Any legal entity has its own registration data necessary to determine the place of registration with the tax office and display other individual data. Each number has its own meaning, which will help you understand many issues. The company has the right to open many additional offices and each division is registered with the tax authority and assigned a checkpoint. However, there may be many reasons for this, as well as the procedure for changing the code, its determination and identification in other tax offices.

Codes for separate divisions

In accordance with Russian regulations, each business entity has a whole set of codes, which are used to classify the corresponding structure and its accounting. It is important to remember that not all separate divisions have codes that are different from those of the parent organization. Thus, some branches and representative offices do not have their own OKPO codes. And some, on the contrary, have their own codes.

For example, to the question “OKPO code of a separate division, what is it?”, you can give the following answer: this is the code used for decoding in accordance with the “Regulations on maintaining the All-Russian Classifier of Enterprises and Organizations (OKPO) and making changes to it” (hereinafter - Regulations), put into effect by Rosstat Order No. 107. This code is used to exchange information about the relevant entity both within government bodies and departments, and during interdepartmental information exchange. It is also necessary for unambiguous and accurate identification of a business entity (clause 2.1 of the Regulations).

OKPO is assigned to legal entities and their separate divisions, as well as individual entrepreneurs.

Along with OKPO, the following codes are used to identify a business entity: OKOGU, OKATO, OKTMO, OKVED, OKFS, OKOPF.

It is important to remember that neither OKPO nor other codes named above are contained in an extract from the Unified State Register of Legal Entities or in an extract from the Unified State Register of Individual Entrepreneurs.

In order to find out the OKPO code of a separate division, you can use a special service on the Rosstat website at the Internet address:

To use this service, you need to know the INN or OGRN of the main organization for which OKPO is being sought. After the search, the service will display the name of the separate division and its OKPO.

Find out statistics codes online for free

To control the state of the economy, the state maintains constant statistical records of the economic activities of legal entities and individual entrepreneurs.

The functions of generating official statistical information, as well as conducting state statistical observations and research, are assigned to the Federal State Statistics Service (Rosstat). To fulfill these functions, Rosstat created a special database - the Statistical Register of Business Entities (Statregister). It contains information:

- On state registration of organizations (their branches and divisions) and individual entrepreneurs.

- Identification codes according to all-Russian classifiers of enterprises and organizations (OKPO), objects of administrative territorial division (OKATO), bodies of state power and administration (OKOGU), forms of ownership (OKFS), organizational and legal forms of organizations (OKOPF).

Interesting!

Rosstat codes are not indicated in the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs. However, there is an exception to this rule - these are OKVED codes.

Although they are essentially statistical identifiers, information about them is necessarily included in the information that makes up the unified state register of legal entities or individual entrepreneurs.

Statistics codes are assigned to an organization or individual entrepreneur after their registration by the tax authorities (information about making an entry in the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs is transferred to Rosstat from the tax inspectorate as part of interdepartmental cooperation).

Previously, in order to find out about the statistical identifiers assigned to a specific organization or individual entrepreneur, it was necessary to personally contact the Rosstat authorities. Now you can receive notification of their assignment using the Internet.

For your convenience, we have launched a new service with which you can find out statistics codes online for free at any time convenient for you.

Our service:

- Very easy to use. In order to request information about statistics codes, just enter the TIN or OGRN of the company (individual entrepreneur) and enter (the numbers from the picture).

- Absolutely free. To obtain information, you will not have to pay a state fee or pay any other fee for generating a notification.

- Works anytime. You can request statistics codes online at any time twenty-four hours a day, both on weekends and on weekdays.

Information on the assignment of statistical identifiers obtained using our online service has the same legal force as the data on a paper document (notification) issued by Rosstat employees when directly contacting them with a request. They can also be used when opening a personal bank account, when filing tax returns, and when generating payment orders.

Getting statistics codes has now become even easier, because you have eRegistrator.ru!

How to find out

Before you understand the decoding of the assigned checkpoints in order to obtain information about the EP, you need to understand how you can find out including by TIN

Information about such structural divisions as branches and representative offices is displayed in the Unified State Register of Legal Entities (other types of EP do not appear in it). Tax officers transmit all checkpoint numbers of existing separate divisions to the inspectorate at the head office address.

Many people believe that to obtain information about the checkpoint of a separate unit, it is enough to go to the official website of the Federal Tax Service of Russia and request an extract from the Unified State Register of Legal Entities. Exact link - .

However, this won't help. The fact is that by order of the Ministry of Finance dated No. 115n, the exact composition of the information in the extract from the Unified State Register of Legal Entities was approved. And the checkpoint of the separate unit is not mentioned in it. Therefore, such an extract will not help to recognize the checkpoint of a separate unit by TIN .

About “isolations”

According to the current edition of the Civil Code of the Russian Federation (Article 48), it is permissible to create any legal entities to achieve certain goals. Most often we are talking about entrepreneurial activity, although this is not the only task.

The law also gives the right to existing organizations to divide themselves into parts. For example, allocate a head office and several branches, representative offices, and other structures. In the official language they are called separate units (see also see 55 of the Civil Code of the Russian Federation).

Important! “Singles” cannot exist on their own. They are not legal entities. Therefore, all management decisions are made not by them, but by the main center. They just carry out the instructions they receive.

Before we tell you how to find out the OKPO of a separate division, let’s turn to the Tax Code.

Its article 11 provides a description of the separate structures. In particular, it states what they should look like - their main distinguishing features. So, each such unit should have:

- separate location (cannot be located in the same place as the head office);

- at least one stationary workplace (created for a period of 1 month).

An interesting clarification: not only an entire branch or representative office, but even one single workplace can be recognized as a separate structure.

Such separate divisions as branches and representative offices must be especially carefully documented. The fact is that the company's management must provide information about them to the tax office in the form of a completed special notification form. The data will be entered into the Unified State Register of Legal Entities.

Download the specified message on our.

And only after this, such “isolations” are assigned certain individual codes. Including - according to the All-Russian Classifier of Territories of Municipal Entities (abbreviated as OKTMO), which takes into account the territory on which the unit is located.

Basic codes

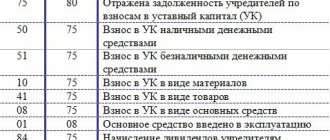

When the registration of an OP has occurred, it may be assigned special codes. But the parent organization and all its divisions will still have the same TIN. This is due to the fact that the OP is not a legal entity.

Thus, find out the checkpoint of a separate division using the TIN of the main enterprise by applying for an extract from the Unified State Register of Legal Entities.

The judgment that there is no need to obtain a separate TIN is based on an analysis of the regulatory document regulating the procedure for obtaining, using and changing the TIN (approved by order of the Ministry of Taxes of Russia dated No. BG-3-09/178). And it is valid only when registering or deregistering legal entities and individuals.

A TIN can only be assigned to the organization itself. None of its divisions, including separate ones, have the right to receive their own TIN. Only upon initial registration with the Federal Tax Service does the organization receive its TIN at the place of registration.

Where is it used?

Checkpoint is one of the ways to identify an enterprise and its structural units. It is traditionally used as one of the details when drawing up forms, contracts, powers of attorney and other documents. In addition, this OP attribute is used in the invoice. The invoice form contains fields for indicating the code of the seller and the buyer; the place where the checkpoint of a separate division is indicated in the invoice is marked with red arrows.

According to Letter of the Ministry of Finance of Russia dated 04/03/2012 N 03-07-09/32, when making a sale through an OP, the invoice indicates its code, and not the digital designation of the main organization. The same rule applies to purchasing goods through OP. When carrying out such transactions, the organization's TIN is indicated on the invoice, since separate divisions are not assigned this code.

Your code

The All-Russian Classifier of Enterprises and Organizations (hereinafter OKPO) appeared in Russia in 1994, when the corresponding Gosstandart resolution No. 297 was adopted.

The OKPO code is a number from 8 to 10 characters. It is needed to identify a specific legal entity by it. Each company receives its own OKPO number. It is usually indicated in accounting documents.

Also see January 2021 Reporting: Full Review.

Amendments to OKPO are made by Rosstat using its special statistical register.

Russian laws allow legal entities to create their own separate divisions. For this purpose, there are special norms that spell out the process itself and the requirements for such structures. And what is most important: any separate division cannot arbitrarily use OKPO of the main company. Immediately after their occurrence, some of them receive their numbers. of how to find out the OKPO of a separate unit becomes important .

Right to a reason code

Absolutely any business entity receives certain codes, as stated in the law. They are needed for the following purposes:

- identification in classification systems according to various criteria (territory, industry, etc.);

- maintaining records of subjects (for the purposes of taxes and insurance premiums, statistics, etc.).

And if for the main organization codes are an integral attribute, then separate divisions may have their own or coincide with the codes of the main organization.

Any organization must register with the tax service before starting its activities. This is enshrined in paragraph 1 of Article 83 of the Tax Code of the Russian Federation. But not everyone understands which inspectorate they need to contact in order to register. Belonging to the Federal Tax Service can be determined:

- the address of the organization itself (for an individual entrepreneur - the address of his permanent registration);

- the location of its real estate;

- OP's address.

The organization is required to register with the tax office at the address not only of the head office, but also of all separate divisions.

The company must inform the tax authorities about the opening of a separate division. After this, it is registered.

General points

The current Civil Code provides for the possibility of forming and conducting their activities by various legal entities, which, just like all other business entities, take part in business activities or are engaged in achieving certain goals.

Any legal entity has the right and opportunity to create separate divisions, and the current legislation stipulates two main types of such bodies - branches and representative offices. It is worth noting the fact that, according to the law, separate divisions do not belong to the category of legal entities, and therefore do not have the corresponding legal capacity.

In accordance with the norms prescribed in Article 11 of the Tax Code, separate divisions must have a territorial location different from that of the parent organization, and at the same time have at least one stationary workplace, that is, one that is created for a period of more than thirty days . Thus, the current legislation considers not only representative offices or branches, but also individual stationary workplaces as a separate unit.

Information about all created separate divisions (with the exception of simple workplaces) must be entered into the unified state register of legal entities, for which the company that creates them will have to submit statements drawn up in accordance with approved forms to tax officials.

After a branch or representative office undergoes the state registration procedure, it is assigned a unique code by which the territory of the municipality and other features of the created unit will be characterized.

How are staffing schedules approved?

Many entrepreneurs prefer to use the currencies of foreign countries when calculating salaries with allowances. This is especially true for companies where a significant part of the capital is formed in precisely this currency, or where the founders are citizens of foreign countries. At the same time, there are no rules directly in the Labor Code of the Russian Federation that would prohibit doing this.

The main thing is to take into account several legislative norms at once. For example, those relating to rates and allowances, standard salaries. Salary refers to transfers with fixed amounts in connection with the performance of duties of the position. When determining this payment, compensation, incentives and similar calculations are not taken into account. But the tariff rates are only included in the salary. They should not change while the employment contract is in force. With the exception of situations where the parties manage to come to an agreement when determining the due amounts.

Document approval

In practice, it is more often believed that this issue is within the competence of the person who currently runs the enterprise. You can draw up a separate order in which the responsibility for drawing up the document is assigned to one or another employee. Responsibilities are also established by job descriptions and employment contracts.

If enterprises are small, then scheduling becomes the responsibility of those who represent the personnel department: either accountants or lawyers. But for large enterprises, it is important to delegate the issue to a separate economic planning unit, or department, which deals with issues of wages and working conditions.

The main reasons for registering using a checkpoint code

Also, specific data in the checkpoint indicate the following signs:

- state the fact that the organization has its main place of accounting;

- 05 and 31-32 - indicates the presence of structural divisions and their legal form;

- availability of property in a specific territory;

- 10-29 – registered vehicles;

- 30 – the organization was not registered as an existing taxpayer;

- over 51 are large companies, including foreign ones.

Thus, the reasons that allow the organization to register are confirmed by the corresponding code.

We can summarize the following reasons for obtaining a code when registering:

- Confirmation of registration of a legal entity and its location.

- Due to a change in tax authority and registration address.

- Opening of other divisions of the company.

- Finding the office or real estate of the organization with its documentary evidence.

These are the most common reasons, but they are not the only ones. A full list of reasons for obtaining a checkpoint is discussed in the Tax Code of the Russian Federation.

Staffing: about the number of units

This issue is dedicated to the column, which is designated by number 4. Here it is permissible to use both whole numbers and their parts. For example, 0.25 and so on. The rule also applies to part-time workers.

Staff units

Not only the staff units that are currently retained require display, but also the jobs that are included in the vacancies section. Only if open positions are maintained can new employees be hired. A mandatory requirement is to include vacancies in the staffing table.

Make no mistake - there is a high probability of differences between the actual work and the description of the units. For example, when introducing part-time work, when one position is occupied by several people, or if a working day is introduced, which is supplemented by part-time shifts. Then they first write about positions, and then about the total number of units.

Main details

In order to establish or determine in the future the code of a separate division, you need to remember several key features of working with this information.

Main provisions

The Unified State Register of Companies and Organizations was formed by the State Committee on Statistics back in 1992. EGRO itself is a full-fledged information system, which includes an organizationally ordered set of documents and various information technologies, with the help of which the unambiguous identification of various economic entities throughout Russia is ensured.

The maintenance of this register is ensured by the State Committee on Statistics, as well as its individual territorial bodies, which, in particular, are responsible for assigning and confirming OKPO codes, as well as other all-Russian classifiers related to the work of legal entities and their separate divisions.

In addition, the branches of this body are also involved in organizing work related to the assignment of OKPO codes and other all-Russian classifiers for individual objects of the Unified State Register of Pools of Public Promotion, which are formed in district or city statistics departments.

Required documents

Constituent or organizational and administrative documentation can be used as the basis for filling out the basic details of the Register object registration card. In this case, a charter or a corresponding memorandum of association may be provided as constituent documents for legal entities, depending on the chosen organizational and legal form. Those legal entities that do not belong to the category of commercial organizations can operate in accordance with the provisions adopted for the organization of this type of company.

Branches and representative offices, as well as all other separate divisions of legal entities that were created before the first part of the Civil Code came into force, must provide a charter registered with their parent organization, which must reflect information that the specified legal entity a person has some separate divisions.

If the charter of a given company does not have any instructions regarding the presence of separate divisions, then in this case the basis for accounting for these divisions can be the administrative documentation adopted by the management of a higher organization in order to create the specified separate division. In addition, a registered charter must also be provided.

If the branch has developed its own regulations, then in this case, the basis according to which data about this division will be included in the Unified State Register of Legal Entities will be considered precisely this regulation, if it is approved by the legal entity that created it.

In addition to the already mentioned provision, separate units can provide a certificate confirming the approval of their location in this territory, which is received from the relevant registration authorities.

Those cases when branches are transferred to independent balance sheets ultimately lead to the fact that they turn into full-fledged legal entities, as a result of which, accordingly, the norms prescribed in Article 55 of the Civil Code can no longer be used in relation to them. Such companies are registered in the USRPO in accordance with the rules and requirements established by law.

The VAT return for the 4th quarter of 2021 includes a title page and twelve sections, which are supplemented by special annexes.

The new VAT return form for 2021 can be viewed here.

To correctly separate VAT from the amount, use the formula from this article.

Legal rules

In accordance with the Tax Code, the concept of “separate division” includes any divisions territorially isolated from the parent company, at the location of which stationary workplaces are equipped. It is worth noting the fact that a separate division of a company is recognized as such, regardless of whether information about it is in the constituent or organizational and administrative documentation of the company, as well as the powers of this division. A workplace has stationary status only if its duration is more than one month.

In accordance with the provisions of Article 209 of the Labor Code, a workplace is understood as a place in which an employee must constantly remain or where he needs to appear regularly due to the specific performance of his official duties, and which is under the indirect or direct control of the employer.

Article 209. Basic concepts

The procedure according to which representative offices for LLCs must be created is established by Law No. 14-FZ, adopted on February 8, 1998. A company may form branches or open representative offices on the basis of a decision made during a general meeting of participants, which is adopted by a majority of no less than 67% of the total number of votes of participants in a given company, unless the need for a larger number is provided for by the adopted charter of the company. At the same time, the formation of branches of joint stock companies is regulated by Law 208-FZ, adopted on December 26, 1995.

Federal Law No. 208-FZ (as amended) On Joint-Stock Companies (as amended and supplemented, came into force from )

Tariff information

The fifth column is for displaying salaries determined by tariff rates. It is mandatory to indicate the tariff grid, the main unit of measurement being rubles.

Using the so-called “fork” leads to additional difficulties. This means that different salaries are introduced for the same position in different conditions. The application of this procedure leads to the fact that the law is violated. It obliges to establish equal tariffs for everyone.

The document must contain a description of each position with a salary of the same size. Except for situations where several structures have the same positions at once. Allowances are one of the tools that help regulate wages.

Reason code for registration of separate divisions

In order to decipher the checkpoint and glean the necessary information and information from it, you need to understand the question of how to recognize the checkpoint of a separate unit.

As stated above, information about all structural divisions that are separate is contained in the Unified State Register of Legal Entities, and the checkpoint is transferred to the tax authorities at the place of registration of the main organization.

Accordingly, the checkpoints of structural divisions can be found on the website of the Federal Tax Service of Russia by receiving an extract from the Unified State Register of Legal Entities in electronic form and studying its contents. To search for relevant information, you need to know the TIN and OGRN of the main organization or its name, as well as the subject of the Russian Federation in which it is located.

Also, the specified information can be obtained in an extract from the Unified State Register of Legal Entities, received in paper form from the tax authorities. To generate a request, you also need the TIN and OGRN of the main organization.

In addition to these methods, you can use various databases and search services on the Internet. But we must take into account that such information is not official.

All these methods allow you to find out the checkpoint of a separate unit by TIN.

After the checkpoint has been received, you can find out from its contents:

- code of the tax authority that assigned the checkpoint (first 4 digits of the number);

- reason for registration (5th and 6th digits of the number);

- serial number of registration of the corresponding subject with the Federal Tax Service (last 3 digits).

How and where is it possible to find out the checkpoint of an organization by TIN

You can find out your reason code for registration, including separate divisions, in different ways:

- Using online servers and the taxpayer’s personal account, access to which can be granted by the tax office upon presentation of a passport and TIN.

- Use of the registering authority's database, but only after sending a corresponding request through an authorized representative.

- Extract from the Unified State Register of Legal Entities, in some cases, is paid.

- Official websites of the Federal Tax Service.

Free legal consultation by phone

In Moscow and the Moscow region7 St. Petersburg and the region7 Federal number7

You can find out for free; TIN, KPP, name of the organization, legal address and main OKVED and a number of other records.

Information is requested for a fee on all available OKVED, contact information of the director, arbitration cases, documentation, including the balance sheet. This also includes the presence of documents confirming registration, authorized capital, certificates and extracts. The checkpoint is usually indicated immediately after the TIN, separated by a fraction. It is indicated in all declarations and when carrying out any financial transactions.

Code of separate divisions

According to Russian laws, each organization has a whole set of its own codes. They help the state keep records of a business entity according to its structure. These digital symbols are also used to exchange data between various government bodies and departments. It can be used to identify a specific company. All this is spelled out in detail in the “Regulations on the maintenance of OKPO and amendments to it (approved by Rosstat order No. 107 dated).

Not every branch or representative office has its own separate code. There are many cases where they work with head office codes.

In each specific case, you can clarify the code of a separate division if you use a special service on the official website of Rosstat at the address -. There you will definitely answer the question of how to find out the OKPO of a separate unit.

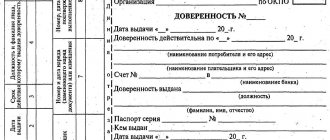

The request form looks like this:

As you can see, in order to use the service, you need to know certain information about the organization. First of all, TIN and/or OGRN. Moreover, this information relates to the main office of the company.

After entering it into the appropriate fields on the website, the system will automatically search and provide information both about the company as a whole and about its separate divisions. That's all! This is not difficult to do. Any user can understand how the service works.

Also see “Electronic services for accountants on the Federal Tax Service website: use wisely.”

If you find an error, please select a piece of text and press Ctrl+Enter.

Russian legislation provides domestic organizations with the opportunity to open separate divisions. The procedure for opening separate divisions and the requirements for them are described in detail in domestic regulations. As a result of the creation of separate divisions, they may be assigned OKPO. In this regard, the answer to the question of how to find out the OKPO of a separate unit becomes essential.

What is okpo and how is the okpo code unlaced correctly?

Changes need to be made only when changing the industry in which the enterprise, organization or individual entrepreneur specializes.

its task is to determine the industry in which a given enterprise or organization operates. This is the main state classifier that unites entities by sectors of their activity.

Unlike OKVED, which contains complete, detailed information about an economic entity, OKPO gives only a general idea of the industry.

It is used for the following purposes: ensures compatibility of state information systems with information about business entities; identifies subjects throughout Russia; promotes information exchange between various departments; development of a unified information space; automated information processing; classification of information, which subsequently makes it possible to make a forecast of socio-economic development in the state and improve the organization of statistical accounting.

What is a checkpoint?

KPP – reason code for registration. This number is assigned automatically when an organization is registered with the Federal Tax Service and is issued a taxpayer identification number (TIN).

Free legal consultation by phone

For Moscow and the Moscow region7 St. Petersburg and the region7 Federal number7 Contents:

- Why do you need to know the gearbox code?

- Structure

- The main reasons for registering using a checkpoint code

- How and where is it possible to find out the checkpoint of an organization by TIN

- How to find out the checkpoint of a foreign organization?

- How to find out the code of a separate division of an organization

- Main cases of code changes

- Is it possible for one company to have several checkpoint codes?

The company can register with the tax inspectorates at the place of its main activities, as well as where separate divisions and owners of vehicles and property operate. A company has the right to register for a variety of reasons, as well as choose any tax authority. All these actions are confirmed by a specific checkpoint, which means there may be several of them, but they will all be tied to one TIN.

The registration reason code is a mandatory requisite when filling out all kinds of documents, but individual entrepreneurs do not have it. This allows individual entrepreneurs to simply indicate 0 or a dash in the checkpoint column when filling out declarations.

It shows the main reason for registration with the Federal Tax Service, as well as the legal entity’s affiliation with a specific registration authority.

General provisions on separate divisions

The Civil Code of the Russian Federation, as amended currently in force, allows for the creation and existence of legal entities that, along with other business entities, to one degree or another participate in business activities or are created to achieve specific goals (Article 48 of the Civil Code of the Russian Federation) .

Each legal entity has the right and can create separate divisions (Article 55 of the Civil Code of the Russian Federation). Domestic legislation distinguishes between separate divisions a representative office and a branch. It is important to remember that separate divisions are not legal entities, and therefore lack the legal capacity inherent in legal entities.

According to Art. 11 of the Tax Code of the Russian Federation, a separate division in any case must be territorially separate from the parent organization and have stationary jobs, i.e. jobs created for a period of more than one month. A separate unit is not only a branch or representative office, but also a separate stationary workplace.

Information about each separate division (with the exception of stationary workplaces) is indicated in the unified state register of legal entities, for which the organization creating them must submit completed applications to the tax office on approved forms.

After state registration, each branch and representative office can be assigned various codes, including the OKTMO code of a separate subdivision, which is the All-Russian classifier of municipal territories and characterizes the territory of the municipality on which the corresponding separate subdivision is located.

A little about approval and making changes

In this case, the order itself must contain the date when the schedule itself was drawn up, and the number under which it is registered. The procedure for approval can be specified in specific documents at the enterprise, developed independently. If documents are drawn up with errors, they are approved only after all necessary changes have been made.

The number at the top right is a required attribute, without which registration is impossible. This number is entered into the accounting journals. Adjustments also require an order.

State schedules are part of the local regulatory documents. It needs to reflect information not only about units in states, but also about the amount of wages. They are also established by regulations developed at the enterprise itself. At the same time, it is not necessary to affix the organization’s seal to approve the document.

Sometimes an enterprise first drafts several schedules, and then they are entered into a single document. Such papers are also stored, but not more than five years. Routine schedules are kept permanently in the company. Some companies are in correspondence, deciding on the introduction of a position into the structure. Such correspondence is stored for a maximum of three years.

Top

Write your question in the form below

Checkpoint 997950001 what city

In the Other section, the question is OKPO and KPP the same? The best answer given by the author of Beautiful life is OKPO - which stands for “All-Russian Classifier of Enterprises and Organizations” and consists of a ten-digit number. the first nine are the serial number, and the tenth is the control number. The OKPO code is assigned at the time of registration and indicates the type of activity. The objects of OKPO classification are legal entities, individual entrepreneurs, branches, representative offices, organizations carrying out their activities without forming a legal entity. The main code in the all-Russian classifier of enterprises and organizations is the OKPO code. The OKPO code provides unambiguous identification of an economic entity of the Russian Federation. This code is the main one in the state information systems of Rosstat and is used as an identifier for interdepartmental exchange, as well as for the integration of federal databases and other information resources about business entities. ************************************************ Reason code registration (KPP) is a nine-digit code, where: ►the first two digits are the code of the subject of the Russian Federation in accordance with Article 65 of the Constitution ►the third and fourth digits are the code of the State Tax Inspectorate, which registered the organization at its location, location its branches and (or) representative offices located on the territory of the Russian Federation or at the location of the real estate and vehicles owned by it; ►the fifth and sixth characters (representing numbers or capital letters of the Latin alphabet from A to Z) are the reason codes for registration; ►the seventh, eighth and ninth digits are the serial number of registration for the corresponding reason. The combination of INN and KPP codes allows you to uniquely identify each organization (enterprise). The largest taxpayers (such as, for example, Bank of Moscow, Vnesheconombank) are also assigned an additional checkpoint 997950001. Thus, the organization has two checkpoints: 1) At the place of registration as the largest taxpayer - 997950001. This code is indicated when registration of documents related to the bank's settlements with the budget for taxes at the federal level, including when preparing documents for transactions subject to value added tax (contracts, invoices, payment orders, etc.). 2) At the location of the organization - 775001001. Indicated when preparing documents related to other payments to the budget, as well as when sending the information provided for in paragraph 2 of Art. to the tax authority at the location of the organization. 23 of the Tax Code of the Russian Federation (on opening/closing accounts, on participation in Russian and foreign organizations, etc.).

How to introduce a new structural unit into the ShR?

In cases where a new department or structure is introduced, the following actions must be taken:

- The management of the organization decides to create a new division. This may be a personal decision of the manager, or the opinion of one of the specialists supported by him (for example, submitted in an internal memo).

- An order is drawn up to prepare a new staffing table or an addition to the existing one. Employees responsible for completing this task are appointed.

- A draft of a new document on the organizational structure of the enterprise is being prepared.

- The project is approved by order of the head of the organization (how to draw up and approve the staffing table?).

- A regulation or other local act is being prepared that describes the created department or service (is the staffing table a local act?).

- If a division is being created from scratch and all positions in it are vacant, employment contracts are drawn up with new employees. If there is a reorganization of existing structures, personnel documentation on the transfer of employees is drawn up, changes are made to personal cards, employment contracts, etc.

After all procedures are completed, the newly created division begins its activities within the enterprise.

It is important for everyone who is responsible for the staffing table to know how to properly draw up and store it, how to make changes to the document, and whether it is necessary to draw it up at all.

Although divisions are not a mandatory element of an enterprise, they can be organized. And in this case, it is necessary that the staffing table approved in the organization adequately reflects the formed structure of the company.

Why do you need to know the gearbox code?

Any large company may have several branches (separate divisions), which have different territorial affiliations, but this does not exempt them from registering with the tax office at their location.

Thus, each subsidiary will be assigned its own code, which can tell about a specific company and officially confirm the following data:

- recognize the identification of a legal entity based on a specific feature;

- determination of the fact of carrying out activities or the presence of own property on the territory;

- indicate the main place of activity of the organization and its branches in other regions.

However, to determine all these signs, you must be able to decipher the checkpoint.

General provisions on separate divisions

The Civil Code of the Russian Federation, as amended currently in force, allows for the creation and existence of legal entities that, along with other business entities, to one degree or another participate in business activities or are created to achieve specific goals (Article 48 of the Civil Code of the Russian Federation) .

Each legal entity has the right and can create separate divisions (Article 55 of the Civil Code of the Russian Federation). Domestic legislation distinguishes between separate divisions a representative office and a branch. It is important to remember that separate divisions are not legal entities, and therefore lack the legal capacity inherent in legal entities.

According to Art. 11 of the Tax Code of the Russian Federation, a separate division in any case must be territorially separate from the parent organization and have stationary jobs, i.e. jobs created for a period of more than one month. A separate unit is not only a branch or representative office, but also a separate stationary workplace.

Information about each separate division (with the exception of stationary workplaces) is indicated in the unified state register of legal entities, for which the organization creating them must submit completed applications to the tax office on approved forms.

After state registration, each branch and representative office can be assigned various codes, including the OKTMO code of a separate subdivision, which is the All-Russian classifier of municipal territories and characterizes the territory of the municipality on which the corresponding separate subdivision is located.

TOSP identification number - what is it?

TOSP stands for Territorial Separate Structural Unit. That is, it is a certain part of an enterprise or production facility, which, from a spatial point of view, is located in one place where it carries out its economic (production) activities.

According to regulatory legal acts, each TOSP of a legal entity must have a personal taxpayer identification number (TOSP TIN), consisting of fourteen characters (digits). At the same time, the TOSP TIN is formed regardless of whether the legal entity has an OKPO code (All-Russian Classifier of Enterprises and Organizations).

The identification number is generated as follows:

• first 8 characters – OKPO code of the enterprise to which the structural unit belongs; • the following 2 characters – code of the subject of the Russian Federation according to OKATO (All-Russian Classifier of Objects of Administrative-Territorial Division); • 1 character after OKATO – the number of branches or representative offices of the organization; • the last 3 characters are the serial number of the structural unit that is part of the legal organization.

The identification number is issued by the tax office, which registers legal entities. It turns out that the TIN is assigned when registering a TOSP and is written in the tax registration certificate of the organization.

The Tax Code of the Russian Federation stipulates that the body that carries out the registration of TOSP (tax inspectorate) must necessarily issue, together with the identification number, a reason for registration code (KPP). This code is formed from nine digits.

The TOSP identification number must be indicated in the following documents:

• in all documents and applications submitted by a legal entity to a tax institution without exception; • in all insurance premiums and other payment orders, including when paying taxes; • in invoices.

It is also worth considering that the TOSP identification number and the registration reason code in all documents must be indicated and used together, as this makes it possible to easily identify each structural unit of a legal entity.

Information about the TOSP identification number is publicly available and is contained in the Unified State Register of Legal Entities (USRLE).

The procedure for registering a separate division of an organization

In accordance with paragraph 2 of Art. 11 of the Tax Code of the Russian Federation, a separate division of an organization is any division territorially isolated from it, at the location of which stationary workplaces are equipped. Recognition of a separate division of an organization as such is carried out regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in the specified division. In this case, a workplace is considered stationary if it is created for a period of more than one month.

In the absence of documents confirming the creation of a separate division, registration of the organization with the tax authority at the location of its separate division is carried out on the basis of an application for registration and a duly certified copy of the certificate of registration with the tax authority of the organization at its location (The procedure and conditions for assigning, applying, as well as changing the taxpayer identification number and forms of documents used for registration, deregistration of legal entities and individuals, approved by order of the Ministry of Taxes of the Russian Federation dated No. BG-3-09/178).

All-Russian Classifier of Enterprises and Organizations (OKPO)

the data in column 1 of line 401 of section 4 is greater than “1”).

Section 9 provides data on the head and each territorially separate division of a legal entity, indicating their name, location (by postal address). For the parent enterprise, the name and location must correspond to those indicated on the 1st page of Form N 1-enterprise.

If a territorially separate division does not have an OKPO code, then the position “OKPO Code” in this section is not filled in.

In the field “Main type of activity: OKVED code” for each territorially separate division, the type of economic activity that this division is primarily engaged in is entered.

A separate division of an organization is any territorially separate division from it, at or from the location of which economic activity is carried out at equipped stationary workplaces, while the workplace is considered stationary if it is created for a period of more than one month.

>Is OKPO assigned to a branch?