To fill out some documents, both Russians and citizens of other countries need to know citizenship codes in order to enter them in the appropriate fields. Failure to fill out official papers correctly will result in penalties. An individual, whether a foreigner or a citizen of Russia, being a taxpayer, is required to know all the necessary codes for the 2-NDFL certificate.

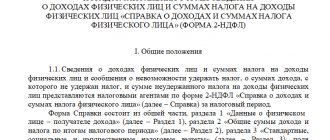

Sample certificate 2-NDFL

All the necessary information for preparing tax documents can be found in a special all-Russian classifier, which includes identification character sets for all countries of the world (abbreviated name OKSM).

All-Russian Classifier of World Countries (OCSM)

| Code of the country | Short country name | Full title |

| 004 | AFGHANISTAN | Transitional Islamic State of Afghanistan |

| 008 | ALBANIA | Republic of Albania |

| 010 | ANTARCTICA | |

| 012 | ALGERIA | Algerian People's Democratic Republic |

| 016 | AMERICAN SAMOA | |

| 020 | ANDORRA | Principality of Andorra |

| 024 | ANGOLA | Republic of Angola |

| 028 | ANTIGUA AND BARBUDA | |

| 031 | AZERBAIJAN | Republic of Azerbaijan |

| 032 | ARGENTINA | Argentine Republic |

| 036 | AUSTRALIA | |

| 040 | AUSTRIA | Republic of Austria |

| 044 | BAHAMAS | Commonwealth of the Bahamas |

| 048 | BAHRAIN | Kingdom of Bahrain |

| 050 | BANGLADESH | People's Republic of Bangladesh |

| 051 | ARMENIA | Republic of Armenia |

| 052 | BARBADOS | |

| 056 | BELGIUM | Kingdom of Belgium |

| 060 | BERMUDA | |

| 064 | BUTANE | Kingdom of Bhutan |

| 068 | BOLIVIA, | Plurinational State of Bolivia |

| 070 | BOSNIA AND HERZEGOVINA | |

| 072 | BOTSWANA | Republic of Botswana |

| 074 | BOUVE ISLAND | |

| 076 | BRAZIL | Federative Republic of Brazil |

| 084 | BELIZE | |

| 086 | BRITISH TERRITORY IN THE INDIAN OCEAN | |

| 090 | SOLOMON ISLANDS | |

| 092 | VIRGIN ISLANDS, BRITISH | British Virgin Islands |

| 096 | BRUNEI DARUSSALAM | |

| 100 | BULGARIA | Republic of Bulgaria |

| 104 | MYANMAR | Republic of the Union of Myanmar |

| 108 | BURUNDI | Republic of Burundi |

| 112 | BELARUS | Republic of Belarus |

| 116 | CAMBODIA | Kingdom of Cambodia |

| 120 | CAMEROON | Republic of Cameroon |

| 124 | CANADA | |

| 132 | CAPE VERDE | Republic of Cape Verde |

| 136 | CAYMAN ISLANDS | |

| 140 | CENTRAL AFRICAN REPUBLIC | |

| 144 | SRI LANKA | Democratic Socialist Republic of Sri Lanka |

| 148 | CHAD | Republic of Chad |

| 152 | CHILE | Republic of Chile |

| 156 | CHINA | People's Republic of China |

| 158 | TAIWAN (CHINA) | |

| 162 | CHRISTMAS ISLAND | |

| 166 | COCONUT (KEELING) ISLANDS | |

| 170 | COLOMBIA | Republic of Colombia |

| 174 | COMOROS | Union of Comoros |

| 175 | MAYOTTE | |

| 178 | CONGO | Republic of the Congo |

| 180 | CONGO, DEMOCRATIC REPUBLIC | |

| 184 | COOK ISLANDS | |

| 188 | COSTA RICA | Republic of Costa Rica |

| 191 | CROATIA | Republic of Croatia |

| 192 | CUBA | Republic of Cuba |

| 196 | CYPRUS | Republic of Cyprus |

| 203 | CZECH REPUBLIC | |

| 204 | BENIN | Republic of Benin |

| 208 | DENMARK | Kingdom of Denmark |

| 212 | DOMINICA | Commonwealth of Dominica |

| 214 | DOMINICAN REPUBLIC | |

| 218 | ECUADOR | Republic of Ecuador |

| 222 | EL SALVADOR | Republic of El Salvador |

| 226 | EQUATORIAL GUINEA | Republic of Equatorial Guinea |

| 231 | ETHIOPIA | Federal Democratic Republic of Ethiopia |

| 232 | ERITREA | |

| 233 | ESTONIA | Republic of Estonia |

| 234 | FAROE ISLANDS | |

| 238 | FALKLAND ISLANDS (MALVINAS) | |

| 239 | SOUTH GEORGIA AND SOUTH SANDWICH ISLANDS | |

| 242 | FIJI | Republic of Fiji |

| 246 | FINLAND | Republic of Finland |

| 248 | ELAND ISLANDS | |

| 250 | FRANCE | French Republic |

| 254 | FRENCH GUIANA | |

| 258 | FRENCH POLYNESIA | |

| 260 | FRENCH SOUTHERN TERRITORIES | |

| 262 | Djibouti | Republic of Djibouti |

| 266 | GABON | Gabonese Republic |

| 268 | GEORGIA | |

| 270 | GAMBIA | Republic of Gambia |

| 275 | PALESTINIAN TERRITORY, OCCUPIED | Occupied Palestinian Territory |

| 276 | GERMANY | Federal Republic of Germany |

| 288 | GHANA | Republic of Ghana |

| 292 | GIBRALTAR | |

| 296 | KIRIBATI | Republic of Kiribati |

| 300 | GREECE | Hellenic Republic |

| 304 | GREENLAND | |

| 308 | GRENADA | |

| 312 | GUADELOUPE | |

| 316 | GUAM | |

| 320 | GUATEMALA | Republic of Guatemala |

| 324 | GUINEA | Republic of Guinea |

| 328 | GUYANA | Republic of Guyana |

| 332 | HAITI | Republic of Haiti |

| 334 | HEARD ISLAND AND MACDONALD ISLANDS | |

| 336 | PAPAL THRONE (STATE – CITY) | |

| 340 | HONDURAS | Republic of Honduras |

| 344 | HONG KONG | Hong Kong Special Administrative Region of China |

| 348 | HUNGARY | Hungarian Republic |

| 352 | ICELAND | Republic of Iceland |

| 356 | INDIA | Republic of India |

| 360 | INDONESIA | Republic of Indonesia |

| 364 | IRAN, ISLAMIC REPUBLIC | Islamic Republic of Iran |

| 368 | IRAQ | Republic of Iraq |

| 372 | IRELAND | |

| 376 | ISRAEL | State of Israel |

| 380 | ITALY | Italian Republic |

| 384 | COTE D'IVOIRE | Republic of Cote d'Ivoire |

| 388 | JAMAICA | |

| 392 | JAPAN | |

| 398 | KAZAKHSTAN | The Republic of Kazakhstan |

| 400 | JORDAN | Hashemite Kingdom of Jordan |

| 404 | KENYA | Republic of Kenya |

| 408 | KOREA, DEMOCRATIC PEOPLE'S REPUBLIC | Democratic People's Republic of Korea |

| 410 | REPUBLIC OF KOREA | The Republic of Korea |

| 414 | KUWAIT | State of Kuwait |

| 417 | KYRGYZSTAN | Kyrgyz Republic |

| 418 | LAOTIAN PEOPLE'S DEMOCRATIC REPUBLIC | |

| 422 | LEBANON | Lebanese Republic |

| 426 | LESOTHO | Kingdom of Lesotho |

| 428 | LATVIA | Latvian republic |

| 430 | LIBERIA | Republic of Liberia |

| 434 | LIBYA | Libya |

| 438 | LICHTENSTEIN | Principality of Liechtenstein |

| 440 | LITHUANIA | Republic of Lithuania |

| 442 | LUXEMBOURG | Grand Duchy of Luxembourg |

| 446 | MACAO | Macau Special Administrative Region of China |

| 450 | MADAGASCAR | Republic of Madagascar |

| 454 | MALAWI | Republic of Malawi |

| 458 | MALAYSIA | |

| 462 | MALDIVES | Republic of Maldives |

| 466 | MALI | Republic of Mali |

| 470 | MALTA | Republic of Malta |

| 474 | MARTINIQUE | |

| 478 | MAURITANIA | Islamic Republic of Mauritania |

| 480 | MAURITIUS | Republic of Mauritius |

| 484 | MEXICO | Mexican United States |

| 492 | MONACO | Principality of Monaco |

| 496 | MONGOLIA | |

| 498 | MOLDOVA, REPUBLIC | The Republic of Moldova |

| 499 | MONTENEGRO | |

| 500 | MONTSERRAT | |

| 504 | MOROCCO | Kingdom of Morocco |

| 508 | MOZAMBIQUE | Republic of Mozambique |

| 512 | OMAN | Sultanate of Oman |

| 516 | NAMIBIA | Republic of Namibia |

| 520 | NAURU | Republic of Nauru |

| 524 | NEPAL | Federal Democratic Republic of Nepal |

| 528 | NETHERLANDS | Kingdom of the Netherlands |

| 531 | CURACAO | |

| 533 | ARUBA | |

| 534 | SAINT MARTIN (Dutch part) | |

| 535 | BONAIR, SINT ESTATIUS AND SABA | |

| 540 | NEW CALEDONIA | |

| 548 | VANUATU | Republic of Vanuatu |

| 554 | NEW ZEALAND | |

| 558 | NICARAGUA | Republic of Nicaragua |

| 562 | NIGER | Niger Republic |

| 566 | NIGERIA | Federal Republic of Nigeria |

| 570 | NIUE | Niue |

| 574 | NORFOLK ISLAND | |

| 578 | NORWAY | Kingdom of Norway |

| 580 | NORTHERN MARIANA ISLANDS | Commonwealth of the Northern Mariana Islands |

| 581 | SMALL PACIFIC REMOTE ISLANDS | |

| 583 | MICRONESIA, FEDERATED STATES | Federated States of Micronesia |

| 584 | MARSHALL ISLANDS | Republic of the Marshall Islands |

| 585 | PALAU | Republic of Palau |

| 586 | PAKISTAN | Islamic Republic of Pakistan |

| 591 | PANAMA | Republic of Panama |

| 598 | PAPUA NEW GUINEA | |

| 600 | PARAGUAY | Republic of Paraguay |

| 604 | PERU | Republic of Peru |

| 608 | PHILIPPINES | Republic of the Philippines |

| 612 | PITKERN | |

| 616 | POLAND | Republic of Poland |

| 620 | PORTUGAL | Portuguese Republic |

| 624 | GUINEA-BISSAU | Republic of Guinea-Bissau |

| 626 | TIMOR-LESTE | Democratic Republic of Timor-Leste |

| 630 | PUERTO RICO | |

| 634 | QATAR | State of Qatar |

| 638 | REUNION | |

| 642 | ROMANIA | |

| 643 | RUSSIA | Russian Federation |

| 646 | RWANDA | Republic of Rwanda |

| 652 | SAINT BARTHELEMY | |

| 654 | SAINT HELENA, ASCENSION ISLAND, | |

| 659 | SAINT KITTS AND NEVIS | |

| 660 | ANGUILLA | |

| 662 | SAINT LUCIA | |

| 663 | SAINT MARTIN | |

| 666 | SAINT PIERRE AND MIKELON | |

| 670 | SAINT VINCENT AND THE GRENADINES | |

| 674 | SAN MARINO | Republic of San Marino |

| 678 | SAO TOME AND PRINCIPE | Democratic Republic of Sao Tome and Principe |

| 682 | SAUDI ARABIA | Kingdom of Saudi Arabia |

| 686 | SENEGAL | Republic of Senegal |

| 688 | SERBIA | Republic of Serbia |

| 690 | SEYCHELLES | Republic of Seychelles |

| 694 | SIERRA LEONE | Republic of Sierra Leone |

| 702 | SINGAPORE | Republic of Singapore |

| 703 | SLOVAKIA | The Slovak Republic |

| 704 | VIETNAM | Socialist Republic of Vietnam |

| 705 | SLOVENIA | Republic of Slovenia |

| 706 | SOMALIA | Somali Republic |

| 710 | SOUTH AFRICA | South Africa |

| 716 | ZIMBABWE | Republic of Zimbabwe |

| 724 | SPAIN | The Kingdom of Spain |

| 728 | SOUTH SUDAN | Republic of South Sudan |

| 729 | SUDAN | Republic of Sudan |

| 732 | WEST SAHARA | |

| 740 | SURINAME | Republic of Suriname |

| 744 | SPITSBERGEN AND JAN MAYEN | |

| 748 | SWAZILAND | Kingdom of Swaziland |

| 752 | SWEDEN | Kingdom of Sweden |

| 756 | SWITZERLAND | Swiss Confederation |

| 760 | SYRIAN ARAB REPUBLIC | |

| 762 | TAJIKISTAN | The Republic of Tajikistan |

| 764 | THAILAND | Kingdom of Thailand |

| 768 | TOGO | Togolese Republic |

| 772 | TOKELAU | |

| 776 | TONGA | Kingdom of Tonga |

| 780 | TRINIDAD AND TOBAGO | Republic of Trinidad and Tobago |

| 784 | UNITED ARAB EMIRATES | |

| 788 | TUNISIA | Tunisian Republic |

| 792 | Türkiye | Turkish Republic |

| 795 | TURKMENIA | Turkmenistan |

| 796 | TURKS AND CAICOS ISLANDS | |

| 798 | TUVALU | |

| 800 | UGANDA | Republic of Uganda |

| 804 | UKRAINE | |

| 807 | REPUBLIC OF MACEDONIA | |

| 818 | EGYPT | Arab Republic of Egypt |

| 826 | UNITED KINGDOM | United Kingdom of Great Britain and Northern Ireland |

| 831 | GUERNSEY | |

| 832 | JERSEY | |

| 833 | ISLE OF MAN | |

| 834 | TANZANIA, UNITED REPUBLIC | United Republic of Tanzania |

| 840 | UNITED STATES | USA |

| 850 | VIRGIN ISLANDS, USA | United States Virgin Islands |

| 854 | BURKINA FASO | |

| 858 | URUGUAY | Eastern Republic of Uruguay |

| 860 | UZBEKISTAN | The Republic of Uzbekistan |

| 862 | VENEZUELA | Bolivarian Republic of Venezuela |

| 876 | WALLIS AND FUTUNA | |

| 882 | SAMOA | Independent State of Samoa |

| 887 | YEMEN | Yemen Republic |

| 894 | ZAMBIA | Republic of Zambia |

| 895 | ABKHAZIA | Republic of Abkhazia |

| 896 | SOUTH OSSETIA | Republic of South Ossetia |

Filling out a certificate by Russians

Regardless of whether your place of permanent registration is Russia, Ukraine, Belarus or another country, when filling out tax forms and other documents related to work and income, you must know all the necessary codes, OKIN, citizenship, etc. Until they are entered in the appropriate boxes, the document will be considered invalid, since it will not provide complete and comprehensive information about you.

Russian citizens will need to indicate the code combination of numbers assigned by the Russian Federation in the 2-NDFL certificate. It is written in paragraph 2.5 of the second block of the document called “Data on a civilian.” The OKSM of the Russian Federation is assigned the number 643. It must be entered in the above column.

The status of a stateless person does not relieve you of the obligation to enter the data recorded in the classifiers into the certificate. In the document, such a person needs to enter information about the country that issued him the identity paper. The 2-NDFL certificate form and a sample form can be downloaded here.

Sample of filling out certificate 2-NDFL

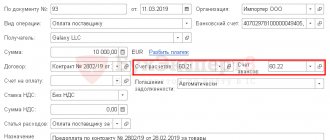

Next, continuing to work with the help, you should repeat the number from paragraph 2.5, but in line 2.9. Next, indicate the detailed address where the person for whom the document is being filled out lives. If we are talking about a foreign citizen, it is not the Russian temporary registration where the registration was carried out that is entered, but information about the foreigner’s place of residence in his homeland, the code of which he indicates, taking it from the all-Russian classifier. For convenience, the line can be filled in with both Cyrillic characters and Latin characters.

Features of issuing certificates for foreign citizens

A citizen of whatever country you are, when applying for work in the Russian Federation, you become registered with the tax service.

Employed foreign citizens are subject to the legislation of the Russian Federation, which they must strictly follow.

Having received taxpayer status, you become the owner of a TIN. If this abbreviation is also relevant in your home country, both INNs are indicated in the personal income tax. A foreign worker is allowed to write his personal data in Latin letters. For example, holders of Moldovan citizenship can enter their first and last names as is customary in their homeland. This will not be considered an error. It is important that the certificate data corresponds to the data of the foreign passport and other documents.

Taxpayer identification number (TIN) is a digital code that streamlines the accounting of taxpayers in the Russian Federation.

2-NDFL includes the code and address of the Russian Federation, as well as the code and address of the country of residence.

Table of codes of states, a large percentage of whose citizens work in Russia.

| № | State | Code in numbers | Code in letters | |

| Alpha2 | Alpha3 | |||

| 1. | Russia | 643 | RU | RUS |

| 2. | Abkhazia | 895 | AB | ABH |

| 3. | The Republic of Azerbaijan | 031 | AZ | AZE |

| 4. | Armenia | 051 | A.M. | ARM |

| 5. | Belarus | 112 | BY | BLR |

| 6. | Georgia | 268 | G.E. | GEO |

| 7. | Ukraine | 804 | U.A. | UKR |

| 8. | Kazakhstan | 398 | KZ | KAZ |

| 9. | Kyrgyzstan | 417 | KG | KGZ |

| 10. | Moldova | 498 | M.D. | MDA |

| 11. | Tajikistan | 762 | T.J. | TJK |

| 12. | Turkmenistan | 795 | TM | TKM |

| 13. | Uzbekistan | 860 | UZ | UZB |

That is, in relation to the Russian Federation, everyone should write “643” in the column dedicated to encoding, and below, in the column “Code of country of residence,” the code of the country of citizenship. If this is Belarus, indicate “112”, citizens of Ukraine write “804”, citizens of Armenia - “051”, an individual whose main country is Kyrgyzstan must write “417”.

Thus, information about the citizenship of the registered taxpayer is entered into the document. Sometimes accountants have a question about what to do with persons who are not citizens of any country. The code 999 is relevant for them.

The complete all-Russian classifier of countries of the world can be downloaded here.

What is indicated in columns 10 and 10a?

Column 10 requires the indication of the name of the country of origin of the goods, and subcolumn 10a - the code of this country. If the product was produced in a country belonging to a group of states, then the country of origin is indicated in column 10, and the name of the association in 10a. For example, “United States”, “European Union”.

An exception is goods imported from the countries of the EAEU - the Eurasian Economic Union, since when importing them into Russia, it is not necessary to fill out a customs declaration.

Essence 2 of personal income tax, where it applies

In general, this document reflects the level of income and taxes of an individual for a certain period. When filling out, the past calendar working year is usually taken and at the end of the year the certificate is submitted by the accounting department to the tax office. In addition, at the request of the employee, the following may be provided to him for the following needs:

- may be useful if he takes out a large bank loan, and in the case of mortgages and car loans, a certificate is required

- sometimes they ask in the human resources department during employment, but on the other hand it happens that such a certificate is automatically issued upon dismissal

- at the tax office to process deductions (for example, if the parents have a child studying at a university for a fee, they have the right to a deduction)

- to calculate pension

- adoption

- litigation, especially related to labor relations

- when assigning alimony

The certificate is prepared free of charge within three days and must bear the signature of the manager, sealed (if applicable). At the same time, if an employee has changed several jobs in a year, then the employer has the right to draw up a certificate only for the period of work at his enterprise.

Taxable period

The title page contains two fields at once, requiring the indication of the tax period for which the individual is claiming a deduction. The first field consists of two cells in which you need to enter the period code, and the second - of four, intended for entering the year that entitles the taxpayer to a personal income tax refund.

On November 26, 2014, the Federal Tax Service introduced order number MMV-7-3/600, which specifies all existing tax period codes. We propose to consider the main ones, which are most often indicated in tax returns:

- 34 – this code is intended for deduction applicants who provide information on their income for a period of time equal to one year in the 3-NDFL form;

- 35-45 – code 35 is written in situations where an individual wants to reimburse the tax for a period of one month, 36 - two months, 37 - three, and so on until the number 45, intended for a tax period of eleven months;

- 50 – this code is necessary to indicate the last tax period in case of termination of the enterprise's activities.