The issuance of financial assistance to employees, current and former, may entail questions related to the procedure for reflecting in the accounting records the entries for its issuance, the calculation of personal income tax and insurance contributions, and the formation of tax accounting for income tax.

Many organizations provide financial assistance to their employees, and the accountant has questions about what documents to draw up and how to reflect the issuance of financial assistance in accounting:

- in connection with the death of an employee or members of his family;

- for vacation;

- in connection with the birth or adoption of a child;

- in other cases.

Registration of issuance of financial assistance

The package of documents for processing the issuance of financial assistance is not defined by law, and therefore the management of the organization needs to develop regulations for this business transaction. We offer the following package of standard documents:

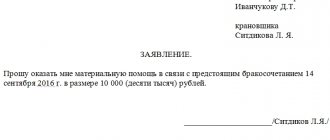

- an employee’s application when going on vacation with a request to provide an additional payment for the vacation, if the procedure for its payment and amount are determined in the collective or employment agreement;

- an employee’s application with a request to provide financial support on any other grounds stipulated by a collective or labor agreement, or any other local regulatory act of the organization (the employee must attach to the application a document confirming the occurrence of circumstances that are the basis for this payment);

- payment order (issued after receiving an application for financial assistance (for any reason)).

These documents will be the basis for the accountant to accrue financial assistance (entries to be reflected in accounting will be indicated in the next section).

Accounting for financial assistance using retained earnings

When calculating financial assistance from retained earnings, make the following entry:

Debit 91-2 Credit 73 (76)

– financial assistance has been accrued to an employee (an employee’s family member) from retained earnings from previous years.

This posting must be made regardless of whether the net profit of previous years or the current year (including profit based on the results of the quarter, half a year, nine months) is aimed at paying financial assistance. The fact is that such expenses cannot be reflected using account 84. These will be other expenses that also affect the financial result of the organization. Accordingly, such expenses must be reflected in the debit of account 91-2. Similar explanations are given in letters of the Ministry of Finance of Russia dated December 19, 2008 No. 07-05-06/260 and dated June 19, 2008 No. 07-05-06/138.

An example of reflecting in accounting financial assistance provided to an employee at the expense of retained earnings

On April 7, 2015, manager of Alpha LLC A.S. Kondratyev wrote a statement asking for financial assistance.

On April 10, 2015, a general meeting of founders was held, at which it was decided to allocate part of the profit for 2014 to pay financial assistance to employees. On April 13, 2015, the general director of Alpha, guided by the decision of the general meeting of participants, issued an order to issue 4,000 rubles to Kondratyev. financial assistance from current year profits.

Alpha's accountant reflected this operation on April 13, 2015 as follows:

Debit 91-2 Credit 73 – 4000 rub. – financial assistance was accrued to the employee at the expense of the current year’s profit.

Situation: is it possible to provide financial assistance to an employee (an employee’s family member) with property?

Answer: yes, you can. The legislation does not contain a ban on this.

In accounting, reflect the issuance of material assistance with property by posting:

Debit 73 (76) Credit 41 (10, 01, 58)

– financial assistance was provided to the employee (employee’s family member) with property.

Financial assistance, accounting entries

The provision of material assistance is reflected by entries in the debit of accounting account 91 “Other income and expenses”, subaccount 2 “Other expenses” in correspondence with the credit of account 73 “Settlements with personnel for other operations” as part of payments to active employees, or account 76 “Settlements with various debtors and creditors" when providing financial support to other individuals.

It is allowed to reflect the accrual of financial assistance by posting a credit to account 70 “Settlements with personnel for wages”; this procedure should be fixed in the accounting policy of the organization.

Employee support can be in either monetary (1) or in-kind (2) form:

- Financial assistance was issued: posting in correspondence with the credit of account 50 “Cash” (when issued in cash) or account 51 “Current account” (when transferred to a bank account).

- Support was provided to the employee in kind: correspondent account - accounting of issued property, for example 10 “Raw materials and materials”, 40 “Finished products and goods”.

In cases where retained earnings are used to support employees, account 91 is replaced by 84, “Retained earnings (uncovered loss).”

Sources of payment

The organization has the right to provide an employee (an employee’s family member) with financial assistance. It is usually paid from the organization’s own funds. Both retained earnings from previous years and current year profits can be used for these purposes.

Financial assistance can be provided from the retained earnings of the current year or previous years only with the permission of the founders (participants, shareholders) of the organization. The decision to use net profit to pay bonuses, financial assistance and other amounts is made by the general meeting of founders. If the organization has one founder (participant, shareholder), there is no need to hold a general meeting. For joint stock companies, such rules are provided for in subparagraph 11 of paragraph 1 of Article 48 and paragraph 3 of Article 47 of the Law of December 26, 1995 No. 208-FZ. For LLC - in subparagraph 7 of paragraph 2 of Article 33 and Article 39 of the Law of February 8, 1998 No. 14-FZ.

The decision of the general meeting must be documented in minutes (Article 63 of the Law of December 26, 1995 No. 208-FZ, paragraph 6 of Article 37 of the Law of February 8, 1998 No. 14-FZ), the sole founder (participant, shareholder) - by written decision (clause 3 of article 47 of the Law of December 26, 1995 No. 208-FZ, article 39 of the Law of February 8, 1998 No. 14-FZ).

There are no mandatory requirements for the minutes of the general meeting of an LLC in the legislation. But there are details that are better to indicate. This is the number and date of the minutes, place and date of the meeting, agenda items, decisions made.

The minutes of the general meeting of shareholders differ from the minutes of an LLC in that they are drawn up in two copies and have mandatory details. They are listed in paragraph 2 of Article 63 of the Law of December 26, 1995 No. 208-FZ and paragraph 4.29 of the Regulations approved by order of the Federal Financial Markets Service of Russia dated February 2, 2012 No. 12-6/pz-n.

After the founders (participants, shareholders) have decided to direct part of the retained earnings to pay out financial assistance, the decision to issue it can be made by the head of the organization (clause 2 of article 69 of the Law of December 26, 1995 No. 208-FZ, subclause 4 p 3 Article 40 of the Law of February 8, 1998 No. 14-FZ). To do this, the manager issues an order.

Personal income tax

The employer must withhold personal income tax from the amount of financial support provided to its employees (Article 210 of the Tax Code of the Russian Federation), with the exception of:

- amounts of one-time financial support not exceeding 4,000 rubles per calendar year (clause 28, article 217 of the Tax Code of the Russian Federation);

- the amount of a one-time payment from the employer, but not more than 50,000 rubles (clause 8 of Article 217 of the Tax Code of the Russian Federation), paid to parents at the birth of a child (adoptive parents, guardians). Limit of 50,000 rubles. is subject to application by the employer in relation to each of the parents (Letter of the Ministry of Finance of Russia dated July 12, 2017 No. 03-04-06/44336).

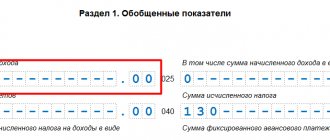

In all other cases, it is necessary to reflect the accrual of personal income tax on financial aid by posting to the debit of account 73 “Settlements with personnel for other operations”, account 70 “Settlements with personnel for wages” or account 76 “Settlements with various debtors and creditors”, in correspondence with the loan Account 68 “Calculations for taxes and fees.”

Amounts of assistance provided by employers to close relatives of their deceased employee, even a former or retired employee, are not subject to personal income tax (Clause 8 of Article 217 of the Tax Code of the Russian Federation). We also received exemption from personal income tax for amounts paid in connection with emergency situations, the victims of which were employees or their close relatives (clauses 8.3, 8.4 of Article 217 of the Tax Code of the Russian Federation), and one-time payments made to an employee retiring (clause 8.5 Article 217 of the Tax Code of the Russian Federation).

In cases where assistance is provided to employees in kind and it is impossible to withhold personal income tax until the end of the calendar year, the employer must notify the tax authorities of this fact no later than March 1 of the following year (clause 5 of Article 226 of the Tax Code of the Russian Federation).

Normative base

Letter of the Federal Tax Service of the Russian Federation dated 08/18/2011 N AS-4-3/

Letter of the Ministry of Finance of Russia dated 08/27/2012 N 03-04-05/6-1006

Order of the Federal Tax Service of Russia dated September 10, 2015 N ММВ-7-11/ “On approval of codes for types of income and deductions”

Letter of the Ministry of Finance of Russia dated February 17, 2016 N 03-04-05/8718

Letter of the Ministry of Finance of Russia dated December 16, 2014 N 03-04-05/64847

Letter of the Ministry of Finance of Russia dated December 2, 2016 N 03-04-05/71785

Letter of the Ministry of Finance of Russia dated January 20, 2017 N 03-04-06/2414

Ruling of the Supreme Court of the Russian Federation dated August 20, 2015 N 304-KG15-9468 in case N A45-16187/2014

Letter of the Ministry of Finance of Russia dated 02.09.2014 N 03-03-06/1/43912

Letter of the Federal Tax Service of Russia dated December 15, 2016 N BS-4-11/

Insurance premiums

Insurance premiums, on the basis of Art. 421 of the Tax Code of the Russian Federation, and contributions “for injuries” (Article 20.1 of Law No. 125-FZ): when financial assistance is accrued - posting to the debit of accounting account 91 “Other income and expenses”, subaccount 2 “Other expenses” in correspondence with the credit of the account 69 “Calculations for social insurance and security.”

Lump sum payments in the form of financial assistance are not subject to insurance premiums on the same grounds as for personal income tax (Article 422 of the Tax Code of the Russian Federation).

At the same time, the employer must take into account that employee support expressed in kind is also the basis for calculating insurance premiums and “injury” contributions.

Contributions to funds

Amounts of accrued financial assistance are subject to contributions paid to the funds. In a number of cases, Law No. 212-FZ in Article 9 provides for tax exemption

| Type of assistance | Link to article of law |

| Payments due to natural disasters or acts of terrorism | Art. 9 clause 3a |

| Assistance to an employee in connection with the death of relatives | Art. 9 paragraph 3b |

| Payments to a parent, adoptive parent or guardian in connection with the birth of a child, his adoption or the appointment of guardianship | Art. 9 p. 3c |

| Payments for various needs up to 4 thousand rubles annually | Art. 9 p. 11 |

All other cases of providing targeted or non-targeted assistance are subject to contributions to funds allocated for employee insurance. The issue of taxation of amounts of social payments with contributions to funds is ambiguous and controversial. There are a number of examples of challenging fund decisions on pre-charges in arbitration courts.

Tax accounting

For tax accounting purposes, for organizations using different taxation systems, it is possible to take into account payments of financial assistance for vacation, but only if this type of payment is fixed in a collective or employment agreement and depends on the implementation of labor discipline and wages (Letters of the Ministry of Finance of the Russian Federation dated July 3, 2012 No. 03 -03-06/1/330, dated 09/03/2012 No. 03-03-06/1/461).

This means that if the collective agreement establishes the same amount of vacation payment for all employees, then the organization will not be able to accept such expenses when accounting for income tax, and if the additional payment for vacation serves as a one-time payment related to the employee’s performance of his job functions, then it can be accepted as expenses for tax accounting purposes for income tax.

It is important to note that, despite the fact that payments of financial assistance for the birth or adoption of a child, in connection with the death of family members and other types of payments determined by an employment or collective agreement are not accepted for tax accounting purposes in accordance with tax legislation, insurance contributions accrued for these payments are allowed to be accepted for tax accounting purposes (Letter of the Ministry of Finance of the Russian Federation dated April 29, 2010 No. 03-03-06/4/53).

Reasons for providing assistance

The list of events and reasons in the event of which an employee can count on assistance from the enterprise is approved by the employer. Common reasons include:

- Extraordinary circumstances – loss of property or damage caused by natural or natural disasters.

- Medical indications – illness, disability or need for recovery.

- Family circumstances - the birth or adoption of a child, illness or loss of a loved one.

- Personal motives - difficult financial situation, anniversary, retirement.

- Other situations determined by the employer and enshrined in internal documents.

The employee must indicate the occurrence of a case in which assistance is required in the application for financial assistance.

matpomoshch.jpg

Related publications

Unlike wages, financial assistance (MA) is not paid as remuneration for the performance of official duties. Such payments are not regulated by the Labor Code of the Russian Federation, but are provided for by local regulations of the company and are paid to the employee as support in various life circumstances, for example, upon the birth of a child, the death of a family member, a natural disaster, etc. Let's look at how financial assistance is calculated and the postings used to formalize such operations.

Kinds

The birth of a baby in most Russian families requires the mobilization of all financial resources. State social programs come to the aid of parents with infants. They contribute to some normalization of the budget of families with newborns. At the same time, there are several types of cash payments at the birth of a baby, which can also be called financial assistance.

What kind of financial assistance for the birth of a child in 2021 awaits parents in Russia? For better orientation in the variety of payments, you can divide them into:

- Required.

- Optional.

The first includes all types of assistance that the child’s mother will receive from the state. To the second - from the enterprise where she works.

The next difference lies in the type of payments. They can be:

- one-time (received once after childbirth);

- monthly (paid until the child reaches the age of one and a half or 3 years.

Another difference between benefits is that they can be:

- federal (allowed to all Russian mothers in labor and comes from the national budget);

- regional (issued by constituent entities of the Russian Federation).

Regions pay benefits for the birth of a child from their treasury. They themselves determine the conditions for receiving such benefits. For example, provided that families need such money.

The most significant type of government financial assistance today is maternity capital. Certificates for it are issued throughout the country at the birth of the 2nd and subsequent children. The main goal of this measure is to stimulate the birth rate in Russian families.

Support for quitting employees

An interesting question: what to do with insurance deductions from payments to ex-employees. Article 420 of the Tax Code of the Russian Federation will help answer this, which states that contributions are accrued for remuneration under employment agreements or GPC agreements. Since there are no such relationships with those who quit, there is no need to retain anything. At the same time, inspectors may have questions on what basis financial support was provided. Organizations need to keep this point in mind when discussing financial assistance (taxation 2021, insurance premiums).

Features of taxation

There are two options for accounting for material assistance for the purpose of calculating income tax:

- One-time financial assistance not included in the base (Article 270 of the Tax Code of the Russian Federation).

- Regular payments that can be considered labor costs and included in the tax base. For example, assistance issued for annual leave or for long service.

The Tax Code in Article 217 establishes the types and amounts of assistance that are not subject to personal income tax. Any help up to RUB 4,000. not subject to personal income tax. In all other cases or if the amount specified in Art. 217 of the Tax Code of the Russian Federation, the employer, as a tax agent, is obliged to withhold and transfer personal income tax from the accrued amount of assistance.

Financial assistance over 4,000 rubles is subject to insurance contributions, except for the cases specified in Article 9 212-FZ, and is reflected by posting:

- Dt 91.2 Kt 69 – contributions (FSS, Pension Fund) are accrued for financial assistance.

When drawing up regulatory documents on financial assistance, you need to be especially precise in the wording to reduce the risk of additional taxes:

Add a comment Cancel reply

You must be logged in to post a comment.

This site uses Akismet to reduce spam. Find out how your comment data is processed.

Grounds and procedure for calculating assistance

The purpose of accruing and paying financial assistance to an employee is to create or maintain conditions for resolving certain life situations, in particular:

- At the birth of children;

- Upon the death of an employee or close relative;

- Need for treatment;

- Damage caused by natural disasters or terrorist attacks;

- In other cases established by the employer.

In order to receive financial assistance, an employee must meet certain conditions:

- The procedure, reasons, amount and timing of payment of assistance must be fixed in internal regulatory documents, for example, in the “Regulations on Social Policy” or the “Collective Agreement” of the company;

- Help should not be systemic;

- Issue an order signed by the manager based on the employee’s application:

Get 267 video lessons on 1C for free:

The reason why the employee needs help, he must indicate in the application and attach copies of documents (for example, a marriage certificate, certificates from public or private institutions about treatment, family composition and financial situation, etc.)

Financial assistance can be issued in cash from the cash register or by transfer to the employee’s personal bank account, which must also be indicated in the application. The recipient of assistance may be a close relative of the employee (in accordance with the family code). In some cases, he may himself turn to the employer for help (in case of illness, death of the employee or other circumstances); the right of a family member to seek help must be reflected when drawing up the “Regulations on Social Policy” or the “Collective Agreement”.

What is required from the state

A pregnant employee goes on prenatal leave already in the 30th week of her pregnancy. She is given a sick leave certificate.

The first payment that an expectant mother can receive is a benefit for early registration at the antenatal clinic. To do this, you must first appear within 12 weeks. From February 1, 2021, a one-time benefit for women registered with medical organizations in the early stages of pregnancy (up to 12 weeks) is paid in the amount of 655 rubles 49 kopecks.

If the pregnancy progresses well and the birth is normal, she will be given a certificate of temporary incapacity for work for 2 months before giving birth and for three months after. And if complications arise during labor and delivery, sick leave is issued for a larger number of days.

Read more about this in the article: “Extension of sick leave for pregnancy and childbirth.”

After being discharged from the maternity hospital, the woman submits documents to receive a one-time benefit. Moreover, the above type of financial assistance for the birth of a child in 2021 is provided to a woman in labor, regardless of her status: working, studying or unemployed.

From January 1, 2021, the one-time payment at the birth of a baby is approximately 17,479 rubles 73 kopecks.

To receive the benefit in question, you must submit the following documents:

- application from the mother or father for financial assistance;

- original certificate from the second parent who did not receive this payment;

- original certificate from the registry office;

- child's birth certificate;

- passports of both parents.

Keep in mind: the last two items must be presented in originals, but copies of these documents must be submitted.