Land use in the country is regulated by land legislation, and the conditions for calculating the tax for land use are dictated by the Tax Code of the Russian Federation. But, since this tax is local, the Tax Code of the Russian Federation gives general interpretations, establishing tax rates for land tax and defining groups of payers, as well as the conditions for providing benefits. Funds from the payment of the tax go to the budgets of municipalities, and therefore regions are given the right, based on territorial characteristics, to designate the rates, terms and conditions for transferring payments. Our publication will answer the questions of who sets land tax rates and how to determine the tax rate for land tax.

Land tax rate for individuals and legal entities

Individuals pay the fee on a general basis. It is calculated based on the cadastral value of the property, which is indicated in the state register. This value is then multiplied by the coefficient established in a particular region.

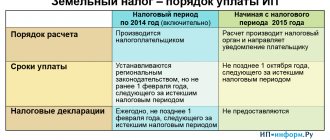

For enterprises and entrepreneurs, it is the same as for individuals and cannot be more than the established value if the object is used for agricultural needs or for housing construction. Other areas are taxed at 1.5%. Legal entities independently draw up declarations and make payments. The tax period for this duty is one year.

Registration of a real estate property on the cadastral register: land plot, house. How to get USRN?

Calculation of ZN

The amount of tax payers for individual payers is determined by the tax authorities, and organizations evaluate the tax payer independently. To check the correctness of the ZN, you can calculate it yourself using the formula:

N=K*S*M/12, where:

- N – land tax, rub.;

- K is the cadastral value of the land plot as of January 1, rubles;

- C — tax rate, %;

- M - time of land ownership (month).

In addition, when calculating the salary, the share of the right to the land and the available benefits must be taken into account.

When calculating ZN, the value of KS can be found on the Internet on the Rosreestr website in the “Public cadastral map” section. To do this, you must indicate the site number or its address.

A table will be issued showing the area of the land plot and its cadastral value.

In accordance with the Tax Code (Article 394), the tax rate should be no more than 0.3% for plots used:

- for agricultural production;

- for dwellings;

- for subsidiary farming, gardening, dacha farming;

- for the defense or security of the country.

The tax rate for memory for other purposes should not exceed 1.5%.

Deadline for payment of land tax

Individuals and entrepreneurs are required to transfer funds before December 1 of the current year. Please remember that payments are made for the past year. This year, reporting persons will pay for 2021. A month before the specified date, they receive written notifications from the supervisory authority, which indicate the amount of payment and have a receipt for payment. You can do it using online services or through the cash desk of any bank branch.

For legal entities, a different time frame is established, since they do not receive written notifications, but they independently draw up a declaration and transfer funds. Organizations make advance payments once a quarter, which include the amount of tax. At the end of April, July and October, companies and firms pay them for the current year. The last quarter of the current period is paid until February of the following year.

Land tax rates for household plots and summer cottages in the Moscow region

Below, in tabular form, are tax rates for plots of land intended for running personal subsidiary plots (garden plots), summer cottage farming, gardening and vegetable gardening in urban districts and districts of the Moscow region. These rates have been in effect since 2014.

Table of land tax rates by districts of the Moscow region

| Municipal district of the Moscow region | Land tax rates | |

| 1. | Volokolamsk district | 0,3% |

| 2. | Voskresensky district | 0,3% |

| 3. | Dmitrovsky district | 0,3% |

| 4. | Egoryevsky district | 0,3% |

| 5. | Zaraisky district | 0,3% |

| 6. | Istra district | 0,3% |

| 7. | Kashirsky district | 0,2% — 0,3% |

| 8. | Klinsky district | 0,15% — 0,3% |

| 9. | Kolomna district | 0,3% |

| 10. | Krasnogorsk district | 0,2% — 0,3% |

| 11. | Leninsky district | 0,15% — 0,3% |

| 12. | Lotoshinsky district | 0,3% |

| 13. | Lukhovitsky district | 0,3% |

| 14. | Lyubertsy district | 0,2% — 0,3% |

| 15. | Mozhaisk district | 0,3% |

| 16. | Mytishchi district | 0,15% |

| 17. | Naro-Fominsk district | 0,3% |

| 18. | Noginsky district | 0,2% — 0,3% |

| 19. | Odintsovskii district | 0,1% — 0,3% |

| 20. | Orekhovo-Zuevsky district | 0,15% — 0,3% |

| 21. | Pavlovo-Posadsky district | 0,1% — 0,3% |

| 22. | Podolsky district | 0,2% — 0,3% |

| 23. | Pushkinsky district | 0,1% — 0,3% |

| 24. | Ramensky district | 0,07% — 0,3% |

| 25. | Ruzsky district | 0,2% — 0,3% |

| 26. | Serebryano-Prudsky district | 0,3% |

| 27. | Sergiev Posad district | 0,1% — 0,3% |

| 28. | Serpukhov district | 0,15% — 0,3% |

| 29. | Solnechnogorsk district | 0,15% — 0,3% |

| 30. | Stupinsky district | 0,2% — 0,3% |

| 31. | Taldomsky district | 0,3% |

| 32. | Chekhovsky district | 0,08% — 0,3% |

| 33. | Shatura district | 0,3% |

| 34. | Shakhovskoy district | 0,3% |

| 35. | Schelkovsky district | 0,2% — 0,3% |

Land tax rates in cities of regional subordination and urban districts of the Moscow region

| Urban district (city of regional subordination) of the Moscow region | Land tax rates | |

| 1. | Balashikha | 0,3% |

| 2. | Bronnitsy | 0,3% |

| 3. | Dzerzhinsky | 0,3% |

| 4. | Dolgoprudny | 0,2% — 0,25% |

| 5. | Domodedovo | 0,25% — 0,3% |

| 6. | Dubna | 0,3% |

| 7. | Zhukovsky | 0,3% |

| 8. | Zvenigorod | 0,3% |

| 9. | Ivanteevka | 0,2% — 0,25% |

| 10. | Klimovsk | 0,2% — 0,3% |

| 11. | Kolomna | 0,13% — 0,2% |

| 12. | Korolev | 0,3% |

| 13. | Kotelniki | 0,3% |

| 14. | Krasnoarmeysk | 0,3% |

| 15. | Lobnya | 0,3% |

| 16. | Losino-Petrovsky | 0,3% |

| 17. | Lytkarino | 0,3% |

| 18. | Lakes | 0,3% |

| 19. | Orekhovo-Zuevo | 0,3% |

| 20. | Podolsk | 0,3% |

| 21. | Protvino | 0,2% |

| 22. | Pushchino | 0,3% |

| 23. | Reutov | n/a |

| 24. | Roshal | 0,3% |

| 25. | Serpukhov | 0,3% |

| 26. | Fryazino | 0,3% |

| 27. | Khimki | 0,2% |

| 28. | Chernogolovka | 0,3% |

| 29. | Elektrogorsk | 0,3% |

| 30. | Elektrostal | 0,3% |

Mobile version about land taxes

Tax on the sale of land

Its value is 13% of the value of the property being sold. It is paid if the period of ownership is less than 5 years. You can sell land before this period without charging a duty when it:

- privatized;

- became the property under a maintenance agreement with a dependent;

- received under a gift agreement or inheritance from close relatives.

In these cases, the tenure period is reduced to 3 years. If you make a sale before this period, you will need to make mandatory contributions to the state treasury.

The tax base

The main changes affected the method of calculation. Previously, the tax amount was determined based on the book value of the site. From the beginning of 2021, the amount that a legal entity must pay is calculated based on the cadastral value.

The changes did not affect all regions of the country. The new system was introduced in only 29 regions. The government decided to make a relaxation so that the innovation does not become a shock for companies.

Firstly, the system will be tested in pilot regions. The results will be carefully studied. After this, the calculations will be adjusted if the situation requires it.

Secondly, a differentiated rate has been introduced. It will increase gradually. It is planned that the tax increase will not occur immediately, but will take approximately 5 years. Each year the amount will increase by approximately 20%; companies will begin paying land tax in full by 2021.

It is planned that the funds received from paying the tax will remain in the subject. They will be used to develop the region's infrastructure.

Most of the questions taxpayers have are the determination of the cadastral value of a plot. You can find it out on the Rosreestr website, or by sending a corresponding request to the territorial office. The applicant will receive a certificate.

Land tax for individuals and legal entities

Any person who owns a land plot is obliged to pay contributions to the budget for this area. The rates applied to owners are the same, regardless of whether they are private users, entrepreneurs or organizations.

The only difference is the timing of payment and the procedure for completing documentation. Firms and companies independently fill out declarations and submit reports to the supervisory authority. Individuals only need to make contributions on time according to the statements that come from the supervisory service.

Results

To correctly calculate land tax, you must carefully study local legislation. It is this that determines the specific tax rates applicable in the territory of the exemption, and the deadlines for payment by legal entities.

Individuals do not need to calculate taxes on their own. They pay it based on tax notices. However, if there are benefits, they must be reported to the inspectorate.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated March 26, 2018 No. ММВ-7-21/167

- Order of the Federal Tax Service of Russia dated November 14, 2017 No. ММВ-7-21/897

- Letter of the Federal Tax Service of Russia dated May 23, 2018 No. BS-4-21/9823

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

New changes in land tax

Interesting fact! This year, a change regarding the procedure for calculating and calculating this duty comes into force. It will be calculated based on the cadastral value, which is equal to the market price.

This will hit citizens’ pockets and affect the amount of deductions, significantly increasing them. Previously, the amount of deductions was determined based on the balance sheet valuation, which is why their size was so low.

The increase will occur gradually and will stretch over several stages. Starting this year, the payment amount will increase by 1/5 and will reach the required value no earlier than by 2022. This will allow the country’s citizens to comfortably adapt to the new amounts that will have to be transferred to the state budget. These changes will affect all regions of the Russian Federation.

Corporate bonds 2021: market, profitability and taxation

All funds of the owners will remain in local budgets, thereby forming them. This will create a new source of funding that will help improve infrastructure. Currently, this issue is extremely relevant, since after the crisis the situation in some regions remains extremely deplorable and the budget is experiencing an acute shortage of funds.

Cadastral value of plots

Starting from 2021, the calculation of taxation is carried out according to the new tax base, which is used as the cadastral value (CV) of the site. Sometimes, to assess the CV of land in the cadastral sector, the average specific indicator of the cadastral value of 1 m² of land (UPKS) is used.

In Moscow, Government Decree No. 791-PP at the end of 2021 approved the results of the assessment of the city’s lands.

At the same time, the CS for each cadastral quarter depends on its location and the permitted use of the land plot. At the same time, in the capital, the UPCS indicator can reach 100,000 rubles/m².

In 2013, a revaluation of land assets in the Moscow region was carried out. At the same time, the cost of storage

has grown significantly. The results of the cadastral assessment of lands for agricultural purposes, dacha (horticultural) use, and lands of settlements were approved by orders of the Ministry of Ecology of the Moscow Region (No. 563-RM, 564-RM and 566-RM, respectively).

At the same time, the results were divided by municipal districts and cadastral sectors. In addition, the cadastral value of land in each sector was divided depending on the type of land use.

At the same time, for the use of land in populated areas for dachas and gardening farms, the range of UPKS ranges from 133 rubles/m² (Serebryanye Prudy) to 2580 rubles/m² (in Podolsk). In Klin this UPKS is 512 rubles/m², and in Zaraysk - 597 rubles/m².

At the same time, permission to use land for the construction of multi-storey buildings raises the UCC in Podolsk to almost 7,600 rubles/m², and in Serebryanye Prudy – to 2,700 rubles/m².

In the cities of the nearest Moscow region, such UPKS reaches 10,000 rubles/m².

How to calculate land tax

The formula for determining the amount of deductions is as follows:

Cadastral value (per 1 m²) * object area (m²) * coefficient (%)

This is a standard calculation option that does not take into account all kinds of deductions and benefits. If there are any, they will be aimed at reducing the base, which will affect the reduction in the amount of mandatory contributions.

For owners who took possession in the middle or end of the calendar year, the amount received will be divided by 12 months and multiplied by the actual number of months of ownership of the plot. Shared ownership implies distribution of payment according to the size of the share in use. Those who have ¼ of the area will have to pay a quarter of the total amount.

You can find out the cadastral value by contacting the Cadastral Chamber or the Rose Register. It contains all the data about the object, its area, location, individual number and cost used in determining the amount of the fee. You can also find it out using online services that are available on various websites.

Individual entrepreneurs, along with private individuals, are exempt from independent calculations. They receive a written notice containing information and the exact amount to be paid. Organizations make the calculations themselves and then make transfers.

Cadastral registration of land and houses

It must be remembered that a plot of land and a house built on it are different real estate objects. Each of them must be registered in the cadastral register, and their cost is determined separately. Also, a separate statement of the owner’s rights is issued for each object. Taxation of real estate also varies.

For example, the land tax in 2021 for pensioners does not provide any benefits other than those established by local authorities. As indicated, in the Ramensky municipal district it was reduced by 20%. Since 2015, such a benefit has been provided only for one real estate property, at the owner’s choice.

Land tax benefits

Not only certain categories of citizens are exempt from payment, but also, in some cases, organizations and entrepreneurs. Individuals who have benefits include:

- Heroes of the Soviet Union and Russia, as well as those awarded the Order of Glory;

- disabled people of 1st and 2nd degree, established before 2004, disabled people of 3rd degree;

- nuclear weapons testers and man-made disaster liquidators;

- liquidators of the accident at the Chernobyl nuclear power plant;

- participants in the Great Patriotic War and other military operations.

State support for small and medium-sized businesses: what can entrepreneurs expect?

The listed categories can count on a deduction that reduces the taxable base by 10,000 rubles. Other relaxations are established by regional authorities. These are federal benefits established by the state.

Interesting fact! Each region has the right to independently expand the list. In some regions, pensioners are exempt from paying; exemptions also apply to large families, labor veterans and other segments of the population. To clarify information on benefits, you must contact the inspectorate at the place of registration of the payer.

Entrepreneurs carrying out agricultural activities on a plot of land for the purpose of making a profit can count on exemption from the duty if they own the property under a lease agreement. In this case, the responsibility for payment falls on the shoulders of the owner.

Organizations that own land on which a forest, reservoir or nature reserve is located are completely exempt from this burden. In other cases, they are required to calculate and transfer funds to the supervisory inspection on a general basis.

Tax rate in Moscow region

The tax rate specified in the Tax Code is the highest threshold.

Therefore, local authorities for one reason or another may reduce this rate. For example, local authorities, by their decision, can reduce the tax rate for pensioners and large families.

For household plots and summer cottages in the Moscow region, different rates apply in different areas.

Of the 35 districts of the Moscow Region, 16 have maximum rates of 0.3%. In one (Mytishchi) district the rate for all gardeners was reduced to 0.15%. In other areas, NS varies from a minimum value to 0.3%.

This minimum ranges from 0.07% (in the Ramensky district) to 0.2% (in the Kashira, Lyubertsy, Noginsky and Ruzsky districts).