax base as part of depreciation charges. This applies to situations where the duty was paid before the facility was put into operation. If payment was made after this point, the state duty is included in the expenses of the simplified tax system at a time.

Accounting entries for accounting for state duties in expenses under the simplified tax system

An important point: according to the regulations of Article 333.40 of the Tax Code of the Russian Federation, before recording transactions for accrual of fees in accounting, you must remember that in some cases the amount of the paid duty can be returned, but it can also be offset against other mandatory payments to government agencies at the request of the payer. Based on this, it follows:

Before the actual commission of a legally significant action on the part of government agencies (or if it is refused), the state duty cannot be taken into account as an expense either in tax or accounting.

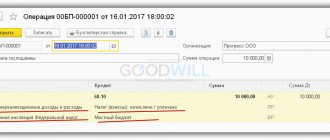

The state duty collected when interacting with government bodies is reflected in accounting in a special subaccount to account 68.

The entries for this subaccount are as follows:

- Dt 68 / Kt 51 (50) - payment of state duty;

- Dt 20, 23, 25, 26, 29, 44, 91 / Kt 68 - charge of state duty;

- Dt 91 / Kt 68 - payment of state duty is included in non-operating costs in case of refusal to perform a legally significant action;

- Dt 08 / Kt 68 - increase in the initial cost of the depreciable object by the amount of the state duty;

- Dt 51 / Kt 68 - return of the amount of paid state duty to the company’s bank account.

Are state duties included in expenses during simplification?

The list of costs taken into account when determining the single tax during simplification is indicated in Art. 346.16 Tax Code of the Russian Federation. According to sub. 31 clause 1 of the above-mentioned article, the state duty under the simplified tax system, income minus expenses, reduces the tax base. But according to paragraph 2 of Art. 346.16 of the Tax Code of the Russian Federation, costs must meet the requirements of paragraph 1 of Art. 252 of the Code.

First of all, this paragraph mentions the economic feasibility of expenses. This means that as a result of paying the state duty, some significant result must be obtained. Otherwise, the fee paid cannot be considered an expense.

This applies, for example, to situations where, when submitting an application to make changes to the Unified State Register of Legal Entities, the registration action was refused due to an error made by an employee of the enterprise when filling out the form. In this situation, the paid state fee is not returned to the legal entity, but cannot be accepted as expenses.

IMPORTANT! In case of reimbursement of state duty to an enterprise by a court decision, the amount received must be included in income. This is how the Ministry of Finance of the Russian Federation interprets the norms of the code in letters dated 02/20/2012 No. 03-11-06/2/29, dated 05/17/2013 No. 03-11-06/2/17357.

Read about what expenses are accepted for accounting under the simplified tax system.

As part of what costs during simplification is the state duty taken into account?

How the state duty is accepted as an expense under the simplified tax system depends on the action for which the duty was paid. If the state fee is paid for filing a lawsuit, registering changes in the Unified State Register of Legal Entities, issuing duplicate documents or other similar actions, then such a fee is included in the costs for determining the simplified tax according to the norms of subsection. 22 clause 1 art. 346.16 Tax Code of the Russian Federation.

Check out this publication for a list of tax deductible expenses.

But if the state duty is paid to register a vehicle or register real estate, then such a fee will increase the amount of depreciable property and will reduce the tax base in accordance with the procedure described in paragraph 3 of Art. Code 346.16. But this applies only to those fees that were paid before the depreciable property was put into operation. If the fee is paid after, then the state duty is included in the expenses under the simplified tax system at a time in accordance with clause 2 of Art. 346.17 Tax Code of the Russian Federation.

Government duty

In accordance with the Tax Code of the Russian Federation, a state duty is a fee levied on organizations and individuals when they apply to state bodies, local governments, other bodies and (or) officials who are authorized in accordance with the legislative acts of the Russian Federation , legislative acts of the constituent entities of the Russian Federation and regulatory legal acts of local governments, for the performance of legally significant actions in relation to these persons provided for by the Tax Code, with the exception of actions performed by consular offices of the Russian Federation, namely:

- when applying to courts of general jurisdiction, to magistrates;

- when applying to arbitration courts;

- when applying to the Constitutional Court of the Russian Federation and constitutional (statutory) courts of the constituent entities of the Russian Federation;

- for notarial acts;

- for actions related to civil registration;

- for actions related to the acquisition of citizenship of the Russian Federation or renunciation of citizenship of the Russian Federation, as well as entry into the Russian Federation or departure from the Russian Federation;

- for actions related to the official registration of a program for electronic computers, a database and an integrated circuit topology;

- for the actions of authorized government agencies in the implementation of federal assay supervision;

- for the actions of the authorized executive body during the state registration of medicinal products;

- for the actions of the authorized executive body during the state registration of medical devices;

- for state registration of legal entities, political parties, mass media, issues of securities, property rights, vehicles, etc.

Among other things, the Tax Code of the Russian Federation provides for state duties for:

- the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of legal entities;

- the right to export cultural values, collectibles

paleontology and mineralogy;

- issuing permits for transboundary movement of hazardous waste;

- issuing permits for the export from the territory of the Russian Federation, as well as for the import into the territory of the Russian Federation, of species of animals and plants, their parts or derivatives, subject to the Convention on International Trade in Endangered Species of Wild Fauna and Flora.

How to take into account the cost of state duty for income tax purposes and under the simplified tax system

Tax accounting of state duty depends on its type.

The state duty for registering rights to real estate and for registering cars both under the OSN and under the simplified tax system is taken into account depending on when it is paid:

- if before the facility is put into operation, it is included in the initial cost of the operating system;

- if after putting the facility into operation, it is taken into account in expenses at a time.

The state fee paid by an organization when filing an application, statement of claim, complaint (appeal, cassation or supervisory) in court (arbitration or general jurisdiction), both under the OSN and under the simplified tax system, is taken into account in expenses.

The state fee, which the court decides to reimburse the defendant, is taken into account:

1) the defendant has expenses:

- in case of OSN - on the date of entry into force of the court decision;

- under the simplified tax system - on the date of payment;

2) the plaintiff’s income:

- in case of OSN - on the date of entry into force of the court decision;

- under the simplified tax system - on the date of receipt of money.

In other cases, both under the OSN and under the simplified tax system, the state duty is taken into account in expenses on the payment date, which always coincides with the accrual date.

This also applies to state fees for state registration:

- changes made to the organization's charter (Unified State Register of Legal Entities);

- real estate lease agreement concluded for a period of at least one year;

- rights to land plots.

Refund of state duty from the budget

If the proceedings in the case were terminated, or the application was left by the court without consideration, or the state duty was paid (collected) in excess, then the amount of the state duty (partially or fully) is returned to the taxpayer. The basis is the corresponding indication in the court decision.

So, according to paragraph 2 of Art. 129 of the Arbitration Procedure Code of the Russian Federation, when the court makes a ruling on the return of the statement of claim, the arbitration court decides the issue of returning from the federal budget the state duty paid by the plaintiff.

The refund of the state duty to the taxpayer is carried out in accordance with Art. 78 of the Tax Code, taking into account the features established by Ch. 25.3 of the Code.

The procedure for a taxpayer’s actions when returning state duty is determined by clause 3 of Art. 333.40 Tax Code of the Russian Federation. An application for the return of the overpaid (collected) amount of state duty is submitted to the tax authority at the location of the court in which the case was heard. The application is accompanied by decisions, rulings and certificates from the courts regarding the circumstances that are the basis for a full or partial refund of the overpaid (collected) amount of state duty.

If the state duty is refundable in full, then along with the above documents, original payment documents (orders and receipts confirming payment of the state duty) are also submitted. If the state duty is partially refundable, copies of payment documents.

This procedure has been in effect since January 31, 2006 in connection with the provisions of Federal Law dated December 31, 2005 N 201-FZ.

The taxpayer has the right to a refund of the state duty within three years from the date of payment. In other words, the corresponding application must be submitted before this period expires.

The tax authority is obliged to return the amount of state duty within a month from the date the taxpayer submits the application. Otherwise, the tax authority may be charged interest on the amount of state duty not returned within the prescribed period, calculated based on the refinancing rate of the Bank of Russia (clause 9 of Article 78 of the Tax Code of the Russian Federation).

In tax accounting, the organization includes the amount of returned state duty as part of non-operating income. This is stated in paragraph 3 of Art. 250 Tax Code of the Russian Federation.

An organization using the accrual method recognizes non-operating income based on the procedure established by Art. 271 Tax Code of the Russian Federation. According to this procedure, the amount of state duty returned to the organization is reflected in non-operating income on the date of entry into force of the court decision on such return.

A similar position regarding the procedure for recording and recognizing returned state duty is set out in Letters of the Ministry of Finance of Russia dated January 18, 2005 N 03-03-01-04/2/8 and dated July 1, 2005 N 03-03-04/1/37.

Under the cash method, the amount of the refunded state duty is recognized in the manner provided for in Art. 273 of the Tax Code of the Russian Federation, - as funds arrive in the taxpayer’s account or cash desk.

In the corporate income tax return for the reporting (tax) period, the amount of non-operating income in the form of returned state duty is reflected in line 100 “Non-operating income - total” of Appendix No. 1 to sheet 02 and, accordingly, is included in the total line 020 “Non-operating income” of sheet 02.

Example 2 . CJSC Aton filed a claim with the arbitration court to recover a penalty in the amount of 100,000 rubles from its supplier. for violation of the terms of a business contract. On the same day, before submitting the application, Aton CJSC paid the state fee.

The amount of state duty was calculated according to paragraphs. 1 clause 1 art. 333.21 Tax Code of the Russian Federation. It states that in property cases considered in arbitration courts, if the value of the claim is from 50,001 to 100,000 rubles. The fee is 2000 rubles. plus 3% of the amount exceeding RUB 50,000.

Thus, the amount of state duty paid by Aton CJSC amounted to 3,500 rubles. [2000 rub. + (RUB 100,000 - RUB 50,000) x 3% : 100%].

However, when considering the case in the court of first instance before the court decision was made, the plaintiff (Aton CJSC) reduced the amount of claims to 60,000 rubles. The arbitration court recognized this as not contrary to the law and not violating the rights of other persons.

If the plaintiff reduces the amount of the claim, the amount of the overpaid state duty shall be refunded. In accordance with paragraphs. 1 clause 1 art. 333.40 of the Tax Code of the Russian Federation, the state duty is subject to partial or full refund if it is paid in a larger amount than provided for in Chapter. 25.3 of the Code.

The amount of state duty, calculated based on the new price of the claim, amounted to 2,300 rubles. [2000 rub. + (60,000 rub. - 50,000 rub.) x 3% : 100%].

Thus, on the date of filing the statement of claim to reduce the size of the claim, the plaintiff must be returned 1,200 rubles. (3500 rub. - 2300 rub.).

As already noted, the refund of the overpaid amount of state duty is made upon the application of the taxpayer (plaintiff) to the tax authority. The application is accompanied by the relevant court rulings (decisions) and payment documents referred to in clause 3 of Art. 333.40 of the Tax Code of the Russian Federation, which confirm the fact of payment of the state duty.

Let's assume that Aton CJSC lost the case and its legal costs were not reimbursed. In this case, the organization’s accountant must make the following entries in accounting:

Debit 68 subaccount “Calculations for payment of state duties” Credit 51

- 3500 rub. — the state fee for consideration of the case in the arbitration court is transferred;

Debit 91-2 Credit 68 subaccount “Calculations for payment of state duties”

- 3500 rub. — the amount of the state duty paid is reflected in non-operating expenses;

Debit 68 subaccount “Calculations for payment of state duties” Credit 91-1

- 1200 rub. — the debt of the tax authority for the refund of state duty is reflected (as of the date of filing the relevant application);

Debit 51 credit 68 subaccount “Calculations for payment of state duties”

- 1200 rub. — the amount of overpaid state duty was returned to the bank account of Aton CJSC.

In tax accounting, the accountant of Aton CJSC reflects:

- as part of non-operating expenses - 3,500 rubles;

- as part of non-operating income - 1200 rubles.

State duty on expenses

In addition to the duties paid after the property is registered (put into operation), duties not related to the acquisition of property will be directly included in the organization’s expenses. We are talking, for example, about the state fee when filing a statement of claim in court, the state fee for performing notarial acts, the fee for making changes to the constituent documents of the organization, etc. In these cases, when accounting for state duties in accounting, the entries (from the point of view of the debited account) may be different.

Court fees are usually reflected as part of the organization's other expenses:

Debit account 91 “Other income and expenses”, subaccount “Other expenses” - Credit account 68.

The procedure for accounting for other duties depends on what type of activity the payment of the duty relates to.

So, for example, the state duty paid for amending the charter will be reflected as follows (clauses 5, 7 PBU 10/99, Order of the Ministry of Finance dated October 31, 2000 No. 94n):

Debit account 26 “General business expenses”, 44, etc. – Credit account 68.

[1]

For example, the state duty paid for issuing a certificate for a released license plate unit when disposing of an organization’s vehicle will be reflected as follows (clause 11 of PBU 10/99):

Debit account 91, subaccount “Other expenses” - Credit account 68.

How to reflect the state duty in income tax returns and the simplified tax system

In the income tax return, the state duty paid by the organization (except for that included in the initial cost of fixed assets) is reflected on line 041 of Appendix No. 2 to Sheet 02 on an accrual basis in the total amount of taxes and fees accrued in the reporting (tax) period.

In the tax return under the simplified tax system in Section 2.2, in the total amount of expenses incurred, the amounts of state duty (except for those included in the initial cost of fixed assets) paid during:

- I quarter - on line 220;

- half a year - on line 221;

- 9 months - on line 222;

- year - on line 223.

As follows from Article 333.16 of the Tax Code, state duty is a payment for performing legally significant actions in their interests in the interests of a certain person. Such actions are carried out by various state administrative bodies authorized to do so by current legislation.

Of course, all this applies to commercial activities. Any company or individual entrepreneur, as part of doing business, may be faced with the need to notarize documents, register a trademark, or file a claim in court. How does paying state duty under the simplified tax system affect expenses? Let's figure it out.

State duty as an expense in the usn

Despite this

These types of expenses often cause distrust among tax authorities, and taxpayers have to defend the legality of their implementation.

As usual, the main arguments here are: the validity of postal expenses, documentary evidence and focus on business activities.

Regarding the second question about the possibility of taking into account the amount of state duty for urgent issuance of an extract when taxing, we note the following. Taxpayers using the simplified tax system have the right to reflect the amounts that went towards paying the state duty in expenses during the period of payment (letter of the Ministry of Finance of Russia dated 02/09/2011 No. 03-11-06/2/16*, Federal Tax Service for Moscow dated 18.07. 2011 No. 16-15/070485).

However, this provision does not apply to fees for early provision of information from the Unified State Register of Legal Entities. The “simplifiers” cannot reflect the amount of such payment as part of the costs, since the “early payment” fee is not a state duty.

* The document and commentary to it were published in “NA”

№ 6, 2011.

Tax consultant D.G. Nikolaev

State duty and expenses for the simplified tax system

The use of the simplified tax system-15% assumes that a company or individual entrepreneur can reduce the tax base for strictly defined expenses. Their list is given in Article 346.16 of the Tax Code. This is a closed list, which means that no other expenses other than those expressly indicated in this article can be taken into account for tax purposes.

There is no directly provided item in this list that would state that state duty is accepted as an expense under the simplified tax system. However, it contains another provision that allows you to reduce the tax base at the expense of the amounts of taxes and fees that were paid in accordance with the current legislation (subclause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation). What follows from this definition?

The amounts of state duties are established by Chapter 25.3 of the Tax Code. It provides for specific amounts to be charged in certain cases. Various government agencies, local authorities and other officials authorized to carry out legally significant actions are required to focus on these tariffs. Accordingly, since the fee amounts are established by law, this makes it possible for firms and individual entrepreneurs to take into account the state duty in expenses under the simplified tax system of 15%.

Answer

In accounting, recognize the costs of paying state duties in the reporting period in which these actions were performed (clause 18 of PBU 10/99). The length of the period during which the organization will benefit from their results does not matter. For example, if an organization pays a state duty for issuing a license to conduct a certain type of activity, then, regardless of the validity period of the license, the costs of paying the state duty in accounting should be recognized in the period when the license was issued: Debit 68 subaccount “State duty” Credit 51 – state duty paid ;

Debit 20 Credit 68 subaccount “State duty” - state duty on transactions related to the main activities of the organization is taken into account.

When calculating the simplified tax system, the duty is taken into account as part of expenses (subclause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation).

The rationale for this position is given below in the materials of the Glavbukh System

1. Recommendation: How to reflect the state duty in accounting

The state duty is a federal fee and represents a payment for the commission of certain legally significant actions by authorized government bodies (officials) (Article 13, 333.16 of the Tax Code of the Russian Federation).

Recognition of expenses

Recognize the costs of paying the state duty in the reporting period in which these actions were performed (clause 18 of PBU 10/99). The length of the period during which the organization will benefit from their results does not matter. For example, if an organization pays a state fee for issuing a license to conduct a certain type of activity, then, regardless of the validity period of the license, the costs of paying the state fee in accounting should be recognized in the period when the license was issued.

Accounting

In accounting, take into account the accrual and payment of state duties on account 68 “Calculations for taxes and fees.” To do this, open a “State Duty” subaccount for account 68.

Reflect the payment of the state duty by posting:

Debit 68 subaccount “State duty” Credit 51 – state duty paid.

Is state duty accepted as an expense under the simplified tax system for notary costs?

Separately, it is worth mentioning the costs associated with notarization of documents. Such state duty under the simplified tax system is included in expenses, taking into account certain specifics.

Firstly, the fact that the notary state fee is taken into account in the costs of the simplified tax system is dedicated to a separate paragraph 14 in the above-mentioned list of “simplified” costs. Secondly, in this case it is also important to remember about the maximum tariffs approved by law.

The point here is this. The services provided by a notary can be divided into actions that must be notarized without fail, and those that do not require mandatory notarization. According to the first, both public and private notaries charge state fees at rates in accordance with Article 333.24 of the Tax Code. Other operations are paid according to tariffs in accordance with Article 22.1 of the Law of February 11, 1993 No. 4462-1 “Fundamentals of the legislation of the Russian Federation on notaries.” It is in these amounts that notary state fees for the simplified tax system can be taken into account. If for some reason the notary’s services were more expensive, for example, due to the urgency of the registration, the excess amount cannot be taken into account in the tax base.

In both cases, the reflection of the paid amount in the company’s accounting occurs on the basis of a receipt issued by a notary office.

Simplified taxation system

Our organization received an award from the supplier in 2014. in the amount of 300,000 rubles. under certain conditions, these conditions were not met in October 2021. According to the writ of execution, 309,000 were withdrawn from the organization’s account (9,000 rubles in legal costs). Is it possible to reduce the tax base by this amount under the simplified tax system (income minus expenses) It is advisable to receive an answer by email. mail.

So is the state duty an expense under the simplified tax system? Definitely - YES! Issues related to state duty are regulated by Chapter 25.3 of the Tax Code of the Russian Federation. Based on paragraph 1 of Art.

The state fee for registering real estate is included in the list of expenses that reduce the tax base under the simplified tax system (income minus expenses).

On income by court decision This norm mentions only taxes and fees paid in accordance with tax legislation.

If the state duty for registering rights to real estate is paid after the object is put into operation, include its amount in other expenses that reduce the tax base under the simplified tax system (income minus expenses).

In other cases, both under the OSN and under the simplified tax system, the state duty is taken into account in expenses on the payment date, which always coincides with the accrual date.

It is also important to note that the changes will also affect existing contractual relations, i.e. a mandatory claim procedure is required for concluded contracts if the obligation arose after 06/01/2016, otherwise the court will leave the claim without consideration. An important innovation is the appearance of writ proceedings in the arbitration process. This rule has previously been applied - and quite successfully - in civil proceedings, but it is being introduced in arbitration courts for the first time.

They filed a claim in court. We would like to invalidate the transaction with the counterparty. Our lawyer paid the state fee for filing a claim in cash. To do this, we gave the employee money on account.

If the organization paid a state duty when purchasing or creating property, include it in the actual cost of such property (clause 6 PBU 5/01, clause 24 of the order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, clause 8 PBU 6/01, p 8 PBU 14/2007).

However, we can safely conclude that the state duty under the simplified tax system is included in expenses on the basis of subclause. 22 clause 1 art. 346.16 Tax Code of the Russian Federation. This paragraph lists the costs that, in the final calculation, reduce the single tax on the simplified tax system.

Accounting for state duty for profit tax purposes

Regardless. If the company wins and the state duty is reimbursed by the losing party, the company will simply include this amount in income. Letter of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of the Russian Federation dated January 18, 2005 N 03-03-01-04/2/8 Question: LLC requests clarification of the following. The organization filed a claim with the Moscow Arbitration Court and paid the state fee. The case was pending when the organization abandoned the claim in connection with the settlement of the dispute, the refusal was accepted by the court, and the proceedings were terminated. Is it legal to attribute the costs of paying state duty to reduce the tax base for income tax in this situation? Answer: The Department of Tax and Customs Tariff Policy of the Ministry of Finance of the Russian Federation has considered your letter dated November 25, 2004. and reports the following. In accordance with paragraph 1 of Article 252 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), expenses for the purpose of calculating income tax are recognized as economically justified expenses, confirmed by documents drawn up in accordance with the legislation of the Russian Federation, provided that they were incurred to carry out activities aimed at to receive income. Article 265 of the Code establishes that non-operating expenses not related to production and sales include reasonable costs for carrying out activities not directly related to production and (or) sales. Subparagraph 10 of paragraph 1 of Article 265 of the Code determines that non-operating expenses include legal expenses and arbitration fees. According to Article 101 of the Arbitration Procedural Code of the Russian Federation, court costs consist of state fees and legal costs associated with the consideration of the case by the arbitration court. At the same time, paragraph 1 of Article 102 of the Arbitration Procedural Code of the Russian Federation establishes that state fees are paid for statements of claim, other statements and complaints in the manner and in the amounts established by federal law. Thus, the cost of paying the state fee when filing a claim with the arbitration court reduces the tax base for corporate income tax. However, the paid state fee is subject to partial or full refund if the proceedings are terminated or the application is left without consideration by a court of general jurisdiction or an arbitration court (subparagraph 3 of paragraph 1 of Article 333.40, Chapter 25.3 “State Duty” of the Code). In this case, in our opinion, the amount of the returned state duty should be included in non-operating income. A copy of this response has been sent to the Department of Profit (Income) Taxation of the Federal Tax Service of Russia. Deputy Director of the Department A.I. Ivaneev

Classification of legal expenses

Legal expenses consist of state fees and legal costs associated with the consideration of the case by the arbitration court. This is stated in Article 101 of the Arbitration Procedure Code.

According to Article 106 of the Arbitration Procedure Code of the Russian Federation, these legal costs include:

- amounts of money to be paid to experts, witnesses, translators;

— costs associated with on-site inspection of evidence;

— payment for the services of lawyers and other persons providing legal assistance (representatives);

- other expenses incurred by the parties to the dispute in connection with the consideration of the case in the arbitration court.

Legal costs are not

:

— office and postal expenses;

— costs of organizing and conducting mobile court hearings;

— monetary payments to experts and translators for performing certain actions as part of their official assignment.

Let us consider in detail how to correctly take into account, for profit tax purposes, legal expenses that arise in various situations.

Costs of attorneys' and lawyers' fees

As a rule, a representative of an organization in court is required to have high legal qualifications. Small firms cannot always afford to have such specialists on staff and turn to law firms, legal or audit firms. The cost of services depends on the complexity of the dispute, the cost of the claim and the number of court hearings.

These legal costs are reflected in tax accounting by analogy with state duties, that is, as part of non-operating expenses. However, such expenses should be accepted for profit tax purposes, taking into account the requirements of Article 252 of the Tax Code. Namely: legal costs are taken into account as non-operating expenses in accordance with subparagraph 10 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation, if they are documented, incurred at the time of consideration of the dispute and are economically justified.

The justification of expenses is determined based on a number of circumstances. For example, such as the outcome of the dispute, prevailing prices for lawyers’ services in a particular region, the number of documents, the terms of reference of the representative in the court.

note

: if an organization is represented in court by its full-time employee, then his salary is not accepted as legal expenses. In such a situation, judicial practice proceeds from the fact that the salary of a full-time lawyer is paid regardless of the presence or absence of a legal dispute. For profit tax purposes, such costs will be qualified as labor costs under Article 255 of the Tax Code.

In order for the amounts paid to the in-house lawyer to be taken into account as legal expenses, a civil law agreement must be concluded with him for representation in court. The contract should provide for payment for participation in a specific case. But this will only help if the lawyer’s job description does not include such a duty.

The following situation is also possible: if there is a full-time lawyer, the organization attracts a third-party specialist to participate in the court. In this case, it is necessary to strictly distinguish between the tasks of in-house and outsourced lawyers. Those issues that will be resolved by a third-party lawyer must be clearly stated in the contract. The fact is that it is possible to economically justify payment for the services of a third-party specialist (and, accordingly, accept these expenses for profit tax purposes) only if the services he provided do not duplicate the job responsibilities of an in-house lawyer.

At what point are legal costs for legal services reflected in the tax accounting of an organization?

Let's say a taxpayer accounts for income and expenses on an accrual basis. In this case, the date of inclusion of the specified legal costs in non-operating expenses is the day of presentation of the act on the services rendered by the lawyer in accordance with the terms of the contract concluded with him (regardless of when the court makes its decision). This is indicated by subparagraph 3 of paragraph 7 of Article 272 of the Tax Code of the Russian Federation.

If the organization uses the cash method, then it writes off the corresponding expenses at the time of payment for the cost of services in accordance with the contract (clause 3 of Article 273 of the Tax Code of the Russian Federation).

Expenses for witnesses, experts and translators

Amounts to be paid to witnesses and experts or necessary to pay the costs of an on-site examination shall be paid in advance by the party who made the corresponding request. If such a request was received from both parties, then they contribute the required amounts equally (Article 108 of the Arbitration Procedure Code of the Russian Federation).

When attracting experts and witnesses, the organization must transfer money to pay for their services to the deposit account of the arbitration court. Article 109 of the Arbitration Procedure Code of the Russian Federation determines that amounts of money due to experts and witnesses are paid after they have fulfilled their duties. This means that these amounts can be taken into account as non-operating expenses for tax purposes only after the expert presents an opinion and the witness gives testimony. That is, the moment of recognition of such expenses does not depend on what method the organization uses in tax accounting: accruals or cash.

The court must ensure the participation of an interpreter in cases established by law. Persons participating in the case have the right only to propose candidates for translator to the arbitration court (Clause 2 of Article 57 of the Arbitration Procedure Code of the Russian Federation). Payment for the services of an interpreter invited by the arbitration court to participate in the process, as well as payment of daily allowance and reimbursement of expenses in connection with his appearance in court, are made from the federal budget. This is stated in paragraph 3 of Article 109 of the Arbitration Procedure Code of the Russian Federation.

What the law says

The Tax Code of the Russian Federation, as well as its norms devoted to simplifications, does not say whether state duty is accepted as expenses under the simplified tax system. At the same time, companies and individual entrepreneurs using the simplified tax system are faced with this mandatory payment everywhere: in court, in the tax service, and in other structures. That is, it can be argued that without paying state duties, activities under the simplified regime are virtually impossible.

However, we can safely conclude that the state duty under the simplified tax system is included in expenses on the basis of subclause. 22 clause 1 art. 346.16 Tax Code of the Russian Federation. This paragraph lists the costs that, in the final calculation, reduce the single tax on the simplified tax system.

This norm mentions only taxes and fees paid in accordance with tax legislation. So is the state duty an expense under the simplified tax system? Definitely - YES!

Issues related to state duty are regulated by Chapter 25.3 of the Tax Code of the Russian Federation. Based on paragraph 1 of Art. 333.16 of the Code, the state duty refers specifically to fees when applying to:

- Government structures.

- Local authorities.

- Other bodies and/or officials who are legally authorized to perform legally significant actions.

There should be no controversy as to whether state duty is taken into account in expenses under the simplified tax system when a document or a duplicate of it is issued to a simplifier for a fee. Yes, this is equated by law to legally significant actions.

As follows from the meaning of sub. 22 clause 1 art. 346.16 of the Tax Code of the Russian Federation, state duty is accepted as expenses under the simplified tax system in any amount upon its transfer to the treasury to the appropriate account.

Another important point: the state duty is taken into account in expenses under the simplified tax system also when calculating the advance payment.

Expenses for a simplifier arise only from the date of its state registration as an individual entrepreneur or legal entity. Therefore, up to this point, the state duty paid for the initial registration is the personal costs of the founder (owner). Therefore, it cannot be taken into account on the simplified tax system.

A simplifier can save a little when installing an advertising structure. The state duty is included in the costs of the simplified tax system if it is transferred for this service, permitted by local authorities. For 2021, its size is 5,000 rubles.

At the same time, the simplifiers have no right to attribute the fee for the right to install and operate an advertising structure as expenses. The Ministry of Finance and the Federal Tax Service believe there, since clause 1 of Art. 346.16 of the Tax Code of the Russian Federation there is no corresponding position (letters dated 09/01/2014 No. 03-11-06/2/43627 and dated 08/06/2014 No. GD-4-3/15322).

Reimbursement of legal expenses for state fees in case of registration expenses minus income

N.G. Bugaeva, economist If a counterparty or the state returned some amounts to a company using the simplified tax system, then it is clear that the organization will not want to take them into account in its income and pay tax on them. Especially simplified with the object “income” p. 1 tbsp. 346.14 Tax Code of the Russian Federation.

Let's try to figure out in what cases it is necessary to include returned amounts in income and in what cases not. What refundable amounts are not income Organizations and individual entrepreneurs using the simplified tax system when calculating tax take into account income from sales and non-operating income. 1 tbsp. 346.15, articles 249, 250 of the Tax Code of the Russian Federation.

But they do not recognize in income:

Road accident, No. 21

- Educational program for the intermediary-simplifier, No. 21

- Invoices from intermediaries using the simplified tax system, No. 21

- Real estate purchased on credit: how to take expenses into account for a simpler, No. 16

- How to take into account natural loss and technological losses during the “income-expense” simplification, No. 16

- Where should a simplifier put VAT when purchasing a fixed asset, No. 14

- Bonus product from Simplified, No. 13

- Simplification on the verge, No. 12

- We write off OS in a simplified manner: should we recalculate tax expenses, No. 11

- Can an individual entrepreneur take into account land tax in expenses?, No. 10

- Tax accounting for a simplified person during gratuitous transfer, No. 10

- UTII + simplified tax system: we divide the total expenses, No. 7

- Tax for “income” simplified tax system = 0, No. 6

- Taking into account “simplified” losses, No. 5

- The accountant spent his money: when to recognize expenses on the simplified tax system, No. 3

- 2013

Online magazine for accountants

The postings will be like this:

- Dt 68 Kt 51 (50) - payment of state duty;

- Dt 20, 23, 25, 26, 29, 44, 91 Kt 68 - charge of state duty;

- Dt 91 Kt 68 - payment of the state duty is attributed to non-operating expenses in connection with the refusal to perform a legally significant action;

- Dt 08 Kt 68 - the duty increased the initial cost of the property;

- Dt 51 Kt 68 - state tax is returned to the payer’s account.

Results The attribution of state duty to expenses during simplification depends on why such a duty was paid, as well as on whether this action was carried out or a refusal was received from government agencies.

If the simplifier receives back the amounts previously paid by him

Rationale for the conclusion: In accordance with paragraph 1 of Art. 346.15 of the Tax Code of the Russian Federation, taxpayers using the simplified tax system, when determining the object of taxation, take into account the following income: - income from sales, determined in accordance with Art.

249 of the Tax Code of the Russian Federation; - non-operating income determined in accordance with Art. 250 of the Tax Code of the Russian Federation. The exception is the income specified in Art. 251 of the Tax Code of the Russian Federation (clause 1.1 of Article 346.15 of the Tax Code of the Russian Federation).

Income in the form of funds, the return of which was made to the taxpayer on the basis of a court decision, in Art.

Is the state duty included in the expenses for registration?

Court fees By virtue of subparagraph 31 of paragraph 1 of Article 346.16 of the Tax Code, simplifiers with the object “income minus expenses” can take into account the costs of:

- Court expenses.

- Arbitration fees.

Thus, the costs of state fees to the court can always be taken into account on the simplified tax system. Moreover, simplifiers do this on the date of payment, and not on the date of entry into force of the court decision (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

To be more precise, the obligation to pay court fees arises due to the filing of a claim.

Accordingly, such a state fee can be included in the expenses of the simplified tax system on the day the court issues a ruling to accept the application for proceedings.

Attention

It also happens that at first the simplifier attributed the state duty to the expenses of the simplified tax system, which he paid under a civil law agreement. However, a court decision was subsequently issued, which, among other things, returned the paid state duty to him.

What should I do? It must be included in income.

On income by court decision

This norm mentions only taxes and fees paid in accordance with tax legislation. So is the state duty an expense under the simplified tax system? Definitely - YES! Issues related to state duty are regulated by Chapter 25.3 of the Tax Code of the Russian Federation. Based on paragraph 1 of Art. 333.16 of the Code, the state duty refers specifically to fees when applying to:

- Government structures.

- Local authorities.

- Other bodies and/or officials who are legally authorized to perform legally significant actions.

There should be no controversy as to whether state duty is taken into account in expenses under the simplified tax system when a document or a duplicate of it is issued to a simplifier for a fee. Yes, this is equated by law to legally significant actions. As follows from the meaning of sub. 22 clause 1 art. 346.16 of the Tax Code of the Russian Federation, state duty is accepted as expenses under the simplified tax system in any amount upon its transfer to the treasury to the appropriate account.

Court fee

By virtue of subparagraph 31 of paragraph 1 of Article 346.16 of the Tax Code, simplifiers with the object “income minus expenses” can take into account the costs of:

- Court expenses.

- Arbitration fees.

Thus, the costs of state fees to the court can always be taken into account on the simplified tax system. Moreover, simplifiers do this on the date of payment, and not on the date of entry into force of the court decision (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

To be more precise, the obligation to pay court fees arises due to the filing of a claim. Accordingly, such a state fee can be included in the expenses of the simplified tax system on the day the court issues a ruling to accept the application for proceedings.

It also happens that at first the simplifier attributed the state duty to the expenses of the simplified tax system, which he paid under a civil law agreement. However, a court decision was subsequently issued, which, among other things, returned the paid state duty to him. What should I do? It must be included in income. Letters of the Ministry of Finance of Russia dated March 20, 2014 No. 03-11-11/12250 and dated May 17, 2013 No. 03-11-06/2/17357 insist on this. Moreover, on the date of actual receipt of money from the other (losing) party. Also see “Bank services under the simplified tax system “income minus expenses”.

If you find an error, please select a piece of text and press Ctrl+Enter.

accountant

For income tax and under the simplified tax system, include the state duty paid to the budget as expenses.

This applies to state fees to the court, for registering changes to the charter or the Unified State Register of Legal Entities, for issuing a license, paragraphs. 1, 40 p. 1 art. 264, paragraphs. 22 clause 1 art. 346.16 Tax Code of the Russian Federation. An exception is the state duty for registering a car and real estate rights. It increases the initial cost of the object if paid before its commissioning. And if after that, it is included in expenses at a time Letters of the Ministry of Finance dated July 24, 2018 N 03-03-06/3/51800, dated June 1, 2007 N 03-03-06/2/101.

The defendant takes into account the reimbursement of expenses for paying the state duty on the basis of a court decision in expenses, and the plaintiff in income:

- for income tax - on the date of entry into force of the court decision Letters of the Ministry of Finance dated January 13, 2015 N 03-03-06/1/69458, dated July 24, 2013 N 03-03-05/29184;

- under the simplified tax system - on the date of payment, pp. 31 clause 1 art. 346.16, paragraph 1 of Art. 346.17 Tax Code of the Russian Federation.

Accounting entries for state duty accounting

| D 68 - K 51 | State duty paid |

| D 08 - K 68 | State duty is included in the initial cost of real estate, car |

| D 20 (26, 44) - K 68 | State duty on transactions related to the normal activities of the organization. For example, for obtaining a license or extract from the Unified State Register of Legal Entities |

| D 91-2 - K 68 | State duty paid when going to court |