In business activities, the purpose of which is to make a profit, it is necessary to keep records. The income the entrepreneur receives and the expenses incurred are taken into account. The results of activities are summed up, losses or profits are calculated. In any case, you must report to the state and pay taxes. The key tax that a company must pay on OSNO is income tax. Of course, if the company is not a member of the simplified taxation system and uses other special regimes (UTII, Unified Agricultural Tax).

It turns out that the company must keep accounting records in order to determine the financial result of its activities, which shows how the company worked; it is required by the founders, investors, banks, etc. In addition, it is obliged to maintain tax records necessary to determine the base for calculating the tax on profit. Different types of accounting lead to different profit figures.

The main legal acts governing income tax accounting are the Tax Code and PBU 18/02 “Accounting for corporate income tax calculations.”

What are the differences between income tax in accounting and tax accounting?

To reflect operations on the formation of income tax (hereinafter referred to as NP), PBU 18/02 “Accounting for calculations of income tax of organizations” is used. In accordance with PBU, a business entity must distinguish between accounting profit and profit for calculating NP. Profit in accounting (hereinafter referred to as BU) is adjusted for differences that arise between accounting records and tax calculations, forming profit in tax accounting (hereinafter referred to as TA). These differences are divided into temporary and permanent (clause 3 of PBU 18/02).

There are two types of temporary differences - deductible and taxable (clause 10 of PBU 18/02). Deductible temporary differences form a deferred tax liability (DTL). Such differences occur if the amount of expenses according to the financial accounting system exceeds the amount of expenses in the financial accounting system or the amount of income in the financial accounting system exceeds the amount of income in the financial accounting system. IT is the product of the tax rate of 20% and the difference between the accounting and tax bases; the resulting “deferred tax” reduces the value of the tax base in the current period, while increasing the tax in subsequent periods. The reasons for the formation of ONO may be, for example, the use of unequal depreciation methods (in the accounting system the cost of a fixed asset can be written off faster than in the accounting system), the use of a depreciation bonus in the accounting system (in the accounting system the depreciation bonus is taken into account in expenses, for accounting this concept does not exist), purchase of workwear (in BU the cost of clothing is written off gradually, in NU - immediately). Taxable differences, or deferred tax assets (DTA), on the contrary, occur when expenses in the accounting system exceed expenses in the accounting system and income in the accounting system exceeds income in the accounting system. For example, the sale of a fixed asset at a loss (if the accounting system recognizes the loss immediately, and in the accounting system gradually), the gratuitous receipt of a fixed asset not from the founder (in the accounting system, the income from the received fixed asset will be taken into account immediately in non-operating income, in the accounting account the amount of income will be taken into account in parts the entire depreciation period). The algorithm for determining ONA is similar to that used when calculating ONA, while the resulting value, on the contrary, increases the IR of the current period, but reduces the future IR.

Let us consider with examples the emergence and calculation of ONA and IT.

Example 1

The amount of costs incurred in connection with the depreciation of fixed assets as of June 30, 2016, in the accounting system amounted to 1,500,000 rubles, in the national accounting system - 1,300,000 rubles.

Let's determine the difference between BU and NU:

1 500 000 – 1 300 000= 200 000.

Note that the resulting difference is due to different rules for calculating depreciation provided for by the accounting policy (hereinafter referred to as the UP), taking into account the requirements of PBU 6/01 and Chapter. 25 Tax Code of the Russian Federation. This discrepancy led to the formation of ONA in the amount of 20% × 200,000 = 40,000 rubles. IT will be written off as the amount of depreciation in NU increases.

Example 2

When putting a fixed asset into operation, the organization applied a depreciation bonus in accordance with clause 9 of Art. 257 of the Tax Code of the Russian Federation in the amount of 10%. The initial cost of the fixed asset is RUB 7,000,000.

The amount of depreciation bonus that can be taken into account in expenses for NU was 7,000,000 × 10% = 700,000 rubles. For the purpose of calculating BU, the specified expense cannot be taken into account, since PBU 6/01 does not provide for this. In accounting, an IT will be formed in the amount of 20% × 700,000 = 14,000 rubles, which will be repaid after the cost of the specified fixed asset is completely written off.

PBU 18/02 also highlights permanent differences. Permanent differences are classified into permanent tax liability (PNO) and permanent tax asset (PNA) (clause 4 of PBU 18/02). PNO has the same principle of occurrence as ONA, since PNO increases the value of NP of the reporting period. The main difference between the two differences is that PIT will not be taken into account in the future when calculating tax. PNA has common features with ONO, reducing the tax of the current period, but just like PNA, it is not written off later. The value of PNO and PNA is calculated as the product of the difference between BU and NU and the rate of 20%.

Let's look at examples.

Example 3

The organization in 2015 incurred advertising expenses in the amount of 850,000 rubles. At the same time, revenue for the specified period amounted to 50,000,000 rubles.

In accordance with paragraph 4 of Art. 264 of the Tax Code of the Russian Federation, advertising expenses for the purposes of NP can be taken at a value not exceeding 1% of revenue.

The organization has the right to take into account 1% × 50,000,000 = 500,000 rubles in expenses.

The difference between BU and NU will be 850,000 – 500,000 = 350,000 rubles.

PNO - 350,000 × 20% = 75,000 rubles.

Example 4

The tax authority returned the previously overpaid property tax in the amount of 300,000 rubles to the organization’s current account.

In the accounting system, the specified amount will be reflected in income, while in the tax accounting system, tax refunds are not recognized as income when determining the taxable base when calculating income tax (subclause 21, clause 1, article 251 of the Tax Code of the Russian Federation).

Thus, a PNA of 300,000 × 20% = 60,000 rubles will be formed.

What are the rates in 2021

The general income tax rate for 2021 is 20% of profits. Of these, in 2021, 2% received the federal budget, 18% received the regional budget. [email protected] came into force , which introduced a new declaration form and changed the procedure for distributing interest between budgets. In 2021, 3% will go to the federal treasury, 17% to the regional treasury.

At the local level, authorities have the right to lower the tax rate, but only in that part that goes to the local budget: 3% is added on top. Local regulations indicate what indicator is used to calculate income tax in the region - not lower than 13.5%. Together with payments going to the federal budget, the lower threshold is now 16.5% (13.5 + 3) - it has increased compared to 2021.

In Moscow, a rate of 13.5% is paid by certain categories of taxpayers who:

- use the labor of disabled people;

- produce cars;

- work in a special economic zone;

- are residents of technopolises and industrial parks.

In St. Petersburg, 13.5% of profits is paid only by residents of the special economic zone who operate on its territory.

In most regions, the rate has been reduced for at least some types of activities.

In addition to the main one, there are special rates. Profit tax at such rates is fully directed to the federal budget.

They are used if you have a certain status or for special types of income:

- 20% is paid by foreign companies without Russian representation, hydrocarbon producers and controlled foreign companies;

- 10% - foreign companies without a representative office in the Russian Federation from income from leasing vehicles and international transportation;

- 13% - local organizations from dividends of foreign and Russian companies and from dividends from shares on depositary receipts;

- 15% - foreign organizations from dividends of Russian companies; all owners of income from state and municipal securities (CB);

- 9% - from interest on municipal securities and other income from paragraphs. 2 clause 4 art. 284 Tax Code of the Russian Federation;

- 0% - rate for medical and educational institutions, residents of special economic zones (EZ), participants in regional investment projects, free EZ in Crimea and Sevastopol, residents of the territory of rapid socio-economic development.

How to maintain corporate income tax accounting?

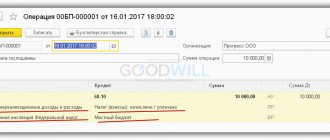

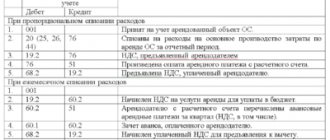

In the BU NP account 68 is used, to which the “Income Tax” subaccount is opened (for example, 68.01).

It is necessary to highlight the following sequence of reflection in the accounting of transactions for calculating NP:

- Accrual of conditional expenses - Dt 99 Kt 68.01 or conditional income - Dt 68.01 Kt 99.

Conditional expense is a tax calculated at a rate of 20% on accounting profit. Conditional income is the amount of tax in the accounting system determined from the loss that is formed on the basis of accounting data (clause 20 of PBU 18/02).

For example, in accordance with the accounting system, the amount of profit for the 1st quarter. 2021 — 1,100,000 rub. The conditional expense will be determined as 20% × 1,100,000 = 220,000 rubles.

- Reflection of entries for differences that have arisen: Dt 09 Kt 68.01 - ONA;

- Dt 68.01 Kt 77 - IT;

- Dt 99 Kt 68.01 - PNO;

- Dt 68.01 Kt 99 - PNA.

In this case, the repayment of the differences will be reflected in “mirror” entries: Dt 68.01 Kt 09 - repayment of IT, Dt 77 Kt 68.01 - repayment of IT.

The conditional expense (income) reflected in the accounting, as well as temporary and permanent differences, form a current IR or loss in account 68, the value of which will be reflected in the IR declaration.

Let's look at an example.

The organization reflected the following income and expenses for 2015:

| Article | BOO |

| Total income: | 5 420 000 |

| sales income | 3 300 000 |

| free receipt of property | 780 000 |

| Other income | 1 340 000 |

| Total expenses: | 2 165 000 |

| depreciation | 700 000 |

| salary | 1 000 000 |

| entertainment expenses | 65 000 |

| employee meals | 150 000 |

| other expenses | 250 000 |

| Accounting profit | 3 255 000 |

In the NU register, the organization will reflect the following income and expenses:

| Article | WELL |

| Income: | 4 640 000 |

| sales income | 3 300 000 |

| Other income | 1 340 000 |

| Expenses: | 1 840 000 |

| depreciation | 600 000 |

| salary | 950 000 |

| entertainment expenses | 38 000 |

| other expenses | 250 000 |

| Profit | 2 800 000 |

Thus, in the organization’s accounting, the following differences have been identified between accounting and financial accounting:

| Type of income (expense) | BOO | WELL | Difference | Cause |

| Free receipt of property | 780 000 | 0 | 780 000 | It is not income to NU according to subparagraph. 11 clause 1 art. 251 Tax Code of the Russian Federation |

| Depreciation | 700 000 | 600 000 | 100 000 | Different methods of calculating depreciation in accordance with Art. 257 Tax Code of the Russian Federation and PBU 6/01 |

| Salary | 1 000 000 | 950 000 | 50 000 | Different methods of forming a reserve for vacations, taking into account the requirements of Art. 324.1 Tax Code of the Russian Federation and PBU 8/2010 |

| Entertainment expenses | 65 000 | 38 000 | 27 000 | In NU 4% of labor costs: 950,000 × 4%, according to clause 2 of Art. 264 Tax Code of the Russian Federation |

| Employee meals | 150 000 | 0 | 150 000 | Unreasonable expenses for NU purposes, taking into account the provisions of paragraph 1 of Art. 252 Tax Code of the Russian Federation |

The organization on December 31, 2015 will reflect the following transactions:

Dt 99 Kt 68 - 651,000 rub. = 3,255,000 × 20% — accrual of conditional expenses for NP;

Dt 09 Kt 68 — 30,000 rub. = (100,000 +50,000) × 20% — accrual of ONA;

Dt 99 Kt 68 - 35,400 rub. = (27,000 +150,000)× 20% — accrual of PNO;

Dt 68 Kt 99 - 156,000 rub. = 780,000 × 20% — accrual of PNA

Thus, the current NP will be equal to RUB 560,400. = 651,000 + 30,000 +35,400 – 156,000.

In reporting in Form 2, the organization will reflect information on the calculation of NP in the following lines:

- 2300 - 3,255,000 - profit before tax;

- 2410 - 560 400 - current NP

- 2421 - 120,600 (156,000 - 35,400) - the value of PNA and PNA;

- 2450 - 30,000 - ONA amount;

If the organization had accrued IT, then the value for the specified difference would be shown on line 2430.

Payment for NP will be reflected by posting Dt 68.1 Kt 51 - 560,400 rubles.

The rules for changing the depreciation calculation method have been changed

The method of calculating depreciation (linear or non-linear) is established by the taxpayer independently for all objects of depreciable property (with the exception of objects for which depreciation is always calculated using the straight-line method) and is reflected in the accounting policy. You can change the method of calculating depreciation from the beginning of the next tax period, but switching from a non-linear to a linear method is allowed no more than once every 5 years. Until 01/01/2020, to switch from a linear to a nonlinear method, you did not have to wait 5 years (Clause 1 of Article 259 of the Tax Code of the Russian Federation).

From 01/01/2020, the requirement for the mandatory application of the chosen depreciation method for at least five tax periods applies to the linear method, which limits the freedom of action of taxpayers (clause 24 of article 2 of Federal Law dated 09.29.2019 No. 325-FZ). Moreover, no transitional provisions are provided. Therefore, it is not entirely clear whether it was possible, for example, in December 2021 to make a change to the accounting policy and apply the non-linear method from 01/01/2020, if the linear method had previously been used for less than 5 years. We believe it is safer not to do this.

How to organize tax accounting?

The procedure for organizing NU is stated in Art. 313 Tax Code of the Russian Federation. In accordance with this norm, business entities calculating NP need to formulate an accounting policy (hereinafter referred to as UP) for NP purposes. The UE should reflect the main points of the NU, which make it possible to determine the possibility of including income and expenses in the taxable base. In addition, the UE contains tax registers developed and used by the organization, from which one can see the composition of income and expenses involved in the formation of the tax base.

Based on the NU data, the taxpayer draws up a IR declaration, the form of which was approved by Order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/ [email protected]

Depreciation of fixed assets transferred for free use

The norm of paragraph 3 of Article 256 of the Tax Code of the Russian Federation, in force until 01/01/2020, established a ban on charging depreciation on fixed assets (fixed assets) transferred for free use and including it in expenses. An exception is OS transferred for free use to state authorities and local governments, as well as state and municipal institutions and unitary enterprises.

This rule has changed since 01/01/2020. Fixed assets transferred for free use are not excluded from depreciable property (paragraph 2, paragraph “b”, paragraph 23, article 2 of Law No. 325-FZ).

Consequently, depreciation should continue to be calculated for such objects. However, it will not be possible to include it in expenses. This is prohibited by the new paragraph 16.1 of Article 270 of the Tax Code of the Russian Federation. An exception is all cases where the taxpayer’s obligation to provide property for free use is established by the legislation of the Russian Federation (Clause 29, Article 2 of Law No. 325-FZ).

Who has the right not to account for corporate income tax?

In accordance with PBU 18/02, accounting for NPs is not carried out (clauses 1, 2 of PBU 18/02):

- Companies and individual entrepreneurs that do not calculate taxes. These categories include: special regime officers - on the simplified tax system, UTII, Unified Agricultural Tax, as well as those executing a production sharing agreement and other persons exempt from paying tax in accordance with the provisions of Chapter. 25 Tax Code of the Russian Federation. Let us remind you that economic entities under special regimes pay a single tax and are exempt from the tax burden under NP.

- Credit organizations.

- State or municipal enterprises.

- Organization with simplified accounting. Moreover, if such organizations do not have NU, this must be reflected in the UP.

For information on who should apply PBU 18/02, see the article “ PBU 18/02 - who should apply and who should not?” "

Ways to reduce the tax rate

Today, the most popular way to reduce the tax percentage is to officially register a company in another country. After gaining a stable position in the market, the owners of a company registered in this way at the initial stage of active business begin to carefully withdraw financial profits to the so-called offshore. As a result, the profit received by the enterprise is not taxed, which makes it possible to manage it independently.

You should also know that in the Russian Federation, taxable profit is calculated by enterprises using OSNO. Only organizations working on UTII and the simplified tax system are exempt from this. The tax interest rate is 20%, of which 2% will be directed to the state budget, and 18% to the regional budget. Some businesses carrying out commercial activities can take advantage of special tax incentives and a reduction in the rate to 0%. Educational and medical institutions, as well as agricultural enterprises, can receive tax benefits.

To confirm the right to a reduction in the tax rate, you need to provide the tax office with the appropriate package of documents proving that the enterprise belongs to one of the listed types of activities.

What is the responsibility for non-application of PBU 18/02?

The legislation does not provide for liability for non-application of PBU 18/02. At the same time, there are currently 2 articles that are applied as punishment for non-compliance with accounting rules:

- Art. 15.11 of the Administrative Code, which is applied in case of distortion of accounting records by more than 10%. For this violation, a fine of 5,000 to 30,000 rubles is provided.

- Art. 120 of the Tax Code of the Russian Federation: if accounting and tax registers are not used or the rules for reflecting expenses and income are violated, a fine of 10,000 to 30,000 is imposed; in case of underestimation of the base - a penalty of 20% of the unpaid amount.

If the taxpayer correctly keeps accounting records, forms all registers and fills out the declaration, then in order to apply the specified penalties, the tax authorities should first independently apply PBU 18/02 in order to determine the real amount of NP for calculating the amount of deviations, which can be a difficult procedure for them. But in order not to encounter questions from the tax authorities, we recommend that you still follow the rules provided for by PBU 18/02.

New restrictions on carry forward losses

According to the wording of paragraph 2.1 of Article 283 of the Tax Code of the Russian Federation, which was in force until 01/01/2020, taxable profit for the reporting (tax) periods 2017-2020 can be reduced by previously received losses by a maximum of 50%.

This restriction, which is disadvantageous for many taxpayers, was extended for one year. Profits received in 2021 also cannot be reduced by losses from previous years by more than 50% (clause “b”, clause 35, article 2 of Law No. 325-FZ).

Another limitation is related to taking into account losses during the reorganization of companies. If an organization is liquidated as a result of reorganization (in the form of a merger, accession, division, transformation), then its successor can transfer its loss to the future (clause 5 of Article 283 of the Tax Code of the Russian Federation).

Starting from 2021, the norm will be specified. If the tax authorities determine that the main purpose of the reorganization is to reduce the taxable profit of the successor by the amount of losses that were received by the predecessor before the reorganization, then the transfer of losses to the successor will be denied (subclause “b”, paragraph 35 of Article 2 of Law No. 325-FZ). In our opinion, this amendment is of a technical nature, since the provisions of Article 54.1 of the Tax Code of the Russian Federation and the explanations in the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation of October 12, 2006 No. 53 allow tax authorities to “remove” these losses.

Results

Applying the norms of PBU 18/02, organizations are faced with accounting for income tax calculations, which consists of reflecting entries for accounting for conditional expenses (income), as well as permanent and temporary differences. It should be noted that the current legislation does not provide for liability for non-application of the provisions of PBU 18/02.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Expenses and income

What is included in income?

Income is your revenue from your main activity (sales, provision of services or performance of work) and from additional sources (bank interest, rental of property). When the tax base for income tax is calculated, income is taken into account without VAT and excise taxes, confirmed by invoices, payment orders, entries in the book of income and expenses, and accounting documents.

What are expenses?

Expenses are confirmed and justified expenses of the company. They may be related to production activities, for example:

- employee salaries;

- cost of raw materials and equipment;

- depreciation.

But there are also those not related to production:

- legal costs;

- difference in exchange rates;

- interest on loans.

What expenses are deducted from income?

Accountants pay close attention to papers that confirm income tax expenses, since reducing income by expenses is allowed only if the following conditions are met:

- it is necessary to justify expenses - to prove economic feasibility;

- prepare primary documents (book of income and expenses, tax documentation).

There is a list of costs that cannot be taken into account when reducing the base.

Subtracted from income:

- commercial, transport, production costs (raw materials, wages, depreciation, rent, services of third-party lawyers, representation expenses);

- interest on debts;

- expenses on advertising (with a limitation - only 1% of sales revenue is written off);

- insurance costs;

- spending on research (to improve products);

- expenses for education and training of personnel;

- expenses for the purchase of databases and computer programs.

What expenses cannot be deducted?

The list of costs that do not reduce income is given in Article 270 of the Tax Code of the Russian Federation:

- remuneration of members of the board of directors;

- contributions to the authorized capital;

- contributions to the securities reserve;

- payments for exceeding the level of emissions into the environment;

- losses associated with economic activities in the communal, housing and socio-cultural spheres;

- penalties and fines;

- money and property transferred to pay for loans and borrowings;

- fees for notary services above the tariff;

- prepayment for a product or service;

- repayment of loans for employee housing;

- voluntary membership contributions to public funds;

- the amount of revaluation of the Central Bank with a negative difference;

- the cost of property that was given free of charge, transfer costs;

- payment for employee travel to work and home, if it is not provided for by production features and contract;

- pension benefits;

- vouchers for treatment and rest of employees;

- payment for vacations that are not provided for by law, but are specified in the contract with the employee;

- payment for sports and cultural events;

- payments for personal consumption goods purchased for employees;

- the cost of subscriptions to newspapers, magazines and other literature not related to production;

- payment for food for employees, unless this is provided for by law or collective agreement.