Filling out tax returns is not a very simple or interesting process. However, this must be done. When preparing the 3rd personal income tax return, everyone is faced with the need to indicate the adjustment number. This column is located on the title page of the declaration and raises many questions. Especially many questions arise for those who fill out the declaration for the first time. Let's figure it out further. what to write the adjustment number in 3 personal income tax and what it is in the income declaration.

What does the adjustment number mean in 3 personal income tax?

Declaration 3 Personal income tax is one of the few types of tax reporting that ordinary citizens face. After all, according to Article 226 of the Tax Code of the Russian Federation, tax agents report for individuals. Only if the agent is unable to withhold personal income tax and submit a report for an individual, the citizen is obliged to report to the tax office and pay tax.

Important! 3 Personal income tax is filed by a citizen if the employer cannot withhold income tax from him.

The most common examples of such cases:

- Payment of income to a person in kind. According to the rules of Article 226 of the Tax Code of the Russian Federation, when issuing income in the form of things, property rights and other non-monetary equivalents, the tax agent is obliged to withhold personal income tax from the next cash payment. But if this is not expected, then the agent reports to the Federal Tax Service that he did not withhold the tax, and the Federal Tax Service itself is already engaged in collecting the amount due from the citizen.

- Receipt of income by an individual from another individual: sales, rental transactions. A tax agent is an organization or individual entrepreneur, and an ordinary individual cannot act as an agent, therefore, in economic relations between an individual and an individual, it is impossible to withhold tax at the source of payment.

- Submitting a return to use the tax deduction. Chapter 23 of the Tax Code of the Russian Federation provides for 5 types of tax deductions, for the application of which it is necessary to submit Form 3 of personal income tax with accompanying documents to the inspectorate.

The following reporting form is currently in effect:

It was adopted by order of the Federal Tax Service of Russia dated October 3, 2021 No. ММВ-7-11 / [email protected] as amended on October 7, 2021. This form is valid from 2021. Required sheets:

- title;

- section 1;

- section 2.

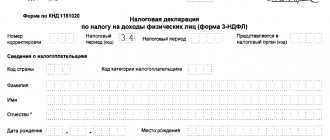

Other pages are added to the form as needed. On the title page 3 of the personal income tax the adjustment number is indicated. What this detail means is the order in which reports are submitted for the same period.

Important! Adjustment is information about how many times the declaration for the same period is adjusted in turn. The adjustment can be zero or numeric.

Features of the Corn payment account

Immediately after authorization on the website, the following options become available to the bank client:

- replenishing a mobile account without charging a commission;

- payment for housing, utilities and Internet services;

- transfer of funds to wallets of electronic payment systems;

- payment for purchases in online games;

- checking for fines from the traffic police and paying them (you can also receive notifications about the issuance of new fines);

- transfer of funds to any MasterCard, Maestro or Visa bank cards (regardless of what country the recipient is in);

- tracking receipts and debits from the account, receiving statements;

- viewing data on the size of the credit limit and the amount of minimum required payments.

In addition, Kukuruza cards are serviced in all Russian banks, and to replenish them you can use a card from any financial and credit organization.

Check your Corn balance online by card number

All user data entered into the Kukuruza online banking system is under reliable protection. In order to prevent unauthorized debiting of funds from a client’s account, access to data about him is provided only when visiting his personal account.

Checking your Corn card balance by card number

To do this, you will need to log in to the site using your username and password, and also confirm the implementation of the login procedure by entering the code received on your phone. After this, the main profile page will open, where all significant information about the balance status of the main and bonus account will be presented.

Activation of the Corn card through your personal account

Card activation is required if it is replaced. When providing a new plastic key to replace the lost one, Euroset employees send an activation code to the user’s cell phone (you should not delete it without first completing the activation procedure).

To resume using the Corn card as usual, you will need:

- Open the login form to your personal account and click “Login using the replaced card”;

- In the activation window that opens, indicate the barcode of the updated card;

- Enter the activation code (which was previously sent to the phone);

- Click the “Activate” button.

Activation of the Corn card by barcode

At this point the procedure can be considered complete.

Bonus program - managed through your personal account kykyryza.ru

Participation in a special loyalty program allows Kukuruza customers to accumulate special bonus points on the card, which can be used to receive discounts on various products offered by program partners.

Bonus program and promotions Corn

To get as many bonuses as possible, it is recommended to take part in promotions organized by well-known stores. A complete list of such offers can be found on the Kukuruza Internet Bank website in the “Promotions” section.

How to find out the number

How to find out the adjustment number in personal income tax return 3:

- if you submit a report for the first time for the period, then your adjustment is zero, that is, there is no adjustment at all, you did not make an adjustment and your report was submitted for the first time;

- if you submitted reports, then there was a need to supplement it or correct errors, then an updated form is submitted and the order of correction is indicated: “1” - correction for the first time, “2” - information is updated for the second time, etc.

Often a citizen does not remember all the transactions made in past periods and misses them when filling out the form. Considering that the statute of limitations for personal income tax is 3 years, this is natural. For example, in 2021 you turned in the 2021 form to receive a property deduction from your paycheck. And in 2021, they remembered that among your income from which the tax was paid was not only your salary, but also the proceeds from the sale of your car. To enter additional information, you will have to fill out the form again and indicate that it is updated, i.e. adjustment “1”.

What to write in the declaration

You need to write the adjustment number in 3 personal income tax in a special column on the title page at the top of the page, next to the year and period.

Note! The column “adjustment number” is required to be filled out. Submitting a report without specifying this detail may result in questions from the Federal Tax Service or a negative response based on the results of a desk audit.

Primary

In fact, the primary adjustment code in 3 personal income tax is “0”, since you are submitting the report for the first time. To correct any information, you first need to formalize it at least for the first time.

https://www.youtube.com/watch?v=aItjLw7-1k4

Take into account! Submitting form 3 personal income tax for the first time is accompanied by an adjustment number “0”, which means that the form has no clarifications and has not been submitted before for the same period.

Code “0” is the most common when filling out form 3 of personal income tax. How to write it:

- on a paper form - write down the combination “000” in the column;

- in the program or in the service of the taxpayer’s Personal Account - enter one “0”.

For reference! The income tax return can be submitted in paper or electronic form. The paper form is filled out manually or on a computer with subsequent printing; the electronic format is compiled using a program or online service and submitted to the Federal Tax Service via a telecommunication channel.

Refined

A correction number in the personal income tax return occurs if a citizen:

- supplements the report with new information on its own initiative;

- corrects errors identified by the inspection.

The Tax Code of the Russian Federation has no limits on the number of adjustments to the form. In fact, you can clarify information an unlimited number of times, but, of course, such actions without justification are not welcomed by the tax authorities.

Tax inspectors may not notice that you failed to report an old sale or deduction. The main thing is that the result on the form matches the data in the AIS database: the amount of personal income tax to be paid or refunded.

Addition to the "duck"

When the return is refiled, the payer does not need to consider the difference between the incorrect and fair values. The document should contain only current indicators and look as if the primary declaration did not exist at all. Only the “Adjustment number” attribute changes.

When resubmitting, the document must contain current data

In this case, the tax authority does not officially require clarification, but may subsequently request details and clarifying details. An example of such a situation is a desk audit. It is recommended that you include an explanatory note with comprehensive details in the package.

For a complete picture, the cover letter may include the following information:

- The period for which the declaration is submitted.

- Type of tax.

- Graphs that contain clarifications (it is necessary to explain where the primary data and the newly corrected data are located).

- If the tax amounts and tax base have changed, the latest information is indicated.

- Details of the payment order, if the taxpayer has previously eliminated the arrears and paid the penalty in full.

When penalties and arrears are received into the budget before the “clarification” is submitted, copies of the “payments” should be included in the documents. Other information (also in the form of photocopies) may be needed if it was not provided for consideration the first time.

In case of counting errors, additional documents are not needed. When a taxpayer issues a social deduction (to receive the unpaid balance of the amount), he submits an updated declaration and the necessary confirmations.

Sanctions for errors in the declaration

Responsibility for errors in the tax return 3 personal income tax is regulated by Article 81 of the Tax Code of the Russian Federation. Consider the following nuances:

- errors are divided into 2 types - underestimating the tax payable and not underestimating the tax payable;

- if a citizen himself discovers that he made a mistake that reduces the personal income tax payable, and managed to pay the missing amount before the deadline for paying the tax and before the inspection error was discovered, then no fines will be accepted based on the submitted updated form; Documents confirming that personal income tax has been paid in full within the prescribed period must be attached to the report;

- if the payer submitted the form without independently paying the arrears or after an inspection error was discovered, then he may be held liable; According to Article 81 of the Tax Code of the Russian Federation, such citizens are fined in the amount of 20% of the amount of tax required to be paid to the state budget.

Useful links:

The Taxopedia dictionary, in a popular form accessible to the widest range of users, explains the most commonly used concepts and concepts of the Russian taxation system, in particular, the taxation system for individuals. Taxology was prepared by the Taxation team. Taxology exists only in electronic form on the Taxation website (www.nalogia.ru). All copyrights to Taxopedia articles belong to Taxation and are protected by law.

You can see the list of dictionary entries here.

If a taxpayer discovers an error in a declaration previously submitted to the Federal Tax Service, then sometimes he may not make an adjustment to it, and sometimes he is simply obliged to submit an updated declaration.