A cash book (form KO-5 - accounting for received and issued funds) is purchased and filled out in organizations of all forms of ownership. Whether to start this book or not is a matter of necessity. They are required to maintain a cash book in form KO-5 even in an organization where there are only two cashiers. But we're not just talking about two cashiers. And about if operations of receiving and issuing money will be carried out between them. Then one cashier is senior, the second is junior. This is a mini example. In reality, the scale is completely different. In large organizations, the staff of supervised cashiers alone reaches 200 people. The senior cashier can only manage to enter data into the cash book.

What kind of document is this?

This book reflects similar operations that have a certain economic essence and justification. They are associated with the moment of transfer of cash and monetary documents from one official to another: from the chief (senior) cashier to an ordinary cashier - at the beginning of the work shift, and in the reverse order - at the end of the shift .

The journal is filled out in order to record as accurately as possible the direct fact of the transfer of the specified material assets, and is used only when there is a central cash desk and departmental cash desks. Naturally, if the organization’s staff includes only one cashier, then the specified register does not need to be maintained.

You can see the procedure and sample for filling out the cash book in this article. How to properly maintain a general ledger in accounting - read here.

conclusions

Book KO-5 is a unified form of cash accounting, often used by an economic entity that has a complex, hierarchical structure of its own cash register.

In other words, it is advisable to use it in cases where the organization has a chief cashier who is responsible for working with the cash register at the level of the entire enterprise, and junior cashiers whose competence includes maintaining the corresponding cash registers for individual divisions of this enterprise.

Filling out KO-5 is done by indicating the required information in the columns/lines of this form.

Instructions for filling

As for the procedure for filling out the book, it is quite simple and does not cause any particular difficulties for workers. On the front side of the document is the name of the organization, for which year this accounting register is maintained, the surname and initials of the cashier.

On the inner sheets, the journal is divided into two parts - incoming and outgoing :

- The receipt table (on even pages) contains information about the amount of money received by an ordinary cashier. Each operation is reflected by day, respectively, all of them have their own date. The second column reflects the amount of cash that is available as a balance at the department's cash desk. Then the amount of money transferred to the employee for cash transactions is written down and secured with his own signature. In addition, this part reflects data on receipt transactions that were carried out by the cashier of the structural unit throughout the day.

- The expense table (on odd-numbered pages) shows data related to the expenditure of funds on any operations. The most important columns in it are how much cash and paid documents were handed over by an ordinary cashier to a senior one, indicating the total amount for these two columns. These figures are checked and signed by the chief cashier. The last column contains the balance of available cash, which will be in the employee’s hands at the end of the working day. It is calculated as the balance at the beginning plus the amount of funds received and minus the amount of returned money and payment documents. The balance at the end of the day is exactly transferred to the receipt at the beginning of the next working day.

Here you can download the book form and a sample of how to fill it out for free.

It should be noted that this accounting register is compiled separately for each year , and balances from the previous year are transferred to the next.

The role of the book of accounting for funds accepted and issued by the cashier

Money is issued from the main cash register and returned there. All processes involving the movement of money through the main cash register are reflected in the cash book. In this case, strict forms (receipt and expense orders) are filled out.

Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88 On approval of unified forms of primary accounting documentation for recording cash transactions and recording inventory results.

1. On accounting of cash transactions.

Book of accounting of funds accepted and issued by the cashier (form No. KO-5).

Relevant in 2021.

What sections does KUDiR consist of?

KUDiR consists of a title page and five sections:

- Section I - for accounting of income and expenses.

- Section II - for calculating expenses for fixed assets and intangible assets.

- Section III is for calculating losses for past periods that reduce the tax base.

- Section IV - for accounting for expenses that reduce tax.

- Section V - for calculating the amount of the trade fee that reduces the tax.

Which sections you have to fill out depend on the object of taxation: “Income” or “Income minus expenses”. Let's take a closer look at the differences.

Results

A cash book is a mandatory document when working with cash, be it revenue or other payments. Its form and procedure are strictly regulated, and violations when working with it may result in liability. Therefore, it is very important to maintain this cash register accurately and without errors.

Sources: Directive of the Bank of Russia dated March 11, 2014 N 3210-U

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Procedure, rules, example of filling out a book for recording accepted and issued cash

Title page

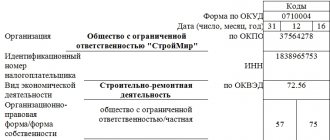

The information entered must not contradict the content of the enterprise’s Charter.

If you receive the OKPO code, we enter that too.

Enter the name of the structural unit if available.

Title page of the cash book (form KO-5)

Amendments and corrections are not welcome. If an erroneous entry needs to be corrected, it must first be carefully crossed out. The current entry is written next to it. The corrected code (date), the signature of the person who made the entry, the surname and a stamp must be indicated.

We draw up odd-numbered pages (form KO-5)

Sample of filling out the odd pages of the cashier's book

Related documents

- Sample. Limit fence card. Form No. m-8

- Sample. Limit fence card. Form No. M-9

- Sample. Local estimates. Form No. 4-в

- Sample. Invoice is a requirement for release (internal movement) of materials. Form No. m-11

- Sample. Inventory of cash tickets sent for examination (instruction of the Central Bank of the Russian Federation dated 10/04/93 No. 18 (as amended on 02/26/96))

- Sample. Determining Average Percentage of Gross Income

- Sample. List of rented premises

- Sample. List of debtors of a liquidated credit institution included in the liquidation balance sheet (Regulation of the Central Bank of the Russian Federation dated April 2, 1996 No. 264)

- Sample. List of creditors of a liquidated credit organization included in the liquidation balance sheet (Regulation of the Central Bank of the Russian Federation dated April 2, 1996 No. 264)

- Sample. List of creditors of a liquidated credit institution included in the interim balance sheet indicators (Regulation of the Central Bank of the Russian Federation dated April 2, 1996 No. 264)

- Sample. List of objects of social, cultural and public utility purposes (appendix to the agreement on the procedure for using federal property assigned to a state educational institution with the right of operational management

- Sample. List of creditor organizations

- Sample. List of creditor organizations

- Sample. Payment statement. Form No. 253

- Sample. Regulations on the organization of reporting in a joint-stock company (standard form)

- Sample. Transmittal sheet for the bag with cash proceeds

- Sample. Order on conducting an inventory of property and financial obligations (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

- Sample. Order on accounting policies for a budgetary institution

- Sample. Order on accounting policies for a non-profit organization

- Sample. Approximate list of technical and economic indicators for public buildings and structures

How to fill out KUDiR on the simplified tax system “Income”

On a simplified system with the “Income” object, you need to fill out sections I, IV and V.

Section I. Income and expenses

In this part, enter all business transactions in order, indicating the date and number of the primary document: payment order, sales receipt, act, invoice and others. Also write down the content of the transactions, and in column 4 indicate the amount of income.

Column 5 is usually not filled in. But if you received a subsidy to support small and medium-sized businesses, indicate the expenses that you paid with this money. You also need to display the subsidy in your income, but not at the same moment as you receive it. We spent part of the subsidy and added this amount immediately to income and expenses. We spent another portion and made entries again. And do this until you spend the subsidy completely.

Example of filling out Section I (display of subsidies)

Record income received only when money from the buyer is received at the cash register or in the bank account. Prepayment is also considered income, so it should also be entered in column 4. Even the prepayment returned to the buyer must be indicated in this column, only with a minus sign. There is no need to take the return into account as expenses and enter it in column 5, because it reduces taxable income.

Example of filling out Section I (return of prepayment)

Section IV. Tax-reducing expenses

In this section you need to enter those amounts by which your tax will later be reduced: insurance premiums for employees, contributions under voluntary personal insurance contracts and hospital benefits for the first three days of disability paid by the organization. Individual entrepreneurs must also indicate insurance premiums for themselves.

Record expenses as they are paid, and at the end of each quarter, add up the total in column 10 to compare the deduction with the limit and calculate the tax.

Example of filling out section IV. Tax-reducing expenses

Section V. Trade Fee Reducing Tax

In this section, add the trading fee amounts for each quarter. All taxpayers using the simplified tax system “Income” must fill it out, and not just those who are required to pay a trade tax.

If there is no trade tax in your region, indicate the reporting year, and put dashes in the indicators so that the tax inspector does not decide that you forgot to fill out the section.

If there is a trade fee in your region, indicate the serial number of the transaction, the date and number of the primary document, the period for which the payment was made, and the amount.

Example of filling out Section V. Amount of trading fee

How to properly maintain a cash book in 2021

At each enterprise, by order of the manager, a special employee must be appointed responsible for the cash register. If the state allows, then this is a separate cashier; if not, then, as a rule, this is the chief accountant. It is this person who must keep records of all transactions and the cash book. In any case, the chief accountant controls the process. The cash book itself is a journal if maintained in paper form, or a separate section of the accounting program if maintained electronically. Both methods are allowed, so let’s look at each method of maintaining a cash book in more detail.

First, let's look at the responsibilities of a cashier, since they do not depend on the method of maintaining the cash book and have a certain algorithm that looks like this:

- At the beginning of a new shift, the cashier must open the day, that is, make an entry with the date and amount of the balance in the cash register. This amount should always be equal to the balance at the end of the previous working day. Such operations may not be daily, so it is necessary to open a shift and make an entry in the cash book only on the day on which the movement of funds occurred. On other days, the balance is simply transferred.

- Each operation for issuing or receiving cash must be formalized by a cash receipt order (PKO) or an expenditure cash order (RKO). The cashier prepares these documents, assigns them numbers and makes a record of each of them.

- At the end of the shift, the cashier sums up the day's income and expenses, makes appropriate entries in the cash book and displays the balance. The recordings made during the day are certified by the signature of the performer with a decoding of the last name, first name and patronymic. After which the cash book is submitted to the chief accountant for verification and approval.

This procedure is provided for each shift. These are only general requirements for maintaining a book; the basic procedure is slightly different, depending on the organization of the process.

Separately, it is necessary to note the requirements for storing the cash book. All cash registers, cash registers, tear sheets, various checks and the magazine itself must be kept in the company for 5 years. After the expiration of this period, the documentation should be destroyed in accordance with the established procedure.

How to maintain and print a finished KUDiR

KUDiR can be maintained on paper and electronically, but the main thing is to enter data in chronological order. If you plan to record all business transactions by hand, print out the finished form at the beginning of the tax period. And if you want to keep records electronically, be sure to print out the completed book at the end of the reporting period. Otherwise it will not be considered valid.

Regardless of the maintenance format, the completed and verified KUDiR must be stitched, numbered, certified with the signature of the manager and seal, if any. Also, don’t forget to indicate the total number of pages on the last sheet. To do everything correctly, look at the photo instructions.

The procedure for working with KUDiR is established by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n, but it and other documents do not say how to correctly print a book and number its pages. Therefore, entrepreneurs usually turn to the generally accepted procedure: they use one-sided printing and start numbering from the title page, leaving it without a number.

It is important to print out the book with all sections, even those that do not need to be filled out on your tax system. All pages will also have to be numbered, even blank ones.

If you decide to take a vacation and have not made any financial transactions during the year, you still need to print out the KUDiR. Just fill out the title page and replace the numbers in the columns with zeros. The zero KUDiR must also be numbered, stitched and certified.

In order not to lose a single document and not look for errors before submitting reports, it is better to make entries in KUDiR regularly. It is more comfortable. But no one forbids you to enter all transactions retroactively at the end of the reporting period.

Blank book for accounting income and expenses

Submit reports in 3 clicks

Elba will calculate taxes and prepare business reports based on the simplified tax system, UTII and patent. It will also help you create invoices, acts and invoices.

Try 30 days free Gift for new entrepreneurs The promotion is valid for individual entrepreneurs under 3 months old