Employer reporting

Natalya Vasilyeva

Certified Tax Advisor

Current as of November 27, 2019

At the end of the past year, employers are required to report to the Federal Tax Service on the income paid to their employees and the tax withheld from it. This is done by submitting a 2-NDFL certificate to the inspectorate at the place of registration. Let’s figure out whether there is a zero form of this document and whether it needs to be submitted to the Federal Tax Service.

No money

The accountant’s task is to timely fill out and submit reports taking into account all changes made to the legislation. Since amendments to the Tax Code are regularly issued, it is important for an accountant to promptly respond to their adoption.

If an organization (IP) was recently registered or for some reason did not conduct business, the accountant may have a question: is it necessary to show zero income in 2-NDFL to the tax authorities.

Zero reporting may result if no wages were paid to employees during the year or if the organization does not have a single employee on staff. Also, achieving zero reporting is possible if all the company’s employees, due to economic circumstances, were sent on vacation without pay for a long period.

Online magazine for accountants

Do I need a sample for filling out a zero report? As we have already found out, you do not need to submit zero 6-NDFL reporting, so you do not need a sample for filling it out. The preparation of reports for income payments arising during the reporting year follows fairly simple rules (letter of the Federal Tax Service of Russia dated February 18, 2016 No. BS-3-11/650). According to them, section 2 shows data from the last quarter of the reporting period:

- in specific figures, if payments and tax accrued on them take place;

- putting a zero instead of a digital value if there is no information about payments and tax accruals for these payments (clause 1.8 of the Procedure for filling out form 6-NDFL, approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/).

Section 1 is filled in with data that includes values corresponding to the entire reporting period.

What income should be taxed?

The Tax Code defines a list of income that is subject to taxation. These include:

- remuneration for work performed or services provided;

- interest and dividends received by an individual;

- income from property rental;

- income from the sale of property.

The list of income can be supplemented, as it is open.

The following income is not subject to personal income tax:

- financial assistance, the amount of which does not exceed 4,000 rubles per year;

- financial assistance paid at the birth of a child, if its amount does not exceed 50,000 rubles;

- maternity benefits;

- gifts worth no more than 4,000 rubles per year;

- compensation to workers for work in dangerous and harmful conditions;

- reimbursement of interest for using a loan for employees who took out a loan for the purchase or construction of housing.

It should be understood that income can only be an economic benefit that can be assessed. For example, if an employee is compensated for travel expenses on a business trip, this amount cannot be classified as income

Controversial situations

Deductions for children

It is not uncommon for a woman who returns to work after maternity leave to apply for a child benefit. In this case, the question arises from what period she has the right to deduct, from the beginning of the year or from the moment she started working.

According to the provisions of Articles 210 and 218 of the Tax Code of Russia, deductions are accrued in each month of the tax period if there is income that is taxed at a rate of 13%. However, eligibility for child credit does not depend on whether the employee received income in certain months or when the child credit claim was filed.

Taking this into account, a woman who returns from maternity leave in the middle of the year has the right to child deductions starting from the beginning of the year. Deductions will not be provided only if the income level exceeds 280 thousand rubles, as determined by Article 218 of the Tax Code of Russia.

Threat of tax audits

It should be understood that inspectors may be interested in an organization that does not operate for a long period of time or does not pay wages to employees. In this case, unscheduled desk and (or) on-site inspections cannot be ruled out. During them you will have to provide a number of documents.

Tax authorities have the right to request materials confirming the unprofitability of the activity, as a result of which a decision was made to suspend the company’s operations. Often, such audits check a large amount of information. Inspectors are trying to find out the reason for this development of the company. Sometimes the manager is asked to choose a different business development strategy, although this already goes beyond tax control.

Do I need to explain to inspectors the lack of income certificates?

There is an opinion among accountants that if you only have zero certificates in Form 2-NDFL, you must submit a special application at the end of the year. And it will display the reasons why the organization did not provide certificates in Form 2-NDFL and there were no payments in favor of individuals.

Please note: The Tax Code does not provide for the obligation to submit such reports, so there is no need to submit such statements to the tax authorities.

If you find an error, please select a piece of text and press Ctrl+Enter.

Certificate 2-NDFL is a document that is annually submitted to the tax authority by companies and entrepreneurs who have employees and act as tax agents. The role of a tax agent implies that the employer withholds personal income tax from payments to the employee and transfers it to the budget. All this information is indicated in the certificate and submitted to the tax authority. But what should a tax agent do when he did not make payments to his employees during the tax period? Whether in this case a zero 2-NDFL certificate is submitted, we will consider in this article.

Advice to managers on how to avoid problems in 2016-2017

There are several options on how to avoid problems with tax authorities and at the same time reduce the cost of paying contributions to the state.

- Reduce the director's salary and replace him with one of the company's founders. This method is good in that it is not necessary to submit 2-NDFL annually when using it, as well as to pay taxes on the income received by the director, because there is no basis for their accrual. Without an employment contract, it is impossible to determine the level of wages.

- If it is impossible to lay off a director, then you can send him on leave at your own expense, for example, with the wording “for family reasons.” It is only worth considering that submitting reports remains his direct responsibility. Inspectors may consider such leave to be fictitious if it continues for a long enough time. It is safest to take it for just a year.

- The most reliable method, but a little more troublesome, is to reduce the director’s working hours. In this case, you will need to submit reports in the form of 2-NDFL. However, the transition to part-time work and hourly wages must comply with regional earnings standards. The inspector needs to explain that the manager only needs a few hours a month to perform his duties. To document changes in income on which tax is calculated, a new employment contract must be concluded. It necessarily reflects changes in working conditions and remuneration. Additionally, it is necessary to maintain documentation of the time worked by the director.

If the company does not plan to expand in the near future and it is impossible to reduce the position of the manager, then the founders should choose the most reliable method - saving on salaries. In this case, a 2-NDFL certificate will be required, but there will be no suspicions or claims against the organization’s activities from the tax office.

Help 2-NDFL

Each organization and individual entrepreneur with employees must act as a tax agent and withhold tax from the employee’s paid income, and then transfer it to the budget. It should be remembered that there is a list of income exempt from personal income tax. These include various benefits (except sick leave) and compensation payments. That is, the following types of payments are not subject to taxation:

- in connection with dismissal, except for compensation for unused vacation;

- related to travel expenses.

But for certain travel expenses, restrictions are set on the possibility of being fully taken into account. For example, daily allowances of up to 700 rubles for trips within the Russian Federation and up to 2,500 rubles for trips abroad are exempt from taxation.

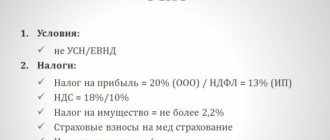

Depending on the status of the employee, the following tax rates are provided for him:

- for residents of the Russian Federation – 13% and 35%;

- for non-residents – 13%, 15% and 30%.

| 13% tax rate is used | 35% tax rate is used |

| For all income related to the performance of labor functions (including vacation pay) and paid by the employer For the income of entrepreneurs who pay personal income tax instead of income tax In case of receiving income from the sale of certain types of property Upon receipt of dividends | In case of payment of winnings, the amount of which exceeds 4000 rubles In case of obtaining economic benefits by saving on interest For interest income on deposits |

The procedure for submitting a 2-NDFL certificate to the tax office

The provision of form 2-NDFL by tax agents occurs in the following cases:

- The certificate is provided in accordance with clause 5 of Art. 226 of the Tax Code of the Russian Federation, when it is not possible to withhold tax.

- The certificate is a confirmation of the income of an individual and is provided in accordance with clause 2 of Art. 230 Tax Code of the Russian Federation.

By submitting a certificate to the tax authority, employers thereby inform about what income each employee has. The billing period indicated in the certificate is one year. The employer submits information for the past calendar year in the 2-NDFL certificate to the Federal Tax Service by April 1 of the year following the reporting year. If this deadline is violated, the employer will be held accountable.

Zero certificate 2-NDFL

In the course of a company’s business activities, situations may arise when, at the end of the tax period, a loss was incurred and payments to employees were simply not made. This forces employers to send their employees on leave without pay. In this case, the company accountant may have a question about the need to submit a zero certificate 2-NDLF for this period. If we turn to the current legislation and the opinion of tax authorities, we can conclude that if the employee has no income, the employer no longer acts as a tax agent, and therefore there is no need to submit a 2-NDFL certificate. However, in order to avoid misunderstandings, many accountants try to inform the tax authority about this by drawing up a zero certificate 2-NDFL and attaching an explanatory note to it. In the explanation, they describe the current situation and explain the reason for the lack of payments to employees.

Of course, organizations that do not operate for quite a long time and do not pay wages to employees attract the attention of the tax authorities. And this leads to unscheduled desk and field tax audits. In this case, the tax authorities will require the company to provide documents confirming the loss incurred in the course of its activities. This way they can determine how realistic the picture described by the taxpayer is.

Do I need to take it?

Tax reporting documentation will be considered zero if there are no tax indicators. The 2-NDFL certificate will be zero if the company has not made a single payment to an employee for 12 months of the calendar year, which would have become subject to personal income tax. This is possible when a business ceases to function or is in a difficult economic situation.

The situation when there is no object of taxation means that the tax is not paid, and therefore there is no need to report on it. 2-NDFL with zero income cannot be submitted, since this type of documentation does not exist. This form of reporting directly concerns employees, and if there are none, then there is no reason to draw up such a document.

If we assume that there are employees on the company’s staff, but they are not paid wages, that is, there is no income, the organization will also not pay tax, since no employer will do this at his own expense.

If a company does not file 2-NDFL reports, this means that no payments were made to employees. This fact leads tax authorities to believe that the company is unprofitable and will soon cease to exist. To confirm this fact, the tax service may request a number of documents.

How to fill out a 2-NDFL certificate

Help 2-NDFL is presented in five sections, which contain information:

- An organization that acts as a tax agent, withholds tax from the employee’s income and transfers it to the budget.

- About an individual from whose income personal income tax is withheld.

- About income paid to an individual, from which tax is withheld at different personal income tax rates.

- About deductions provided for various reasons to an individual.

- About the total amount of income of an individual and the total amount of personal income tax.

The procedure for filling out the 2-NDFL certificate is as follows:

| Help sections 2-NDFL | Filling procedure |

| First section | The year for which the certificate is being filled out, the serial number of the document, and the tax code for which the certificate is being submitted are indicated. Provide information about the organization (name, tax identification number). |

| Second section | Information about the individual to whom the company paid income. His TIN and status are indicated (for residents - 1, for non-residents - 2). Information about the employee's citizenship, country code and passport information is displayed. |

| Third section | Data on an individual's income is provided, broken down depending on the tax rate. Income for each month is reflected separately. |

| Fourth section | Indicate information about tax deductions of an individual. If he has the right to receive a property deduction, then the 2-NDFL certificate reflects information about the corresponding notification from the tax authority. |

| Fifth section | Generalized information about income, deductions provided and transferred to the personal income tax budget is reflected. |

Important! According to the requirements of the law, if the employer does not have the function of a tax agent (the employees were not paid salaries, there was no activity), the company does not have the obligation to generate and submit a 2-NDFL certificate to the Federal Tax Service.

Components of a document

Actually, the letter will consist of just one phrase. Everything else is a “mandatory program” accepted in business communication. These include:

- Drawing up a letter on a specialized company letterhead. Communication with the tax service must be conducted at a decent level. If official forms are not at hand or do not exist in nature, then the sender’s company details are simply listed at the top of the letter stating that there is no obligation to submit a 2-NDFL calculation. This way it will be possible to identify the message in the general flow of correspondence.

- The name and number of the specific division of the Federal Tax Service to which the paper is sent. It is very important that the company is registered within the area of responsibility of this section of the tax office.

- Signature of the head of the organization.

- If possible, print.

- Date the letter was written.

- If such a system is accepted, then the number of the message sent.

The letter can be registered in the outgoing correspondence journal.

Tax Agent Responsibility

Important! If the tax agent does not have the opportunity to withhold personal income tax from the income of employees, then they are obliged to inform the tax authority about this, as well as notify the employee himself. Failure to provide such information may result in fines for the company ranging from 200 to 500 rubles.

For the past calendar year, the 2-NDFL certificate is submitted to the tax authority by the employer before April 1 of the year following the reporting year. For example, certificates for 2021 must be submitted to the tax office by April 1, 2021. If this deadline is violated, the employer will be held accountable. For each document not submitted, he will face a fine of 200 rubles for the organization. Thus, if certificates are not provided in large quantities, the amount of the fine for the company can be impressive. As for officials, the fine for them ranges from 300 to 500 rubles.

What to do if the CEO is the only employee of the organization

The CEO can be an employee or a founder. If the only employee of the company is also its founder, then he will not need to send an information letter to the tax office.

The situation is more complicated if the director of the company is an employee. In this case, the company is obliged:

- conclude an employment contract;

- to pay salary;

- withhold income tax;

- transfer contributions to the Social Insurance Fund and the Pension Fund.

In such a situation, it is almost impossible to do without filing 2-NDFL.

Procedure for provision

All companies or individual entrepreneurs with employees are required to annually submit a report in form 2-NDFL to the tax authorities.

This report allows tax authorities to check how responsibly companies perform their role as tax agents for personal income tax. If the company has no more than ten employees, the law allows submitting a report to the inspectorate in paper format. If there are more than 10 employees, 2-NDFL can only be submitted to the tax control authorities electronically.

Despite the fact that a report should be submitted to the inspection once a year, if necessary, this certificate must be issued to a company employee upon request.

You must report to the fiscal authorities no later than April 1 at the place of registration of the company (or individual entrepreneur).

In the process of a company carrying out the types of activities for which it was created, situations often arise when, at the end of the period, not a profit was received, but a loss and no payments were made to employees at that time. Often, a crisis in a company forces employers to send employees on unpaid leave; of course, no payments are provided for them during this period. In addition to the difficult economic situation in the organization, the lack of income may be due to the start of activities when, after registration, the company has not yet reached the break-even level.

In these cases, accountants have a question: is it necessary to generate a zero 2-NDFL certificate? According to the tax authorities, in the absence of income, the company is not a tax agent for taxpayers and, therefore, there is no need to submit a certificate in Form 2-NDFL.

Thus, the legislation does not provide for the need for companies to submit zero 2-NDFL certificates. However, many accountants still generate this report at the end of the year, even in the absence of income, and submit it to the inspectorate along with an explanatory note about the reason for the lack of payments to employees.

Of course, a company that does not actually operate and does not pay wages to employees for a long period of time becomes the object of close attention of tax control authorities. And if such a situation arises, then the possibility of unscheduled desk and field inspections cannot be ruled out. First of all, fiscal control authorities will require documents confirming the receipt of a loss in the course of carrying out activities. This is how tax authorities are trying to determine how realistic the prospects for bankruptcy are for a company.

Instructions for filling

In order to correctly draw up a 2-NDFL certificate, you should use the information from tax registers for income tax accounting. Indicators of income received by taxpayers, as well as the amount of tax deductions, are reflected in the certificate in rubles and kopecks. While tax amounts must be indicated in full rubles according to the rules of mathematical rounding.

Form 2-NDFL can be downloaded from the link below:

Help 2-NDFL consists of five sections that disclose information:

- About the organization that withholds and transfers calculated amounts of tax to the budget, that is, about the tax agent;

- About the recipient of income;

- About the types of income subject to different income tax rates;

- On the amount of deductions to which an individual has a legal right;

- About the total amounts of income and accrued tax.

The certificate should be completed as follows:

In accordance with the requirements of tax legislation, if the company does not have the functions of a tax agent (employees are not paid wages, activities are not actually carried out), the company does not need to generate and submit a report in Form 2-NDFL to the tax control authorities.

Companies that are entrusted by the state with the obligation to perform the functions of a tax agent must certainly take a responsible approach to the issues of settlements with the budget. It is necessary to monitor every change in tax legislation and timely implement these innovations in practical life.

Tax object

To prepare reports in Form 2-NDFL, it is necessary to correctly calculate the tax. And for this, first of all, it is necessary to correctly determine the object of taxation for income tax.

The law recognizes as an object income that was received by an individual - a taxpayer. For residents of the Russian Federation, the object is any enrichment. For non-residents - only the one received from sources in Russia. In general, taxes should only be paid on those incomes that are subject to taxation. See “Calculating income tax.”

Responsibility

The tax agent’s inability to withhold the calculated tax may arise in a situation where the status of a tax resident has changed and a resident has become a non-resident.

In this regard, the personal income tax rate has changed accordingly. Also, situations often arise when an employee receives part of the income in kind or a material benefit arises in favor of the employee. Tax authorities must be notified of all cases of payment of income to employees without withholding the corresponding amounts of income tax. In addition to the tax control authorities, the employee himself must be notified.

Failure to provide information about the inability to withhold tax from an employee’s income threatens the company with a fine of 200 to 500 rubles. If the tax authorities independently discover this violation during an audit, the company will also have to pay a penalty for this tax.

All these situations in practice complicate the life of an accountant, thereby reducing the time it takes to transfer the reporting certificate to the inspectorate.

Commitment

There is no need to submit the 2nd calculation if there have been no accruals, with zero indicators, however, the fiscal authorities will be interested in a business entity that is registered but not working.

Companies that have no employees and therefore no income are subject to special control. In this case, an inspection is sent to the legal entity, which will review the accounts on the spot.

When reflecting losses, inspectors will check the legality of the formation, and therefore will make a decision to suspend the work of the business entity. In addition, tax authorities will offer a strategy to overcome the crisis situation and eliminate losses.

The obligation under 2 personal income tax is as follows:

- If a business entity does not notify the fiscal authorities on time about the impossibility of withholding income tax, this threatens with sanctions in favor of the legal entity in the amount of 200-500 rubles. In addition, if this error is detected by the Tax Inspectorate, a penalty will be charged;

- for errors in the certificate, the responsible person will be punished for each incorrect figure in the amount of 500 rubles. However, if an employee independently discovers deviations and submits a “clarification,” no punishment will follow.