For a beginner, it may seem that using the 1C 8.3 program is very difficult and nothing is clear, but in fact, everything is completely the opposite. This software has a completely user-friendly interface, a significant part of the functionality of which is intuitive. And it will be very easy to use for both managers and office workers. In this article, we will sequentially look at the accounting of fixed assets in 1C with example screenshots.

First, let's define the terminology. Fixed assets are property used as a means of labor for more than one year and costing more than one hundred thousand Russian rubles. In a company, accounting for fixed assets includes a large number of different operations, including registration, putting into use, depreciation and, ultimately, disposal. Each is worth considering separately.

Receipt and commissioning, acceptance of fixed assets for accounting in 1C

So, some basic equipment is purchased, for example, a lathe. Information about this needs to be added to the program. To do this, we will use the corresponding item “Receipt of equipment”, which can be easily found in the section “OS and intangible assets”.

Filling out such a document will not be difficult. In its header we indicate the name of our organization and the name of the other company from which the purchase was made in accordance with the main agreement. Our example situation under consideration is the simplest. The part with the table will only have one row with the lathe. In addition, VAT, invoices and prices are noted there.

When the posting is completed, the document assigns the lathe, which in our example costs three hundred and fifty thousand rubles, to the required account.

In order for the lathe to be put into operation in accordance with the software accounting and depreciation to be calculated correctly, this must be noted in the document “Acceptance for accounting of fixed assets.” The document can be easily found in the “OS and intangible assets” section.

Next you need to fill out the header of the document that we created. In our case, we should select “Equipment” as the type of operation, because a lathe is precisely equipment. Next, we note the OS event and, if necessary, the financially responsible person and the place where the machine is located.

Now you need to go to the first tab of the document called “Non-current asset”, and there, in turn, to the directory position “Nomenclature”. In our case, again there will be a lathe. If necessary, it is permissible to note the method of its receipt (say, for a fee). The department field is also optional.

Let the lathe be listed on 04/08/01 (for example, this will be useful below when considering depreciation).

Next, about the “Fixed Asset” tab. There, only one position was added to the tabular part, selected from the corresponding directory. The directory has certain filling features. In the directory, we noted the price of our equipment at three hundred and fifty thousand rubles, some data on depreciation, and so on.

In our example, the purchased machine will be used for five years, that is, sixty months, and depreciation will be calculated using a linear method. Thus, the entire amount will be written off in equal parts throughout these five years, when the month closes.

Let's move on again to filling out the document for putting the lathe into use. There we are now interested in the “Accounting” tab. It is necessary to be a little more specific about the accounts, the method of calculating depreciation and the operating time of the machine. This data should already be in the card of our main asset, that same machine.

Next is the “Tax Accounting” tab. With almost the same data as in the one that came before. Only significantly less data should be noted, and such data will be used not for accounting, but for tax purposes.

In the last tab, data about the depreciation bonus is filled in. The percentage is indicated by the group in which our fixed asset (machine) should be included according to the period of use. For us it will be 30%.

When all the fields in all tabs are filled out correctly, it’s worth double-checking! - you can post the document.

If everything was done in full accordance with the instructions written above, then in the end 2 different accounting entries should be generated.

The first posting will include the actual acceptance of our machine for accounting with a note of the amount (three hundred and fifty thousand rubles). In the second line of movements, a depreciation bonus of 30% will be noted - in terms of money it turns out to be one hundred and five thousand rubles.

Our machine began operation in July 2021. Accordingly, in August 2021 the program will already take into account all the noted information.

Regulations

Key points regarding depreciation of property of commercial organizations, as well as its concept, are enshrined in the third section of PBU 6/01. In this regulatory document, the legislator focuses on:

- methods for calculating

depreciation of fixed assets in accounting; - the specifics of calculating the period

during which means of production can be used in economic activity.

The second most important document is the chart of accounts, or more precisely, section 02 “Depreciation of fixed assets.” All possible transactions that an entrepreneur may encounter when conducting business are described here in detail. Close attention should be paid to the Tax Code (TC) of the Russian Federation. In Russia, there have been discrepancies between the accounting and tax accounting rules for many years, and it is in the context of depreciation that they are especially noticeable. In addition to the listed documents, the accountant-calculator can be guided by additional instructions, reference books and letters from the Ministry of Finance, which explain specific situations.

Important! Significant assistance in calculating depreciation is provided by the Decree of the Government of the Russian Federation dated January 1, 2002 N 1, which provides a detailed breakdown of fixed assets according to the maximum time of their operation.

Moving fixed assets to 1C

The movement of a fixed asset in 1C 8.3 is quite similar in essence to the movement of goods. The key difference is that the product is moved between warehouses, and the asset is moved between departments, because it has already been taken into account.

When such a document is drawn up, only some details may cause difficulties, for example, the calculation of depreciation and the method of reflecting expenses on it. Information should be noted there only if additional depreciation is charged after the move. In the example on the screenshot, we will not fill them out. Depreciation, as usual, is calculated at the end of the month.

Method of writing off cost in proportion to the volume of work or products

This method of calculating depreciation uses the natural indicator for the reporting period. Also, accruals are made from the original cost. This method is convenient for car depreciation.

Example 1

Initial cost $500\000$ rub. Estimated mileage - over useful life - $250\000$. Service life $3$-$5$ years.

- Depreciation per $1$ km run:

- A = $500\000$ rub. / $250\000$ = $2$ rub.

Figure 3.

Inventory of fixed assets in 1C

In the same way, inventory has few differences when compared with a similar operation carried out with goods. Only, again, instead of a warehouse, you need to indicate a division. Where there is a table, it will be necessary to note not the quantity, but the sign that the main means is there.

When a fixed asset is not noted in accounting, but in fact exists, then you need to make an inventory document for accepting the asset for accounting. And if, on the contrary, it is indicated in the accounting, but in reality is missing, it needs to be written off.

Depreciation of fixed assets: physical and moral

So, OS wear and tear is the loss of value during operation or inactivity. It can be physical or moral. Physical manifests itself as the loss of technical qualities and characteristics under the influence of time and production processes. Physical wear and tear is divided into productive (in which a loss of value occurred during operation) and unproductive (when an object wears out after being in storage for a long time).

Moral wear and tear is when the value of an object decreases as a result of the appearance on the market of its improved analogues with higher productivity and lower cost.

By studying the logic of physical and moral wear and tear, the duration of wear of a certain OS object is established. These studies form the basis for the calculated standard service lives (SLI) of property and depreciation rates.

Depreciation of fixed assets in 1C

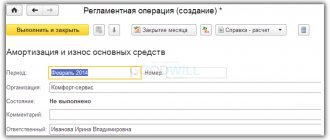

Depreciation is typically performed once at the end of the month.

To perform it, go to the “Operations” menu, then to “Closing the month”. We choose a period, our company. Further everything is already automated in detail. The assistant makes the calculations sequentially and first calculates depreciation charges. If everything was done correctly, then a depreciation document will be created, as in the screenshot.

Let's look at a specific example. By the way, it is important to note that the rules and depreciation options are set up in the company’s accounting policy, and depreciation is calculated monthly from the month from which our fixed asset was added to the program and accepted for accounting.

So, the result was a transaction in the amount of 2950 rubles. The settings indicate a linear option for calculating depreciation. The machine, as we remember, must be used for five years. Everything is calculated correctly.

Property tax

Non-profit organizations that apply the general tax system are recognized as payers of property tax (Clause 1, Article 373 of the Tax Code of the Russian Federation). When calculating property taxes, consider:

- objects of movable property registered before January 1, 2013 and reflected in the balance sheet in accounts 01 “Fixed Assets” and 03 “Profitable Investments in Material Assets”;

- real estate objects reflected in the balance sheet in accounts 01 “Fixed Assets” and 03 “Profitable Investments in Material Assets”.

When calculating this tax, fixed assets are taken into account at their residual value, determined according to accounting rules. Since fixed assets of non-profit organizations are not depreciated in accounting, they must be included in the calculation of the tax base at their original cost minus depreciation. To determine the average annual value of property, the amount of depreciation that must be accrued for the year is distributed evenly over the months of the tax period. This procedure is established by paragraph 1 of Article 375 of the Tax Code of the Russian Federation and is explained in the letter of the Ministry of Finance of Russia dated April 18, 2005 No. 03-06-01-04/204.

Some non-profit organizations are eligible for property tax relief. The list of benefits and conditions for their application are given in the table.

Reducing balance method

Depreciation is calculated in the same way as with the linear method, only instead of the original cost, the residual value of the fixed assets at the beginning of the reporting year is taken into account.

Organizations can apply a multiplying factor , but not more than 3.0. Until 2006, only small enterprises could apply the maximum coefficient. The size of the coefficient must be reflected in the accounting policy.

Monthly depreciation = (residual value of fixed assets at the beginning of the year x depreciation rate x increasing factor)/12

Depreciation rate = 100 / useful life, years.

Example: The initial cost of a passenger car is 720,000 rubles. Useful life - 5 years. Increasing factor - 3. Depreciation rate = 100/5=20.

Depreciation calculation

| Year of use | Residual value at the beginning of the year, rub | Depreciation rate, % | Depreciation for the year, rub. (column 2 x column 3 x coefficient 3) | Depreciation per month, rub (column 4:12) | Residual value at the end of the year, rubles (column 2 - column 4) |

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1 | 720 000 | 20 | 432 000 | 36 000 | 288 000 |

| 2 | 288 000 | 20 | 172 800 | 14 400 | 115 200 |

| 3 | 115 200 | 20 | 69 120 | 5 760 | 46 080 |

| 4 | 46 080 | 20 | 27 648 | 2 304 | 18 432 |

| 5 | 18 432 | 20 | 11 059,2 | 921,6 | 7 372,8 |

The useful life of 5 years has ended, but the residual value is not zero. What to do with it? There may be two options, so the organization must document the chosen method in its accounting policies:

- Option 1 - charge depreciation until disposal of the fixed asset: sale, moral, physical wear and tear.

- Option 2 - write off the residual value as expenses in the last month of its useful life.

What is good about the reducing balance method is that in the first years of using the OS, depreciation occurs faster. Disadvantage - the useful life of the OS is shorter than the period of its full repayment.

Accounting nuances in 2021

To contents

Property subject to depreciation in 2021 includes tangible and intangible objects that:

- belong to the company by right of ownership or ownership;

- used to generate income in the industrial area, service sector for more than 1 year;

- with an initial cost of more than 40,000 rubles .

Land plots and other natural resources, unfinished buildings and structures are not subject to depreciation. Depreciation of fixed assets such as art, gifts or purchases through targeted subsidies, and stock market instruments is not carried out.

Depreciation charges for fixed assets for the reporting year are accrued monthly, regardless of the calculation method used, in the amount of 1/12 of the calculated annual amount from the first day of the month following the month of input or, vice versa, withdrawal of fixed assets. At the end of the useful life of fixed assets, depreciation is not charged.

Display in accounting (accounts and postings)

Deductions for fixed assets are indicated in the reporting period in the accounting to which they are included, regardless of the results of the enterprise's activities. The amount of accrued depreciation is displayed in accounting as a debit to accounts for the cost of production or sale (except for leased fixed assets) under the credit of passive account 02 “Depreciation of fixed assets.”

In this case, the following postings are made: Debit (D) – Credit (C):

- D20 (23, 25, 44) – K02 – reflects the OS used in the manufacture of goods, when performing work and providing services.

- D08.3 - K02 - is carried out for non-construction organizations carrying out capital work with.

- D29 - K02 - goes, employed in service industries and farms.

Depreciation on fixed assets that are used for management needs outside the production process is reflected as D26 - K02.

Peculiarities of calculating depreciation of fixed assets in taxation

In tax accounting in 2021, the useful life is set by the company in strict accordance with the Classifier of fixed assets. It sets the maximum operating period within the depreciation group. Belonging to a certain category is determined by the enterprise based on the supplier’s documents and the description of the Classifier.

If the Classifier does not contain data about a specific OS, data from analogues is used.

In the process of establishing the operational period for an OS that was in use, the new owner needs to take as a basis the data provided by the previous owner. The new owner does not have the right to change membership in the previously determined depreciation group. If there is no data on the property or the operating period exceeds the standard one, the new owner has the right to independently determine how much useful life of the fixed asset remains.