Declaration allows you to control the movement of goods across the Russian border, limit the transportation of some of them, prohibit the export of national values, and also collect taxes and customs duties. The cargo customs declaration is included in the list of documentation required for foreign trade activities.

Cargo manager tasks

When exporting and importing goods, the main action of a participant in foreign economic activity remains its declaration and execution of the appropriate export (import) document.

The registration of a cargo customs declaration when moving goods is carried out by the following persons:

- Declarant - the manager of the cargo.

- A customs broker who carries out the declaration on behalf of the manager.

- The declarant and (or) broker presents and presents the goods to the customs authority in accordance with the completed customs declaration.

Only Russian legal entities and individual entrepreneurs equated to them under customs legislation who move goods across the border of the Russian Federation for commercial purposes can act as declarants.

The necessary information about the product, its value, sender, recipient and other data is recorded in the declaration. Without this document, customs will not allow the cargo to move across the border.

GTD for a vehicle

Well, let's get to the fun part. What is a gas customs declaration for a car, why might it be needed, and what should you do when buying a car from abroad?

GTD for a vehicle

In fact, a car is also a product, and a cargo customs declaration is issued for it. And, as in other cases, the document indicates the details of the seller, buyer, carrier, cost and other necessary data. The car is registered at customs, then all necessary duties are paid, and one of the copies of the customs declaration goes into the package of documents for the car.

Why is this necessary?

Then, in order to protect, first of all, buyers of such used cars. The declaration is a certain guarantee that the car is not stolen or assembled from pieces (this is exactly what scammers do - they import sawn-up cars as spare parts, then weld them back together and sell them).

In addition, a cargo customs declaration is necessary to register a car with the traffic police, since it is a kind of vehicle passport confirming its origin. And here you need to take into account that the slightest inaccuracy in the design of the customs declaration will be the reason for an endless journey through all the “circles of hell” with documents, certificates, invoices and other pieces of paper.

If a car was imported by a legal entity and then sold to an individual buyer, the seller is obliged to hand over, along with other documents, a certified copy of the customs declaration, receipt order and vehicle passport (PTS). Without these documents, registering the car will be impossible (or very expensive).

How can you import a car without a customs declaration?

There are many options, and the main one is the so-called “constructor”, when the body is first sawn, then transported as separate elements, then welded. You can disassemble the body and bring only the frame; it is not subject to mandatory declaration. And then weld new body parts to this frame on site.

Customs declaration: decoding and example of the necessary information in the document

The list of information contained in the cargo declaration is divided into the following main blocks:

- Information about the person moving the goods, the sender.

- Name and coordinates of the cargo recipient.

- The name and codes of the country where the contract was concluded - the grounds for moving the cargo (export or import).

- Information about the country of origin and country of destination with codes adopted by the Customs Code of the Russian Federation.

- Delivery conditions, vehicle at the border, contract currency. This information is duplicated from the transaction passport, which is issued by the bank of the sender or recipient of the goods.

- Information about the cargo in accordance with the code classifier of goods (commodity nomenclature of foreign economic activity).

- Information about customs checkpoints, including the place of registration of the declaration and the place of border crossing.

- Data on the received quota for the goods (if they exist for the import or export of goods).

- Information on customs duties and fees calculated depending on the declared value of the cargo being transported.

- Other information required to fill out the customs declaration.

Important! Any discrepancy between the data declared in the declaration and the actual data will lead to a delay in customs procedures and will result in additional costs for a tidy sum.

Documents for exporting from Russia and obtaining a certificate for exported goods

Exporting goods from Russia is a profitable but troublesome business. It is necessary to think through all stages of the transaction, study Russian legislation regarding the export activities of enterprises, delve into the features of different types of international transport, and first of all, deal with the documents for export from the Russian Federation.

We will tell you about the actions of an entrepreneur necessary to register cargo for export. We will provide a list of export documents: contract and certificate of origin, papers for transportation, confirmation of customs value and additional documentation.

Export operations in Russia

Exporting goods from Russia opens up great opportunities for entrepreneurs to increase the sales market and expand the company.

What needs to be done to export cargo? You need to study the list of all necessary documents and read about the algorithm of actions for legal registration of export. The more aware you are of all the intricacies of design, the fewer problems will arise when transporting the goods.

Actions when exporting goods

What is needed to send goods for export?

Cargo clearance is carried out in three main stages:

- You need to draw up a foreign trade agreement with the counterparty and open a transaction passport . The transaction passport is opened by the exporting company at the servicing banking institution. It contains basic information about this foreign trade cooperation. A transaction passport is required if the contract amount exceeds $50,000.

- If this is a transaction on the terms of self-export FCA, EXW , it is necessary to obtain from the counterparty information about the vehicle, the driver responsible for transporting the cargo. Information is required for customs clearance of cargo. If you want to know the EXW terms according to INCOTERMS 2010, look here. Read about the transfer of risks under the terms of delivery of FCA INCOTERMS 2010 here.

- If the cargo is manufactured in the Russian Federation , you will need to issue a certificate in Form ST-1 (if these are CIS countries) or Form A (if these are European Union countries).

This is the main list of actions for exporting cargo. Using it you can roughly imagine the features of going through this procedure. However, to export goods you will need to prepare a whole set of documents for export from Russia.

Products manufactured in the Russian Federation will require a ST-1 certificate.

Documents for exporting goods

From the article you can find out only an approximate list of required export confirmation documents. The list of documents for import to Russia is in the previous article. Depending on the type of exported product and other conditions, the package of documents may be expanded or changed.

So, the main package of papers for export:

- constituent papers of the exporting organization (copies). The list of statutory documents of a legal entity is here;

- foreign economic agreement (original, two photocopies) with additional agreements. You can see a sample foreign trade contract here. Photocopies must be provided with the seal of the exporting company;

- If the contract amount is over 50 thousand dollars, you will need to issue a transaction passport. An original and a copy stamped by the exporter are required;

- invoice attached to the cargo. The invoice must be stamped by the exporter. It must contain the following information: details of the exporting company, the party receiving the cargo, contract number, price of the cargo, terms of transportation according to INCOTERMS. The information specified in the invoice must be similar to the information specified in the contract;

- invoice with data on weight and number of pieces;

- transport documents. Their forms depend on the type of transportation; more details about shipping documents here;

- certificates or passports for goods;

- payment documents confirming the fact of payment for goods and customs duties.

The above list of documents will be needed to prepare the main document - the cargo customs declaration for exported and imported products.

Having received a customs declaration with an export permit (stamp “release permitted”), you will need to confirm the fact of exporting products abroad in order to receive a VAT refund.

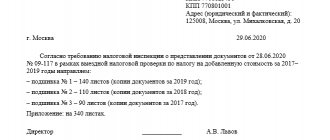

In order to reimburse VAT, send a letter to the customs post releasing your goods with an application and the necessary documents confirming export (TIR cargo customs declaration, etc.).

Transportation of cargo to a foreign counterparty also requires the execution of a number of documents:

- If this is road transportation , then you will need a CMR (6-12 completed CMR forms), a waybill (rules for filling out new TTN here), CARNET TIR, a certificate that the vehicle can carry out transportation, an act of loading cargo into the vehicle . We have already told you what TIR is on trucks;

- If this is sea transportation , an order for loading, a bill of lading, will be required. Look for information about the features of the on-board bill of lading at this link;

- Various permitting papers . These can be certificates, licenses that give the right to carry out certain business activities (for example, the sale of alcoholic beverages). The list of permits depends on the activities your company conducts;

- Papers confirming the right to dispose of goods for export . You will need a copy of them, stamped by the exporter;

- Papers indicating the origin of the cargo . These may be certificates of origin or conformity, passports and the like.

Obtaining a customs declaration is the main stage in the implementation of export and import operations.

Documents indicating the customs value of the cargo:

- invoices, proforma invoices (copies);

- For foreign-made cargo, an import cargo customs declaration is required. It must be accompanied by a contract, invoice, financial papers (receipts, payments);

- technical description of the cargo, passport for equipment, production products, components, etc.;

- papers indicating that payment has been made under a purchase contract in the Russian Federation, an extract from the personal account of the exporting organization;

- If the exporter was not involved in the production of transported products, a complete list of documents (invoices, payments) involved in receiving the goods from the manufacturer will be required;

- accounting records for transported cargo, certified by a tax organization.

List of documents for registration of customs declaration

Transportation of goods between different states requires a mandatory package of documents presented by the participant in foreign economic activity at customs.

To pass control and register a customs declaration you will need:

- A contract (purchase/sale agreement) concluded between individuals or legal entities. Attachments to it: specifications, bills (invoices), packing lists.

- Original contract.

- Receipts for payment of customs duties after determining the value of the goods.

- List of documents confirming data on customs assessment of cargo and financial control.

- Availability of licenses, official permits from government officials, if required by the goods being moved, availability of certificates of quality and origin from the manufacturer.

- A package of documents giving the right to the cargo manager to move it - a certificate of state registration, Taxpayer Identification Number (TIN) and certificate of foreign trade participant, registration documents of an individual entrepreneur, passport.

Documents for import registration

The movement of goods across the customs border of the Russian Federation can be aimed at import or export. The documents accompanying the registration of a customs declaration for foreign trade transactions are different.

To fill out the customs declaration for imports, when deciphering the fields of the declaration, you will additionally need:

- Proof of compliance of imported goods. The specification is issued to the recipient company.

- Certificate form ST-1 (certificate of the country of origin of the goods).

- Price list, invoice, invoice, which contains an indication of the customs declaration number. Deciphering product codes in the price list is not required.

- Quality certificates, operational documents issued abroad in the country of origin.

Feature: when re-exporting, you may need a Form A certificate proving the origin of the goods in Russia.

- An invoice that contains the customs declaration number. Deciphering product codes in this document is not necessary, since it indicates the final indicators of export or import. Either a proforma invoice is issued in the form of an annex to the contract, or a specification.

- Documents confirming the purchase of goods on the territory of the Russian Federation, certificate form A.

- When transporting goods by road, it is mandatory to provide the customs authorities with a TIR-carnet (carrier insurance document) and a CMR - international road consignment note.

- Technical characteristics of products reflected in the relevant acts attached to the specifications or contract invoice.

Taxpayer liability

Information about the registration number of the document that is the basis for the movement of goods between states is mandatory in the document that serves as the basis for VAT calculations (Article 169 of the Tax Code of the Russian Federation).

What happens if you do not indicate the number in column 11? The absence of data in column 11 of the invoice is recognized as a reason for tax inspectors not to accept such a primary document for accounting when providing a VAT deduction.

Judicial practice confirms the unequivocal position of the tax inspectorate: the taxpayer is responsible for indicating the customs declaration number (resolutions of the Federal Antimonopoly Service of the Volga Region dated May 16, 2012 No. F06-2967/12, FAS East Siberian District “F20-477/12 dated March 6, 2012, FAS North-Siberian District Western District No. F07-1879/11 dated 02/01/2112).

The Federal Tax Service Inspectorate recommends not interacting with a supplier who is unable to confirm the origin of the goods sold.

Features of documents for goods in the customs regime of export/import

Information data reflected in the customs declaration indicates the legitimacy of the transaction and the cargo being moved. They prove the absence of counterfeit products in full compliance with the rules for the import and export of goods on the territory of the Russian Federation.

The rules for filling out the declaration are regulated by Federal Law No. 113 “On customs regulation in the Russian Federation” as amended on November 27, 2010.

In its structure, the customs declaration form consists of two forms:

- TD 1 is the main sheet of the declaration; the export or import sign is affixed to it (EC, IM, respectively). Filled out for products with the same name. For example, spare parts for cars, with one code according to the Commodity Nomenclature of Foreign Economic Activity up to the ninth digit.

- TD 2 – additional bound sheets of the customs declaration. Filled out if there are goods that are not included in the main declaration sheet. No more than three different product categories can be entered here, while the total number of units of cargo cannot exceed 33 items per one main sheet of the declaration.

Important. In some cases, goods are registered according to the inventory. It replaces TD 2 and is applied in the absence of mandatory payment of duties, taxes and fees, licenses and quotas.

What documents are submitted along with the DT?

The package of accompanying documents includes:

- Power of attorney for the declarant's right to submit a declaration of declaration.

- Transport documents confirming border crossing.

- A copy of the document regulating the transaction on foreign economic activity.

- Declaration of the customs value of the cargo.

- Financial documents confirming payment of taxes and fees.

- Documents confirming control of delivery of goods.

When transmitting an electronic copy of the DT, the registration process is significantly reduced. In this case, the end date of the customs procedure becomes the date the document is assigned a registration number.

Requirements for gas customs declaration

The main requirements for filling out a cargo customs declaration are as follows:

- Information in the columns of the customs declaration, decoding of their contents in accordance with the classification and codes is entered in Russian.

- Records must be legible and easy to read.

- Corrections in the declaration are allowed only for numbers. At the same time, they are entered by carefully crossing out and writing the correct (updated) data.

- All adjustments are certified by the signature and seal of the declarant.

- The customs declaration is accepted by customs in printed form. It is possible to fill in cost indicators with a value of more than nine characters by hand.

- It is unacceptable to enter information that is not contained in the fields of the form. On the back indicate information that does not fit into the fields of the declaration. They write on the main form: “see. on the back."

- Codes cannot be duplicated; it is permissible to indicate previously entered data with the link “see. column no.

- The declaration is certified by the signature and seal of the declarant.

Declaration fields - correct filling

The rules for filling out the declaration fields for export and import are the same:

- The first section indicates the type of declaration, marked with the letters IM (import) or EC (export). In the case of import of goods into the customs territory of the Russian Federation without restrictions on use, the second subsection of the column is entered with code 40. If the document is issued in electronic form, then the ED marker is placed in the third subsection - electronic declaration. In our sample, the declaration is issued in paper form, and this subsection in the declaration is not completed.

- In the upper right corner of the form, in section A, the customs declaration number is indicated; the decoding includes three groups of numbers, under which the customs code, the date of drawing up the declaration and the serial number in the accounting journal are indicated.

- The leftmost section means the declaration form, where the first number 1 means that this is the main sheet - TD1, and the second indicates the number of additional sheets. If they are not issued, 1/1 is entered.

- Column 4 is completed if loading specifications are present.

- The fifth and sixth columns indicate the total imported goods and the number of cargo items. In the presented sample - 1 product, 1 place. This is an important indicator; it must correspond to actual transportation.

- The seventh column is filled in if a preliminary declaration has been carried out, and the design features are indicated. It is filled out by customs.

- 2 columns - sender, 8 columns - recipient. Full names, legal address are written, the country of departure and receipt is indicated in the form of a code in accordance with the rules of customs clearance.

- Column 9 indicates the person responsible for the finance. the settlement is usually the counterparty to the contract. May be the same as the recipient of the shipment.

- Column 12 indicates the total amount of delivery. 22 and 23 - indicate in what currency the delivery is made, with codes of the contract currency and the exchange rate on the date of registration of the declaration.

- Field of column 20 - terms of delivery - is filled in according to the information provided by the contract documents. The delivery location is recorded here. In our case, these are the CIP terms of Incoterms, which means that transportation and insurance of cargo is paid up to a certain point along the route. Maybe to the border, to a warehouse, in our case - to a customs warehouse in Moscow.

- Columns for indicating payments and duties. Each indicator is indicated in its own column: customs duties - 1010, duties - 2010, VAT - 5010.

Below is a sample of the complete filling out of the customs declaration for imports: a breakdown of the columns indicating the completed information.

More details about the rules for filling out declarations, including in electronic form, can be found in the video below.

In what cases is GDT mandatory?

1) The first method is simple compared to the second, because the owner of the vehicle will need to submit an application to the appropriate authorities, after which it will become half official.

This document must be written in any form and contain complete information about the goods with which the carrier intends to cross the state border. This declaration option is valid only if the total total value of the entire product is no more than 7,000 thousand rubles, or 100 EUR.

The main fields in the application are required to be filled out:

- Full name and legal address of the carrier who transports the declared cargo across the border.

- A complete list of goods transported abroad, indicating their full quantity and the barcode of each product.

2) The second method will be described in more detail below, since it is in the second method that it is necessary to fill out the customs declaration.

In order for the transported goods to be declared using the customs declaration, the carrier needs to write a special written application that contains complete information about the carrier itself, as well as complete comprehensive information about the transported goods.

The application is drawn up on special customs forms and written on two sheets of paper - this is not without reason. And all because the first sheet is the main one for the gas customs declaration, and the second is additional.

The first form TD1 consists of four self-copying sheets:

- The first copy is given to customs,

- The second instance is statistical,

- The third copy remains in the hands of the carrier for crossing the border on the way back,

- And the final, fourth copy is itself a regional specimen.

If you are transporting goods of different subgroups, you need to fill out both declarations at the same time: TD1 and TD2. The second declaration is an integral part of the customs declaration.

We type correctly: customs declaration number, decoding, example of creation

Any declaration, regardless of whether an export or import is drawn up by a participant in foreign economic activity, begins with a number.

This is what it looks like in X format:

xxxxxxxxxx/xxxxxxx/xxxxxxxxxx

All elements of the declaration number are placed through a separator, and spaces between them are not allowed.

An example with numbers: let’s say the customs authority code is 10101020, the release date (import of goods) is December 6, 2012, the serial entry in the journal is 00012503. Then the declaration number for these data will be written like this:

10101020/061212/00012503

The gas customs declaration number and the decoding of its digital elements are determined by the content of information hidden in it and grouped into three blocks:

- The first block is the code of the customs department exercising control over the import of goods.

- The second is the date of registration of the declaration; the day, month, and last two digits of the current year are indicated.

- A serial number assigned according to the register of cargo customs declarations by the customs office that registers the declaration. Every year it starts anew, from one.

xxxxxxxxxx/xxxxxxx/xxxxxxxxxxx/xx

As stated in the format provided, the invoice number consists of the following elements:

- The number of the cargo customs declaration, which is prepared for the corresponding accounting document. In this case, the decoding of the customs declaration in the invoice is identical to the set of elements when generating the declaration number.

- Commodity item: the serial number of the product from column 32 of the main or additional sheet of the customs declaration is indicated through a slash sign in the invoice.

If the goods are issued as a list, this element of the invoice number indicates the quantitative ordinal item from the list of goods. Spaces between number elements are not allowed.

There are cases when the customs declaration number does not need to be entered into the invoice, for example, in the case of importing goods from the EAZU (Eurasian-Asian Union) countries.

Customs declaration from the supplier

If you do not find the information you need on this page, try using the site search: Return to previous page Latest news Free legal consultation by phone:

- Moscow, Moscow region+7

- St. Petersburg, Leningrad region+7

- Federal number 8 ext. 141

Calls are free. We work seven days a week March 12, 2013 Draft Federal Law No. 410960-7 “On Amendments to the Criminal Code of the Russian Federation and Art. 151 of the Criminal Procedure Code of the Russian Federation” The bill is aimed at strengthening liability for violations in the field of procurement of goods, works, services to meet state or municipal needs.

Customs declaration for import in 1s. receipt of imported goods and their sale

When selling goods whose country of origin is not the Russian Federation, columns 10, 10a, 11 must be filled in in invoices issued to customers.

They indicate (clauses 13, 14, clause 5, article 169 of the Tax Code of the Russian Federation, clauses.

“k”, “l” clause 2 Important Rules for filling out an invoice, approved. Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137):

- digital code of the country of origin of the goods;

- short name of the country of origin of the goods;

- Number of customs declaration.

The norms of Chapter 21 of the Tax Code of the Russian Federation and the Rules for filling out an invoice do not provide for any exceptions in relation to cases when imported goods are supplied by a Russian counterparty.

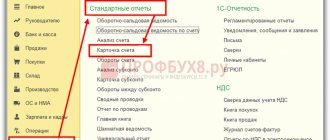

Accounting for import transactions in 1C:Enterprise

A cargo customs declaration (CCD) is a document required for registration when importing (exporting) goods across the customs border of the Russian Federation.

In the case when an invoice is issued for imported goods, data on the customs declaration must be entered in this document.

Attention

In our article we will answer the main questions regarding the preparation of a customs declaration and entering data on the declaration into the invoice.

What is a customs declaration (ready customs declaration) If your organization imports imported goods, or you, as an entrepreneur, sell products for export, then the customs declaration is one of the main documents that you will have to prepare.

The customs declaration confirms the legality of your cargo transportation.

If the customs declaration is not issued by you, then the goods crossing the border of the Russian Federation will be recognized as contraband.

The document is drawn up in the prescribed form - on forms DT1n DT2n.

Declaration of goods: who to give and who to refuse? (Manokhova S.V.)

Draft Federal Law No. 365529-7 “On amendments to Article 99 of the Federal Law “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs” The purpose of the bill is to increase the efficiency of control, optimization of staffing levels and the formation of uniform methods carrying out control activities, bringing to administrative responsibility persons who committed violations during procurement for municipal needs.

In the spotlight: Administration of the municipal formation “Vsevolozhsk municipal district” of the Leningrad region (location: 188643, Leningrad region, city.

CCD (customs declaration) in the invoice in 2021

In April 2021, Molot LLC imported fabric and sewing accessories (buttons, zippers, etc.) from Poland. In August 2021, in the territory of its own sewing workshop, Molot produced 120 items of clothing (men's trousers) from imported fabric.

According to the foreign economic activity classifier, trousers are recognized as a new product with the country of origin being the Russian Federation.

A batch of “Molot” trousers was sold to the “New Style” store; the customs declaration was not indicated in the invoice.

Option 3. Imported goods (raw materials) purchased in the Russian Federation Another important question that interests many entrepreneurs is how to issue an invoice if imported raw materials for the production of goods were purchased in Russia. Similar to the case described above, everything will be overestimated depending on whether the manufactured goods differ from the purchased raw materials.

Customs declaration number in the invoice for resale

Law enforcement authorities cannot interpret the concept of “bona fide taxpayers” as imposing additional obligations on taxpayers not provided for by law.

That is, if the goods were received from a Russian seller, then failure to indicate the DT number (reflecting the incorrect DT number) due to the fact that this information is not available to the taxpayer (the incorrect DT number is indicated in the incoming invoice) is not a violation of the invoice issuing procedure and the basis for refusal to apply a VAT tax deduction from the buyer.

But let’s return to the question raised at the beginning of the article: how to argue for the buyer’s refusal to provide him with a copy of the goods declaration? In our opinion, in this case, one should refer to the norms of the Tax Code outlined in this article, and also invite the buyer to familiarize himself with the positive arbitration practice on this issue.

Customs declaration number on the invoice. how and when it is entered. answers on questions

And there are good reasons for this. According to the last paragraph of paragraph 5 of Art. 169

Taxpayer of the Russian Federation, a taxpayer selling goods whose country of origin is not the Russian Federation is responsible only for the compliance of the information specified in columns 10, 10a and 11 of the invoices he presents to the buyer with the information contained in the invoices and shipping documents received from the supplier .

That is, the taxpayer purchasing goods cannot be held responsible for the accuracy of the information about customs declaration numbers contained in the invoices issued to him. Here we should remember the norm set out in paragraph. 2 p. 2 art. A total of 3 goods are declared, which occupy 3 places. Let's go a little lower: Here we see that the total customs value of all 3 goods is: 505,850 rubles and 58 kopecks.

Secrets of the Commodity Nomenclature of Foreign Economic Activity, or how to correctly determine the product code

The cargo customs declaration indicates various indicators characteristic of each specific case of movement of goods across the customs border of the Russian Federation. The indicators must correspond to the actual cargo transported.

During customs clearance, importance is attached to the correct declaration of goods and their compliance with the commodity nomenclature of foreign economic activity - TN FEA. Customs duties, fees and payments depend on how accurately the selected code matches the product.

Commodity Nomenclature for Foreign Economic Activity are systematized cargo codes that are accepted for circulation in international trade.

When you don’t have to fill out a declaration

A number of legally required situations do not require filling out a declaration form.

This is possible in three cases:

- The customs value of transported goods is less than 100 euros.

- The goods are transported by an individual for personal use.

- Imported/exported products are not subject to customs duties.

Such conditions may be revised periodically, so it is better to update the information on the website of the Federal Customs Service of the Russian Federation when importing/exporting cargo.

This is interesting: simplified tax system - an overview of the changes that have entered into legal force and those planned from October 1, 2019

How to get a child tax credit in 2021: rules and features

What taxes should a freelancer pay: a guide to legal issues

Sections, subsections and positions of product groups

In the Commodity Nomenclature of Foreign Economic Activity, goods are systematized into categories and types, provided with a short name and description.

Product indicators are formed by:

- sections;

- groups;

- subgroups.

For those goods that are not classified in sections or groups, the following code decoding is used in the customs declaration: “other” and “other of other” items of the product nomenclature.

For example, when filling out a declaration in the product description column, you need to perform the following sequence of actions:

| Description | |

| HS codes | indicate a four-digit code separated by commas or specify up to ten characters |

For example, the query “oil sensor” will find examples of declarations with several types of product descriptions of the form: “... pressure sensor...” “... pressure measuring device - special sensor...”

From the proposed options for answering the request, you must select the greatest match for keywords that relate to the target product group for the declared cargo in the declaration. For example, for the word “tractor,” the HS search engine can return codes for an agricultural tractor, as well as a toy tractor. Carefully deciding on the product group is the key to successful declaration. The more complete the request, the more accurate the codes of the cargo being processed.

And, of course, don’t forget about the “other” goods position. In customs slang, such groups are called “baskets”. Used when your cargo is not in the named product sections and positions. Then the description uses the chain “other-other-other”.

Statistics, accounting and control

A cargo customs declaration is required when crossing the border in 98 countries with which Russia has trade relations. In addition, the customs declaration is used as a state accounting and statistical document. This is done by separating the declaration sheets. They are distributed in the following directions:

- The first one remains in the customs department for the archive of the declaration issue.

- The second sheet of the customs declaration is sent to the statistics department.

- The third is given to the declarant for reporting by the foreign trade participant to the tax office and the bank.

- When exporting, the fourth sheet is attached to the accompanying documents and sent to the checkpoint at the border; when importing, it remains in the cost department of the customs office that inspected the imported cargo.

The passed control is certified by permitting marks on the customs declaration, as a result of which it becomes a kind of passport of the goods, which has legal force in the management and customs structures of foreign countries.