All enterprises that have fixed assets on their balance sheet are required to keep records of depreciation charges.

To do this, monthly entries are made in accounting to write off part of the cost of fixed assets as depreciation. In addition, the accountant encounters this concept when revaluing, modernizing, retiring, or writing off objects. Each of these operations entails the need to reflect double entries in the depreciation accounts.

The procedure for calculating depreciation of fixed assets in accounting

Depreciation involves the gradual inclusion in expenses of the cost of fixed assets, which is a significant amount for any organization.

Fixed assets can participate in generating income for a long time and have a long service life. Depreciation of fixed assets must be calculated for all groups. But some of the property does not need to be depreciated:

- if the initial cost is within the limits of the maximum value not exceeding 40,000 rubles. (clause 5 of PBU 6/01) (if these objects are accepted for accounting as inventories);

- if the object is on the list of property for which depreciation is not accrued (clause 17 of PBU 6/01).

Read about non-depreciable fixed assets in the material “Rules for calculating depreciation of non-current assets”.

PBU 6/01 is the main document that establishes the rules for calculating depreciation of fixed assets in accounting. When accepting for accounting for each individual object, the organization determines the depreciation procedure based on PBU 6/01 and fixes the parameters: the method of calculating depreciation of fixed assets , and their useful life.

Read about the basic rules for calculating depreciation of fixed assets in the already familiar material “Rules for calculating depreciation of non-current assets.”

Analytical accounting for account 02

Depreciation is tightly tied to fixed assets, so all analytics for account 02 are built around individual fixed assets inventory objects. They include both the asset itself and all the necessary fixtures and accessories for its functioning.

They keep analytical records in one of three standard documents, which are also used for OS analytics:

- OS object inventory card;

- inventory card for group accounting of OS objects;

- inventory book for accounting of OS objects.

They reflect information about the receipt, movement, disposal, modifications, improvements of fixed assets, and also make entries about depreciation accrued from the beginning of operation.

Example of calculating depreciation of fixed assets

Let's look at an example of how to calculate depreciation of fixed assets in practice.

Example

In January 2021, the organization accepted the facility into operation with an initial cost of 72,000 rubles. The fixed useful life is 3 years (36 months).

The linear depreciation method chosen by the organization provides for the following calculation of the annual depreciation amount: 72,000 × 1 / 3 = 24,000. Here 1/3 is the depreciation rate. It is calculated based on the specified number of years of operation. In fact, the annual amount can be obtained by simply dividing the cost by the number of years; in practice, this is how the calculation is made.

The monthly depreciation amount is equal to the result of dividing the annual amount by the number of months in the year: 24,000 / 12 = 2,000. Or, which is equivalent, the result of dividing the original cost by the number of months of use: 72,000 / 36.

What is wear and tear

Fixed assets, being repeatedly used in the production process, retain their characteristics for some time, and then begin to gradually lose them due to exploitation and natural factors.

Depreciation of fixed assets is the process and result of partial or complete loss of their technical characteristics and qualities, consumer properties, residual value, occurring as a result of operation and/or inaction (under the influence of time).

Depreciation of fixed assets has been accrued - how to reflect the entries in accounting?

Depreciation amounts are accumulated on the credit of account 02. The account in the debit of the entry depends on the characteristics of the activity in which the object is operated.

| Wiring | Object in use |

| Dt 20, 23, 25 Kt 02 | In the main production, auxiliary, general production workshops |

| Dt 26 Kt 02 | For management purposes |

| Dt 29 Kt 02 | In service farms |

| Dt 44 Kt 02 | In trading and procurement activities For the purpose of selling products in production activities |

| Dt 91 Kt 02 | In other activities |

For rent and leasing

Under agreements for the provision of fixed assets for lease, only the lessor has the right to calculate depreciation. An exception is cases where the tenant has made capital investments in the property, which can be classified as inseparable improvements. Of course, all improvements are made with the consent of the landlord.

A leasing agreement is a type of rental agreement. One of the differences is that depreciation is calculated by the party on whose balance sheet the property is located. The leasing agreement provides for the possibility of accounting for fixed assets on the balance sheet of both the leasing recipient and the lessor.

Depreciation of fixed assets on the balance sheet

The balance sheet form does not provide a separate line for the amount of depreciation accrued as of the reporting date. But this amount participates in the formation of the line indicator 1150 as a regulating value. Namely, to reflect how the indicator in the net valuation is formed for the specified line: the original cost reduced by the amount of accumulated depreciation. The book value of the asset is equal to the difference between the balance of account 01 and the balance of account 02.

In this case, information on depreciation, including accrued, retired, accumulated as of the reporting date, is deciphered by groups of objects and provided to users of the statements in the notes to the balance sheet.

The following disclosure requirements in reporting are established:

- clause 35 of PBU 4/99 (order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n),

- clause 49 of the regulations on accounting (order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n),

- clause 32 of PBU 6/01 (order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n).

Physical and moral wear and tear

There are two forms of depreciation of fixed assets - physical and moral.

Physical wear and tear – loss of consumer value

When fixed assets are affected by various physical forces, as well as technical and economic factors, including storage conditions, the assets gradually fail, lose value and sooner or later must be replaced. In some cases, physical wear and tear must be restored through, for example, major repairs.

For each group of fixed assets, the form of manifestation of physical wear and tear will differ in its characteristics:

- equipment and tools during wear can change shape, size, performance, accuracy, etc.;

- buildings and structures undergo physical wear and tear more slowly;

- transfer devices lose their quantitative and qualitative characteristics as their service life expires;

- production and household equipment wears out most quickly.

Physical deterioration is an uneven process, since factors that are not always predictable affect different types of assets differently. Characteristic pattern of wear rates:

- at the beginning of operation - more accelerated wear;

- during the main service life - a slight slowdown in the pace due to the establishment of a working rhythm;

- towards the end there is acceleration again.

The forms of physical wear and tear may vary depending on the characteristics of the degradation and its completeness.

- Depending on the impact of certain factors on the fixed asset, the following are distinguished:

- mechanical wear;

- decrease in key indicators over time of use;

- wear and tear of inactive assets under the influence of storage conditions and natural factors (humidity, fungus, etc.).

- Depending on the degree of wear, we can distinguish:

- partial wear and tear is a loss of value and properties that can be compensated by repairs, returning a significant part of the original characteristics to the fixed asset;

- complete wear and tear - the fixed asset is subject to replacement (reimbursement) by purchasing a new one (equipment, tools, etc.) or capital construction (buildings and structures).

Obsolescence - you can use it, but it’s no longer worth it

Obsolescence shows the loss of value of fixed assets that are physically still suitable for use, but are already less profitable due to the emergence of other, more efficient types. Depreciation can be considered a synonym for obsolescence.

Forms of obsolescence vary according to its underlying causes.

- In the context of scientific and technological progress, the cost of reproduction of fixed assets is becoming cheaper. Manufacturers of fixed assets are increasing their capacity and modernizing their enterprises, as a result of which new equipment and tools are beginning to cost less than their analogues that have been used for some time and are still physically suitable for use. The decrease in value occurs due to the fact that the cost of living labor for the production of certain fixed assets is reduced. In this case, the consumer properties of the assets are, as a rule, preserved.

- New technologies and equipment models are emerging that make it possible to produce more products with the same labor costs. More modern tools, equipment, vehicles, etc., which are more economical, will reduce the cost of production, that is, they will surpass the old one that is still working in qualitative and/or quantitative parameters.

- Social wear and tear occurs when the characteristics of a fixed asset that are relevant to society exceed the acceptable social level (for example, the level of safety, harmful emissions, etc.).

NOTE! Obsolescence does not always mean the need to replace fixed assets.

Depreciation of fixed assets in 2018-2019 in tax accounting

The procedure for accounting depreciation in 2018-2019 has not changed. However, in 2021, changes affected tax accounting. Thus, the Law of June 8, 2015 No. 150-FZ (clauses 7–8 of Article 5) introduced amendments to Art. 256, 257 Tax Code of the Russian Federation. They consist in increasing the value of property that is not classified as depreciable.

Previously, this figure was equal to 40,000 rubles. and corresponded to a similar limit in accounting. Now the amount in the Tax Code of the Russian Federation has been increased to 100,000 rubles. The new rules only apply to property put into operation on or after January 1, 2021. For other objects costing over 40,000 and up to 100,000 rubles, which were already in operation before this date, no adjustment is required in the form of writing off the remaining cost.

As we already know, in accounting the amount is 40,000 rubles. represents the upper limit on the cost of non-depreciable assets. In this case, in order to decide on classifying property as fixed assets, an organization can:

- select the maximum limit amount in the accounting policy;

- choose an amount less than this limit;

- take into account objects with a cost less than the limit as part of the inventory;

- do not set a limit by depreciating all objects of any value accounted for as fixed assets.

In tax accounting, the amount of 100,000 rubles is a cost limit that determines the recognition (or non-recognition) of an object as part of depreciable property. Items valued up to this limit are not considered depreciable property. Their full cost at the time the objects are accepted for accounting is written off as material expenses in accordance with subparagraph. 3 p. 1 art. 254 Tax Code of the Russian Federation.

At the same time, the legislator in the same sub-clause. 3 p. 1 art. 254 of the Tax Code of the Russian Federation provides the opportunity to include these amounts in expenses not at once in full, but by distributing the amount over a time interval greater than one reporting period. The period for progressive recognition of expenses is determined as the expected useful life. This is an action similar to accounting depreciation, which allows you to “stretch” the accounting of the cost of non-depreciable property in material expenses.

How to calculate the annual depreciation rate

The indicator calculated when calculating the deduction rate for depreciation for the year is the base that helps determine the percentage of the total price of fixed assets owned by the enterprise.

This percentage will be carried forward to the final price of the product or service to compensate for wear and tear. The basis for calculating deductions for depreciation is initially taken from the operating life of the funds, which is indicated in the relevant documents, as well as the depreciation rate established using the straight-line method.

The calculation formula looks like this:

Ag=((F – Fl)/Tn*F)*100

Agn is the annual deduction rate for depreciation, indicated as a percentage;

Tn is the service life according to the standard, indicated in years;

F is the book price of the object, which is determined at the time when it is put into use and contains the cost of its acquisition, as well as various costs associated with delivery, installation and further maintenance;

Fl is the liquidation price of a specific object. An amount showing the expected income from the sale of a fixed asset or its balances at the end of its service life. The indicator is calculated in rubles.

Conclusion

In the total system of financial resources of production, depreciation charges can be recorded in the category of internal production sources, which also contain that part of the profit that appears in the balance and is used by the enterprise to satisfy personal needs. The redistribution of material resources significantly affects the final monetary result of production activities.

Today it is customary to calculate depreciation not only within the framework established by accounting, but also on the basis of tax accounting. The state apparatus has the right to establish appropriate restrictions on depreciation charges. Such limits allow the company to reduce the total amount of tax imposed on profits.

In the meantime, the choice of the method of deductions from fixed assets falls on the shoulders of production, unless otherwise provided by law. Also, enterprises working with homogeneous groups of products or services need to remember that they will have to make depreciation charges based on a single chosen method.

When do differences arise according to PBU 18/02?

A question that worries many accountants. But it is reasonable to approach it taking into account the benefits of taxation on property and profits.

For clarity, we have compiled the following table.

| Cost of objects | Expenses in accounting | Expenses in tax accounting | |

| Including the cost of property at one time in expenses | Gradual inclusion of property value in expenses | ||

| ≤ 40,000 rub. | Objects are not accounted for as inventories, but are depreciated as part of fixed assets | There are differences according to PBU 18/02 | There are no differences according to PBU 18/02 |

| > 40,000 rub. ≤ 100,000 rub. | Depreciation of fixed assets | There are differences according to PBU 18/02 | There are no differences according to PBU 18/02 |

| > 100,000 rub. | Depreciation of fixed assets | Impossible | There are no differences according to PBU 18/02 |

IMPORTANT! The choice in favor of not reflecting differences according to PBU 18/02 does not always entail a reduction in the complexity of accounting. From the point of view of tax reduction, it is often more profitable for an organization to use the right to a one-time attribution of the cost of objects to expenses in both accounting and tax accounting.

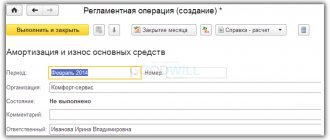

Accounting for OS receipt in 1C

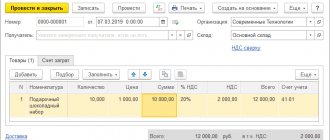

When purchasing new equipment, we draw up the “Equipment Receipt” document:

OS and intangible assets -> Receipt of fixed assets -> Receipt of equipment

Fill in the document details:

- Invoice No. – receipt document number

- Counterparty - supplier from the “Counterparties” directory

- Agreement — select an agreement with a supplier (the list contains only those agreements whose type of agreement is “With a supplier”)

- Warehouse - where the equipment will be stored until the OS is put into operation

- Calculations — are filled in automatically according to the program settings, you can verify their correctness by clicking on the hyperlink

- Equipment - filled in from the “Nomenclature” directory

On the “Additional” tab, it is possible to fill in the fields Consignor, Consignee, Invoice for payment

The result of the document is opened for viewing by clicking:

To account 08.04 “Purchase of fixed assets” we received:

- woodworking machine 2 pcs. at a price of 100,000 rubles;

- slipway for assembling doors 2 pcs. at a price of 70,000 rubles.

In addition, accounts payable were formed in the amount of RUB 401,200.

We register the supplier's invoice (only after posting the receipt document, otherwise the invoice will not be posted):

the transaction type code “01” Goods, works, services received”:

Based on the receipt document, you can create a payment document to the supplier. To do this, by clicking “Create based on”, select the document “Payment order”:

In the document form “Payment order” we indicate the payment details.

You must select the Paid and, by clicking on the link, create a document “Write-off from current account“.

When we receive a bank statement, it will be necessary to confirm the fact of debiting funds from the current account in the program and generate transactions. Confirmed by bank statement checkbox in the “Write-off from current account” document

After posting the document, postings will be generated confirming the fact of payment for the received material assets (fixed assets).

Results

When deciding how depreciation of fixed assets will be calculated in 2018-2019, the organization has the right to choose: reducing the labor intensity of accounting or the absence of differences according to PBU 18/02.

At the same time, it is reasonable to make a decision also from the point of view of reducing tax expenses. This, in particular, is facilitated by the use of the right to immediately attribute the cost of objects to expenses. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

conclusions

Accounting for depreciation of fixed assets consists of reflecting monthly deductions to account 02 in correspondence with cost accounts (sales or production).

When a fixed asset is deregistered, accumulated deductions are also written off.

Accumulations in account 02 may change if the value of the object changes as a result of revaluation; in this case, accruals are recalculated. Additional accrued depreciation is reflected in additional capital, and reduced depreciation is included in other income.