Organizations often practice the acquisition of foreign currency.

Typically, the purchase of foreign monetary units can be carried out both by business entities related to foreign economic activity, and by organizations not directly related to the export or import of any goods. Accordingly, the company’s purposes for acquiring foreign currency may vary. Foreign currency can be purchased both for subsequent payment of import supplies, and for other purposes other than financing imports.

Accounting for the purchase and subsequent use of foreign currency is of great importance in the work of an economic entity.

A separate aspect is the correct recording of exchange rate differences in accounting.

How the purchase of foreign currency is carried out, how this operation is formalized and accounted for - all these points require detailed consideration.

Who keeps track of currency?

Currency records are maintained by participants in foreign exchange transactions who are legally entitled to them. Currency transactions between residents and non-residents can be carried out an unlimited number of times, but they are prohibited between residents.

Question: How to reflect in an organization’s accounting transactions for the acquisition of foreign currency at a rate exceeding the rate established by the Bank of Russia? The organization purchased 20,000 euros from an authorized bank at the rate of 74.2 rubles/euro. Funds for the purchase of currency are transferred from the organization's current account, the purchased currency is credited to the organization's foreign currency account. The currency was used for settlements with a foreign supplier in the month following the month of its purchase. The organization prepares interim financial statements on the last day of each calendar month. The euro exchange rate established by the Bank of Russia was (conditionally): - on the date of acquisition of the currency - 73.5 rubles/euro; — as of the reporting date — 75.0 rub/euro; — on the date of transfer of foreign currency funds to the counterparty — 74.6 rubles/euro. The organization uses the accrual method of tax accounting. View answer

There are, however, exceptions to this rule. For example, the following are allowed:

- currency transfers from resident to resident or in the accounts of the same resident if they are opened abroad;

- with the participation of residents and authorized banks;

- settlements and payment for services in foreign currency during international transportation;

- transactions with external securities at auction;

- expenses for business trips outside the Russian Federation, etc.

This is stated in Art. 6, 9 FZ-173.

How to take into account transactions on a foreign currency account and revalue balances on it ?

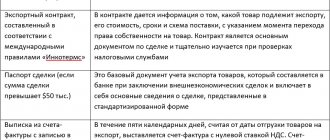

Purchasing currency, example with transactions

purchases currency in the amount of $5,000 from the bank. For this purpose, 300,000 rubles were transferred to the bank. The dollar exchange rate approved by the Central Bank for this day is 58.50 rubles, the bank rate is 58.90 rubles. for a dollar. The bank commission is 1,500 rubles.

Marena's accountant makes an accounting entry when purchasing currency from a bank:

| Dt | CT | Operation description | Amount, rub. | Document |

| 57 | 51 | Transfer of funds to the bank | 300 000 | Payment order |

| 52 | 57 | Transfer of currency to a foreign currency account (5,000*58.9) | 294 500 | Bank statement |

| 91.2 | 57 | Reflection of bank commission | 1 500 | Bank statement |

| 91.2 | 57 | Negative exchange rate difference reflected ((58.9-58.5)*5,000)) | 2 000 | Accounting information |

| 51 | 57 | Reflection of the return of unspent funds (300,000 - 294,500 - 1,500) | 4 000 | Bank statement |

How to determine the date?

Federal Law 402 (Article 12) states that all accounting and reporting objects must be expressed exclusively in rubles, and assets calculated in foreign currency must be recalculated into rubles. According to PBU, such recalculation is carried out at the rate of the Central Bank or by agreement of the parties to the transaction.

The exchange rate of any monetary unit constantly fluctuates, therefore, determining the correct date of conversion is one of the main tasks of an accountant.

PBU sets the date depending on the nature of the transaction:

- cash, banking volumes of currency - at the time of transactions and at the reporting date, as well as following changes in the exchange rate (if necessary);

- for reporting, all currencies: non-cash, cash, are recalculated on the reporting date;

- Intangible assets, fixed assets, inventories, other non-monetary assets - as of the date of the transaction and their registration;

- foreign currency income and expenses - as of the date of recognition (travel expenses in foreign currency are recalculated on the date of signing the advance report);

- costs for VNA - as of the date of recognition of costs that determine these assets, their value.

In addition, when receiving a foreign currency advance payment or deposit, the amount is taken into account at the exchange rate at the time of its receipt, and when paid - on the date when the payment was made.

According to PBU, paragraph 10, non-current and other assets, except cash, as well as advances and prepayments after being reflected in accounting, are not subject to recalculation due to exchange rate fluctuations.

Important! If the official exchange rate changes insignificantly and a large number of similar currency transactions take place, the average rate for a month or for a shorter period can be used for recalculation (clause 6 of PBU 3/2006).

Preliminary setup 1C

Before you start working with currency, you need to configure the program.

In the event that a transfer between a foreign currency and ruble account takes more than a day, you will need to use an intermediate account.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

From the “Main” section, go to your company’s accounting policies.

In the window that opens, find the item called “Account 57 “Transfers in transit” is used when moving funds” and mark it with a flag. This add-on does not need to be enabled.

It is also recommended to check the installation of another add-in. In the "Administration" menu, select "Functionality". In the settings window that appears, open the “Calculations” tab and check whether the checkbox for “Calculations in foreign currency and monetary units” is checked. We already had it installed by default.

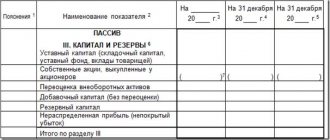

Accounting and postings

One of the important concepts of currency accounting is exchange rate difference. It appears when recalculating the value of assets in foreign currency, for different dates, into rubles. At the end of the year, it is included in the income (expenses) of the company. Exchange rate differences on founders' contributions affect the amount of additional capital and do not relate to financial results. Differences in the organization's assets located abroad are taken into account in the same way - in additional capital, if, according to the legislation of the country of location, they have been recalculated. The Central Bank exchange rate at the time of recalculation is taken into account.

Exchange rate differences on debt (both receivables and payables) usually arise due to the time interval when the debt is recorded in accounting and when it is paid. In addition, it occurs when funds in foreign currency are converted at the cash desk, in a bank account, in accordance with the norms of currency legislation, into rubles.

When reporting on foreign currency assets, the ruble meter is used. If in the country where a Russian organization operates, reporting is required in foreign currency, it is also duplicated in foreign currency.

Currency accounting presupposes, first of all, the presence of account 52 “Currency account,” which is similar in meaning to the ruble settlement account. Subaccounts for it are opened taking into account account data: within the country and abroad. In addition, subaccounting of the following order can take into account assets depending on the name of the currency or divide transactions into:

- current;

- transit;

- special transit accounts.

The current account involves recording revenue in foreign currency, bank interest, and other ordinary foreign exchange transactions permitted by law. A special-purpose transit account is opened by an authorized banking institution independently for the client. It takes into account the purchase and sale of currency.

A regular transit account in foreign currency is currently maintained to reflect on it funds for which the bank has not yet received information confirming their “origin”, their relationship to a specific legal agreement.

Account 55 can occasionally be involved in foreign exchange transactions, if we are talking about currency on letters of credit, deposits, and other forms of payment, except bills. On account 57, the legislator allows you to reflect currency amounts for sale, rubles for the purchase of currency before the moment of purchase, etc.

The following entries are most often used in currency accounting:

- D50 (52) K52 (50) – receiving currency at the cash desk and returning it to the bank.

- D71 (50) K50 (71) – receipt by the “accountable” of currency from the cash register and return of the unused balance.

- D52 K62, 66, 67, 76, etc. – receiving currency to the account from buyers, in the form of a loan, other income.

- D57 K52, D51 K57 – currency transfer and proceeds from the sale of currency credited to the current account.

- D57 K51, D52 K57 – “reverse” operation of purchasing currency for rubles and transferring it to a foreign currency account.

- D91(57) K57(91) – fin. the result of transactions with currency.

- D60, 66, 67, 76, etc. K52 – payment in foreign currency to suppliers, payments on loans, other transactions with counterparties.

Let's consider what has been said using a conditional example. A legal entity sells $1,100 to a bank at an exchange rate of 63 rubles/dollar. At the time of sale, the exchange rate was 64 rubles/dollar. The banking institution's commission is 1,300 rubles.

Actions:

- 1100 * 63=69300 rub.

- 1100 * 64=70400 rub.

- D57 K52 - 70400.00 - funds were written off from the foreign currency account.

- D51 K57 - 69300.00 - funds were credited for the currency sold.

- 64 — 63 = 1

- 1 * 1100 = 1100 rub.

- D91 K57 - 1100.00 - negative exchange rate difference on sale.

- D91 K51 - 1300.00 - bank commission paid.

How to reflect currency transactions in 1C: Accounting 8

In the 1C:Accounting 8 program, currency transactions are supported by default - no additional functionality settings are required.

Currency accounting indicator in the Chart of Accounts

In the Chart of Accounts "1C:Accounting 8" edition 3.0 (section Main) for those accounts where currency accounting is supported (including accounting in conventional units, hereinafter - cu), in the Val column. the sign of currency accounting has been established (Fig. 1).

Rice. 1. Accounts with currency accounting feature

An entry for the debit or credit of an account with an established sign of currency accounting, along with the amount in rubles, will also contain a foreign currency amount. Accordingly, using any standard program report - account balance sheet or account analysis, which uses accounts with the currency accounting feature, you can analyze accounting data, both in ruble and currency equivalent.

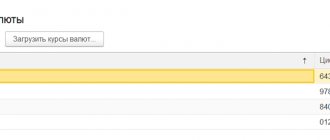

Directory of currencies

The program supports multi-currency accounting and allows you to enter transactions and view reports in any currency presented in the Currencies directory. The directory can be accessed via the Currencies hyperlink from the Directories section.

Moreover, if no currency other than the Russian ruble is entered into the currency directory, then it is considered that the organization does not have foreign exchange transactions. Therefore, accounts with the currency accounting feature will not be available.

Working with the Currency directory involves two stages:

- filling out the directory;

- setting exchange rates.

There are two ways to fill out the Currency directory:

- using the All-Russian Currency Classifier OK (MK (ISO 4217) 003-97) 014-2000, approved. Resolution of the State Standard of Russia dated December 25, 2000 No. 405-st (hereinafter referred to as the Currency Classifier). The currency classifier, as well as other classifiers, are downloaded via a web service if there is an Internet connection and authorization on the 1C:ITS Portal;

- by manually creating a new currency.

The Create - By Classifier command allows you to add a new element of the Currency directory by selecting it from the Currency Classifier. In the Currencies directory element created in this way, the following details will be automatically filled in: Name of currency, Symbolic code, Numeric code. If the exchange rate of the selected currency can be downloaded via the 1C web service, the Loaded from the Internet flag will be set by default (Fig. 2).

Rice. 2. Currency card

The Create - New command allows you to add a new element of the Currency directory manually. As a rule, this method is used if the monetary obligation under an agreement with a counterparty, payable in rubles, is expressed in conventional units (cu). In this case, you must fill out all the details yourself.

It is not always necessary to create a Currency directory element with the selected currency in advance. When creating a new foreign currency account opened in a Russian bank, the currency will be determined by the account number and will be added to the Currency directory automatically.

As soon as at least one currency other than the Russian ruble appears in the currency directory, access to accounting accounts with the currency accounting feature opens.

There are three ways to set exchange rates:

- specify manually in the Exchange rates list;

- upload manually via 1C web service;

- automatically download through the 1C web service according to a specific schedule.

To automatically download currency rates according to a specific schedule, use the default routine task Loading currency rates. Users with administrator rights can independently configure routine tasks in the Routine and background tasks form (section Administration - Maintenance - Routine operations).

How to display exchange rates on the home page in “1C: Accounting 8” (rev. 3.0)

Contracts in foreign currency

If an organization keeps records with counterparties under agreements, then in the agreement card you can set up an agreement currency other than the Russian ruble. This can only be done if foreign currency is entered into the Currency directory.

In the form of the directory element Contracts, you should expand the Calculations collapsible group and select the contract currency in the Price in field (Fig. 3).

Rice. 3. Agreement card in foreign currency

When you select a currency other than the ruble, the Payment in switch will appear, with which you can set the currency in which payments are made under this agreement.

Payment can be set in rubles (if the agreement is concluded in conventional units) or in the currency of the agreement (if the agreement is foreign currency).

Bank accounts

To record funds in accounts opened in credit institutions (banks), accounting accounts are intended (Chart of accounts for accounting of financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n):

- 51 “Current accounts”;

- 52 “Currency accounts”;

- 55 “Special bank accounts.”

Analytical accounting is maintained for each bank account.

To store information about Russian and foreign bank accounts of all legal entities and individuals (both their own organizations and third-party counterparties), the program uses the Bank Accounts directory. The list of bank accounts of your own organization or counterparty is determined by those bank accounts that are subordinate to the directory element Organizations, Counterparties and Individuals. The transition to the list of bank accounts is carried out using the link Bank accounts from the organization’s card (from the card of the counterparty or individual).

For each organization (each counterparty), you can select a main bank account. This account will be inserted by default into payment documents.

A new bank account, including a foreign one, is created by clicking the Create button. In the bank account card that opens, you should fill in the basic details: the bank in which the account is opened; Account number; currency of funds, correspondent bank for indirect settlements, as well as other additional information.

It is recommended to start filling out a bank account with the Bank field, since the specified bank affects the display of details in the bank account card and the composition of the input checks. To select a bank, simply enter the BIC or the first letters of the bank's name. When entering a value, the bank is searched in the Banks directory and the values are substituted into the remaining fields. If there is no bank with such a BIC, you need to add a new bank to the directory.

To enter a new entry about a Russian bank into the Banks directory, it is recommended to use the Create - By classifier command.

The Classifier of Russian Banks is a separate directory of the program, which contains detailed information about all Russian banks and is kept up to date. You can update information about banks using the Load classifier command. Using the switch you can select the boot option:

- Download updates via the Internet;

- Download updates from a file.

In the Russian Bank Classifier selection form that opens, you should find the required bank (you can use the search), highlight it with the cursor and click the Select button (also by double-clicking the mouse). A new element is introduced into the Banks directory, where basic information about the bank is automatically filled in (name, BIC, correspondent account, bank contact information, etc.).

To enter a new entry about a foreign bank into the Banks directory, you should use the Create - New command, refusing the program’s offer to select a bank from the classifier.

If a Russian bank is selected, the program allows you to enter only a Russian account number, consisting of 20 digits. In this case, a check will be performed using the account check digit. If the verification fails, a message will appear: the account number or bank was entered incorrectly. An incorrect Russian account number cannot be saved in the program.

Selecting a foreign bank allows you to enter a bank account in the formats provided for foreign banks. For foreign banks, it is possible to enter an account in IBAN format (for banks with SWIFT and located in countries registered in the IBAN Registry) or in national format.

For Russian bank accounts, the currency of funds is filled in automatically based on the correct account number being entered. If the specified currency is not in the Currency directory, it is created automatically. For foreign bank accounts, you must specify the currency by selecting a value from the Currencies lookup.

How to create a bank account for an organization or counterparty in 1C:Accounting 8 (rev. 3.0), including in foreign currency

Conversion of currency amounts

If a currency transaction is registered in the program by a standard document of the accounting system (for example, Receipt (act, invoice) or Sales (act, invoice), etc.), then the currency amounts reflected in the accounts with the attribute of currency accounting (except for advances accounting accounts) are automatically are converted into rubles. In accordance with the rules of accounting and tax accounting, to convert the amount of a foreign exchange transaction into rubles, the rate specified in the Currency Directory is used, which was in effect:

- on the date of transfer (receipt) of funds - in terms of prepayment (advance payment, deposit);

- on the date of the currency transaction - in the part exceeding the amount of the prepayment (advance payment, deposit).

In some cases, on the date of the currency transaction, a manual revaluation of currency balances will be required. For example, when issuing and receiving loans in conventional units, the accounting of which is not automated in the program.

| 1C:ITS For more information on the reflection of issued and received short-term interest-bearing loans in conventional units, see the “Directory of Business Transactions. 1C: Accounting 8" section "Instructions for accounting in 1C programs": short-term interest-bearing loan in cu. (accounting with the borrower), short-term interest-bearing loan in monetary units. (accounting with the lender). |

The monthly revaluation of currency funds, claims and obligations expressed in foreign currency is performed automatically by the regulatory operation Revaluation of currency funds, which is included in the Month Closing processing (Operations section). Balances in foreign currency recorded in accounts with the sign of currency accounting (except for advances accounting accounts) are recalculated into rubles at the rate indicated at the end of the month in the Currency directory.

When conducting currency transactions and routine operations for the revaluation of foreign currency funds, account balances specified in the Accounts with a special revaluation procedure are not revalued. This register is accessed from the program's Chart of Accounts using the Accounts with a special revaluation procedure hyperlink.

The Accounts with a special procedure for revaluation register stores information about accounting accounts on which currency accounting is provided, but which for one reason or another should not be automatically revalued in the general manner, with exchange rate differences written off to accounts 91.01 “Other income” and 91.02 “ Other expenses". For most users, the Accounts information register with a special revaluation procedure does not need to be filled out, while the accounts accounting for advances received and issued expressed in foreign currency are not revalued in any case. This register should be filled out in special rare cases when non-standard program documents or atypical situations are used.

Briefly

- When accounting for transactions with currency, it is most important to determine the date of its conversion into the ruble equivalent and the exchange rate difference as a result of the conversion.

- Accounting for such transactions is kept on accounts 52, 57, and less often on account 55. They correspond with accounts payable to suppliers, customers, credit accounts, etc.

- Exchange rate differences, positive or negative, affect the overall financial result; in other cases concerning settlements under the charter capital, the company’s foreign assets go into additional capital.

conclusions

An organization’s purchase of foreign currency may be due to different purposes. However, the implementation of this procedure must always be accompanied by proper documentation and correct accounting.

Foreign currency is reflected and displayed in accounting at the current exchange rate of the Central Bank in a separate foreign currency account of a business entity. At the same time, we should not forget about adequately reflecting the positive and negative difference that is often detected between the purchase price and the current exchange rate of the Central Bank.

Another specificity is the use of a transit accounting account to display funds allocated for the purchase of foreign currency (this is due to the fact that the bank often fulfills a client’s request not immediately, but after some time).