The calculation of 6-NDFL is one of the most confusing; even in automatic mode, accounting programs do not always fill it out correctly. In contrast, RSV looks quite harmless, but also requires attention.

At the end of each period (quarter, half-year, 9 months, year), reporting is submitted to the tax office. During a desk audit (usually annual calculations), tax officials compare the amounts in the reports using control ratios and, if, in their opinion, something does not add up, they send the organization a request for clarification or clarification.

In 2021, the deadlines for submitting reports for the first quarter have shifted: RSV - to May 15, 6-NDFL - to July 31, although usually during the year calculations are submitted almost at the same time. In fact, in July you can submit a personal income tax report for two periods at once - the first quarter and half a year.

The gap between quarterly reports provides an opportunity to respond to already received requests from the Federal Tax Service and prepare for future responses. If differences arise constantly for the same reasons, I recommend creating a standard form in which you only have to change the periods and numbers. I will provide approximate formulations at the end of the article.

Providing explanations to the tax office regarding 6-NDFL

Form 6-NDFL is submitted by tax agents quarterly, starting from 2021 (Order of the Federal Tax Service of the Russian Federation dated October 14, 2015 No. ММВ-7-11/450). After checking the received Calculation, if inconsistencies, inaccuracies or errors are detected, tax authorities can send a request for clarification, which requires a response, or for making corrections to the Calculation. Explanations regarding 6-NDFL must be provided to the tax office no later than 5 working days after receiving the request (clause 3 of Article 88 and clause 2 of Article 105.29 of the Tax Code of the Russian Federation).

You should not ignore the demands of the tax authorities, because... For a tax agent, this is fraught with a fine of 5,000 rubles, and if the requirement is not fulfilled again within a calendar year - 20,000 rubles. (clause 1 of article 129.1 of the Tax Code of the Russian Federation).

There is no set form for drawing up explanations, so they can be drawn up in any form. It is important that the explanations are convincingly formulated and justified.

To calculations with errors

The second type of most common situation in which you can’t get away with 6-NDFL alone is when the inspectorate has requested comments from a tax agent and wants him to adjust the submitted calculation. This usually happens when a specialist from the Federal Tax Service has found obvious “jambs” in the calculation. Then it is absolutely in the interests of the tax agent to submit explanations to the tax office for errors 6 personal income tax .

Clause 3 of Article 88 of the Tax Code of the Russian Federation provides five working days for submitting updated reports. The law says nothing about any explanations. This means that there is no need to explain anything. At your discretion.

Explanations to the tax office: errors 6-NDFL

Before submitting 6-NDFL, the calculation must be checked for compliance with the control ratios (letter of the Federal Tax Service of the Russian Federation dated March 13, 2017 No. BS-4-11/4371). If this is not done, the camera will reveal, for example, a discrepancy between the 6-NDFL calculation data and the 2-NDFL certificates, or other violations due to which the calculation will not be accepted by the inspectorate. The list of main violations in form 6-NDFL was recently published by the Federal Tax Service of the Russian Federation in letter dated November 1, 2017 No. GD-4-11/22216.

A common reason for tax authorities to request clarification is a technical error in the calculation. The tax agent may make a simple typo that will distort the indicators and lead to logical inconsistencies. For example, when entering the amount of tax deductions, an extra zero was indicated, and as a result, the deductions exceeded the amount of income.

In addition to explanations to the tax office regarding 6-NDFL, a sample of which we provide, you must submit to the Federal Tax Service a corrected form with updated indicators.

To the Head of the Federal Tax Service of Russia No. 43 for Moscow

from Antares LLCINN 7701111111/KPP 770000000

OGRN 12345678910111

Ref No. 12/34 dated 11/19/2017

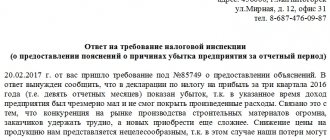

Explanations

In response to your request No. 0001-111-33/222 dated November 15, 2017, we inform you of the following:

in the calculation we presented on form 6-NDFL for 9 months of 2017, a technical error was made - a typo, which resulted in a discrepancy: the amount of tax deductions on line 030 exceeded the amount of accrued income on line 020. Corrected calculation on form 6-NDFL for 9 months of 2021 submitted to the Federal Tax Service on November 19, 2017 (attached a copy).

Appendix: copy of the calculation in form 6-NDFL for 9 months of 2017

General Director Pavlov V.V. Pavlov

Reasons for sending an explanatory letter

The three most common reasons for requests from the tax office, which will require sending an explanatory letter:

- The discrepancy between the amounts of paid and accrued tax. It may arise as a result of an error in the payment order or in the calculation itself.

- The checkpoint or OKTMO is incorrectly indicated in the reporting document. This often happens when a division mistakenly puts the codes of the parent organization on its reporting.

- Contradictions in the dates of calculation of 6-NDFL (lines 100, 110,120).

In addition, a desk audit may draw attention to the discrepancy between the company’s reporting (2-NDFL and 6-NDFL) and the income statement provided by the employee himself - 3-NDFL.

Independent clarification and correction of inaccuracies and technical errors before they are discovered by the inspector should be made a rule.

Explanations if there are no errors in 6-NDFL

The Federal Tax Service can send a demand not only when obvious errors are detected, but also in a number of other cases. The reason for requesting clarification can be anything that interests the inspectors: a discrepancy between the amounts of withheld and transferred tax, withholding personal income tax earlier than the salary is paid, or the lack of transfer of tax to the budget, etc.

In this case, according to Form 6-NDFL, tax explanations are given without providing a “clarification”, because the report was drawn up correctly, but it is necessary to explain the reason for the situation that arose. For example, a discrepancy between the calculation and transfer of tax arose due to the fault of the bank, which did not transfer funds from the tax agent’s current account on time. To confirm your words, you need to attach all available documents (bank statements, copies of payment slips, etc.) to your explanations.

Specific examples

Whatever happens in reporting practice.

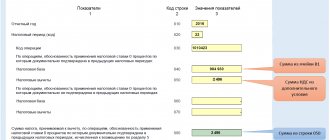

Let's look at possible specific cases. For example, form 6-NDFL was drawn up correctly and submitted on time. At the same time, as the control ratios for verification indicate, the calculated tax (line 070), reduced by the amount of the returned tax (line 090), should not exceed the amount of the paid tax shown in the budget settlement card. If the reporting shows the opposite, the inspector will have reason to believe that the withheld amount only partially went to the budget.

Another acceptable situation: when paying tax, the OKTMO code is entered incorrectly in the payment order. As a result, an automatic check detected arrears. Here there is a need for an explanatory note to the Federal Tax Service.

When compiling it you must:

- Indicate the details of the payment order, the exact and full name of the recipient and the digital code.

- Inform that the company has sent an application to clarify the payment, citing the relevant article of the Tax Code of the Russian Federation.

- Indicate that the payment must be taken into account in the taxpayer’s settlement card with the budget.

- It is imperative to emphasize that the Federal Treasury account number and bank details were correctly entered into the payment order. Consequently, the payment has actually been made, which eliminates the need to make corrections to the personal income tax calculation.

Explanation as an inevitable document

After passing f. 6-NDFL, tax authorities study it without the presence of a company specialist. The tax inspector often has questions about the submitted document, or the company itself has discovered errors and inaccuracies in the report that has already been submitted.

It becomes inevitable to write a letter of explanation for the calculation of personal income tax.

The form of the explanation and its content are not regulated by either instructions or regulatory documents. There are also no methodological instructions. Therefore, an employee of the enterprise, most likely an accountant, has to independently generate the text.

It is necessary to write the explanation in such a way that the tax office no longer has any questions. You need to approach the formation of the text of a document from approximately the same positions as the motivation in the tax audit process.

Features of drawing up different types of statements

Different types of applications can be sent to the tax office. They are divided into types depending on the purpose of the direction and content.

About obtaining a TIN

Any tax payer is registered with the Federal Tax Service. Registration is carried out within 5 days after sending the application. The latter is compiled according to form No. 2-2-Accounting, established by order of the Federal Tax Service No. YAK-7-6 / [email protected] dated August 11, 2011.

About the deduction

A deduction is an amount that reduces the calculation base when determining tax. There are these types of deductions:

- Regular.

- Child deduction.

- For investment.

Tax refunds are made based on the application. Its form is established by order of the Federal Tax Service No. ММВ-7-8 / [email protected] dated February 14, 2021.

On issuing a certificate stating that the payer has no debts

The payer may request information about the presence/absence of tax debts. To do this you need to request a certificate. It may be needed, for example, when obtaining a mortgage.

The application form has not been approved. That is, the document can be drawn up in free form. However, it is recommended to adhere to the standard structure: “header”, title, text with a formulated request, signature and date.

For a refund or offset of tax that was overpaid

A company may mistakenly pay too much in taxes. To get a refund, you need to send an application to the tax office. You need to formulate your request in the “body” of the document. It could be:

- refund;

- offset of funds against future payments.

The application must be submitted within 3 years from the date of overpayment. Funds must be returned within a month from the date of receipt of the tax paper. The application can be submitted in electronic format. To do this, you need to go to your personal account of the Federal Tax Service.

About deferment of payment

Sometimes individuals or legal entities cannot pay taxes on time. In this case, they can request an installment plan. The amounts for which the installment plan is issued cannot exceed the value of the debtor's property on which the tax is paid. To receive the benefit, you must fill out an application in the form specified in Appendix No. 1, approved by Order of the Federal Tax Service No. ММВ-7-8 / [email protected] dated September 28, 2010.

About the issuance of benefits

A number of payers can reduce the amount of taxes on land, transport and property, or cancel the payment altogether. In particular, the benefit is given to military personnel, disabled people of the first and second groups, pensioners and persons who have earned the status of Hero of the Russian Federation. You will also need to submit an application to receive benefits.

Letter of no activity

In practice, there are situations when an organization is unable to carry out its financial and economic activities for a long period of time. It should be remembered that when filling out documents with the Russian pension fund, territorial tax authority and social insurance fund for the purpose of submitting mandatory reporting, the head of the enterprise must necessarily provide the above authorities with an information letter about the absence of his activities.

Such a notification is issued, as a rule, on the letterhead of a legal entity, indicating the period of non-performance of activities and attaching documents confirming this circumstance. In other words, in order to reduce costs when the organization does not carry out business activities, the latter can send a document to the reporting authorities that will confirm that the company’s work has been suspended. This document will be called in practice a letter of absence of activity.

Components of a document

Actually, the letter will consist of just one phrase. Everything else is a “mandatory program” accepted in business communication. These include:

- Drawing up a letter on a specialized company letterhead. Communication with the tax service must be conducted at a decent level. If official forms are not at hand or do not exist in nature, then the sender’s company details are simply listed at the top of the letter stating that there is no obligation to submit a 2-NDFL calculation. This way it will be possible to identify the message in the general flow of correspondence.

- The name and number of the specific division of the Federal Tax Service to which the paper is sent. It is very important that the company is registered within the area of responsibility of this section of the tax office.

- Signature of the head of the organization.

- If possible, print.

- Date the letter was written.

- If such a system is accepted, then the number of the message sent.

The letter can be registered in the outgoing correspondence journal.

Text of the letter

Although the message should be concise, it should reflect the fundamentally important points. In the sample letter provided for download, in its main part it is stated:

- Full name of the sender's organization, its INN, KPP.

- The year for which the 2-NDFL calculation must be provided.

- Did the organization conduct economic and financial activities?

- Whether wages were paid to employees. The letter does not indicate the exact reason why it was not paid.

- Do employees registered with the organization apply for seniority?

The last column is important because, from a legal point of view, employees who are registered with the company, in some cases, can count on accrual of experience for any activity.

Tax mitigating circumstances: choose, declare

- the list of mitigating circumstances given in the Tax Code is not exhaustive; , therefore, literally anything that can evoke sympathy, pity or a feeling among tax officials or judges that the punishment is disproportionate to the offense can be recognized as such.

- the fact that mitigating circumstances have already been taken into account by a higher tax authority does not matter to the court; see, for example,;

It must be remembered that recognition of those not specified in paragraph.

1 tbsp. 112 of the Tax Code, mitigating circumstances are a right, not an obligation of the court or tax authority;

- the presence, along with mitigating aggravating circumstances, does not interfere with the reduction of the fine, see, for example,.

Having analyzed arbitration practice over the past 3 years, we have identified frequently encountered mitigating circumstances.

Letter dated 08/01/2016 No. BS-4-11/ [email protected]

The Federal Tax Service sends for use in the work clarifications on the issues of submitting and filling out the form for calculating the amounts of personal income tax calculated and withheld by the tax agent (Form 6-NDFL).

Please bring this letter to the lower tax authorities.

Acting State Advisor of the Russian Federation, 2nd class S.L. Bondarchuk

Question 1. Are organizations and individual entrepreneurs required to submit a “zero” calculation of the amounts of personal income tax calculated and withheld by the tax agent in Form 6-NDFL (hereinafter referred to as calculation in Form 6-NDFL)?

Answer:

If a Russian organization and individual entrepreneur do not have employees and do not pay income to individuals, then the obligation to submit a calculation in Form 6-NDFL does not arise.

Rationale:

Paragraph 1 of Article 226 of the Tax Code of the Russian Federation (hereinafter referred to as the Code) provides that Russian organizations, individual entrepreneurs, notaries engaged in private practice, lawyers who have established law offices, as well as separate divisions of foreign organizations in the Russian Federation, from which or as a result of relations with which the taxpayer received the income specified in paragraph 2 of Article 226 of the Code, are recognized as tax agents in relation to such income paid to an individual, and are obliged to calculate, withhold from the taxpayer and pay the amount of tax calculated in accordance with Article 224 of the Code.

In addition, paragraph 2 of Article 2261 of the Code lists persons who are recognized as tax agents when carrying out transactions with securities and operations with financial instruments of futures transactions, when making payments on securities for the purposes of this article, as well as Articles 2141, 2143 and 2144 of the Code .

According to paragraph 3 of paragraph 2 of Article 230 of the Code, tax agents submit to the tax authority at the place of their registration a calculation of the amounts of personal income tax calculated and withheld by the tax agent (hereinafter referred to as the calculation in form 6-NDFL), for the first quarter, half a year, nine months - no later than the last day of the month following the corresponding period, for the year - no later than April 1 of the year following the expired tax period, in the form, formats and in the manner approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] “On approval of the form for calculating the amounts of personal income tax calculated and withheld by the tax agent (form 6-NDFL), the procedure for filling out and submitting it, as well as the format for presenting the calculation of the amounts of personal income tax calculated and withheld by the tax authority agent, in electronic form."

Thus, the obligation to submit to the tax authority at the place of their registration a calculation in Form 6-NDFL arises for organizations if they are recognized as tax agents in accordance with Article 226 of the Code and paragraph 2 of Article 2261 of the Code.

Question 2. A former employee of the organization received income in kind on June 1, 2021. The organization does not produce any other income for the benefit of this person. How to fill out the calculation on form 6-NDFL when paying income in kind?

Answer:

If an employee is paid income in kind on 06/01/2016, then this operation is reflected in lines 020, 040, 080 of section 1 and lines 100 - 140 of section 2 of the calculation in form 6-NDFL for the half-year of 2021.

In section 2 of the calculation in form 6-NDFL for the first half of 2021, this operation should be reflected as follows:

line 100 indicates 06/01/2016;

on lines 110, 120 – 00.00.0000;

on line 130 - the corresponding total indicator;

on line 140 – 0.

Question 3. What amounts should be included in line 030 “amount of tax deductions” of section 1 of the calculation in form 6-NDFL?

Answer:

Line 030 “Amount of tax deductions” is filled in according to the values of codes for types of taxpayer deductions approved by Order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected] “On approval of codes for types of income and deductions.”

Question 4. Are income that is not subject to personal income tax subject to reflection in line 020 “Amount of accrued income”?

Answer:

The calculation according to Form 6-NDFL does not reflect income that is not subject to tax on the income of individuals listed in Article 217 of the Code.

Question 5. What amounts must be reflected in line 080 “the total amount of tax not withheld by the tax agent on an accrual basis from the beginning of the tax period” of section 1 of the calculation in form 6-NDFL?

Answer:

Line 080 “total amount of tax not withheld by the tax agent on an accrual basis from the beginning of the tax period” of section 1 of the calculation in Form 6-NDFL indicates the total amount of tax not withheld on the reporting date by the tax agent, on an accrual basis from the beginning of the tax period, taking into account the provisions paragraph 5 of Article 226 of the Code and paragraph 14 of Article 2261 of the Code.

This line reflects the total amount of tax not withheld by the tax agent from income received by individuals in kind and in the form of material benefits in the absence of payment of other income in cash.

Question 6. How to reflect the calculated amount of personal income tax on wages accrued for June, but paid in July,

on lines 070 and 080 of section 1 of the calculation in form 6-NDFL for the first half of 2021?

Answer:

Line 070 “Amount of withheld tax” of Section 1 indicates the total amount of tax withheld by the tax agent, cumulatively from the beginning of the tax period. Line 080 “Amount of tax not withheld by the tax agent” of Section 1 indicates the total amount of tax not withheld as of the reporting date by the tax agent, cumulatively from the beginning of the tax period, taking into account the provisions of paragraph 5 of Article 226 of the Code and paragraph 14 of Article 2261 of the Code.

Since the withholding of the amount of tax on income in the form of wages accrued for June, but paid in July, the tax agent must be made in July directly upon payment of wages (provided there are no income payments in January - June), in lines 070 and 080 of section 1 for the calculation of 6-NDFL for the first half of 2016, “0” is entered. This tax amount is reflected in line 040 of section 1 of the calculation in Form 6-NDFL for the first half of 2016.

At the same time, this tax amount must be reflected in line 070 of section 1, as well as the transaction itself in section 2 of the calculation in form 6-NDFL for the nine months of 2021.

Question 7. The procedure for submitting a calculation in Form 6-NDFL if the tax agent and its separate divisions (additional offices) are registered with one tax authority, but are located in different municipalities subordinate to this tax authority, since there are additional sheets for reflection of the line “Code by OKTMO” with different OKTMO is not provided

.

Answer:

The calculation in form 6-NDFL is filled out by the tax agent separately for each separate division, including those cases when separate divisions are registered with the same tax authority.

Rationale:

In accordance with the provisions of paragraph 2 of Article 230 of the Code, tax agents submit to the tax authority at the place of their registration a calculation in form 6-NDFL for the first quarter, six months, nine months - no later than the last day of the month following the corresponding period, for the year - no later April 1 of the year following the expired tax period, in the form, formats and in the manner approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected]

In accordance with paragraph 1 of clause 1.10 of section I of the Procedure for filling out and submitting the calculation in form 6-NDFL, approved by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [email protected] , the calculation form is filled out for each OKTMO separately.

Tax agents - Russian organizations with separate divisions submit calculations in form 6-NDFL in relation to employees of these separate divisions to the tax authority at the place of registration of such separate divisions, as well as in relation to individuals who received income under civil law contracts, to the tax office body at the place of registration of separate divisions that have entered into such agreements.

Tax agents - organizations classified as the largest taxpayers, having separate divisions, fill out the calculation in Form 6-NDFL separately for each separate division and submit it, including in relation to the employees of these separate divisions, to the tax authority at the place of registration as the largest taxpayer , or in relation to employees of these separate divisions to the tax authority at the place of registration of such a taxpayer in the corresponding separate division.

Question 8. An individual entrepreneur who combines two tax regimes - UTII and simplified tax system, has several retail outlets in different cities. An individual entrepreneur, as a payer of UTII, is registered with the Federal Tax Service at the place of trading activity for each outlet, and as a payer of the simplified tax system - at the place of residence of the individual entrepreneur. An individual entrepreneur has employees. Where should I pay personal income tax and, accordingly, submit a calculation using Form 6-NDFL?

Answer:

An individual entrepreneur carrying out activities using the simplified taxation system (hereinafter referred to as the simplified taxation system), transfers personal income tax on income paid to employees hired for the purpose of carrying out such activities to the budget at the place of residence of the individual entrepreneur, and on income paid to employees, those engaged in activities in respect of which the taxation system is applied in the form of a single tax on imputed income for certain types of activities (hereinafter referred to as UTII), transfers the personal income tax to the budget at the place of registration of the individual entrepreneur in connection with the implementation of such activities.

An individual entrepreneur carrying out activities using the simplified tax system submits a calculation in accordance with Form 6-NDFL in relation to employees hired for the purpose of carrying out such activities to the tax authority at the place of his residence, and in relation to income paid to employees engaged in activities in respect of which the taxation system in the form of UTII is applied, the calculation in form 6-NDFL is submitted to the tax authority at each place of registration of an individual entrepreneur in connection with the implementation of such activities.

Rationale:

In accordance with paragraph 7 of Article 226 of the Code, the total amount of tax calculated and withheld by the tax agent from the taxpayer, in respect of whom it is recognized as a source of income, is paid to the budget at the place of registration (place of residence) of the tax agent with the tax authority, unless another procedure is established by this point.

According to paragraph 4 of paragraph 7 of Article 226 of the Code, tax agents are individual entrepreneurs who are registered with the tax authority at the place of activity in connection with the application of the taxation system in the form of a single tax on imputed income for certain types of activities and (or) a patent taxation system, from the income of hired workers are required to transfer calculated and withheld tax amounts to the budget at the place of their registration in connection with the implementation of such activities.

Individual entrepreneurs are required to keep separate records of income received for each type of business activity.

At the same time, taking into account the provisions of paragraph 2 of Article 230 of the Code, tax agents - individual entrepreneurs who are registered with the tax authority at the place of activity in connection with the application of the taxation system in the form of UTII, submit a calculation of the amounts of personal income tax calculated and withheld by the tax authorities. agent (Form 6-NDFL), in relation to his employees hired for the purpose of carrying out such activities, to the tax authority at the place of his registration in connection with the implementation of such activities.

In accordance with paragraphs 1 and 5 of clause 1.10 of section II of the Procedure for filling out and submitting the calculation in form 6-NDFL, approved by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [ email protected] , the calculation form is filled out for each OKTMO separately.

Individual entrepreneurs who are tax agents who are registered at the place of carrying out their activities using the taxation system in the form of UTII for certain types of activities, indicate the OKTMO code at the place of registration of the individual entrepreneur in connection with the implementation of such activities; in relation to their employees, indicate the code according to OKTMO at the place of its registration in connection with the implementation of such activities.

Question 9. How to fill out the calculation using Form 6-NDFL if an anniversary bonus of 10,000 rubles was paid to an employee on May 20, 2016?

Answer:

If an employee received income in the form of an anniversary bonus in the amount of 10,000 rubles on May 20, 2016, then this operation is reflected in section 2 of the calculation in Form 6-NDFL for the first half of 2021 as follows:

line 100 indicates 05/20/2016;

on line 110 – 05/20/2016;

on line 120 – 05/23/2016 (taking into account paragraph 7 of Article 61 of the Code, the first working day following the day of tax withholding);

on line 130 – 10,000;

on line 140 – 1300.

Rationale:

In accordance with subparagraph 1 of paragraph 1 of Article 223 of the Code, the date of actual receipt of income is defined as the day of payment of income, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties - when income is received in cash.

Thus, the date of actual receipt of income in the form of an anniversary bonus is defined as the day of payment of income in the form of an anniversary bonus to the taxpayer, including the transfer of income to the taxpayer’s bank accounts.

According to paragraph 4 of Article 226 of the Code, tax agents are required to withhold the accrued amount of tax directly from the taxpayer’s income upon their actual payment, taking into account the specifics established by this paragraph.

At the same time, tax agents are required to transfer the amounts of calculated and withheld tax no later than the day following the day of payment of income to the taxpayer (clause 6 of Article 226 of the Code).

Question 10. In May 2021, the employee was paid a salary of 10,000 rubles, a temporary disability benefit for the first three days was assigned at the expense of the employer of 1,000 rubles, at the expense of the Social Insurance Fund of the Russian Federation 2,000 rubles, an additional payment was accrued up to the average earnings for the period of incapacity. according to the collective agreement 2,000 rubles. No personal income tax deductions were provided. Personal income tax calculated on wages and additional payments amounted to 1,560 rubles. ((10000+2000)*13%). Personal income tax calculated on temporary disability benefits is 390 rubles. ((1000+2000)*13%).

In fact, wages and temporary disability benefits were transferred to the employee on June 15, 2016 in the amount of RUB 13,050. And also on June 15, 2016, personal income tax in the amount of 1,950 rubles was withheld and transferred to the budget. How to reflect these transactions in the calculation using Form 6-NDFL for the first half of 2021?

Answer:

The calculation according to Form 6-NDFL for the first half of 2021 is filled out as follows:

In section 1, transactions for the payment of income in the form of wages and temporary disability benefits are reflected in lines 020, 040, 070.

In this case, the operation to pay wages for May 2021 in section 2 is reflected on line 100 – 05/31/2016, on line 110 – 06/15/2016, on line 120 – 06/16/2016, on line 130 – 10000, on line 140 – 1300 .

The operation for the payment of temporary disability benefits in section 2 is reflected on line 100 - 06/15/2016, on line 110 - 06/15/2016, on line 120 - 06/30/2016, on line 130 - 3000, on line 140 - 390.

The operation to pay income in the form of an additional payment up to average earnings for the period of incapacity for work under a collective agreement in section 2 is reflected on line 100 - 06/15/2016, on line 110 - 06/15/2016, on line 120 - 06/16/2016, on line 130 - 2000, on line 140 – 260.

Rationale:

In accordance with paragraph 2 of Article 223 of the Code, the date of actual receipt of income in the form of wages is recognized as the last day of the month for which the taxpayer was accrued income for the performance of labor duties in accordance with the employment agreement (contract).

The date of actual receipt of income in the form of benefits for temporary disability, as well as in the form of additional payment up to average earnings for the period of incapacity for work under a collective agreement is determined in accordance with subparagraph 1 of paragraph 1 of Article 223 of the Code as the day of payment of these incomes, including the transfer of income to the taxpayer’s accounts in banks or on his behalf to third party accounts.

According to paragraph 4 of Article 226 of the Code, tax agents are required to withhold the accrued amount of tax directly from the taxpayer’s income upon their actual payment, taking into account the specifics established by this paragraph.

At the same time, tax agents are obliged to transfer the amounts of calculated and withheld tax no later than the day following the day of payment of income to the taxpayer. When paying a taxpayer income in the form of temporary disability benefits (including benefits for caring for a sick child) and in the form of vacation pay, tax agents are required to transfer the amounts of calculated and withheld tax no later than the last day of the month in which such payments were made (clause 6 of Article 226 of the Code ).

Question 11.

Is income in the form of temporary disability benefits accrued to the employee for June, but transferred on July 5, 2021, to be reflected in lines 020 and 040 of section 1 of the calculation in Form 6-NDFL for the first half of 2021?

Answer:

If income in the form of temporary disability benefits accrued to an employee for June is actually transferred in July, there are no grounds for reflecting this operation in lines 020 and 040 of the calculation in Form 6-NDFL for the first half of 2016. This operation is subject to reflection in section 1 of the calculation in form 6-NDFL for the nine months of 2021.

When filling out section 2 of the calculation in Form 6-NDFL for the nine months of 2021, the operation to pay the specified income in July is reflected as follows:

on line 100 – 07/05/2016;

on line 110 – 07/05/2016;

on line 120 – 08/01/2016 (taking into account paragraph 7 of Article 61 of the Code, the first working day following the deadline for tax transfer);

on lines 130, 140 - the corresponding total indicators.

Rationale:

In accordance with paragraph 3 of paragraph 2 of Article 230 of the Code, tax agents submit to the tax authority at the place of their registration a calculation in form 6-NDFL for the first quarter, six months, nine months - no later than the last day of the month following the corresponding period, for the year - not later than April 1 of the year following the expired tax period, in the form, formats and in the manner approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected]

Clause 1.1. The procedure for filling out and submitting the calculation of the amounts of personal income tax calculated and withheld by the tax agent in Form 6-NDFL, approved by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] established that the calculation in Form 6- Personal income tax is filled out on the basis of accounting data for income accrued and paid to individuals by a tax agent, tax deductions provided to individuals, calculated and withheld tax on personal income contained in tax accounting registers.

Section 1 of the calculation in form 6-NDFL is filled out with an accrual total for the first quarter, half a year, nine months and a year.

The date of actual receipt of income in the form of temporary disability benefits is the day of payment of income, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties (subparagraph 1 of paragraph 1 of Article 223 of the Code).

According to paragraph 4 of Article 226 of the Code, tax agents are required to withhold the accrued amount of tax directly from the taxpayer’s income upon their actual payment, taking into account the specifics established by this paragraph.

When paying a taxpayer income in the form of temporary disability benefits (including benefits for caring for a sick child) and in the form of vacation pay, tax agents are required to transfer the amounts of calculated and withheld tax no later than the last day of the month in which such payments were made (clause 5 of Article 226 of the Code ).

Question 12. How to determine the period for which income was paid for the purposes of filling out form 2-NDFL and calculating 6-NDFL?

Answer:

The period for which income is paid is determined by the date of actual receipt of income, taking into account the provisions of Article 223 of the Code.

Example

:

— wages for December 2015 were paid to the employee in January 2021. The period for which the income was paid is December 2015;

— payment under a civil law agreement for services provided on 12/22/2015 was made on 02/01/2016. The period for which income was paid is February 2021;

— employee vacation pay for annual paid leave from 07/01/2016 to 07/14/2016 was transferred on 06/27/2016. The period for which income was paid is June 2021.

In 2-NDFL, income is less than what employees declared in 3-NDFL.

Perhaps an employee of your company filed a 3-NDFL return for last year. For example, to declare income from the sale of a car or to receive a deduction for the purchase of an apartment, treatment or study.

Inspectors, after checking the declaration with the certificate, sometimes discover that the income in 2-NDFL is less than in the declaration. For tax authorities, such inconsistencies are one of the signs that the company is issuing shady salaries.

These types of discrepancies are not the concern of the company accountant. Indeed, how does an organization know why a person declared more income than in the 2-NDFL certificate? Maybe it was a typo. Or the citizen received additional income from other organizations or from the sale of property, etc.

And if so, the person himself must explain to the inspectors the origin of income in 3-NDFL. The company may limit itself to reporting that there are no errors in its 2-NDFL certificates.

We invite you to read: Scratched a car in the yard - what should the culprit and the victim do under CASCO and OSAGO?

Of course, before this you need to check again to see if there are any inaccuracies in the certificates.

When is written clarification needed?

Situations in which tax authorities have the right to demand an explanation from an organization are listed in articles of the Tax Code of the Russian Federation: 88, 105.29, 25.14. In practice, fiscal services require a written response for other reasons. If they are not specified in tax laws, the company can ignore the request without fear of penalties. However, experts recommend not to do this: without receiving the necessary information, employees of the Federal Tax Service can visit the enterprise with an on-site inspection.

The basis for the request is any inconsistencies between reports, noted inaccuracies and contradictions. The appeal of the fiscal services should not be ignored: since the beginning of January 2021, amendments have been made to the Tax Code (Article 129.1), introducing financial liability for failure to provide explanations. The first precedent is punishable by a fine of 5 thousand rubles, repeated “silence” is punishable by a fine of 20 thousand rubles.