From January 1, 2021, all insurance premiums must be sent to the Federal Tax Service, with the exception of the “injury” contribution, which will continue to be paid to the Federal Tax Service. In this regard, the BCC indicated in payment orders by payers should also change. These twenty-digit codes must be indicated in field 104 of the payment slip for the correct distribution of taxes and contributions going to the budget. Today, new BCCs for insurance premiums are in effect, plus for many taxes, codes for 2021 have also been adopted. In this article we will try to figure out which BCCs will be in effect next year for contributions.

KBK for payment of insurance contributions to the Pension Fund for employees

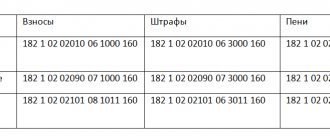

| TAX | KBK |

| Insurance contributions for pension insurance to the Pension Fund for employees for the payment of the insurance and funded part of the labor pension | 182 1 02 02010 06 1010 160 |

| Insurance contributions to the Pension Fund at an additional rate for insured persons employed in hazardous conditions according to List 1, for the payment of the insurance part of the labor pension | 182 1 02 02131 06 1010 160 |

| Insurance contributions to the Pension Fund at an additional rate for insured persons engaged in heavy types of work on list 2, for payment of the insurance part of the labor pension | 182 1 02 02132 06 1010 160 |

KBK for payment of penalties on insurance contributions to the Pension Fund for employees

| PENES, FINES | KBK | |

| Penalties, fines on insurance contributions for pension insurance to the Pension Fund for employees for the payment of the insurance and funded part of the labor pension | penalties | 182 1 02 02010 06 2110 160 |

| fines | 182 1 02 02010 06 3010 160 | |

| Penalties and fines for insurance contributions to the Pension Fund of the Russian Federation at an additional rate for insured persons employed in hazardous conditions according to List 1, for the payment of the insurance part of the labor pension | penalties | 182 1 02 02131 06 2100 160 |

| fines | 182 1 02 02131 06 3000 160 | |

| Penalties and fines for insurance contributions to the Pension Fund of the Russian Federation at an additional rate for insured persons engaged in heavy types of work on list 2, for the payment of the insurance part of the labor pension | penalties | 182 1 02 02132 06 2100 160 |

| fines | 182 1 02 02132 06 3000 160 | |

In FFOMS

Using KBK in payment orders

Budget classification codes (BCC) were introduced in 1998 with the aim of streamlining financial flows, identifying tax payments, and budget distribution. BCCs are regularly reviewed, which requires control over changes in details.

The relevance of the KBK used when paying contributions is the main guarantor of the correct transfer of payments. The BCC consists of 20 digits, divided into 4 groups, allowing you to determine:

- Administrator. The first 3 digits indicate the payee. When specifying “393”, the administrator is the FSS.

- Income category. A group of indicators of 10 digits indicates payment data - source, type of tax or contribution, subgroups, sub-items, elements that more accurately characterize the payment.

- Distribution of receipts by type. 4-digit indicators allow you to determine whether a deduction is in the form of a tax, penalty or fine.

- Payment classification. The last 3 digits indicate the type of budget income. If “160” is indicated, the data indicates contributions to the Social Insurance Fund.

Data on KBK is indicated in field “104” of the payment order provided to the bank to repay obligations in the form of accrued contributions to the Social Insurance Fund (

KBK for payment of penalties on insurance contributions to the Social Insurance Fund for employees

| PENES, FINES | KBK | |

| Penalties and fines on insurance contributions to the Social Insurance Fund for employees for compulsory social insurance in case of temporary disability and in connection with maternity | penalties | 182 1 02 02090 07 2110 160 |

| fines | 182 1 02 02090 07 3010 160 | |

| Penalties and fines for insurance contributions to the Social Insurance Fund for workers from industrial accidents and occupational diseases | penalties | 393 1 02 02050 07 2100 160 |

| fines | 393 1 02 02050 07 3000 160 | |

FILES

KBK in the FSS (NS and PZ) 2021

Details for transferring insurance premiums, penalties, fines:

Recipient : UFK for the Novosibirsk region (GU-Novosibirsk RO Social Insurance Fund of the Russian Federation l/s 04514С51000);

TIN 5406023745;

checkpoint 540701001;

OKTMO 50701000;

Bank : Siberian Main Directorate of the Bank of Russia, Novosibirsk;

BIC 045004001;

r/s 40101810900000010001;

| 393 1 0200 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity |

| 393 1 0200 160 | Penalties on insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity |

| 393 1 0200 160 | Penalties for insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity |

| 393 1 0200 160 | Insurance contributions for compulsory social insurance industrial accidents |

| 393 1 0200 160 | Penalties on insurance premiums for compulsory social insurance against accidents at work and occupational diseases |

| 393 1 0200 160 | Penalties for insurance premiums for compulsory social benefits against industrial accidents and occupational diseases |

| 393 1 1100 120 | Income from the placement of temporarily free funds of the Social Insurance Fund of the Russian Federation, generated from the receipt of the unified social tax |

| 393 1 1100 120 | Income from the placement of temporarily free funds of the Social Insurance Fund of the Russian Federation, generated from the receipt of insurance contributions for compulsory social insurance against industrial accidents and occupational diseases |

| 393 1 1100 120 | Income from the rental of property under the operational management of the Social Insurance Fund of the Russian Federation |

| 393 1 1100 120 | Other income from the use of property under the operational management of the Social Insurance Fund of the Russian Federation |

| 393 1 1400 410 | Income from the sale of property under the operational management of the Social Insurance Fund of the Russian Federation (in terms of the sale of fixed assets for the specified property) |

| 393 1 1400 440 | Income from the sale of property under the operational management of the Social Insurance Fund of the Russian Federation (in terms of the sale of material reserves for the specified property) |

| 393 1 1600 140 | Monetary penalties ( fines ) for violation of the legislation of the Russian Federation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (regarding the budget of the Social Insurance Fund of the Russian Federation) ( for example , failure to submit a report or late submission of a report) |

| 393 1 1600 140 | Monetary penalties (fines) and other amounts collected from persons guilty of committing crimes and for compensation for damage to property, credited to the budget of the Social Insurance Fund of the Russian Federation |

| 393 1 1600 140 | Other receipts from monetary penalties (fines) and other amounts for damages, credited to the Social Insurance Fund of the Russian Federation ( administrative fine ) |

| 393 1 1700 180 | Receipts of capitalized payments of enterprises |

| 393 1 1700 180 | Other non-tax revenues to the Social Insurance Fund of the Russian Federation ( voluntary insurance contributions ) |

KBK 393 1 0200 160 Insurance contributions for compulsory social insurance against accidents at work and occupational diseases (payment amount (recalculations, arrears and debt on the corresponding payment, including the canceled one) ( insurance contributions for compulsory social insurance against accidents at work and occupational diseases ) ;

KBK 393 1 0200 160 Insurance contributions for compulsory social insurance against accidents at work and occupational diseases (penalties on the corresponding payment) (penalties accrued for failure to pay insurance contributions on time) ;

KBK 393 1 0200 160 Insurance contributions for compulsory social insurance against accidents at work and occupational diseases (interest on the corresponding payment) (interest accrued on the amount of deferment (installment plan) for the payment of insurance premiums) ;

KBK 393 1 0200 160 Insurance contributions for compulsory social insurance against industrial accidents and occupational diseases (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) (fines calculated based on the amount of accrued or unpaid (not fully paid) insurance contributions) ;

KBK 393 1 1600 140 Monetary penalties (fines) for violation of the legislation of the Russian Federation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (in terms of the budget of the Social Insurance Fund of the Russian Federation) (federal state bodies, Bank of Russia, government bodies extra-budgetary funds of the Russian Federation)

(receipts from monetary penalties (fines):

— for violation by policyholders of the established deadline for registration as an insured;

— for failure to comply with the procedure for submitting calculations for accrued and paid insurance premiums in electronic form;

- for refusal or failure to submit documents and (or) other information required to monitor the correctness of calculation, completeness and timeliness of payment (transfer) of insurance premiums);

KBK 393 1 1600 140 Other receipts from monetary penalties (fines) and other amounts for damages credited to the budget of the Social Insurance Fund of the Russian Federation (federal state bodies, Bank of Russia, management bodies of state extra-budgetary funds of the Russian Federation) (receipts from organizations (officials) persons of organizations) other proceeds from monetary penalties (fines), including fines for administrative offenses, and other amounts for damages credited to the budget of the Social Insurance Fund of the Russian Federation) ;

KBK 393 1 1700 180 Receipts of capitalized payments of enterprises in accordance with the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against accidents at work and occupational diseases” (federal government bodies, the Bank of Russia, management bodies of state extra-budgetary funds of the Russian Federation) (receipts from the crediting of capitalized payments of enterprises) ;

KBK 393 1 1700 180 Other non-tax revenues to the Social Insurance Fund of the Russian Federation (federal state bodies, Bank of Russia, management bodies of state extra-budgetary funds of the Russian Federation) (other revenues from non-tax revenues subject to credit to the Social Insurance Fund of the Russian Federation, for which there are no separate budget classification codes, within the competence of the Social Insurance Fund of the Russian Federation) .

| 0401060 | |

| Admission to the bank of payments. | Debited from account plat. |

| PAYMENT ORDER No. 20 sample | 02.02.2017 sample | 08 | |

| date | Payment type | ||

| Suma in cuirsive | One hundred rubles 00 kopecks sample | |||||||||||

| TIN 5402103414 sample | Gearbox 540601001 sample | Sum | 100-00 sample | |||||||||

| LLC "Success" sample | ||||||||||||

| Account No. | 40702810200010115443 sample | |||||||||||

| Payer | ||||||||||||

| NF JSCB "LANTA-BANK" (JSC) NOVOSIBIRSK sample | BIC | 045004837 sample | ||||||||||

| Account No. | 30101810000000000837 sample | |||||||||||

| Payer's bank | ||||||||||||

| Siberian Main Directorate of the Bank of Russia , Novosibirsk | BIC | 045004001 | ||||||||||

| Account No. | ||||||||||||

| payee's bank | ||||||||||||

| TIN 5406023745 | checkpoint 540701001 | Account No. | 40101810900000010001 | |||||||||

| UFK for the Novosibirsk region (GU-Novosibirsk RO Social Insurance Fund of the Russian Federation l/s 04514С51000) | ||||||||||||

| Type op. | 01 | Payment deadline. | ||||||||||

| Name pl. | Essay. plat. | 5 | ||||||||||

| Recipient | Code | 0 | Res. field | |||||||||

| 39310202050071000160 | 50701000 | 0 | 0 | 0 | 0 | |||||||

| Insurance contributions for compulsory social insurance against industrial accidents and occupational diseases for January 2021, amount: 100-00, excluding VAT | ||||||||||||

| Purpose of payment | ||||||||||||

Signatures Bank marks

| M.P. |

Summing up the application of these BCCs

An entrepreneur who employs employees must make mandatory contributions for them to extra-budgetary funds. Which BCC should I indicate in the relevant payment orders? The amount of deductions, as well as coding, depend on the conditions in which employees work.

Contributions to employee pension insurance

The budget classification code does not depend on whether the employer’s income from the use of the labor of hired employees exceeds the maximum base value (300 thousand rubles). Deductions for employees with a base value both less and more than the maximum must be paid according to the following BCC: 392 1 0200 160. Separate codes for this type of payment have been cancelled. According to this BCC, the following types of contributions to the Pension Fund for the payment of an insurance pension are credited:

- main payment;

- outstanding principal payment;

- debt on canceled payment;

- the resulting arrears;

- recalculation payment.

Sanction payments for insurance contributions to the Pension Fund of Russia

- Fines - must be transferred according to KBK 392 1 02 02010 06 3000 160.

- Penalties are credited according to KBK 392 1 0200 160.

If employees work under special conditions

For employers who provide employees with harmful and/or dangerous working conditions, there is an additional rate of contributions to the Pension Fund, since the law will allow employees “for harmfulness” to retire earlier than the age prescribed. It is the deductions of these additional contributions that will help in the future to calculate the moment from which employees will be entitled to early retirement.

1. Hazardous work requires deductions for employees according to KBK 392 1 0200 160.

- Penalties for late payments are according to KBK 392 1 02 02131 06 2100 160.

- Fines for such contributions are according to BCC 392 1 0200 160.

2. For those employed in difficult working conditions, KBK 392 1 02 02132 06 1000 160.

- Peni – KBK 392 1 0200 160

- Fines – KBK 392 1 0200 160.

Contributions for hired employees to the Federal Compulsory Compulsory Medical Insurance Fund

Deductions for compulsory health insurance for employees are required by KBK 392 1 0211 160.

Penalties for this payment are according to KBK 392 1 0211 160.

Fines, if any, are assessed - according to KBK 392 1 0211 160.

KBK insurance premiums for accidents and occupational diseases (fines)

According to the explanations of Art. 26.24 of the Federal Law of July 24, 1998 No. 125-FZ, if the entrepreneur does not submit the payment in accordance with the form in a timely manner. 4-FSS, he is fined.

The BCC for filling out a payment order will differ from the budget classification code that is used in the case of paying the contributions themselves:

| Details in the payment order | KBK for 2021 (NS and PZ) |

| KBK to pay a fine for late submission of the 4-FSS report | 393 1 0200 160 |