On the territory of the Russian Federation, all kinds of accessible economic activities that entrepreneurs, registered enterprises, as well as organizations have the right to freely and legally engage in are established according to the All-Russian Classifier of Types of Economic Activities (hereinafter we will call it OKVED), enshrined in the resolution of the Civil Code of the Russian Federation on standardization and metrology number 454-st, dated November 6, 2001. Currently, two versions of the classifier operate in parallel with each other - the OK 029-2001 edition and the newer OK 029-2007 version. The first document is suitable for use by legal entities, entrepreneurs and peasant farms. It is this that we will talk about further, since it is used to correctly establish the types of activities when registering as individual entrepreneurs.

What are OKVED codes and what are they intended for?

The abbreviation OKVED stands for All-Russian Classifier of Types of Economic Activities.

OKVED is a collection of statistical codes assigned to the types of activities that business entities are allowed to conduct in our country for the purpose of making a profit. In 2021, only one edition of the classifier is relevant - OKVED-2 (or OK 029-2014 [NACE rev. 2]). Classifiers of earlier editions of OKVED-1 (or OK 029-2001 [NACE rev. 1]) and OKVED-2007 (or OK 029-2007 [NACE rev. 1.1]) have ceased to be valid since the beginning of 2021.

Why are OKVED codes needed:

- Based on them, the Social Insurance Fund determines the tariff for individual entrepreneurs to calculate insurance premiums against industrial accidents and occupational diseases. To assign a tariff, organizations submit an application and a calculation certificate confirming their main type of activity.

- The codes are important for the ability to use a special tax regime - simplified tax system, unified agricultural tax, UTII, which, in turn, affects the amount of tax obligations and the volume of reporting forms submitted to controllers.

- The right to take advantage of reduced rates of insurance premiums for compulsory insurance depends on the selected OKVED codes and the share of income from the main activity. However, this year, for most categories of insurers, including individual entrepreneurs, the possibility of applying reduced rates has been abolished.

Main activity according to OKVED

Employers, before April 15 of the year following the reporting year, must send documents to the Social Insurance Fund that confirm the main type of activity, in accordance with Order of the Ministry of Health and Social Development No. 55 of January 31, 2006. LLCs provide this confirmation once a year, and individual entrepreneurs only if the main activity has changed.

The main type of activity is the one in which the profit received is greater in comparison with the income from other activities over the past year.

How codes for entrepreneurial activity are selected for individual entrepreneurs

So, OKVED codes for individual entrepreneurs in 2021 are selected from OKVED-2.

To begin with, a potential businessman determines the area in which he wants to work. For this purpose, the classifier contains 21 sections. The most popular sections among individual entrepreneurs are related to:

- with retail trade;

- repair and construction;

- household services;

- freight and passenger transportation;

- repair and tailoring, etc.

IMPORTANT! There are areas in which a sole proprietor is not entitled to operate due to current legal provisions. These are, for example, activities related to the production of alcohol, medicines, weapons and military equipment, pyrotechnic products, as well as space, security activities, etc. That is, OKVED codes for individual entrepreneurs in 2021 tied to the indicated and some other areas of activity year are prohibited.

In each section of the OKVED-2 classifier there is a gradation into classes (two symbols), subclasses (three symbols), groups (four symbols), subgroups (five symbols) and then the type of activity is specified (six symbols). This is how the choice occurs from the general to the specific.

After the choice is made, the individual will have to go through the registration procedure as an individual entrepreneur, which we will discuss in more detail below.

Popular questions

Due to the lack of knowledge and experience, novice entrepreneurs have a lot of questions about OKVED: how not to “miscalculate”, what the codes influence, and what errors can cause when choosing them.

Maximum number of codes you can choose

As much as you like - this is speaking from the point of view of the law. In forms P11001 and P21001, for example, as many as 57 fields are provided for listing types of activities. And if this is not enough, you can print several such sheets. But in practice, it is better to be guided by basic common sense: rarely does any business need more than 20 codes - perhaps large corporations, but certainly not individual entrepreneurs.

Is it possible to take codes from different sections/groups?

Again, there are no clear restrictions. The new directory contains more than 1600 codes. Which, naturally, are combined depending on what range of services you offer and the specifics of the company.

Example: if your business is the production of ready-made meals for sale, it is predictable that you will also indicate delivery as additional services.

However, it is worth adhering to elementary logic. Returning to the example given above, it would be at least strange to indicate codes related to legal services in additional types of activities.

Do the selected codes affect the amount of insurance premiums?

There is Law No. FZ-212, Article 58 of which provides benefits for entrepreneurs engaged in production or providing social services. For example, the same release of products or the organization of educational clubs for children falls into this category. A complete list of preferential activities can be found in Art. 427 of the Tax Code of the Russian Federation.

To take advantage of the “discount”, you must receive at least 70% of your total income from those areas of work that are included in the list of preferential ones. That is, it is not enough to simply indicate the appropriate OKVED codes in the documents - tax authorities take into account the actual activities of the individual entrepreneur.

And also the main code affects how much you will have to pay for insurance of employees against accidents, work injuries, and occupational diseases. The higher the risk, the correspondingly larger the size of these deductions.

Does the tax system used by an individual entrepreneur matter for choosing OKVED?

Undoubtedly. For example, the selected codes directly determine whether an entrepreneur will be able to work on UTII. This nuance is determined by the Tax Code of the Russian Federation. Chapter 26.3 (Article 346.26) contains a complete list of areas in which imputation can be applied. These are mainly repair services, transportation, real estate rental, as well as everything related to retail trade.

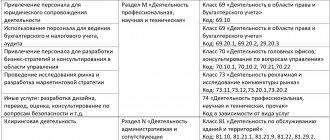

The second point is the simplified tax system. Some OKVEDs impose a ban on the use of “simplified”. In particular, this applies to the following codes:

- 64.92: Carrying out pawnshop activities;

- 92.11: Casino activities;

- 92.12: Activities of slot machine halls;

- 12.00: Production of tobacco products;

- 29.10: Production of motor vehicles.

Please note: for tax authorities, what is primarily important is not the codes, but the activities that you actually engage in. Of course, they are unlikely to come to you with a sudden inspection, but inconsistencies will be discovered when you submit a declaration (usually compliance is checked by the line where the business transactions of the individual entrepreneur are listed).

Inconsistency between OKVED codes and actual activities may result in additional charges of insurance premiums

How many OKVED codes can be specified when registering an individual entrepreneur

The future individual entrepreneur must fill out an application for registration of a citizen as an individual entrepreneur using form P21001. The types of activities that he intends to carry out are prescribed by OKVED codes in sheet A.

The entrepreneur needs to decide on the main direction of the business and write down its code in section 1 of sheet A. Section 2 includes additional codes - there can be as many of them as you like, the legislation does not limit the entrepreneur in this matter. That is, the individual entrepreneur has the right to indicate 1 code (this is the minimum), and then, if desired, it can be 5 codes, or 20, or 30... If all the desired codes do not fit on one sheet, several are filled in (clauses 2.16.2, 14.11 Requirements for the preparation of documents submitted by business entities during registration, approved by Order of the Federal Tax Service of Russia dated January 25, 2012 No. ММВ-7-6 / [email protected] ).

NOTE! The requirements for indicating OKVED are such that each code must consist of at least 4 digits. Thus, not only the class and subclass are specified, but also at least a group of activities. For example, if an entrepreneur wants to engage in retail trade, then using OKVED codes he will register what exactly he intends to sell and how the trade will be carried out. For example, OKVED code 47.51 means that an individual entrepreneur will retail textile products in specialized stores, and 47.81 means that retail trade in food products, drinks and tobacco products will be carried out in non-stationary retail outlets and markets.

Features of the situation

For entrepreneurs on the simplified tax system

Correctly and competently choosing statistics codes for those entrepreneurs who are on the simplified tax system is fundamentally important, since there are types of activities that are categorically prohibited from engaging in, relying on minimum tax rates.

Thus, tax structures will not allow an entrepreneur to transition to a simplified taxation system if codes were introduced in the original version that presuppose that a citizen is engaged in the following areas of activity:

- insurance;

- notarial activity and legal practice;

- activities related to the maintenance and organization of pawnshops and others.

The list of types of such activities is exhaustive, but not very large. It is recommended that before submitting documents to change the tax regime, you study it in full to exclude the possibility of refusal to make the transition.

The tax inspectorate studies all information about OKVED codes for entrepreneurs in the event of an application to switch to the simplified tax system thoroughly and personally. There is no need to provide any supporting or refuting documents, since all the data is already included in the system.

In export-import activities, many documents are used. Find out when a certificate of supporting documents is not provided. Dismissal of a part-time worker at the initiative of the employer is not particularly difficult. Instructions here.

How can an individual entrepreneur withdraw money from his current account? Read the article.

Is it possible to make changes to OKVED IP - addition, change

Often, in the process of doing business, an entrepreneur begins to realize that some direction has become uninteresting to him, for example, due to its unprofitability, and some, on the contrary, he is ready to try in order to get maximum profit. To do this, you will need to close one type of activity and open a new one. Is it possible to do this?

Yes, it's possible. An entrepreneur can repurpose his business at any time.

However, the following question arises: what to do if, during registration, the entrepreneur did not declare the required code that determines his new direction? In this case, you need to add the OKVED code for the individual entrepreneur. We'll talk about how to do this correctly in the next section.

What is an individual entrepreneur allowed to do?

Conventionally, permitted types of activities can be divided into 3 groups:

- Not requiring any permits or licenses.

- Requiring approval or permission from individual regulatory authorities.

- Requiring licenses.

Activities that do not require any permits can be carried out immediately after registration. At the same time, there is no need to obtain a license or go around authorities to obtain approval. You can start working right away.

Such activities include, for example, the provision of personal services (except for hairdressing and cosmetology services), creative and publishing activities, intermediary, legal and consulting services, rental and rental services, wholesale trade of goods, with the exception of those goods that are limited in circulation or prohibited, advertising and transportation (except for freight over 3.5 tons).

In relation to the implementation of certain types of activities, the consent of individual authorities or obtaining a special permit - license may be required. See below for more details.

How to add OKVED for individual entrepreneurs to registration documents

An individual entrepreneur adds OKVED by submitting an application to amend the information about an individual entrepreneur contained in the Unified State Register of Individual Entrepreneurs, according to form P24001. In this application, in addition to the mandatory title page and sheet G, page 1 of sheet E is filled out, which contains the codes to be included in the Unified State Register of Individual Entrepreneurs.

When changing the OKVED ID of an individual entrepreneur, you will need to fill out not only page 1 of sheet E, but also page 2. It reflects the codes that the businessman asks to be excluded from the Unified State Register of Entrepreneurs.

You do not need to fill out the remaining sheets of the form if nothing else changes.

The application must be printed and the pages numbered. Then the last name, first name, and patronymic of the businessman are manually written down on sheet F. The document is signed only at the time of its submission (if it is presented to the registration authority in person) - this should not be done in advance.

Learn about the order in which organizations change and add new activities in this article .

Submission of documents

You can provide documents in person or remotely:

- directly to the inspection - in person or through a representative with a notarized power of attorney

- to the multifunctional center - in person or through a representative with a notarized power of attorney

- by mail with declared value and description of the contents

Within the territory of Moscow, documents can also be sent and received via DHL Express and Pony Express.

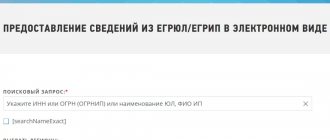

- electronic. Go Submit documents using the service: “Submission of electronic documents for state registration”

When generating an electronic package, document images must be scanned taking into account certain technical requirements and certified by your electronic digital signature (DS) or by a notary.

Go You can receive an electronic signature at a Certification Center accredited by the Ministry of Telecom and Mass Communications of Russia.

Attention! The electronic signature key must be valid at the time of signing the electronic document and on the day the documents are sent to the tax authority.

Results

When starting a business, an entrepreneur usually assumes what he will do. Each area of his business must be recorded in the Unified State Register of Individual Entrepreneurs using OKVED codes. Their choice must be approached with all seriousness, because they will influence the rate of insurance premiums for accidents and occupational diseases, the possibility of using one or another special regime, the volume of reports submitted, etc.

If a businessman wants to repurpose his activity, he has the right to report the addition or replacement of codes to the registration authority at any time.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What if you don't add codes?

OKVED codes not only inform counterparties and the tax authorities about the specialization of the business activities of your LLC or individual entrepreneur.

Based on the main code, the rate of insurance contributions for employees is calculated. If the code is entered incorrectly, you may receive a fine from the tax office and an increased percentage of deductions from social insurance.

Banks, based on OKVED, monitor the receipt and expenditure of funds from the enterprise’s account. In case of unusual transactions, the bank has the right to block the current account in accordance with Law 115-FZ.

If an LLC or individual entrepreneur is under a special taxation regime: simplified taxation system, UTII or patent, then adding OKVED codes should be approached in more detail. Incorrectly added OKVED code may lead to a change in the taxation regime.