Tax accounting policy is a document that approves the set of methods chosen by the organization for registering financial, economic and fiscal transactions. Must be combined with accounting UP.

The accounting policy for tax accounting (UP) determines the procedure for maintaining records and document flow for operations related to the formation of the value of taxable bases, the set of methods (methods) permitted by the Tax Code of the Russian Federation for determining income and (or) expenses, their recognition, assessment, distribution and accounting of other necessary for tax purposes, indicators of the financial and economic activities of the taxpayer. The accounting policy for tax accounting of an organization is established before the start of activity - no later than 90 days after the start of the organization's operation. If necessary, changes and additions are made to it.

Let's consider the main points that should be taken into account when developing accounting policies for tax accounting purposes. When giving recommendations, we will use the algorithms offered by the Accounting Policy Designer program provided by the ConsultantPlus legal system.

Organizational provisions

- For the purpose of generating information on tax accounting, the company discloses within the specified section data that allows it to more accurately generate the necessary information both in general and for each of the taxes for which it is a payer.

- Information about whether the company is newly created or not is necessary to establish whether the tax accounting policy of the organization is completely new or represents a modification of the old one. We note that the accounting policy is formed no later than 90 days from the date of establishment of the company and is applied consistently from year to year.

- Next, the company must indicate the types of business activities it carries out. This information, in addition to stating a fact, carries an additional burden. Depending on the specific type of activity, the organization forms the features of its accounting tax policy (primarily in terms of income tax).

- For the same purposes - to characterize the characteristics of the company’s activities, taken into account when generating data on tax accounting for income tax - the organization must indicate information about whether it carries out transactions with securities and whether it incurs R&D expenses in the course of its activities.

- For the purpose of generating information on the procedure for maintaining property tax records, an organization must indicate whether it has property subject to taxation on its balance sheet.

- For structural characteristics, it is necessary to indicate in the accounting policy the presence (absence) of separate structural divisions, including those located on the territory of one subject of the Federation.

- What follows is a block of questions, the answers to which characterize the procedure for organizing tax accounting. The company has the right to keep records of data both with the involvement of a third-party organization or a specially authorized person (in this case, their name should be indicated in the text of the accounting policy), and on its own. If tax accounting is carried out in-house, then it is necessary to indicate who is doing this - an individual employee or a specialized service. In both cases, specification is required, that is, an exact indication of the employee’s position according to the staffing table or the name of the department in accordance with the company structure.

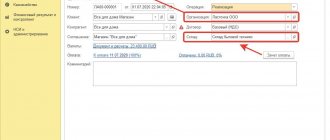

- An essential point is to indicate the method of tax accounting (automated or non-automated). When choosing an automated method, you must additionally specify the specialized program with which tax accounting is maintained.

Provisions not included in the finished document

Due to the fact that these areas of activity and accounting objects are not involved in any way in the activities of a particular enterprise, this accounting policy does not disclose the following procedures:

- recognition of revenue for work (services) with a long cycle (clause 13 of PBU 9/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n);

- recalculation and presentation in reporting of items denominated in foreign currency (clauses 6, 7 of PBU 3/2006, approved by order of the Ministry of Finance of Russia dated November 27, 2006 No. 154n);

- accounting for budget financing and other targeted financing (PBU 13/2000, approved by order of the Ministry of Finance of Russia dated October 16, 2000 No. 92n);

- accounting for R&D (PBU 17/02, approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 115n);

- accounting of financial investments (PBU 19/02, approved by order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n).

For information on what aspects you should pay attention to if an enterprise is also developing a policy for management accounting, read the article “Accounting policies for management accounting purposes .

How to approve the UE

Each organization independently determines the form in which its accounting policy is drawn up for tax accounting purposes. There is no single approved template. The main principle is to list all taxes and the principles for calculating them. The manager approves the document by his order. The order looks like this:

| LLC "PPT.ru" ORDER on approval of accounting policies for tax purposes 21.12.2020 № 27 Approve for application from 01/01/2021 the accounting policy for tax purposes (appendix to the order). General Director Ivanov Ivanov P.S. |

The document itself can be both detailed and concise. A typical sample accounting policy for tax accounting purposes for 2021 (OSNO) looks like this:

Change mid-tax period

The letter of the Ministry of Finance of Russia No. 03-03-06/1/45756 dated 07/03/2018 states that Article 313 of the Tax Code of the Russian Federation defines the possibility of making adjustments to the tax accounting policy of an organization only in two cases:

- when legislation on taxes and fees changes;

- when changing the accounting methods used.

Changing accounting methods is allowed only from the beginning of a new tax period, that is, from the beginning of the year. But if the legislation changes, it is allowed to change the accounting policy from the moment the new rules come into force. It depends on the organization on what principle to formulate its tax accounting policy. When new activities appear, changes must be made to it. In the middle of the tax period, the taxpayer has the right to change the accounting policy in two cases:

- the legislation has changed and these changes have entered into legal force;

- The company began to carry out a new type of activity.

When can you change an organization's accounting policy?

The UE is allowed to be changed in two cases:

- changes in tax legislation;

- changing the selected accounting method.

Changes are made by order of the manager, who determines the date of their entry into force. This date also depends on the reason for the changes. In the first case, they come into force no earlier than the date from which the change in legislation comes into force. In the second case - from January 1 of the year following the one in which the UE was changed.

The Kontur.Accounting web service has accounting policy options for accounting and tax accounting, which is suitable for different tax regimes and their combination. The service makes it easy to keep records, pay salaries, pay taxes and submit reports. All newcomers receive 14 days of work in the service for free.

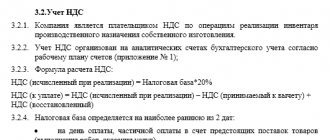

Value added tax (VAT)

This section must be completed only by organizations that are VAT payers.

Periodicity

As part of the general provisions on the procedure for maintaining VAT tax accounting, the organization must indicate the frequency of renewal of the numbering of invoices. There are no strict restrictions in regulatory and legislative acts on this issue, so the organization has the right to indicate any of the proposed options - monthly, quarterly, annually, or with other frequency.

Enterprises engaged in the manufacture (production) of goods, works and services with a long production cycle (more than 6 months, according to the list approved by the Government of the Russian Federation), must provide in their accounting policies for determining the tax base upon receipt of an advance payment on account of upcoming deliveries of goods (performance of work, to provide the method, the organization fixes in its accounting policy one of the proposed dates - either on the day of shipment or on the day of receipt of payment (full or partial). If the organization provides for the use of a “separate” method, then it has the right to use both of the above dates to determine the tax base. In The text of the accounting policy must indicate for which transactions the tax base is determined on the date of shipment, and for which - on the date of payment.

Separate VAT accounting

Further points disclosed in the accounting policy regarding the procedure for maintaining tax accounting for VAT are related to the organization of separate VAT accounting for organizations that carry out transactions subject to and non-taxable with VAT, and types of activities for which different rates of this tax are applied. Accordingly, only organizations that have the above operations in their business practice should disclose in their accounting policies the specifics of tax accounting. The first point in the disclosure in the accounting policy of information on the procedure for maintaining separate accounting for VAT is an indication of the fact that the organization has business transactions that are not subject to VAT (if there is taxable turnover) and transactions taxed at a rate of 0% (if there are transactions taxed by other means). rates other than 0%).

Next, the organization needs to decide for itself whether it applies the so-called “5% rule” for the purposes of separate accounting (separate accounting of “input” VAT is allowed not to be carried out in those tax periods in which the share of total expenses on transactions not subject to VAT is less or equal to 5% of the total total production costs). Accordingly, ignoring this rule means that separate accounting is carried out regardless of the proportion of the ratio between taxable and non-taxable transactions. The “5% rule” is used by those organizations whose share of non-VAT-taxable transactions is insignificant.

If an organization applies the 5% rule, then it needs to disclose some additional information in its accounting policies. The first point related to this concerns the expense register for the purpose of applying this rule. At the choice of the organization, this is either a special sub-account allocated in the working chart of accounts, a separate accounting register, or another independently developed method. The choice of one of the options depends on the general order of organization of the accounting process.

Next, the base is determined in proportion to which the distribution of general business expenses is made. This indicator is determined in proportion to the share of revenue from non-taxable transactions in the total volume of sales, in proportion to the share of direct expenses in the total amount of expenses, or in any other way adopted by the organization. The choice of method is made solely on the basis of the professional judgment of officials of the organization.

When choosing the “share of expenses” as a base indicator, the organization provides for the creation of a special form (tax accounting register) in its accounting policy. Let's consider an example of accounting policy for tax purposes for 2021 with VAT:

The next point related to maintaining separate accounting for VAT is determining the period for calculating the proportion of VAT to be deducted on fixed assets and intangible assets (intangible assets) accepted for accounting in the first or second month of the quarter. The organization can choose to determine the specified ratio between taxable and non-taxable turnover under VAT either on the basis of monthly data or based on quarterly results. The choice of option depends on whether the organization generates data on sales of goods, works, and services on a monthly basis or not. If not, then you should choose the option based on the “quarterly” proportion.

An organization has the right to maintain separate accounting of “input” VAT either in a special subaccount to balance sheet account 19 “VAT on acquired values,” or in a separate register, or in another independently determined order. The choice of this procedure depends on the organization’s accounting process.

The procedure for maintaining separate accounting of transactions for the sale of goods, works and services, subject to and non-taxable with VAT, is provided for in the accounting policy. By analogy with the above, such accounting is electively kept either in a special sub-account, or in a separate register, or in any other way. The choice of option is at the discretion of the company.

To quickly and correctly draw up a document, use the free accounting policy designer for 2021 from ConsultantPlus experts.

What is the time frame for approval?

There is no need to approve a new document annually. The program should be applied in the institution from year to year. Only those provisions that have changed due to the entry into force of new regulations or in connection with changes in the activities of the enterprise and other cases are adjusted.

Legislators have determined the deadlines within which the entity is obliged to approve the management program. We are talking about newly created state-owned companies. The UE for accounting must be approved no later than the reporting period in which this government agency was created. For the UE regarding taxation, a document should be developed and approved no later than the end of the first tax period in which the enterprise or company was created (clause 12 of article 167, article 313 of the Tax Code of the Russian Federation).

Income tax

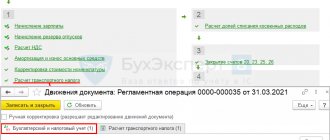

The profit section in the accounting policy is filled out only by organizations that are payers of income tax. First, you need to indicate how information is generated for the purposes of calculating the taxable base for income tax:

- by filling out specially designed tax accounting registers;

- by filling out accounting registers, supplemented, if necessary, with relevant details.

The choice of one of the options depends on the organization itself, taking into account how its accounting procedures are organized and document flow is structured.

Next, the organization must indicate which reporting period it applies for income tax - monthly or quarterly. The choice depends solely on the organization itself and its desire to generate income tax indicators in one way or another.

Tax accounting policies should reflect the payment of monthly advance payments. There are no choice options, since those who are exempt from making advance payments of income tax are directly named in paragraph 3 of Article 286 of the Tax Code of the Russian Federation. This moment is purely ascertaining in nature.

Organizations that have separate structural divisions located on the territory of different subjects of the Federation must disclose in their accounting policies information about the basic indicator in proportion to which (in addition to the residual value of depreciable property) the share of profit attributable to the separate division is distributed. The organization chooses either a share of the average number of employees of the department, or a share of the costs of paying for their labor. The choice of one of the options depends solely on the organization itself, depending on the professional judgment of its officials.

Tax UP on OSNO and special modes

UP for tax purposes is most often formed by taxpayers on OSNO, because their accounting and tax accounting have the most differences, and tax accounting itself has many variations. They need to have sections for all the taxes they pay. These are at least three: VAT, income tax and property tax.

Among special regime employees, accounting policies are less common. After all, the procedure for recognizing income and expenses is strictly regulated and there is nothing to choose from. But everything changes if you start combining several tax regimes. In this case, the UP must provide for separate accounting of operations, property and liabilities. Here are the combination possibilities we have already talked about:

- Accounting policy when combining UTII and OSNO.

- Accounting policy when combining simplified taxation system and UTII.

- Combination of patent and simplified tax system.

Accounting for income and expenses

What follows is a large block of questions related to accounting for the organization’s income and expenses. The first and most significant issue in this block is the method of recognizing income and expenses. Only organizations whose average revenue from the sale of goods (work, services) excluding VAT over the previous four quarters did not exceed 1 million rubles for each quarter can afford to freely choose one of the two methods. That is, those who have the right to use the cash method, but want to use the accrual method. Other organizations are required to indicate the “accrual method” in their accounting policies on a non-alternative basis. The accounting policy of the organization for tax purposes does not reflect other features of accounting; there is a separate document for this.

The next question concerns only enterprises with a long technological cycle (production, the start and end dates of which fall on different tax periods, regardless of the number of days of production), for which stage-by-stage delivery of work (services) is not provided. Such organizations have the right to establish in their accounting policies the procedure for recognizing income by distributing it between reporting periods either in equal shares based on the number of periods, or in proportion to the costs incurred, or in another reasonable way. The choice of one of the options depends on the principles of tax planning determined by the organization independently.

Next, the point related to the procedure for recognizing losses from the assignment of the right to claim a debt before the maturity date is revealed. The indicator on the basis of which the normalization of the amount of loss is calculated is calculated at the choice of the organization:

- based on the maximum interest rate established by type of currency;

- based on rates on debt obligations confirmed by the methods provided for in paragraph 1 of Article 105.7 of the Tax Code of the Russian Federation (methods used in determining for tax purposes profit in transactions to which the parties are interdependent persons).

If an organization uses the comparable market prices method for these purposes, then it needs to establish comparability criteria (for example, the same currency, the same period, another similar indicator at the discretion of the organization).

For R&D expenses, an organization needs to specify how these expenses will be accounted for. There are two options:

- These expenses will form the cost of intangible assets (in this case, inclusion in expenses is made through depreciation over a certain useful life).

- As part of other expenses (in this case, inclusion in expenses is carried out within two years).

An organization has the right to apply a coefficient of 1.5 to actual R&D expenses for the purpose of including them in expenses that reduce the taxable base for income tax. An appropriate indication of this fact should be made in the accounting policy. It must be remembered that if an organization chooses to use this coefficient, it is additionally charged with the obligation to provide to the tax authority at its location a report on R&D performed, the costs of which are recognized in the amount of actual costs using a coefficient of 1.5. The report is submitted to the tax authority simultaneously with the tax return based on the results of the tax period in which the relevant R&D was completed. A progress report is provided for each R&D project.

The next question concerns the accounting treatment of rental income. At the choice of the organization, they are taken into account either as part of sales income or as part of non-operating income. The choice of option depends on how the specified income was recognized in accounting.

What is included in the accounting policy?

The document consists of several sections:

- general provisions containing references to legal acts;

- sections containing the specifics of applying accounting policies for taxes of various types that an enterprise is obliged to accrue and pay;

- a list of persons responsible for the development and control of tax accounting documentation.

Income tax

The company's profits are calculated by:

- Revenue from sales for the main type of activity and other types in accordance with the OKVED classifier.

- Direct and indirect costs. These include:

- production cost (cost of raw materials, materials and components);

- purchase price of goods sold;

- fare;

- rental of premises;

- employee salaries;

- other expenses associated with activities (costs of storing goods and products, maintaining commercial and industrial premises and offices, advertising, office supplies, etc.).

- Non-operating income and expenses (accrued and paid interest, written off accounts receivable and payable, profit and loss from the sale of assets, accrued and paid premiums to suppliers and customers and other types of income and expenses not directly related to sales).

Key points affecting the procedure for calculating and paying income tax in the accounting policy of an organization, determined in accordance with Chapter. 25 Tax Code of the Russian Federation:

- Method of revenue recognition (accrual or cash basis).

- The procedure for calculating and paying advance payments.

- Application of PBU 18/02 “Permanent and temporary differences”, aimed at reflecting in reporting the differences between accounting and tax accounting. Small businesses are permitted not to apply this standard.

- Method of calculating depreciation of fixed assets and intangible assets.

- The procedure for determining the cost of purchased goods (FIFO, LIFO, average cost).

- A method for assessing materials when they are written off for production.

- Dividing costs into direct and indirect.

- Formation of reserves for doubtful debts and the procedure for their reflection in tax accounting.

Property tax

In accordance with Chapter 30 of the Tax Code of the Russian Federation, payers of property tax are organizations that have real estate on their balance sheet. If the company has such property, it should include a short section in its accounting policy that contains data on the specifics of determining the tax base for the constituent entity of the Russian Federation in which the property is registered.

VAT

The section on VAT is regulated by Chapter. 21 of the Tax Code of the Russian Federation and contains the following information:

- Types of documents for VAT accounting used in an organization (invoice, UPD).

- The procedure for issuing invoices and their registration in the sales book. Particular attention should be paid to the numbering of invoices in the presence of separate divisions.

- Forms of accounting certificates reflecting the amounts of recovered tax, deductions of VAT paid at customs, and other transactions for which unified forms are not provided.

- List of persons authorized to sign invoices.

- The procedure for reflecting corrections in the books of purchases and sales and the numbering of adjustment documents.

Personal income tax

Personal income tax payers are individuals who receive income in the form of wages and other cash receipts from an organization (for example, income from renting out property). The enterprise is a tax agent, and therefore the order on accounting policies reflects the following points:

- Tax agent status.

- The procedure for calculating and paying personal income tax at the location of separate divisions (if any). If OPs are registered with other Federal Tax Service, the tax is paid separately at the location of each OP.

- Personal income tax accounting documents used in the organization (for example, prepared in the 1C: Accounting program).

Accounting for expenses and income

The method and date of recognition of income and expenses, dividing them into direct and indirect - these provisions are indicated in the “Income Tax” section. In addition, for organizations that, in addition to production, perform various types of work, the procedure for writing off material costs should be indicated. Write-off is done in one of the following ways:

- with distribution to the remains of work in progress;

- without distribution.

Accounting for inventory items

In addition to the method of writing off materials and goods (FIFO, LIFO or average cost), the accounting policy reflects the procedure for accounting for workwear and its write-off to production (one-time, daily, monthly, etc.).

Warehouse inventory is an important element that is subject to a detailed description in the accounting policy: how often an inventory is carried out, what documents are drawn up for this, a list of responsible persons, etc. In addition, shortages and surpluses identified during the inventory are attributed to the financial result. It is recommended to record this item separately.

Accounting for intangible assets

If there are intangible assets, you should indicate the method of calculating depreciation (linear, reducing balance method, etc.) and the primary documents used to account for intangible assets. The list of accounting accounts used for intangible assets is not reflected in the accounting policy of the organization for tax purposes. Separately, it is worth listing intangible assets for which depreciation is not accrued (if any).

Formation of reserves

The formation of reserves for doubtful debts for tax accounting purposes is the right, not the obligation of the organization. However, if the company creates reserves, the accounting policy indicates the frequency of their review (for example, monthly or quarterly). Particular attention should be paid to debts with an expired statute of limitations and the procedure for writing them off for financial results.

How to approve the accounting policy

The approval procedure depends on the form in which the accounting policy for tax accounting purposes is drawn up - it can be an order or a regulation.

The order is drawn up indicating the responsible persons, who put their signature confirming familiarization with the responsibilities assigned to them. The order is signed by the head of the company.

An approximate sample of the accounting policy of an LLC on OSNO for 2021 in the form of an order:

The accounting policy regulations are drawn up by the chief accountant or any other person responsible for maintaining tax accounting at the enterprise, and approved by the manager.

An example of an accounting policy for tax purposes for 2021:

| Order on the adoption of accounting policies for tax purposes at the LLC Clubtk.ru enterprise December 31, 2021 I order: I. In accordance with paragraph 2 of Art. 11 of the Tax Code of the Russian Federation to approve the organization’s accounting policy for tax purposes. Value added tax 1. Maintain a log of received and issued invoices, a purchase book, a sales book and additional sheets to them in electronic form using the 1C: Accounting computer program. 2. Control over the correctness of maintaining the log of received and issued invoices, the purchase book, the sales book and additional sheets to them is carried out by the chief accountant V.F. Smirnova. Decree of the Government of the Russian Federation “On the forms and rules for filling out (maintaining) documents used in calculations of value added tax” No. 1137 of December 26, 2011 (as amended by Decree of the Government of the Russian Federation No. 981 of August 19, 2017). 3. A single continuous numbering is provided for invoices. Invoices issued for prepayment are numbered with the prefix “A”. 4. The right to sign invoices extends, in addition to the manager and chief accountant, to the following responsible persons:

Income tax 1. Tax accounting is carried out in a mixed way, both with the use of accounting documents for individual groups of business transactions, and with the use of specialized tax accounting documents for those groups of business transactions, the tax accounting of which differs significantly from the accounting rules (Article 313, 314 Ch. 25 “Profit Tax” of the Tax Code of the Russian Federation). 2. The date of receipt of income (expense) is determined using the accrual method (Articles 271, 273, Chapter 25 “Income Tax” of the Tax Code of the Russian Federation). 3. In the case of the organization providing services, the amount of direct expenses incurred in the current reporting (tax) period when carrying out this activity in full shall be attributed to the reduction of income from production and sales of this reporting (tax) period without distribution to the balances of work in progress (clause 2 Article 318 Chapter 25 “Profit Tax” of the Tax Code of the Russian Federation). 4. Form the cost of goods purchased for the purpose of their further sale, without taking into account the costs associated with the acquisition of goods (Article 320, Chapter 25 “Profit Tax” of the Tax Code of the Russian Federation). 5. When determining the amount of material expenses when writing off raw materials and materials used in the production (manufacturing) of goods (performing work, providing services), in accordance with the accounting policy adopted by the organization for tax purposes, one of the following methods for assessing the specified raw materials and materials at the average cost (clause 8, article 254, chapter 25 “Profit tax” of the Tax Code of the Russian Federation). 6. When selling purchased goods, the cost of purchasing these goods is written off as expenses at the average cost (Clause 1, Article 268, Chapter 25 “Profit Tax” of the Tax Code of the Russian Federation). 7. Calculate depreciation on fixed assets using the straight-line method (Clause 1, Article 259, Chapter 25 “Income Tax” of the Tax Code of the Russian Federation). 8. For intangible assets specified in subparagraphs 1–3, 5, 6 of paragraph three of paragraph 3 of Article 257 of the Tax Code, determine the useful life in the usual manner (clause 2 of Article 258, Chapter 25 “Income Tax” of the Tax Code of the Russian Federation) . Personal income tax 1. The organization is a tax agent for personal income tax. To control the correctness of calculation, withholding and payment of personal income tax, the 1C: Accounting program is used. II. Provide for the possibility of introducing clarifications and additions to the accounting policy of the enterprise in connection with changes in tax legislation, the emergence of business transactions, the reflection of which in tax accounting is provided for by several methods, the choice of which is entrusted to the enterprise by law, or for other reasons. III. Responsibility for organizing tax accounting at the enterprise should be assigned to the chief accountant V.F. Smirnova. Gene. Director _______________________/Voronov A.V./ M.P. |

Accounting for direct and indirect costs

What follows is a block of questions regarding the specifics of accounting for direct and indirect costs. To begin, the organization should approve the list of direct expenses, selecting them from the proposed list. At the request of the organization, this list can be either shortened or expanded as much as possible. Typically, the list of direct expenses for tax accounting purposes for income tax corresponds to a similar list accepted for accounting purposes.

With regard to direct costs associated with the provision of services, the organization has the right to provide for either their distribution to work in progress (WIP) balances, or to take them into account in full as part of current expenses. The choice of one of the options remains entirely at the discretion of the organization itself, based on its existing tax planning principles.

The organization also needs to disclose in its accounting policies the principles for the distribution of direct costs for work in progress. Depending on the characteristics of the production process and based on the professional judgment of officials, the organization has the right to choose any of the methods proposed in the list, or to approve its own method. It is allowed to use different methods for distributing direct costs depending on the type of product produced.

If an organization has direct costs that cannot be unambiguously attributed to the production of specific products, this fact should be indicated in the accounting policy. An indicator should be provided on the basis of which such costs will be distributed between types of products. This indicator is:

- wages of employees engaged in primary production;

- material costs;

- revenue;

- another indicator chosen by the organization.

Inventory accounting

Let's move on to the block within which issues related to accounting for inventory items (TMV) are considered. First, let's look at the accounting of goods.

In relation to purchased goods, an organization has the right to establish the formation of their value in tax accounting both without taking into account additional costs for their acquisition, and taking them into account. The organization decides whether all additional costs are included in the cost of purchased goods or only certain types of them. The list of additional expenses included in the cost of purchasing goods is established in the accounting policy. Typically, the choice in favor of one or another method of forming the value of goods depends on how their value was formed in accounting.

The next point is an indication of the method of evaluating the product during its sale. One of three methods is selected: unit cost, average cost, FIFO method. It is possible to use a single method for all types of goods, or to select an individual method for each group.

In relation to raw materials and materials, the organization indicates the method of their valuation when written off. The same methods that were used to evaluate goods are offered to choose from. Similarly, it is possible to use different assessment methods for different groups of raw materials and supplies.

In relation to low-value property (tangible assets of durable use that do not fall into the category of depreciable property), the organization must indicate how its value is included in current expenses: at a time (by analogy with raw materials) or in equal shares over more than one reporting transition (based on useful life or other economically justified indicator).

How to make changes correctly

Making changes and additions to the fundamental document requires compliance with a certain algorithm. In Order of the Ministry of Finance No. 274n, officials strictly established the grounds for carrying out this procedure.

Make changes to the accounting policy only in three cases:

- The provisions and norms of legislation that establish general requirements for the organization and maintenance of accounting have been changed. In this case, the organization is obliged to make appropriate changes to its accounting policies.

- The institution has developed new forms of accounting that will allow the generation of more reliable and relevant information about accounting objects.

- The operating conditions of an economic entity change significantly. For example, a government institution is undergoing a reorganization stage, or the functions and powers assigned to the institution have been changed.

In all other cases, changes and additions are made to the current document from the beginning of the year.

IMPORTANT!

When making changes during the financial year, the institution must coordinate all actions with the founder and the financial authority. Otherwise, innovations will be regarded as a violation of current legislation.

The new standard has defined situations that are not considered a change in accounting policies. These include cases when, to reflect the facts of economic activity that arose for the first time, the following are determined:

- absolutely new rules for organizing and maintaining accounting within a given economic entity;

- a method of accounting used for essentially different business transactions that occurred previously.

IMPORTANT!

The new provisions of the FSBU do not differ from the provisions of Federal Law No. 402-FZ.

Please note that some adjustments will require retrospective analysis. These should include those changes that will affect or are capable of significantly affecting the financial result, financial position, and cash flow of the entity.

An accountant or other responsible person is obliged to make the appropriate adjustments:

- change the data of opening balances under the article “Financial result of the institution”;

- adjust the values of reporting items that are related to the financial result of the entity.

There is no need to change last year's reporting figures. But when preparing financial statements for the current period, you will have to submit the corresponding data on adjusted comparative indicators.

Depreciation

Now let's turn to the procedure for accounting for depreciable property (fixed assets and intangible assets). The first question concerns the procedure for forming the initial cost of fixed assets. The organization has the right to establish a list of expenses for the creation of fixed assets that are not included in their initial cost. Refusal to include any type of expense in the initial cost of fixed assets will lead to disagreements with regulatory authorities. Disclosure of this information in accounting policies is associated with additional risks.

If an organization operates in the field of IT technologies and meets the criteria established by paragraph 6 of Article 259 of the Tax Code of the Russian Federation, then it has the right to choose the option of accounting for the cost of electronic computer equipment as expenses: either as part of material expenses or in the form of depreciation. If the option of accounting as part of material expenses is chosen, then inclusion in current expenses occurs electively either at a time or in certain shares over more than one reporting period, based on the service life or other economically justified indicator.

If an organization leases or plans to lease fixed assets, it needs to indicate how depreciation of non-recoverable capital investments in leased fixed assets (inseparable improvements) is carried out. Such depreciation is based on either the useful life of the leased asset or the useful life of the permanent improvement itself. The choice of one of the options is made by the organization independently.

The organization has the right to provide for a review of the useful life of an object of depreciable property based on the results of its reconstruction, modernization or technical re-equipment, as well as not to carry out such a review.

In relation to fixed assets that were previously operated by previous owners in the same capacity, the organization establishes a special procedure for determining the useful life - taking into account the service life of the previous owner. This option is optional. The organization has the right to determine the general procedure for determining such a period (that is, without taking into account the period of previous operation).

In the next block, we will consider the information that needs to be disclosed regarding the procedure for calculating depreciation. To begin with, one of two methods is selected: linear (even distribution over the useful life) or non-linear (accelerated write-off in the first years of operation). With the non-linear method, depreciation is calculated not individually for each fixed asset object, but in groups.

Accordingly, when choosing a non-linear method, the organization faces the need to disclose additional information. In particular, it may provide for the liquidation of a depreciation group with a total balance of less than 20,000 rubles (with a one-time transfer of the under-depreciated balance to non-operating expenses) or not to do this (in this case, depreciation is charged until the cost is fully repaid). The choice of option is entirely at the discretion of the organization.

The organization has the right to provide for the use of a “depreciation bonus” (one-time inclusion in expenses of part of the cost of depreciable property). Its use (subject to the restrictions imposed by the Tax Code of the Russian Federation) is permitted both in relation to the initial cost and the costs of increasing it. It is possible to apply a depreciation bonus only in one of the two indicated areas.

With regard to the depreciation bonus, it is possible to either establish a lower threshold for the initial cost of fixed assets and expenses for its increase to which it applies, or waive such a limitation. In the latter case, it is applied to all fixed assets (except for those for which the Tax Code of the Russian Federation directly prohibits its use).

Organizations that have fixed assets that meet the criteria given in paragraphs 1–3 of Article 259.3 of the Tax Code of the Russian Federation have the right to apply appropriate increasing factors to depreciation rates.

If several increasing factors are applied to a fixed asset for different reasons, the organization must choose only one. This is the maximum, minimum or other intermediate coefficient.

In relation to absolutely any fixed depreciable assets, the organization establishes the use of coefficients that reduce the depreciation rate. The accounting policy should indicate a list of groups of depreciable property for which such coefficients are applied, and a link to the document containing this list.

Expense reserve

The next block of this section concerns the formation of expense reserves. The organization has the right to create the reserves listed in the list or not to form them. When choosing to “form” in the accounting policy, additional information must be disclosed.

Organizations that form a reserve for the repair of fixed assets must additionally indicate whether they accumulate funds for particularly complex and expensive repairs of fixed assets over more than one reporting period or not.

Organizations that form a reserve for warranty repairs and warranty service are required to indicate the period during which they sold goods (work) with a warranty period. The size of this period, depending on the characteristics of the organization, is:

- 3 or more years;

- less than 3 years.

This information is necessary to calculate the maximum percentage of deductions to the reserve for warranty repairs and warranty service.

Also, with regard to the reserve for warranty repairs and warranty service, it is necessary to indicate the direction of use of the unspent part of the reserve, that is, whether its balance is transferred to the next year or not. The choice is up to the organization.

Organizations that create a vacation reserve must disclose the methodology for its formation: is it formed in a uniform manner throughout the organization or is it carried out individually for each employee. You can freely choose any of the proposed options, based on the organization’s accepted accounting process scheme.

Organizations that form a reserve for the payment of remuneration for long service must provide a criterion for clarifying its unspent balance carried over to the next reporting year. This criterion is the amount of remuneration per employee, or some other method justified by the organization. The choice of criterion is at the discretion of the organization.

The question regarding the criterion for clarifying the unspent balance of the reserve that is carried over to the next reporting year must also be answered by organizations that form a reserve for the payment of remunerations based on the results of work for the year. Such criteria are:

- amount per employee;

- percentage of the profit received;

- another economically feasible indicator.

The choice of criterion is at the discretion of the organization.

What is accounting policy for tax purposes and why is it needed?

Tax legislation does not regulate all issues, and sometimes allows taxpayers to choose accounting methods and methods that are convenient for them.

The management program is needed to record in it the methods for determining and recognizing income and expenses, assessing assets, liabilities and distribution. A competent accounting policy not only standardizes accounting, but also helps reduce the tax burden. Each organization should have two accounting policies (hereinafter referred to as UP): one for accounting, the other for tax. And if accounting is needed only by organizations, then even individual entrepreneurs set up a tax office.

The UE can be drawn up in separate documents or divided into two sections in one document. Approve the UP within 90 days from the date of establishment of the company and then approve it for each subsequent year until December 31 of the current year.

Accounting for transactions with securities

Next comes the block related to accounting for securities transactions.

If a transaction with securities meets the criteria for a transaction with financial instruments of futures transactions, then the organization independently classifies the specified transaction for tax purposes as a transaction with securities or a transaction with financial instruments of futures transactions and makes an appropriate note about this in its accounting policy. The selection is based on the professional judgment of authorized personnel within the organization.

In relation to securities that are not traded on the organized securities market, the organization must indicate in its accounting policies the methods for determining their settlement prices. The selection options are presented in the attached list. The organization has the right to choose absolutely any option. It is allowed to use different methods for determining the settlement price depending on the type of securities.

For securities being disposed of, the entity must indicate the method of write-off: either the FIFO method or the unit cost method. It is advisable to apply the unit value valuation method to non-equity securities that assign an individual volume of rights to their owner (check, bill, bill of lading, etc.). On the contrary, the FIFO method is more suitable for equity securities (stocks, bonds, options). They are placed in issues, within each issue they all have the same denomination and provide the same set of rights. The FIFO method is preferably used when the prices of securities being sold are expected to decline.

If an organization carries out transactions for the sale of securities with the opening of short positions on them (that is, the taxpayer sells a security in the presence of obligations to return securities received under the first part of the repo), then the organization must indicate the sequence of closing these positions (purchase of securities of the same issue (additional issue) for which a short position is opened). Closing short positions is done either using the FIFO method or at the cost of the securities for a specific open short position. The organization chooses independently.

If an organization has transactions with non-negotiable securities for which it is impossible to determine the place of conclusion of the transaction, then it has the right to pre-fix in its accounting policies the place of conclusion of the transaction. This is the territory of the Russian Federation, the location of the buyer, seller or another agreed place. If it is still possible to determine the place of the transaction, then the right to choose the organization is not granted.