Each company strives to take into account the costs incurred for the purchase or creation of non-current assets when calculating income tax. However, for one category of property, a one-time write-off of the full cost of the object is allowed, while for another, attribution to costs is carried out gradually. Tax law establishes a minimum value of assets, which makes it possible to classify them as fixed assets. At the same time, the approved limit on fixed assets in 2021 has not changed. For the purposes of recognizing company property in accounting as subject to depreciation, its value must, in accordance with the requirements of PBU 6/01, exceed 40 thousand rubles.

New

To begin with, in order to take into account the property, they find out the period of its useful operation. It is important for both types of accounting – tax and accounting. The main assistant accountant when determining this period:

- codes from the All-Russian Classifier of Fixed Assets (OKOF);

- government Classification of fixed assets for the purposes of assignment to depreciation groups (hereinafter referred to as the Classification).

Please note: the changes affected both of these documents. So, starting from 2021, the Classification has undergone adjustments. They were introduced by Decree of the Government of the Russian Federation dated July 7, 2016 No. 640. In addition, new OKOF codes will come into effect starting next year: OK 013-94 will be replaced by OK 013-2014.

It must be said that all these regulatory documents are insanely long multi-page tables with types of OS, codes and deadlines. Therefore, you can easily get confused and also waste a lot of time.

But I didn’t forget about Rostandart accountants. He issued order No. 458 dated April 21, 2016, which helps to understand which old OS code corresponds to the new one. And vice versa. Also in the form of tables.

From 2021, property must cost more than 100,000 rubles to be considered fixed assets and depreciated.

Let's find out how updating the codes will affect the work of an accountant.

What property is depreciable?

Depreciable property is property with a useful life of more than 12 months and an original cost of more than 100,000 rubles (clause 1 of Article 256 of the Tax Code of the Russian Federation). The specified cost applies to depreciable property objects put into operation starting from January 1, 2016.

Until 2021, the initial cost to recognize property as depreciable had to be more than 40,000 rubles.

Depreciation begins on the 1st day of the month following the month in which the facility was put into operation (clause 4 of Article 259 of the Tax Code of the Russian Federation). Let me remind you that to begin calculating depreciation on objects of depreciable property, the rights to which are subject to state registration and which are put into operation from December 1, 2012, compliance with the conditions for submitting documents for registration of these rights is not required (Article 3.1 of the Federal Law of November 29, 2012 No. 206-FZ).

Depreciable property also includes intangible assets with a useful life of more than 12 months and an original cost of more than 100,000 rubles. This interpretation is set out in the explanation of the Ministry of Finance of Russia dated 09.09.2011 No. 03-03-10/86. At the same time, the Tax Code does not provide for an increase in the initial value of intangible assets as a result of additional equipment, modernization, etc. (letter of the Ministry of Finance of Russia dated September 27, 2011 No. 03-03-06/1/595).

How to determine

In 2021, you need to continue to find out the code of a specific fixed asset using the fixed asset service life classifier OK 013-94. And the depreciation group of the registered property is according to the government Classification dated January 1, 2002 No. 1.

Starting in 2017, the situation will change dramatically. Your main documents in the question of how to determine the service life of fixed assets will be:

- collection OK 013-2014 with new codes;

- updated mid-2021 Depreciation classification.

What is most reassuring is that the mechanism for determining the useful service life of fixed assets has remained the same - as in the current year (see table).

| № | What to do |

| 1 | First, find the most suitable name of your property in OK 013 and remember the code |

| 2 | It happens that an identical name is missing in the classifier. Then - the group to which your object can be assigned. See group code. |

| 3 | Then use the code to find your OS in the Classification (the codes are there in the left column) |

| 4 | See the depreciation group into which the property falls |

| 5 | Determine the useful life period according to this group |

How to take into account in tax accounting the costs of acquiring property worth less than 100 thousand rubles?

From 2021, costs for the acquisition of property with an initial cost of less than 100,000 rubles are subject to inclusion in material costs in full as they are put into operation (subclause 3 of clause 1 of Article 254 of the Tax Code of the Russian Federation). At the same time, according to subclause 26 of clause 1 of Article 264 of the Tax Code of the Russian Federation, other expenses associated with production and sales include the costs of acquiring exclusive rights to computer programs worth less than 100 thousand rubles, that is, less than the amount of the cost of depreciable property determined by clause 1 of the article 256 Tax Code of the Russian Federation.

How to document

When you have determined the useful life of fixed assets, secure this with an order establishing the standard service life of fixed assets on behalf of the head of the company.

Oddly enough, such a document is free-form. There is no required form or template in the law. Probably the most important thing that it should contain:

- OS name;

- the useful life that you have adopted.

To make your task easier, we will show this using an example with a sample order for establishing standard service life of fixed assets .

EXAMPLE A company purchased a regular freight elevator. Its OK code 013-94 is 14 2915263. According to the Classification, it belongs to the third depreciation group. The standard service life of a fixed asset is from three to five years inclusive. This means you can choose any number of months ranging from three to five years. Specify the final period of use in the order of the general director.

When putting the operating system into operation, do not forget to indicate the code according to the classifier of standard service life of fixed assets in:

- acceptance certificate;

- OS inventory card.

The corresponding column is present in standard OS-1 forms (see below):

You can download this form on our website here:

And OS-6 (see below):

You can download the card on our website here:

Let us remind you that the law does not oblige you to use these forms in your work. Therefore, if your company prefers its own developments, do not forget to add a window for OKOF code.

Keep in mind: the standard service life of fixed assets is the same for accounting and tax accounting.

Are we talking about the paid price?

For the purposes of classifying property as a fixed asset when using the accrual method, the actual payment does not matter. Depreciation can be charged, for example, when purchasing property in installments, but provided that the initial cost of the property is formed, the property is accepted for accounting and put into operation (letter of the Ministry of Finance of Russia dated September 15, 2009 No. 03-03-06/2/170). Similarly, a depreciation bonus for acquired but not yet paid for property can be applied (letter of the Ministry of Finance of Russia dated August 16, 2010 No. 03-03-06/1/550).

A special reminder to simplifiers

New limit

In 2021, you can work on the simplified tax system, provided that the residual value of the fixed assets (it is needed for accounting purposes) is no more than 100 million rubles. (Subclause 16, Clause 3, Article 346.12 of the Tax Code of the Russian Federation). Let us immediately draw your attention to the fact that starting from 2021, this bar has been raised to 150 million. That is, more firms and individual entrepreneurs will be able to apply the simplified tax system.

Thus, for simplified people, not only the service life of fixed assets will change from 2021 .

The residual value is determined using a simple formula:

Initial. price - Depreciation = Residual value And in order to depreciate property (if this can be done by law), you need to clarify the service life (clauses 18 and 19 of PBU 6/01 “Accounting for fixed assets”). In fact, the organization determines it itself. True, we still advise you to look into the Classification for depreciation purposes. It was adopted by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1. This will protect you from disputes with tax authorities.

Revision of the tax base

The use of the “income minus expenses” object in many cases allows tax accounting to include acquired fixed assets as expenses within one year. You just need to pay for the property and start working with it.

But keep in mind: if you quickly get rid of the written-off operating system, the tax base under the simplified tax system for previous periods will have to be revised. And the recalculation mechanism is influenced precisely by the service life of fixed assets (see table).

| OS service life | When to recalculate |

| Up to 15 years | Less than three years have passed since the cost of the OS was written off, but it has already been sold |

| From 15 years old | Less than 10 years have passed since it was written off, but the OS has been sold |

Thus, it will be possible to include in costs not the cost of the entire property, but only depreciation on it. It is calculated according to income tax regulations. This means that we will again have to turn to the service life of fixed assets according to the classifier .

Also see “Accounting on the simplified tax system”.

Penalties and penalties for loss of simplified tax system

There are situations when exceeding the maximum value threshold for fixed assets cannot be avoided. In this case, you need to consider the following.

If, despite the measures taken, the “simplified” person does not meet the 150 million limit of the residual value of fixed assets, he loses the right to apply the simplified tax system. The loss of the right to apply this special regime occurs from the beginning of the quarter in which the excess was allowed (clause 4 of Article 346.13 of the Tax Code of the Russian Federation). The “simplified” person will have to switch to a different taxation regime and calculate taxes as if he were a newly created organization (a newly registered individual entrepreneur).

Moreover, you will not have to pay penalties and fines for late payment of monthly payments during the quarter in which the former “simplified” switched to OSN. Since the amount of such payments paid during the transition to a different taxation regime is not regarded as an additional payment due to incomplete payment of taxes on time. These are the rules of paragraph 4 of Article 346.13 of the Tax Code.

Based on this, in letter dated December 1, 2015 No. 03-11-06/2/70012, the Ministry of Finance reminds that exceeding the permissible limit of the residual value of fixed assets entails the loss of the right to use the simplified tax system from the beginning of the quarter in which such an excess occurred , and transition to a different taxation regime in the period of excess. In this case, the taxpayer is exempt from paying penalties and fines.

Old deadlines and codes: what to do with them?

Now let’s talk about whether it is necessary to review the service life of fixed assets from 2021 . We hasten to reassure you: for property that was registered before December 31, 2016 inclusive, the law does not require anything to be re-registered or revised.

Thus, the standard service life of fixed assets according to the updated Classification does not need to be replayed. The fact is that it is determined only once - when the property is put into operation. And it can be extended only if the company decides to improve the facility through modernization and reconstruction. This is a common point for both types of accounting.

Feel free to leave the previous codes in the “primary” for your OS. At the same time, nothing prevents you from adding new ones next to them. Why are we talking about this? But because the developers of accounting software can rush ahead of you and replace all the old codes.

Let us remind you: you can find out the new code by the old value from the first table of Rosstandart order No. 458 dated April 21, 2016. Moreover, many positions have ceased to be considered fixed assets at all.

Here's a good example:

Read also

24.11.2016

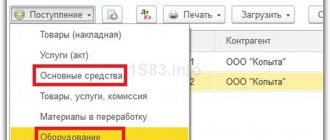

Accounting for receipt of fixed assets

Accounting accounts are designed to carry information about all movements of objects, including the receipt of fixed assets. All procedures are clearly regulated. In fact, all accountants in the country use the same operations when a company acquires fixed assets: guidelines for accounting for fixed assets dictate uniform rules. You can choose the option of calculating depreciation amounts and the cost limit for assignment to fixed assets.

IMPORTANT: materials, finished products, and objects for resale are not considered fixed assets, even if all other recognition criteria are met.