The company's supplier requested that payment for the shipment of goods be transferred not to his bank account, but to his landlord. He explains this by saying that he must pay off his rent arrears, but currently has no available funds. Can a company in such a situation make payment for another legal entity? Yes, today there is nothing unusual in such a request. After all, the law allows business entities to pay their obligations not only directly. It is quite acceptable that another organization transfers funds on behalf of the debtor.

Legal basis

The debtor's right to transfer the obligation to pay for it to a third party is provided for by the Civil Code. This is stated in Article 313. A reservation is also made that this is legal in the event that any other laws or conditions of the paid obligation do not require that the debtor fulfill them strictly independently. Such conditions, for example, may be included in the contract. But most often there are no obstacles to attracting a third party to pay.

How safe is it in terms of audits of the paying organization? Will the Federal Tax Service inspectors have any complaints that the company made payments for another legal entity? Practice shows that if the operation is properly executed, inspectors usually do not have any questions. And if they do arise, they are very quickly “closed” with supporting documents.

About legality and safety

Having received an offer from his counterparty to pay his debt to a third-party organization, any novice businessman will ask himself several questions. How legal is this? Is it possible to refuse such an offer? And will the inspection authorities have any complaints about this?

In accordance with Article 313 of the Civil Code, the debtor may entrust the performance of his duties to a third party , if laws, other legal acts, the essence and conditions of this obligation do not oblige the debtor to fulfill it personally. In practice, in most cases there are no restrictions on payment by a third party for the debtor. And the creditor is obliged to accept such payment. Moreover, now you can even pay taxes for a third-party organization.

Does a company have the right to refuse to pay its counterparty’s obligations to another organization? Of course, there is, unless otherwise specifically stated in the contract. No one can force a company to transfer its funds to a person with whom it does not have a contractual relationship , not even an arbitration court.

However, is it worth abandoning this option? Today, payment of obligations by a third party is not uncommon. A fairly decent practice has been developed, which suggests that if everything is properly formalized, then the tax authorities usually do not have questions about this.

How to make a payment for another legal entity?

The legislation did not provide for any special form or type of document that would formalize the payment procedure under consideration. However, its implementation requires an agreement between the parties. To do this, the company whose obligations will be paid must send a letter to the head of the organization (or to the entrepreneur), which, at his request, will make the payment.

The letter is drawn up in free form, but it is mandatory to include the following data:

- the name of three persons: the debtor for whom payment will be made;

- payer (that is, the addressee of the letter);

- the person who will receive the funds (the debtor's creditor);

The company that draws up the specified letter is recommended to describe all the circumstances and parameters in as much detail as possible. And the addressee of the letter, that is, the paying organization, should receive its original.

So, the main document for making payment for another legal entity is a letter, a sample of which is presented in the following image.

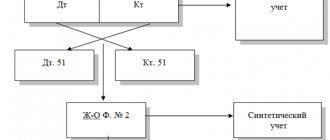

Accounting

A company repaying the debt of another organization is obliged to correctly enter the necessary information into its financial statements. To select the correct wiring, it is recommended to study the example:

- company A acts as a tenant of organization B, paying a monthly fee of 80 thousand rubles;

company A sold goods to company B for 70 thousand rubles, after which it sent the buyer a letter asking to transfer funds for the products to the account of company B to pay rent;- after transferring the funds, company A additionally paid company B 10 thousand rubles;

- organization A is obliged to correctly reflect the transaction in its accounting documentation;

- the debt of company B for shipped goods is reflected by the posting: D63 K90-1;

- rent and debt to the lessor are fixed: D44 K60;

- repayment of debt at the expense of company B is reflected by the entries: D60 K62.

Attention! Information is entered into accounting only after receiving a payment order confirming the transfer of funds.

Reflection in tax accounting for the payer

The company has paid the obligations of its counterparty, and now this transaction must be reflected in the accounts. First, let's consider whether this will have any tax consequences for the payer.

If the company is on the OSN, then in some cases it can offset VAT on the transferred amount. The operation will not entail any other tax consequences. To offset VAT, the following conditions must be met:

- the company transferred funds for its supplier as an advance payment;

- the agreement on the basis of which the company and the supplier operate contains an advance payment clause;

- the supplier has given instructions to pay its obligations (the letter mentioned above) and issued an invoice;

- there is a payment document confirming the transfer of funds to the counterparty's creditor.

For a payer who uses the simplified tax system, accounting for the transaction will depend on the nature of the payment. If he had a debt to the person for whom he paid for the goods or services supplied, then it will be considered repaid (in whole or in part). In the event that the payer took out a loan with interest from his counterparty, they can be written off as expenses within the limits of the transferred amount.

Registration procedure

The process of repaying a debt for a third party is divided into successive stages:

- initially, the company acting as a debtor sends a letter to a partner or counterparty, and the text includes a request to repay the debt against its own debt or on other terms;

- the organization that received the letter decides to fulfill the obligations of another enterprise;

- After the funds are transferred, a payment letter is sent along with the payment slip.

A company that has repaid someone else’s debt is obliged to keep documentation confirming this operation for at least 5 years, since it can be requested at any time by representatives of the Federal Tax Service. These include letters sent between companies, as well as a payment slip in which a note indicating the purpose of payment is placed.

Attention! The debtor is obliged to keep papers proving that his debt was repaid by a third party, since the lack of documentation leads to negative tax consequences, since the company may demand a refund if it can prove that the money transfer was erroneous.

Tax payments

You can pay for another person not only for the obligations that he or she has under an agreement with contractors. Recently, tax and other obligatory payments can be transferred in the same way. Previously, the tax service considered this option unacceptable - the taxpayer was obliged to pay his taxes independently. An exception was made only in very rare cases, for example, taxes for a reorganized entity could be paid by its legal successor.

However, at the end of 2021, amendments were made to the Tax Code that abolish this rule. So paying tax for another legal entity in 2021 is quite trivial. Thus, it is possible to pay tax payments, insurance premiums, state duties, both current accruals and debts for previous periods.

Distribution letter for payment sample

An order is a legal act issued by the head of a company (both private and public) to solve primarily operational problems and issues related to the activities of the enterprise, in particular the execution of certain orders, various kinds of instructions, documents, as well as to communicate the decision made by the employer to employees separate divisions.

Such an act is issued on a specific, narrow issue and cannot in any way contradict the current constitution, legislation, or decrees of the president of the country.

The order does not imply unquestioning execution/obedience; it is only an indication to employees of the most appropriate course of action. That is, unlike orders that require complete obedience, it only implies consent.

To avoid misinterpretation, in most domestic companies, orders have the same power as instructions: they must be obeyed and strictly followed. What could be the order?

The following types of orders are distinguished:

• oral;

• written (implies an act presented in the prescribed written form).

A written order can be presented not to one person, but to a group of employees.

Who can pay taxes for whom?

The law today does not establish any restrictions on who and under what conditions can pay tax for another person. Company taxes can be paid by any other organization, entrepreneur or just an individual.

The new rules make it possible to avoid sanctions for late payment of mandatory payments. For example, today is the last day to pay taxes, and the company does not have enough funds in its accounts. Just a year ago, such circumstances would have led to her having to pay late fees. Now, any person, for example, a director from his personal account, can fulfill the company’s obligation.

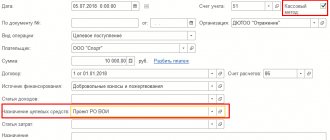

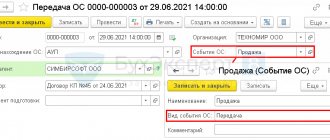

How to fill out a payment order?

There are several features in filling out a document to pay tax for another legal entity:

- in the payer field you should indicate the name of the organization (or the name of the individual) that makes the payment;

- in the fields “Taxpayer INN” and KPP, the relevant details of the organization for which the tax is paid are indicated;

- in the “Purpose of payment” field, you should first indicate the INN and KPP (if any) of the payer, and then, separated by two slashes (//), the name of the organization for which the payment is made, the name of the tax, period, type of payment and other important data;

- in field “101” the code “01” is entered - this means that the person for whom the payment is being made is a legal entity.

An example of how to fill out a “payment form” to pay taxes for another legal entity is shown in the following image.

In the above example, the individual K.I.V. makes an advance tax payment for U____ LLC in connection with the application of the simplified tax system.

What documents are required?

The official operation is properly formalized, for which the following documents are prepared:

- a letter from a debtor who asks a counterparty, founder or other organization for financial assistance;

- a payment order, which is marked by a bank employee, and it confirms the transfer of money to the specified details;

- a letter drawn up by the payer and containing information about the date of transfer of funds for the counterparty;

- reconciliation statements that include data on the remaining obligations of each participant.

Attention! It is recommended that each documentation indicate the purpose of the payment.

About writing a letter on video:

Let's sum it up

So, paying an obligation to a third party is a completely common and safe operation. It does not entail any negative consequences either for the payer or for the one for whom he makes the payment. It does not matter whether the payer and the debtor are in a contractual relationship or not. At the same time, this is very convenient, since it allows you to avoid unnecessary operations, delays in fulfilling obligations and related troubles. In this way, you can pay not only under contracts with counterparties, but also pay taxes.

Possible risks

A company deciding to repay the debt of a counterparty or supplier faces some pitfalls. Difficulties may arise even for the immediate debtor. The most popular risks include:

- a debtor who has written a letter requesting repayment of his debt may renege on his words if the documentation is not drawn up correctly, so the paying company will have to face serious losses;

the counterparty who made the payment can return the funds after the debt is written off by the creditor, insisting on an erroneous transfer, but this is only possible in the absence of a response letter and payment document;- the creditor can send a complaint to the debtor about the lack of payment, although in fact the payment was made by a third party.

Companies can easily protect themselves from the above troubles if they pay attention to the proper execution of documents that are needed when performing this operation. With the help of such papers, various operations and transactions are confirmed. Therefore, even if the case comes to trial, the defendant will be able to defend his rights by stopping the plaintiff’s illegal claims.