The need for accounting and accounting policies

The basic provisions on the rules of accounting are contained in the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (as amended on December 28, 2013, as amended and supplemented). According to this 402-FZ, any economic entity is required to maintain accounting, unless otherwise established by this law.

According to the Federal Law “On the Development of Small and Medium Enterprises in the Russian Federation” and other regulations, an individual entrepreneur can use simplified methods of accounting , including simplified accounting (financial) reporting.

When choosing which simplified methods to use for accounting, an individual entrepreneur must proceed from the requirement of Part 1 of Article 13 of the Federal Law “On Accounting” - accounting statements must provide a reliable representation of the financial position and cash flows.

Accounting policies must provide for rational accounting.

An individual entrepreneur, when forming an accounting policy, may provide for maintaining accounting using a simple system (without using double entry, without a chart of accounts), adopt a simplified system of registers (simplified form) of accounting, or decide to conduct accounting without using accounting registers (according to PBU 1/2008 “Accounting Policy organization”, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n).

A simple form of accounting (without registers) means recording business transactions only in the Book (journal) of recording facts of economic activity. Maintaining this book allows, if necessary, to determine the availability of property and funds from an individual entrepreneur on a certain date and to draw up financial statements, i.e. solve accounting problems.

may not maintain accounting (according to the Federal Law “On Accounting”, Article 6, Part 2).

Thus, individual entrepreneurs using the simplified tax system may not conduct accounting or submit financial statements.

Is it difficult to do it yourself?

As an individual entrepreneur, every penny counts, and having an accountant on staff or paying for the services of an outsourcing company costs a lot of money, so the “own accountant” scheme looks simple and convenient.

How to conduct accounting for individual entrepreneurs using the simplified tax system 6% yourself - step-by-step instructions

Brief instructions on how to keep records yourself:

- Estimated income and expenses should be calculated in advance, even before opening an individual entrepreneur. At the same stage, you need to decide whether there will be hired workers, and if so, how many.

- Based on previous calculations, choose a suitable taxation scheme, calculate the expected tax burden, and study the reporting filing time.

- When a business is already open, it is necessary to keep everything related to finances in writing - record the income and expenses of the enterprise, employee salaries, and draw up contracts. If the counterparty refuses to draw up documentation, this is a reason to think about his honesty.

- It is advisable to install specialized programs for small businesses that help keep records and fill out forms (1C-Entrepreneur). This will make the documentation process more convenient and transparent.

- If the taxation scheme has changed, or the business has been closed, documents must be retained for 3 years - this is how long the statute of limitations period lasts. At this time, a former counterparty or employee may sue, and without documents it will be difficult to prove that the individual entrepreneur handled the finances fairly.

Note ! The experience of small enterprises, where all financial accounting is carried out by the owner himself, shows that this method of maintaining documentation is quite viable.

In difficult situations, you can always order advice on accounting and legal issues; on some sites it is free for beginning entrepreneurs. But it is important to remember that an outsider does not know the nuances of a particular enterprise and is not interested in its financial well-being.

To do your bookkeeping correctly, you can hire an accountant.

Transition of individual entrepreneurs to a simplified taxation system

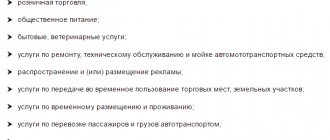

The individual entrepreneur makes such a transition on a voluntary basis. However, there are conditions under which you cannot switch to the simplified tax system . According to clause 3 of Article 346.12 of the Tax Code of the Russian Federation, individual entrepreneurs cannot switch to and apply the simplified tax system:

- engaged in the production of excisable goods;

- engaged in the extraction and sale of non-common minerals;

- switched to paying the unified agricultural tax (USAT);

- whose average number of employees exceeds 100 people;

- who failed to notify the tax authority of the transition to the simplified tax system within the prescribed period.

Read more about the application of the simplified tax system in the article - Simplified taxation system, as well as in Chapter 26.2 of the Tax Code of the Russian Federation.

How can an individual entrepreneur switch to the simplified tax system?

In order for an individual entrepreneur to use the simplified tax system, you need to submit a notification to the tax authority in the form “26.2-1” :

notifications about the transition to a simplified taxation system.

If the individual entrepreneur has just been registered (newly), then the notification of the transition to the simplified tax system is submitted no later than 30 calendar days from the date of registration of the individual entrepreneur for tax registration. In this case, it is considered that the individual entrepreneur has switched to the simplified tax system from the date of tax registration (this day often coincides with the day of state registration of the individual entrepreneur).

If the individual entrepreneur is already operating and uses other taxation systems, then a notification of the transition to the simplified tax system from the beginning of the next year must be submitted to the tax authority no later than December 31 of the current year . That is, such an individual entrepreneur will not be able to switch to the simplified tax system before next year.

With one exception.

An individual entrepreneur who has ceased to be a payer of the single imputed tax (UTI) has the right to switch to the simplified tax system from the month in which his obligation to pay UTII ceased. To do this, he must submit a notification about the transition to the simplified tax system no later than 30 days after the termination of his obligation to pay UTII.

An individual entrepreneur who pays UTII for certain types of activities simultaneously apply the simplified tax system, but in relation to other types of activities.

In the notification, the individual entrepreneur must indicate his chosen option for the object of taxation on the simplified tax system - “income” or “income reduced by the amount of expenses.”

An individual entrepreneur who has switched to the simplified tax system does not have the right to switch to a different taxation regime until the end of the year (as well as to change the variant of the object of taxation of the simplified tax system), but has the right to simultaneously apply the patent taxation system and, as noted above, UTII.

If an individual entrepreneur has ceased the type of activity in respect of which he applied the simplified tax system, he is obliged to notify the tax authority of the date of such termination no later than 15 days.

Read more about the transition to the simplified tax system in the article - Notification of the transition to the simplified tax system.

Cost of accounting

The cost of accounting will depend on various indicators.

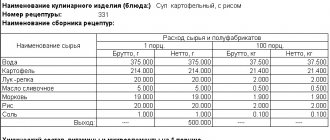

Table: cost estimate based on the actions of the accountant

| Actions to be assessed | Indicators affecting cost |

| Accounting and tax accounting work | Depends on the name of the documents and their quantity, as well as on the taxation system. |

| Payroll and personnel records | The cost of these works depends on the number of employees. |

| The cost of restoring accounting | Depends on:

|

The cost of accounting varies depending on the type of activity of entrepreneurs

When carrying out entrepreneurial activities, citizens can delegate some of their accounting responsibilities to third-party organizations. Transferring accounting services to specialized organizations (outsourcing) has a number of advantages:

- There are no extra costs for setting up a workplace with all the attached equipment. Such organizations already have everything they need;

- there is no need to make contributions to the tax authorities for the organization’s remote work. A full-time employee always has the right to count on payment of salary regardless of his presence at the workplace (vacation, maternity leave, sick leave, etc.);

- rapid resolution of complex issues is ensured due to well-functioning work;

- a company or individual entrepreneur is protected by an agreement, which is drawn up when transferring accounting responsibilities. Companies or individual entrepreneurs that have their own accountant are not insured against paying fines due to his errors;

- maintaining confidentiality.

At the same time, no one is immune from risks. There are the following disadvantages in delegating accounting powers to organizations:

- risk of loss of reputation (it may be associated with unsatisfactory provision of services by the outsourcer);

- risk of information leakage (despite a formalized confidentiality agreement, leakage sometimes occurs);

- the risk of reduced responsiveness to accounting problems.

The cost of attracting an outsourcing company depends on the turnover of business activities

The accounting services package typically includes the following responsibilities:

- 1C support;

- current accounting of all registers;

- formation of a book of purchases, sales, cash reporting;

- calculation of salaries and other remunerations;

- personnel records management;

- preparing tax and accounting reports and submitting them to government agencies;

- protection of the customer’s interests in the tax office.

When an individual entrepreneur loses the right to use a simplification

If during the reporting (tax) period the income of an individual entrepreneur exceeded 150 million rubles and (or) the individual entrepreneur did not comply with the above conditions for applying the simplified tax system (established in paragraph 3, paragraph 4 of Article 346.12 and paragraph 4 of Article 346.13 of the Tax Code of the Russian Federation), then such an individual entrepreneur is considered to have lost the right to the simplified tax system from the quarter in which the violations were committed.

The individual entrepreneur must report such loss to the tax authority no later than 15 days.

An individual entrepreneur can switch to the simplified tax system again, but not earlier than a year after losing the right to the simplified tax system.

If, at the end of the year, the conditions for applying the simplified tax system were not violated, the individual entrepreneur has the right to apply the simplified tax system next year.

When can you outsource your accounting?

Certificate from the place of work with an individual entrepreneur - how to do it correctly

Outsourcing IP management is a way to reduce the cost of accounting services and at the same time receive professional help. Outsourcing firms offer accounting support for individual entrepreneurs and small firms that cannot employ their own accountants.

The advantages of this approach are that outsourcers have sufficient resources for full reporting, guarantee quality services and are cheaper than staff accountants. For small businesses and individual entrepreneurs, the pros far outweigh the cons.

What does switching to the simplified tax system give to individual entrepreneurs?

First of all, the use of the simplified tax system replaces three with one tax. In accordance with paragraph 3 of Art. 346.11 of the Tax Code of the Russian Federation, individual entrepreneurs are exempt from the obligation to pay:

- personal income tax (on income from activities as an individual entrepreneur, but excluding dividends);

- tax on property of individuals (but except for property not used by individual entrepreneurs for business activities, as well as except for property, the tax base for which is determined from the cadastral value);

- value added tax (VAT) (but excluding VAT on import transactions).

Expenses that may reduce income

Under the simplified tax system, not all costs of an individual entrepreneur associated with generating income can be classified as expenses that reduce income. But only those defined by Art. 346.16 of the Tax Code of the Russian Federation. This is a fairly extensive list, but it is better not to interpret it yourself.

You only need to count as expenses what is on this list.

Expenses include:

- for the purchase of raw materials;

- for the acquisition of fixed assets;

- to pay for goods purchased for subsequent sale;

- for remuneration of employees;

- to pay taxes, insurance premiums, fees and other costs.

The most important rule when accounting for expenses on the simplified tax system: expenses are recognized as expenses only after actual payment and in the presence of supporting documents.

Money Lover

Money Lover app

The program is an excellent tool for those who want to keep their personal finances under control. The app seamlessly integrates across multiple devices and provides easy access to data anywhere

Main functions and features:

- budget planning;

- notifications about exceeding the spending limit;

- creating categories for any occasion;

- reminders about upcoming payments;

- shared access to the wallet for all family members and partners;

- generation of reports in the form of simple and understandable diagrams with visual...;

- personalization – beautiful icons for individual categories;

- saving and restoring data.

Premium package users have access to additional privileges:

- access to the web version;

- no advertising;

- management of debit cards and credit cards;

- export operations and much more.

The application is available on Google Play and App Store.

Losses

A loss is the excess of expenses over income.

Choosing an individual entrepreneur as an object of taxation under the simplified tax system “income reduced by the amount of expenses” allows you to reduce the tax base of the current year by the amount of losses from previous years. Moreover, losses can be carried forward to the next year for 10 years following the year in which losses were incurred.

Also, the individual entrepreneur has the right to add to the loss or include in the expenses of the following years the difference between the calculated tax and the minimum tax paid.

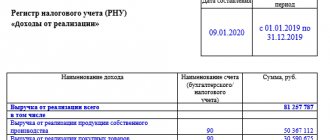

Book of income and expenses

An individual entrepreneur must take into account his income and expenses and reflect them in a special “ Book of accounting for income and expenses of organizations and individual entrepreneurs using a simplified taxation system .” This is necessary to determine the taxable base and calculate tax.

Order of the Ministry of Finance of the Russian Federation dated October 22, 2012 No. 135n (as amended on December 7, 2016 No. 227n) approved the form of the book and the procedure for filling it out.

organizations and individual entrepreneurs using a simplified taxation system.

Software to simplify accounting

Automated data accounting is a convenient form of entering income, expenses and generating reports. When using the program:

- ensuring the relevance of legal requirements;

- data is grouped according to analytical criteria to obtain reports and internal reporting;

- automatic calculation of taxes for advance payments and final settlement with the budget is carried out;

- KUDiR and reporting are generated automatically based on the entered data;

- Data is downloaded for further transmission to control authorities.

A program to help keep records of individual entrepreneurs allows you not to have a staff of special workers or reduce the complexity of data processing. The product is adapted to individual operating conditions.

Read about the characteristics of the software in the material “Review of free accounting programs for the simplified tax system.”

Calculation and payment of tax simplified tax system

The tax amount is equal to the product of the taxable base for a certain period and the tax rate.

But before you count, individual entrepreneurs need to check the simplified tax system tax rate with their tax office. The fact is that a specific rate of the simplified tax system is established by a subject of the Federation, which is given the right by federal legislation to reduce the rate (and even set it to zero) for a certain period or for certain categories of tax payers.

“The tax levied on taxpayers who have chosen income as an object of taxation” (as it is called in the table of budget classification codes - KBK) is equal to the product of the tax base (amount of income, revenue) and the tax rate equal to 6%.

The amount of the simplified tax system can be reduced to 50% if you deduct the amount of insurance contributions paid for a specific reporting period for compulsory and voluntary pension, compulsory medical, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory social insurance against accidents for production and occupational diseases, as well as the amount of the trade tax (if applicable).

“The tax levied on taxpayers who have chosen income reduced by the amount of expenses as an object of taxation” is equal to the product of the taxable base (i.e., the difference between the amount of income and the amount of expenses (determined in accordance with Article 346.16 of the Tax Code of the Russian Federation) and the tax rate, equal to 15%.

Next, you need to compare the resulting tax amount with the amount of the so-called minimum tax (it is equal to 1% of revenue).

If the calculated tax amount is less than the minimum, then the minimum tax must be paid. That is, when comparing two amounts, we choose to pay the larger one.

The simplified tax system must be calculated and paid for the tax period (year). But in the middle of the year, three advance payments must be calculated and paid quarterly, which are then taken into account when calculating the tax for the year.

The calculation of advances is the same as the tax in general, but the amounts of income and expenses are taken on an accrual basis for a specific reporting period - first for the first quarter, then for six months, then for 9 months.

Advance payments of the simplified tax system must be paid by the 25th day of the month following the reporting period (quarter, half-year, 9 months):

- for the first quarter of the year (from January to March) – until April 25;

- for six months (from January to June) – until July 25;

- for 9 months (from January to September) – until October 25.

Tax for the year is paid by individual entrepreneurs no later than April 30 of the following year.

The following BCCs must be indicated in payment orders (receipts):

income - 18210501011011000110

income minus expenses - 18210501021011000110

Pros and cons of using online accounting

The use of Internet technologies for accounting has long been common. Transferring accounting to electronic version has a number of advantages:

- there is no attachment to a specific place of work (all information is concentrated on servers that can be connected to from any computer);

- no need to download special applications and programs;

- security guarantee (it is believed that information stored on servers is difficult to intercept).

It is worth keeping in mind that the cost of online services can be significantly lower than the cost of licensed accounting programs

The disadvantages of online accounting are as follows:

- dependence on the Internet;

- dependence on the quality of the browser;

- standard set of settings (cannot be adjusted to suit your interests).

Electronic accountant Elba

Using the service, an individual entrepreneur can maintain primary documentation, generate reports, plan finances, etc. Using an electronic accountant allows you not to spend extra money on accounting services from third-party organizations or a professional specialist. Electronic accounting is intended for those who use the simplified tax system and UTII with no more than 50 employees.

Electronic accountant Elba was specially designed for small businesses

Electronic accountant Elba consists of the following sections:

- trade (filling out accounts, acts, drawing up contracts);

- personnel records (salaries, taxation of personnel salaries, etc.);

- accounting;

- reporting (individual for each specific case).

Pros of this online accountant:

- preparing and sending tax reports via the Internet;

- data encryption when opening access to multi-level authorization;

- possibility of opening a bank account;

- there is a version for mobile devices;

- provides expert advice on accounting within the service;

- provides a customized tax calendar, etc.

Cons of Elba:

- lack of a common taxation system;

- there is no support for some specialized tasks (for example, accounting for agricultural producers).

Online accounting from Tinkoff

To pay taxes and insurance premiums, businessmen can use accounting from Tinkoff. This accounting is designed not only for large companies, but also for representatives of small and medium-sized businesses.

Online accounting from Tinkoff is suitable for entrepreneurs using the simplified tax system and UTII

Advantages of accounting from Tinkoff:

- a fairly long trial period (i.e. the system can be tested for 2 months or the first six months after registering your own business);

- timely reminder of the need to pay taxes;

- there is access to built-in accounting with free issuance of a personal electronic signature;

- automatic calculation of taxable income;

- quickly generate a tax return and send it over the Internet.

The main disadvantage of this accounting is considered to be the insufficiently wide coverage of taxation systems.

Other electronic assistants

In addition to the above-mentioned online accountants, there are others. Thus, the “My Business” service for small businesses and “Sky” for small companies and individual entrepreneurs are popular.

Advantages of an accountant “My Business”:

- inexpensive service, especially for individual entrepreneurs without employees;

- unlimited consultations;

- fast technical support.

Internet accounting “My Business” has a large number of videos on accounting

Disadvantages of this online system:

- there is no general taxation system;

- you must pay a subscription for the year;

- three-day trial period (significantly lower than many other services).

The capabilities of the Sky service are as follows:

- supports accounting for systems such as OSNO, simplified tax system and UTII;

- prepares and tests reports;

- supports payroll and warehouse accounting;

- provides an individual tax calendar;

- sends reporting documents and more.

Individual entrepreneurs using UTII, general or simplified taxation systems can use the online service "Sky"

The disadvantage of this service is that the trial version is only valid for 2 weeks. In addition, there is no opportunity to maintain management accounting.

When choosing one or another electronic assistant, you need to familiarize yourself with the capabilities of each system and analyze the functions offered. The choice of individual entrepreneur will depend on the tax system, i.e. on the nature of the reporting activity.

Tax return simplified tax system

Before April 30, an individual entrepreneur must submit to the tax office at his place of residence (registration of an individual entrepreneur) a tax return on the tax paid in connection with the application of the simplified taxation system for the past tax period (year). This deadline coincides with the deadline for paying the simplified tax system.

There is no point in waiting until the last minute to give up. And it makes more sense to submit your declaration first, and only then pay the tax.

tax return for tax paid in connection with the application of the simplified taxation system.

You can fill out the declaration using numerous software tools or on-line services.

Useful tools for individual entrepreneur accounting

Programs that help with online accounting will make it more transparent and make the work of an entrepreneur easier.

Special programs simplify accounting

Most popular:

- “My Business” is a tool for running a small business that takes into account different taxation systems, helps calculate salaries, and a system for drawing up contracts. There is a possibility of free consultation with specialists. The service is paid.

- “Accounting: Kontur” – independently generates declarations, helps draw up documentation and allows you to view the history of relationships with another client of the system. For those who recently purchased the software, step-by-step instructions are provided. The service is paid, the demo version works for a month.

- "BukhSoft-online" - helps to take into account warehouse turnover, accounting documents, and prepares reports to the Pension Fund and the tax office. The program allows you to buy software modules and use only the sections you need.

- “Sky” - the service allows you to manage several legal entities. You can also monitor your accounting outsourcing. The service is free for individual entrepreneurs without employees; it comes with a tutorial for those who installed it for the first time.

Note ! Each of these services has its own advantages and disadvantages. The entrepreneur independently chooses the most convenient service for him.

Insurance premiums for individual entrepreneurs

For himself, without employees, the individual entrepreneur must pay contributions to mandatory pension and health insurance.

The annual amount of these payments is fixed and is paid regardless of whether the individual entrepreneur has income or not.

Fixed amount of contributions for compulsory pension insurance:

- with income for 2021 of less than 300 thousand rubles. = 36,238 rub.;

- with income for 2021 of more than 300 thousand rubles. = 36,238 rub. + 1% from amounts over 300 thousand.

Fixed amount of contributions for compulsory health insurance = 6,884 rubles.

1 percent of the amount exceeding 300 thousand rubles must be paid before July 1, 2021, and the remaining contributions must be paid before December 31, 2019.

The amounts of insurance contributions for compulsory pension and compulsory health insurance are calculated and paid separately.

KBC fixed contributions:

OPS – 18210202140061110160

Compulsory medical insurance – 18210202103081013160

If an individual entrepreneur is registered in the current year, his fixed contribution amount is proportional to the number of months starting from the beginning of his activities. For an incomplete month, the amount of contributions is proportional to the number of calendar days of that month.

If an individual entrepreneur ceases his business activities in the current year, the fixed amount of insurance premiums is determined in proportion to the number of calendar months up to the month in which state registration as an individual entrepreneur expired.

For an incomplete month of activity, the fixed amount of insurance premiums is determined in proportion to the number of calendar days of this month up to and including the date of state registration of termination of activity as an individual entrepreneur.

In case of termination of the activities of an individual entrepreneur, payment of insurance premiums is carried out no later than 15 calendar days from the date of deregistration with the tax authority.

For detailed information on individual entrepreneur insurance premiums for yourself, see the article - Individual entrepreneur insurance premiums, for employees - Taxes and contributions for individual entrepreneur employees

Individual entrepreneur accounting: is there a need for it?

According to the legislative acts of our country, a citizen engaged in entrepreneurial activity is not required to keep accounting records. An individual entrepreneur is exempt from it regardless of what taxation regime he uses. However, accounting will help a businessman to properly plan his activities.

Although the law exempts individual entrepreneurs from the obligation to keep accounting records, for successful business activities it would be useful to maintain such records.

The advantages of accounting are as follows:

- helps to make the correct and timely choice of taxation system, i.e., choose a lower tax burden;

- it makes it easier to meet deadlines for filing various types of reports, pay taxes and fees.

Accounting can be carried out by an entrepreneur independently, but it would still be better to hire a professional - a full-time employee - if the individual entrepreneur himself does not have sufficient qualifications in this area. And there is also a practice of attracting companies specializing in such activities. Independent accounting will be justified if a businessman does not have many business transactions. It should be borne in mind that the chosen taxation system affects the nature of the reporting documentation, the amount of tax and the deadline for its payment.

Video: how to do accounting for an individual entrepreneur

Simplified methods of accounting

Small businesses have the right to use simplified accounting options.

Simplified accounting methods are possible in the following cases:

- the average number of employed people does not exceed 100 people (for microenterprises - up to 15 people);

- revenue from the sale of goods (works, services) excluding VAT or the book value of assets and intangible assets for the previous calendar year does not exceed 400 million rubles. (for microenterprises - 60 million rubles);

- the total share of participation of the Russian Federation, constituent entities of the Russian Federation, municipalities, foreign legal entities, public and religious organizations, charitable and other foundations in the authorized capital is not more than 25%.

Simplified accounting methods can only be used by micro-enterprises that employ up to 15 people

Table: simplified methods of accounting

| Name | Character traits |

| Full form | It is similar to conventional accounting due to the use of the double entry method. In registration documents, all business transactions are recorded twice. This form is suitable for business participants using the accrual method. Diversity in business transactions also serves as a basis for using a full form of accounting. |

| Short form | This form is preferred by taxpayers who use the cash method in their activities. Also suitable for those whose operations are monotonous. |

| Simple form | It is used only by those companies where the number of employees does not exceed 15 people, and revenue for the previous year is no more than 120 million rubles. |

Economic entities that are granted the right to use simplified accounting methods independently make a choice between them. The choice will depend on business conditions, the size of the organization, taking into account the requirement of rationality.

The meaning of simplified methods is to legally reduce payments to the budget when doing business. Simplifying accounting involves preparing reports in an abbreviated form.

Individual entrepreneurs have a choice: keep accounting in a general manner or use a simplified version

The simplified version opens up the following opportunities for individual entrepreneurs:

- reducing the number of synthetic accounts used;

- keeping records using the cash method;

- use of a simplified system of accounting registers to systematize and accumulate information;

- correction of serious errors in accounting and reporting for the current period.