In accordance with current tax legislation, Russians who are individuals are required to pay certain taxes. Some of them, in particular, transport and land taxes, as well as on income and real estate (apartment and other property), are calculated by the tax office. In order for the counterparty to be able to pay them on time, every year he receives a corresponding notification by mail, from which he learns the debt that has formed at the moment and the timing of its payment.

It should be taken into account that this notification must arrive at least 30 days before the deadline for paying each of the taxes listed above. The main document that the counterparty receives by mail is a receipt, which is printed separately for each payment. It is necessary to obtain the details for payment. In addition, the data from the receipt also makes it possible to find out, using online services on specialized websites, an individual’s debts for various taxes, in particular, the already mentioned ones, land, transport and others.

Almost always, a receipt is required when filling out the relevant documents to pay taxes at Sberbank or other financial institutions.

Who should calculate taxes and when and how to find out the debt

Property taxes for individuals are calculated by the tax authorities themselves. This is stated in paragraph 3 of Article 396, Article 408 and paragraph 1 of Article 362 of the Tax Code of Russia.

These articles provide rules for calculating each tax, and the payer can double-check the amount or calculate it in advance in order to plan his budget.

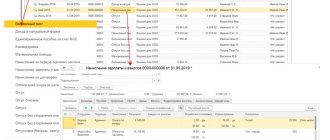

The inspectorate calculates taxes in advance and, based on the amounts received, generates tax notices - written messages to payers about the objects of taxation they have with a table indicating the size of the tax base, rates, accrued amounts and debts, as well as a penalty, if it is collected from the person. The notification is accompanied by ready-made payment notices and receipts for payment.

What is the FSSP - how to find out your debts on a website on the Internet?

Notifications are sent out several months before the due date for payment of taxes for individuals.

There is a single deadline for payment of property payments - December 1 of the year following the year in which the objects of taxation arose.

Personal income tax must be paid by July 15 of the year following the year in which the taxable items arose.

How to find out about debt:

- receive a tax notice by mail - it arrives at the address indicated in the AIS-Tax database; usually this is a citizen’s registration; if the payer is actually located at a different address, you need to inform the inspectorate about this;

- visit the Federal Tax Service and inquire about the presence of charges and arrears;

- view the debt in your Personal Account on the website of the Federal Tax Service of Russia;

- monitor tax accruals through the State Services portal.

If the debts are small, then the inspectorate may not send a demand for payment of taxes, fines and penalties, but the penalty will be accrued every day. In the case of large amounts, the Federal Tax Service creates a demand, and if it is ignored, it proceeds with forced collection.

User's personal account on fiasmo.nalog.ru

In the case of personal income tax, payers independently calculate income, except for wages - it is calculated and paid by the employer.

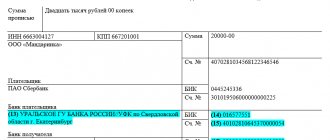

What other details should I pay attention to?

“According to the order of the Ministry of Finance of Russia, since 2015, when paying taxes, taxpayers should not indicate anything at all in field 110 “Type of payment” (Order of the Ministry of Finance dated October 30, 2014 126n). The financial department considered this detail to be unimportant, since it can be easily determined by the BCC indicated in the payment.

At first, the Central Bank of Russia did not agree with this, which demanded that “0” be indicated in field 110 (letter of the Central Bank dated December 30, 2014 No. 234-T). But in November 2015, he changed his position. In the instruction “On amendments to the Regulations of the Bank of Russia dated June 19, 2012 No. 383-P “On the rules for transferring funds”” dated November 6, 2015 No. 3844-U, the Bank of Russia directly stated that field 110 does not need to be filled out. The above instruction came into force on March 28, 2016, and from that moment on, the issue of filling out field 110 was finally resolved.

How to fill out all other fields (22, 101, 104–110) and details in payment orders for VAT payment is described in detail in Order of the Ministry of Finance dated November 12, 2013 No. 107n. The rules for filling out field 24 are given in Bank of Russia Regulations dated June 19, 2012 383-P “On the rules for transferring funds.”

See also the material “What order of payments should I indicate when transferring VAT?” .

When filling out payment documents, you should also clarify the budget classification codes for this type of tax, since the Ministry of Finance of Russia, by its order No. 150n dated December 16, 2014, made changes to the BCC.

See the current BCC here.

You can see a sample payment order for VAT payment in the article “Payment order for VAT in 2019-2020 - sample”.

A third party has the right to pay VAT on behalf of the taxpayer. For details, read the article “Rules for filling out payment orders when paying taxes by third parties have been approved.”

Receipt for payment of transport and property taxes

To ordinary citizens, receipts for transport and land taxes and personal property taxes are sent out at least 1 month before the deadline for paying the fiscal payments themselves - that is, notifications must be received by November 1. Usually they come back in August-September.

If payments have not arrived, then the citizen has the right not to pay the accrued amounts. But at the same time, the Federal Tax Service may present claims to the payer for payments for the previous 3 years - for example, the payer did not receive letters from the tax office, he did not pay property payments for 3 years. And then the Federal Tax Service sent him a demand indicating the arrears and penalties for this period.

How to check debt - enforcement proceedings with bailiffs

If the sent payment slip is not on hand, the applicant can take a new form from the inspectorate or print it out through the electronic services of the tax website or on the Government portal.

Filling out a payment order to pay tax: main fields of the document

The main columns of the payment order are:

| Order field | Description |

| Field No. 2 | Information on the order of payment (for all types of taxes the fifth is considered). |

| Field No. 5 | Payment type |

| Field No. 16 | Information about the name of the payment recipient (name of the local Federal Tax Service, abbreviated name of the regional Federal Tax Service). |

| Field No. 18 | Tax payment – code “01”. |

| Field No. 22 | UIP code (if the code is specified by the Federal Tax Service in the tax request, it must be duplicated in the document). |

| Field No. 101 | Tax payer status (usually code “01”, for personal income tax – “08”). |

| Field No. 104 | KBK |

| Field No. 105 | OKTMO |

| Field No. 106 | Basis of payment |

| Field No. 107 | Tax payment period |

| Field No. 108 | To be filled in if the debt or the amount of the fine is paid (in other cases - 0). |

| Field No. 109 | Date of signing the tax return (in other cases – 0). |

| Field No. 110 | Not to be filled out |

Where can I get a new copy of the receipt for taxes paid long ago?

A situation is possible when a person paid tax to the budget on time, but after some time received a demand from the Federal Tax Service to pay it. When visiting a government agency, it turns out that the payment is not listed in the Federal Treasury system.

Typically, such situations are associated with payment using incorrect details or loss of payment in the document flow and the expiration of a large amount of time - several years.

How to find out the TIN for an individual via the Internet using a passport

You can only find a receipt from two or three years ago at a bank.

Methods:

- if a person paid charges with a bank card or through an open savings account, then you need to order an account statement for a certain period - it will reflect all monetary transactions, incl. for lost payment;

- if a citizen paid in cash, he will have to remember in which specific bank branch, on what date and in what amount he paid; If this information is available, the bank will accept an application to seek payment.

Paid receipts must be kept for 3 years.

Payment characteristics

A receipt for payment of transport tax is a payment document. It is needed to cover the tax on the car.

Transport tax is regional in nature. These are funds collected from a citizen for the fact that he owns movable property in the form of a car. The tax is paid annually, and the proceeds are transferred to the regional budget.

It is the regional nature of the charges that confuses citizens - they do not know where to get payment orders to carry out the transaction. Fortunately, receipts are ordered the same way in all regions.

Procedure for printing a tax receipt

The fastest and easiest way to receive a payment order is to generate it through the bank’s website or on the Russian Federal Tax Service portal.

Through Sberbank

To print a receipt through Sberbank’s electronic services, you need to have a personal account in the Sberbank Online service.

The account is registered if the following conditions are met:

- the person has a bank card;

- the card is linked to a phone number;

- connected on the card.

Login and password must be obtained at the branch - in the terminal.

Taxpayer's account on the State Services portal

Next you need to follow the step-by-step instructions:

- After creating your account and logging into it, you need to find the “Payments and Transfers” section at the bottom.

- Find the Federal Tax Service in the list of departments.

- Next, the departmental stages open - choosing a service. In this case, “paying taxes.”

- The system will open the next stage - entering details. Here you can find payments by TIN and document number. If it is not there, then the line “Payment using arbitrary details” is selected.

- You need to enter the recipient's BIC, account, KBK and TIN. These data are available on the website of the Federal Tax Service of Russia.

- Next, the request is confirmed by entering the code that is sent to the phone number and executed. Based on the results, a receipt is generated that can be printed in several copies.

Procedure for filling out a payment order

The payment order is issued in 2 copies (the first is stored in the credit institution, the second is returned to the taxpayer with the bank’s mark on execution). A “payment” is issued on a printed form (form 0401060) or in electronic form.

The payment order must be filled out from top to bottom in legible handwriting. The following errors will lead to the fact that the tax will not be recognized as paid with all the ensuing consequences (you will have to send funds again and pay penalties)

:

- incorrect UFC account number;

- incorrect (or incomplete) name of the credit institution to which the funds were sent.

Personal appeal

A receipt for payment of transport tax is an important document, but not mandatory. Without it, certain methods of closing a payment simply become unavailable, but nothing more.

You can apply for a receipt to the authorized bodies. Namely, to the MFC or the tax service. It is enough to have a passport with you. Having title documents for the car and TIN certificate will also not be superfluous.

It is worth noting that tax bills are not issued to third parties. You can request them if you have an official power of attorney, but in reality such situations almost never occur.

Places to order

Where can I get a receipt for payment of transport tax? There is no clear answer to such a question. This is due to the fact that tax payments in Russia can be obtained in various ways. Next, we will try to familiarize ourselves with all existing options. They are completely legal and do not contradict current legislation.

Where can I get a receipt for payment of transport tax? It can be:

- order through online services;

- request from the authorized bodies.

Each technique involves several solutions. And each person will be able to choose the method that suits him.

Searching for information without payment

A receipt for payment of transport tax by individuals is an important document, but not at all mandatory. Now you can find information about tax assessments remotely. It is enough to have a passport and TIN. It would be enough.

To accomplish this task, you can use:

- service "GosOplata gosuslug";

- Internet banking;

- electronic wallet.

In the case of “StateCheck Your Taxes”. Just a couple of minutes and it's done. True, the data in the ESIA database is not updated immediately, but after about 2 days. This means that immediately after paying the tax, the debt will still be displayed in the system. This is not an error - you just need to be patient and wait for the information to be updated.

Guide to Searching Through Wallets

We figured out where to get a receipt for paying transport tax. But, as already mentioned, in order to contribute funds to the state treasury, you can do without it. It is enough to find information about the accrual in the database of the Federal Tax Service of the Russian Federation.

This can be done via the Internet. Let's look at the process using the example of working with electronic wallets. In the case of Internet banking and the “Payment for government services” service, the algorithm of actions will be approximately the same.

Instructions for searching taxes through Yandex.Money look like this:

- Open your e-wallet.

- Select the “Check taxes” option.

- Indicate the person's tax identification number.

- Confirm database scanning.

All accrued and outstanding taxes will be displayed in the menu that appears. You need to select the “Transport…” item, and then confirm the payment. That's all. And you don't need a receipt!