- Purpose of the article: reflection of information about other obligations.

- Line number in the balance sheet: 1450, 1550.

- Account number according to the chart of accounts: Credit balance 60, 62, 68, 69, 76, 86.

Other liabilities are non-essential indicators for settlements with various creditors. In this case, materiality is the main selection criterion for reporting.

What are these – short-term liabilities on the balance sheet

Liabilities reflected in the balance sheet are recognized as short-term if their maturity period is more than 1 year (counting starts from the reporting date). These include accounts payable to:

Take our proprietary course on choosing stocks on the stock market → training course

- lenders, creditors;

- extra-budgetary funds and budget;

- founders of the enterprise;

- employees of the organization;

- consumers (debts on advance payments received);

- suppliers (goods, works, services).

Important! In addition to the types of accounts payable listed above, the company's short-term liabilities also include reserves for future expenses.

Debts with a short repayment period include the following components:

- debts with a maturity of no more than 1 year;

- conditional payment;

- loans on bills of exchange that must be repaid in less than a year;

- money borrowed for a long time, but part of which is required to be paid back within 12 months;

- dividends to shareholders;

- accounts payable;

- tax payments;

- lost income;

- deposits for a period of up to 1 year, subject to return;

- borrowed funds on demand.

Important! Taxes are always included in the structure of current liabilities. Tax deductions include all types of payments to the budget.

Let's consider the features that characterize short-term liabilities of enterprises:

- The total amount of debt financing significantly affects the duration of the company's production cycle. The more short-term liabilities on a company's balance sheet, the less funds it is willing to raise to pay for current expenses in the course of business activities.

- The amount of debt with a short maturity is difficult to estimate in the long term, since it is not possible to accurately calculate the amount underlying the debt obligations.

- Debts with a maturity of up to 1 year serve as a substitute for a free source of debt financing.

- The volume of short-term debts varies depending on the frequency of payments on them, and this allows you to quickly work with sources of financing during business.

- The total volume of debt obligations is often determined by the degree of success in the sale of the goods produced by the company. A company that operates actively spends money all the time and attracts new borrowed funds.

- Sometimes debts with a payment term of up to 1 year can be paid using current assets. This money is required to carry out operational activities, and in order to use it to pay off short-term debts, it must be returned to circulation within 1 year from the moment the debt was formed.

- Short-term debts in the Balance Sheet are Liabilities.

Short-term liabilities on the balance sheet: varieties

Debts with a short repayment period can be divided into 3 groups:

| Type of short-term liabilities | Details |

| Debts that must be paid within 1 year | The 12 month count starts from the date of reporting. |

| Operating | This may include: – tax payments, – advances received, – current payments to the budget, - rental payments, – advances paid, – debts for materials received for production activities, – accrued wages to staff (not yet paid). |

| Money to pay off debts with a repayment period of up to 1 year | This group includes: – staff vacation payments, – bonuses to salaries, – other short-term debts. |

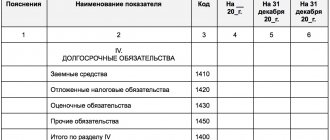

Formation of indicators according to the lines of section V of the liabilities side of the balance sheet

The obligations of the enterprise are listed in 2 sections of the Liabilities of the Balance Sheet. The company's borrowed capital, which requires quick repayment (maximum 12 months from the date of inclusion in Liability), belongs to Section V. Let's break it down line by line:

| Line of section V “Current liabilities” of the balance sheet | Line Formation |

| 1510 "Borrowed funds" | Credit balance account 66 “Settlements on short-term loans and borrowings.” Part of the amounts from the loan account 67 “Settlements for long-term loans and borrowings” (only in the part that must be repaid within the next 1 year). |

| 1520 "Accounts payable" | The company has the right to split this line into several clarifying lines, for example: “Short-term debt to the budget”, “...suppliers”, “...employees”, etc. The total amount of short-term debts of all types (to the budget, extra-budgetary funds, individuals and legal entities). This is the sum of the credit balances of nine accounts in terms of “short” debts: 60, 62 (only in terms of short-term accounts payable for prepayments and advances received), 68-71, 73, 75 (account 2), 76. |

| 1530 "Revenue of the future periods" | To be completed only if the recognition of this accounting object is provided for by the accounting regulations of the enterprise. For commercial companies: the sum of credit balances account 98 and account 86. |

| 1540 “Estimated Liabilities” | Credit balance account 96 (except for long-term debts). |

| 1550 “Other obligations” | Other short-term debts that were not mentioned elsewhere in Section V. |

| 1500 “Total for Section V” | Sum of lines 1510-1550 (total volume of company loans). |

Important! In order to detail the indicator on line 1520, the company has the right to add decoding lines, because Accounting rules allow independent approval of details for financial reporting items.

So, the algorithm for calculating the above indicators is presented below:

| Index | Line code | Calculation formula |

| Borrowed funds | 1510 | K66+K67 (only debts with a maturity of up to 1 year) |

| Accounts payable | 1520 | K60+K62+K68+K69+K70+K71+K73+K75+K76 (only debts with a maturity of up to a year, less VAT taken into account on advances received and issued) |

| revenue of the future periods | 1530 | K98 |

| Estimated liabilities | 1540 | K96 (only estimated liabilities with fulfillment up to 1 year) |

| Other obligations | 1550 | K86 (except for long-term debts) |

Where can I find financial reporting forms for business?

By law, all enterprises that issue shares must disclose their information (in accordance with the requirements of paragraph 1.7. “Regulations on the disclosure of information by issuers of equity securities”, approved by Order of the Federal Service for Financial Markets of the Russian Federation dated October 4, 2011 No. 11-46 /pz-n). All financial statements of joint stock companies can now be viewed.

Public reporting means that it is publicly available to all users. For example, on enterprise websites you can see the “Information Disclosure” section and there, as a rule, there is a “Shareholders and Investors” tab. It will contain the financial results of the year or financial reports by quarter.

The figure below, on the website of JSC Tupolev, shows the financial statements of the enterprise for 2013. There are 4 forms of financial reporting. An audit report is a fact of verification by an independent body of financial statements. There's no point in watching it for us. We also don’t really need explanations for the balance sheet to carry out financial analysis.

How to calculate the amount of current liabilities of an enterprise

Now that we know what data is reflected in the lines under code 1510-1550, we can move on to the algorithm for calculating the value of the enterprise’s current liabilities. Knowing the volume of total debt with a maturity of less than a year is important for assessing the solvency of a company :

- if it turns out that the company is unable to cope with the repayment of short-term (current) obligations, then it can be considered insolvent;

- the lower the indicator of short-term liabilities, the higher the solvency and liquidity of the organization.

So, below is a diagram for calculating the amount of short-term (current) liabilities of the company:

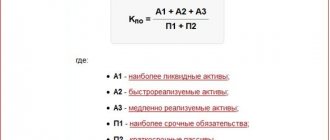

Comparison of groups of assets and liabilities: division of assets, current standards and their meanings

When assessing the liquidity of an enterprise, it is customary to compare groups of liabilities and assets. Before moving on to this issue, you should take into account some important factors accompanying the division of assets and liabilities into groups.

The division of liabilities has already been described above. As for assets, they, like liabilities, can be divided into 4 groups: A1 (the most liquid), A2 (quickly liquid). A3 (slowly liquid) and, accordingly, A4 (slowly liquid).

Among other features of this classification of assets, the use of different names for the same groups should also be separately noted. They can be consonant, synonymous, or not differ significantly, but in practice they still designate the same group and do not change their purpose.

For example, the most liquid assets from gr. A1 can be called the most liquid, and, for example, quickly liquid assets from gr. A2 – urgently liquid or quickly marketable. In fact, this phenomenon occurs very often in practice during analysis. Therefore, you just need to know and take this point into account so as not to be misled due to some difference in the name of one or another group of assets (liabilities).

Important! When assessing the liquidity of an enterprise, all groups of assets and liabilities should be compared, and not just one of the groups.

Thus, they compare: A1 with P1, A2 with P2, A3 with P3, A4 with P4. It is appropriate to make such comparisons for any period (for a month, a quarter, a year, two years, etc.). That is, essentially, if necessary. Comparisons over several periods are considered the most effective, since this allows you to track ongoing changes in dynamics. Based on the results of such comparisons, the overall liquidity indicator of the book is derived. balance sheet and determine the level of financial viability of the enterprise as a whole.

The following ratios are recognized as standard: A1>P1, A2>P2, A3>P3, A4 < or = P4. The ideal option is to meet all three standards. Then they “automatically” imply compliance with the third relationship: A4 < or = P4, and b. the balance is recognized as absolutely liquid. But in practice, such an “ideal” option does not occur very often.

A direct comparison of quickly liquid assets and short-term liabilities, subject to the ratio A2>P2, will mean the following:

- The company is able to pay off debt obligations using quickly liquid assets.

- Repayment of these debts is possible in the near future (relatively speaking, in the short and medium term).

It should be taken into account that if, after a comprehensive comparison of assets and liabilities, it turns out that A4>P4, then the enterprise can be called illiquid.

How do short-term liabilities appear on the balance sheet?

Obligations with a short period of fulfillment arise in the balance sheet for the reason that the accountant cannot predict the amount of income for future periods, as well as the amount of projected losses . For example, due to a man-made disaster, production disruptions and, accordingly, monetary losses may occur. The probability of such events can be assessed as small, medium or large.

Company accountants divide short-term debts into 2 groups:

- Precisely definable . These are payments planned for the future and subject to precise calculation (thanks to a calculation algorithm in a legislative act or the presence of an exact amount in an agreement with the borrower). If you have such debts, you should always check your capital to see if you have the means to pay them. Examples: dividends, bills, bills, bank loans.

- Calculated . Such obligations include debts, the amount of which cannot be determined until the payment date. And since the settlement date will come in any case, the accountant is required to accurately determine the amount to be transferred to the borrower. Examples: income tax, property tax, warranty claims, vacation pay.

Answers to frequently asked questions on the topic “Current liabilities on the balance sheet”

Question: Do budgetary commercial organizations fill in line 1530 of Section V of the balance sheet if the enterprise has short-term liabilities?

Answer: No. If a commercial enterprise is financed from the budget, the funds allocated to it, which will be spent on the purchase of inventories or non-current assets, must be reflected in deferred income. If funds remain unclaimed (remains), they will be taken into account in the same way. Therefore, line 1530 is not filled in.

Question: What short-term liabilities of an enterprise can be reflected in line 1550 “Other liabilities”?

Answer: These may be amounts of value added tax (VAT) that were taken for deduction at the time of payment of the advance/prepayment, and which now need to be restored and transferred to the budget at the time of actual receipt of products, services, and works. Such funds are usually accepted for accounting on account 76. It may also be amounts of targeted financing that were received by the developer, and which now oblige him to deliver the completed construction project within 1 year from the reporting date (finances are taken into account on account 86)

Which sections to fill out?

The annual financial statements include:

- balance sheet;

- income statement;

- statement of changes in equity;

- cash flow statement;

- report on the intended use of funds;

- Explanations to the balance sheet and income statement.

The above reporting forms for commercial organizations are mandatory, except for the report on the intended use of funds.