Accounting statements: forms 1 and 2

Accounting statements are prepared and presented in accordance with the forms approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

ATTENTION! From 2021, financial statements will be submitted exclusively in electronic form. Paper forms will no longer be accepted. Read more about changes to the rules for presenting financial statements here. We also remind you that in 2021 the reporting forms have been updated.

Accounting statements - forms 1 and 2 - are submitted by all organizations. In addition to forms 1 and 2 of the financial statements, there are appendices to them (clauses 2, 4 of the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n):

- statement of changes in equity;

- cash flow statement;

- Explanations to the balance sheet and income statement.

Find out what features need to be taken into account when preparing annual financial statements in the Guide from ConsultantPlus by getting trial access to the system for free.

For small enterprises, as part of the annual reporting, it is mandatory to submit only Form 1 of the financial statements and Form 2.

Have you encountered difficulties in filling out financial statements? Ask on our forum! For example, in this thread, experts advise forum members on how to reflect a major transaction on the balance sheet.

Form 2 of the balance sheet: one report - two titles

Form 2 of the balance sheet - by this name we traditionally mean a reporting form that contains information about the income, expenses and financial results of the organization. Its current form is contained in the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n, in which it is called a report on financial results.

In the Law “On Accounting” dated November 21, 1996 No. 129-FZ, which was in force until 2013, this form was called the Profit and Loss Statement, and in the law that replaced it dated December 6, 2011 No. 402-FZ, it was called the Financial Results Report. At the same time, the form itself began to bear this name quite recently: the “Profit and Loss Statement” was officially renamed to the Financial Results Statement only on May 17, 2015, when Order No. 57n of the Ministry of Finance of Russia dated April 6, 2015, which introduced changes to the reporting forms, came into force .

By the way, now Form 2 is not the official, but the generally accepted name of the report. It has ceased to be official since 2011, when the order of the Ministry of Finance of the Russian Federation dated July 22, 2003 No. 67n, which approved the previous forms of accounting, which were called: Form 1 “Balance Sheet”, Form 2 “Profit and Loss Statement”, Form 3 “Statement of changes in capital.”

In 2021, changes were made to Form 2 (Order of the Ministry of Finance dated April 19, 2019 No. 61n). So, when filling out the report for 2021, consider:

- you cannot fill out reports in millions; the unit of measurement has become thousands of rubles;

- OKVED was replaced by OKVED2;

- line 2410 changed the name “Income Tax” (instead of “Current Income Tax”);

- lines 2421, 2430, 2450, dedicated to tax liabilities (assets), disappeared;

- lines 2411 “Current income tax”, 2412 “Deferred income tax”, 2530 “Income tax from transactions, the result of which is not included in the net profit (loss) of the period” appeared.

And the total financial result is determined as the sum of the lines:

- "Net income (loss)";

- “The result of the revaluation of non-current assets, not included in the net profit (loss) of the period”;

- “Result from other operations not included in the net profit (loss) of the reporting period”;

- “Tax on profits from transactions, the results of which are not included in the net profit (loss) of the period.”

You can download a sample of Form 2 in the new edition with comments on completion from K+ experts in the ConsultantPlus legal reference system. To do this, get a free trial demo access to K+:

For more information about the forms that supplement the balance sheet and financial results report, read the article “Filling out forms 3, 4 and 6 of the balance sheet.”

Using the book profit indicator

The balance sheet profit indicator is used when analyzing the financial and economic activities of an organization, which is necessary for making management decisions and developing a business development strategy for the organization. It allows you to install:

- factors influencing its size;

- reasons for non-fulfillment of the organization’s income and expenses budget and finding sources of losses;

- weaknesses of the organization’s activities, its unprofitable links;

- reserves for further increase in profits (reduction of losses);

- the impact on the size of the balance sheet profit of the accounting methods established in the accounting policies of the organization;

- dynamics of growth or decline in business efficiency (when analyzing this indicator for several reporting periods).

Based on the balance sheet profit, the level of profitability and capital turnover are determined. The importance of balance sheet profit for an organization is multifaceted. This:

- a criterion for the economic efficiency (profitability) of the organization’s activities as a whole (important for shareholders and participants);

- guide for investors;

- a reference point for creditors (to study creditworthiness) and for counterparties (to determine the reliability of a business partner);

- source of business financing (technical development, expansion of production, increase in sales volumes, investments in working capital);

- source of formation of reserve capital (fund), for example, to pay off possible losses;

- factor of increasing solvency;

- financial source of incentives for employees (increasing salaries, tariff rates, compensation and incentive payments, implementation of social programs of the organization);

- source of funding for charitable events;

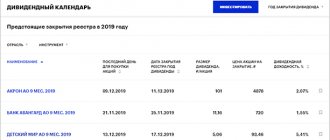

- financial source for accrual and payment of dividends;

- source of increase in the market value of the organization.

E.V. Orlova Head of the Audit Department of PARTI LLC

What does Form 2 of the balance sheet look like?

Form 2 of the balance sheet is a table above which are given:

- reporting period and date;

- information about the organization (including codes OKPO, INN, OKVED, OKOPF, OKFS);

- unit of measurement (from 2021 - only thousand rubles).

The table with reporting indicators consists of 5 columns:

- number of the explanation to the report;

- name of the indicator;

- line code (it is taken from Appendix 4 to Order No. 66n);

- the value of the indicator for the reporting period and the same period of the previous year, which is transferred from the report for the previous year.

The indicators of the previous and reporting year must be comparable. This means that if the accounting rules change, last year’s ones should be transformed to the rules in force in the reporting year.

Read about how such a transformation is done in the material “Balance sheet of an enterprise for 3 years (nuances).”

Income Statement: Breakdown of Lines

Statement of financial results - decoding of lines is carried out according to certain rules. Let's look at how to fill out individual lines of the report.

1. Revenue (line code - 2110).

Here they show income from ordinary activities, in particular from the sale of goods, performance of work, provision of services (clauses 4, 5 of PBU 9/99 “Income of the organization”, approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n).

This is the credit turnover of account 90-1 “Revenue”, reduced by the debit turnover of subaccounts 90-3 “VAT”, 90-4 “Excise taxes”.

To find out whether it is possible to judge the amount of revenue from the balance sheet, read the article “How is revenue reflected in the balance sheet?” .

2. Cost of sales (line code - 2120).

Here is the amount of expenses for ordinary activities, for example, expenses associated with the manufacture of products, the purchase of goods, the performance of work, the provision of services (clauses 9, 21 PBU 10/99 “Organization expenses”, approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n).

This is the total debit turnover for subaccount 90-2 in correspondence with accounts 20, 23, 29, 41, 43, 40, 46, except for accounts 26 and 44.

The indicator is given in parentheses because it is subtracted when calculating the financial result.

3. Gross profit (loss) (line code - 2100).

This is profit from ordinary activities excluding selling and administrative expenses. It is defined as the difference between the indicators of lines 2110 “Revenue” and 2120 “Cost of sales”. The loss, as a negative value, is reflected hereinafter in parentheses.

4. Selling expenses (line code - 2210, value written in parentheses).

These are various expenses associated with the sale of goods, works, services (clauses 5, 7, 21 PBU 10/99), that is, debit turnover on subaccount 90-2 in correspondence with account 44.

5. Administrative expenses (line code - 2220, the value is written in parentheses).

The costs of managing the organization are shown here if the accounting policy does not provide for their inclusion in the cost price, i.e. if they are written off not to account 20 (25), but to account 90-2. Then this line indicates the debit turnover for subaccount 90-2 in correspondence with account 26.

ATTENTION! With the reporting campaign for 2021, changes to PBU 18/02, 16/02, 13/2000, FSBU 5/2019 “Reserves” come into effect. And starting with reporting for 2022, the new FSBU 25/2018 “Lease Accounting”, FSBU 6/2020 “Fixed Assets”, FSBU 26/2020 “Capital Investments” should be applied. You can start applying new accounting standards earlier. This decision needs to be fixed in the accounting policy of the enterprise.

For example, ConsultantPlus experts explained in detail how to correctly apply FAS 25/2018 in practice. Get trial access to the K+ system and study the material for free.

6. Profit (loss) from sales (line code - 2200).

Profit (loss) from ordinary activities is shown here. The indicator is calculated by subtracting lines 2210 “Commercial expenses” and 2220 “Administrative expenses” from line 2100 “Gross profit (loss)”; its value corresponds to the balance of account 99 in the analytical account of profit (loss) from sales.

7. Income from participation in other organizations (line code - 2310).

These include dividends and the value of property received upon leaving the company or upon its liquidation (clause 7 of PBU 9/99). The data is taken from the analytics for the loan of account 91-1.

8. Interest receivable (line code - 2320).

This is interest on loans, securities, commercial loans, as well as interest paid by the bank for the use of money available in the organization’s current account (clause 7 of PBU 9/99). Information is also taken from the analytics on the loan of account 91-1.

9. Interest payable (line code - 2330, value written in parentheses).

This reflects interest paid on all types of borrowed obligations (except those included in the cost of an investment asset), and the discount payable on bonds and bills. This is analytics for the debit of account 91-1.

10. Other income (line code - 2340) and expenses (code - 2350).

This is all other income and expenses that went through 91 accounts, except those indicated above. Expenses are written in parentheses.

11. Profit (loss) before tax (line 2300).

The line shows the accounting profit (loss) of the organization. To calculate it, to the indicator of line 2200 “Profit (loss) from sales” you need to add the values of lines 2310 “Income from participation in other organizations”, 2320 “Interest receivable”, 2340 “Other income” and subtract the indicators of lines 2330 “Interest to payment" and 2350 "Other expenses". The value of the line corresponds to the balance of account 99 in the analytical account of accounting profit (loss).

12. Current income tax (line code - 2410).

This is the amount of tax accrued for payment according to the income tax return.

Organizations in special regimes reflect on this line the tax corresponding to the applied regime (for example, UTII, Unified Agricultural Tax). If taxes under special regimes are paid along with income tax (when combining regimes), then the indicators for each tax are reflected separately on separate lines entered after the current income tax indicator (attachment to the letter of the Ministry of Finance of Russia dated 02/06/2015 No. 07-04- 06/5027 and 06/25/2008 No. 07-05-09/3).

Organizations applying PBU 18/02 (approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n) further show:

- permanent tax liabilities (assets) (line code - 2421);

- change IT (line 2430) and ONA (line 2450).

To learn how the application of PBU 18/02 affects the calculation of income tax, read the material “Which accounting entry should be reflected if income tax is charged?”

Line 2460 “Other” reflects information about other indicators that affect net profit.

The net profit itself is shown on line 2400.

The following is background information:

- about the result of the revaluation of non-current assets, not included in the net profit (loss) of the period (line 2510);

- as a result of other operations not included in the net profit (loss) of the period (line 2520);

- the cumulative financial result of the period (line 2500);

- basic and diluted earnings (loss) per share (lines 2900 and 2910, respectively).

Form 2 of the balance sheet is signed by the head of the organization. The signature of the chief accountant has been excluded from it since May 17, 2015 (Order of the Ministry of Finance of Russia dated April 6, 2015 No. 57n).

Retained earnings: formula

Generally speaking, this measure measures the total amount of profit a company has earned since its inception, minus any losses incurred and the amount of profit distributed to shareholders. Retained earnings can also be a negative number. This occurs when total losses up to date increase profits. Such accumulated losses are also called “accumulated deficit.”

The formula for retained earnings for a given period looks like the picture below.

The amount shown on the balance sheet as "retained earnings" is referred to as "Ending Retained Earnings" (ERE).

As can be seen from the formula, retained earnings are equal to the difference in the amount of net income and dividends paid, summed with the previous value of retained earnings itself, in accordance with the definition and economic meaning of the indicator.

Financial results report: example of filling

For clarity, we present excerpts from the balance sheet for 2021 (in rubles), generated before the balance sheet reform and necessary for filling out the financial results report.

| Account (sub-account) | Turnover | ||

| Number | Name | Debit | Credit |

| 09 | Deferred tax assets | 45 000 | 40 000 |

| 77 | Deferred tax liabilities | 110 000 | 90 000 |

| 90.01 | Revenue | 110 799 640 | |

| 90.02 | Cost of sales | 76 880 000 | |

| 90.03 | VAT | 16 901 640 | |

| 90.08 | Administrative expenses | 5 865 000 | |

| 90.09 | Profit/loss from sales | 11 153 000 | |

| 91.02 | other expenses | 352 000 | |

| 91.09 | Balance of other expenses | 352 000 | |

| 99 | Profit and loss | ||

| 99.01 | Profits and losses (excluding income tax) | 11 153 000 | 352 000 |

| 99.02 | Income tax | 2 210 200 | |

| 99.02.1 | Conditional income tax expense | 2 160 200 | |

| 99.02.3 | Permanent tax liability | 50 000 | |

When reforming the balance sheet, posting Dt 99.01.1 Kt 84.01 will write off net profit in the amount of RUB 8,590,800.

Based on the above data, let's look at Form 2 of the financial statements - sample completion for 2021 (data for 2021 taken from last year's report):

| Indicator name | Code | For 2021 | For 2021 | ||||

| Revenue | 2110 | 93 898 | 88 365 | ||||

| Cost of sales | 2120 | (76 880) | (75 993) | ||||

| Gross profit (loss) | 2100 | 17 018 | 12 372 | ||||

| Business expenses | 2210 | ( — ) | (545) | ||||

| Administrative expenses | 2220 | (5 865) | (3 682) | ||||

| Profit (loss) from sales | 2200 | 11 153 | 8 145 | ||||

| Income from participation in other organizations | 2310 | — | 23 | ||||

| Interest receivable | 2320 | — | — | ||||

| Percentage to be paid | 2330 | ( — ) | ( — ) | ||||

| Other income | 2340 | — | — | ||||

| other expenses | 2350 | (352) | (513) | ||||

| Profit (loss) before tax | 2300 | 10 801 | 7 655 | ||||

| Income tax | 2410 | (2 235) | (1 894) | ||||

| incl. Current income tax | 2411 | (2260) | (1894) | ||||

| deferred income tax | 2412 | 25 | — | ||||

| Other | 2460 | — | — | ||||

| Net income (loss) | 2400 | 8 591 | 5 761 | ||||

| Indicator name 2) | Code | For 2021 | For 2021 |

| Result from the revaluation of non-current assets, not included in the net profit (loss) of the period | 2510 | — | — |

| Result from other operations not included in the net profit (loss) of the period | 2520 | — | — |

| Total financial result of the period | 2500 | 8 591 | 5 761 |

| For information Basic earnings (loss) per share | 2900 | — | — |

| Diluted earnings (loss) per share | 2910 | — | — |

Small businesses have the right to submit simplified reporting, which includes a balance sheet and Form 2 in a stripped-down version. Get trial access to ConsultantPlus and learn how to fill out a simplified report for free.

Impact on activities

How the presence of a loss in accounting will affect the organization is the question that owners and managers primarily ask. If your management stubbornly believes that you need to pay taxes as little as possible, therefore there should be as many expenses as possible (by the way, not always real), and a loss is generally super (yes, there are many of those too), show them the following list of reasons why it’s bad such situation:

- Dividends . Despite the fact that the founder is pleased with the income in management accounting, a loss in accounting will not allow the accrual and payment of dividends. Even if there are millions in the account. Part or all of the retained earnings from previous years (if any) can be used to cover this; this allows the indicators to be leveled (although dividends still cannot be paid), but makes it impossible to distribute the available profits for other purposes.

- Loans. Would you give a loan to a person who spends more than he earns and is in the red? Hardly. The bank will have the same attitude towards the organization if you decide to take out a loan; even collateral is unlikely to help in this matter.

- Bank guarantees . Participation in public procurement under 44-FZ involves in some cases the use of bank guarantees: when submitting an application, concluding a contract, providing guarantee obligations to the customer. This allows you not to distract or freeze working capital. This is especially true for large contracts, when the security amounts are substantial, you may simply not have that kind of money, and state employees do not indulge performers with advances. The bank will again evaluate the financial position of the procurement participant, and negative indicators will not be beneficial.

- Participation in procurement. Participation in trading itself is called into question if you have unprofitable activities. According to 44-FZ, accounting reports are not required, but according to 223-FZ they are, because customers set their own requirements (federal law gives such a right) in relation to a potential participant and performer. These include the submission of reports for the previous year, confirming the reliability of the future supplier or contractor (availability of assets, absence of debts, etc.)

- Checks and requirements. The Federal Tax Service checks not only the loss in the income tax return or the simplified tax system, it will also be interested in the “accounting” negative result. Most likely, the service will inquire about the reasons, perhaps request documents. In particularly advanced cases (if you ignore the requirements), an on-site inspection is possible.

- Bankruptcy. Losses go hand in hand with bankruptcy. By themselves, of course, they do not indicate insolvency, but indirectly they do. If you are delaying payments to the supplier, he checked your statements (this can really be done, even the consents are open data) and found out that there has been a loss for a couple of years, there is a possibility that the creditor will go to court with a demand to declare the organization bankrupt. You will have to prove your worth to the judge or negotiate.

- Liquidation. Again, losses do not necessarily mean that net assets have fallen below share capital, but most likely they have. The tax service has the right to initiate a liquidation procedure by going to court (clause 11 of Article 7 of the Law “On Tax Authorities of the Russian Federation”), and the organization is obliged to make a decision if the situation does not change for three years in a row.

Options for solutions: liquidation or reduction of the capital. Moreover, if it is minimal, then, on the contrary, it may be necessary to increase it, bringing it to the level of the average.

Probably not a single item will please the owners. Cost reduction and optimization can be carried out without bringing the company to a crisis (even a formal one).