Distinctive features

The main feature of the regime is that the amount of income received does not matter when determining the tax base. The calculation is made based on the amount of expected income, which is determined at the state level. Hence the colloquial name “imputation”. In other words, government agencies establish, or more precisely impute, the amount of profit.

The taxation system does not require payment of the following taxes:

- on the income of individuals;

- VAT;

- property tax.

Individual entrepreneur liquidation reorganization codes

They are used if in the last reporting period the taxpayer organization underwent a reorganization procedure.

What reorganization (liquidation) code should be indicated on the title page of the calculation of insurance premiums in 2021? Is it possible to leave this field blank?

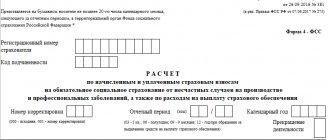

The form of calculation for insurance premiums used in 2021 was approved by order of the Federal Tax Service of Russia dated October 10, 2021 No. ММВ-7-11/551.

For a person who does not know the intricacies of the process of terminating the activities of an organization, it is quite difficult to find the differences between reorganization and liquidation.

There it was possible to determine that the inspector’s demands are not valid for the 3-NDFL tax period when closing an individual entrepreneur.

This means, indeed, when closing an individual entrepreneur, a specific code for the tax period is entered in the UTII declaration - 3 quarters. "55", 4 sq. "56".

- do not overload the completed form;

- special programs could analyze this report more quickly.

figure out which code to enter in the simplified tax return in a given case.

The reorganized enterprise still remains an active legal entity, but the liquidated organization ceases to exist as a legal entity. face.

- carried out transactions with securities and futures transactions;

- made payments on securities issued by Russian companies.

Code designations for reorganized companies are taken from Appendix 3 to the Filling Out Procedure (approved by Order No. ММВ-7-3/ [email protected] ).

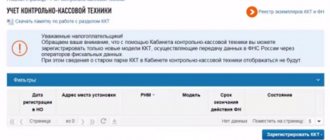

To do this, take your cash register and visit the tax office with it. An authorized person will check it and deregister it independently.

You may need a package of documents, the composition of which is determined by the bank. It must be specified in the agreement that you entered into to open the account.

Liquidation

The definition of liquidation of an individual entrepreneur is the termination of registration of an individual as an entrepreneur. As soon as a person goes through the entire procedure and receives written confirmation of removal from the register, he is immediately deprived of all rights and obligations that he had while carrying out his activities. Naturally, there is a limitation. If there are still debts, then an individual, without having the status of an entrepreneur, must pay them off.

In addition to the desire of an individual, liquidation of an individual entrepreneur on UTII can be carried out in the following cases:

- bankruptcy;

- expiration of the validity period of registration documents that allow you to legally stay in the country;

- making an appropriate decision by the court;

- death of an individual.

In principle, all the methods described can be classified as coercive measures, not counting the bankruptcy procedure, which was initiated by the individual himself.

Application of a simplified taxation system

The Tax Code of the Russian Federation provides for a deadline for submitting a declaration on the occasion of the abolition of an individual entrepreneur operating under a simplified taxation scheme. This must be done no later than the 25th day of the month following the month of cessation of activity. At the same time, the merchant must pay tax obligations. The taxpayer provides the tax authorities with a notice of termination of the individual entrepreneur’s work no later than 15 days from the date of closure. The Federal Tax Service of the Russian Federation issued an order dated July 4, 2014, in which it approved the Procedure for entering specific data into the declaration under the simplified system.

Appendix No. 1 of this document contains the following codes for the liquidation of individual entrepreneurs:

- 50 – indicates the last tax period of the individual entrepreneur;

- 34 - indicates the calendar year;

- 96 – denotes the last calendar year when the individual entrepreneur is stopped according to the simplified system;

- 0 – IP liquidation code.

When an enterprise is liquidated, the merchant must submit a zero declaration under the simplified system (profitability). Tax laws oblige entrepreneurs to file a declaration at their place of registration, no later than April 30 after the last calendar year. In this case, the tax code does not provide any alternative deadline for filing such documentation (even if the company is liquidated). Declaratory business paper when stopping the work of an individual entrepreneur must be submitted by the entrepreneur no later than May 3 after the last calendar year. This means that an individual, no longer acting as a businessman, can present a tax return to the tax authority.

At the same time, the Ministry of Finance states that an individual is obliged to submit a declaration to the tax authority and pay the tax established for the period of entrepreneurial activity. In this scenario, in accordance with the decree of the tax service mentioned above, the tax period code will be 50.

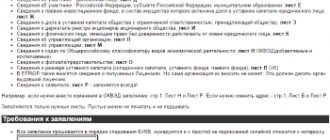

Filling out an application

Before submitting documents, you must fill out an application on the approved form P26001. The form can be obtained from the territorial office of the Federal Tax Service or downloaded from the official website.

The application can be filled out on a computer or manually. If the second option is chosen, it is better to use a pen with black ink and write all letters in capitals.

When filling out a document on a computer, you must select Courier New font with a height of 18 pt.

At the top of the document, fill out the fields with information about the full name and OGRNIP of the individual entrepreneur. Then the method by which the application will be transmitted, contact information, even e-mail, is indicated.

Reporting

In addition to the measures described above, it is necessary to fill out UTII when liquidating an individual entrepreneur and submit reports, even for an incomplete period.

When paying tax on imputed income, reporting is submitted by the 20th day of the month following the reporting quarter. Therefore, if the certificate was received in March of the current year, then you must report before April 20. In cases where the 20th falls on a holiday or day off, you can transfer the papers on the next business day.

Declaration form for UTII for the 4th quarter. 2021

When submitting reports for the Ⅳ quarter, you must use the form that was approved by Order of the Federal Tax Service dated June 26, 2018 No. ММВ-7-3/ [email protected] and came into force on November 26, 2021.

Read more: Declaration of UTII for the 2nd quarter of 2021 - which form to use?

Changes in the form were associated with the need to reflect in reporting deductions for the purchase of online cash registers by individual entrepreneurs using UTII, since until July 1, 2019, they had the right to reduce the tax by the amount of the cost of purchased cash registers. The maximum allowable deduction amount was 18,000 rubles. for each purchased cash register. Now you cannot use the deduction for the purchase of cash registers.

You can download the current form from the link at the end of this article.

General rules for filling out the report

All data is entered from right to left. If any cells are not filled in, be sure to put dashes in them. All indicators that do not have an integer value must be rounded according to the general rule. You should also adhere to the following requirements:

- if the report is filled out manually, then all letters must be capitalized;

- the color of the pen should be black or blue;

- absolutely all pages of the declaration should be numbered in the format 001, 002, and so on;

- the first page of the report must contain the date of completion and the signature of the compiler, that is, the individual entrepreneur;

- the exact code of the tax period when liquidating an individual entrepreneur on UTII;

- If there is a seal, its imprint is placed on the title page.

The declaration cannot be stapled or printed on both sides on one sheet. Under no circumstances should the report contain corrections or omissions. The declaration does not indicate accrued penalties and interest.

Otherwise, filling out reports is no different from other cases of filling out similar documents.

Liquidation declaration when closing an individual entrepreneur

When a business is closed, the entrepreneur is excluded from the Unified Register and from that moment the individual entrepreneur is considered officially liquidated. The procedure is regulated by Law No. 129-FZ of 08.08.01 and implies the performance of a number of mandatory actions. This includes paying debts on taxes and fees to the budget and social funds, as well as filing a declaration when closing an individual entrepreneur.

In what form are the reports prepared? This depends on the specifics of taxation of business activities. Let's figure out how to properly file a declaration when liquidating an individual's business.

Regulatory regulations for closing individual entrepreneurs - general requirements

The mechanism for terminating a business is described in detail in stat. 22.3 of Law No. 129-FZ. First of all, in order to initiate the closure procedure, you should submit a package of documents to the territorial tax authorities at the place of residence of the citizen (or his temporary stay). In this case, an application of the approved form P26001 is filled out, and a state fee in the amount of 160 rubles is paid. Additionally, certificates from the Pension Fund of the Russian Federation are attached stating that all personalized information for employees was submitted on time.

Individual cases of liquidation of individual entrepreneurs are described in clauses 2-6 of the statute. 22.3. In particular, this is the closure of a business due to a court decision, the death of a citizen, recognition of insolvency, deprivation of the right to conduct business, etc. If all documents are filled out correctly, the information is reliable, the liquidation period does not exceed 5 days (working days) from the moment the data is submitted to the Federal Tax Service (Article 8 of Law No. 129-FZ).

Regarding declarations, it is better to submit all forms before the individual entrepreneur is liquidated. But if for some reason the entrepreneur did not have time to report, the tax authorities do not have the right to refuse to liquidate the individual entrepreneur or to accept the reporting forms. In case of violation of the legal deadlines for submitting declarations, as well as when transferring tax payments late, the taxpayer will be subject to penalties. The Federal Tax Service can collect fines even after the entrepreneur officially liquidates his activities.

Liquidation declaration when closing an individual entrepreneur on OSNO

When an individual entrepreneur conducts business under the general tax regime, the main taxes for which he is required to report are VAT and personal income tax on income. Consequently, when closing an individual entrepreneur, declarations for the last tax period for VAT and income tax are submitted to OSNO.

Deadlines for filing declarations for individual entrepreneurs on OSNO:

Personal income tax - according to clause 2 of stat. 229 individuals liquidating their business are required to report according to f. 3-NDFL for the current tax period within 5 days from the date of closure of the individual entrepreneur. The amount of income tax must be transferred to the budget within 15 days from the date of submission of the declaration.

VAT – according to clause 5 of stat. 174 value added tax declaration (with code “0” on the title page) is submitted within the general deadlines for all taxpayers, including closing individual entrepreneurs. The deadline for filing is set as the 25th day of the month following the tax period. Tax payment is carried out as usual, that is, in equal amounts divided into 3 subsequent months.

Closing an individual entrepreneur - tax return for UTII

When conducting business activities using a special imputed regime, the main form of reporting for an individual becomes a single tax declaration, UTII. Deregistration of the payer's imputation in the middle of the quarter gives businessmen the legal opportunity to calculate tax not for the entire quarter, but for the calendar days actually worked in the reporting months. Since the tax period for UTII is not a year, but a quarter, when closing an individual entrepreneur it is necessary to report to the Federal Tax Service by filing a declaration under the imputed regime.

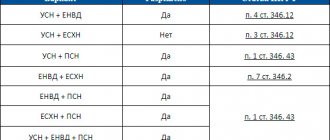

The report must be submitted by the 20th. The form was approved in Order of the Federal Tax Service No. ММВ-7-3/353 dated 07/04/14, which lists the rules for drawing up the document. When filling out, you need to pay attention to the correctness of the codes on the title page. In particular, if an individual entrepreneur is being liquidated, code “0” should be reflected in the reorganization/liquidation code field. And along the line of the period code a special digital indicator is given:

The deadlines for paying the single tax when closing an individual entrepreneur correspond to the general ones according to stat. 346.32. The deadline for transferring amounts for the quarter is the 25th. Therefore, the general deadlines for submitting the report (paying tax) for 2021 will be as follows:

For 4 sq. 2021 – until 01/22/18 (submission) / until 01/25/18 (payment).

For 1 sq. 2021 – until 04/20/18 / until 04/25/18

For 2 sq. 2021 – until 07.20.18 / until 07.25.18

For 3 sq. 2021 – until 10.22.18 / until 10.25.18

For 4 sq. 2021 – until 01/21/19 / until 01/25/19

Note! When working for UTII, an entrepreneur has the status of not only an individual entrepreneur, but also a tax payer. Therefore, you will probably need to additionally deregister as a UTII payer; it is better to clarify the nuances of this procedure with your inspection.

Declaration after closing an individual entrepreneur on the simplified tax system

Simplified mode is most common among businessmen. The declaration upon closure of a simplified entrepreneur is submitted in a general form in accordance with the requirements of Federal Tax Service Order No. ММВ-7-3 / [email protected] dated 02.26.16. When filling out, the taxpayer must indicate the reorganization/liquidation form code - 0, period code - 50 The filing deadline is set in stat. 346.23 Tax Code and is defined as the 25th day of the month after the closure period.

For example, an entrepreneur decided to liquidate an individual entrepreneur and was excluded from the Unified State Register of Individual Entrepreneurs on December 20, 2017. According to regulatory requirements, he must submit a declaration under the simplified tax system by January 25, 2018. If the deadline for submitting reporting forms is violated, the citizen will have to pay penalties according to stat. 119 NK.

Note! Both when conducting business on a simplified basis, and in the case of an entrepreneur using other tax regimes, when closing an individual entrepreneur, a declaration is submitted only for the last period, subject to the timely submission of reports for previous periods. If the reporting was not completed and submitted, you need to generate the necessary documents and also submit them to the Federal Tax Service.

How to fill out a zero declaration of an individual entrepreneur at closing

When business activity ceases, filing zeros is required if the citizen does not have income and expenditure indicators. However, this statement does not apply to UTII, since the calculation of tax during imputation is based on the estimated profitability. It is also not allowed to submit blank declarations under the Unified Agricultural Tax, except for those entrepreneurs who have been doing business for the first year.

If the individual entrepreneur does not have indicators on OSNO, zero declarations should be drawn up according to f. 3-NDFL and VAT. Filling out such reports is no different from generating regular forms. The only difference is that all lines with digital indicators will be crossed out. It is recommended to promptly fulfill taxpayer obligations when closing a business, so as not to be responsible for debts to the state in the future.

Liquidation declaration when closing an individual entrepreneur on the simplified tax system - download a sample here.

Front page

In the field called “TIN” the number that is indicated in the certificate or in an extract from the Unified State Register of Legal Entities is indicated. The code consists of 10 digits. The form is designed to be filled out by legal entities and individuals. Therefore, the individual entrepreneur puts dashes in the last two cells.

Individual entrepreneurs do not fill out the field with the name “Checkpoint”.

Depending on the length of time an individual has worked as an entrepreneur, data is entered in the “Adjustment number” line. If the report is being compiled for the first time, then 0 is entered, if the report is submitted for the second quarter of work, then 1 is entered, and so on.

The next column is “Tax period”, that is, a column confirming the period for which the report is submitted. As mentioned earlier, when liquidating an individual entrepreneur on UTII, the tax period code is very important.

Then comes the “Reporting period” item, where the period for which the report is submitted is specified.

In the field “Submitted to the tax authority” the code of the tax authority is indicated. The column “By place of registration” displays the code of the place where the declaration is submitted.

Below in the report, the taxpayer’s personal data and full name are indicated. Then codes are written that correspond to the OKVED classifier and are specified in the statutory documentation, that is, for individual entrepreneurs they are indicated in an extract from the register of registration of legal entities and individuals. If the activity is carried out in several directions, then the type of activity with the maximum income is indicated.

Then the data is entered in the “Reorganization Form” line. The block must be completed only in the event of liquidation or reorganization. In other cases, dashes are added.

In the “Contact telephone number” field, enter a number by which you can contact the filer of the declaration.

In the “On pages” block the number of attached pages is written in the “000...” format.

Next comes the column “Power of attorney and completeness of information.” If the declaration is submitted by proxy from an authorized person, then code 2 is entered. If the report was filled out by an individual entrepreneur, then code 1.

Business winding down during the quarter

After submitting an application to remove the individual entrepreneur status at the end of the tax period, the entrepreneur, following the algorithm for liquidating the business, counts the employees, hands over the cash register, submits the necessary documents to the Federal Tax Service and pays taxes in the prescribed manner.

Some tax inspectors allow you to postpone the completion of formalities (except for the dismissal of employees, of course) to the period after the closure of the business. But there is a catch: according to some indicators, an individual who becomes an individual entrepreneur will pay more taxes than an individual entrepreneur.

FAQ

I fell behind on my insurance premiums as an individual entrepreneur. I haven't cried for 3 months now. What will it cost me and how can I close an individual entrepreneur with debts if I now live in another region?

The tax office will establish arrears and calculate all your debts and fines. Then he will ask them to pay, indicating the due date. To close an individual entrepreneur in another city: go to a notary and write an application to terminate the work of an individual entrepreneur using a special form - the notary will give it to you. Verifies your signature. Then to the bank to pay the state fee for closing - 160 rubles. Next, go to the post office and send the application and paid receipt by registered mail with acknowledgment of receipt to the address of the tax office where you opened the individual entrepreneur. Ask a question that interests you - use the online consultant form on the right or call by phone (Moscow). It's fast and free!

I have an individual entrepreneur, no business, I have never filed reports, the bailiffs seized the accounts. What to do in such a situation?

First, find out how much debt you have. After you figure out the exact amount of the debt, there are two options - you can pay the bailiffs in installments, or if the debt is more than 300 thousand, file for bankruptcy. Ask a question that interests you - use the online consultant form on the right or call by phone (Moscow). It's fast and free!

Will an individual entrepreneur's current account be seized because of bank debts as an individual?

If an entrepreneur owes the bank on personal loans, and they sue, then the judge can seize all the entrepreneur’s accounts, including the current account, since an individual entrepreneur is an individual and is liable for debts with all his property. Ask a question that interests you - use the online consultant form on the right or call by phone (Moscow). It's fast and free!

Hotline for citizen consultations: 8-800-350-57-94

Place of filing the declaration

The UTII declaration upon liquidation of an individual entrepreneur is submitted at the actual place where business activities are carried out. If it is impossible to clearly define it, for example, an individual entrepreneur provides motor transport services or carries out retail trade, then the documents are submitted at the place of registration of the individual.

In cases where there are several points of business, and they are all located in the same area, then only one declaration is submitted, but with total indicators for all points, information about which is displayed in the second section. If the activities are the same, but the points are located in different territorial units, then a separate report will have to be submitted to each tax service; the second section of the report is not filled out, but the indicators are simply summed up.

Reasons for closing an individual entrepreneur on UTII

The legislation regulates the probable reasons for the closure of individual entrepreneurs, defining separate codes for the grounds for terminating the functioning of a business. To terminate a business, you will need to indicate what caused such a decision. This may be the end of the entrepreneur’s activities or a transition to another area of business or the formation of a legal entity and so on.

Acceptance of reports

Regardless of the chosen reason for liquidation, you will have to interact with the tax service. One of the reporting methods is a declaration, which may change in case of closure.

Declaration methods

When liquidating an individual entrepreneur on UTII, there are no special requirements for submitting a report.

The first method is a paper version, which is submitted in 2 copies. On the second, the tax service must mark receipt.

The second way is through the post office. It is advisable to issue a registered letter. It is recommended to send documents with a notification, which, after receipt by the tax service, should be returned to the sender. Don't forget that there is a shipping deadline that needs to be taken into account. Therefore, the declaration should be sent in advance.

The third way is through the Internet. To use this method, you will have to have your signature notarized. If this has been done previously, there will be no problems with submitting the report.

Filling procedure

Let's look at the procedure for generating a declaration when closing an individual entrepreneur in 2020 using an example and provide a sample for filling it out.

An entrepreneur from the city of Shatura, Moscow region, Anna Petrovna Zakharova provided hairdressing services in a small salon. This type of activity relates to the provision of household services. In July 2021, she decided to stop working and on the 20th she was deregistered as an individual entrepreneur. She fired her employees in the second quarter, so she no longer paid contributions for their insurance in July. For herself this month she had to pay an additional 5,000 rubles, since the rest of the insurance premiums had been paid earlier.

In the table we list all the data that is necessary to fill out the UTII declaration when closing an individual entrepreneur in 2021.

Table 1. Information for drawing up a declaration on UTII

| Parameter | Meaning | Where to get |

| Physical indicator (PF). For the provision of household services, this is the number of employees, including individual entrepreneurs | 1 (Individual entrepreneur Zakharova worked without employees in the third quarter) | Article 346.29 of the Tax Code of the Russian Federation |

| Basic return (BR) – imputed income per unit of physical indicator. | 7 500 | |

| Deflator coefficient K1. Adjusts income depending on the level of inflation | 2,005 | Order of the Ministry of Economic Development dated December 10, 2019 No. 793 |

| Reduction factor K2. Established by municipal authorities. | 0,8 | Decision of the Council of Deputies of the Shatura District dated December 7, 2016 No. 3-07/325 |

| Number of days in the month of closure (K days) | 31 | |

| Number of days worked (K neg days) | 20 | |

| UTII rate | 15% (may be reduced by decision of local authorities) | Article 346.31 of the Tax Code of the Russian Federation |

Tax for a month not fully worked is calculated using the formula:

FP x DB x K1 x K2 x Rate / K days x K negative days.

The amount of UTII can be reduced by insurance contributions that were made in the reporting quarter. The entrepreneur in the example has no employees, so he will deduct from the tax amount all contributions paid for himself. If there were employees, the tax due to this deduction could only be reduced by half.

Next, we’ll look at how to generate a UTII declaration when closing Zakharova’s individual entrepreneur and present a sample of how to fill it out. The order is as follows - first sheet, section 2, section 3 and section 1. Section 4 is not filled out, since it is not relevant in 2021.

Title page

On the first sheet we indicate the following parameters:

- adjustment number – “0–” (primary feed);

- tax period – 23 (III quarter);

- reporting year – 2020;

- tax authority code – 5049 (Interdistrict Federal Tax Service No. 4);

- registration place code – 320 (Appendix No. 3, code for the place of activity);

- Full name IP;

- telephone;

- number of report pages – 5, attachments – 0.

In the lower part on the right we put the code “1” - this means that the report is signed directly by the entrepreneur. There is no need to write your full name again. We cross out all other cells, indicating only the date of completion.

Section 2

In this section we will calculate the tax amount. In the lines we indicate the following data:

- 010 – activity code “01” from Appendix No. 5;

- 020 – address of the place of provision of services;

- 030 – OKTMO;

- 040 – OBD indicator

- 050 – K1;

- 060 – K2.

Data for filling out lines 040-060 must be taken from Table 1.

In line 070, information is entered in the following columns:

- 2 – physical indicator “1”;

- 3 – the number of days that individual entrepreneur Zakharova worked in July – “20”.

- 4 – calculation of the base for the month using the above formula – 7761.

Lines 080 and 090 are not filled in in our example, since Zakharova was deregistered in July.

In line 100 we will reflect the final base, in line 105 - the UTII rate, and in line 110 - its amount: 7761 × 15% = 1164.

Section 3

This section identifies deductions and calculates the amount of tax that must be paid for the quarter. Let's fill the lines like this:

- 005 – “2”, since there were no payments to individuals;

- 010 – tax before deduction (line 110 of section 2);

- 020 – dash;

- 030 – the amount of insurance contributions of the individual entrepreneur for himself (5,000) – we will deduct it from the tax;

- 040 – dash, cash deduction was previously reflected here;

- 050 – the amount of UTII tax payable after deducting contributions. It turns out that there will be no additional tax.

Section 1

The calculation results will be reflected in section 1. There are only 2 lines:

- 010 – OKTMO;

- 020 – the amount of UTII that the former entrepreneur must pay for the last quarter (in our example, 0).

A sample of filling out the UTII declaration upon termination of business activity.

When closing an individual entrepreneur on UTII, the finished liquidation declaration is signed and sent to the Federal Tax Service, in which the entrepreneur was registered as a payer of imputed tax. The method can be any - in person or with a representative (a notarized power of attorney is required), by mail or electronically with an electronic signature.

Filling out the declaration

It is very important to correctly indicate the tax period code when liquidating an individual entrepreneur on UTII. It is he who makes it possible for the Federal Tax Service specialists to understand that the business is closing.

In general, tax period codes are a two-digit number:

- 22 corresponds to 1st quarter;

- 23 – 2nd quarter and so on.

If we are talking about closure, then the individual entrepreneur liquidation code in the UTII declaration is different:

| 51 | Reorganization or liquidation of individual entrepreneurs in the 1st quarter |

| 54 | Reorganization or liquidation of individual entrepreneurs in the 2nd quarter |

| 55 | Reorganization or liquidation of individual entrepreneurs in the 3rd quarter |

| 56 | Reorganization or liquidation of individual entrepreneurs in the 4th quarter |

In addition to the tax period code when closing an individual entrepreneur, it is necessary to indicate the code of the reorganization form, that is, provide clarification. The liquidation code is 0.

When do you need to submit a UTII declaration when closing one of the types of “imputed” activities?

Good afternoon, tell me, if an LLC on UTII closes one of its activities in the 1st quarter of 2021, namely on February 6, 2021, when should the declaration be submitted? April 20th or immediately after closing?

Solution of the problem

The legislation does not establish separate deadlines for submitting a UTII declaration when closing one of the “imputed” types of activities. You have the right to submit UTII reports for the 1st quarter by April 20, 2021. The Federal Tax Service adheres to a similar opinion in its letter dated March 20, 2015 N GD-4-3/ [email protected] :

Clause 3 Art. 346.32 of the Tax Code of the Russian Federation stipulates that tax returns for UTII based on the results of the tax period are submitted by taxpayers to the tax authorities no later than the 20th day of the first month of the next tax period.

According to Article 346.30 of the Tax Code of the Russian Federation, the tax period for UTII is a quarter.

The Code does not provide for any specifics regarding the deadlines for submitting a tax return for UTII in the event of termination by the taxpayer of activities subject to UTII taxation and deregistration as a UTII taxpayer.

, therefore, the tax authority deregistering the specified taxpayer only on the basis of an application is justified.

I would like to note that when submitting reports, after deregistration in relation to one of the types of imputed activities, some problems may arise. They are connected with the fact that often the tax authorities at the place of business on UTII refuse to accept the declaration if the individual entrepreneur has ceased the imputed activity. In this case, the declaration can be sent by mail or submitted to the Federal Tax Service at the place of registration as an individual entrepreneur.

I wrote a statement to the tax office via VLSI stating that one of the activities was discontinued and submitted a declaration plus, as a result, the answer was: the report was not submitted, because There is no such type of activity, I don’t understand anything, before this we reported to the tax office quarterly and accepted declarations.

What happened was what I assumed in the answer above. You have deregistered one type of activity and now the tax office at the place where it is conducted does not want to accept reporting, or rather, cannot, since the system does not allow it. This happens very often.

In this situation, I recommend that you send your UTII reports to the Federal Tax Service at the place of registration (not conducting business!) by mail. During a personal visit to you, most likely they will not want to accept her either.

Zero declaration

Many businessmen are interested in the question of whether it is possible to submit a UTII declaration when closing an individual entrepreneur with a liquidation code and a zero result. No, you can't do that. Do not forget that the amount of imputed tax is calculated by the state and in no way depends on the income that the entrepreneur actually received during the reporting period. Therefore, even if there was no profit, you will have to pay tax. Even if the entrepreneur has truly exculpatory factors, a fire occurred or the store was robbed, it is impossible to submit a zero declaration. Simply put, there is only one point of view of the regulatory authorities: if you run a business, pay tax; if you don’t, get deregistered.

Closing before the end of the period

The procedure for closing an individual entrepreneur before the end of the quarter is also standard: you will have to submit the same papers within the same time frame. But the declaration will be filled out as partially zero.

If the individual entrepreneur does not complete the three-month period, he recalculates the tax. In order not to overpay, enter 0 in column 2 of lines 070-090 of section 2. It will equate the basic profitability and, therefore, UTII to zero - so you won’t have to pay for “unworked” time.

We must not forget about UTII-4: even zero indicators, if the entrepreneur is not deregistered as a payer, are subject to minimal taxes.

Penalties

Even when liquidating an individual entrepreneur, do not forget that there are penalties for failure to submit reports.

| Violation | Amount of sanctions |

| In case of late submission of reports but payment of UTII | 1 thousand rubles |

| In the absence of a report and non-payment of tax | 5% of the tax amount, and for each month of delay, even if it is incomplete. Penalties are accrued from the time required for submitting the report, but cannot exceed 30% and cannot be less than 1 thousand rubles. |

What to do after liquidation

Any individual must remember that even after the closure of an individual entrepreneur, a person is not exempt from paying all taxes, insurance premiums and debt obligations that arose while running a business.

If the individual entrepreneur had a seal, then it is not subject to mandatory destruction. After all, you can use it when opening a new individual entrepreneur. And you can open a new business the next day after closing. Documents that were generated during the activities of the individual entrepreneur must be stored for 4 years.

Tax return UTII 2018

• When filling out the Declaration, it is recommended to use black, purple or blue ink. But still better - a black pen.

• A dash is placed in empty unfilled cells. If these amounts are equal to 0, then dashes are also added.

14) Section “I confirm the accuracy and completeness of the information specified in this Declaration.”

— If the declaration is submitted by an individual entrepreneur, this field is not filled in, only a personal signature and the date of signing are put.

See the table of basic profitability, physical indicators by code and each type of business activity in the section on UTII.

2) Line 020. Indicate the full address of the place of business activity indicated in line 010.

See the table of basic profitability, physical indicators by code and each type of business activity in the section on UTII.

BOX 2 . Indicate the value of physical indicators. How the physical indicator is calculated depending on the type of activity, see the table.

If a physical indicator changed during the quarter, then indicate this in the line of the month in which the change occurred.

If you worked for UTII for a full quarter without registration or deregistration, put a dash in all lines of column 3.

1 - if you are a taxpayer making payments to individuals. Simply put, if you have employees, put the number 1.

2) If you have 2 or more sheets of section 2, add up all the sums of lines 110 from each such sheet of section 2 and write the result in line 010.

3) Line 020. Indicate the amount of insurance premiums already paid in the reporting quarter for employees engaged in UTII activities.

4) Line 030. Indicate the amount of insurance premiums already paid in the reporting quarter for yourself.

In this case, the taxpayer has no employees, so the tax can be reduced by 100% of the amount of all fixed insurance premiums paid for oneself.

line 020 = page 040 of section 3 * (Sum of lines 110 of all sheets of section 2 for this OKTMO / line 010 of section 3)

3) The section at the bottom of the sheet “I confirm the accuracy and completeness of the information indicated on this page.”