Detailed instructions for transferring a business to PSN are contained in Chapter 26.5 of the Tax Code of the Russian Federation. The normative act sets out the procedure for calculating tax, filing applications and the timing of their consideration. However, not a single article of the Code gives clear instructions on how to fill out a payment document. When drawing up bank orders to pay for a patent, merchants often have questions.

Who must make patent payments in 2018?

The patent tax system is an independent tax regime that is applied voluntarily. Individual entrepreneurs - individual entrepreneurs - have the right to apply this regime (Chapter 26.5, paragraph 2 of Article 346.44 of the Tax Code of the Russian Federation). It is possible to switch to a patent taxation system only in those constituent entities of the Russian Federation where this tax regime is established by regional legislation (clause 1 of Article 346.43 of the Tax Code of the Russian Federation). See Where the Patent System Works in 2021.

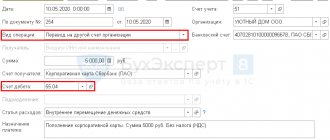

Sample payment order fields in 2021

In electronic form, a payment order can usually be found in two formats: Word and Excel. We also suggest using the online service to automatically fill out all the columns of the payment order.

Payment order, download in Word format : form and sample

Payment order, download in Excel format: form and sample

Requirements for the use of the patent system in 2018

In 2021, individual entrepreneurs can apply the patent taxation system while simultaneously meeting the following conditions:

- The type of activity that the individual entrepreneur is engaged in is specified in paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation. Then he has the right to apply the patent system when providing services (performing work) both for the population and for organizations (letter of the Federal Tax Service of Russia dated June 10, 2014 No. GD-4-3/11215). At the same time, constituent entities of the Russian Federation have the right to expand this list by adding other household services to it (subclause 2, clause 8, article 346.43 of the Tax Code of the Russian Federation). However, it is possible to apply the patent taxation system when providing such services (extended) only in relation to those that are provided only to the population (letter of the Ministry of Finance of Russia dated September 2, 2014 No. 03-11-12/43824);

- An individual entrepreneur operates independently or with the involvement of hired personnel (including under civil contracts), the average number of which does not exceed 15 people for all types of activities. Determine the average number for the period for which the patent was issued;

- The activities of an individual entrepreneur are not carried out within the framework of a simple partnership agreement (joint activity agreement) or a property trust management agreement.

Such conditions must be met throughout the life of the patent.

IMPORTANT

If, since the beginning of 2021, the income of an individual entrepreneur has not exceeded 60 million rubles, then he can switch to PSN. It is necessary to take into account sales income, determined in accordance with Article 249 of the Tax Code, for all types of business in respect of which the individual entrepreneur switches to a patent.

Filling in the fields

INN and KBK details are the most important values in payments. If they are correct, then the payment will most likely go through. Period, payer status, priority - if there are errors in these fields (they didn’t make it in time), then payments almost always go through anyway, but it’s better not to take risks. There are no fines for filling out payment slips incorrectly (it’s your money), but the payment may not go through, in which case you will have to look for it, return it, and possibly pay penalties.

The account (number) of payment orders (above) can be anything and they can be made with the same numbers. But it's better to take turns.

VAT in payment orders is always indicated in the purpose of payment. If it does not exist or cannot exist, it is credited as “Without VAT”.

The order of payment in all examples is fifth, except for salary - there it is third.

Individuals and individual entrepreneurs put “0” in the “Checkpoint” field.

TIN, KPP and OKTMO should not start from scratch.

Since 2015, in the Code field (aka UIN), 0 has been entered in all tax payments (this is the answer to where to get the UIN). A UIN is indicated if the payer’s TIN is not indicated on the payment slips or if payments are transferred at the request of officials. They don’t put anything in the non-tax department.

On the payment order at the bottom in the top line there must be the signature of the manager (IP) or the person acting by proxy. Also, if an organization or individual entrepreneur uses a seal, then it should also be there.

In field 109 (date, below the “reserve field”, on the right) enter the date of the declaration on which the tax is paid. But under the simplified tax system and all funds (PFR, FSS, MHIF) they set 0.

In the detail (field) “110” of the order for the transfer of funds until 2015, the indicator of the type of payment was indicated (“PE” - payment of penalties; “PC” - payment of interest). Now there is nothing indicated there.

From October 1, 2015, instead of “OPERU-1” you need to indicate “Operations Department of the Bank of Russia” in the Recipient’s Bank field for state duties, customs and some other payments.

In the payment order field “Type of op.” (type of operation) is always set to 01.

Fig. Sample of filling out a tax payment order.

BCC for patent payment in 2021 in the table

Further in the table we summarize the BCC for paying for a patent in 2021, as well as the current codes for paying penalties and fines.

| Purpose | Mandatory payment | Penalty | Fine |

| tax to the budgets of city districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| tax to the budgets of municipal districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| tax to the budgets of Moscow, St. Petersburg and Sevastopol | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| tax to the budgets of urban districts with intracity division | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| to the budgets of intracity districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

Accordingly, in order, for example, to pay for a patent in 2021 in the city of Moscow, use KBK 182 1 0500 110. The twenty-digit KBK must be indicated in field 104 of the payment order for payment of the patent.

Read also

15.12.2017

What is a payment order?

A payment order is a document that contains the payer’s information for the bank engaged in servicing him about the payments necessary to make from his current account to the accounts of counterparties or to government agencies for a certain amount.

There are two types:

- in electronic;

- in writing.

If the organization does not have remote access to Internet banking, then this order can be downloaded from the link and filled out by hand or on a computer.

How to pay for a patent

If we have figured out the payment deadlines, then all that remains is to understand what documents the individual entrepreneur needs to collect and where to submit them, since payment in cash to the specialists of the federal tax service is not implied. Moreover, this is prohibited by law.

An entrepreneur who is ready to pay for the purchase of a patent permit for activities is issued a receipt, using the details of which he pays the required amount to the bank branch.

The receipt itself contains only the total amount, that is, the cost of the entire time of using the patent. Therefore, if you decide to divide the payment into parts, then you will need to find the form of this receipt on the official FSN resource on the Internet and start generating it yourself with the required amount. This is done simply. Find, fill out the fields provided and print. The main thing is, where it says “details”, enter exactly the details of the tax office, which will accept the payment from you.

The online banking service is also available. For example, in the Sberbank service you need to find the section for paying taxes to the Federal Tax Service. And then a payment will be generated for you. Moreover, the online banking service can allow you to schedule an automatic payment. Then, having filled it out once and completed the operation, you can set the system to auto-pay using the same details and the same amount on a certain date of each month. This will save you from the danger of late payment. The main thing here is that there is always money in the account, otherwise the system will have nowhere to write off funds for payment to the tax office.

Patent for a period of seven months to one year

For 2021, the rules are such that a patent can be paid for in two installments.

The first is paid in the amount of one third no later than the end of the third month from the date of validity of the patent.

The second (or the rest, if the board is divided into more parts) - until the last day of the patent.

Again, what is good for newcomers in business whose business turnover has not yet reached full stability, there are no specific strict recommendations for paying for a license. You can divide the payment by the number of months, pay in equal installments, or pay off everything at once and not think about it. The main thing is to avoid delays and debts and to approach this matter carefully and responsibly.

What opportunities does the “Payment of taxes for individuals” service provide?

The Internet service “Payment of taxes for individuals” allows an individual taxpayer to:

- generate payment documents for the payment of property, land and transport taxes before receiving the Unified Tax Notice (in advance);

- generate payment documents for the payment of personal income tax, as well as payment documents for the payment of a fine for late submission of a tax return in Form No. 3-NDFL;

- generate payment documents for debt payment;

- print generated documents for payment at any credit institution or make non-cash payments using the online services of banks that have entered into an agreement with the Federal Tax Service of Russia.

Thus, using this service, individuals can pay the following taxes:

Federal Tax Service Inspectorate Receipt for Payment of Tax for a Foreign Citizen's Patent

Payment for a work patent The procedure for hiring foreign citizens in the Russian Federation Every employer who considers it advisable to employ a foreign worker in his company must begin the procedure for drawing up an employment contract by clarifying the tax status of the future employee and the reasons for his stay in the Russian Federation. read also In addition, the employer must notify the Federal Tax Service, the employment center and the Main Department of Migration Affairs of the Ministry of Internal Affairs about hiring a foreigner. It’s easiest with those who come from the EAEU countries. In terms of employment, they are practically equal to Russian citizens.

For those who decided to look for work in the Russian Federation, having moved here from states with a visa-free entry-exit regime, concluding an employment contract is possible only after the candidate presents a labor patent.

Errors when filling out the KBK

Tax legislation specifies situations when the obligation to pay tax is considered unfulfilled (Clause 4 of Article 45 of the Tax Code of the Russian Federation), namely:

- incorrect indication of the Federal Treasury account number;

- incorrect indication of the name of the recipient's bank.

The tax legislation does not mention any other errors in payment orders that resulted in non-transfer of funds.

But in accordance with Federal Law No. 125-FZ of July 24, 1998 “On compulsory social insurance against accidents at work and occupational diseases,” the obligation is considered unfulfilled if the following is incorrectly indicated:

- Federal Treasury account numbers;

- name of the recipient's bank;

- budget classification code.

Based on these documents, we can conclude that if section (104) of the payment order is filled out incorrectly, the tax authorities do not have the right not to count the payment, but the fund has the right to do so.

Thus, in order to avoid troubles, you must be very careful when filling out the BCC in the payment order.

We generate a receipt and select payment methods

It is worth noting that the receipt is generated in PDF format. This is what the generated personal income tax payment receipt looks like:

If you indicate your TIN, then both payment methods will be available to you to choose from: Cash and Non-cash.

When choosing a non-cash payment, you will see a list of available banks. It is important that you must be a client of the selected bank and be authorized on its website. If everything is in order, all you have to do is follow the instructions on your bank's website and pay the tax you need.