Determination of the amount of sick leave benefits in 2021.

Sick leave in 2021 It will be correct to calculate using the following formula, which is provided for in Article No. 14, paragraph 1 and Article No. 1, paragraph 2 of Federal Law No. 255:

The amount of benefits due to temporary disability in 2021. = Salary (average daily) for calculating sick leave benefits in 2021. X Percentage, which depends on the employee’s length of insurance (60-100%) X Number of calendar days of illness.

Read on the topic: Examples of calculating sick leave in 2020

New figures: table

In conclusion, we have summarized the most important figures that have changed due to the increase in the minimum wage and the calculation of benefits reimbursed from the Social Insurance Fund. This table will help consolidate information about the increase in benefits from July 1, 2021.

| New values | |

| 7800 rubles | Increased minimum wage from July 1, 2021. Before this – 7500 rubles. |

| 187,200 rubles | The new minimum earnings for the billing period are 187,200 rubles (7,800 rubles x 24). Previous value: 180,000 rubles (7,500 rubles x 24). |

| 256.44 rubles | New minimum average daily earnings – (RUB 187,200 / 730). The previous value is 246.58 rubles. |

Read also

07.07.2016

How does the amount of sick leave benefit depend on the employee’s length of insurance?

Reason for temporary disability

| Employee length of service | Amount of benefit, % of average salary | Base | |

| Own illness | more than 8 years | 100% | Article No. 7 of Federal Law No. 255 |

| within 5-8 years | 80% | ||

| less than 5 years | 60% | ||

| Occupational disease/work accident | not installed (any) | 100% | Article No. 9 of Federal Law No. 125 of July 24, 1998. |

| Outpatient care for a sick child (child must be under 15 years old) | more than 8 years | 100% - first 10 days of incapacity for work, 50% - subsequent days of sick leave | Article No. 7, paragraph 3, subparagraph 1 of Federal Law No. 255 |

| within 5-8 years | 80% - first 10 days of incapacity for work, 50% - subsequent days of sick leave | ||

| less than 5 years | 60% - first 10 days of incapacity, 50% - subsequent days of sick leave | ||

| Inpatient care for a sick child (age less than 15 years) / outpatient care for an adult family member | more than 8 years | 100% | Article No. 7, paragraph 3, subparagraph 2, Article No. 7, paragraph 4 of Federal Law No. 255 |

| within 5-8 years | 80% | ||

| less than 5 years | 60% |

It is worth noting that the amount of benefits for employees who have worked for less than 6 months is limited to the minimum wage when calculating for a full calendar month (the regional coefficient should also be taken into account, if it is provided for a given area). This fact is stated in Article No. 7, Clause 6 of Federal Law No. 255.

Results

The calculation of an employee's average daily earnings depends on where he worked for 2 years before he became ill and how much he earned there. However, there is an upper and lower limit for receiving disability payments. For employees who have cared for children under 3 years of age in the previous 2 years, the calculation period can be changed.

Please note that the average daily earnings for sick leave for a pregnant woman are calculated according to different rules than for regular sick leave. See the calculation details in the material “When is sick leave given for pregnancy and childbirth?” .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to calculate average earnings for accrual of sick leave in 2021?

The average salary should be calculated taking into account payments for two calendar years that precede the year of occurrence of insured events. In this case, the insured event is the moment the illness begins.

In this case, if the employee becomes ill in 2021. The average salary is calculated taking into account payments for 2015. and 2021 Also, payments included in the calculation include wages, bonuses, travel allowances, vacation pay, and financial assistance in the amount of more than 4,000 rubles. By the way, these should be the amounts from which insurance premiums were paid to the Social Insurance Fund of the Russian Federation.

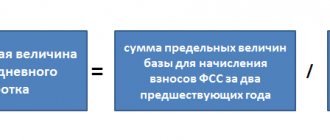

The formula for calculating the average salary for benefits due to temporary disability can be found below:

Average daily wage for calculating sick leave benefits in 2021. = income for 2021 (the maximum limit has not been set for today) + income for 2015. (maximum limit 670,000 rubles) / 730.

This formula is approved by Article No. 14, clause 1 of Federal Law No. 255, Regulations (clause 15(1)), approved by Decree of the Government of the Russian Federation No. 375. By the way, the number 730 does not need to be adjusted in any way, since it is a fixed value, regardless of whether it falls on a leap year or not. Also, in this situation there are no excluded periods.

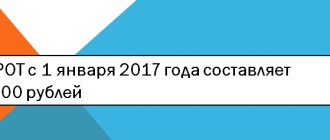

The average daily wage that was actually calculated must be compared with the minimum limit. It can be determined based on the minimum wage in the manner prescribed in paragraph 15/3 of Regulation No. 375. Minimum limit of average daily wage for calculating sick leave benefits in 2021. is 246.57 rubles (7500 rubles X 24 months / 730 days). After comparing the actual average daily earnings and the minimum limit for its size, the amount that is larger is assigned to payment.

The reason for the changes is the increase in the minimum wage

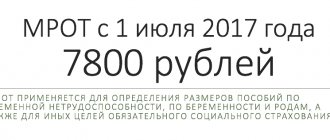

From July 1, 2021, organizations and individual entrepreneurs are required to pay employees wages of at least 7,800 rubles (that is, no less than the new minimum wage). See “Minimum wage from July 1 in Russia.” If the salary does not reach the specified amount, then it needs to be increased.

Note that the increase in the minimum wage from July 1 in some situations will affect the calculation of sick leave, maternity and child benefits. Let's look at this issue in more detail. However, we will immediately say that no indexation of benefits has occurred since July 1, 2021. It’s just that due to the increase in the minimum wage, there have been changes in the calculation and minimum values.

Calculation of sick leave benefits using an example

Manager A.A. Petrov has been on sick leave since January 15, 2017. until January 21, 2017 inclusive (that is, seven full calendar days). The employee’s insurance experience is more than 8 years; for this reason, he is entitled to receive benefits due to temporary disability in the amount of 100% of the average salary.

The average daily wage for calculating benefits is 723.29 rubles. Thus, the amount of the benefit for the first three days of illness, which should be paid to the employer, is 2169.87 rubles (723.29 rubles X 3 days).

The benefit for the remaining days of illness must be paid at the expense of the Social Insurance Fund of the Russian Federation; its amount is 2893.16 rubles (723.29 rubles X 4 days).

The total amount of the benefit is 5063.03 rubles (2169.87 rubles + 2893.16 rubles).

Table with totals

In the table below we have summarized the values associated with benefits. In the table, in particular, you can see changes in the amount of child benefits from July 1.

| Benefit | From February 1, 2021 | From July 1, 2021 |

| Maximum monthly child care benefit | 23 120, 66 rub. | 23 120, 66 rub. |

| Minimum amount of maternity benefit | · RUB 34,521.20 - in general; · RUR 47,836.62 – during multiple pregnancy; · RUB 38,466.48 - during complicated childbirth. | · RUB 35,901.37 (256.438356 × 140 days) – in the general case; · RUR 49,749.04 (256.438356 x 194 days) – in case of multiple pregnancy; · 40,004.38 rub. (256.438356 x 156 days) – for complicated childbirth. |

| Maximum amount of maternity benefit | · RUR 266,191.8 - in general; · RUR 368,865.78 – during multiple pregnancy; · RUR 296,613.72 - during complicated childbirth. | · RUR 266,191.8 - in general; · RUR 368,865.78 – during multiple pregnancy; · RUR 296,613.72 - during complicated childbirth. |

| Minimum amount of benefit for child care up to one and a half years old | · 3065.69 rubles – for the first child; · 6131.37 rubles – for the second and subsequent children. | · 3120 rubles – for the first child; · 6131.37 rubles – for the second and subsequent children. |

| Maximum monthly allowance for child care up to 1.5 years | RUB 23,120.66 | RUB 23,120.66 |

| Benefit for registration in early pregnancy | 613, 14 rub. | 613, 14 rub. |

| One-time benefit for the birth of a child | 16,350, 33 rub. | 16,350, 33 rub. |

Determining the amount of maternity benefit in 2021.

To calculate the amount of benefits due to pregnancy and childbirth, you should apply the appropriate formula (according to Article No. 14, paragraphs 4, 5 of Federal Law No. 255).

Amount of maternity benefit in 2021 = average daily wage X number of days of maternity leave.

The formula according to which it is necessary to determine the average daily wage for calculating maternity benefits in 2021 can be found below:

Average daily wage for calculating maternity benefits in 2017 = income received in 2021 (maximum limit not established) + income received in 2015 (maximum limit is 670,000 rubles) / 731 days (excluded days should be subtracted).

It should be recalled that 731 is the number of calendar days in the billing period (in other words, 365 days in 2015 and 366 days in 2016). In addition, certain days, if any, must be subtracted from the specified period. Accordingly, from the income the amounts that were accrued for these days. Which days are excluded are presented in the table below.

| № | Periods excluded from the calculation of average daily wages |

| 1 | Period of temporary incapacity for work |

| 2 | Parental leave |

| 3 | Leave due to pregnancy/childbirth |

| 4 | Days on which a woman was released from work in accordance with the laws of the Russian Federation, with the condition of full or partial retention of wages (if contributions to the Social Insurance Fund were not paid from the wages that were saved) |

The resulting average salary should be compared with the maximum permissible limit. If the calculated result turns out to be greater, this amount should be taken into account for calculating benefits. This is stated in Article No. 14, paragraph 3.3 of Federal Law No. 255.

New minimum child care size

Now let's talk about the increase in child benefits from July 1, 2017. So, let us recall that the employer must pay child care benefits to the employee monthly in an amount equal to 40% of average earnings, but not less than the minimum amount (Clause 1, Article 11.2 of the Federal Law of December 29, 2006 No. 255-FZ).

At the same time, the minimum basic amount of child care benefits is established by Part 1 of Article 15 of the Law of May 19, 1995 No. 81-FZ and is:

- when caring for the first child - 1500 rubles. per month;

- when caring for the second and subsequent children - 3000 rubles. per month.

These amounts are indexed each year by the appropriate coefficient. Taking into account all indexation coefficients, as of February 1, 2021, the minimum child care benefits were as follows (“Children’s benefits from February 1, 2021”):

- 3065.69 rubles – for the first child;

- 6131.37 rubles – for the second and subsequent children.

However, due to the increase in the minimum wage, the minimum amount of child benefit from July 1, 2021, set for February 1, 2021, will increase. After all, the amount of the minimum benefit (for the first child) from July 1, 2021 cannot be less than the amount calculated from the new minimum wage, namely 3,120 rubles (7,800 rubles x 40%).

The minimum amount of benefit for caring for the first child from July 1, 2017 is 3120 rubles. (RUB 7,800 × 40%). However, the new value can only be used if the holiday began on or after 1 July 2021. At the same time, the “minimum wage” for caring for the second and subsequent children has not changed. It will remain at 6,131 rubles after July 1.

Reflection of benefits in accounting

All benefits are not subject to personal income tax, with the exception of sick leave benefits. This tax should be withheld from the entire amount of this benefit in accordance with Article No. 217, paragraph 1 of the Tax Code of the Russian Federation.

As for social benefits, according to Article No. 9, paragraph 1, subparagraph 1 of Federal Law No. 212, as well as Article No. 20.2, paragraph 1, subparagraph 1 of Federal Law No. 125, they are not subject to insurance contributions.

In accounting, during the calculation of benefits, the following entries should be made:

D (20,26,44...) K 70 – benefits are accrued (on sick leave, for the first three days of the employee’s incapacity for work), which is paid at the expense of the company/organization.

D (69) K 70 - the benefit has been accrued, which is paid from the funds of the Social Insurance Fund.

D (70) K (68) – withholding of personal income tax from benefits due to temporary disability.

D (68) subaccount “Calculation of personal income tax” K (51) – payment of personal income tax, which was withheld from benefits due to temporary disability.

D (70) K (51, 50) – payment of benefits to the employee.

It is worth noting that under the simplified tax system, only that part of the benefits that is not reimbursed by the Social Insurance Fund can be taken into account. In other words, this is only a benefit due to temporary disability for the first three days of illness. Therefore, the amount for these days can be included in the tax base under the simplified tax system. If the object is “income minus expenses”, then it is included in the expenses of the “simplified”, and if the object is “income”, then in the tax deduction line. This is approved by Article No. 346.16, paragraph 1, subparagraph 6 and Article 346.21, paragraph 3.1 of the Tax Code of the Russian Federation.

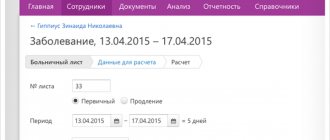

A sick leave certificate is a document in the form established by law issued by a medical institution to a citizen to confirm his absence from work and failure to fulfill his duties due to temporary disability.

According to the law, only employees who work full time on the employer’s premises have the right to payments under this sheet. Those working under a civil contract also do not have the right to claim sick leave.

Incapacity for work on vacation days at your own expense, as well as arrest, are not covered by payments.

For example, if an employee took a week of unpaid leave, but two days before returning to work he opened a sick leave. He stayed sick for a few more days, thus “extending” his vacation. In this case, benefits for the first two days of incapacity will not be accrued to him; in the calculation, only the days when he should have been present at the workplace will be taken into account.

Even citizens who quit their job less than a month ago can receive a small amount of money after illness. The benefit is available to all insured citizens of Russia, as well as foreigners living in the Russian Federation and even stateless persons. But provided that before the citizen fell ill, the policyholder regularly paid contributions to the Fund for six months.

The reasons for obtaining sick leave from a medical institution may be:

- Own illness (injury);

- A relative has an illness as a result of which he or she requires care;

- Approaching birth, postpartum period for women;

- Quarantine.

Until recently, the FSS was strict about whether a medical institution had an expert license, but after a series of lawsuits they lowered the requirements for certification.

An employee is required to submit a sick leave certificate to the accounting department at his place of work no later than six months after his recovery.

Regional minimum wage

In addition to the federal minimum wage, there is a regional minimum wage. It is determined by the authorities of the constituent entity of the Russian Federation, taking into account the position of trade unions and employers. Private organizations that are not financed from the federal budget have the right to participate in this process (if desired). The decision is formalized by a regional agreement.

According to Art. 133.1 of the Labor Code, it is permissible to set the indicator in question greater than or equal to the federal minimum wage. But no less. Its values for some regions are presented in the table below.

| Minimum wage in some regions of Russia | ||

| Region | Minimum wage value | Minimum wage forecast |

| from 07/01/2016, rub. | as of 01.07. 2021, rub. | |

| Moscow | 17300 | 17992 |

| Moscow region | 12500 | 13750 |

| Saint Petersburg | 11700 | 16000 |

| Murmansk region | 13650 | 14196 |

| Kirov region | 7500 | 7800 |

| Vladimir region | 8500 | 8840 |

| Kursk region | 9293 | 9665 |

| North Ossetia | 7500 | 7800 |

When the regional minimum wage is increased, the legislation does not require that the average salary also be compared with this indicator, and an additional payment occurs before it. The management of each organization can make such a decision only at its own discretion.

Also see “Minimum wage from January 1, 2021.”

Read also

02.05.2017

Limitation of sick pay days

In certain situations, the law provides for restrictions on the maximum period of illness for which benefits can be received.

Let us list the main cases.

| Happening | Maximum duration of one paid sick leave | Maximum paid days per calendar year |

| Caring for a sick child under 7 years of age (of any degree of relationship) | – | 60 days (for each child) Exception: a number of diseases approved by order of the Ministry of Health and Social Development N 84n - 90 days |

| Caring for a disabled minor | – | 120 days |

| Child care 7-15 years old | 15 days | 45 days |

| Caring for any other family member | 7 days | 30 days |

| For disabled employees | 120 days | 150 days |

| Continuation of treatment in a Russian sanatorium | 24 days | Not limited |

| Singleton pregnancy | 140 days | Not limited |

| Multiple pregnancy | 194 days | Not limited |

| Complicated childbirth | 156 days | Not limited |

The employer himself is obliged to keep records of paid periods for each employee. If an employee presents a sick leave certificate after his absence, but he has already received the permissible maximum payments for this calendar year, then the document becomes a certificate confirming a valid reason for the leave.

What else should a temporarily disabled person know?

Even if an employee falls ill during his vacation, he must consult a doctor. Having received a sick leave certificate, he has the right to ask for an extension of leave for the number of days indicated on the certificate of incapacity for work. Sick leave during vacation is paid in the same way as if the person had to work at that time.

They don't let me go on vacation - what should I do? Types of leave and procedure for granting

If a person works in several organizations, he has the right to receive sick pay in each of them. If an employee who terminates the contract with the organization falls ill, he is also entitled to disability benefits. It is paid taking into account a coefficient of 0.6 if the employee falls ill within 30 days after termination of the contract.

Rules for filling out sick leave

A certificate indicating a period of incapacity for work is filled out by a doctor, however, the employer is obliged to check the authenticity of the document and the absence of errors in it.

An incorrectly drawn up sheet sometimes becomes the reason for the FSS’s refusal to reimburse benefits. Errors in names and dates are especially common.

Basic filling rules relevant for this year:

- The doctor can leave the “place of work” field blank, then the employer must enter the correct name using a gel pen with black ink;

- Corrections made by a doctor are not permitted. Therefore, if he made a mistake when filling it out, he is obliged to immediately issue a duplicate;

- The document must bear the seal of the medical institution. The law does not establish any requirements for its type;

- Technical design flaws (stamps falling on fields to be filled out) cannot become a reason for the FSS not to accept the sheet, provided that the main condition is met - the text is readable and there are no factual errors in it.

Calculation of sick leave

Before paying an employee for the period of his illness, the amount of payment must be correctly calculated.

Let's divide this stage into several steps:

Step 1. Calculate the citizen’s total salary for the two previous calendar years.

Even if he goes on sick leave at the end of 2021, the calculation will be based on his salary from January 1, 2015 to December 31, 2016.

Only payments from which contributions to the Fund were paid can be taken into account. If an employee joined your organization less than two years ago, you will have to obtain a certificate of income from the previous place of work, or request it from the Pension Fund.

Here we also encounter limitations. The Social Insurance Fund has determined the maximum value to be insured. In 2015 – 670,000 rubles, in 2021 – 718,000 rubles. An employee's income exceeding the limit will have to be rounded to the maximum possible amount.

Step 2. Calculate average daily earnings.

Divide the value obtained after the first step by 730 (this is a constant average number of days in two calendar years).

The result can be anything, but for further calculations you should make sure that it is greater than the minimum equal to the minimum wage (in 2017 this is 246.58 rubles per day). This value is the same for all regions of Russia and is valid until the summer of 2021. If the amount turns out to be less or even zero (the citizen did not receive earnings subject to insurance contributions), the value of 246.58 rubles is used for further calculations.

At the beginning of 2021, the minimum average daily earnings is 246.58 rubles. Maximum – 1901.37 rubles.

The minimum wage will increase to 7,800 rubles starting in July of this year; accordingly, the minimum daily wage will increase to 256.44 rubles.

Step 3. Daily earnings must then be adjusted according to the employee’s insurance coverage.

The longer a citizen’s experience as an insured person, the greater the amount of benefits that he can receive after illness.

Calculation of length of service for sick leave is done according to the following scheme:

- The number of full calendar years, months, days that the citizen worked in each place where contributions to the insurance fund were paid for him is calculated;

- The values are added up separately by full year, month, and day;

- The resulting terms must be rounded. The sum of months is more than 12 - converted into years, and if there are more than 30 days, they are converted into months. Thus, the length of service is rounded up to years, and the remainder of incomplete months and days is discarded.

Exception: workers with difficult and harmful conditions, or injured at work through no fault of their own - for them the benefit is paid in full.

For caring for a sick child (this does not have to be a son or daughter; a younger brother or sister, nephew or grandson can get sick), according to the table below, only the first 10 days are paid, the next - 50%.

| Employee's insurance period | Benefit amount relative to average salary |

| More than 8 years | 100% |

| 5-8 years | 80% |

| Less than 5 years | 60% |

| An employee who left the organization less than 30 days ago (for any length of service) | 60% |

The length of service is restored according to the work record book, certificates from previous places of work or upon request to the Pension Fund.

Step 4. Multiply the value obtained as a result of the third step by the number of days during which, according to the certificate, the employee was incapacitated.

When counting days you need to be extremely careful. As practice shows, this is where the most common mistakes lie. For example, a sick leave opened on April 1, and closed on April 16 is equal to 16 days (not 15!).

Only some days are not taken into account, which are exceptions:

- The employee was suspended from performing his duties in accordance with the law (for example, for a violation), or was released from work with continued pay;

- The employee was taken into custody and was under arrest;

- Period of the forensic medical examination;

- Days of downtime.

Step 5. Subtract personal income tax (13%).

The tax amount must first be rounded to the nearest ruble. The resulting value will be the amount of the benefit issued.

New minimum maternity benefit

When calculating maternity benefits, the average daily earnings cannot be less than the value determined by the following formula (Part 1.1, Article 14 of Law No. 255-FZ):

Minimum average daily earnings = minimum wage at the beginning of vacation x 24 / 730

From January 1, 2021, the federal minimum wage was 7,500 rubles. See “Minimum wage from January 1, 2021.”

Therefore, if maternity leave began in 2021 (from February 1 to June 30), then the minimum average daily earnings for calculating maternity benefits should be taken equal to 246.58 rubles. (RUB 7,500 × 24 / 730). This value is used for further calculation if it turns out to be greater than the actual average daily earnings of the employee. The minimum amounts of maternity benefits from January to June 2021 (inclusive) are as follows:

- RUB 34,521.20 (246.58 rubles × 140 days) – in the general case;

- RUR 47,836.62 (246.58 rubles x 194 days) – in case of multiple pregnancy;

- RUB 38,466.48 (RUR 246.58 x 156 days) – for complicated childbirth.

From July 1, 2021, the federal minimum wage will increase and amount to 7,800 rubles. Therefore, for insured events after June 30, 2021, earnings for maternity benefits must be compared with the new “minimum wage” - 256.438356 rubles. (RUB 187,200 / 730) If actual earnings are below the minimum, then assign a benefit based on this value. Here are the minimum amounts of maternity benefits from July 1, 2021:

- RUB 35,901.37 (256.438356 × 140 days) – in the general case;

- RUB 49,749.04 (256.438356 x 194 days) – in case of multiple pregnancy;

- RUB 40,004.38 (256.438356 x 156 days) – for complicated childbirth.

Who pays for sick leave?

Initially, the employer pays the benefit to the sick person, then, after all the documents are completed and submitted to the Social Insurance Fund, he is compensated for part of the amount - payments for the fourth and subsequent days of incapacity for work.

This situation, which is costly for the entrepreneur, applies in cases where a subordinate was absent from the workplace due to his own illness or injury.

For other cases (for example, caring for a sick relative), the Social Insurance Fund reimburses sick leave starting from the first day.

Already now, in certain regions of the country (for example, in the Samara region), there is an experimental system in place where sick leave payments are credited directly to the employee’s individual account by the Social Insurance Fund.

At the all-Russian level, it is planned to introduce a similar system from January 2021. That is, the Social Insurance Fund will not compensate the payment to the employer, but will independently accrue it to the insured person.

New participants in the pilot project

In 2021, the FSS continues the pilot project. As part of this project, workers receive benefits through the Social Insurance Fund, and not through employers. From July 1, several additional entities will join the pilot project. We list them in the table:

| Region |

| Republic of Adygea (Adygea) |

| Altai Republic |

| The Republic of Buryatia |

| Republic of Kalmykia |

| Altai region |

| Primorsky Krai |

| Amur region |

| Vologda Region |

| Omsk region |

| Oryol Region |

| Magadan Region |

| Tomsk region |

| Jewish Autonomous Region |

Documentation

To reimburse funds spent on sick leave, an entrepreneur must provide to the Social Insurance Fund at the place of his registration:

- An application containing the details of the entrepreneur and the amount of benefits paid;

- Calculation (form 4-FSS) indicating the average earnings, period and cause of incapacity for work of the insured citizen, his length of service;

- A copy of the certificate of incapacity for work.

Documents are reviewed on average no more than 10 working days.