The strict reporting form is used not only in the process of carrying out the activities of legal entities and entrepreneurs. As an example, which documents relate to BSO, airline tickets, tour packages, receipts, coupons, and subscriptions can be mentioned.

At the same time, it is allowed to issue BSOs as an equivalent replacement for regular cash receipts. Any service provided to the population must be issued with a form.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

After the introduction of recent changes to the legislation, many questions arose related to the new procedure for working with these documents. To organize the process in accordance with the latest changes, you need to understand the new operating rules.

Violation of the procedure for registering BSO entails dire consequences for organizations in the form of penalties and liability.

What it is

The practical significance of a strict reporting form lies in documentary evidence of the receipt of funds as payment for work or services performed to individuals or entrepreneurs. BSO is a complete alternative to a cash receipt, which freed many organizations and entrepreneurs from the need to have a cash receipt and spend money on servicing it.

The use of BSO covers the entire range of services provided: from payment for services to the civilian population to settlements with entrepreneurs who, like ordinary citizens, apply for a certain service to a particular organization.

The exception is payments for services for LLCs and other legal entities. Such clients must make payments by non-cash method, and issuing strict reporting forms to them is unacceptable.

The document preparation process raises many questions. First of all, the organization must be guided by the provisions of Law No. 54-FZ “On the use of cash register systems in calculations”, adopted on March 25, 2003. Article 2 of this law grants the right to approve forms, the procedure for their storage and accounting to the Government of the Russian Federation. Later, in 2008, an explanatory Resolution No. 359 was issued, which approved the procedure for production, use and listed the requirements for document execution.

Federal Law No. 54 of 2003

Different names of forms are acceptable depending on the nature of the service provided. Among the population, the most commonly used forms are receipts, season tickets, train or plane tickets. The design of each form will differ depending on its purpose.

Before the resolution was issued, Russian organizations used forms developed by Rosbytsoyuz in agreement with the Ministry of Finance. Forms like BO-1 or BO-7 were in circulation until their cancellation. The forms are now outdated and cannot be issued.

Form BO-1

Form BO-7

According to Law No. 290-FZ, adopted on July 3, 2016, work with BSO without the simultaneous use of online cash registers is stopped. This ban comes into force in July 2021, and means it is impossible to apply BSO in the future.

Sample strict reporting form with mandatory details

Registration of cash proceeds

Despite the fact that strict reporting forms are used instead of a cash receipt, for LLCs and individual entrepreneurs it is not entirely clear what to do with the BSO next - at the end of the working day. How to register received income?

It's actually simple:

- at the end of the work shift, based on all strict reporting forms issued for the day, one cash receipt order is issued, which reflects the amount of revenue calculated by adding all amounts from the BSO (clause 5.2 of Bank of Russia Directive No. 3210-U dated March 11, 2014);

- and it is this cash receipt order that is reflected by the cashier in the Cash Book and is transferred along with the Cash Book sheet to the accounting department for verification.

At the same time, in the accounting of a legal entity, a direct entry is made for such amounts of revenue without using account 62 “Settlements with buyers and customers”:

Debit account 50 “Cash” Credit account 90 “Sales” sub-account “Revenue”.

As for entrepreneurs, they can use the specified entries to simplify their accounting - this is not punishable.

It is worth noting that only cash receipts are issued with a cash receipt order, i.e. received in banknotes and (or) coins. And the proceeds from payments with payment cards, despite the fact that they are prepared using strict reporting forms, do not go to the cash desk, but to the bank account of the entrepreneur or organization. Therefore, there is no need to carry it through the cash register and there is no need to issue a cash receipt order for this amount either.

Purchasing methods

Currently, there are several legal ways to obtain and register BSO:

- ordering a ready-made or specially designed form from a printing house;

- purchase ready-made forms in the appropriate stores.

- self-printing through an automated system without the need to register with the tax authority.

A regular printer and the use of a computer to print a strictly reporting form is unacceptable.

If an organization decides to order BSO from a printing house, it should be prepared for certain costs:

- drawing up a layout;

- coordination of details, which can already be printed in advance on the form;

- production of a specific edition.

A special feature of the BSO is that it is assigned a unique number, without the possibility of duplication.

The fastest option for issuing a BSO is to print it after completing the ordered work using equipment that meets the requirements for printing a BSO and or CCP.

Printing is done with protection from access by unauthorized persons, while preserving the individual number and series. Due to the absence of the need to register equipment with the Federal Tax Service, this method is convenient and quick to obtain a document.

BSO: who can do it the old way and for how long

The “old” rules provided that when providing services to the population, instead of cash receipts, documents on strict reporting forms (SSR) could be issued. In this case, the forms of such documents can either be produced in a printing house or generated using automated systems.

BSO according to the “old” rules can continue to be applied for a little more than a year - until July 1, 2021. After this date, it will be possible to generate BSOs and, if necessary, print them out on paper only when providing services (not only to the population, but to services in general) and only with the use of an automated system for BSOs. This system is a special type of cash register, which generates BSO in electronic form and can print them on paper. Printed forms will no longer be used.

Thus, the BSO itself becomes actually an extended cash receipt. It will contain all the details of the cash receipt itself plus BSO-specific indicators. Most likely, the “new” BSOs will be popular when paying for cultural and entertainment events, such as screenings in cinemas, music concerts, performances in theaters, and exhibitions in museums. They are still widely used in this area, and a ticket to a performance or exhibition issued by the organizer replaces a cash receipt.

Changes in legislation

From February 2021, federal legislation introduces the obligation to accompany strict reporting forms in an electronic version. Duplicating a paper document with an electronic one is necessary to send its online version to the tax office after each case of settlement between the client and the organization. This measure means the need to install a special online cash register with the function of transmitting information via the Internet.

As a result, the principles of using cash registers with the design of BSO forms are also changing. As a result of the innovation, a connecting link appears between the entrepreneur and the tax authority in the form of a fiscal data operator. For this reason, the output data for the fiscal data operator (or FDO) was introduced into the list of mandatory details from 2021.

Mandatory BSO details in 2021

Article 4.7 of Federal Law No. 54-FZ establishes a list of mandatory BSO details. In fact, the information entered into the form is similar to the data on a cash receipt and is represented by 20 details.

Mandatory data in the BSO can be supplemented with additional information at the discretion of the organization and taking into account the specifics of its activities. The law provides for the possibility of introducing another requisite - a product nomenclature code.

Another barcode is contained on the form in the form of encoded information about checking details:

- time and date of calculation;

- document number;

- calculation time;

- the nature of the transaction performed (settlement indicator);

- payment amount;

- fiscal sign;

- serial number of the fiscal drive.

This code is applied separately to the cash register receipt or BSO.

Some mandatory details are required to be specified only from February 2021. The name of goods/services and their quantity are optional for individual entrepreneurs working under the PSN, Unified Agricultural Tax, simplified tax system and UTII.

For entrepreneurs selling excisable goods, as well as individual entrepreneurs who have chosen the general taxation regime, indicating the full range of goods or services, as well as their quantitative indicator, is mandatory from 2021.

Federal Law No. 54-FZ establishes requirements for an online cash register receipt of a new format. In this article we present a list of organizations - licensed fiscal data operators.

Nomenclature details

Companies are wondering whether it is necessary to print all the names of goods, because there can be a lot of them. The answer is yes, absolutely all names of goods and services that the buyer pays for must be reflected in the BSO.

We will allow only one scenario, when a receipt or BSO may not fully detail all goods and services. The fact is that in Russia there is no unified nomenclature of goods and services. Therefore, if, for example, an organization sells gift sets that include a large number of items, they can be called “Set 1”, “Set 2” and so on. However, such names may attract the attention of tax inspectors who will want to figure out what these sets represent.

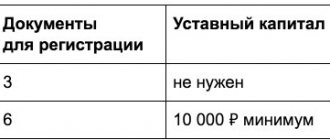

Conditions for LLC and individual entrepreneur

Despite the absence of a unified form, the following information must be indicated in the details:

- document's name;

- 6-digit number with series;

- form of ownership of the enterprise and its name;

- for individual entrepreneurs, you must indicate your last name, first name and patronymic;

- address;

- TIN information;

- nature of the service/product;

- price;

- amount to be paid;

- date of document preparation and settlement;

- information about the employee who performed the operation: name, position;

- employee signature;

- seal of a legal entity (IP);

The information can be supplemented with other details that take into account the specifics of the organization’s activities. Filling out a copy is only necessary if the form does not contain a tear-off part.

After the introduction of the new law, additional details appear in the BSO:

- indication of the tax system;

- serial number of the drive,

- OFD website;

- date, place of payment;

- information about the calculation (receipt or expense transaction);

- indication of goods;

- amount with information about the VAT rate;

- telephone, email when transmitting information electronically;

- payment procedure (cash or electronic payment).

Accounting book and filling it out

Each BSO form is separately accompanied by an entry in KUDIR. When issuing several forms during the day, a combined PKO is compiled reflecting information about each BSO number.

Please note that a combined report is only possible based on data from one business day. If there are damaged forms, information about them is also attached to the accounting log along with the rest of the completed documents.

To keep records of printed forms with manually entered data, a BSO accounting journal is provided. It is filled out sequentially, and when one log is filled, a new one is created.

Automated systems for generating strict reporting forms do not need to be registered

At the same time, the operating parameters of such devices must meet the requirements for cash register equipment. And in order to confirm compliance with these parameters, the company must have technical documentation on the formation, filling and printing of forms.

Automated systems for generating strict reporting forms that meet the requirements of the Regulations on the procedure for making cash payments and (or) settlements using payment cards without the use of cash register equipment, approved by Decree of the Government of the Russian Federation dated May 6, 2008 No. 359 (hereinafter referred to as Regulation No. 359 ), do not apply to cash register equipment.

Storage of forms and their accounting

If forms produced in a printing house are filled out, they are recorded by name, series and number. Information is entered into a form book with the need for page numbering and lacing. The book is signed by the manager and an authorized accountant, or by the private entrepreneur himself with a stamp.

A responsible employee of the organization is appointed who receives, stores, controls the movement of forms in the organization and bears financial responsibility in accordance with the concluded agreement. The same employee has the right to issue forms and accept funds in payment for services/goods from citizens.

It is the responsibility of the manager to ensure conditions for the storage and protection of forms.

The law establishes special rules for monitoring the procedure for obtaining BSO: they are accepted in the presence of a commission appointed by the manager or entrepreneur, and the date of acceptance must be the same day as the day of their receipt.

As part of acceptance, the quantity is checked, the numbers and series of the BSO are verified in accordance with the accompanying documentation. Acceptance of forms is completed by issuing a transfer and acceptance certificate.

The place where forms are stored can be a metal cabinet, a safe, or another specially equipped room with increased protection measures against unauthorized access, damage, and theft. The storage area must be sealed or secured with a seal after the working day is over.

BSO are subject to inventory within the approved time frame for inventory of cash stored in the cash register.

Control over the legality and proper use of strict reporting documents is ensured by affixing the seal of the legal entity/entrepreneur, as well as by signing the form by the entrepreneur.

Information about the BSO is stored in the form of books with issued and paid receipts. There is provision for recording copies, counterfoils evidencing payment in sealed bags, including forms for non-cash payment.

The law establishes a period for systematic storage of documents for 5 years or more. Upon expiration of the storage period, documents are subject to destruction in accordance with the act of destruction drawn up by a special commission. Damaged or incomplete forms must be destroyed in a similar manner.