Online loan application

Every year, a citizen, individual entrepreneur and other legal entity must pay various types of fiscal burdens by receiving receipts by mail or submitting a declaration. How to pay taxes through the taxpayer’s personal account and where to get access from it will be discussed further.

The mechanism for easier repayment of debt to the state is implemented by various services (the State Services portal, mobile applications of banks), but still the fastest and safest is to use the official federal website of the department.

Is it possible to pay taxes through Sberbank online?

Paying taxes via the Internet using online resources is the fastest and most convenient way to pay your budget. To do this, organizations enter into agreements with banks and connect an online resource called “Client-Bank”. “Client Bank” is a service that allows you to pay with any counterparties via the Internet, including the budget. “Client-Bank” is connected when opening an organization’s current account, payments are confirmed using an electronic signature. If everything is clear with organizations, then with individual entrepreneurs questions arise, for example, can individual entrepreneurs pay taxes from a personal account or do they need to open a current account?

Does an individual entrepreneur need to open a current account?

Currently, the law allows individual entrepreneurs not to open a current account. However, some regulations still introduce their prohibition, for example, Central Bank Instruction No. 153-I dated May 30, 2014, as amended on December 24, 2021, prohibits transactions related to business activities on current accounts. Also, the agreement for opening a personal account may contain such prohibitions, therefore, in order to avoid misunderstandings with the bank, it is better for individual entrepreneurs to open a separate current account for conducting their business activities. If an individual entrepreneur works exclusively with individuals, then in this case you can only use your personal account.

How to pay UTII through Sberbank

To pay the tax, you first need to get the details, without which it will be impossible to pay the tax . Details for paying taxes can be obtained from the tax office or can be found on the Internet. It must be remembered that different regions have different details. To pay taxes we take the following steps:

- We go to the online bank;

- Find it in the “Payments and Transfers” menu;

- Select the item “Payment: Taxes, Fines, Duties, Budget payments”:

- Next, select “Payment: Taxes, work patents”;

- Select the following menu item “Payment: Search and payment of taxes to the Federal Tax Service”;

- Next you are asked to select ;

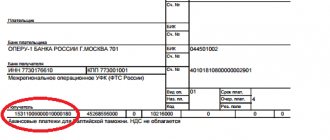

- We take from the details and enter them into the fields - BIC, account number, KBK, recipient's TIN;

- After entering all the details, the bank requests data on OKTMO (regional details), basis for payment (where TP - current payments, PO - debt, etc.), tax period (for example, annual payments for 2021, indicated as GD.00.2021 ), TIN of the payer, payer status (13 for individuals, 02 for tax agents, 09 for individual entrepreneurs);

- Next, indicate the purpose of the payment, first name, patronymic, last name of the individual entrepreneur;

- After filling out all these fields, you must indicate the payment amount and confirm it with a code that will be sent to your phone;

- After this, the tax will be debited from your personal account.

We pay without a payment document

Often, citizens of the Russian Federation who are about to pay taxes simply lose their payment documents. You can pay the debt without presenting a receipt, but this method has both positive and negative aspects.

Advantages:

- You can find out about the existence of a debt on the Federal Tax Service website by logging into your “Personal Account”;

- you can pay off your debt in a few seconds;

- payment is made at a time convenient for the user, and there is no need to adjust to the work schedule of the Tax Service;

- the debt is repaid until the taxpayer is issued a payment document.

Flaws:

To pay the debt, normal communication and Internet Banking are required;- online payment is not available for all categories of citizens;

- any resource works only in automatic mode, so it cannot quickly answer the user’s question;

- Before sending the document, you should carefully check all the entered data INDEPENDENTLY. Important: often one mistake can cause funds to be sent to the wrong recipient.

- Data is registered on the site for a very long time, so there is a high probability that a person will pay one tax - 2 times.

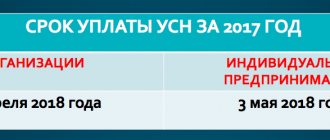

Deadline for payment of UTII tax

The reporting period for UTII is a quarter (three months). The UTII tax must be paid up to and including the 25th day of the month following the reporting period . When you need to pay this tax is clear from the following list:

- For the 1st quarter of 2021, payment must be made by 04/25/2021;

- For the 2nd quarter of 2021, payment must be made by July 25, 2021;

- For the 3rd quarter of 2021, payment must be made by October 25, 2021;

- For the 4th quarter of 2021, payment must be made by 01/25/2021.

If the last day for tax payment falls on a weekend or holiday, then the deadline for payment in this case is the first working day following the holiday or weekend.

Registration of a personal account on the Federal Tax Service website

Login to your personal account on the official website of the Federal Tax Service (Federal Tax Service) https://lkfl2.nalog.ru/lkfl/login

Rice.

1 (click to enlarge). Login to your personal account on the official website of the Federal Tax Service - nalog.ru In line 1 in Fig. 1 you will need to enter your TIN, and in line 2 - the password that was issued by the Federal Tax Service inspection in the “Registration Card” printout.

After entering your login and password, the following message will appear:

“The Federal Tax Service welcomes you to your “Personal Account” and thanks you for connecting! For security reasons, you need to change your primary password."

And immediately, “without leaving the cash register,” you will be given the opportunity (by the way, mandatory) to change the primary password (Fig. 2):

Rice. 2 Change the primary password on the Nalog.ru website and confirm your e-mail

Required fields are marked with a red asterisk. As shown in Fig. 2, you need to enter your new password twice (fields 2 and 3), then your E-mail (field 5 in Fig. 2). It is not necessary to enter a telephone number (field 4 in Fig. 2).

By filling out the fields marked 1, 2, 3 and 5 in Fig. 2, click on the only active button “Send a letter to this e-mail to confirm it” (number 6 in Fig. 2).

We read the message that appears: “A letter with instructions for confirming the e-mail was sent to the address ...”, which we personally entered in the previous step (number 5 in Fig. 2).

To save the new password for your personal account, you need to click on the “Save” button (number 7 in Fig. 2).

Email confirmation is necessary to prove that the email belongs to you and you have access to your email. Such confirmation may come in handy later, for example, if you need to send a message (appeal) to the tax assessment office. The response from the tax office will be sent to your email.

The confirmation email does not arrive immediately; you need to wait 10-15 minutes. However, here it is not necessary to do it once at a time and therefore different options are possible. On the other hand, you shouldn’t put off confirming your e-mail: then it will fly out of your head and the question of registering your personal account will remain “hanging in the air.” It also makes sense to check the “Spam” folder in your mail, because the letter could have ended up there by mistake.

In our mail we find an e-mail confirmation letter with the following heading (click on Fig. 3 to enlarge it):

Rice. 3. A letter with a link to confirm your e-mail.

You need to open the letter from the tax office in your mail (Fig. 3) and click on the longest link. This is a simple check that the e-mail was entered correctly, without errors, and that this is your e-mail, that is, you have access to this mail.

That's it, we are registered in your personal account and can start working in it.

KBK that must be indicated when paying UTII

As already mentioned, in order to pay the tax you need to know the details for the transfer. One of these details includes KBK. KBK is an abbreviation for budget classification codes. The BCC is assigned to each tax separately, so it is not recommended to indicate this detail incorrectly, because in this case the tax will go to another budget and you will have to write a letter to the tax office with a request to count the tax according to another BCC. Budget classification codes are established by law and change frequently, so it is necessary to check the relevance of this detail so as not to make a mistake in payment. In 2021, BCCs were established by Order of the Ministry of Finance No. 132n dated 06/08/2021, they are shown in the following table.

| Designation | KBK |

| UTII tax | 182 1 0500 110 |

| Penalties for UTII tax | 182 1 0500 110 |

| Amounts of fines and penalties | 182 1 0500 110 |

Calculation of the amount of accrued penalties

The procedure for calculating penalties for taxes is not some special classified information. This is clearly stated in Russian legislation (clause 4 of article 75 of the Tax Code).

There are two forms and two calculation formulas.

1) For individuals and legal entities whose overdue payment is no more than 30 days.

Penalties = Amount of tax not paid on time * Central Bank key rate: 300 * number of overdue days

2) For all legal entities (companies, firms, JSC, LLC, etc.) that are overdue for tax payments by more than 30 days.

First 30 days are calculated using the above formula. That is, the last number (number of days) is 30. Starting from 31 according to the following scheme:

Penalties = Amount of tax not paid on time * Central Bank key rate: 150 * number of overdue days, starting from 31

The total debt is summed up using two formulas.

Important! The key rate is taken for the moment for which the penalty is charged. If it changes, the number in the formula also changes.

To correctly calculate the penalty, it is important to consider the following points:

- Transport tax is calculated once a year and must be paid to the local Federal Tax Service. The penalty accrues after 3 months. after delays.

- The property fee is also paid to the local inspectorate. Accrual occurs immediately.

- Income tax goes to the regional budget (a small part goes to the federal center). The penalty begins to “drip” after 1 month. delays.

The Ministry of Finance in letter No. 03-03-РЗ/39299 2021 clarified what is considered the time of debt repayment - the day of payment. Moreover, on the day of presentation of payment receipt, no penalty is charged.

Different formulas are used for calculations depending on how the person is registered

Sanctions for late payment of taxes

If the tax is not paid on time, an organization or individual entrepreneur will be subject to penalties. Penalties consist of a penalty and a fine. Penalties are accrued for each day of tax delay; it is determined as a percentage of the unpaid tax amount. To pay a fine, the Tax Code of the Russian Federation has the concept of unintentional non-payment and intentional non-payment of tax. If there was an unintentional failure to pay the tax, then the penalties, namely a fine, will be 20% of the amount of the unpaid tax, and if there was an intentional failure to pay the tax, then in this case the organization or individual entrepreneur will be fined 40% of the amount of the unpaid tax.