In what standard currency is the document drawn up?

A document that provides the basis for the acceptance of goods or services, property rights, or work is called an invoice. A document from the seller is drawn up, the design and filling details are discussed in Government Decree No. 1137 “On the forms and rules for filling out (maintaining) documents used in calculations of value added tax”, and in Federal Law No. 229. Read more about what details and how they are filled out in various invoices, we described here.

According to the standard model in the Russian Federation, invoices are issued in the currency that is accepted and established in Russia at the legislative level - in rubles.

The presence of a correctly completed document guarantees the return of VAT on the goods, services or work presented.

Who should issue an invoice in foreign currency?

If you look at the lawsuits in which VAT on foreign currency invoices was ultimately accepted for deduction, you can note that the peak occurred in 2011–2013. Then, by 2016–2017, the consideration of such cases practically disappeared.

Most likely, this is due to the fact that residents simply stopped filing VAT documents in foreign currency under agreements under which they are calculated in rubles.

Thus, the answer to the question “In general, is it possible for a resident of the Russian Federation to issue an invoice in foreign currency to a counterparty resident of the Russian Federation?” like this: theoretically possible, but not necessary. Unless, of course, the goal is to make it difficult for the resident partner to deduct VAT on such documents.

To whom exactly can VAT documents be issued in foreign currency?

1. To a counterparty (including a resident), with whom settlements are also carried out in foreign currency. This option is limited by the currency legislation of the Russian Federation. The list of transactions between residents of the Russian Federation that qualify for this option is listed in clause 1 of Art. 9 of the Law “On Currency Regulation” dated December 10, 2003 No. 173-FZ.

2. To yourself. For export transactions (for which the rate is 0%), the resident exporter is not exempt from the obligation to keep VAT records. The exporter must issue an invoice (with zero VAT) and register it in the sales ledger.

When is it possible to deposit foreign money?

Is it possible to issue this document in foreign currency, in euros and dollars, for example? Yes, this is acceptable. Modern suppliers are increasingly purchasing goods from foreign stores and foreign partners. In this case, contracts are concluded in the currency of the selling country.

This is done to eliminate currency exchange rate fluctuations. This is beneficial for managers, but for Russian accountants it is difficult to calculate and transfer tax deductions.

For tax purposes, by law, the invoice is issued in rubles (according to Article 317 of the Civil Code of the Russian Federation - monetary obligations are indicated in rubles and are equivalent to conventional units or foreign money). In cases where purchases are made from foreign sellers, the documentation indicates the currency of the selling party and its code.

The Tax Code does not prohibit the use of foreign currency when filling out documentation. In cases where payment for goods or services is made in foreign money, the invoice can be drawn up indicating the foreign currency. Thus, the currency is indicated in cases of purchases, provision of services and transactions with foreigners, foreign stores and partners, if there is legislative permission.

Special publications by our experts will help you avoid making mistakes when filling out invoices, from which you will learn:

- What is a document number and what does the standard form look like?

- What are the rules for issuing invoices for services, advance payments and return of goods?

- What is the deadline for issuing an invoice to the buyer?

- What are the rules for filling out the document by separate divisions?

How to generate invoices in foreign currency in 1C

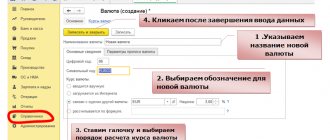

First of all, it is necessary that the “Currencies” directory be filled out in “1C”. You can select the desired currency or add it manually.

NOTE! If the terms of the agreement provide for a “special” conversion into rubles (a currency clause has been made), for example, “payment at the rate of 1 euro plus 3%,” then you can enter the following new position into the directory:

- create a “new currency”;

- link to the euro exchange rate (check the box in the form that opens);

- set the required “surcharge”;

- save with a name that will allow you to quickly find the position if necessary.

Read about the nuances of currency clauses in the article “Sample of a currency clause in a contract and its types .

Then you need to correctly enter information about the contract into the database. In the “Calculations” section of the contract being drawn up, you need to select the desired currency from the directory. Save changes.

When entering a document (for example, a sale) under an agreement, the required currency will be automatically selected and converted into rubles at a given rate for accounting purposes.

The easiest way to issue an invoice is through the “Create based on” option, which is available in all accounts receivable documents. The invoice created on the basis of the source document (sale or payment) will automatically take into account all the nuances of the reflected transaction, including the currency of the contract.

How to display data correctly?

- Rubles – the invoice indicates the name and digital code of the currency – “Russian ruble, code 643, RUB”.

- Dollars – “US dollar, code 840, USA”.

- Euro – “Euro, code 978, EUR”.

In the invoice, line number seven indicates the name of the currencies and their code value. The digital code is checked against the All-Russian Classifier. The price can be expressed in both Russian and foreign currencies, depending on the situation.

For example, when shipping goods in both currencies, the price in the invoice is expressed in different monetary units, or if the final result of the cost is indicated in the ruble, then the Russian currency is indicated in the line.

Accounting info

Despite the fact that the payment currency on the territory of the Russian Federation is the ruble, many companies practice concluding transactions in so-called conventional units. The Civil Code of the Russian Federation does not prohibit expressing the transaction price in foreign currency.Thus, on the basis of paragraph 2 of Article 317 of the Civil Code of the Russian Federation, a monetary obligation may stipulate that it is payable in rubles in an amount equivalent to a certain amount in foreign currency or in conventional monetary units (ecus, “special drawing rights”, etc.). In this case, the amount payable in rubles is determined at the official exchange rate of the relevant currency or conventional monetary units on the day of payment, unless a different rate or another date for its determination is established by law or by agreement of the parties.

The Tax Code of the Russian Federation directly allows for the preparation of an invoice with amounts in foreign currency. This is indicated by paragraph 7 of Article 169 of the Tax Code of the Russian Federation. Please note that amounts must be expressed in foreign currency, and not in conventional units. Therefore, when concluding a transaction, the price of which will be expressed in conventional units, which are accepted by the parties as equal to a unit of any currency at a certain rate, the invoice must contain a link in which currency the amount is expressed.

From January 1, 2006, according to the new edition of Chapter 21 of the Tax Code of the Russian Federation, as a general rule, the conditions for submitting VAT for deduction are:

· purchase of goods for VAT-taxable transactions;

· acceptance of goods for registration and availability of relevant primary documents;

· availability of a properly completed invoice.

To comply with the first condition, it does not matter in what currency the amount of the purchased product is expressed. The following condition imposes an obligation on the buyer to accept the goods for accounting according to properly completed primary documents. If the transaction amount is expressed in conventional units, then in order for the primary documents to comply with the concluded agreement, it would be logical to draw up an invoice also in conventional units. However, paragraph 1 of Article 8 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting” (hereinafter referred to as Law No. 129-FZ) establishes that accounting of property, liabilities and business transactions is carried out in the currency of the Russian Federation - in rubles . And in accordance with paragraph 2 of Article 9 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting,” all business transactions are documented with primary accounting documents drawn up according to the forms contained in the albums of unified forms of primary accounting documentation. In the absence of forms of primary documents in these albums, when preparing primary accounting documents, the requirements for the availability of details listed in paragraph 2 of Article 9 of the Accounting Law must be observed, and the forms of such documents must be approved by an order on the accounting policy of the organization on the basis of paragraph 3 of Article 6 of the Law about accounting.

To register goods in the album of unified forms of primary accounting documentation for recording trade operations, approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132, the TORG-12 consignment note form is provided. The letter of Rosstat dated May 31, 2005 No. 01-02-9/381 directly states that conventional monetary units in unified forms of primary accounting documentation cannot be used on the basis of paragraph 1 of Article 8 of Law No. 129-FZ. Consequently, filling out such a form when shipping goods in conventional units will lead to the fact that such documents may be recognized by the buyer as not properly executed, which will lead to a refusal to deduct VAT even if there is an invoice, since the second condition about the availability of appropriate primary documents. But filling out an invoice in rubles and an invoice in foreign currency leads to additional reconciliations with suppliers, which can lead to “delayed” VAT refunds from the budget. Therefore, to optimally resolve this situation, it can be recommended to issue an invoice in both rubles and foreign currency, which is quite acceptable from the point of view of legislation, since the introduction of additional columns and lines is permitted by Resolution of the State Statistics Committee of Russia dated March 24, 1999 No. 20, as well as paragraph 13 Regulations on maintaining accounting and financial statements in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n.

When presenting VAT on an invoice drawn up in conventional units, the following should be taken into account.

Rules for maintaining journals of received and issued invoices, purchase books and sales books when calculating value added tax, approved by Decree of the Government of the Russian Federation dated December 2, 2000 No. 914 and valid as amended by Decree of the Government of the Russian Federation dated May 11, 2006. No. 283 do not prohibit the preparation of invoices in conventional units or foreign currency. The right to issue invoices in foreign currency, as noted above, is provided for in paragraph 7 of Article 169 of the Tax Code of the Russian Federation. This means that when carrying out purchase and sale transactions, invoices can be prepared both in Russian rubles and using conventional units.

In accordance with paragraph 1 of Article 172 of the Tax Code of the Russian Federation, when purchasing goods (work, services), property rights for foreign currency, foreign currency is converted into rubles at the rate of the Central Bank of the Russian Federation on the date of registration of goods (work, services), property rights. Therefore, unless otherwise specified in the contract (for example, goods are accepted for accounting at the exchange rate established on the day of payment when making an advance payment), then to accept the goods for accounting, the exchange rate on the date of posting is accepted. VAT is claimed for deduction by the buyer in the tax period of registration if there is a corresponding invoice. However, if the agreement provides for payment at the exchange rate established on the date of payment, then amount differences will inevitably arise.

The sale of goods, provision of services, performance of work entails consequences for both parties to the contract. For one party in the form of receiving income, for the other party in the form of making expenses. Moreover, income and expenses relate to the reporting period in which they occurred, regardless of the actual time of receipt or payment of funds. According to paragraph 6 of PBU 9/99, the seller’s revenue is accepted for accounting in an amount calculated in monetary terms equal to the amount of cash receipts and (or) the amount of accounts receivable, and based on paragraph 6 of PBU 10/99, expenses are accepted in an amount calculated in in monetary terms equal to the amount of payment in cash and (or) the amount of accounts payable.

Thus, both parties will have to take into account in accounting the difference caused by changes in the exchange rate of foreign currency (conventional monetary units) in the period between the dates of shipment (purchase) of goods (work, services) and their payment.

According to clause 6.6 of PBU 9/99, the amount difference for the seller (performer) is understood as the difference between the ruble valuation of an asset actually received as revenue, expressed in foreign currency (conventional monetary units), calculated at the official or other agreed rate on the date of acceptance for accounting accounting, and the ruble valuation of this asset, calculated at the official or other agreed rate as of the date of recognition of revenue in accounting.

According to clause 6.6 of PBU 10/99, the amount difference for the buyer (customer) is understood as the difference between the ruble estimate of the actual payment made, expressed in foreign currency (conventional monetary units), calculated at the official or other agreed rate on the date of acceptance for accounting of the corresponding creditor debt, and the ruble valuation of this payable, calculated at the official or other agreed rate on the date of recognition of the expense in accounting.

When calculating VAT on transactions concluded in conventional monetary units, Chapter 21 of the Tax Code of the Russian Federation regulates the following.

Based on paragraph 2 of Article 153 of the Tax Code of the Russian Federation, when determining the tax base, proceeds from the sale of goods (work, services), transfer of property rights are calculated based on all income of the taxpayer associated with settlements for payment for the specified goods (work, services), property rights received by him in cash and (or) in kind, including payment in securities.

In accordance with paragraph 1 of Art. 154 of the Tax Code of the Russian Federation, the tax base for the sale of goods (work, services) is defined as the cost of these goods (work, services), calculated on the basis of prices determined in accordance with Art. 40 of the Tax Code of the Russian Federation, taking into account excise taxes and without including taxes. Thus, if the parties stipulate in the agreement that the rate of a conventional unit is determined on the date of payment, then the cost of goods (work, services) is formed on the corresponding date, that is, taking into account both positive and negative amount differences.

Experts from the financial department repeatedly provided explanations according to which only an increase in the VAT tax base was envisaged, while its reduction was not allowed. Such clarifications were given, in particular, in the letter of the Ministry of Finance of Russia dated July 8, 2004 No. 03-03-11/114: “in accordance with sub. 2 p. 1 art. 162 of the Tax Code of the Russian Federation, the tax base for value added tax increases by amounts associated with payment for goods (work, services) sold. Thus,... in the case when, under the terms of the contract, payment for goods (work, services) is made in rubles in an amount equivalent to the amount in foreign currency, with an increase in the ruble exchange rate and the accounting policy “by shipment” adopted for tax purposes, the previously accrued amount of tax on the added value is increased by the seller based on the actual revenue received from the sale of goods (works, services), that is, it is determined taking into account positive amount differences. As for negative amount differences, the reduction of previously accrued value added tax by the amount of such differences is not provided for by the norms of Chapter 21 of the Tax Code of the Russian Federation.”

It should be noted that the opposite point of view was also expressed. For example, in the letter of the Ministry of Taxes of Russia dated May 31, 2001 No. 03-1-09/1632/03-P115, it is stated that “according to paragraph 4 of Article 166 of the Tax Code of the Russian Federation, the total amount of value added tax is calculated based on the results of each tax period, taking into account all changes that increase or decrease the tax base in the corresponding tax period. In connection with the above, in the case where, under the terms of the contract, payment for goods (work, services) is made in rubles in an amount equivalent to the amount in foreign currency (conventional monetary units), with the accounting policy “by shipment” adopted for tax purposes, previously accrued tax amounts for added value are adjusted by the seller based on the actual revenue received from the sale of goods (works, services), that is, taking into account amount differences.”

But, given that at the moment the tax authorities must be guided by the explanations of the Ministry of Finance, during inspections they will take into account the first point of view.

Thus, it turns out that the taxpayer must calculate VAT on lost income in the event of a lower exchange rate at the time of payment compared to the time of shipment.

As for the deduction of VAT by the buyer when amount differences arise from January 1, 2006, there are no clarification letters on this topic yet. However, it can be assumed that VAT can be claimed as a deduction if all conditions are met, including receiving an invoice in foreign currency. Consequently, the taxpayer can reflect it in the purchase book on the date the goods were accepted for accounting. The current version of the Tax Code of the Russian Federation does not provide for any further adjustments, since from January 1, 2006, VAT must be deducted regardless of the fact of payment. Of course, there is a discrepancy: the seller must recalculate the tax base in the event of positive amount differences and pay VAT on them to the budget, and the buyer does not have the right to deduct the same amount from the budget. Thus, the easiest way at the moment seems to be to conclude an agreement in rubles and draw up invoices for fulfilled obligations in a similar currency.

Comments:

- In contact with

Download SocComments v1.3

| Next > |

Violation of the law

When completing documentation, the name of the settlement currency and its digital code may be indicated incorrectly. In this case, the buyer will have problems when calculating VAT.

But taking into account the nuances of design, minor errors are allowed - for example, the code is not indicated, but only the name is present, this is acceptable in the document.

Articles 15, 25 of the Code of Administrative Offenses provide for administrative liability for violations in the field of currency turnover and regulation. Illegal currency transactions are actions related to illegal transfers and payments for goods and services that bypass tax deductions.

Monetary transactions associated with failure to comply with the requirements for foreign exchange transactions established at the legislative level - failure to use special reserve accounts, debiting/crediting amounts of money or external/domestic securities from accounts without fulfilling the requirements and reservation rules.

Accountant's Directory

TKS.RU Forums > Sections > Customs > Account in foreign currency

View full version : Account in foreign currency

Gentlemen, experts, tell me. Can a Russian carrier company issue invoices in foreign currency? currency to your customers? But all our payments to them are in rubles, they work with us on an advance payment basis, and then after we have “cleared customs” for the cargo, they issue us an invoice in rubles. I probably didn’t explain it very clearly, but as the conversation progresses I will comment on our difficult situation.

passing by

26.04.2009, 14:45

Gentlemen, experts, tell me. Can a Russian carrier company issue invoices in foreign currency? currency to your customers? But all our payments to them are in rubles, they work with us on an advance payment basis, and then after we have “cleared customs” for the cargo, they issue us an invoice in rubles. I probably didn’t explain it very clearly, but as the conversation progresses I will comment on our difficult situation.

The situation is familiar. Almost everyone works this way. You should have a clause in your agreement with them that invoices are issued in foreign currency (dollars or euros), payment at the rate in rubles on the day of payment (which is more common) or on the day of invoice (which is less common). That's all. And if the invoice is in rubles, then I don’t understand, why are you worrying?

Gantenbein

26.04.2009, 14:47

…..all our payments to them are in rubles, they work with us on an advance payment basis, and then after we have “cleared customs” for the cargo, they issue us an invoice in rubles…

If they work on an advance payment basis, then what invoice is then issued in rubles?

The situation is familiar. Almost everyone works this way.

How to issue an invoice in foreign currency

You should have a clause in your agreement with them that invoices are issued in foreign currency (dollars or euros), payment at the rate in rubles on the day of payment (which is more common) or on the day of invoice (which is less common). That's all. And if the invoice is in rubles, then I don’t understand, why are you worrying?

So on the day of filing the customs declaration, we had neither an invoice nor an invoice, but there was a certificate for customs purposes stating that the cost of transportation was 1000 EUROS, the customs released us, they gave us a normal document, and we still got it from the carrier we can't for now.

If they work on an advance payment basis, then what invoice is then issued in rubles? So we have an advance payment in rubles.

Gantenbein

26.04.2009, 15:23

Gentlemen, experts, tell me. Can a Russian carrier company issue invoices in foreign currency? currency to your customers? But all our payments to them are in rubles, they work with us on an advance payment basis, and then after we have “cleared customs” for the cargo, they issue us an invoice in rubles. I probably didn’t explain it very clearly, but as the conversation progresses I will comment on our difficult situation.

I am forced to quote your post again and in full. You write that you are working with a carrier “on an advance payment basis.”

How does your company pay this “prepayment”, on the basis of what document does your company transfer funds to the carrier? If there is an “advance payment”, then why is there no financial document confirming the “advance payment” made? And if an “advance payment” was made, then for what services does your company receive an invoice after the cargo is cleared through customs? We need to deal with this first.

I am forced to quote your post again and in full. You write that you are working with a carrier “on an advance payment basis.”

How does your company pay this “prepayment”, on the basis of what document does your company transfer funds to the carrier? If there is an “advance payment”, then why is there no financial document confirming the “advance payment” made? And if an “advance payment” was made, then for what services does your company receive an invoice after the cargo is cleared through customs? We need to deal with this first.

I'll try to explain. This company X provides us with forwarding services by hiring third parties Y (foreign companies), and for all our transportation, we “drive” money to them (company X) at the beginning of the month, they draw us a certificate of the cost of transportation in foreign currency, and invoices are issued after they have apparently been invoiced by Y companies they hired.

passing by

26.04.2009, 16:21

So on the day of filing the customs declaration, we had neither an invoice nor an invoice, but there was a certificate for customs purposes stating that the cost of transportation was 1000 EUROS, the customs released us, they gave us a normal document, and we still got it from the carrier we can't for now.

Keep shaking. What taxation system do you use - the general one, with VAT? Hardly on UTII.

They are required to issue you an invoice for prepayment (you can use a general invoice), and close each shipment with an invoice and a certificate of completion of work.

If the certificate contains only the cost of delivery to the border, try another one: the total cost and breakdown from the place of loading to the border + from the border to the place of unloading. Let the certificate in foreign currency be normal.

27.04.2009, 04:57

If I'm not mistaken, the s/f must be issued no later than 5 days after the sale of the goods/services.

So on the day of filing the customs declaration, we had neither an invoice nor an invoice, but there was a certificate for customs purposes stating that the cost of transportation was 1000 EUROS, the customs released us, they gave us a normal document, and we still got it from the carrier we can't for now.

And how is it stated in your contract with the carrier when he is obliged to provide an invoice and sf. For example, with us, payment does not depend on “customs clearance”, within 10 days after receipt at the temporary storage warehouse, and if I did not have time to “clear customs” before this period, then customs will charge me with a payment order.

And how is it stated in your contract with the carrier when he is obliged to provide an invoice and sf. For example, with us, payment does not depend on “customs clearance”, within 10 days after receipt at the temporary storage warehouse, and if I did not have time to “clear customs” before this period, then customs will charge me with a payment order.

“And that’s right, comrades!” ©

Source: https://1atc.ru/schet-faktura-v-valjute/

Preparation of primary documents

Primary accounting documents must necessarily contain the amount of the business transaction in rubles (clause “d”, paragraph 2, article 9 of the Federal Law of November 21, 1996 N 129-FZ).

Thus, an act for work (services) or an invoice (for goods) must necessarily contain the amount in rubles. It is allowed to additionally indicate the amount in cu. and conversion rate.

If there was a 100% prepayment, the primary document is issued in an amount equal to the payment amount. If postpayment or partial prepayment, then the primary document is issued according to the following scheme:

- The paid portion is calculated at the exchange rate on the day of payment

- The unpaid portion is calculated at the exchange rate on the day of shipment

PBU 3 clause 6

For accounting purposes, the specified conversion into rubles is made at the rate valid on the date of the transaction in foreign currency.

PBU 3 clause 9

Assets and expenses that were paid by the organization in advance or for the payment of which the organization transferred an advance or deposit are recognized in the accounting records of this organization, assessed in rubles at the rate in effect on the date of conversion into rubles of the funds issued in advance, deposit, prepayment (in part attributable to the advance, deposit, prepayment).

Accounting

Accounting for transactions in monetary units is regulated by PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in foreign currency.”

If the company uses conventional units, then accounting for liabilities must be carried out simultaneously in two units - y. e. (currency of obligation) and rubles (currency of payment) (clause 20 of PBU 3/2006).

PBU says that liabilities in monetary units must be revalued (clause 7 of PBU 3).

What we overestimate:

- Debts (except advances) of buyers

- Debts (except advances) to suppliers

- Debts on loans and borrowings

At what point do we overestimate:

- on the date of any transaction with an obligation expressed in currency. e.

- on the last day of each calendar month.

PBU 3 clause 7.

Recalculation of the value of banknotes at the organization's cash desk, funds in bank accounts (bank deposits), monetary and payment documents, securities (except for shares), funds in settlements, including for borrowed obligations with legal entities and individuals (except for funds received and issued advances and prepayments, deposits), expressed in foreign currency, in rubles must be made on the date of the transaction in foreign currency, as well as on the reporting date. Recalculation of the value of banknotes at the organization's cash desk and funds in bank accounts (bank deposits), expressed in foreign currency, can also be carried out as the exchange rate changes.

At the time of revaluation, an exchange rate difference arises, which is reflected as part of other income or other expenses in 91 accounts.

Sales book and VAT (for seller of goods/works/services)

If the seller issues an invoice in conventional units, then he re-registers it in the sales book - on the date of formation of the exchange rate difference and only for the amount of the exchange rate difference.

If the shipment invoice was issued in rubles, then a separate invoice must be issued for the exchange rate difference. It is drawn up in a single copy and is not issued to the buyer (clause 19 of Resolution No. 914).

Article 167. Moment of determining the tax base

1. For the purposes of this chapter, the moment of determining the tax base, unless otherwise provided by paragraphs 3, 7 - 11, 13 - 15 of this article, is the earliest of the following dates:

1) the day of shipment (transfer) of goods (work, services), property rights;

2) the day of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights.

14. If the moment of determining the tax base is the day of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services) or the day of transfer of property rights, then on the day of shipment of goods (performance of work, provision of services) or on the day of transfer of property rights against previously received payment or partial payment, the moment of determining the tax base also arises.

Often, the conversion rate is equal to the moment of payment, therefore, in the case of full 100% prepayment, exchange rate differences do not arise, since by the time of shipment the transaction amount in terms of rubles is reliably known. In the case of postpayment at the time of shipment, it is not possible to accurately calculate the transaction amount in rubles, so an exchange rate difference arises at the time of repayment of the debt. The difference can be negative (in the case of a decrease in the exchange rate) and positive (in the case of an increase in the exchange rate).

The positive difference increases the tax base for VAT (clause 2, clause 1, article 162 of the Tax Code of the Russian Federation). There are different points of view on the issue of negative difference.

Point of view No. 1. A negative difference does not reduce the tax amount

- Letter of the Ministry of Finance of the Russian Federation dated March 26, 2007 N 03-07-11/74).

Point of view No. 2. A negative difference reduces the amount of tax

- Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 17, 2009 N 9181/08 in case N A40-20314/07-112-124

- Resolution of the Federal Antimonopoly Service of the Moscow District dated December 5, 2008 N KA-A40/10789-08 in case N A40-12417/08-87-37

- Resolution of the Federal Antimonopoly Service of the Moscow District dated March 26, 2008 N KA-A40/14002-07 in case N A40-7008/07-90-16

Exchange rate differences are subject to VAT at calculated rates of 10/110% or 18/118% (clause 4 of Article 164 of the Tax Code of the Russian Federation).