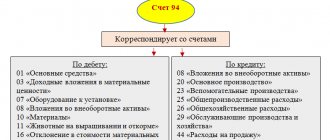

The concept of “total difference” was excluded from accounting terminology. All operations falling under this definition began to be called exchange rate differences. This significantly simplified accounting and contributed to the convergence of requirements in accounting and tax accounting.

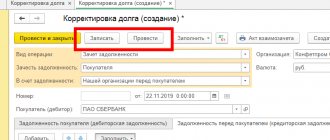

Question: Is the positive exchange rate difference arising from the intermediary taken into account in non-operating income for profit tax purposes when the principal (principal, principal) reimburses expenses incurred by him (clause 11, article 250 of the Tax Code of the Russian Federation)? View answer

The concept of exchange rate and amount differences

According to Part 2 of Art. 12 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, monetary measurement of accounting objects is carried out in the currency of the Russian Federation - in rubles. Tax accounting is also carried out in rubles. According to Part 3 of Art. 12 of Federal Law No. 402-FZ dated December 6, 2011, unless otherwise established by the legislation of the Russian Federation, the cost of accounting items expressed in foreign currency is subject to conversion into the currency of the Russian Federation. In some cases, recalculation is carried out not only on the date of the transaction, but also on another date (usually the reporting date). If the exchange rate has changed compared to the previous revaluation date, an exchange rate or amount difference arises. A change in estimate results in an income (or expense) being added to the books.