Home Finance Taxes

Currently, many organizations that apply VAT are increasingly faced with questions related to the correct calculation of tax. It is believed that this one is one of the most difficult to calculate. By placing a huge tax burden on an organization, its incorrect calculation can lead to financial difficulties.

Many amendments are made to the Tax Code of the Russian Federation every year, so VAT payers are always on guard with the law. For example, the most typical and pressing question that arises from the taxpayer: VAT - how much interest in 2021? Remember, all the little details are important!

Tax authorities exercise serious control over VAT payers. During checks, many different errors are found. All errors are typical and require a deeper understanding and study of even minor details. It is important not to think that complex tax calculations and audits will not allow you to work correctly, without errors. It's not like that at all. You just need to take a deeper look at the tax, its elements, the procedure for their application, and only then draw conclusions that avoid typical mistakes.

Recipients of regional and local subsidies will restore VAT

Starting this year, legal entities receiving subsidies from regional and local budgets will submit applications for the restoration of VAT amounts previously accepted for deduction. The innovation will affect those organizations that receive subsidies for reimbursement of costs (including tax) associated with payment for purchased goods (work, services), including tax, as well as for reimbursement of costs for paying tax when importing goods into the territory of the Russian Federation and other territories located under its jurisdiction.

Recipients of subsidies from the federal budget already have such an obligation. Legal entities that use financial assistance from other budgets will have to restore VAT from July 1, 2021. The corresponding amendments are provided for by Federal Law dated November 30, 2016 N 401-FZ.

Exemption from VAT

Cancellation of VAT payment under Art. 145 of the Tax Code of the Russian Federation obliges to present the following packages of documents: 1. Companies remaining to work in OSNO: • notification of rights to exemption from VAT payment; • balance sheet statement showing accounting revenue for the three-month period before the month of release; • an excerpt from the sales book with results for the three-month period before the month of release.

2. Companies switching from simplified taxation system to OSNO: • notification and excerpt from the book of profit and waste (for a three-month period before the month of exemption).

The following organizations have the right not to pay VAT on advance receipts in 2017: • exempt from VAT; • working under a special regime; • exporting or selling their products outside the Russian Federation; • services sold by the organization; or goods not subject to VAT; or tax rate 0%; • those who have received advance payment for goods whose production period is longer than six months.

Updated: maxim 2017-03-03 09:47:19

The period of the bank guarantee for VAT refund on request has been increased

Law N 401-FZ also introduced a rule according to which the validity period of the guarantee provided by the bank for VAT refund in the application form must be at least 10 months from the date of filing the declaration with the amount of tax to be refunded. Such changes were made to paragraphs. 1 clause 4 of article 176.1 of the Tax Code of the Russian Federation.

Let us remind you that since 2014, the guarantee period for accelerated VAT refunds has been 8 months. At the same time, it remains possible to reimburse the tax without providing a guarantee if the organization has transferred 7 billion rubles or more in taxes to the budget system of the Russian Federation over the past three years. This amount does not include taxes paid in connection with the movement of goods across borders and as a tax agent.

Collection of VAT on paid Internet services of foreign companies

On January 1, Law No. 224 Federal Law came into effect, regulating the procedure for calculating VAT on the services of foreign companies provided by them to citizens of the Russian Federation via the Internet and other information and telecommunication channels. Taxable services include access to archived information, advertising, domain names, hosting and website administration. The Tax Code establishes a rule requiring the collection of VAT on the sale of electronic books, images, audiovisual files, computer programs and games, including the provision of paid access to them on the Internet, if they were purchased by citizens of the Russian Federation. Previously, electronic services provided by foreign residents were not subject to VAT.

A foreign company must submit an application for registration to the Federal Tax Service within thirty days from the beginning of its provision of the above services to Russian citizens. Foreign companies are required to submit declarations and other documents in the tax payer’s personal account registered on the tax website.

The Russian Federation becomes the territory for the provision of Internet services when the bank, bank account for payment for the service, the operator of electronic funds that transferred funds for the service, the network address or telephone code of the buyer of the service are registered in the Russian Federation.

Preferential VAT rates: new and old users

Rail transportation of passengers and baggage in any direction will be subject to a zero value added tax rate. The benefit provided for by Federal Law No. 401-FZ of November 30, 2016 will last 13 years – from January 1, 2021 to January 1, 2030.

Another amendment relating to the amount of VAT rates is contained in Decree of the Government of the Russian Federation dated December 17, 2016 N 1377. This document updates the list of food products to which the tax rate reduced to 10% is applied. We are talking about such food products as livestock and poultry in live weight, meat and meat products, milk and dairy products, eggs, vegetable oil, salt, sugar, bread and bakery products, cereals, flour, pasta, seafood and fish products, vegetables . New items include mushrooms and truffles, asparagus, garlic, rutabaga, and turnips.

The invoice has been updated - does the declaration change for the quarter (month)?

A new detail entered into the invoice was information about the data of the government contract, agreement or agreement, in pursuance of which the shipment is issued, accompanied by the issuance of an invoice, if such a document (contract, agreement or agreement) exists in the relationship between the parties.

The requirement to indicate information about the government contract (contract, agreement) turned out to be mandatory for invoices of all three main types (Article 169 of the Tax Code of the Russian Federation):

- ordinary (subclause 6.2 added to clause 5);

- advance (added subclause 4.2 to clause 5.1);

- adjustment (subclause 6.1 was added to clause 5.2).

Accordingly, the document defining the form and rules for issuing invoices, i.e., Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137, also required updating. The necessary changes were made to it by Decree of the Government of the Russian Federation dated May 25, 2017 No. 625. They are equally touched upon Annexes No. 1 and No. 2 of Resolution No. 1137, thereby covering all types of invoices compiled. The innovations boiled down to the following:

- In the invoice form, another row has been added to the rows located above the main table, called “Identifier of the government contract, agreement (agreement).”

- The filling rules are supplemented with a description of the data that should go into the new line. In comparison with the wording of the name assigned to the new requisite of the Tax Code of the Russian Federation, this description has been expanded by clarifying that the new requisite (state contract, agreement, agreement) must refer to a document concluded in connection with the receipt by a legal entity of funds from the federal budget in the form of subsidies, budget investments or contributions to the authorized capital.

Thus, despite the change in the form of the invoice, which affected all persons working with it, not every taxpayer will have to fill out the new details.

Other documents compiled on the basis of information from invoices are not affected by the innovations. That is, books of purchases and sales, declarations (both quarterly and monthly) are formed on the same forms that were valid before 07/01/2017.

For the new invoice form, see the material “New electronic format and new invoice form from 07/01/2017 (form)”.

Amendments to the VAT return have been approved. The VAT return will change.

This year, taxpayers will be offered a new VAT return form. The corresponding draft amendments are now at the stage of discussion and approval. It was planned that the updated version of the declaration will come into force on January 1, 2021. But the Federal Tax Service did not have time to approve the document, so it is possible that you will have to report according to the new rules based on the results of the first quarter of this year, and for 2021 you must submit the form approved by Order of the Federal Tax Service of Russia dated October 29, 2014 N ММВ-7-3/ [email protected]

As the St. Petersburg Legal Portal has already said, the new declaration will update:

- Section 3 “Calculation of the amount of tax payable to the budget for transactions taxed at the tax rates provided for in paragraphs 2 - 4 of Article 164 of the Tax Code of the Russian Federation”;

- Section 4 “Calculation of the amount of tax on transactions for the sale of goods (works, services), the validity of applying a tax rate of 0 percent for which is documented”;

- Section 6 “Calculation of the amount of tax on transactions involving the sale of goods (works, services), the validity of applying a tax rate of 0 percent for which is not documented”;

- Section 9 “Information from the sales book on transactions reflected for the expired tax period”;

- some other norms provided for by the Procedure for filling out a VAT return.

These are the main changes to VAT planned for 2021, which entrepreneurs operating in Russia need to know about. What amendments have we forgotten about? Write in the comments to this material, and we will definitely add detailed information about the innovations that have entered into force or are planned for the current year.

Formation of value added tax

How VAT is formed is a question that interests all novice accountants and businessmen. For the production cycle, the enterprise purchases raw materials, the cost of which already includes tax. After the goods are manufactured, the moment comes to calculate all costs - the formation of the cost price. Next, the amount of pledged profit is determined and VAT is added on top. The resulting figure is the selling price of the goods produced.

In this case, the amount of tax paid to the supplier of raw materials is a deduction, the so-called. “input” VAT. This figure is taken into account as the debit of account 68 (sub-account for VAT calculations). 18% of the revenue received (when selling products or selling services) is the amount to be taken into account under credit 68 of account. The debit balance is the amount of tax reimbursed by the state, the credit balance is subject to transfer to the budget.

Benefits for the sale of medical products

In accordance with paragraph 2 of Article 149 of the Tax Code of the Russian Federation, the sale of essential and vital medical products is not subject to value added tax. These products are listed in section. I of the List approved by Decree of the Government of the Russian Federation dated September 30, 2015 No. 1042. Starting from 2021, these products are exempt from VAT upon submission of a registration certificate for a medical device to the tax authorities.

From July 1, 2021, it will be allowed to confirm the right to benefits not only with a registration certificate for a medical product, but also with a registration certificate for a medical product (medical equipment).

From July 1, 2021, in order to apply a benefit or a 10 percent tax rate on the sale of medical devices, you can submit a registration certificate of a medical device to the Federal Tax Service. In this case, such a certificate must be issued either according to the rules of the EAEU or according to the legislation of the Russian Federation.

It is worth noting that one of the amendments in paragraph 4 of subparagraph 1 of paragraph 2 of Article 149 of the Tax Code of the Russian Federation is quite controversial. Indeed, from July 1, 2017, a complete exemption from VAT applies to any medical product, and not just the most important and vital ones. Therefore, it is not entirely clear to which medical products the 10% VAT rate will be applied. The fact is that, according to paragraphs. 4 p. 2 tbsp. 164 of the Tax Code of the Russian Federation, a rate of 10% applies to medical devices, with the exception of medical devices, the sales operations of which are exempt from taxation in accordance with paragraphs. 1 item 2 art. 149 of the Tax Code of the Russian Federation. But it turns out that all medical products will be subject to the zero rate. What did the legislators mean?

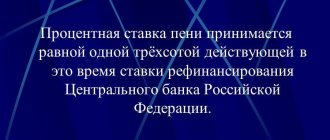

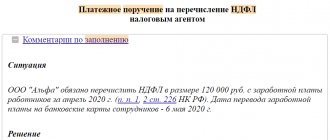

KBK VAT penalties 2021 for legal entities

To make all payments related to VAT, legal entities must use the same BC codes as individual entrepreneurs.

Other codes for legal entities can only be used in cases related to:

- for personal income tax payment;

- to the transfer of funds to extra-budgetary funds that relate to the legal entity itself or employees working in its organization.

All taxpayers should keep a table of budget classification codes at hand, otherwise, if field “104” is filled out incorrectly, they will have to spend a lot of time and effort to ensure that the sent funds reach their recipient.

To return money that was sent using an incorrect bookmaker code, a legal entity needs:

- reconcile the payment with the tax service;

- write an application to the head of the tax service with a request to return the money sent.

But it is better that you do not have to return the money sent due to an incorrect BCC entry. To do this, you should carefully fill out the payment order.

Don't lose sight. Review of VAT changes in 2021.

In this material we will collect changes in legislation relating to VAT that came into force in the second half of 2021 and the beginning of 2021. Simple, convenient, at hand. (Recall that most of the innovation projects were described in the article by O. E. Orlova “What changes is the Ministry of Finance preparing in relation to VAT?”, No. 11, 2021.)

| Standard designation | As it was | How did it happen | Commencement of the innovation | Regulatory act that introduced changes |

| Issuance of guarantees for third parties providing for the fulfillment of obligations in cash | In 2021, such a transaction was not subject to VAT only if it was carried out as a banking transaction, including by an organization that, in accordance with the legislation of the Russian Federation, has the right to carry out them without a CBR license | From 2021, the issuance of a surety (guarantee) will not be subject to VAT even if carried out by an organization that is not a bank (clause 15.3, clause 3, article 149 of the Tax Code of the Russian Federation) | 01.01.2017 | Federal Law of November 30, 2016 No. 401-FZ |

| Application procedure for VAT refund | To refund VAT in the specified order (by taxpayers whose total amount of VAT, excise taxes, income tax and mineral extraction tax for three calendar years prior to the year of filing the application for VAT refund was less than 7 billion rubles), a bank guarantee or bank guarantee is required | From July 2021, an alternative to a bank guarantee will be a third party guarantee (the latter must meet the requirements specified in clause 2.1 of Article 176 of the Tax Code of the Russian Federation) to secure the obligation to pay taxes (Article 176.1 of the Tax Code of the Russian Federation) | 01.07.2017 | Federal Law No. 401-FZ |

| Minimum period of bank guarantee for accelerated VAT refund | The validity period of such a guarantee must expire no earlier than eight months from the date of filing the declaration | According to the rules that came into force in 2021, the validity period of a bank guarantee is 10 months from the date of filing a declaration with the amount of tax to be reimbursed (clause 1, clause 4, article 176.1 of the Tax Code of the Russian Federation) | 01.01.2017 | Federal Law No. 401-FZ |

| Long-distance transportation of passengers and luggage by public railway transport | A VAT rate of 10% was applied to the provision of such services. | From 2021 (the norm will be valid until December 31, 2029), a 0% VAT rate is applied to such services (clause 9.3, clause 1, article 164 of the Tax Code of the Russian Federation). To confirm it, you must submit the documents specified in clause 5.3 of Art. to the tax authorities. 165 Tax Code of the Russian Federation | 01.01.2017 | Federal Law No. 401-FZ |

| Receiving a subsidy to reimburse the costs of purchasing goods, works, services | VAT needs to be restored when receiving such a subsidy from the federal budget | From July 2021, when receiving a subsidy of this type, VAT will have to be restored regardless of which budget it was allocated from (clause 6, clause 3, article 170 of the Tax Code of the Russian Federation) | 01.07.2017 | Federal Law No. 401-FZ |

| Services in electronic form provided by foreign Internet companies | Previously, the “Google tax” was not paid | From 2021, the services of foreign companies listed in paragraph 1 of Art. 174.2 of the Tax Code of the Russian Federation, are subject to VAT if the client is an individual and the place of sale of these services is recognized as the territory of the Russian Federation (clause 4, clause 1, article 148 of the Tax Code of the Russian Federation) | 01.01.2017 | Federal Law dated July 3, 2016 No. 244-FZ |

| VAT return filled out by foreign Internet companies | The tax return is submitted by foreign organizations subject to registration in accordance with clause 4.6 of Art. 83 of the Tax Code of the Russian Federation, to the tax authority through your personal account or via TKS no later than the 25th day of the month following the expired tax period. If the calculation and payment of tax under Art. 174.2 of the Tax Code of the Russian Federation are made by a tax agent, the tax return is submitted by the tax agent | Starting with reporting for the first quarter of 2021 | Order of the Federal Tax Service of Russia dated November 30, 2016 No. ММВ-7-3/ [email protected] | |

| List of codes for types of food products for which a reduced VAT rate applies | This list was approved by Decree of the Government of the Russian Federation dated December 31, 2004 No. 908. Product names here correspond to the OKP classifier | Starting from 2021, the list of food products has been changed. The information is brought into compliance with the new OKPD2 product classifier. There are also meaningful | 01.01.2017 | Decree of the Government of the Russian Federation of December 17, 2016 No. 1377 |

| changes (for example, mushrooms and truffles are included in the list) | ||||

| Explanations for the VAT return | Explanations can be submitted on paper or electronically. | Explanations of errors or contradictions in an electronic VAT return during a desk tax audit can only be submitted electronically. Paper explanations will not be considered submitted (clause 3 of Article 88 of the Tax Code of the Russian Federation). Failure to provide explanations will result in a fine of 5,000 rubles. (clause 1 of article 129.1 of the Tax Code of the Russian Federation) | 01.01.2017 | Federal Law of May 1, 2016 No. 130‑FZ |

| Sales of waste paper | Previously, VAT on the sale of waste paper was accrued in the generally accepted manner | From October 2021 (the norm is valid until December 31, 2018), the sale of waste paper (paper and cardboard waste, rejected and out-of-use printing products, paper and cardboard, as well as business papers, including documents with an expired shelf life) is not subject to VAT ( clause 31 clause 2 article 149 of the Tax Code of the Russian Federation) | 01.10.2016 | Federal Law of June 2, 2016 No. 174-FZ |

| Import and sale on the territory of the Russian Federation of breeding cattle, breeding pigs, sheep, goats, horses, poultry, eggs, as well as semen and embryos obtained from them | These products were subject to VAT at a rate of 10% | From October 2021 (the norm is valid until December 31, 2020), these products are exempt from VAT if the taxpayer has a breeding certificate (subject to submission to the customs authority of a permit) issued in accordance with Federal Law dated August 3, 1995 No. 123-FZ, and its belonging to the list approved by the Government of the Russian Federation | 01.10.2016 | Federal Law dated June 23, 2016 No. 187-FZ; Decree of the Government of the Russian Federation of October 20, 2016 No. 1069 |

| Export operations | For export transactions, VAT is subject to deduction on the last day of the quarter in which documents are collected at a zero rate | For goods registered from July 1, 2016, exporters have the right to claim VAT deductions in the generally established manner, without waiting for confirmation. | 01.07.2016 | Federal Law of May 30, 2016 No. 150‑FZ |

| deduction of the zero VAT rate (clause 3 of Article 172 of the Tax Code of the Russian Federation). Exception: commodity exporters. Codes of such goods must be approved by the Government of the Russian Federation | ||||

| Export to the EAEU countries: about invoices | The exporter issues an invoice to the buyer in the generally established manner, if this is provided for by the legislation of the EAEU member state | Export of goods, the sale of which is not subject to taxation (exempt from taxation) in accordance with Art. 149 of the Tax Code of the Russian Federation, is also accompanied by the preparation of invoices (clause 1.1, clause 3, Article 169 of the Tax Code of the Russian Federation). “Shipping” invoices must indicate the code of the type of goods according to the Commodity Nomenclature of Foreign Economic Activity of the EAEU (clause 15, clause 5, article 169 of the Tax Code of the Russian Federation) | 01.07.2016 | Federal Law No. 150-FZ |

| Compensation under a business risk insurance contract | The Tax Code of the Russian Federation obligated to increase the VAT base by the amount of insurance payments received under insurance contracts for the risk of non-fulfillment of contractual obligations | Compensation under the specified insurance contracts is not subject to VAT (clause 4, clause 1, article 162 of the Tax Code of the Russian Federation) | 01.07.2016 | Federal Law dated April 5, 2016 No. 97-FZ |

| The VAT transaction type codes for the purchase ledger and sales ledger have changed | There were 26 codes approved by Order of the Federal Tax Service of Russia dated February 14, 2012 No. MMV-7-3/ [email protected] and Letter of the Federal Tax Service of Russia dated January 22, 2015 No. GD-4-3/ [email protected] | The list was reduced to 24 codes. The changes did not affect only codes 10, 18 - 20, 22 - 24, 27 and 28 | 01.07.2016 | Order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] |

It is also worth noting that in 2021, amendments are planned to the invoice form and VAT registers (in particular, to the journal of received and issued invoices, the sales book and the purchase book). The deadline for creating registers will be extended by five days – until the 25th.

The form of the VAT declaration will also change. But we will tell you about all this later, when the plans become reality.

VAT: problems and solutions, No. 1, 2021

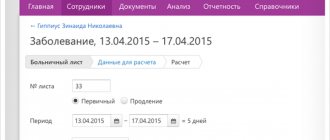

Explanations on the electronic VAT filing form

At the beginning of the year, changes came into force stating that organizations that are required to submit reports in electronic form will be forced to send explanations in the same form. It is mandatory to send explanations through the global network if the tax office requests them in connection with:

- with contradictions or errors in the declaration;

- with clarifications on the reduction of tax payable.

If an organization submits explanations on paper, they will not be accepted and will be perceived as not provided. There are a few exceptions though:

- response formats not approved by the tax service;

- the requirement received by the organization was issued by inspectors in 2021, and the response deadline is 2017;

- The tax office requests an explanation of the company's VAT benefits.

For explanations not sent or sent after the deadline, the inspectorate has the right to fine the organization. The first fine will be 5,000 rubles, and for all subsequent fines, starting with the second, the penalty will be 20,000 rubles. Previously, the tax office had the right to fine only the director for failure to submit an explanation on time.

Presentation of explanations

It is now necessary to send explanations in response to the requirements of the tax authority regarding the VAT return strictly electronically. This is perhaps the main innovation - it will affect VAT payers, to whom, as part of a desk audit, the Federal Tax Service Inspectorate will have questions in accordance with paragraph 3 of Article 88 of the Tax Code.

Let us remind you that until January 1, 2021, the form for presenting explanations was not regulated by law. In accordance with the explanations of the Federal Tax Service, taxpayers could choose between submitting an explanation according to the TKS or on paper. Now documents submitted in the latest form will not be accepted by the inspection. The requirement applies to taxpayers who are required to submit an electronic VAT return, which, let us remind you, is all tax payers, in addition to tax agents who do not pay VAT themselves.

To prepare a response, organizations, as before, have only 5 working days from the date of receipt of the request from the Federal Tax Service. If inspectors do not receive electronic explanations during this time, they will consider that the taxpayer has at least violated the allotted deadline. For this, in accordance with paragraph 1 of Article 129.1, a fine of 5 thousand rubles may be imposed on him, and if the violation is repeated within a year, then in the amount of 20 thousand rubles.

The legal basis is Law No. 136 of 05/01/16, which amended paragraph 3 of Article 88 and paragraph 1 of Article 129.1 of the Tax Code of the Russian Federation.

Transportation on long-distance trains is taxed at a rate of 0%

When providing services for the transportation of passengers and luggage by public railway transport in long-distance traffic between points on the territory of the Russian Federation, from 01/01/2017 a zero VAT rate should be applied (instead of a rate of 10%). This follows from paragraph 2 of Article 2, paragraph 5 of Article 13 of Law No. 401-FZ.

Thus, there is no longer any “input” VAT on travel expenses for employees on long-distance trains.

As for tickets purchased before this date, it is safer not to deduct the VAT indicated on them if the transportation was carried out after January 1.

New invoice format

From July 1, 2021, it is allowed to generate invoices in electronic form exclusively according to the new format approved by Order of the Federal Tax Service dated March 24, 2016 No. ММВ-7-15/155.

Previously, it was possible to choose any of those approved by orders of the Federal Tax Service of the Russian Federation No. ММВ-7-6/93 of 03/04/2015 and No. ММВ-7-15/155 of 03/24/2016, but from July 1, 2021 only the latter remains in force.

An adjustment invoice from July 1, 2021 can also be submitted only in a new format, which was approved by Order of the Federal Tax Service dated April 13, 2016 No. ММВ-7-15/189.

More transactions are exempt from taxation

From 01/01/2017, transactions exempt from VAT also include services for the issuance of sureties (guarantees) by a taxpayer who is not a bank.

Corresponding changes have been made to paragraph 3 of Article 149 of the Tax Code of the Russian Federation (clause “b”, paragraph 1 of Article 2, paragraph 5 of Article 13 of Law No. 401-FZ).

Thus, for guarantees issued from January 1, 2017, the VAT tax base does not need to be determined.

Let us recall that a taxpayer carrying out operations for the sale of goods (work, services) provided for in paragraph 3 of Article 149 of the Tax Code of the Russian Federation has the right to refuse to exempt such operations from taxation (clause 5 of Article 149 of the Tax Code of the Russian Federation).

Functions of KBK

The Russian budget is filled in several ways, namely:

- fees and taxes;

- commissions and duties;

- fines and penalties.

In this regard, we conclude that the main functions of KBK codes are:

- execution and preparation of budgets;

- reporting on the execution of financial transactions.

Thanks to the reporting, each payment quickly and accurately “finds” its recipient.

In addition, KBK allows you to obtain all the necessary information about the payment in a few seconds:

- about the purpose of payment;

- about its sender;

- about the recipient of the money.

The presence of such codes makes it possible to plan budget expenses correctly and on time.