What are the types of wages?

In labor relations, several dozen types of wages can be distinguished. In a private enterprise, the salary can be presented (clause 2 of the Regulations on the specifics of the procedure for calculating the average salary, approved by Decree of the Government of Russia dated December 24, 2007 No. 922):

- payments at a tariff or salary - for time worked;

- payments at piece rates;

- percentage of sales (commission);

- non-cash income;

- royalties;

- allowances, additional payments, bonuses, rewards for labor results;

- payments for special working conditions, etc.

In 2021, payroll in these types can be carried out using a wide range of methods. At the same time, these types of wages can be combined with each other in any way - in accordance with the wage system operating at the enterprise.

You can learn more about the use of various remuneration schemes in an enterprise in the article “Calculation of wages to employees - procedure and formula.”

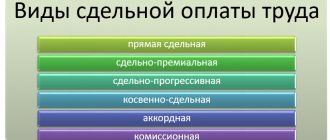

If we talk about traditional payroll schemes, then these include (letter from the State Planning Committee of the USSR, the Ministry of Finance of the USSR, the State Committee for Prices of the USSR No. 10-86/1080, the Central Statistical Office of the USSR dated 06/10/1975 No. AB-162/16-127):

- a time-based scheme, which is based on the calculation of salary payments based on time worked;

- piecework scheme, which is based on the calculation of wages for work results measured objectively or assessed according to established criteria.

Let's study in more detail how wages are calculated within the framework of the 2 most common payment schemes - time-based and piece-rate.

ConsultantPlus experts explained how to calculate wages under other remuneration systems. Get trial access to the system and upgrade to the Ready Solution for free.

One-time charge

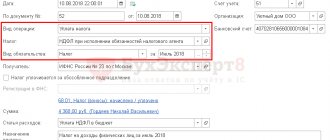

If the accrual settings indicate that it is entered as a separate document, then the One-time accrual document is intended for such accruals.

Step 1: Go to the journal and click Create.

Step 2. Fill out the header of the document. Using the Selection or Add buttons, fill in the list of employees. Click Fill in indicators and set the value of the indicator to be calculated.

The indicator will be set for all employees in the document. When making changes to the document, to update the calculation result, click Recalculate. To undo edits to a document, click Undo edits and select the desired action.

If the payment is made during the inter-reporting period, check the Calculate deductions checkbox. The table will display the personal income tax column and calculate its amount. If you do not check the box, the accrued amount will be paid in full, and personal income tax will be withheld during the final calculation of wages.

Step 3: Click Post and Close. The accrual has been entered.

How are wages calculated for time-based wages?

Time-based (time-based bonus) wages are most often found in the following 2 varieties:

- When the salary is calculated based on the employee’s monthly salary (supplemented in the prescribed manner with bonuses for labor results).

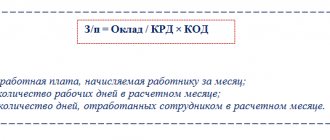

In this case, the following formula is used to calculate wages:

SALARY = (OP / RD) × OD,

Where:

SALARY - salary for the billing period;

OP - the employee’s official salary, supplemented by bonuses if any;

RD - the number of working days in the month that includes the billing period;

OD - days worked in the billing period.

Attention! Salaries must be paid at least twice a month (Article 136 of the Labor Code of the Russian Federation), therefore the billing period cannot exceed half a month (letter of the Ministry of Labor and Social Protection of Russia dated September 21, 2016 No. 14-1/B-911). In this case, salary accrual is displayed in the accounting registers on the last day of the month.

- When the salary is calculated based on the tariff rate per 1 hour or 1 day.

In this case, the following formulas are used to calculate wages:

- for hourly wages:

SALARY = NHT × PCH,

Where:

CHTS - hourly tariff rate under an employment contract,

OCH - the number of hours worked during the reporting period;

- for daily wages:

SALARY = DTS × OD,

where DTS is the daily tariff under the employment contract.

In both cases, the employee receives pay for weekends and holidays:

- when performing work on weekends and holidays - at a double tariff rate (Article 153 of the Labor Code of the Russian Federation);

- when resting on such days - in accordance with local regulations (Article 112 of the Labor Code of the Russian Federation).

In the scenario under consideration, salary calculation is carried out taking into account the fact that the employer is obliged to establish monthly standards (Articles 160, 162 of the Labor Code of the Russian Federation):

- by working hours;

- by production.

The basis for such standards may be, for example, standard indicators for the industry in which the employing company operates.

If the standards established by the employer are met, the employee in any case receives a salary no less than the minimum wage established in the constituent entity of the Russian Federation (Article 133 of the Labor Code of the Russian Federation).

Is it possible not to pay a salary to the director of a company? Find out the answer in ConsultantPlus by receiving free trial access to the system.

Now let’s talk about how wages are calculated under the piecework scheme.

Tariff rates, grouping

Different industries require different tariff rates. Not only the significance of the work is taken into account, but also the complexity. Each division into categories of employees takes into account not only the significance of the work, but also factors such as the complexity and intensity of working conditions. In addition, clear differentiation depends on how remuneration is carried out and the role of the work performed itself.

Calculation

Typically there are three groups of bets:

- Normal working conditions.

- Hard work. 10-15% is added to the usual amount of remuneration.

- Particularly difficult conditions. Then the increase is 20-30%.

Such differentiation makes it possible to easily eliminate possible injustice and attract any categories of employees to perform work.

The tariff rate usually depends on which specific unit of time is chosen for measurement. In most cases, hourly rates are used.

Payroll calculation under the piecework wage system: nuances

With piecework wages, as with the second option of time-based wages, which we discussed above, the employer also sets monthly standards for working time and output. Exceeding the relevant standards can increase piecework wages:

- Proportional to production.

Example

Electrical engineer Ivanov works at a television assembly plant. He receives a salary based on a piece-rate scheme, in which the employer has set a standard for assembling 2 televisions within 8 working hours. If it is completed, Ivanov receives 2,000 rubles (tariff: 1,000 rubles for 1 assembled TV).

For each subsequent assembled TV, Ivanov receives 1,000 rubles, regardless of the volume of production.

- Using a progressive scale.

Example

Machine operator Petrov works at a fastener production plant in the bolt production shop. He receives a piece-rate salary, according to which the employer sets a standard for production: 100 bolts within 8 working hours. When it is completed, Petrov receives 390 rubles (tariff - 3 rubles 90 kopecks for 1 bolt).

For every 50 additional bolts collected, Petrov receives 10 rubles apiece. For every 50 following them - 20 rubles. For each subsequent bolt - 30 rubles.

In some cases, a regressive scale may also be used. For example, when the production model of an enterprise requires employees to fulfill planned targets as accurately as possible without significantly exceeding them (as an option, in order to increase the efficiency of control over costs of raw materials).

A separate type of salary is the one that is paid during the employee’s business trip (Articles 139, 167 of the Labor Code of the Russian Federation). Let's study the specifics of its calculation.

Payroll and wages: the difference between the concepts

The general fund includes basic and additional fees. This means the amount from the basic salary and material rewards.

The Tax Code defines the amounts that fall into this group. Insurance premiums are calculated using this money.

But not every component of the wage fund constitutes the cost of goods. Profit collections are unreasonably reduced due to incorrectly distributed income. Accounting statements are prepared with errors, which leads to a fine from the tax authorities.

Business trip on weekends: how is salary calculated?

How to calculate salary for weekends during a business trip? This problem is solved using the formula:

RVK = DT × RV × 2,

Where:

DT - the employee’s daily tariff in accordance with the accepted wage system (letter of the Ministry of Labor and Social Protection of Russia dated December 25, 2013 No. 14-2-337);

PB - days off worked.

The DT indicator can be directly determined in the employment contract or calculated using the formula:

DT = OKL / RDM,

Where:

OKL - salary (with allowances and bonuses, if provided for in the contract) for the month in which the person was on a business trip);

RDM - the number of working days in the corresponding month.

In addition to the salary in the form of average earnings, the posted employee is also paid a daily allowance.

You can find out how daily allowances are calculated in the article “Amount of daily allowances for business trips (nuances).”

Assignment of planned accrual

Let’s create another accrual as an example – let’s call it Rural Supplement.

The calculation formula uses the Rural Supplement indicator and specifies that it is used in all months after entering a numeric value.

Such accruals are introduced by personnel orders.

To submit an order for assigning a bonus, go to the section Changing employee pay. This section is available both from the Personnel and Salary menus.

Step 1. Click Create and select Planned accrual assignment.

Step 2. Fill out the header of the document - indicate the Accrual and its validity period - Start Date and End Date. The accrual will be calculated monthly over the specified period.

Step 3. Select a list of employees. Fill in the value of the indicator to calculate the accrual - the Fill in indicators button.

Step 4: Click Post and Close. The accrual calculation for such a document is made during the final payroll calculation.

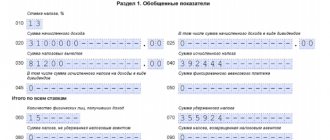

Payroll and taxation in 2021

An employee’s salary, including those represented by vacation pay and travel allowances, is subject to:

- Personal income tax at the rate:

- 13% - if the employee has tax resident status;

- 15% - from 01/01/2021 for income exceeding 5 million rubles. in a year;

- 30% - if the employee does not have resident status.

In the case of applying a tax deduction, personal income tax at a rate of 13% is not charged on the part of the salary amount within the amount of the deduction. At a personal income tax rate of 30%, the deduction cannot be applied.

Personal income tax on wages is accrued at the moment it is recognized as income - on the last day of the month for which wages are calculated (clause 2 of Article 223 of the Tax Code of the Russian Federation). Withheld - at the time of payment. Transferred to the budget no later than the next business day after payment.

Thus, if an employee’s income is transferred before the end of the month, then personal income tax is withheld and transferred to the budget only from the next nearest payment.

- Contributions to social funds (the main part of which is collected through the mediation of the Federal Tax Service):

- to the Pension Fund;

- to the Social Insurance Fund (without the mediation of the Federal Tax Service, the fund collects contributions for injuries);

- in FFOMS.

Contribution rates are divided into standard, increased and reduced, which are established for certain categories of enterprises. Contributions are calculated on salary without deduction of personal income tax.

The deadline for paying all contributions is until the 15th day of the month for which the employee is paid.

Termination of planned accruals

To cancel an accrual assigned to employees, create the Termination of Planned Accrual document. You can enter it:

- Based on the document Purpose of planned accrual – the Based on button.

- From the menu section Salary – Termination of planned accruals.

The document indicates the basis and date for termination of accrual.

After posting the document, accrual for the employees specified in the document is cancelled.

Standard

During the times of a centralized economy, additional wages were calculated using complex formulas. Now its size is calculated as a percentage of the main one. The basis for calculations is data on payments for previous periods, which must be adjusted with minor changes.

The standard (N) is calculated by dividing all additional payments (DS) by the wages for the previous period:

N = DV: FZP

The result obtained will be the basis for calculating all additional payments in the current period. Of course, an enterprise can calculate the standard using a different algorithm, which takes into account industry characteristics of its activities and other factors.

Calculation and accrual of additional salaries in an organization is an important point in planning the total amount of costs. It is necessary to take into account all situations in which there may be a need to compensate for the efforts made. If insufficient funds are allocated for wages, this can lead to high staff turnover. In the opposite situation, there will be an unintentional increase in production costs, and therefore a loss of profit.

Sick leave

When paying compensation for temporary disability certificates, the main part of the costs falls on the Social Insurance Fund (SIF). Only the first three days are paid at the expense of the employer. The amount of payment depends on the length of service:

- less than 5 years – 60% of the average salary;

- 5-8 years – 80%;

- from 8 years – 100%.

Full sick leave compensation is due:

- WWII veterans;

- workers with occupational diseases;

- disabled people;

- persons on holiday for the BiR;

- employees with three or more minor children.

Postings

All transactions for accounting for settlements with employees are reflected in account 70 “Settlements with personnel”. It is passive: all accruals are shown on credit, and deductions are shown on debit. The balance reflects the organization's debt to personnel. Sources of payment of additional wages are:

1. Attribution to the cost of production:

- Dt 20, 23, 25, 26 (main, auxiliary production, general production, general business expenses) and accounts of other costs (29, 44). The CT displays a score of 70.

- Accruals for labor associated with the acquisition of inventories, liquidation of property, and capital investments are reflected by posting Dt 08 (10, 91, 15, 11) Kt 70.

- In enterprises with seasonal work, vacations are provided unevenly. In such conditions, the cost of production is calculated in a different way. Amounts for expenses are written off evenly throughout the year, regardless of the month of payment. This creates a reserve for vacation payments. These figures are displayed on accounts DT 20, 26, 25, 23 CT 96 “Reserves for future expenses.” Then they are written off in KT 70.

2. At your own expense

— A percentage of additional wages can be paid from retained earnings (DT 91 KT 70) or income from participation in capital (DT 84 KT 70).

3. At the expense of the Social Insurance Fund (DT 69 CT 70).

In all these cases, account 70 is debited with:

- 50 “Cashier”, 51 “Cash accounts” - salary is paid in cash or sent to cards.

- 44 “Finished products” – if wages are paid in goods.

- 76.4 “Deposited Funds”. If within three days the employee has not received remuneration, then these amounts must be deposited in the accounts and then paid upon demand.