There is a certain procedure for writing off fixed assets that must be followed in 2021. Let's consider what documents should be prepared, what entries to use to reflect the operation in the accounting of the enterprise.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

All operating systems wear out at some point. Not only physical but also moral aging is possible. And in such cases, the accountant should figure out how to write off the object from the balance sheet of the enterprise.

The meaning of the write-off procedure

Any NFA object of an organization may become unusable due to material or physical wear and tear, breakdowns and other factors.

It makes no sense to continue to account for unusable fixed assets on the balance sheet. Objects that cannot be used in the future must be written off. Key accounting tasks in relation to accounting for non-financial assets:

- Control over property assets from the moment they come into the possession of the enterprise, for example, from the moment of purchase until the moment they are completely disposed of (written off) from accounting. The task is accomplished by conducting a systematic inventory.

- Timely calculation of material depreciation in monetary terms. Reliable reflection of transactions in accounting.

- Receive reliable information about the property status of an economic entity for the preparation of reliable financial and tax reporting.

- Calculation and payment of fiscal payments to the state budget in terms of taxation of the organization’s property.

- Control over the effective use of funds aimed at reconstruction, modernization and repair of the company's operating system.

- Supervision of the effective operation of facilities in the production cycle or core activities.

The standard procedure for writing off fixed assets does not allow all non-financial assets of a budget-funded institution to be removed from accounting. For some types of objects you will have to obtain special permission from the owner or founder.

Valuation and revaluation

The initial cost of an object is the total amount of funds required to purchase, produce or construct the property. It is worth noting the fact that this parameter does not include VAT, and also does not include general business expenses, except for the situation when such expenses do not apply to the entire company, but only to this specific property.

Conducting a revaluation refers to the rights, and not the obligations, of the organization, that is, the company, if desired, can simply refuse this procedure.

If this decision was made, then in this case the revaluation of fixed assets should be carried out in accordance with their condition as of December 31, and the procedure will need to be carried out every year. Revaluation is carried out for all fixed assets that belong to the same category.

The result of the markdown is reflected in account 91, while the additional valuation of property is included in the list of additional capital and is reflected in the credit of account 83.

Types of budget property

The owner of non-financial assets of public sector institutions is the state. According to paragraph 9 of Art. 9.2 of Law No. 7-FZ of January 12, 1996, fixed assets of budgetary institutions are assigned to them with the right of operational management. The following types of budget property are distinguished:

| OS type | Right of disposal |

| Real estate | |

| Any buildings, structures, premises, etc. | Operations on this type of OS without the official consent of the owner are unacceptable |

| Movable | |

| Particularly valuable property transferred or assigned by the founder to a budgetary institution, as well as purchased with subsidies | To carry out transactions using OCI data, the consent of the owner is required |

| Particularly valuable property acquired by a budgetary institution at the expense of its own income from business and other activities | The BU has the right to independently dispose of this OCI Exceptions in which the consent of the founder is required:

|

| Other movable | |

IMPORTANT!

An exhaustive list of OCI, as well as the procedure for defining an OS as an OCI, is determined by the owner - founder of the budgetary institution. OCI are objects without which the implementation of the main activities of a state institution becomes impossible or difficult.

Property disposal rules

Legislators have defined key rules for the disposal of property assets of government agencies. The scope of rights depends on the type of organization:

- government institutions are completely deprived of the right to dispose of any property without appropriate permission from the owner (founder, superior manager, body exercising the functions and powers of the founder);

- a budgetary and (or) autonomous institution does not have the right to dispose of real estate, as well as especially valuable property acquired at the expense of budgetary funds or assigned to the organization by order of the owner.

Budgetary organizations have the right to independently dispose only of movable property acquired at their own expense. An autonomous organization, in addition to movable fixed assets purchased through entrepreneurial activity, can also dispose of real estate acquired through its own assets.

State officials do not have such a right, since all funds received from entrepreneurial and other income-generating activities must be directed to the state budget.

Reasons for write-off

The procedure for writing off fixed assets from the balance sheet implies, first of all, identifying the reasons why the property should be removed from the institution’s accounting records. Situations in which write-off from accounting is required:

- complete or partial loss of useful properties of an object, in which the OS cannot function properly;

- physical loss or damage to an object, these include: breakdown, destruction, damage, loss, liquidation;

- moral or technical obsolescence of the OS, in which the modernization of property is economically unjustified;

- loss of property assets due to emergencies or natural disasters.

Write off assets that have become obsolete during the construction, reconstruction, modernization and technical re-equipment of the enterprise as a whole or its individual structural divisions.

Write-offs are also carried out in cases where it is impossible to restore an asset or it requires significant financial costs, which will be regarded as inappropriate, irrational and inappropriate use of budget funds.

What other grounds are there for writing off fixed assets from accounting:

- if an institution decides to sell a non-financial asset to a third-party company or individual, then the object must be written off from the register;

- if the property is transferred into the ownership of third parties under an exchange agreement or free of charge;

- if NFA is transferred to a third party as a contribution to the authorized capital, then the asset is subject to write-off;

- if it is decided to rent or lease the object, provided that the property will be taken into account by the tenant (lessee).

Objects that are temporarily mothballed, for example, those that are not currently used in the production cycle, are not subject to write-off. Also, NFAs that are undergoing reconstruction and modernization, and whose operation is temporarily suspended, are not written off.

If property is transferred from one structural unit to another, the movement is reflected by internal movement. The NFA acceptance and transfer certificate is filled out. If an object is transferred from one separate division to another or to the head office, provided that the divisions are allocated to a separate balance sheet, then the procedure for the gratuitous transfer of fixed assets is observed.

IMPORTANT!

The end of the useful life of an asset is not a basis for writing it off from accounting.

Conservation

During downtime, the OS can be put into storage. This procedure includes a set of measures to preserve the integrity and serviceability of the property until it begins to be used in business again.

The procedure for conservation of objects is developed and approved by the organization independently. It should be borne in mind that the transfer of idle equipment to mothballing is not the responsibility of the company; such a decision is made by the company’s management.

The costs of conservation and removal of equipment from it are included in the enterprise’s expenses in the current period. When transferring to conservation, you should keep in mind that the property will not be exempt from property tax for this period. But the calculation of depreciation should be suspended when the object is mothballed for a period of more than three months (Clause 2 of Article 322 of the Tax Code of the Russian Federation).

Sample order on conservation of fixed assets

Special commission on write-offs

The organization must create a permanent commission that is authorized to make decisions on similar issues. The composition of the special commission should be fixed by a separate order of the head of the government agency or defined in the accounting policy.

Who to include on the commission:

- chief accountant or his deputy;

- accountant responsible for maintaining NFA records;

- persons responsible for the safety of the operating system at the enterprise;

- heads of structural units, workshops, departments;

- deputy head or the head himself (usually the chairman of the commission);

- other employees of the enterprise, at the discretion of management.

Include in the special commission workers whose activities are directly related to accounting, control and examination of OS. When considering an applicant for write-off, it is necessary to evaluate not only the appearance and technical characteristics of the OS, but also documentation, such as a technical passport, floor plan, diagrams, etc. This is necessary to compare actual performance with the stated technical characteristics.

The commission must indicate the following:

- Determine for what reason a specific piece of property may be removed from the institution’s accounting records.

- Decide whether individual parts of the decommissioned OS can be used in activities as materials or spare parts.

- Indicate the presence of precious metals or other expensive components and parts that can be sold by the enterprise.

- Control the removal of parts, parts and assemblies that can be used or sold.

- Drawing up an effective protocol that reflects the identified positions.

The minutes of the meeting can be drawn up in any form. There is no special form for documentation. The institution has the right to develop and approve an independent form for use in its work.

How is the procedure completed?

The documentation for writing off fixed assets looks like this:

- The minutes of the meeting of the standing committee are approved, which determines the key points of the disposal of fixed assets from the register.

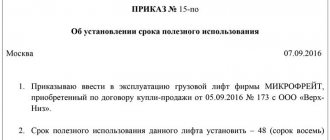

- Based on the protocol, the manager creates a separate order - an order for operations with fixed assets.

- An effective act on writing off fixed assets from accounting is drawn up.

The form of the act is determined individually, depending on the category of the asset being written off.

Regulatory guidance for 2020

The procedure for carrying out the procedure is regulated by clause 29 of PBU 6/01. It also follows from paragraphs 75, 76 of the Methodological Instructions, which were approved within the framework of Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n. If the fixed assets contain several elements, their liquidation can be achieved partially, i.e., only the part that cannot be restored can be dismantled.

There are several circumstances under which OS liquidation is traditionally carried out:

- obsolescence of property;

- physical deterioration;

- occurrence of an emergency;

- disaster;

- theft of units and components;

- lack of certain elements;

- damage;

- reconstruction;

- liquidation of a certain part.

Such provisions are also confirmed within the framework of the Letter of the Ministry of Finance of the Russian Federation dated January 29, 2014 No. 07-04-18/01.

Low value assets

Not all fixed assets should be reflected on the balance sheet accounts of the institution. The accounting regulations of public sector institutions provide special rules for maintaining records of low-value assets. These include fixed assets worth up to 100,000 rubles.

The category of low-value assets is divided into two groups:

- fixed assets, the cost of which is no more than 10,000 rubles per unit;

- fixed assets, the price of which ranges from 10,000 to 100,000 rubles per unit.

Depending on the value of the asset, the standard for reflection in accounting is determined. If the price of a low-value basic non-fiscal asset is below 10,000 rubles inclusive, then it cannot be taken into account on the balance sheet account 0 101 00 000 of accounting and budget accounting. Such fixed assets are subject to simultaneous write-off to the off-balance sheet, where they must be accounted for in a special off-balance sheet account 21 “Fixed assets in operation.”

Reflect the disposal of low-value fixed assets worth up to 10,000 rubles inclusive by the appropriate decision of the special commission. Write off assets based on the primary document (write-off act) at the cost at which they were accepted for off-balance sheet accounting.

Fixed assets worth up to 100,000 rubles, but more than 10,000, are accounted for on the balance sheet account 0 101 00 000. But their initial cost is immediately written off to depreciation charges. In simple words, the initial price of fixed assets in the amount of 100% is written off for depreciation - accounting account 0 104 00 000.

IMPORTANT!

Even 100% depreciation for a specific fixed asset does not provide grounds for its removal from accounting. Therefore, it is impossible to write off fixed assets worth from 10,000 to 100,000 rubles from the balance sheet.

Such an asset can be removed from the balance sheet only for certain reasons: moral and (or) physical wear and tear, liquidation, loss or damage, impossibility of restoration, irrationality and inexpediency of modernization. Or if the property is decided to be leased or rented (reflected on the recipient’s balance sheet), sold, donated or transferred free of charge.

Characteristics of fixed assets

To achieve maximum understanding of what is happening, let us recall the concept of fixed assets and the properties that they possess. So, OS are non-current assets of an enterprise that have a tangible form and retain it during operation. Such objects are created for long-term use.

While they are useful, the operating systems are one way or another involved in the company's business operations. This means that their cost must be included in the cost of finished products. How does this happen? Of course, in parts. In equal shares for the category of goods in the process of creation of which the fixed asset is used. What does this portion of the cost attributable to equipment or facilities look like? This is depreciation. Every month, the calculated amount accumulates in account 02, which is then written off to the cost of production.