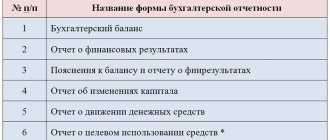

Accounting statements of small enterprises can be prepared in two versions - according to the usual templates of reporting documents and according to simplified forms. The choice of a specific reporting scheme depends on the method of accounting. Small enterprises have the right to conduct simplified accounting (clause 4 of article 6 of the law on accounting dated December 6, 2011 No. 402-FZ). If a business entity has taken advantage of this opportunity, then it decides for itself whether its reporting will be presented in an abbreviated format, or the set of reporting should be complete (clause 6 of Order of the Ministry of Finance No. 66n dated 07/02/2010). Methods of accounting and reporting are fixed in the accounting policy.

Key rules for simplification

Maintaining accounting records and submitting reports to tax and statistical authorities is mandatory for all economic entities in Russia. Financial statements are a set of numerous forms and forms that reflect the results of the financial and economic activities of an enterprise.

Preferential conditions are provided for small businesses. Small businesses have the right to conduct accounting using a simplified system and send to the Federal Tax Service:

- Balance sheet.

- Income statement.

- Report on the intended use of funds (for non-profit institutions).

The remaining forms are not compiled at all if the information in these reporting forms is not essential for assessing the economic activity of a small enterprise. This possibility is enshrined in clause 6 of Order No. 66n of the Ministry of Finance dated 07/02/2010. The relaxing condition for the organization must be specified in the accounting policy, otherwise tax authorities will issue a fine for non-compliance of reporting forms.

IMPORTANT!

The deadline for submitting forms is similar to ordinary registers: a simplified form of the balance sheet for 2021 is submitted in the usual manner until March 31 of the year following the reporting year. Documents must be submitted to the Federal Tax Service in electronic or paper form by March 31, 2020.

Example of filling out a simplified report

Small businesses are allowed to show less information in a simplified annual report compared to other organizations. Let's take a closer look at an example of filling out simplified financial statements for 2021. Thus, the asset balance sheet of a small enterprise consists of one section instead of two; it reflects only five indicators plus a total. The liability side of the balance sheet contains one section of six indicators plus a total. By virtue of Law No. 402-FZ, all lines for which aggregated indicators are indicated (“Tangible non-current assets”, “Intangible, financial and other current assets”) must be assigned a code corresponding to the largest of the indicators included in the total line amount.

In addition, when filling out the line “Tangible non-current assets”, you must include data on debit balances on accounts 01, 03, 07, 08 (except for subaccounts 08-5 and 08-8), 15 and 60, and indicate the balance on account 16 and credit balance on account 02. When filling out the line “Intangible, financial and other non-current assets”, it is necessary to include in it debit balances on accounts 04, 58, 97, and sub-accounts 08-5, 08-8, 55-3, 73-1 and credit balance on accounts 05 and 59. This is defined in paragraph 35 of PBU 4/99.

The simplified income statement for small businesses has only seven lines instead of the usual 18, and eliminates the Reference Data section entirely. An organization has the option not to indicate data on related parties to the financial result and not to provide information on its segments. Any accounting events should be reflected in the report only from the requirement of rationality, as prescribed by clause 19.4 of the Ministry of Finance information. In accordance with this document, when preparing financial statements, small businesses must proceed from the fact that the financial statements provide a reliable and complete picture of the financial position of the organization, the results of its activities and all changes in the financial position for the year.

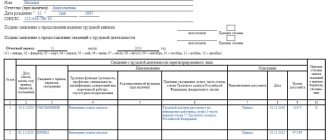

As an example of what simplified reporting should look like (KND 0710096), we took the conditional Primer LLC, which uses simplified forms of financial reporting for 2021. The company applies a simplified income tax system with a tax rate of 6%. She is engaged in appraisal activities. It does not have intangible, financial and other current and non-current assets. The organization's accounting policy provides that revenue is determined as money is received from customers, and expenses are recognized as they are paid and are included in the reduction of the financial result of the current period, as provided for in PBU 1/2008 and PBU 10/99.

Sample of filling out simplified financial statements according to KND 0710096

Income statement

Who submits simplified financial statements

Those economic entities that have been granted accounting privileges are entitled to report in abbreviated forms. Here is who submits simplified financial statements for 2019 (clause 4 of article 6 of law No. 402-FZ of December 6, 2011):

- Small businesses (SMB).

- Non-profit companies.

- Institutions are participants in the Skolkovo project.

But there are exception organizations that do not have the right to simplified accounting and reporting (clause 5 of article 6 402-FZ):

- Firms whose financial statements are subject to mandatory audit.

- Housing and construction cooperatives.

- Consumer credit cooperatives.

- Organizations providing microfinance lending and loans.

- Public sector institutions and political parties (branches and regional divisions).

- Collegiums, chambers and bureaus of lawyers, legal consultations.

- Notary chambers.

- Non-profit institutions registered in the register of foreign agents.

Before submitting preferential forms, check your organization against both lists. It is important to determine whether the company is recognized as an SMP based on the following indicators:

- the average number of employees should not exceed 100 people for the previous year (how to check the indicator is stated in Rosstat order No. 739 dated December 30, 2014);

- income from business activities - no more than 800 million rubles per year (the residual value of fixed assets and assets should not exceed 800 million rubles);

- The share of participation in the authorized capital of the company belongs to the public sector of the Russian Federation (but not more than 25%) or to foreign organizations (not more than 49%).

Deadline and liability for failure to provide

The usual deadline for submitting financial statements for 2021 for small businesses and all other business entities is March 31. In 2020, due to the coronavirus epidemic, the deadlines have been postponed to May 6.

Failure to provide or untimely provision of financial statements, even in an abbreviated version, is an offense. For each document not provided, a legal entity will be fined 200 rubles, and its officials - in the amount of 300 to 500 rubles. In addition, the sanctions of Article 19.7 of the Code of Administrative Offenses of the Russian Federation, which provides for administrative liability for late statistical reporting, will be applied. The fine under this article for an official is up to 5,000 rubles.

Rules and features of filling out accounting reports

The Ministry of Finance published clarifications for simplified reporting in information No. PZ-3/2015. Basic principles of compilation:

- The inclusion of financial information in reporting forms is permitted without detailing the accounting items.

- Disclosure of information in a smaller volume, in comparison with the full volume of final documentation.

- The organization has the right not to disclose information about discontinued activities.

- Transactions after the reporting date are reflected on a rational basis (if the changes are significant).

Let's look at the features of filling out simplified accounting reporting forms.

conclusions

Economic entities officially classified as small businesses, non-profit structures and some other organizations have the right to generate and submit annual reports either in abbreviated form or in standard form.

The possibility of such a choice is clearly provided for by specific provisions of current legislation.

Simplification of reporting consists in the fact that the number of completed reports is reduced, and the information reflected in these documents is noticeably generalized (enlarged).

In some cases, however, it may be necessary to clarify some reporting data by properly detailing the compiled forms or filling out appropriate annexes to the main documents.

The deadlines for submitting simplified financial statements and their required recipients do not differ from the deadlines/addressees typical for submitting standard reporting forms.

Institution's balance sheet

| Line | Explanations |

| Assets | |

| Tangible non-current assets | We indicate the cost of the organization's fixed assets and capital investments in fixed assets. |

| Intangible, financial and other non-current assets | The total value of investments in intangible assets, development and design of intangible assets, we indicate long-term loans, bonds and bills. |

| Reserves | Finished products, inventories, work in progress, fuels and lubricants, etc. |

| Cash and cash equivalents | The organization's funds are in the cash register or on the current account in rubles or foreign currency (equivalent). |

| Financial and other current assets | Accounts receivable in total for the financial period. |

| Passive | |

| Capital and reserves | The amount of authorized, additional, reserve capital and retained earnings. Non-profit organizations include endowed funds and especially valuable property. |

| Long-term borrowed funds | Credit obligations, loans and interest on them (obligation period - more than 1 year). |

| Other long-term liabilities | Creditor and reserves for future expenses for a period of more than one year. |

| Short-term borrowed funds | Loans, credits, installments (term - less than 1 year). |

| Accounts payable | Current accounts payable (suppliers, contractors, founders, budgets, employees). |

| Other current liabilities | Reserves for upcoming expenses, targeted financing (term - less than a year). |

| BALANCE | |

Results

Tax authorities are optimizing the submission of reports by taxpayers, including the filing of financial statements. For electronic submission of simplified reporting, the KND form 0710096 is used. The machine-readable form template has been changed.

Sources:

- Tax Code of the Russian Federation

- Federal Law of December 6, 2011 No. 402-FZ

- Letter of the Federal Tax Service of Russia dated November 25, 2019 No. VD-4-1/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Programs used to create a balance

Today, all enterprises use automated accounting. Special software significantly reduces labor costs and avoids possible errors in calculations and filling. The most common accounting program is 1C, which has numerous configurations for various operating conditions. The program also allows you to upload files for transfer to the Federal Tax Service.

Also, all users of the Federal Tax Service who submit reports electronically through operators can create and send reports directly in the program itself.

The most popular options:

- From the operator "Taxcom" - "Dockliner", which allows you to submit reports from several enterprises at once and "1C-Sprinter", with the ability to download from the 1C program itself.

- From the operator "Tensor" - "SBIS", which makes it possible to work with accounting without being tied to a specific PC, send reports from several companies and check data for compliance with forms.

- From the operator “Kaluga Astral” - “Astral Report”, similar to “SBIS”, but with additional functions.

In addition to these programs for transmitting electronic reporting, there is “Taxpayer”, developed by the Federal Tax Service to simplify the process of sending reports. All relevant information necessary for generating, uploading and submitting reports to the Federal Tax Service is available.

Actions in case of violation of the identity of assets and liabilities of the balance sheet

The systematic structure of all balance sheet items implies that assets and liabilities will be equal. Otherwise, the balance will not converge and it will be necessary to sequentially study all the graphs in search of an error. Or even perform a complete audit of all transactions for the reporting period. Errors may appear:

- When counting any transactions twice due to inattention.

- In case of premature closure of accounts until the latest information is fully verified.

- When the distribution of uncertain income and losses is incorrect.

- After erroneously rounding some data when moving to larger units.

Also, reserves, taxes, fixed assets and contractual additional accounts that balance the main indicators are subject to separate verification. It is especially important to pay attention to monitoring data on second-order accounts through various services.

Simplified reporting

All enterprises that have the right to a simplified reporting scheme have the right to simplify the procedure for generating reports. But even with such possibilities, it is very important that all general reporting conditions established by the legislation of the Russian Federation are met.

Some changes under the simplified tax system:

- The chart of accounts is established immediately in a limited quantity using rounded indicators, and not using selected registers.

- The company groups balance sheet items, rather than displaying them all as separate lines in assets and liabilities.

- Reports are submitted in an abbreviated form and in fewer quantities.

- All other conditions determined by law are the same for any organization, regardless of the use of the simplified tax system.

Where to find forms 0710099 (accounting)

The form can be downloaded on ]]>the website of the Federal Tax Service]]> or on the website ]]>FSUE GNIVC]]>. The forms on these resources are presented with a .tif extension. They can be printed and filled out by hand, but adjustments cannot be made using a computer.

Tax authorities recommend using specialized software. When it comes to form 0710099, financial statements can be generated using the program “]]>Taxpayer Legal Entity]]>”. It is available for free download on the Federal Tax Service website. Using this tool, you can fill out reports even without access to the Internet, automatically recalculate the results and do a basic check using control ratios. The finished accounting statements KND 0710099 are downloaded from the program in XML format, which is adapted for submitting the document to the Federal Tax Service through the tax inspectorate website or through the State Services portal; the forms can simply be printed.

The question of how financial statements are submitted on paper is disclosed in the letter of the Federal Tax Service dated December 9, 2015 No. SD-4-3/21620. In these clarifications, tax authorities indicate that to submit a document in paper form, you can use templates from the official website of the Federal Tax Service. The PDF417 two-dimensional barcode is present on reports generated using the “Legal Taxpayer” program, which can also be used to generate “paper” reports.

Explanatory note to the balance sheet

Full reporting includes an explanatory note that enterprises must provide. This allows you to obtain additional, expanded information about the data reflected in the report. The document reveals the report indicators and is completely independent. It can be compiled in any form, the main thing is that it contains the necessary information.

When compiling, the following are taken into account:

- The information, its composition and presentation format are determined by the organization, since there are no rules governing the document in the legislation.

- There may be text describing the indicators to make it easier to read.

- In addition to descriptive information for reporting, third-party information inherent to the company itself can be included in the note.

- When keeping records in a simplified form, a note is not required, so many do not include it in the financial statements.

Where are financial statements submitted?

As a general rule, companies are required no later than three months after the end of 2021 to submit annual financial statements to the tax office at their location (clause 5, clause 1, article 23 of the Tax Code of the Russian Federation).

The annual accounting (financial) statements of a joint-stock company, subject to mandatory audit, are disclosed by publishing its text together with the auditor’s report on the Internet page no later than three days from the date of drawing up the audit report, but no later than three days from the date of expiration of the period established by the legislation of the Russian Federation for the submission of a mandatory a copy of the prepared annual accounting (financial) statements. A mandatory copy of the prepared annual accounting (financial) statements for 2021 is submitted no later than three months after the end of the reporting period (clause 10, article 13, clause 2, article 18 of Law No. 402-FZ, clause 71.3 and clause 71.4 of the Regulations No. 454-P).

Besides

, the company is required to submit a legal copy of the annual financial statements to the state statistics body.

And if the reporting is subject to mandatory audit, then the organization is obliged to submit an audit report to the state statistics bodies (clause 2 of Article 18 of Law No. 402-FZ). The audit report is submitted to statistics together with the annual financial statements or no later than 10 business days from the day following the date of the audit report, but no later than December 31 of the year following the reporting year (clause 2 of article 18 of Law No. 402-FZ, Appendix to the Letter of the Ministry of Finance of the Russian Federation dated January 29, 2014 No. 07-04-18/01).

The audit report is not submitted to the tax authorities (Letters of the Ministry of Finance of the Russian Federation dated January 30, 2013 No. 03-02-07/1/1724, Federal Tax Service of the Russian Federation for Moscow dated March 31, 2014 No. 13-11/030545, dated January 20. 2014 No. 16-15/003855).

In addition, companies are required to submit financial statements to other addresses provided for by the legislation of the Russian Federation, the constituent documents of the organization, decisions of the relevant management bodies of the organization (clause 44 of PBU 4/99, Information of the Ministry of Finance of the Russian Federation No. PZ-10/2012).

AUDIT CONSULTATION

Materiality of reporting indicators

If data discrepancies are found in previous years' reports, it is necessary to determine whether the erroneous figure is significant and whether the difference with real figures is large. Materiality is determined by the power of influence on management decisions made depending on the financial statements. A five percent deviation of an item from the amount of total assets and liabilities is considered significant. However, an enterprise can independently determine and fix the absolute value of materiality and adhere to the indicators when making corrections.