What is gratuitous receipt?

The considered method of acquiring a fixed asset relieves the recipient from paying the cost of the asset to the supplier.

The procedure for accepting and transferring a gift is regulated by a donation agreement, which is signed by two parties - the first is called the donor, the second is called the donee. In this case, the donor, under a contractual agreement, has the obligation to transfer the asset to the second party, which, in turn, does not bear any obligations. The recipient has the right to agree or refuse the gift. As a rule, a gift transaction is used to transfer assets by the founders of an organization. But it can also occur between other persons. The type of source of donation of fixed assets affects accounting and the type of transactions reflected.

How to account for a gratuitous transfer for income tax purposes

Expenses in the form of the cost of gratuitously transferred property (work, services, property rights) and expenses that are associated with such a transfer cannot be taken into account when calculating income tax (clause 16 of Article 270 of the Tax Code of the Russian Federation).

How can the transferor take into account the gratuitous transfer of property for income tax purposes?

When transferring property free of charge, the value of the transferred property and the costs associated with such transfer should not be taken into account either in your income or in your income tax expenses (clause 16 of Article 270 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated October 27, 2015 N 03 -07-11/61618).

Please note that there is widespread advice that you can include in your income tax expenses the amount of VAT that is accrued in connection with the gratuitous transfer. Such advice is risky, since, according to the Russian Ministry of Finance, the amount of accrued VAT is not taken into account in expenses on the basis of clause 16 of Art. 270 of the Tax Code of the Russian Federation (Letter of the Ministry of Finance of Russia dated March 11, 2010 N 03-03-06/1/123).

If you transfer a fixed asset free of charge, then you do not need to restore the depreciation premium on it (Letter of the Ministry of Finance of Russia dated September 28, 2012 N 03-03-06/1/510).

Accounting

If a company receives an asset free of charge, then, first of all, the possibility of accounting for it as a depreciable fixed asset is determined. If this is possible, that is, the three conditions listed above are met, then the next question arises - what amount to take for the initial cost of this property.

Important! If the price of a fixed asset in the current market value is within the limit - the cost is less than 40 thousand rubles. (the company sets it independently within 40 thousand rubles), then the asset can be classified as an inventory without the obligation of depreciation charges.

Formation of initial cost

The capitalization of a gratuitously received asset is carried out at the market value determined at the moment.

This cost indicator must be calculated on the day the donated object is accepted for accounting as an investment in non-current assets.

What is meant by the current market value of a gratuitously received fixed asset according to the law? According to the official definition, this is the amount of money that can be obtained from the sale of an accepted fixed asset on the day of its receipt.

The 29th paragraph of the Methodological Instructions determines the procedure for determining this indicator. According to the third paragraph of this paragraph, when establishing the market value you can:

- apply information on prices for similar fixed assets - such information can be confirmed by documents from manufacturers;

- analyze statistical indicators - you can get them from Rosstat, inspections, the media, special literature, this information can also be documented;

- resort to the services of experts, appraisers, who, after inspecting the fixed asset, determine its value and write a conclusion.

Important! The calculated cost indicator in the form of a market price must be supported by paper confirmation.

The initial cost of a gratuitously received asset can be formed by the following components:

- Market price.

- Transport expenses.

- Payment for the services of experts and other consultants.

- Payment for obtaining statistical information to assess the cost of the OS.

- Costs for installation, adjustment and assembly.

The sum of all the listed indicators shows the cost at which fixed assets received free of charge must be capitalized.

What documents should I prepare?

When transferring a fixed asset free of charge, you must prepare the following documents:

- Donation agreement – defines the terms and conditions for the acceptance and transfer of fixed assets, while indicating the gratuitousness of the transaction.

- Acceptance and transfer certificate – confirms the fact of transfer of fixed assets to the organization free of charge. As a rule, it is drawn up using standard forms: OS-1a for structures, OS-1b for group assets, OS-1 for other single fixed assets.

The accountant, on the basis of the transfer deed, reflects the necessary entries in the accounting records - postings.

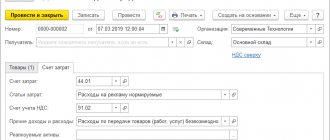

Postings upon gratuitous receipt of OS

The gratuitous receipt of a fixed asset is reflected by an entry in the accounting accounts if there is a transfer form of the act and paper indicating the market price of the asset.

All fixed assets received by enterprises are accounted for in account 01. Debit shows the cost of assets on the balance sheet, credit shows the cost of disposed fixed assets.

The amount of all expenses for the acquisition of an asset is collected in the intermediate account 08, where all investments in the object are reflected, after which it is transferred to the debit of account 01 in one transaction.

Depending on the type of costs, account 08 debit corresponds with the credit of the corresponding accounting accounts:

- 83 – applies when the OS is donated by the founder of the company;

- 98 – applies when OS is donated by another person other than the founder;

- 60 or 76 – used to account for costs of delivery, assembly, installation, consulting services;

- 20, 44, 69, 70, etc. – to account for expenses for delivery and installation carried out on your own.

Fixed assets received free of charge are accounted for in different entries depending on the source of the donation:

- the asset is accounted for as part of additional capital on account 83 if it was received from the founder of the company;

the asset is included in future income in account 98 if it came from any other person.

Important! During the operation and depreciation of the fixed asset used, its cost is consistently included in current income from the 98th account to the 91st.

How to capitalize from the founder of the company

Accounting entries for the free receipt of fixed assets from the founder of the company:

| Operation | Debit | Credit |

| An asset was received free of charge from the founder - the posting is made to the amount of the market price, documented | 08 | 83 |

| Accounting for other expenses related to the acquisition of an asset is reflected (delivery, assembly, services of consultants, experts) | 08 | 60 |

| The costs of obtaining OS for delivery, installation, adjustment, start-up, carried out in-house, are taken into account | 08 | 20 (23,25,26,69, 44, 70) |

| The asset is capitalized as a fixed asset | 01 | 08 |

| Depreciation deduction for gratuitously received fixed assets is shown | 02 | 20 (44) |

Comparable market price method

The most common way to determine the market value of property is the comparable market prices method. Firstly, it is easy to understand and easy to use. Secondly, in the list of methods used in determining income in transactions between related parties, this method is named priority (clauses 1 and 3 of Article 105.7 of the Tax Code of the Russian Federation). To compare the average market value of a particular property, the company has the right to use the Internet or other media.

The advantage is that the company will not have significant financial and labor costs to determine the value of the property. An important condition for a company to use this method is the mandatory availability of publicly available information on prices for similar goods (Clause 7, Article 105.7 of the Tax Code of the Russian Federation). That is, in essence, the method implies that the necessary information already exists and the taxpayer can only compare it.

In this regard, companies often use publicly available data from information and pricing agencies, specialized property valuation sites, as well as advertising information on the sale of similar goods.

The downside is that the courts are against determining the market price based on data from Internet sites, magazines and advertising brochures. Arbitrators view such confirmations negatively. They emphasize that it is impossible to determine from the magazines on the basis of what data and from what sources the prices for goods are indicated in them. Accordingly, it is impossible to conclude whether they belong to official sources (Resolutions of the FAS Central dated 02/17/2010 N A54-2656/2009-С13, Ural dated 05/12/2011 N Ф09-1938/11-С3, dated 07/15/2010 N A76- 18340/2009-47-163/13 (remained in force by the Determination of the Supreme Arbitration Court of the Russian Federation dated November 3, 2010 N VAS-15026/10) districts).

Some courts do not accept such data as confirmation of the marketability of the price, since the information posted in advertising publications is indicated without taking into account the demand for homogeneous goods in comparable economic conditions (Resolution of the Federal Antimonopoly Service of the Ural District dated July 26, 2011 N A07-13869/2010 (upheld in force by the Determination of the Supreme Arbitration Court of the Russian Federation dated 02/09/2012 N VAS-15452/11)).

However, there are also court decisions in favor of taxpayers, in which arbitrators recognize as reliable information about market prices indicated in newspapers, magazines or on Internet sites. For example, in the Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated January 28, 2011 N A11-1952/2010 (left in force by the Determination of the Supreme Arbitration Court of the Russian Federation dated September 20, 2011 N VAS-4714/11), taxpayers used information on the cost of a land plot from the LLC database "PROEKOM", newspapers "From Hand to Hand", newspapers "Express Real Estate & Prices", supplements to the magazine "Real Estate & Prices", Internet: www.vlad-rialty.ru, www.magazine.dm-realty.ru, www .realty.ru, www.sdelka.ru, www.irr.ru, etc. At the same time, the organization compiled a statistical report of the received market information based on the data received. The courts accepted it as significant evidence of the market level of value of similar objects.

The advantage is that the Ministry of Finance recognizes certificates from statistical bodies as official sources of information. It is not so often in practice that situations arise when the Russian Ministry of Finance supports the taxpayer, and the courts oppose it, but this is exactly the option here.

Thus, according to the financial department, when determining market prices, price information published in official publications, in particular, from bodies authorized in the field of statistics and pricing can be used (Letters dated December 31, 2009 N 03-02-08/95 and dated 01.08 .2008 N 03-02-07/1-333).

However, courts often indicate that certificates issued by statistical or pricing authorities indicate average prices without taking into account comparable conditions. And the statistical authorities themselves are not vested with the authority to determine the size of market prices (Resolutions of the Moscow Federal Antimonopoly Service dated June 2, 2011 N A40-12846/10-112-90, North Caucasian Federal Antimonopoly Service dated August 30, 2011 N A53-5598/2010, N A01 dated April 16, 2010 -1433/2009 and Central district dated March 19, 2008 N A09-5751/07-30).

The advantage is that local government regulations can be used as official sources. For example, the Federal Antimonopoly Service of the North-Western District considered a case where the tax authorities determined the market level of rent on the basis of the Resolution of the head of the municipality of Polyarnye Zori dated December 15, 2006 and the Methodology for determining the amount of rent approved by the decision of the Polyarnozorinsk Duma dated December 20, 2006 N 98 And the court recognized such a calculation as legitimate (Resolution dated 07/09/2012 N A42-3355/2011).

The advantage is that the company itself can determine the range of market prices. If we draw an analogy with transfer pricing, then the market price is determined on the basis of a price interval, which is divided into four equal segments. For example, if the value of an asset in information sources varies from 170 thousand to 250 thousand rubles, then the segments will be equal to:

- from 170 thousand to 190 thousand rubles;

- from 190 thousand to 210 thousand rubles;

- from 210 thousand to 230 thousand rubles;

- from 230 thousand to 250 thousand rubles.

In this case, it is accepted without evidence that the extreme intervals - on the side of the minimum and maximum price values - are not market prices, and the prices falling into the two internal intervals of this line are obviously market prices. For tax purposes, the nearest minimum or maximum price may be used, between which there is a range of prices recognized as market prices (clause 7 of Article 105.9 of the Tax Code of the Russian Federation). Accordingly, based on the above example, the market price of the asset will be in the range from 190 thousand to 230 thousand rubles.

The advantage is that the organization can reduce the market value of the property by its wear and tear. According to the rules for determining market prices, official sources of information must contain data on the price of identical or homogeneous goods, works and services sold under comparable conditions in a certain period of time.

However, determining the market value of a particular property can be influenced by various factors, such as the percentage of wear and tear or technical condition, which may cause their value to differ from the market value of any other similar property. This opinion is stated in the Resolution of the Federal Antimonopoly Service of the Far Eastern District dated May 3, 2011 N A73-1426k/2010 (A73-2831/2009).

Accordingly, a company that received used property and applies the market price comparability method can take into account the depreciation factor. It can be determined, for example, based on the period of use of this property by the previous owner and the total useful life.

Read more: How to register ownership of an apartment under a will

Restrictions on gifts in business

Above, we noted the most important nuance regarding the transfer of property free of charge for commercial organizations - the value of the relevant assets cannot be more than 3 thousand rubles. If the gift item costs more, then the receiving party must register it as a purchase.

Thus, the gratuitous transfer of real estate, for example, in most cases cannot be carried out, since it is unlikely that the market price of buildings and structures will be less than 3 thousand rubles. However, in the practice of interaction between businesses, there are other schemes within which, in fact, the gratuitous aspect of legal relations is applicable, even if the value of the property is higher than the designated limit. A little later we will explore options for alternative transactions that are often used by Russian organizations.

Actually, an exception to the rule under consideration may be the procedure described above, in which the main owner transfers property in favor of his company. Also, the restriction in question does not apply if the property is transferred, for example, by a holding company in favor of one of its subsidiaries.

To have income, you need expenses

Another way to avoid double taxation: when further selling property received free of charge, do not write off its value as expenses, but do not include it in income either - on the basis of paragraph 3 of Article 248 of the Tax Code. This paragraph establishes that, when determining taxable income, amounts once recognized as income are not subject to re-inclusion in income. The market value of the “gift” has already been included in income once – upon receipt. Therefore, the second time - when selling it - this cost should not be included in income. If the property is sold at a higher price, then it turns out that only the difference should be recognized in income. The final tax result, as we see, will be the same as when writing off the market value as expenses.

But what if the company does not sell the property received free of charge, but uses it to manufacture its products? After all, you cannot exclude its cost from revenue by calculation - there is no such mechanism in Chapter 25 of the Tax Code; Revenue must be recognized in full.

Perhaps that is why the courts accept the reference to paragraph 3 of Article 248 as confirmation of the organization’s right to write off the market value of something received free of charge as expenses, and not at all the right to exclude it from sales income. The Federal Arbitration Court of the Moscow District reasoned like this. Since the selling price of finished products is formed, among other things, from the cost of materials used in production, the exclusion of materials received free of charge from expenses will lead to their double taxation - both as part of non-operating income when received, and as part of revenue from the sale of finished products. And this contradicts paragraph 3 of Article 248 of the Tax Code (resolution of the Federal Antimonopoly Service of the Moscow District dated February 5, 2009 No. KA-A40/13283-08; similar conclusions are contained in the resolution of the same court dated May 7, 2008 No. KA-A40/3514- 08).

All this is true only for those who pay income tax. In Chapter 26.2 of the Tax Code regulating “simplified taxation” there is no such prohibition on repeated inclusion of the same amount in income. The ban on double taxation cannot be derived from the first part of the Tax Code. However, the Supreme Arbitration Court calls the principle of one-time taxation constitutional (decision of July 20, 2010 No. VAS-9251/10, resolution of the Supreme Arbitration Court of February 25, 2009 No. 13258/08). Therefore, one can with a high degree of probability expect that the arbitration court will not support the re-inclusion of the value of gratuitously received property in income, because judges must follow the interpretation of tax legislation given by their highest authority.